Stock Picks Recap for 3/25/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SPLK triggered long (with market support) and worked:

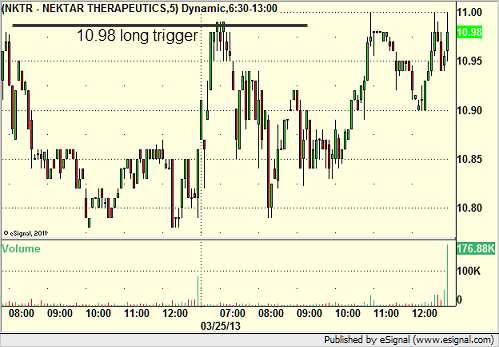

NKTR triggered long (with market support) and didn't work:

HAIN triggered long (with market support) and didn't work:

MDVN triggered short (with market support, but unfortunately right in the middle of lunch) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, NFLX triggered long (with market support) and worked:

Rich's FIVE triggered short (with market support) and didn't work initially, worked later:

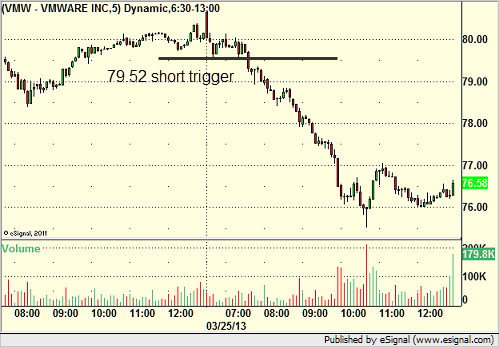

His VMW triggered short (with market support) and worked great:

In total, that's 7 trades triggering with market support, 3 of them worked, 4 did not. Strange win ratio as I had a really nice day.

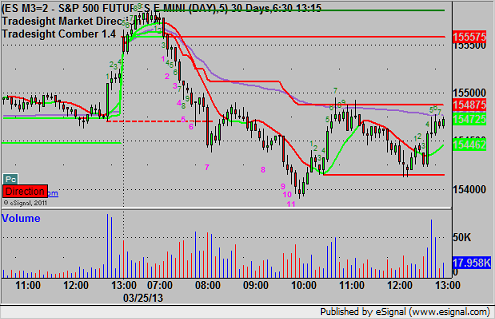

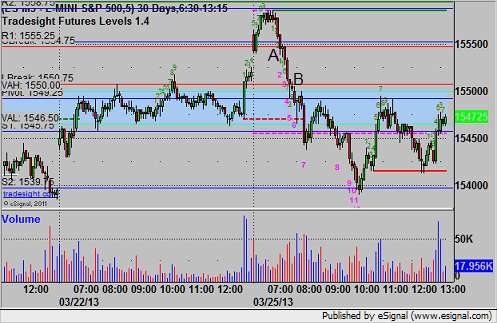

Futures Calls Recap for 3/25/13

Mark had a nice winner on the ES for the session as we finally got some better range. Volume was 1.6 billion NASDAQ shares, which is also a slight improvement from last week.

Net ticks: +8.5 ticks.

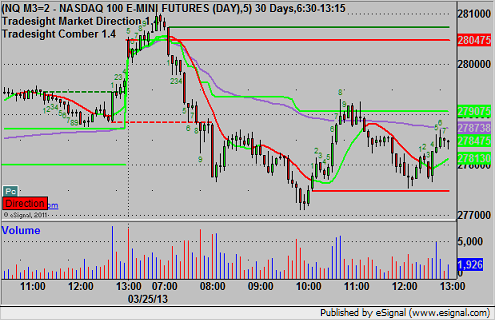

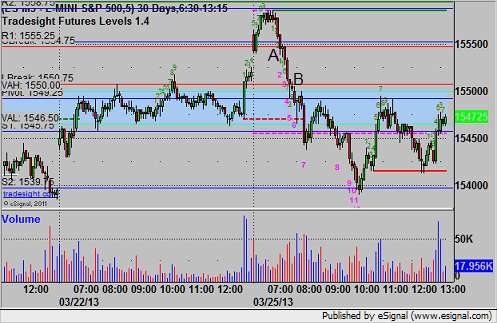

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at A at 1553.75, hit first target for 6 ticks, and he lowered the stop several times and stopped finally at 1551 at A:

Futures Calls Recap for 3/25/13

Mark had a nice winner on the ES for the session as we finally got some better range. Volume was 1.6 billion NASDAQ shares, which is also a slight improvement from last week.

