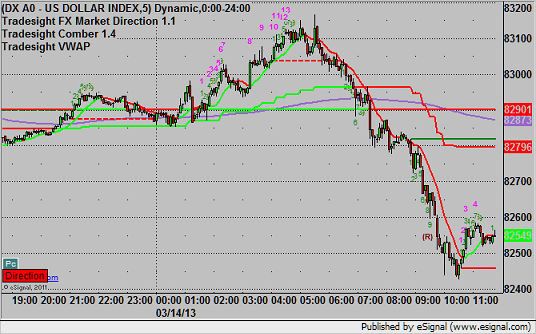

Forex Calls Recap for 3/14/13

One trade that came within 3 pips of the first target and a winner on the EURUSD. See that section below. Also see the GBPUSD section below.

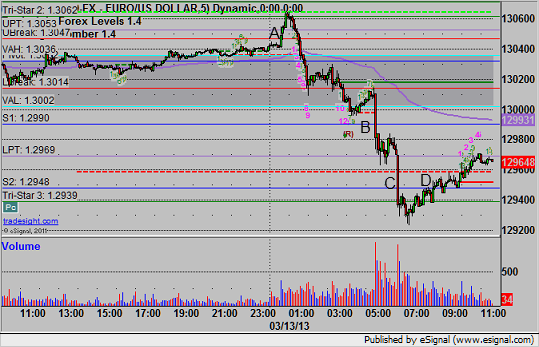

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

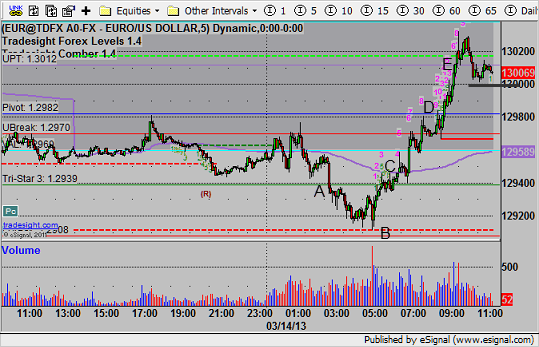

EURUSD:

Triggered short at A, came within 3 pips of the first target (LBreak) at B, which should have gotten you out of at least a piece of the trade under our order staggering rules. Lowered the stop in the morning and stopped at C. Triggered long at D, hit first target at E, still holding with a stop under the black line at 1.3000:

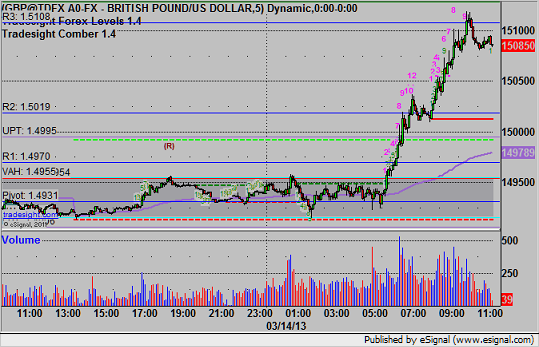

GBPUSD:

We talked last night in the Lab about taking a scalp on the GBPUSD over the Pivot, and you have to love how it triggered and went EXACTLY to the UBreak/VAH. Quite remarkable:

Stock Picks Recap for 3/13/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

We had a LOT of calls, and not many triggered in a slow session.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's VLO triggered short (with market support) and worked enough for a partial:

GOOG triggered short (with market support) and didn't work:

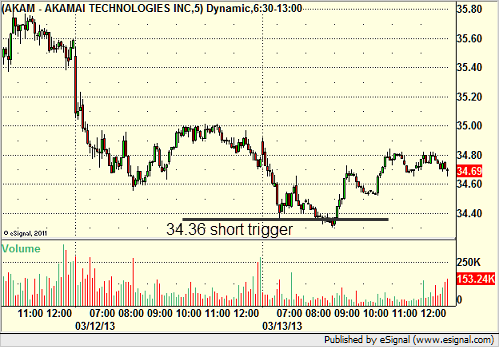

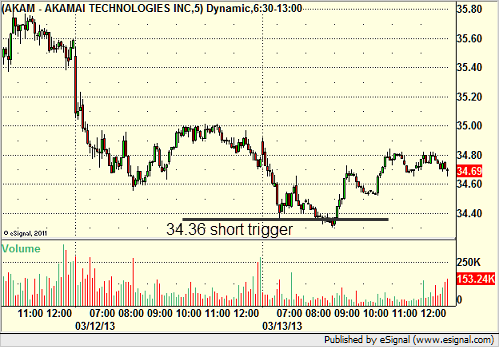

Rich's AKAM triggered short (without market support) and didn't work:

His ONXX triggered long (with market support) and worked enough for a partial (barely):

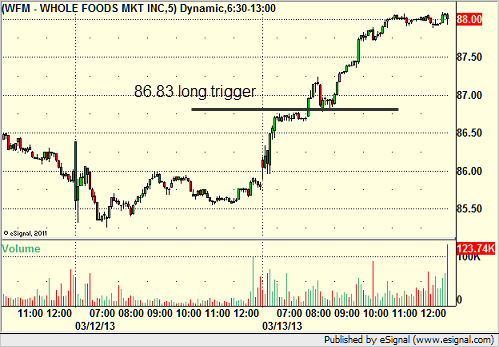

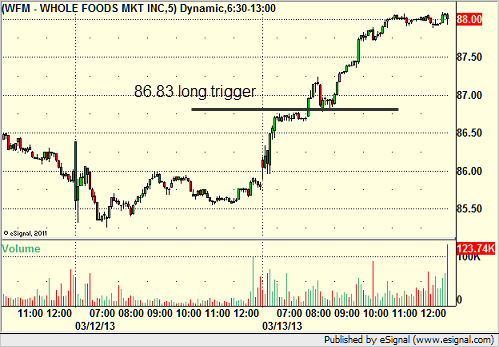

His WFM triggered long (with market support) and worked great:

His AAPL triggered short (without market support) and worked:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Stock Picks Recap for 3/13/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

We had a LOT of calls, and not many triggered in a slow session.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's VLO triggered short (with market support) and worked enough for a partial:

GOOG triggered short (with market support) and didn't work:

Rich's AKAM triggered short (without market support) and didn't work:

His ONXX triggered long (with market support) and worked enough for a partial (barely):

His WFM triggered long (with market support) and worked great:

His AAPL triggered short (without market support) and worked:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Futures Calls Recap for 3/13/13

A nice setup early on the ES that didn't trigger, and another nice setup out of a cup and handle in the afternoon that didn't trigger, so no triggers on the day. We had the lightest volume of the week at only 1.4 billion NASDAQ shares.

Net ticks: +0 ticks.

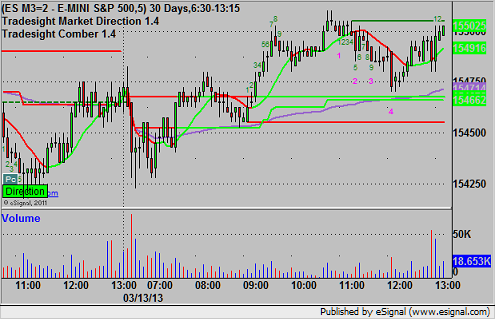

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Futures Calls Recap for 3/13/13

A nice setup early on the ES that didn't trigger, and another nice setup out of a cup and handle in the afternoon that didn't trigger, so no triggers on the day. We had the lightest volume of the week at only 1.4 billion NASDAQ shares.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Forex Calls Recap for 3/13/13

A loser and a winner on the EURUSD. See that section below.

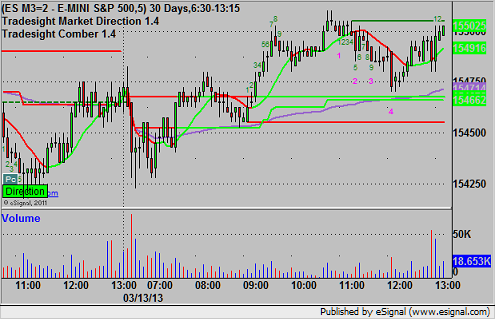

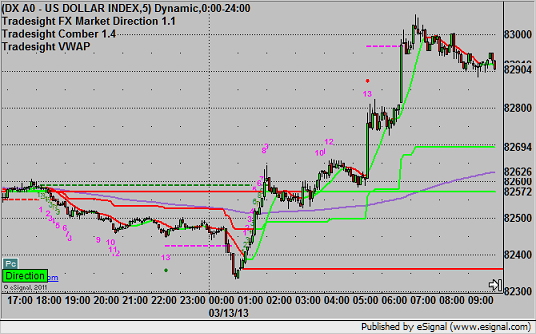

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

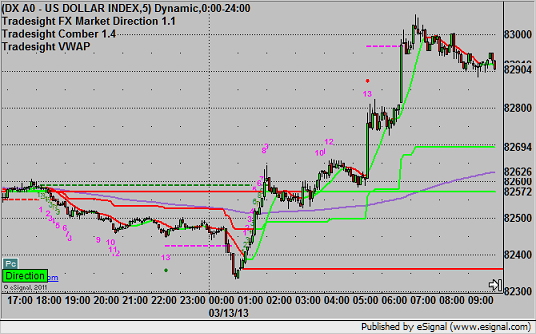

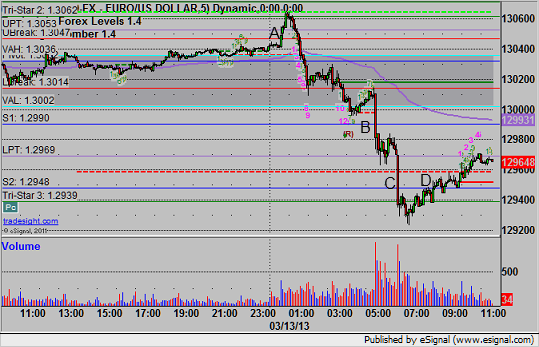

Triggered long at A overnight and stopped for 25 pips. Triggered short at B, hit first target at C, closed second half at D on a stop:

Forex Calls Recap for 3/13/13

A loser and a winner on the EURUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A overnight and stopped for 25 pips. Triggered short at B, hit first target at C, closed second half at D on a stop:

Stock Picks Recap for 3/12/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ZIOP triggered long (without market support) and worked:

MSCC triggered long (with market support) and didn't work:

CPHD triggered long (without market support due to opening 5 minutes) and didn't work. It triggered later and worked:

MNST triggered short (without market support) and didn't work, worked later with market support:

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered long (ETF, so no market support needed) and didn't work, worked later:

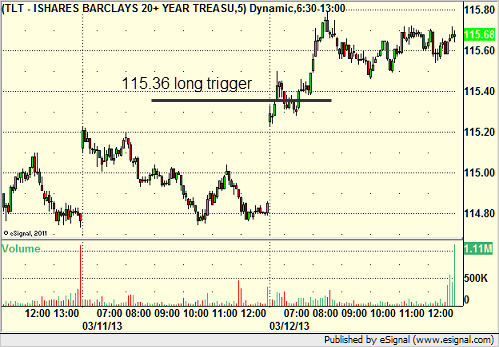

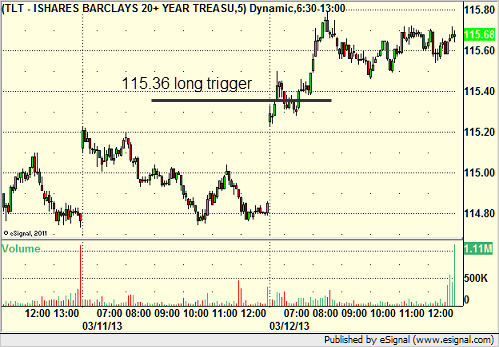

His TLT triggered long (ETF, so no market support needed) and worked great:

His GOOG triggered short (with market support) and didn't work:

We called the GOOG short again and it triggered (with market support) and worked enough for a partial:

His FAS triggered short (ETF, so no market support needed) and didn't work, worked later:

BIDU triggered short (without market support) and didn't work, worked later with market support:

Rich's GDX triggered long (ETF, so no market support needed) and worked:

Rich's second VXX call triggered long (ETF, so no market support needed) and worked:

His NTAP triggered short (with market support) and didn't work:

In total, that's 9 trades triggering with market support, 4 of them worked, 5 did not.

Stock Picks Recap for 3/12/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ZIOP triggered long (without market support) and worked:

MSCC triggered long (with market support) and didn't work:

CPHD triggered long (without market support due to opening 5 minutes) and didn't work. It triggered later and worked:

MNST triggered short (without market support) and didn't work, worked later with market support:

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered long (ETF, so no market support needed) and didn't work, worked later:

His TLT triggered long (ETF, so no market support needed) and worked great:

His GOOG triggered short (with market support) and didn't work:

We called the GOOG short again and it triggered (with market support) and worked enough for a partial:

His FAS triggered short (ETF, so no market support needed) and didn't work, worked later:

BIDU triggered short (without market support) and didn't work, worked later with market support:

Rich's GDX triggered long (ETF, so no market support needed) and worked:

Rich's second VXX call triggered long (ETF, so no market support needed) and worked:

His NTAP triggered short (with market support) and didn't work:

In total, that's 9 trades triggering with market support, 4 of them worked, 5 did not.

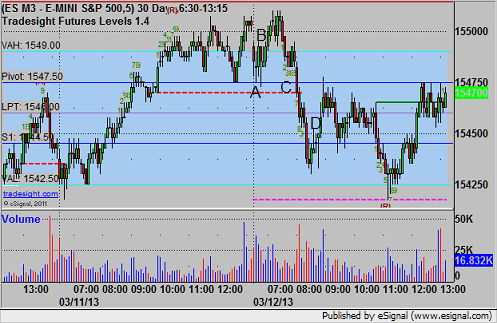

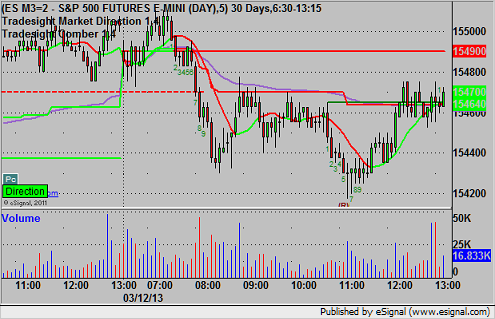

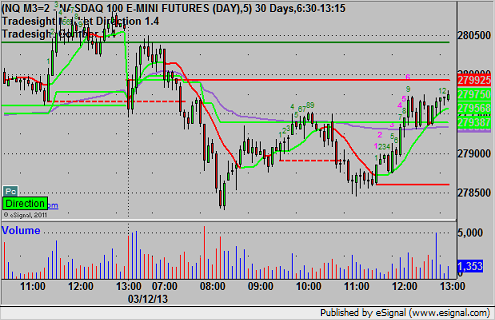

Futures Calls Recap for 3/12/13

A better day, but one false start again and an extremely flat opening hour. The ES filled the gap and then rolled hard. See that section below for the recap of the trades. Volume was 1.5 billion NASDAQ shares again.

Net ticks: +4.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Swept the trigger short at A at 1547.25, and I said to take a retrigger. Triggered long at B at 1549.75 and filled the gap, closed it for four ticks winner when the market seemed to be stalling at the gap fill after some time. Triggered short again at C (same short trigger), hit first target for 6 ticks, lowered stop twice and stopped in the money at 1545.00 at D: