Futures Calls Recap for 2/15/13

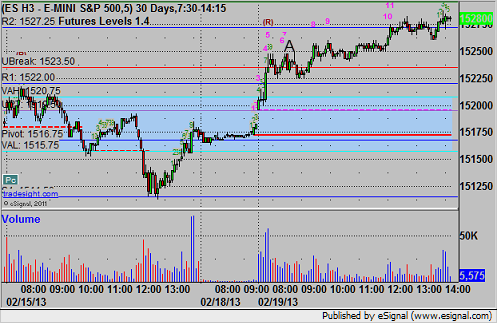

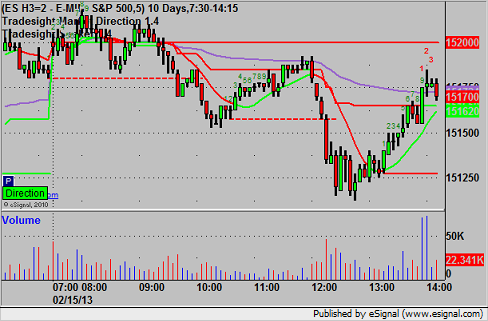

A dull session that gapped up, left the gap behind, and saw half of the day's range covered in 10 minutes around the 20-minute mark of the session. See ES below.

Net ticks: -7 ticks.

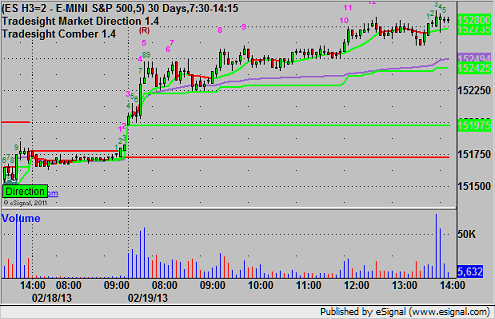

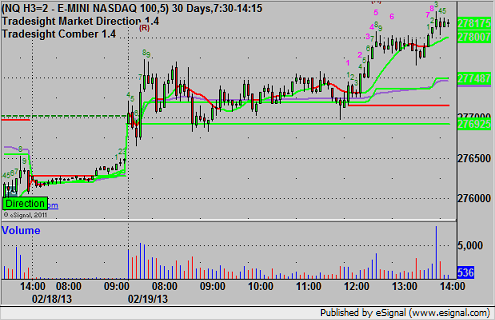

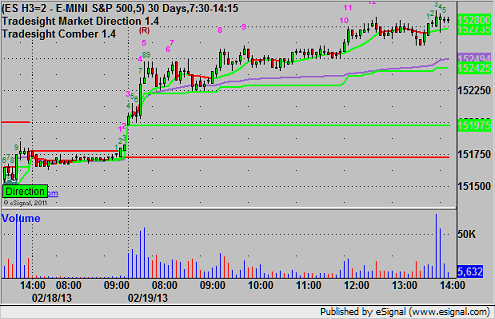

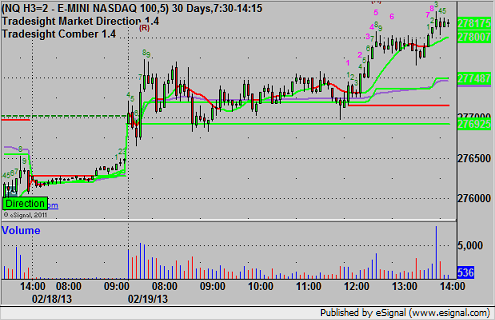

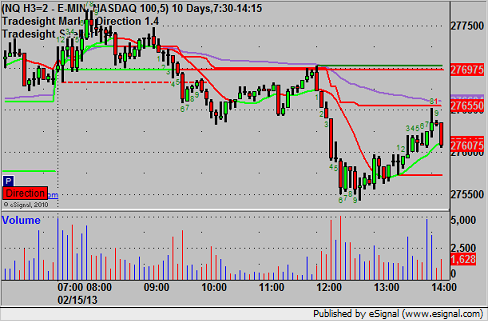

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's ES call triggered long at 1525.00 and stopped for 7 ticks:

Futures Calls Recap for 2/15/13

A dull session that gapped up, left the gap behind, and saw half of the day's range covered in 10 minutes around the 20-minute mark of the session. See ES below.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's ES call triggered long at 1525.00 and stopped for 7 ticks:

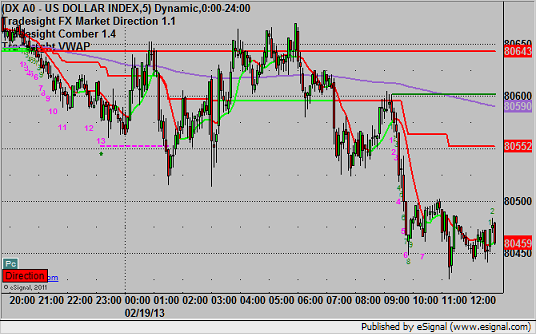

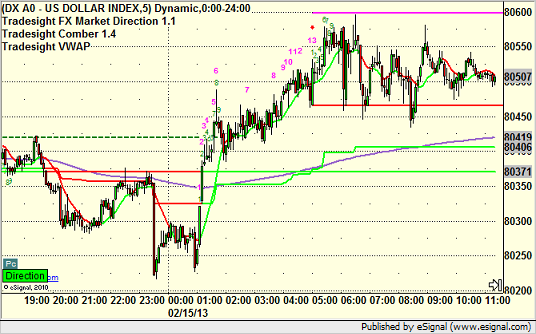

Forex Calls Recap for 2/19/13

When you put one call on the EURUSD and one on the GBPUSD, you run the risk that neither triggers, but that was where the better layouts were. See both sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

Stock Picks Recap for 2/15/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ABMD triggered long (without market support) and didn't work:

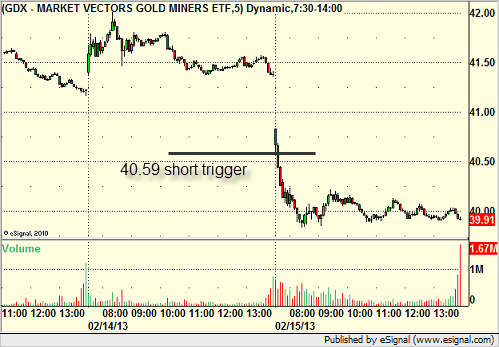

From the Messenger/Tradesight_st Twitter Feed, Rich's GDX triggered short (ETF, so no market support needed) and worked great:

NFLX triggered short (without market support) and didn't work (we took a partial in the Lab though):

His CLF triggered short (with market support) and worked:

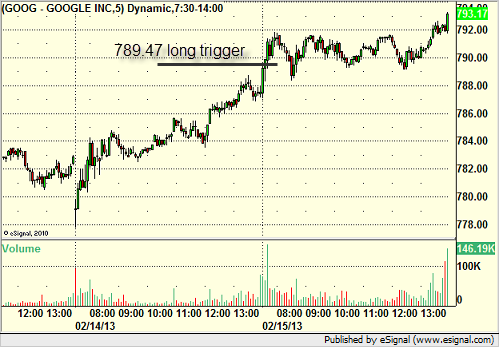

His GOOG triggered long (with market support) and worked:

His WPRT triggered long (with market support) and didn't work:

His EOG triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 2/15/13

No calls for options expiration heading into the long weekend as things were too tight and glue to the VWAP early.

Net ticks: +0 ticks.

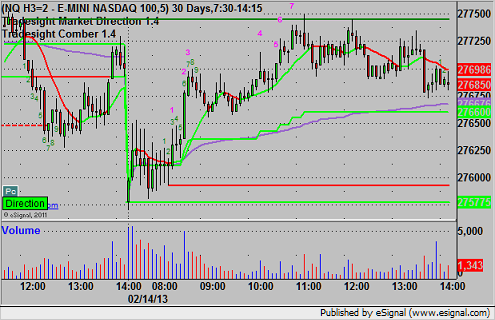

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Forex Calls Recap for 2/15/13

Nothing special for the last day heading into the 3-day weekend here in the US. See EURUSD below for the triggers. The second half of the prior day's trade stopped out well in the money.

As usual on the Sunday report, we will take a look at the action from Thursday night/Friday, then look at the daily charts of the pairs with the Seeker and Comber separately, and then glance at the US Dollar Index.

Here's a look at the US Dollar Index intraday with our market directional lines:

We will have levels posted Sunday but no calls due to the US Bank Holiday on Monday. Calls and everything else resume Monday.

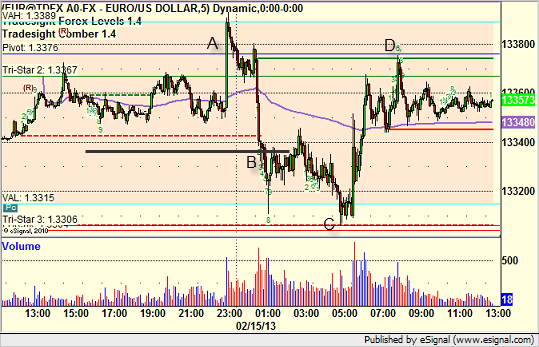

EURUSD:

Triggered long at A and stopped. Triggered short at B, hit first target at C, second half stopped. Note that we exactly hit the Pivot again at D but didn't trigger:

Stock Picks Recap for 2/14/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

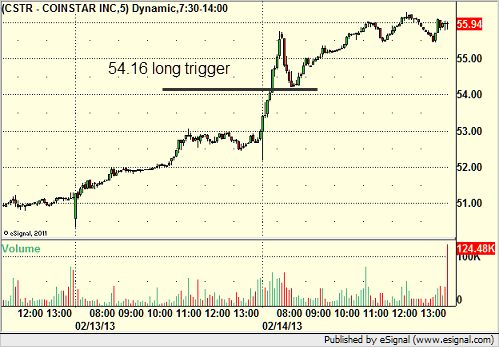

From the report, CSTR triggered long (with market support) and worked great:

From the Messenger/Tradesight_st Twitter Feed, Rich's BBRY triggered short (without market support due to opening 5 minutes) and didn't work:

His NFLX triggered short (without market support) and didn't work:

SINA triggered long (with market support) and worked enough for a partial:

His ALXN triggered short (without market support) and worked enough for a partial:

GOOG triggered long (with market support) and didn't work initially, worked later:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

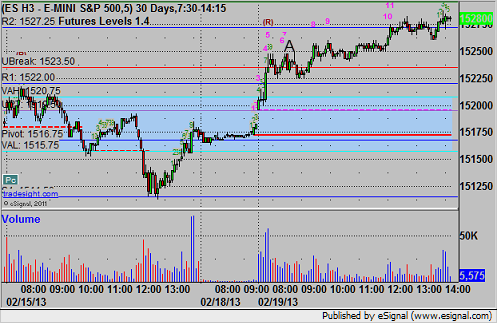

Futures Calls Recap for 2/14/13

Same problem as Wednesday. A very nice setup triggered and stopped once before triggering again and working. See ES below. Friday is options expiration heading into a long weekend, so we may not have any futures calls if the action looks flat early.

Net ticks: -1.5 ticks.

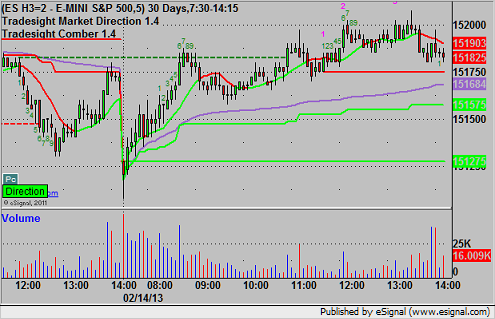

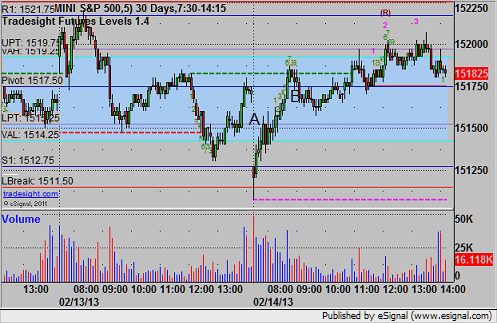

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1515.50 and stopped for 7 ticks, then triggered long again 10 minutes later, hit first target for 6 ticks, and he revised the stop twice and stopped 5 ticks in the money:

Forex Calls Recap for 2/14/13

Another nice winner (still going) on the EURUSD. See that section below.

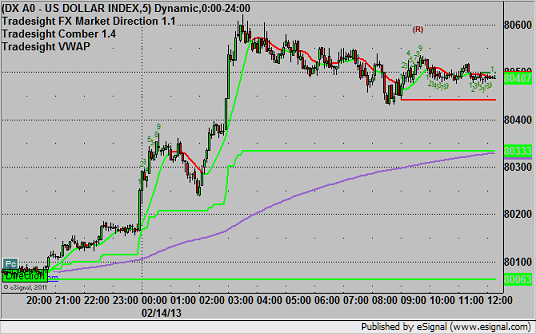

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

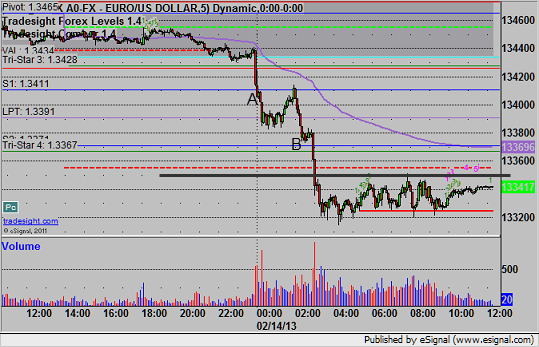

EURUSD:

Triggered short at A, hit first target at B, still holding with a stop over 1.3350 (black line):

Stock Picks Recap for 2/13/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, the great CHKP setup that we have been following triggered long (with market support) and went enough for a partial, but it then faced the options unraveling move that was to the downside:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (without market support due to opening 5 minutes) and worked:

His BTU triggered long (with market support) and didn't work:

His CLF triggered short (with market support) and worked:

His VMW triggered short (with market support) and worked:

His NFLX triggered long (with market support) and worked enough for a partial:

His FFIV triggered short (with market support) and worked:

His FAS triggered short (ETF, so no market support needed) and worked:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.