Stock Picks Recap for 2/27/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

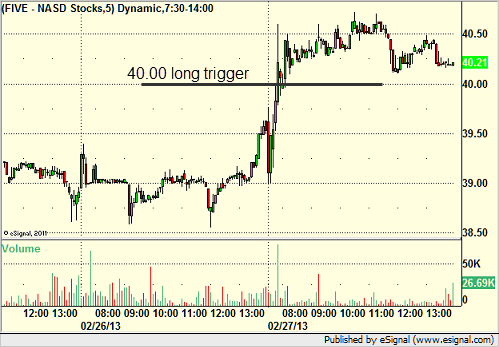

From the report, FIVE triggered long (with market support) and worked:

LPSN triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered short (ETF, so no market support needed) and worked:

NTAP triggered long (with market support) and worked:

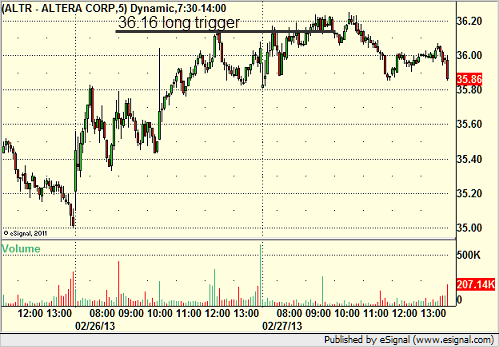

Mark's ALTR triggered long (with market support) and he closed at even when it didn't run with the market:

GOOG triggered long (with market support) and did not work initially (which is what we count officially) but worked great on the retrigger a few minutes later:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 didn't.

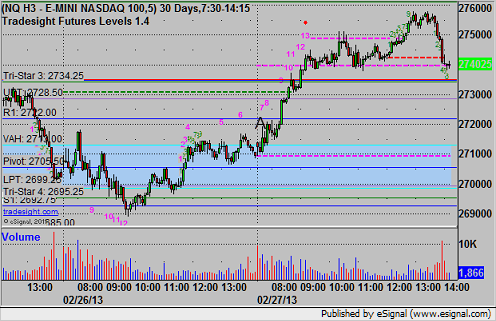

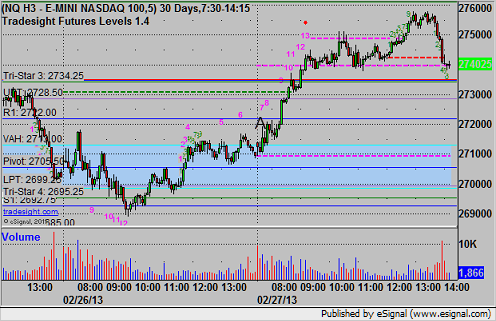

Futures Calls Recap for 2/27/13

A trade that stopped out once and then worked a little the second time (and much better later) on the NQ. See that section below. Volume was crazy low at only 1.4 billion NASDAQ shares.

Net ticks: -4.5 ticks.

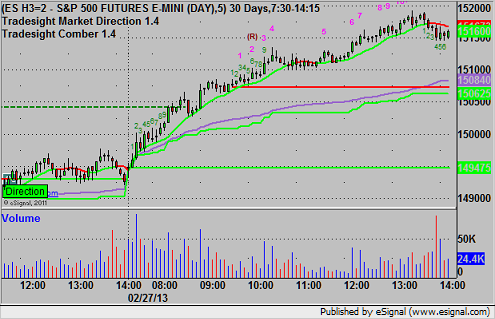

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

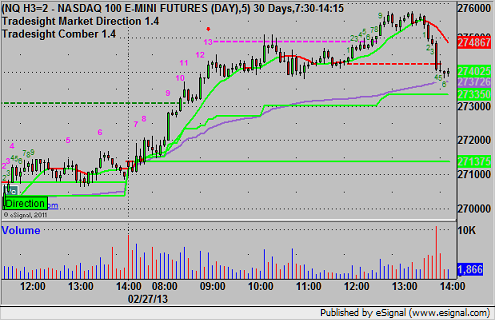

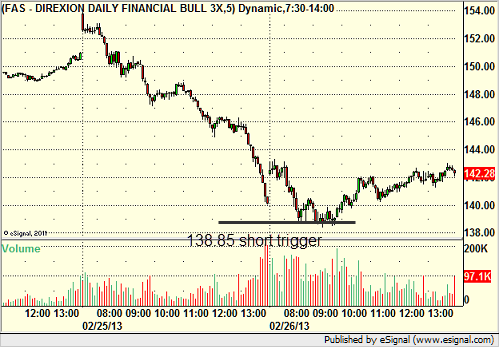

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long at A at 2717.50 and stopped for 7 ticks. Took the trade again 10 minutes later, hit first target for 6 ticks, and stopped second half under the entry:

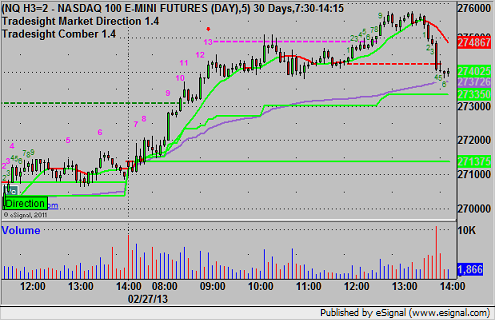

Futures Calls Recap for 2/27/13

A trade that stopped out once and then worked a little the second time (and much better later) on the NQ. See that section below. Volume was crazy low at only 1.4 billion NASDAQ shares.

Net ticks: -4.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long at A at 2717.50 and stopped for 7 ticks. Took the trade again 10 minutes later, hit first target for 6 ticks, and stopped second half under the entry:

Forex Calls Recap for 2/27/13

A winner on the EURUSD. See that section below.

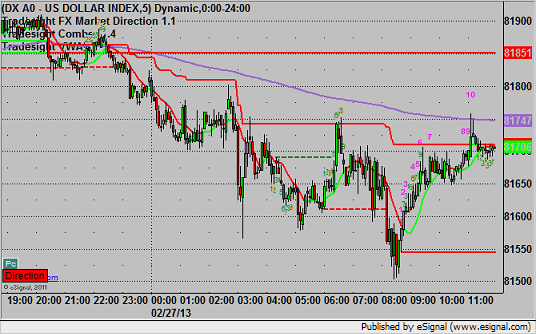

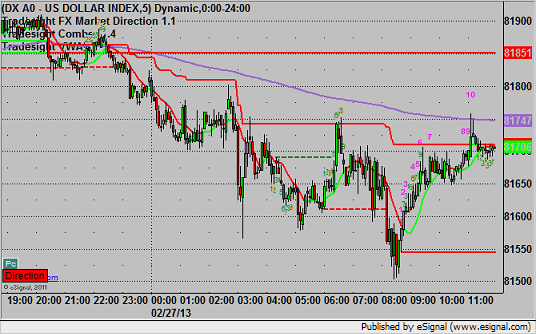

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

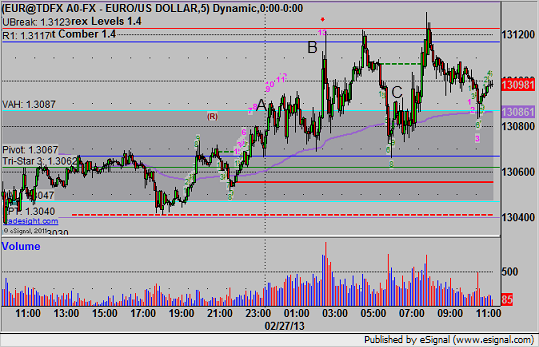

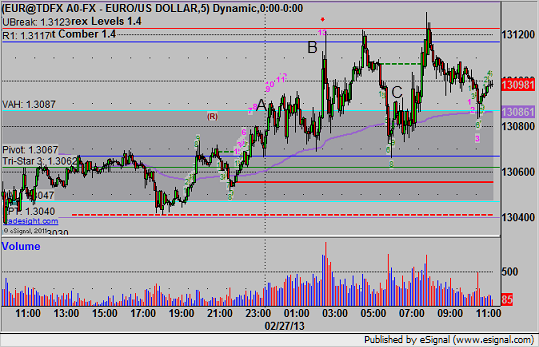

EURUSD:

Triggered long at A, hit first target at B (Comber 13 sell signal right there) and closed out the final piece at the entry under letter C on the chart in the morning:

Forex Calls Recap for 2/27/13

A winner on the EURUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A, hit first target at B (Comber 13 sell signal right there) and closed out the final piece at the entry under letter C on the chart in the morning:

Stock Picks Recap for 2/26/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, COST triggered short (with market support) and didn't work (worked later):

SINA triggered short (with market support) and worked:

JDSU triggered short (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (without market support due to opening 5 minutes) and didn't work, worked a few minutes later:

FB triggered short (with market support) and didn't work:

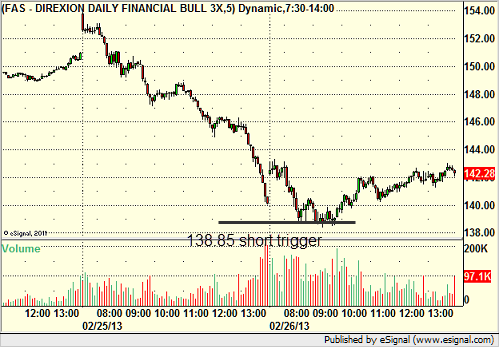

Rich's FAS triggered short (ETF, so no market support needed) and didn't work:

In total, that's 5 trades triggering with market support, 1 of them worked, 4 did not.

Stock Picks Recap for 2/26/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, COST triggered short (with market support) and didn't work (worked later):

SINA triggered short (with market support) and worked:

JDSU triggered short (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (without market support due to opening 5 minutes) and didn't work, worked a few minutes later:

FB triggered short (with market support) and didn't work:

Rich's FAS triggered short (ETF, so no market support needed) and didn't work:

In total, that's 5 trades triggering with market support, 1 of them worked, 4 did not.

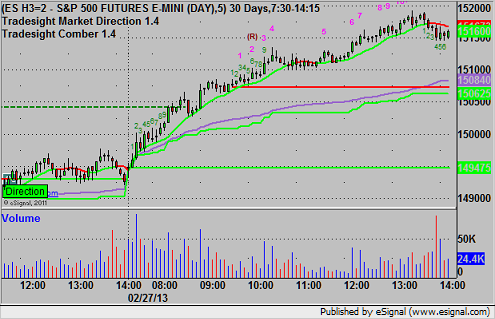

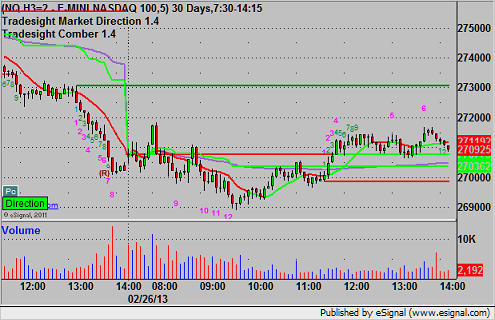

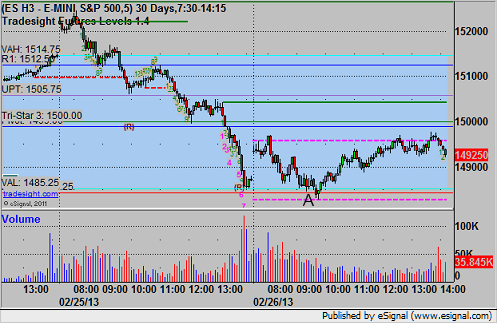

Futures Calls Recap for 2/26/13

Our Levels were spaced pretty wide because of the big range on Monday, so it took a while to get any setups, and we were heading into lunch when it did trigger. I went half size due to time of day, but we count the results equally here. See ES below. NASDAQ volume was only 1.7 billion shares.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at 1484.00 at A and stopped for 7 ticks:

Forex Calls Recap for 2/26/13

Another sideways night that didn't produce anything. Three triggers, see EURUSD and GBPUSD below.

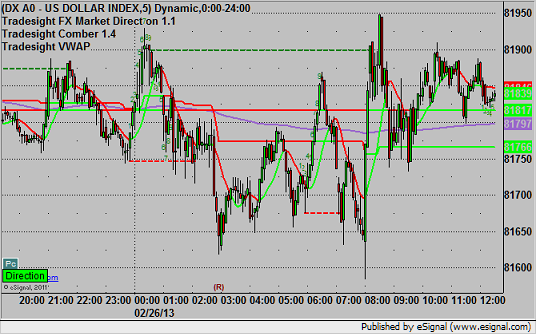

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

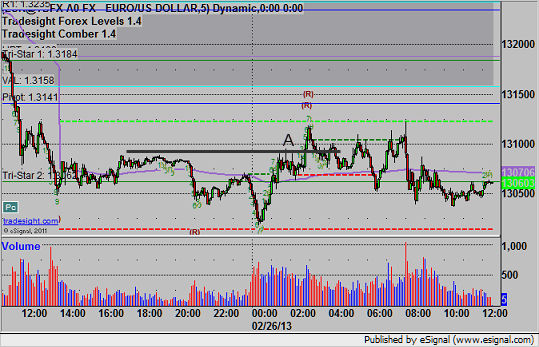

EURUSD:

Triggered long at A and stopped:

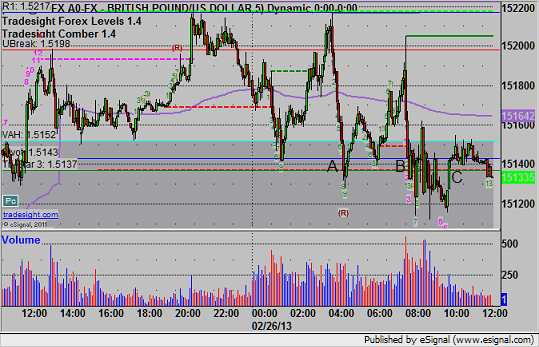

GBPUSD:

Triggered short at A and stopped. Triggered short again in the morning at B, eventually closed around the entry at C:

Stock Picks Recap for 2/25/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, APOL triggered short (just barely without market support) and worked:

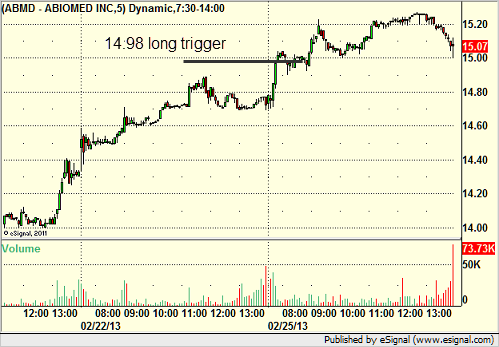

ABMD triggered long (with market support) and worked eventually, but market direction turned completely against the trade:

FTNT gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's TQQQ triggered long (ETF, so no market support needed) and didn't work:

His VXX triggered short (ETF, so no market support needed) and didn't work:

My NFLX triggered short (with market support) and worked:

Rich's AAPL triggered long (with market support) and didn't work:

Rich's CAT triggered short (with market support) and worked:

His BTU triggered short (just barely without market support) and worked:

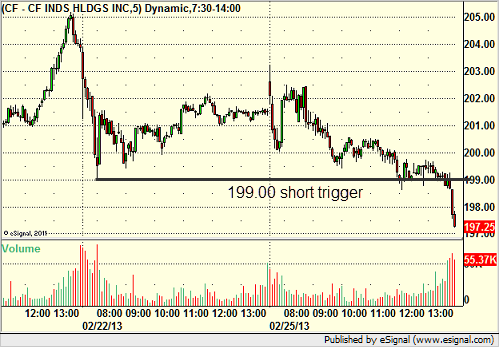

His CF triggered short (with market support) and worked:

BIDU triggered short (with market support) and didn't work:

In total, that's 8 trades triggering with market support, 4 of them worked, 4 did not.