Forex Calls Recap for 3/19/13

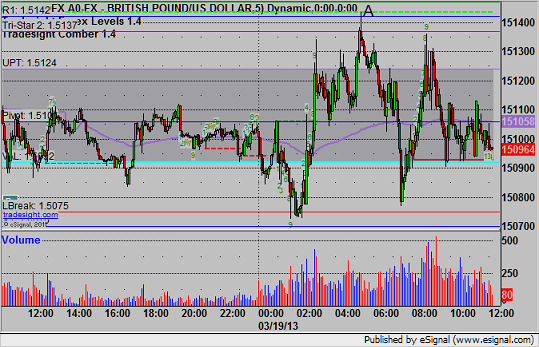

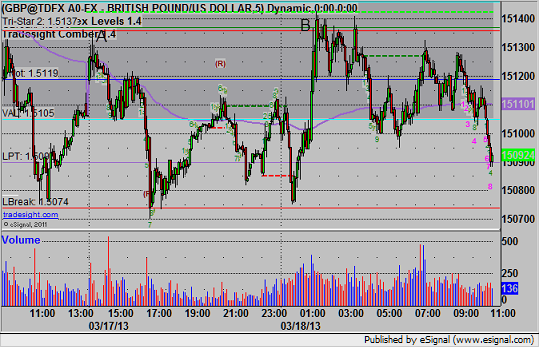

Technically no triggers for the session, or you might have taken one leg of the GBPUSD long. See that section below.

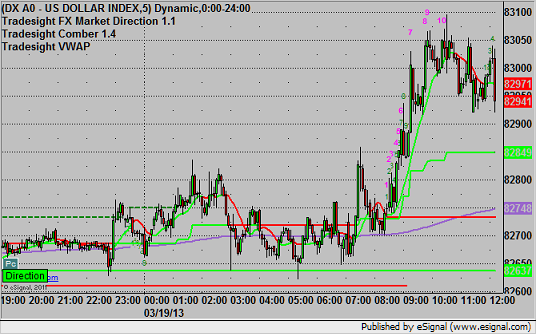

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

GBPUSD:

Under our order staggering rules, if you used the bid, then no trigger at A, but if you used the ask, you might have been put into one out of three legs of the trade, which didn't work. Overall, our short entry was the low and our long entry was the high as the market did nothing again:

Stock Picks Recap for 3/18/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered. FFIV gapped under the short trigger.

From the Messenger/Tradesight_st Twitter Feed, Rich's GLD triggered long (ETF, so no market support needed) and didn't work:

His AXP triggered long (with market support) and worked:

COST triggered long (with market support) and worked:

BIDU triggered long (with market support) and worked:

GOOG triggered long (with market support) and worked enough for a partial:

Rich's AAPL triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Stock Picks Recap for 3/18/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered. FFIV gapped under the short trigger.

From the Messenger/Tradesight_st Twitter Feed, Rich's GLD triggered long (ETF, so no market support needed) and didn't work:

His AXP triggered long (with market support) and worked:

COST triggered long (with market support) and worked:

BIDU triggered long (with market support) and worked:

GOOG triggered long (with market support) and worked enough for a partial:

Rich's AAPL triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

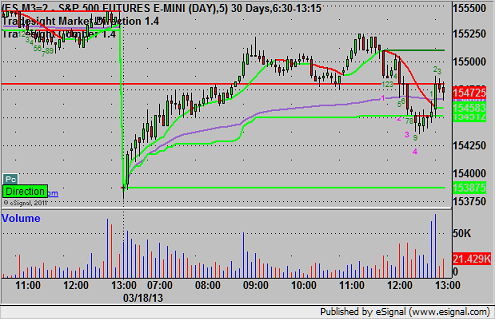

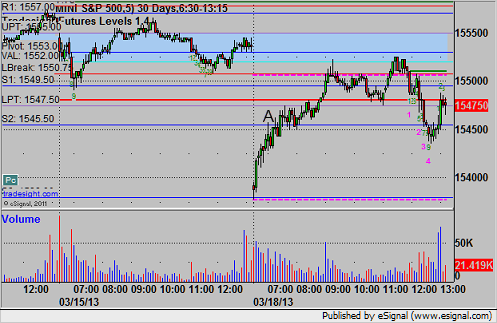

Futures Calls Recap for 3/18/13

We had a big gap down and no volume (1.4 billion NASDAQ shares total). The market recovered from the start. Called one ES trade that stopped, but didn't re-enter due to market volume (the re-trigger worked). See ES below. We continue to hold our futures trading to limit calls as the market is just not showing the volume.

Net ticks: -7 ticks.

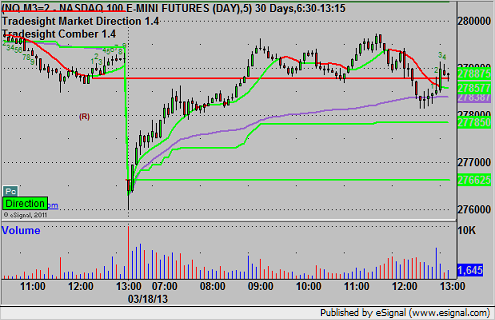

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1546.00 and stopped:

Forex Calls Recap for 3/18/13

Despite the craziness in the equity markets based on news out of Europe, there wasn't as much action in Forex again. The EURUSD gapped out of the gate, one of the bigger gaps we have seen, and it eventually headed back toward Friday's close, although didn't get there. Meanwhile, the GBPUSD was stuck in a narrow 70 pip range. See both sections below.

The action was so limited that we didn't even get a single Seeker or Comber signal on the EURUSD or the GBPUSD.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

GBPUSD:

I was excited about the GBPUSD early as it set the UBreak exactly at A right after the open. However, it ended up triggering long at B and stopping for 25 pips. The range was only 70 pips:

Stock Picks Recap for 3/15/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BIDU triggered short (without market support due to opening 5 minutes) and worked. Even though it was in the opening 5 minutes, you should have taken this one as we have been waiting for it for days:

From the Messenger/Tradesight_st Twitter Feed, Rich's GMCR triggered long (with market support) and worked:

His VXX triggered long (ETF, so no market support needed) and didn't work:

His JPM triggered short (with market support) and didn't work:

In total, that's 3 trades triggering with market support, 1 of them worked, 2 did not, but the big winner was BIDU.

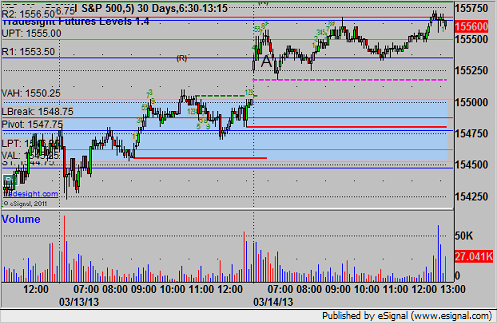

Futures Calls Recap for 3/15/13

I was on the road for the session. Mark had one call, see ES below. There was a nice NQ setup too.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

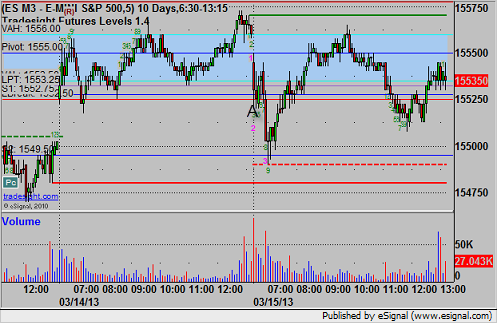

ES:

Mark's call triggered short at A at 1552.25 and stopped for 7 ticks. He called off the retrigger, which worked nicely, as gaps tend to fill more frequently on Fridays. The gap filled also, and note that the Value Area High was the high of the session:

Forex Calls Recap for 3/15/13

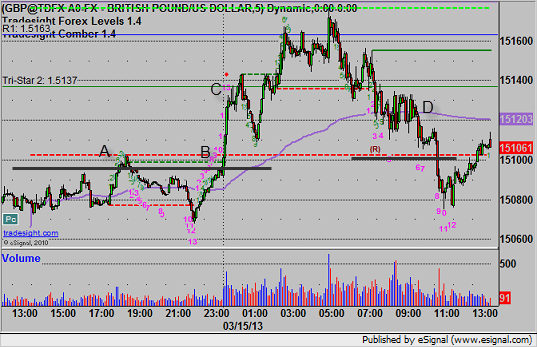

We were only looking to go half size in primetime ahead of the CPI (and triple expiration), so there were two triggers, one early for quarter size and one for half size, both on the GBPUSD. See that section below.

As usual on the Sunday report, we will take a look at the action from Thursday night/Friday, then look at the daily charts of the ten pairs that we cover with the Seeker and Comber separately heading into next week (no signals or chart patterns at ALL), and then glance at the US Dollar Index.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

GBPUSD:

Triggered long very early (quarter size) at A and stopped. Note the Comber buy signal at the low after that, then retriggered at B, hit first target at C. Adjusted the stop in the morning under 1.5100, but should have closed at D for end of week when Europe shut down:

Stock Picks Recap for 3/14/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

We had a LOT of calls, and not many triggered in a slow session.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's VLO triggered short (with market support) and worked enough for a partial:

GOOG triggered short (with market support) and didn't work:

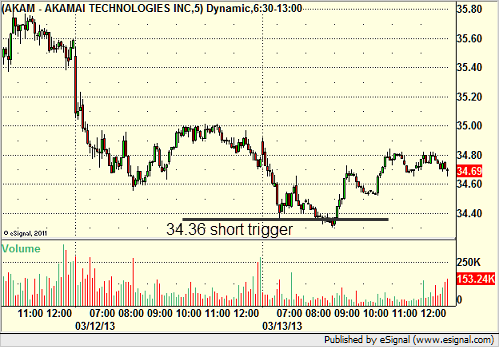

Rich's AKAM triggered short (without market support) and didn't work:

His ONXX triggered long (with market support) and worked enough for a partial (barely):

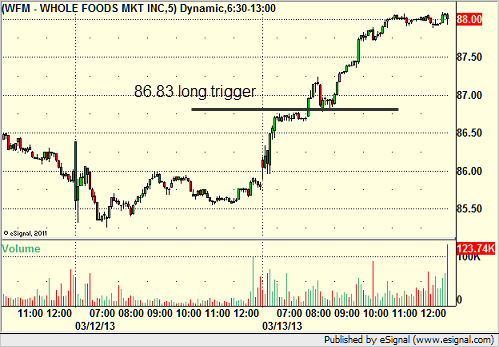

His WFM triggered long (with market support) and worked great:

His AAPL triggered short (without market support) and worked:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Futures Calls Recap for 3/14/13

A trigger on the ES and a few on the NQ, one of which unfortunately stopped before it worked again. Overall, another narrow session, not even half of average daily range, and we really didn't see an options unraveling move for triple expiration, which is unusual but par for the last two weeks. Volume was only 1.45 billion NASDAQ shares.

Net ticks: -6 ticks.

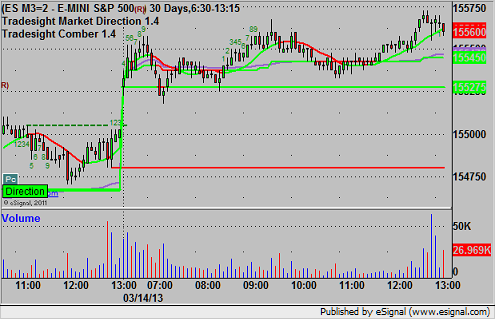

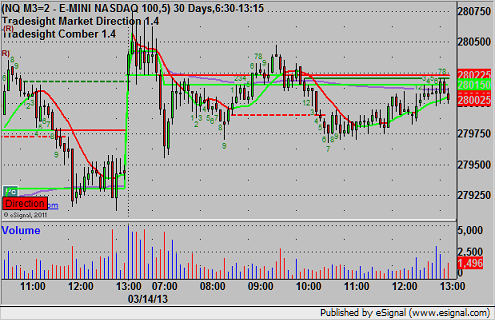

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1553.00, missed the first target by a tick and stopped for 6 ticks:

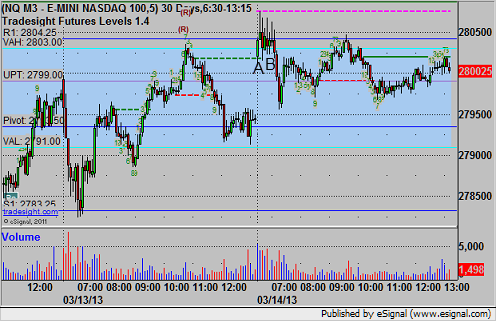

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark had a call and I had a call, which even confused me as I thought I had typo'd Mark's call. So, since they were both their own calls, here we go.

Mark's triggered short at 2801.50 at A and stopped. Triggered short again at B, hit first target for 6 ticks, and stopped the remaining at 2799.50. Mine was under the opening bar low and triggered short at C at 2800.50, hit first target for six ticks, and stopped the second half at 2799.50: