Forex Calls Recap for 3/21/13

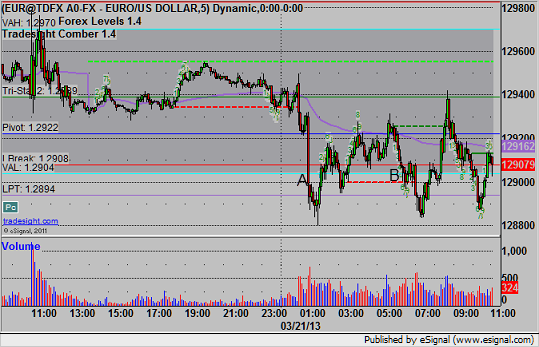

Another day of narrow ranges and the market doing very little. See EURUSD below.

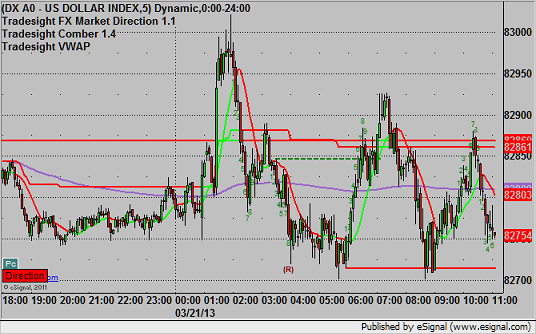

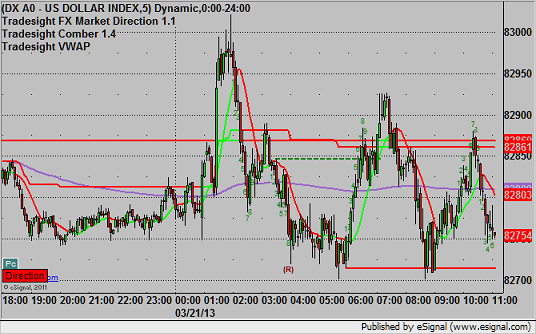

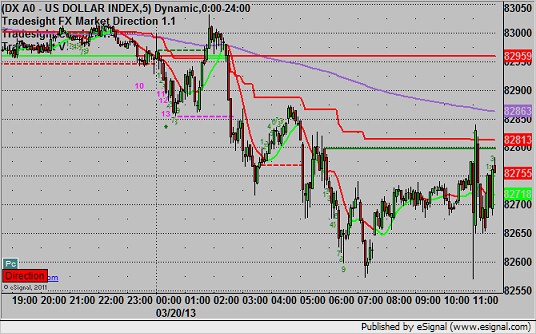

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

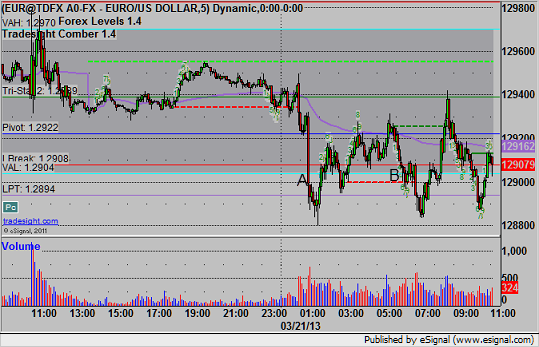

Triggered short at A and stopped. Triggered again in the morning at B and stopped:

Forex Calls Recap for 3/21/13

Another day of narrow ranges and the market doing very little. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

Triggered short at A and stopped. Triggered again in the morning at B and stopped:

Stock Picks Recap for 3/20/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered...again.

From the Messenger/Tradesight_st Twitter Feed, Rich's CLF triggered long (without market support) and worked:

His AMGN triggered long (with market support) and worked:

AMZN triggered short (with market support) and worked:

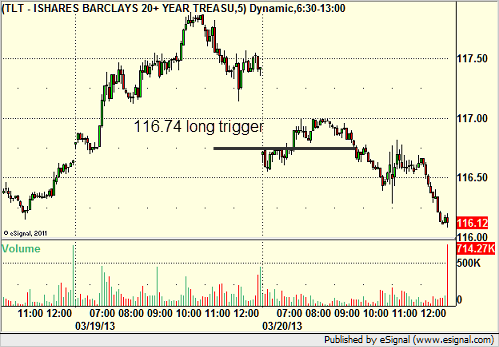

TLT triggered long (ETF, so no market support needed) and didn't work:

Rich's BIDU triggered long (with market support) and didn't work:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

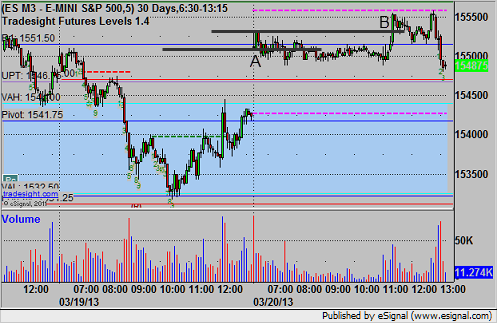

Futures Calls Recap for 3/20/13

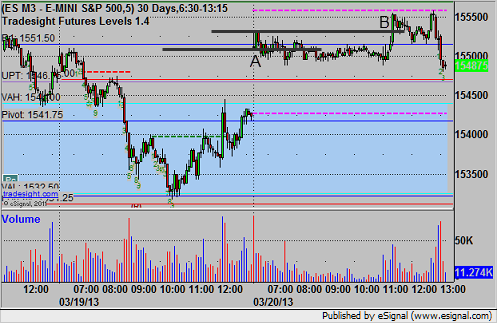

A loser and a winner on the flattest day we've seen yet. Holy smokes was that brutal until a bit after the Fed announcement. At one point, I couldn't even see the VWAP or market directional lines on my charts because it was so flat!

Net ticks: -4.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1550.50 for what should have been an easy slip toward the gap fill and stopped after a long 30 minutes of nothing. Mark's call triggered long at B at 1553.50 and hit first target for 6 ticks, then stopped second half under the entry:

Futures Calls Recap for 3/20/13

A loser and a winner on the flattest day we've seen yet. Holy smokes was that brutal until a bit after the Fed announcement. At one point, I couldn't even see the VWAP or market directional lines on my charts because it was so flat!

Net ticks: -4.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1550.50 for what should have been an easy slip toward the gap fill and stopped after a long 30 minutes of nothing. Mark's call triggered long at B at 1553.50 and hit first target for 6 ticks, then stopped second half under the entry:

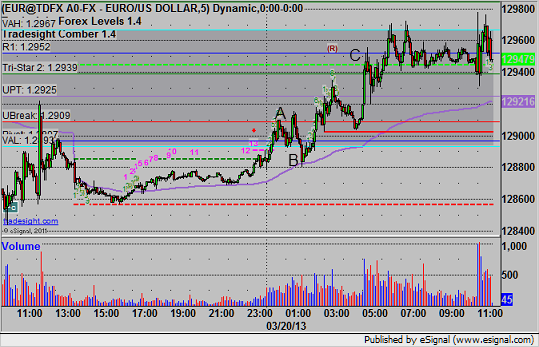

Forex Calls Recap for 3/20/13

Make sure you look at the GBPUSD for what a wild and crazy ride Forex can be (and dangerous). Along those lines, our EURUSD trade triggered and stopped just barely before working perfectly. Sometimes it happens. See both sections below.

There was no real reaction to the Fed announcement today.

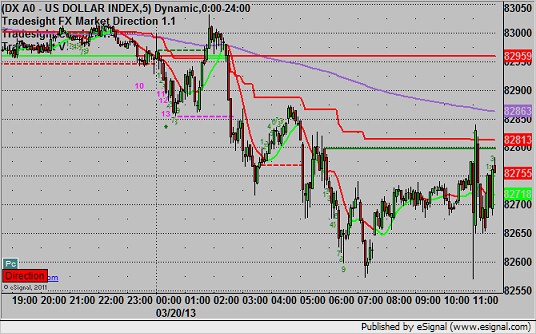

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

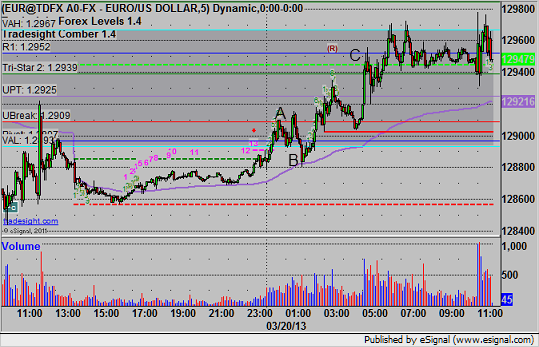

EURUSD:

We were half size ahead of the Fed announcement as little is expected on those nights. Our long triggered at A, but stopped just barely at B (bouncing off the VWAP) before working perfectly to our first target at C. Oh well, sometimes it happens:

Forex Calls Recap for 3/20/13

Make sure you look at the GBPUSD for what a wild and crazy ride Forex can be (and dangerous). Along those lines, our EURUSD trade triggered and stopped just barely before working perfectly. Sometimes it happens. See both sections below.

There was no real reaction to the Fed announcement today.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

We were half size ahead of the Fed announcement as little is expected on those nights. Our long triggered at A, but stopped just barely at B (bouncing off the VWAP) before working perfectly to our first target at C. Oh well, sometimes it happens:

Stock Picks Recap for 3/19/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, LULU gapped under the trigger, no play.

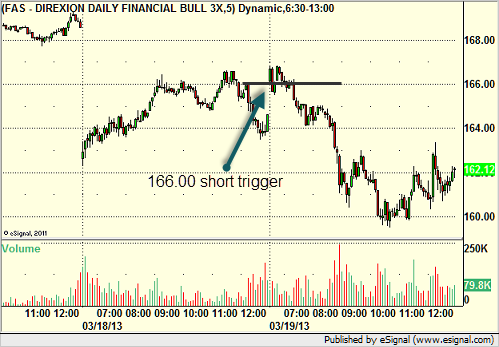

From the Messenger/Tradesight_st Twitter Feed, Rich's FAS triggered short (ETF, so no market support needed) and worked:

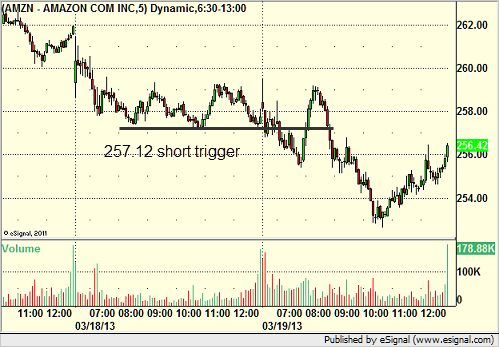

AMZN triggered short (with market support) and didn't work, worked later:

Rich's MCK triggered short (with market support) and worked:

NFLX triggered short (with market support) and didn't work:

GOOG triggered long (without market support) and didn't work:

NTAP triggered short (with market support) and worked:

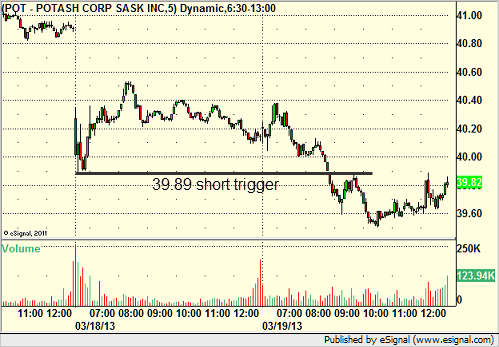

Rich's POT triggered short (with market support) and worked:

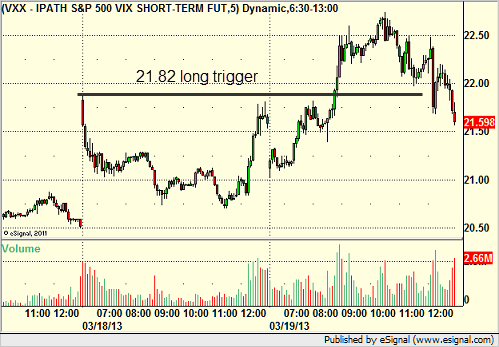

His VXX triggered long (ETF, so no market support needed) and worked:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

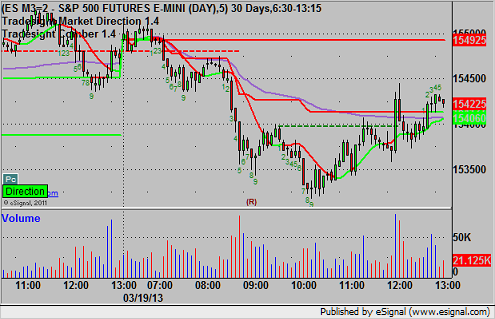

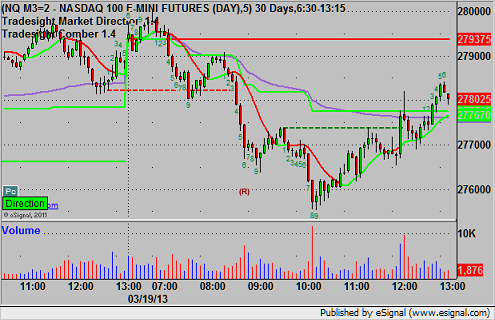

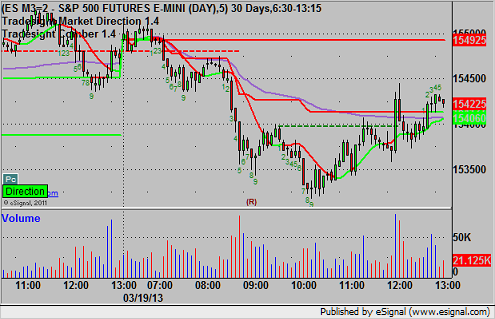

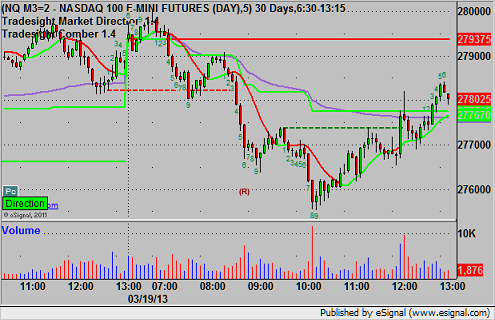

Futures Calls Recap for 3/19/13

Had a nice setup that set itself three times, but never triggered. The market volume was the lightest we have seen yet after an hour (barely over 300 million NASDAQ shares), so we made no additional calls, although the market did break lower on news out of Europe after that.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Futures Calls Recap for 3/19/13

Had a nice setup that set itself three times, but never triggered. The market volume was the lightest we have seen yet after an hour (barely over 300 million NASDAQ shares), so we made no additional calls, although the market did break lower on news out of Europe after that.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session: