Futures Calls Recap for 3/27/13

We got the day that we expected in terms of volume. The market gapped down and took all day to get back to even, with the S&P closing down less than a point, and NASDAQ hitting only 1.3 billion. A winner and a loser on the ES, but I was low size due to the situation (and will be tomorrow).

Net ticks: -4.5 ticks.

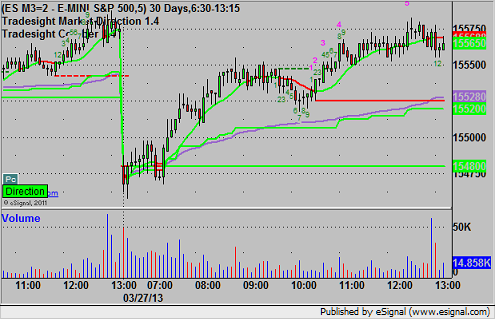

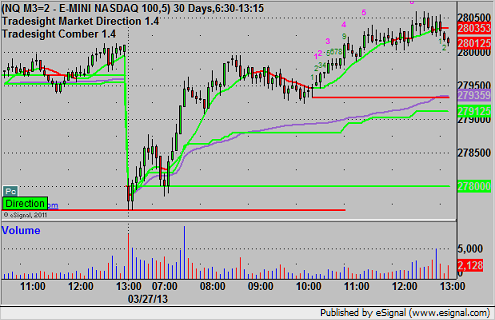

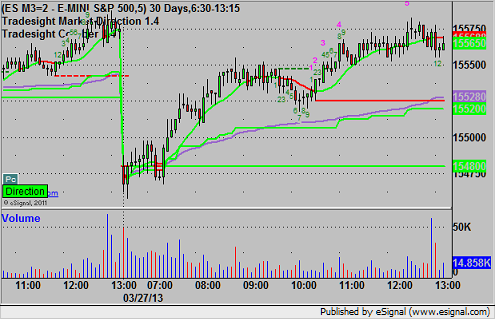

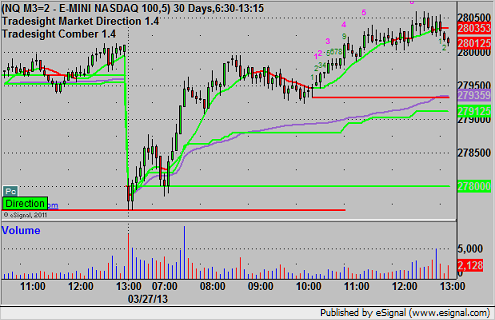

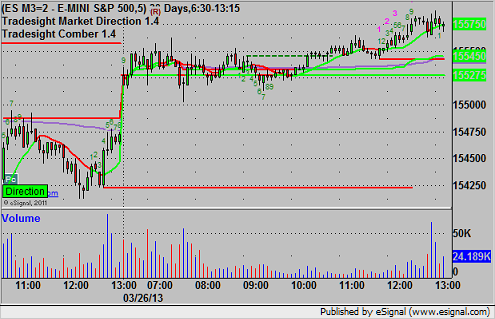

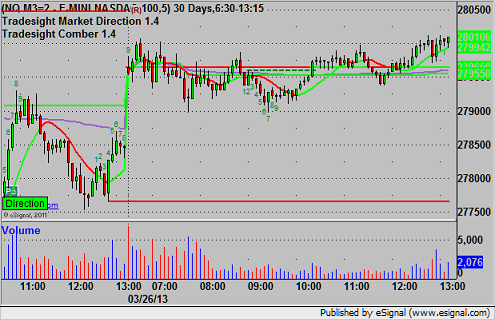

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

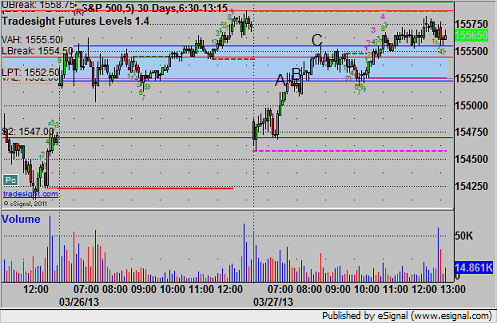

ES:

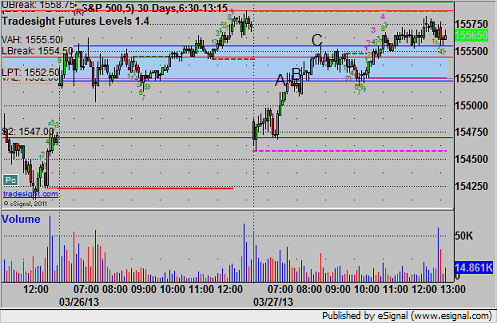

The nice setup into the Value Area over the LPT triggered long at A, but swept initially, then went again at B, hit first target for six ticks, inched higher to exactly the Value Area High at C, and then stopped the second half under the entry:

Futures Calls Recap for 3/27/13

We got the day that we expected in terms of volume. The market gapped down and took all day to get back to even, with the S&P closing down less than a point, and NASDAQ hitting only 1.3 billion. A winner and a loser on the ES, but I was low size due to the situation (and will be tomorrow).

Net ticks: -4.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

The nice setup into the Value Area over the LPT triggered long at A, but swept initially, then went again at B, hit first target for six ticks, inched higher to exactly the Value Area High at C, and then stopped the second half under the entry:

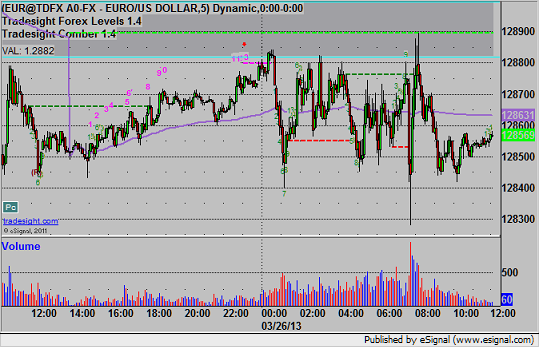

Forex Calls Recap for 3/27/13

A clean trigger that used the LBreak on a retest perfectly so that we didn't get stopped on the EURUSD. See that section below.

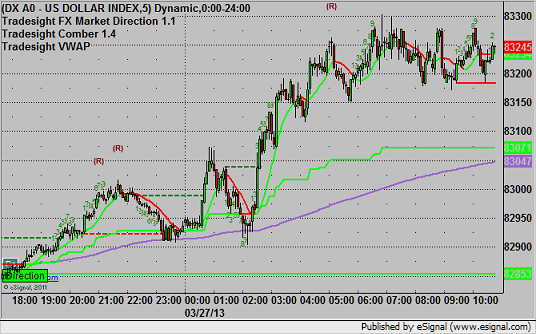

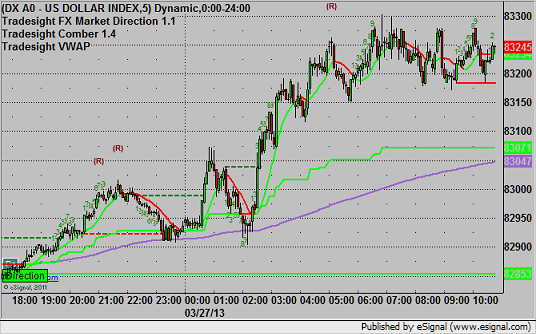

Here's a look at the US Dollar Index intraday with our market directional lines:

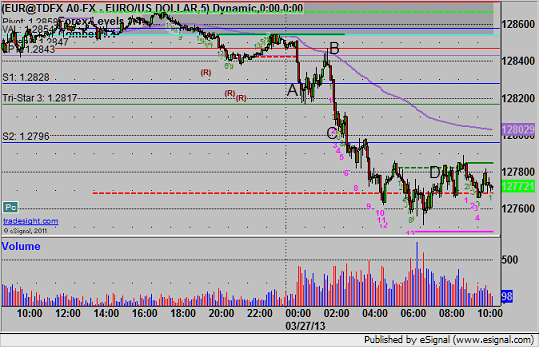

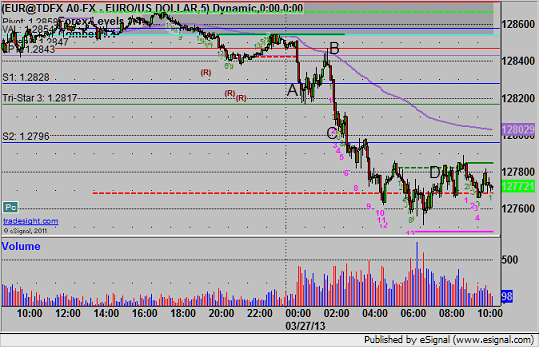

EURUSD:

Triggered short at A, retested the LBreak exactly at B (stop was above it), and hit first target at C. Closed final piece in the money at D:

Forex Calls Recap for 3/27/13

A clean trigger that used the LBreak on a retest perfectly so that we didn't get stopped on the EURUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, retested the LBreak exactly at B (stop was above it), and hit first target at C. Closed final piece in the money at D:

Stock Picks Recap for 3/26/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, GRPN triggered long (with market support) and didn't work:

DISH triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, AAPL triggered short (without market support) and didn't work, worked later with market support:

Rich's VXX triggered long (ETF, so no market support needed) and worked enough for a partial:

His FB triggered long (with market support) and didn't work:

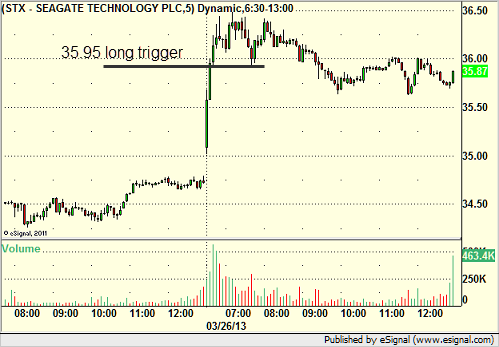

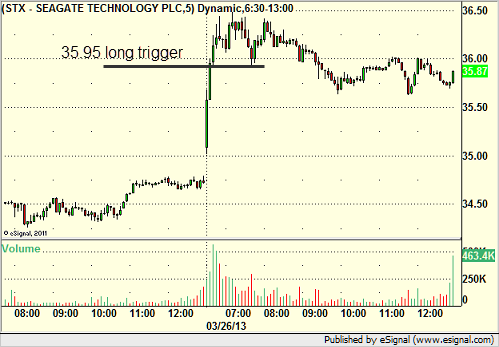

His STX triggered long (with market support) and worked:

His GS triggered short (with market support) and worked great:

His MA triggered long (with market support) and worked:

In total, that's 7 trades triggering with market support, 4 of them worked, 3 did not.

Stock Picks Recap for 3/26/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, GRPN triggered long (with market support) and didn't work:

DISH triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, AAPL triggered short (without market support) and didn't work, worked later with market support:

Rich's VXX triggered long (ETF, so no market support needed) and worked enough for a partial:

His FB triggered long (with market support) and didn't work:

His STX triggered long (with market support) and worked:

His GS triggered short (with market support) and worked great:

His MA triggered long (with market support) and worked:

In total, that's 7 trades triggering with market support, 4 of them worked, 3 did not.

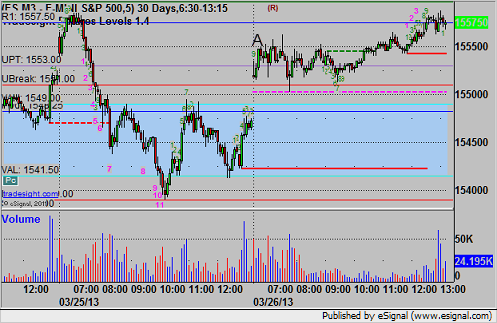

Futures Calls Recap for 3/26/13

A trigger on news on the ES (see below), and then a later better trigger that didn't work. Market volume, after improving yesterday, dropped quite a bit Tuesday, which doesn't bode well for Wednesday and Thursday as we wind up the quarter and head into the long weekend.

Net ticks: -14 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at 1555.25, although the first trigger was on news (Consumer Confidence and New Home Sales) at A at 10:00 am EST. Generally don't want to enter a trade on news, but the call was made 4 minutes before, so we will count it. Stopped, then triggered again 10 minutes later and stopped again. Ended up in a useless range with no volume:

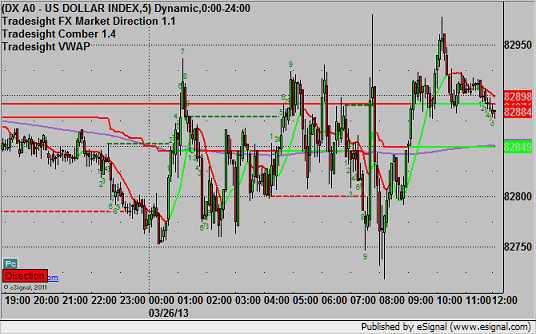

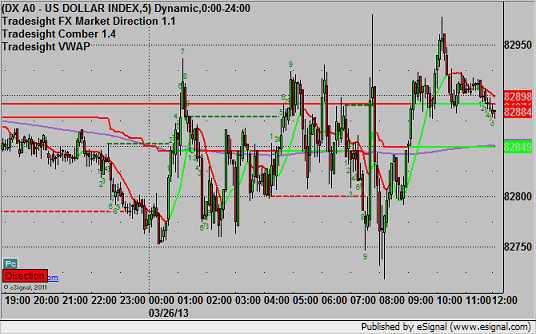

Forex Calls Recap for 3/26/13

From a day with two winners and a carryover to a day with no triggers at all. See EURUSD for the final exit of the prior day's trade about 55 pips in the money. About 50 pips of range today on the EURUSD.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Our short from the prior session's Pivot stopped out just barely in the morning over the VAL here for about 55 pips, the ONLY Level that the EURUSD even touched in a very narrow day. Strange to see:

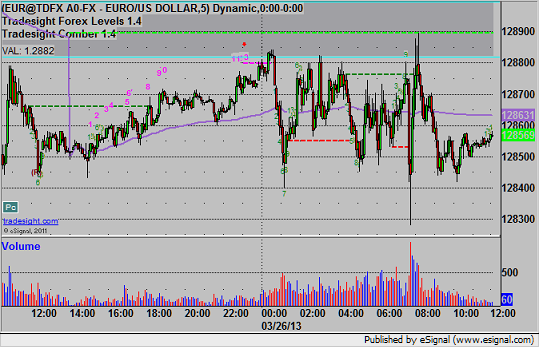

Forex Calls Recap for 3/26/13

From a day with two winners and a carryover to a day with no triggers at all. See EURUSD for the final exit of the prior day's trade about 55 pips in the money. About 50 pips of range today on the EURUSD.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Our short from the prior session's Pivot stopped out just barely in the morning over the VAL here for about 55 pips, the ONLY Level that the EURUSD even touched in a very narrow day. Strange to see:

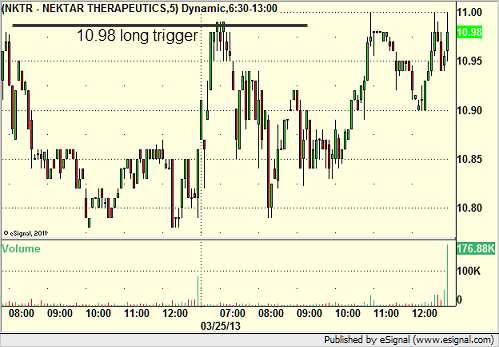

Stock Picks Recap for 3/25/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SPLK triggered long (with market support) and worked:

NKTR triggered long (with market support) and didn't work:

HAIN triggered long (with market support) and didn't work:

MDVN triggered short (with market support, but unfortunately right in the middle of lunch) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, NFLX triggered long (with market support) and worked:

Rich's FIVE triggered short (with market support) and didn't work initially, worked later:

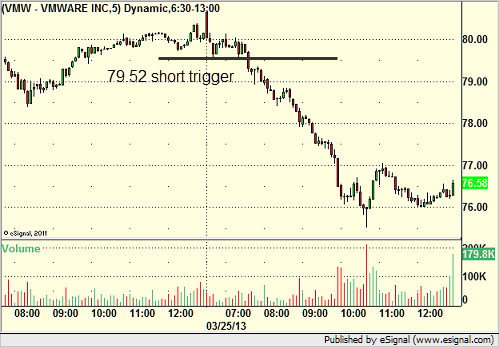

His VMW triggered short (with market support) and worked great:

In total, that's 7 trades triggering with market support, 3 of them worked, 4 did not. Strange win ratio as I had a really nice day.