Net ticks: +8.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at A at 1553.75, hit first target for 6 ticks, and he lowered the stop several times and stopped finally at 1551 at A:

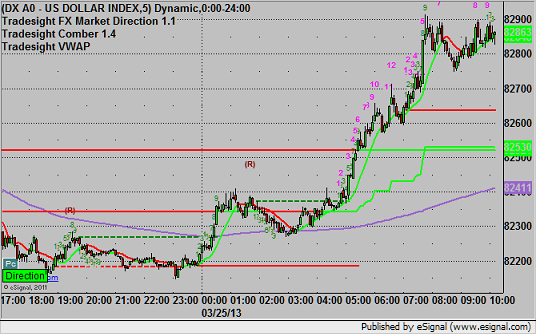

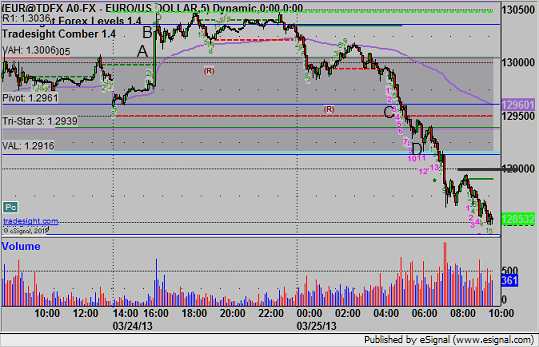

Forex Calls Recap for 3/25/13

A nice session to start the week with two winners on the EURUSD (and some good range). Still holding the second half of the short. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

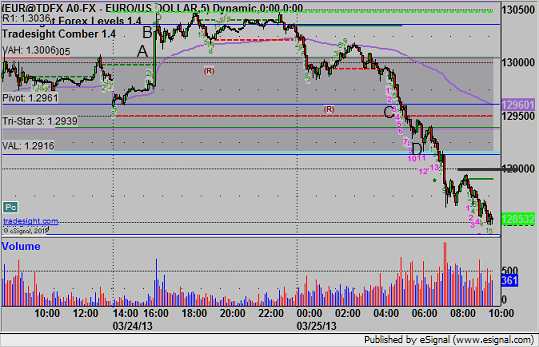

EURUSD:

Triggered long early (half size) at A and hit first target at B, second half stopped. Triggered short a much better setup at a better time at C, hit first target at D, lowered stop several times and holding the rest with a stop over the black line at 1.2900:

Forex Calls Recap for 3/25/13

A nice session to start the week with two winners on the EURUSD (and some good range). Still holding the second half of the short. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long early (half size) at A and hit first target at B, second half stopped. Triggered short a much better setup at a better time at C, hit first target at D, lowered stop several times and holding the rest with a stop over the black line at 1.2900:

Stock Picks Recap for 3/22/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

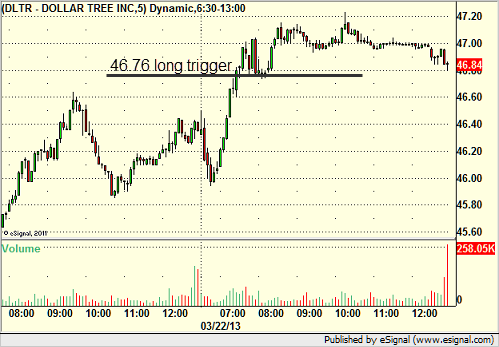

From the report, DLTR triggered long (with market support) and worked:

FNSR triggered short (with market support) and didn't work, worked later:

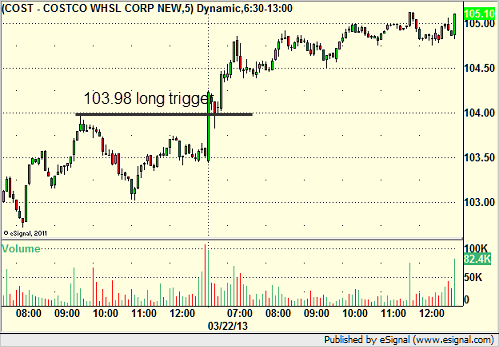

From the Messenger/Tradesight_st Twitter Feed, COST triggered long (without market support due to opening 5 minutes) and worked:

Rich's SNDK triggered short (with market support) and worked eventually:

His SPY triggered short (ETF, so no market support needed) and didn't work:

His FAS triggered short (ETF, so no market support needed) and worked enough for a partial:

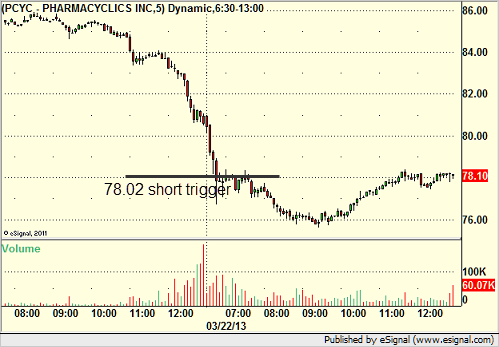

His PCYC triggered short (with market support) and worked:

His FFIV triggered short (without market support) and didn't work initially, but worked after (we don't count it anyway):

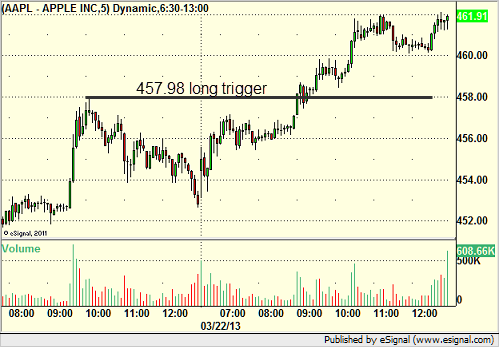

AAPL triggered long (with market support, and the cleanest pattern of the day) and worked great:

Rich's MNST triggered short (without market support) and worked:

His BBRY triggered short (without market support) and worked great:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

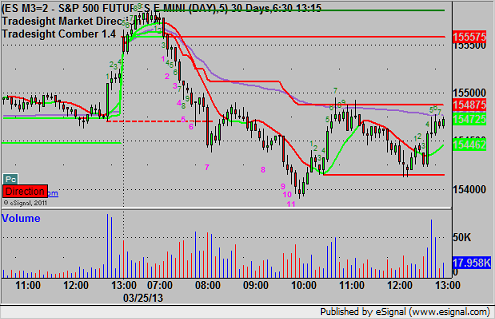

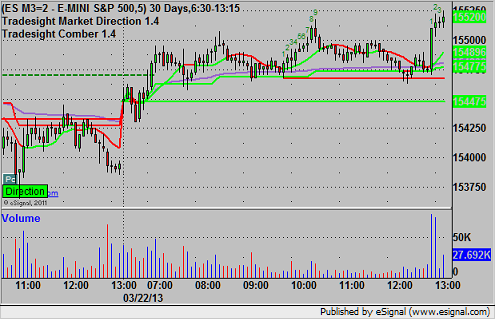

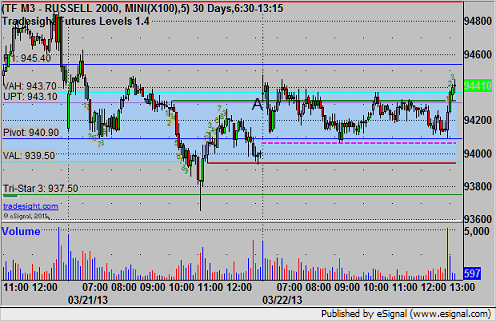

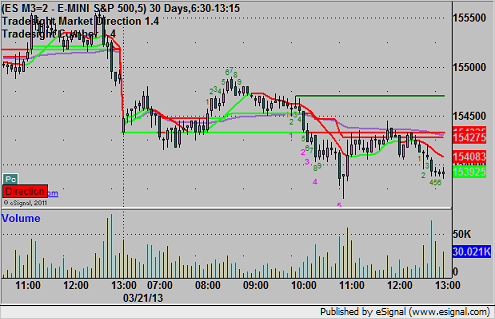

Futures Calls Recap for 3/22/13

Another flat session as expected. NASDAQ volume was 1.6 billion shares. We had a winner in the ER, see below.

Net ticks: +3.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ER:

Triggered short at A at 943.00, hit first target for 8 ticks, stopped second half over the entry. Didn't even fill the gap but used the Pivot as the low:

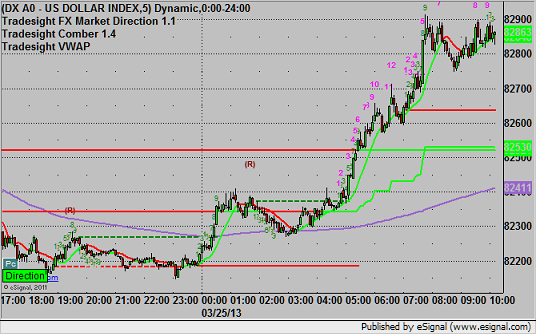

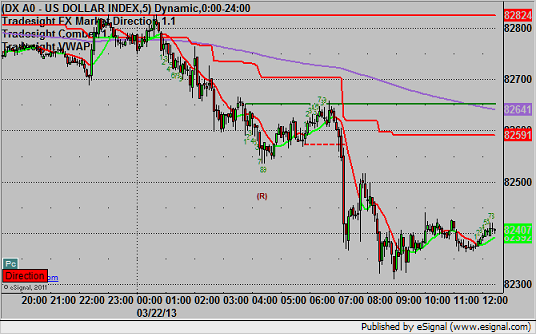

Forex Calls Recap for 3/22/13

A winner to close out the week. See the EURUSD section below.

We have a new format here to the report. I got rid of the trend boxes as they don't apply to what we do anymore. I'm separating this recap section from the section below, which will give you details of the next session calls and when they will be posted.

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

Here's a look at the US Dollar Index intraday with our market directional lines:

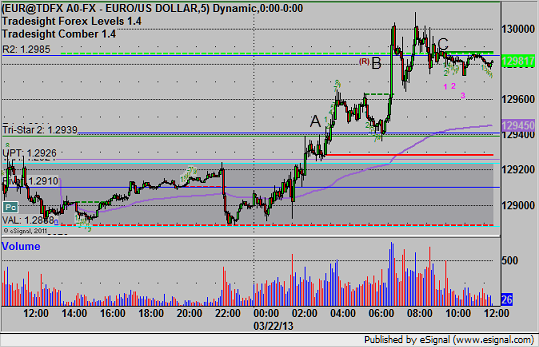

EURUSD:

Triggered long at A, hit first target at B, and closed second half at C for about 50 pips for end of week:

Stock Picks Recap for 3/21/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SPRD gapped over, no play.

QCOR triggered long (without market support due to opening 5 minutes) and didn't work:

FOSL triggered short (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered long (ETF, so no market support needed) and worked enough for a partial:

NTAP triggered short (with market support) and didn't work:

Rich's GS triggered short (with market support) and worked:

His DE triggered short (with market support) and worked enough for a partial but nothing else:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not, but none of it was exciting.

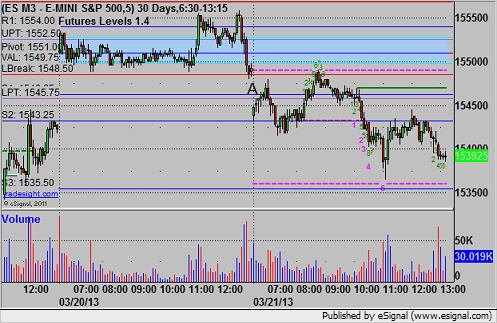

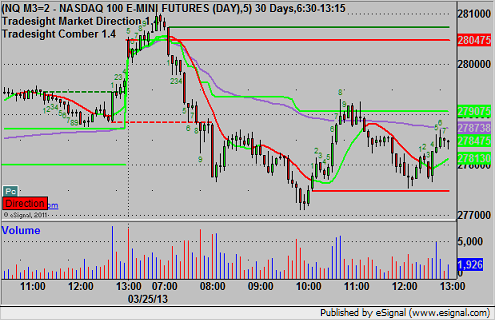

Futures Calls Recap for 3/21/13

The market continues to struggle in narrow range on little volume as things seems to take twice as long to happen. The ES gapped down, made an attempt to fill the gap, then dropped down to fill the gap from yesterday, then came back up to the current gap to the tick. See that section below.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at 1546.50 at A, hit first target for 6 ticks and that was it. Almost took the short under the S2, but that also only went 6 ticks (to fill the gap from yesterday) before we reversed back up to fill the new gap: