Forex Calls Recap for 3/8/13

Closed out the winner from the prior session on the EURUSD, and then a new winner and loser to wrap up the week.

As usual on the Sunday report, we will take a look at the action from Thursday night/Friday, then look at the daily charts heading into the new week (nothing new to see for setups), and then glance at the US Dollar Index.

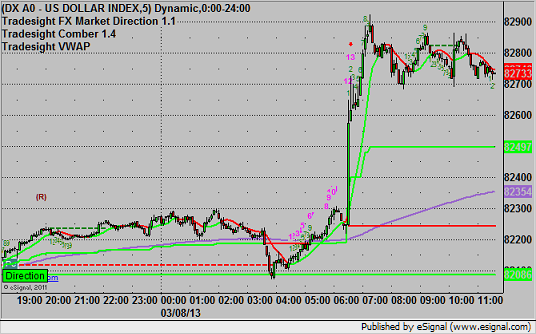

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A and stopped. Triggered short at B, hit first target at C, lowered stop and exited for end of week at D at 1.2980:

Stock Picks Recap for 3/7/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ADSK triggered long (with market support) and didn't go a dime in either direction, doesn't count.

CRZO triggered long (with market support) and worked:

DISH triggered short (with market support) and worked enough for a partial:

EBAY triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOG triggered long (with market support) and didn't work:

Another EBAY call (really an early entry to the main call) triggered short (with market support) and worked:

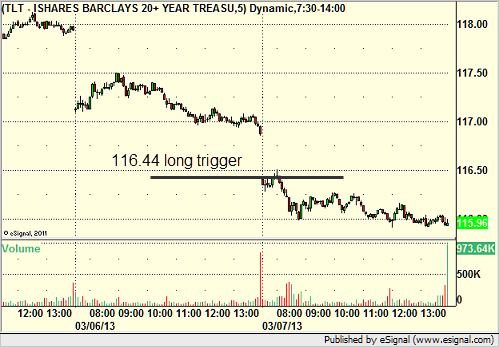

Rich's TLT triggered long (ETF, so no market support needed) and didn't work:

FSLR triggered short (with market support) and worked:

Rich's GILD triggered short (without market support) and didn't work:

His AMGN triggered short (without market support) and didn't work:

His SHLD triggered long (with market support) and worked:

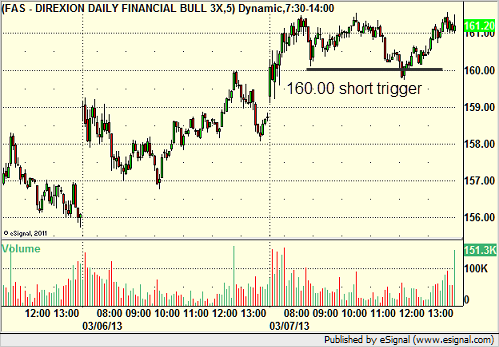

His FAS triggered short (ETF, so no market support needed) and didn't work:

In total, that's 9 trades triggering with market support, 6 of them worked, 3 did not.

Futures Calls Recap for 3/7/13

We always come into the quarterly contract roll date with little expectations. However, we did have enough of a gap and an early setup to give one trade a try. In the end, the market did what it usually does on options contract roll day...nothing at all. Market volume was a horrible 1.4 billion NASDAQ shares to go with it.

Net ticks: -7 ticks.

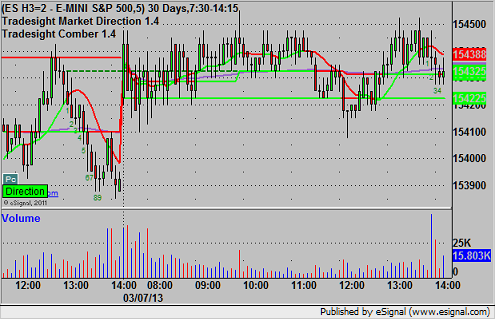

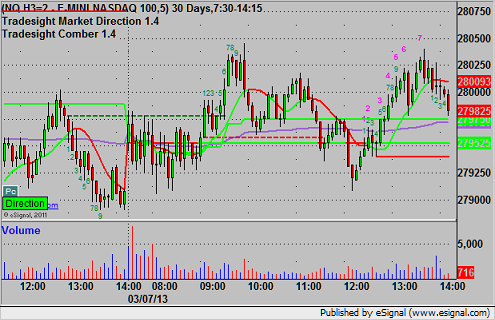

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

The opening bar set the UPT from above, so we took the short at A at 1541.75 breaking under that for the gap, but nothing happened. No re-entry as the market was clearly dead:

Forex Calls Recap for 3/7/13

We closed out the final piece of the prior day's EURUSD trade in the money and then had another nice winner. See that section below.

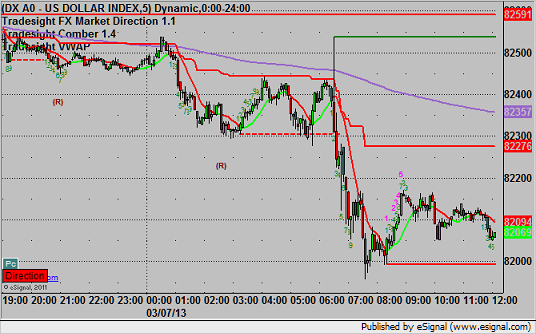

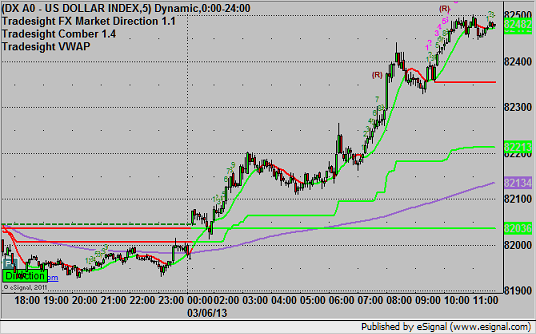

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

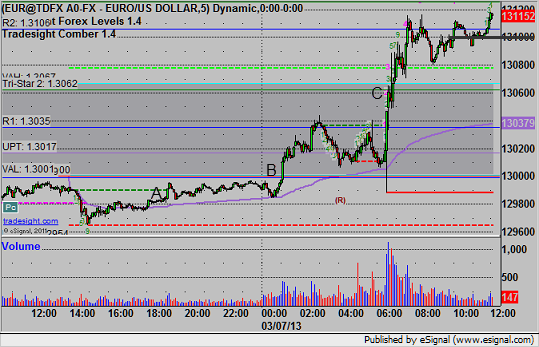

EURUSD:

Stopped the final piece of the short from Wednesday at A about 20 pips in the money. Triggered long at B, hit first target at C, and raised the stop twice and currently holding with a stop under 1.3100:

Stock Picks Recap for 3/6/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PMTC triggered long (without market support) and didn't work:

SPRD triggered long (without market support due to opening 5 minutes) and didn't work:

PAYX gapped over, no play.

JBLU triggered long (without market support) and didn't get a dime in either direction, so doesn't count:

DMND triggered long (without market support just barely) and worked great:

From the Messenger/Tradesight_st Twitter Feed, Rich's SNDK triggered long (with market support) and didn't work:

NFLX triggered short (with market support) and worked enough for a partial:

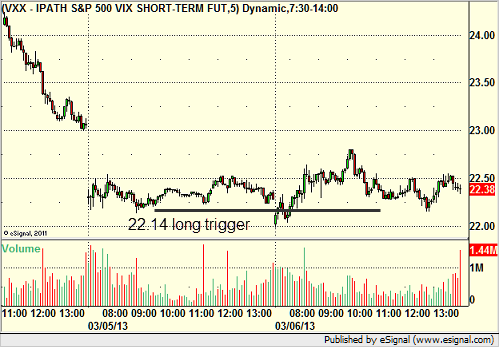

Rich's VXX triggered long (with market support) and worked:

GOOG triggered short (with market support) and didn't work:

AMZN triggered short (with market support) and worked:

GS triggered long (with market support) and didn't work:

Rich's SINA triggered short (with market support) and didn't work:

In total, that's 7 trades triggering with market support, 3 of them worked, 3 did not, 1 didn't do anything. No surprise on a day where the market was stuck.

Futures Calls Recap for 3/6/13

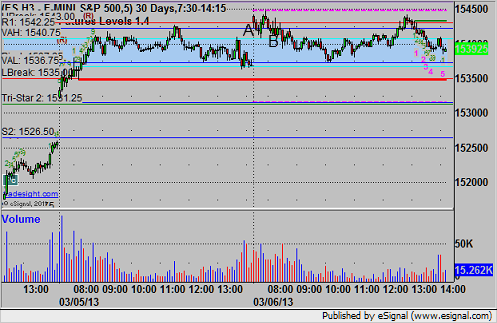

Well, another joke of a session with only 6 points of range on the ES on 1.6 billion NASDAQ shares. Several triggers on the ES and YM, but both had a stop out before they ended up working. Wasn't much to bother with after that as we spent the rest of the session near the VWAP. The ES gap did NOT fill (by a tick, of course).

Net ticks: -12 ticks.

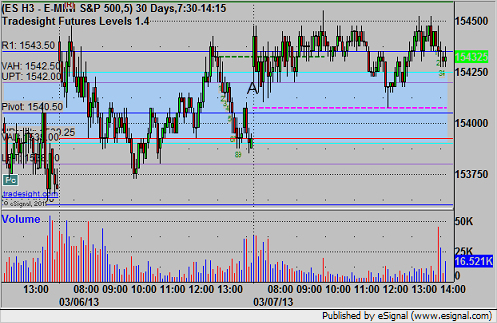

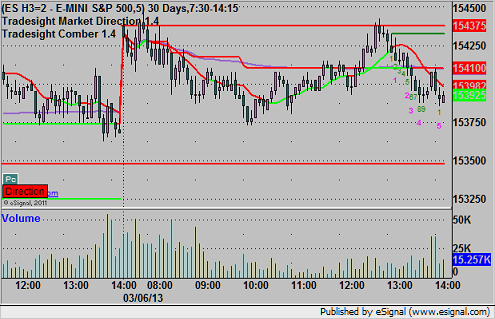

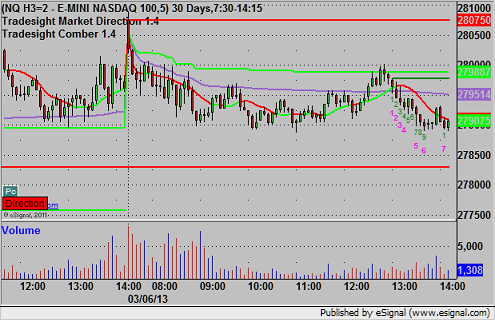

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1542.00, came within a tick of the first target but then reversed and stopped for 7 ticks (the move set the VAH). Second was the Value Area Plays, triggered short at B at 1540.50, hit first target for 6 ticks, I was late adjusting the stop (should have been over entry), so stop went over 1541.00:

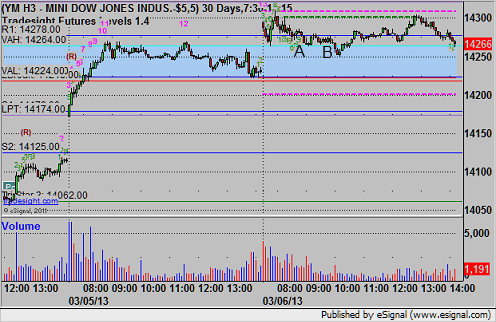

YM:

Mark's call was a nice Value Area setup after the YM bounced off of it early in the session. Triggered short (hit the entry) at A and stopped for 11 ticks. Re-triggered at B and hit first target for 10 ticks, but again, reversed right back up and stopped over the entry:

Forex Calls Recap for 3/6/13

Nothing overnight, but a clean trigger in the morning on the EURUSD. See that section below.

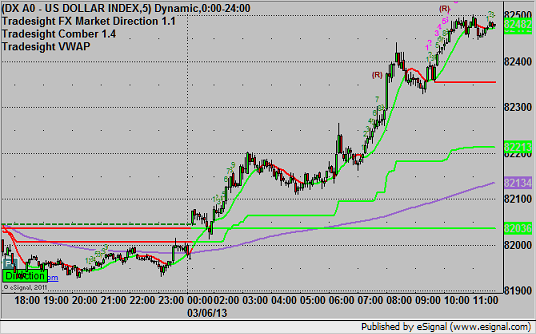

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

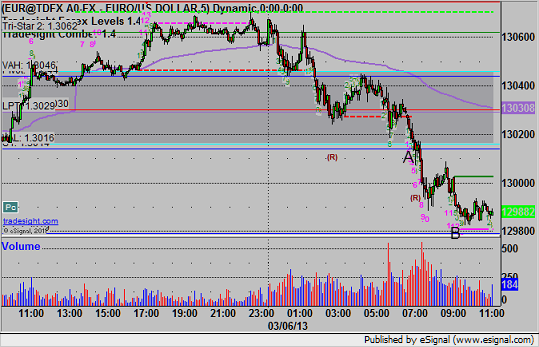

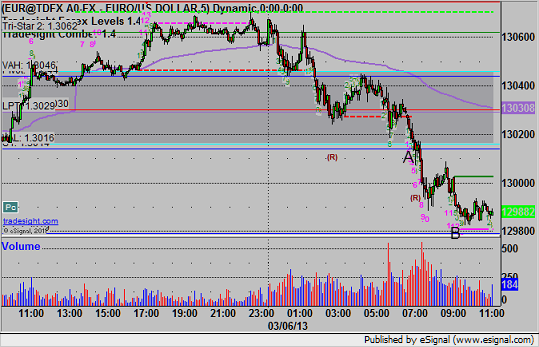

EURUSD:

Triggered short at A, hit first target at B (came within 4 pips, but we got a Comber buy signal, so I posted to make sure everyone took the partial there), and holding second half with a stop over S1:

Forex Calls Recap for 3/6/13

Nothing overnight, but a clean trigger in the morning on the EURUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered short at A, hit first target at B (came within 4 pips, but we got a Comber buy signal, so I posted to make sure everyone took the partial there), and holding second half with a stop over S1:

Stock Picks Recap for 3/5/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, INCY triggered long (without market support due to opening 5 minutes) and didn't work:

CTSH triggered long (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's QCOM triggered long (with market support) and didn't work:

Mark's LRCX triggered long (with market support) and worked:

Rich's SNDK triggered long (with market support) and didn't work:

His CLF triggered long (with market support) and worked:

His XLNX triggered long (with market support) and didn't work:

His GOOG triggered long (with market support) and worked for a point:

In total, that's 7 trades triggering with market support, 4 of them worked, 3 did not.

Stock Picks Recap for 3/5/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, INCY triggered long (without market support due to opening 5 minutes) and didn't work:

CTSH triggered long (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's QCOM triggered long (with market support) and didn't work:

Mark's LRCX triggered long (with market support) and worked:

Rich's SNDK triggered long (with market support) and didn't work:

His CLF triggered long (with market support) and worked:

His XLNX triggered long (with market support) and didn't work:

His GOOG triggered long (with market support) and worked for a point:

In total, that's 7 trades triggering with market support, 4 of them worked, 3 did not.