Forex Calls Recap for 4/2/13

Well, sometimes nothing happens. The Levels were spaced better on the EURUSD than the GBPUSD, so I made the calls there, but the EURUSD didn't do anything for the session and nothing triggered.

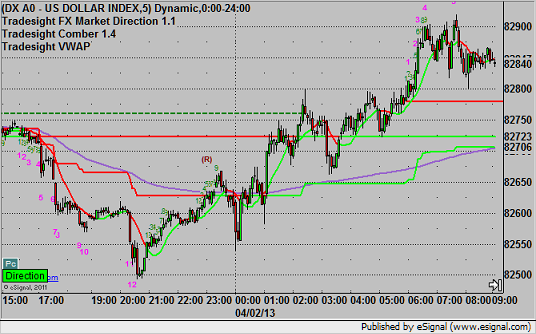

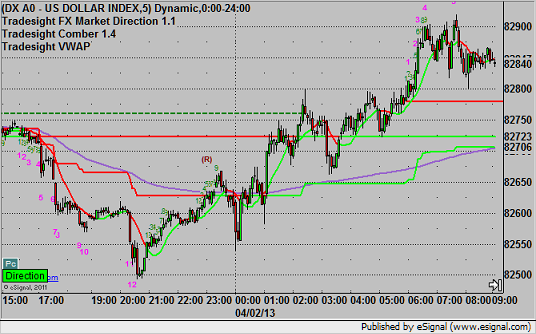

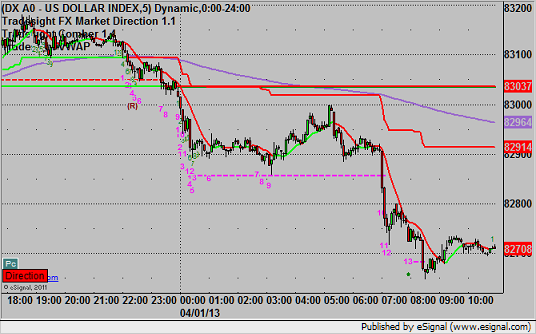

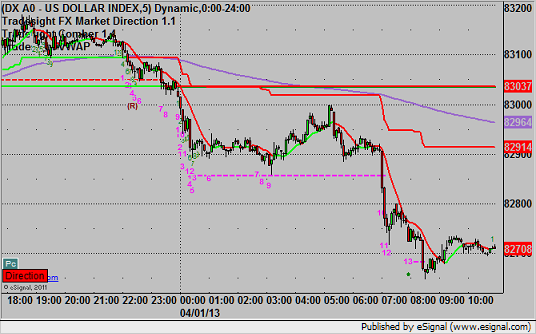

Here's a look at the US Dollar Index intraday with our market directional lines:

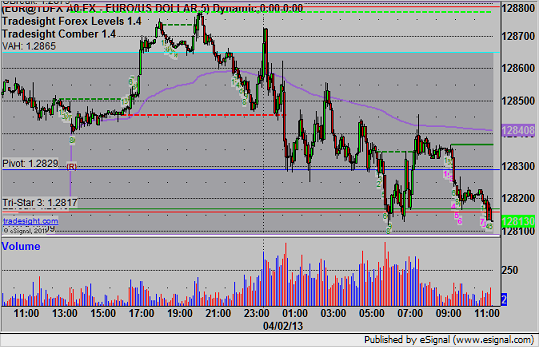

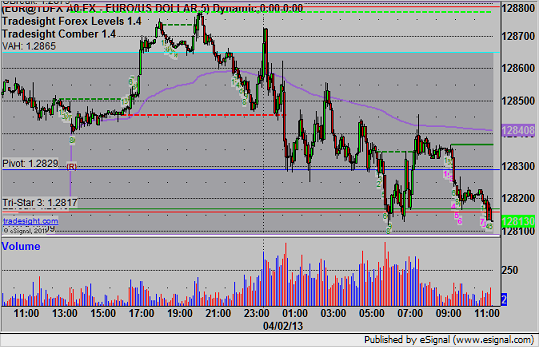

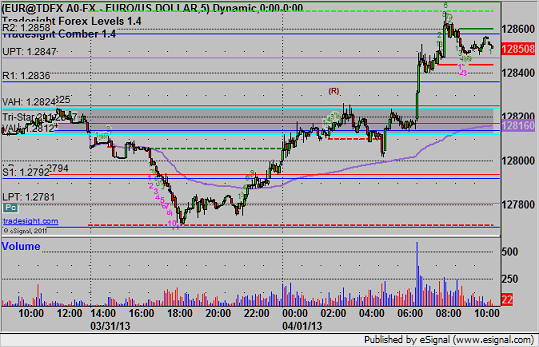

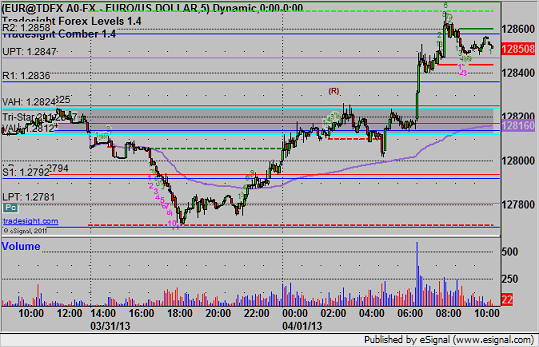

EURUSD:

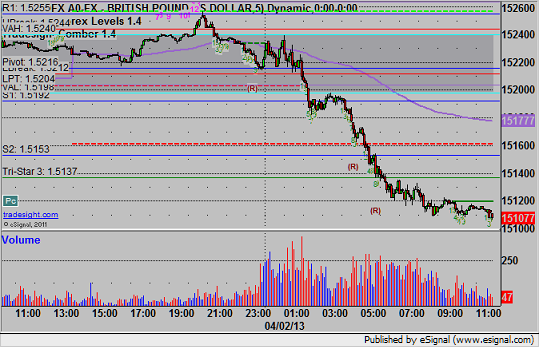

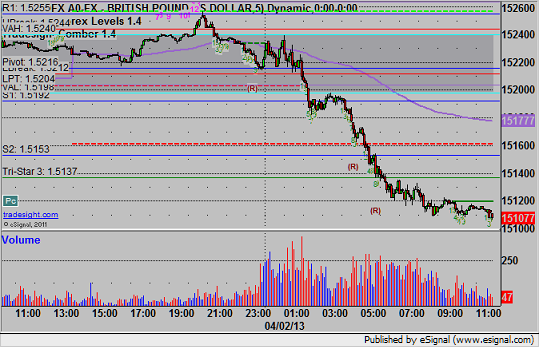

GBPUSD:

Forex Calls Recap for 4/2/13

Well, sometimes nothing happens. The Levels were spaced better on the EURUSD than the GBPUSD, so I made the calls there, but the EURUSD didn't do anything for the session and nothing triggered.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

GBPUSD:

Stock Picks Recap for 4/1/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's FB triggered long (without market support due to opening 5 minutes) and didn't work:

His NFLX triggered short (with market support) and worked great:

His DECK triggered short (with market support) and worked:

AMZN triggered short (with market support) and worked:

In total, that's 3 trades triggering with market support, all 3 of them worked. We are now 13 for 13 in our last 3 days of trades that triggered with market support.

Futures Calls Recap for 4/1/13

No calls as the rest of the world was on Holiday and volume was therefore extremely light at only 1.3 billion NASDAQ shares. We resume Tuesday.

Net ticks: +0 ticks.

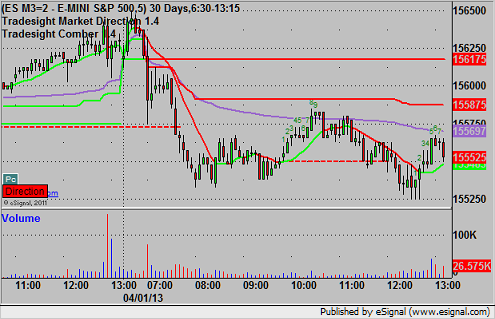

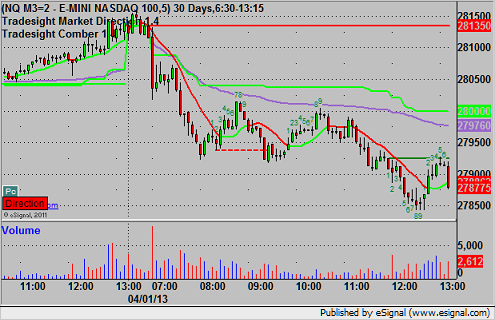

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Forex Calls Recap for 4/1/13

After looking at the opening few hours of play, it was clear that with banks closed around the world (except in the US since we did it Friday), the action was going to be limited, so I didn't make any calls. GBPUSD and EURUSD in about a 50 pip range overnight, so that was a good thing. There was a nice breakout on EURUSD over UBreak in the US session.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Note the breakout over UBreak in the morning:

Forex Calls Recap for 4/1/13

After looking at the opening few hours of play, it was clear that with banks closed around the world (except in the US since we did it Friday), the action was going to be limited, so I didn't make any calls. GBPUSD and EURUSD in about a 50 pip range overnight, so that was a good thing. There was a nice breakout on EURUSD over UBreak in the US session.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Note the breakout over UBreak in the morning:

Stock Picks Recap for 3/28/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ILMN triggered long (with market support) and worked enough for a partial:

ONXX triggered long (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's SINA triggered short (without market support) and didn't work:

His CELG triggered long (with market support) and worked great:

In total, that's 3 trades triggering with market support, all 3 of them worked. (10 for 10 in the last two days of light volume with market support).

Futures Calls Recap for 3/28/13

One winner on another 1.4 billion share NASDAQ session to close out the week, month, and quarter. Have a good long weekend and then we're back to work.

Net ticks: +3 ticks.

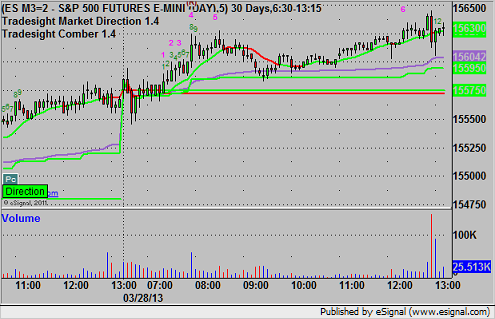

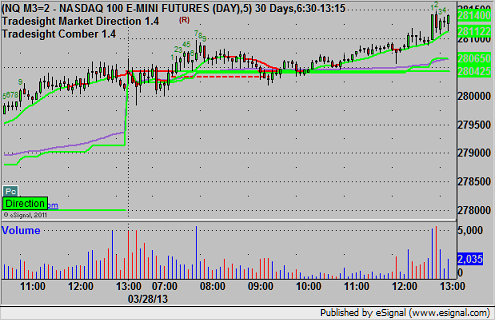

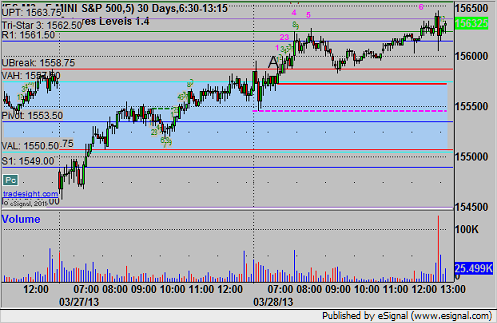

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1559.75, hit first target for 6 ticks, and stopped the second half at the entry:

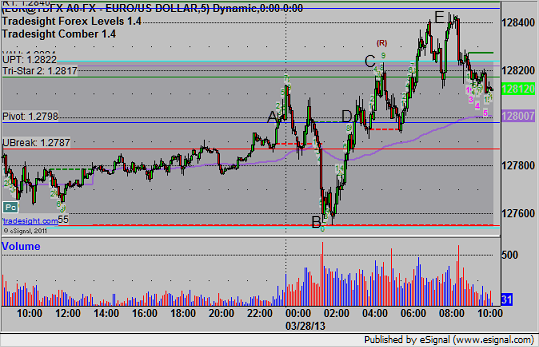

Forex Calls Recap for 3/28/13

A loser in the EURUSD to close out the week, but check the review of it below.

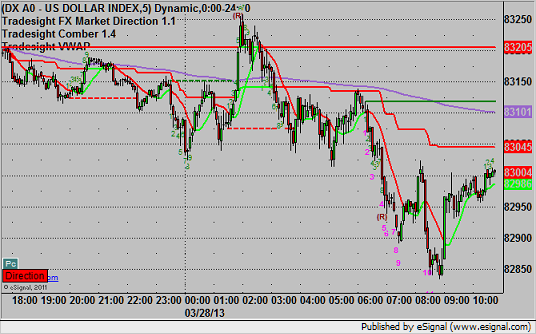

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A and stopped for 25 pips. Note that the market exactly covered the Value Area from B to C overnight. Also, if you had been awake to re-enter at D, it worked to the first target at E:

Stock Picks Recap for 3/27/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

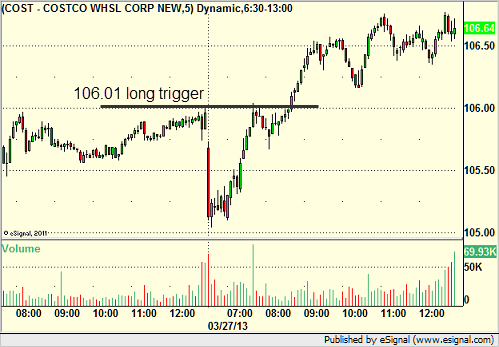

From the report, COST triggered long (with market support) and worked:

CTRP triggered long (with market support) and worked:

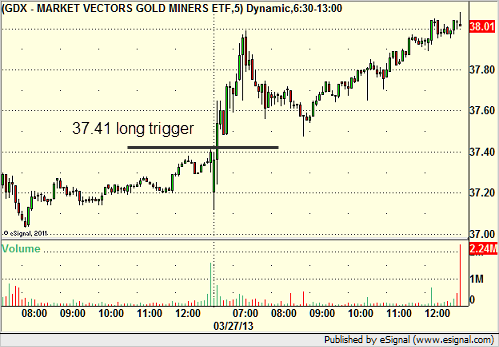

From the Messenger/Tradesight_st Twitter Feed, Rich's GDX triggered long (ETF, so no market support needed) and worked:

His GOOG triggered short late in the day (without market support) and didn't work:

AMZN triggered long (with market support) and worked:

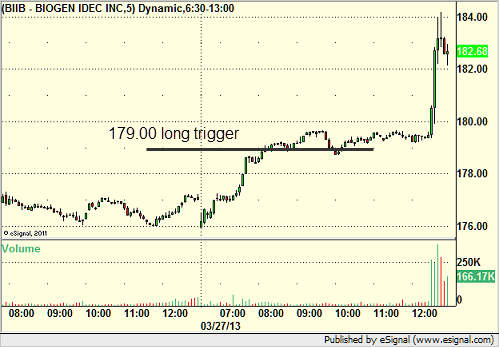

Mark's BIIB triggered long (with market support) and worked:

Rich's BIDU triggered long (with market support) and worked:

His ASML triggered long (with market support) and worked:

In total, that's 7 trades triggering with market support, all 7 of them worked.