Stock Picks Recap for 4/4/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ENDP triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOG triggered short (without market support) and worked for a couple of points:

His MON triggered long (with market support) and didn't work:

His LULU triggered long (with market support) and worked:

His TLT triggered short (ETF, so no market support needed) and didn't work:

AAPL triggered short (with market support) and didn't work, worked later:

In total, that's 5 trades triggering with market support, 1 of them worked, 4 did not. Our nice run of winners comes to a halt with volume hitting the second lowest of the year.

Futures Calls Recap for 4/4/13

One call that worked, one that didn't trigger. See ES below. The volume dropped off sharply in the markets again, back down to 1.35 billion NASDAQ shares.

Net ticks: +2.5 ticks.

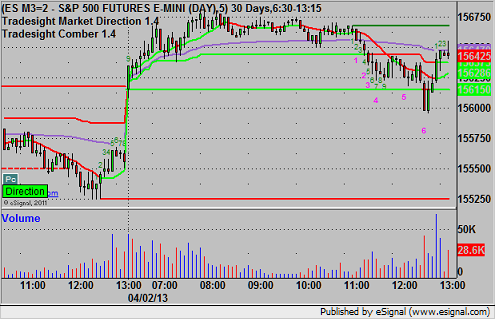

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

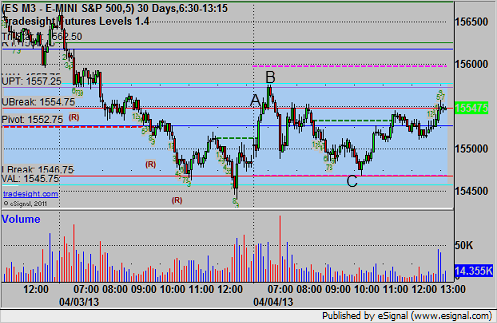

ES:

Mark's call triggered long at A at 1555.25, hit the first target for 6 ticks, and stopped the second half under the entry. Note that the UPT/Value Area High was the high at B and the low was the LBreak to the tick:

Forex Calls Recap for 4/4/13

Two winners for the session. See the GBPUSD below. Still holding half of the long position.

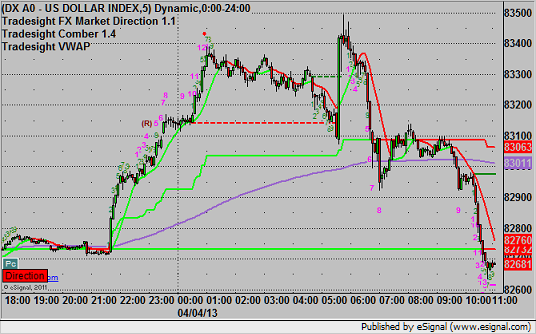

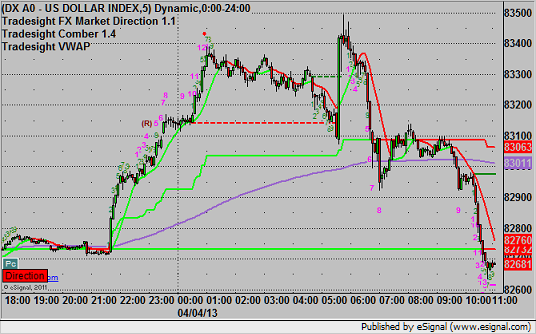

Here's a look at the US Dollar Index intraday with our market directional lines:

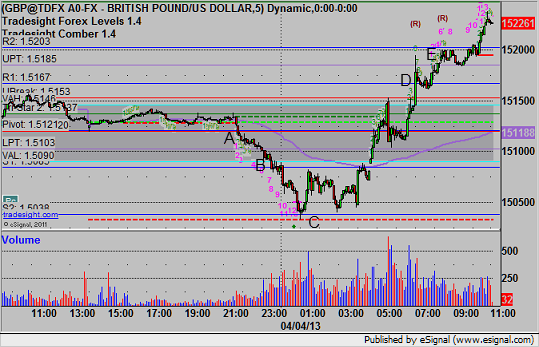

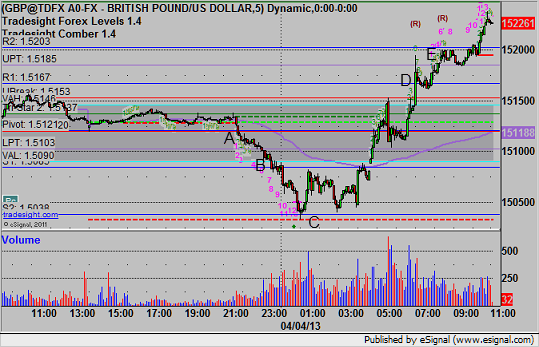

GBPUSD:

Triggered short at A, hit first target at B, kept going overnight. Note that the low was a 13 Comber buy signal at the S2 level at C. New call triggered long at D, hit first target at E, still holding with a stop under R2. Note that right at the end of the chart, we got a Comber 13 sell signal, so that's probably the high of the session:

Forex Calls Recap for 4/4/13

Two winners for the session. See the GBPUSD below. Still holding half of the long position.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, kept going overnight. Note that the low was a 13 Comber buy signal at the S2 level at C. New call triggered long at D, hit first target at E, still holding with a stop under R2. Note that right at the end of the chart, we got a Comber 13 sell signal, so that's probably the high of the session:

Stock Picks Recap for 4/3/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MAKO triggered short (with market support) and didn't work:

QLGC triggered short (with market support) and worked:

KLIC triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's FFIV triggered long (without market support) and worked enough for a quick partial:

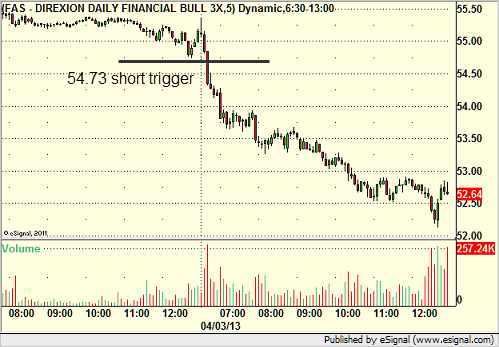

His FAS triggered short (ETF, so no market support needed) and worked great:

His TSLA triggered short (with market support) and worked:

His NFLX triggered short (with market support) and worked:

His VECO triggered long (without market support) and didn't work:

His BIIB triggered short (with market support) and didn't work initially, worked later:

AMZN triggered short (with market support) and worked great:

CELG triggered short (with market support) and didn't work:

Rich's LUV triggered short (with market support) and worked:

His RGLD triggered short (without market support) and didn't work:

In total, that's 10 trades triggering with market support, 7 of them worked, 3 did not.

Futures Calls Recap for 4/3/13

Finally a setup and trigger, worked to first target and the second half stopped over the entry before a big move. See ER section below. There was also a nice setup on the NQ over lunch for the gap fill.

Net ticks: +3.5 ticks.

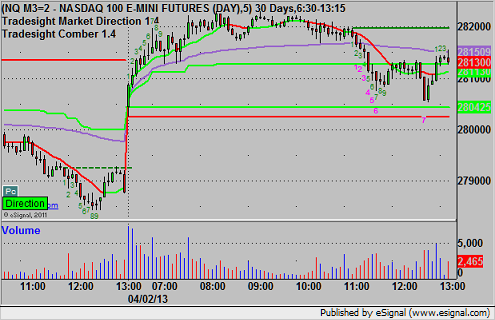

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

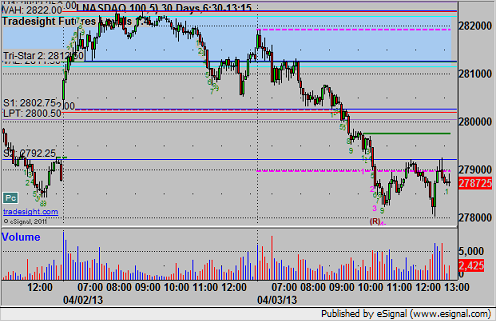

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Note the nice inverted cup and handle that lined up against the LPT over lunch and then triggered and ran to the gap fill from yesterday:

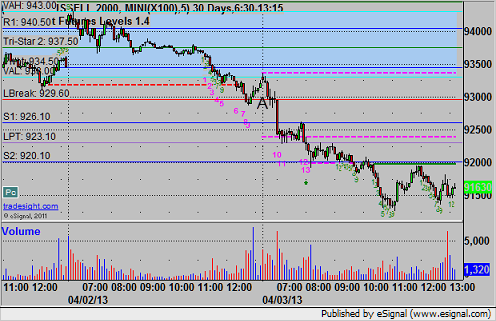

ER:

Triggered short at A at 929.50, hit first target for 8 ticks, and stopped the second half over the entry:

Forex Calls Recap for 4/3/13

Another interesting session with narrow range. The EURUSD bounced off our trigger and the GBPUSD triggered (just barely) and didn't go anywhere. See both sections below.

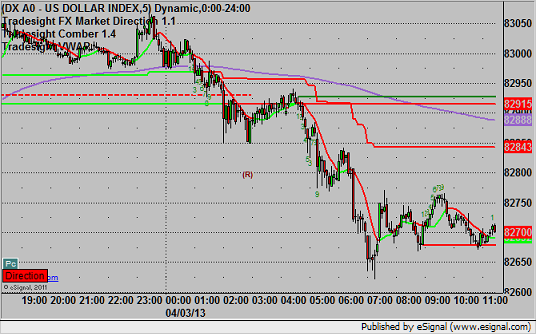

Here's a look at the US Dollar Index intraday with our market directional lines:

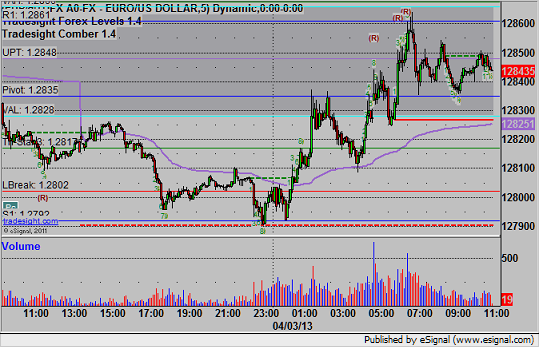

EURUSD:

Our short was under S1, but it didn't get the 2-pip spread under that level to trigger:

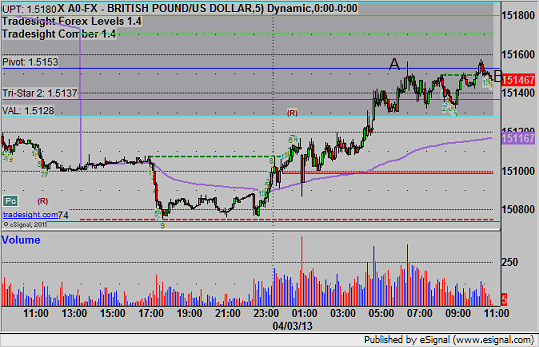

GBPUSD:

Triggered long at A, didn't stop or go anywhere, finally closed just under the entry at B for end of session:

Stock Picks Recap for 4/2/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

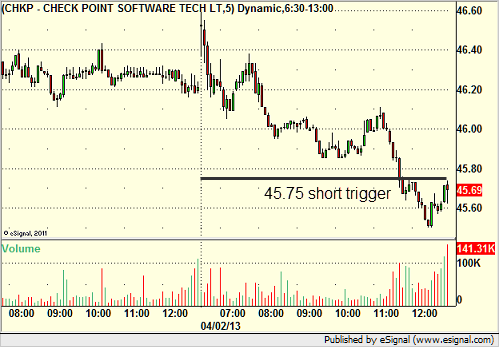

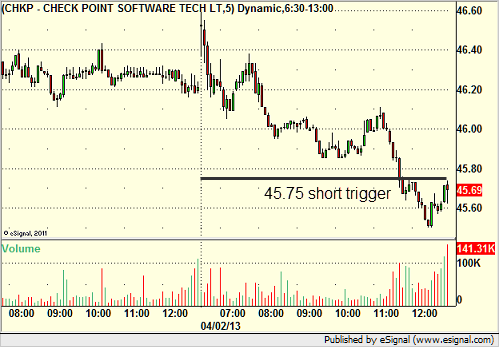

From the report, CHKP triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered long (with market support) and worked great:

His AIG triggered long (with market support) and didn't work (market rolled shortly after the trigger):

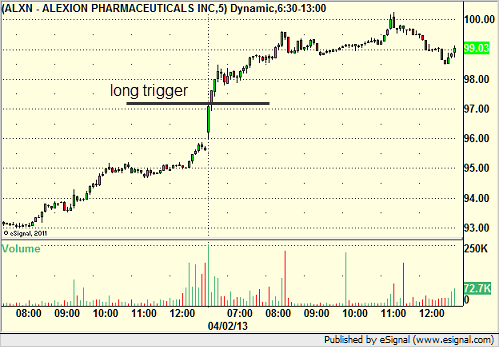

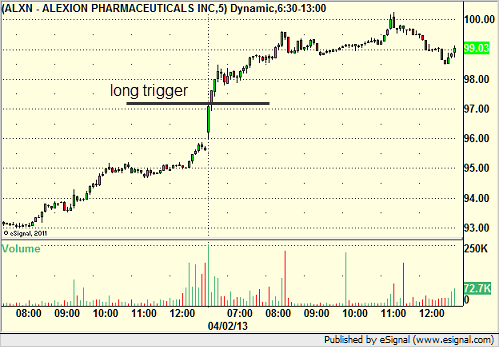

His ALXN triggered long (with market support) and worked:

His TIF triggered long (with market support) and worked:

FSLR triggered short (without market support) and didn't work, worked later with market support:

Rich's VECO triggered short (without market support) and worked enough for a partial:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not. We are also 17 out of the last 18 for triggers with market support.

Stock Picks Recap for 4/2/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CHKP triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered long (with market support) and worked great:

His AIG triggered long (with market support) and didn't work (market rolled shortly after the trigger):

His ALXN triggered long (with market support) and worked:

His TIF triggered long (with market support) and worked:

FSLR triggered short (without market support) and didn't work, worked later with market support:

Rich's VECO triggered short (without market support) and worked enough for a partial:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not. We are also 17 out of the last 18 for triggers with market support.

Futures Calls Recap for 4/2/13

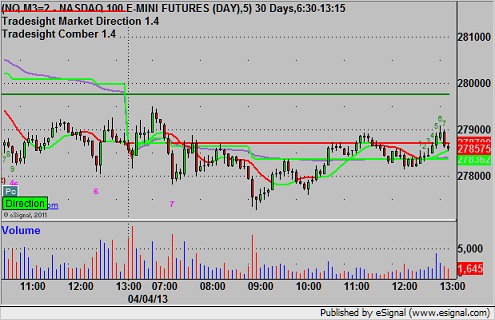

The ES only hit one main level today early and spent several hours in a 3 point range before finally heading back into the gap. Volume was light again in the market at 1.4 billion NASDAQ shares, and although we don't like to do this, no calls.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session: