Forex Calls Recap for 3/12/13

A winner on the EURUSD and some better action as we put the time change sync behind us. See EURUSD section below.

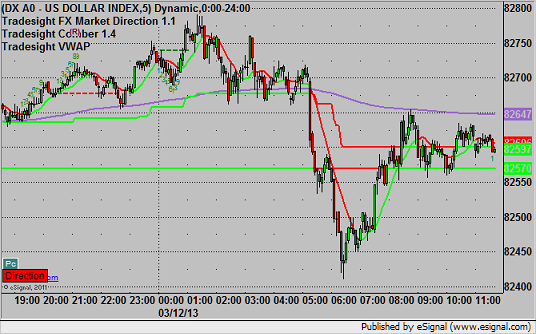

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

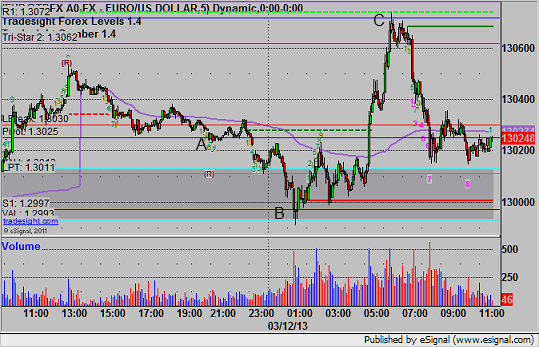

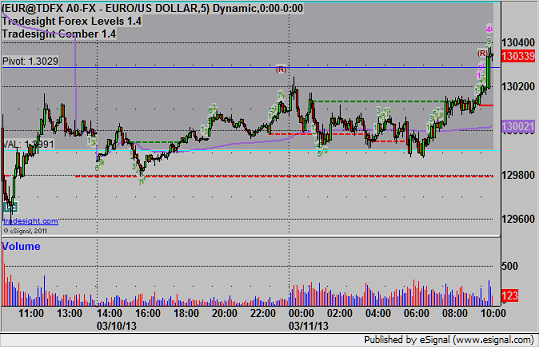

EURUSD:

Triggered short at A, crossed the Value Area perfectly to B, second half stopped. Note the high is R1 at C:

Stock Picks Recap for 3/11/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, VECO triggered long (with market support) and worked enough for a partial (also had a Comber sell signal at the high):

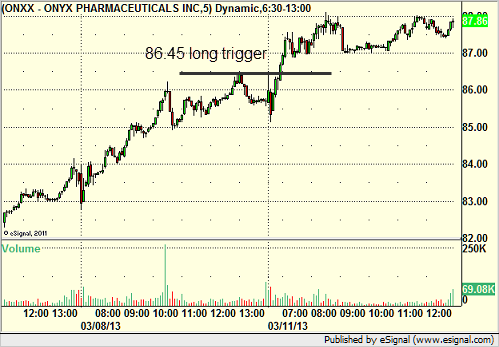

ONXX triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's FIRE triggered long (without market support) and didn't work:

His VXX triggered short (ETF, so no market support needed) and worked great:

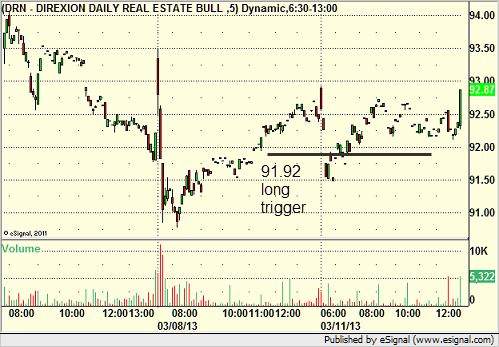

His DRN triggered long (ETF, so no market support needed) and worked, but a very thin ETF:

Mark's C triggered long (with market support) and worked:

Mark's BIIB triggered long (with market support) and worked:

Rich's CLF triggered short (without market support) and didn't work:

AAPL triggered long (with market support) and worked:

AMZN triggered short late in the day (without market support) and didn't work:

In total, that's 7 trades triggering with market support, all 7 of them worked.

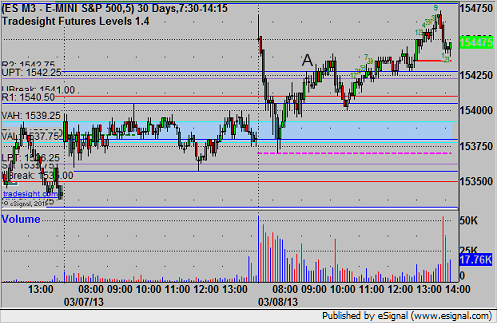

Futures Calls Recap for 3/11/13

Another day of light volume, bad range, and frankly just narrow bars in the futures. One call on the ES stopped and we didn't do any more. It did set the UPT and then break it and work, but action was just too tame.

Net ticks: -7 ticks.

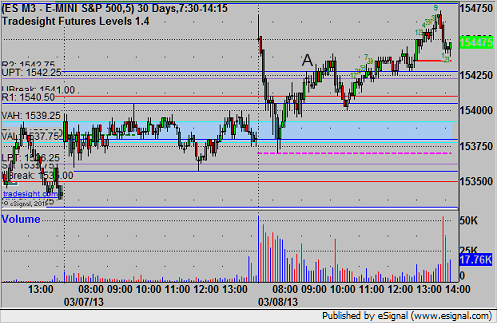

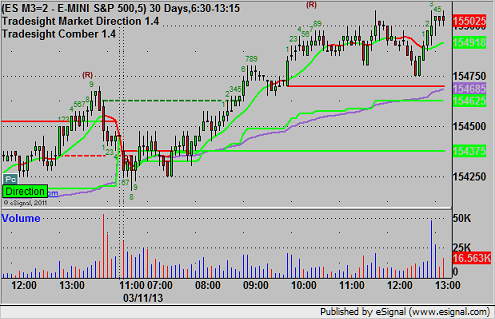

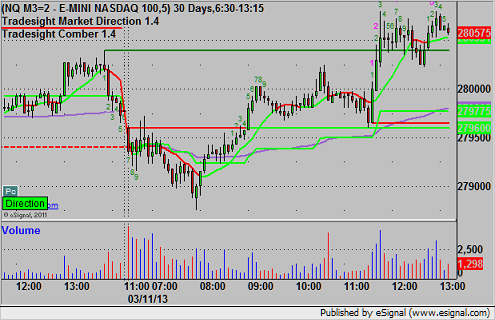

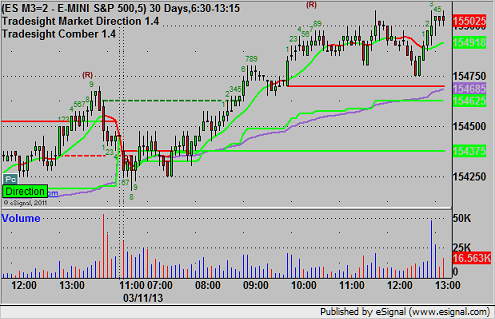

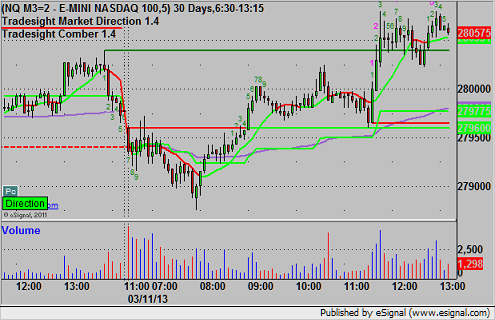

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1542.25 and stopped for 7 ticks:

Futures Calls Recap for 3/11/13

Another day of light volume, bad range, and frankly just narrow bars in the futures. One call on the ES stopped and we didn't do any more. It did set the UPT and then break it and work, but action was just too tame.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1542.25 and stopped for 7 ticks:

Forex Calls Recap for 3/11/13

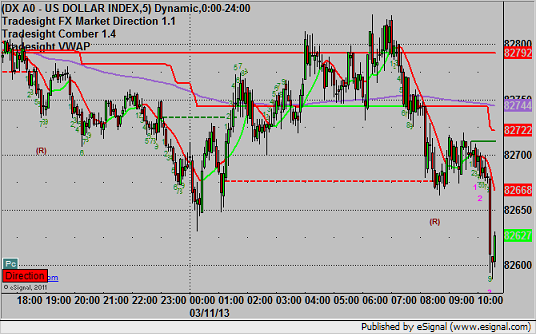

As I mentioned, the first day or two after the time change can be fairly flat as the volume of the Forex pairs changes slightly since the hours aren't synced the same. This led to 40 pips of range in the EURUSD for the session. Our GBPUSD trade triggered, see below. Hopefully, we shake this off and get back to ranges immediately. Note that my charts are now on Pacific Time.

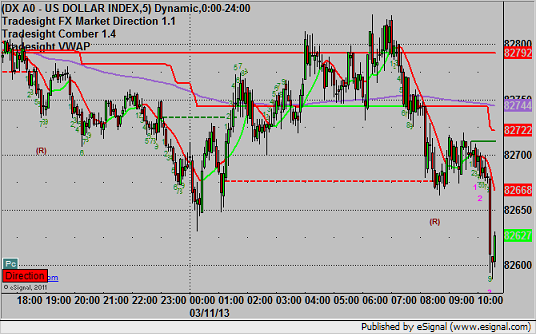

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

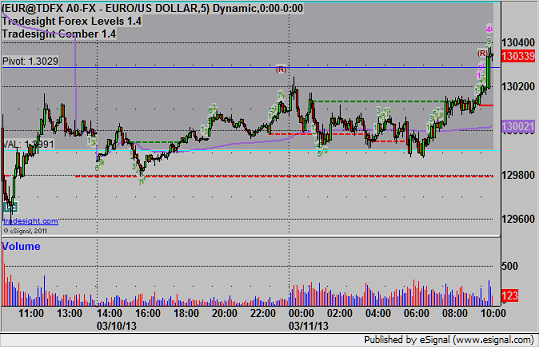

EURUSD:

We had a long over the Pivot, but it triggered too late in the session (just as I was taking screenshots):

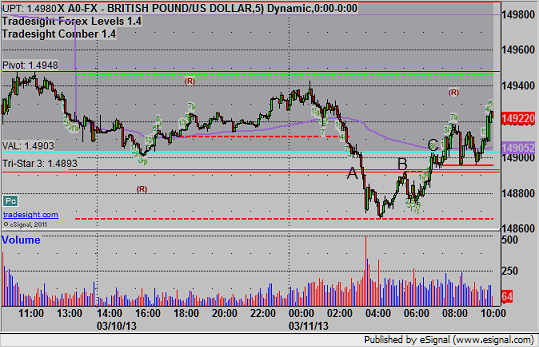

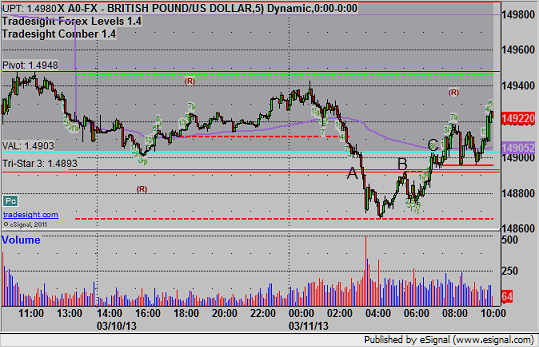

GBPUSD:

Triggered short at A, retested the trigger perfectly at B, and then didn't quite get to the first target. The trade took hours to play out, so in the morning, I lowered the stop just over VAL for little risk and stopped at C:

Forex Calls Recap for 3/11/13

As I mentioned, the first day or two after the time change can be fairly flat as the volume of the Forex pairs changes slightly since the hours aren't synced the same. This led to 40 pips of range in the EURUSD for the session. Our GBPUSD trade triggered, see below. Hopefully, we shake this off and get back to ranges immediately. Note that my charts are now on Pacific Time.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

We had a long over the Pivot, but it triggered too late in the session (just as I was taking screenshots):

GBPUSD:

Triggered short at A, retested the trigger perfectly at B, and then didn't quite get to the first target. The trade took hours to play out, so in the morning, I lowered the stop just over VAL for little risk and stopped at C:

Stock Picks Recap for 3/8/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CROX gapped over the trigger, no play.

SHLD triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered short (with market support) and worked:

His AAPL triggered long (without market support) and worked:

GOOG triggered short (with market support) and worked:

In total, that's 3 trades triggering with market support, all 3 worked.

Stock Picks Recap for 3/8/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CROX gapped over the trigger, no play.

SHLD triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered short (with market support) and worked:

His AAPL triggered long (without market support) and worked:

GOOG triggered short (with market support) and worked:

In total, that's 3 trades triggering with market support, all 3 worked.

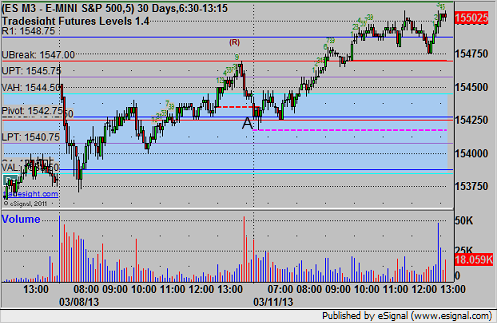

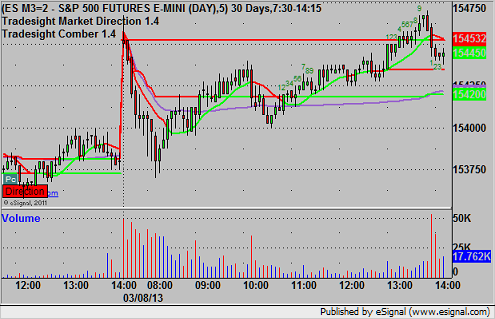

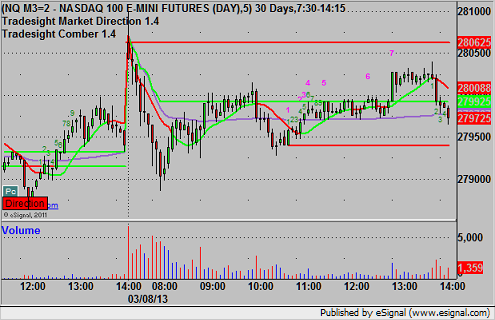

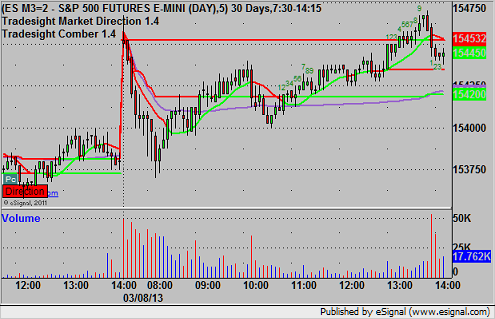

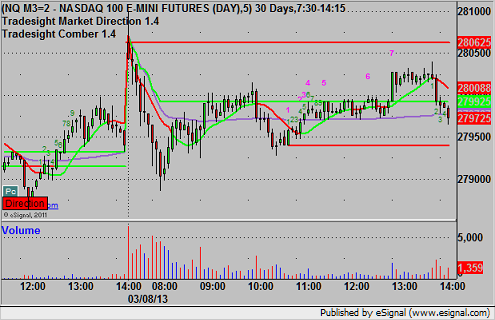

Futures Calls Recap for 3/8/13

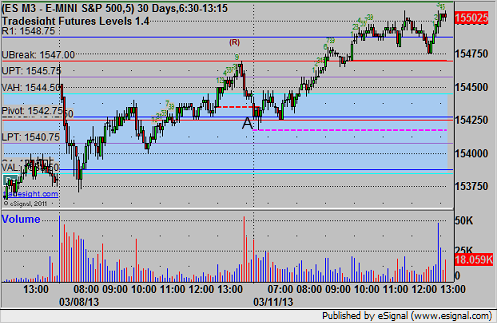

The Levels were very tightly spaced because of how flat Thursday was. We gapped up early and filled the gap quickly without setting any of the Levels, and you knew it wasn't going to turn into much else after that. I posted one trade because the ES set the R2, but listed it as half size because I wasn't expecting much. See that section below.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1543.00 and stopped:

Futures Calls Recap for 3/8/13

The Levels were very tightly spaced because of how flat Thursday was. We gapped up early and filled the gap quickly without setting any of the Levels, and you knew it wasn't going to turn into much else after that. I posted one trade because the ES set the R2, but listed it as half size because I wasn't expecting much. See that section below.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1543.00 and stopped: