Stock Picks Recap for 2/11/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AUXL triggered short (with market support) and worked:

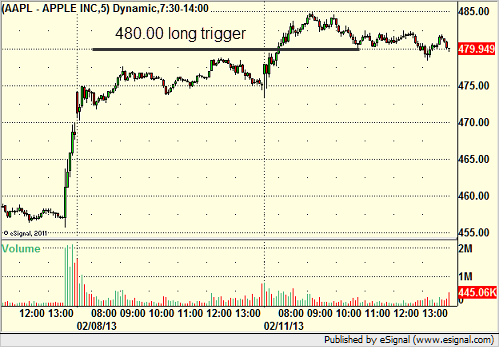

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered long (with market support) and worked:

GOOG triggered long (with market support) and worked:

In total, that's 3 trades triggering with market support, all three of them works, nice clean day despite market volume.

Futures Calls Recap for 2/11/13

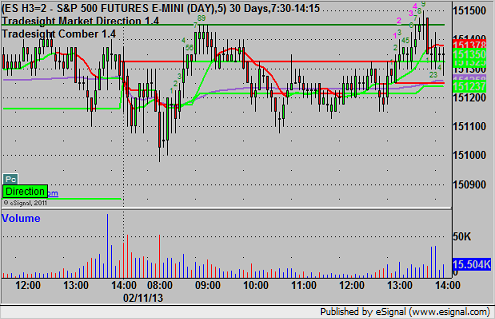

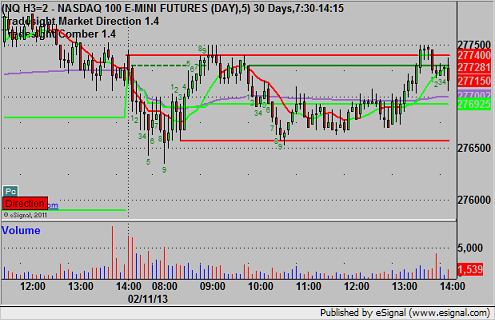

No triggers as the market held in even narrower range than Friday with people back East still digging out of the storm. Volume was only 1.5 billion NASDAQ shares.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Forex Calls Recap for 2/11/13

Nice winner...over 100 pips and still going...for the session. See GBPUSD section below.

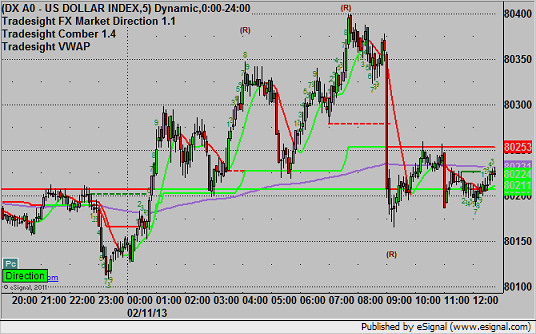

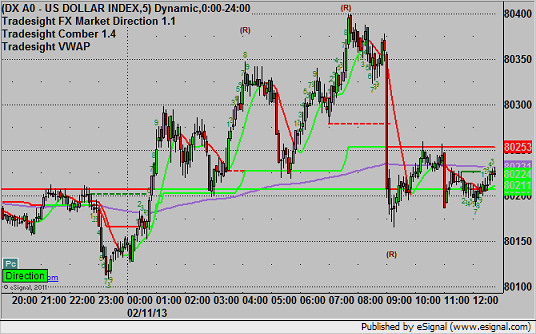

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

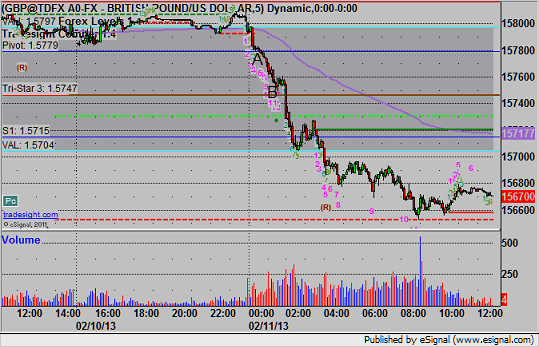

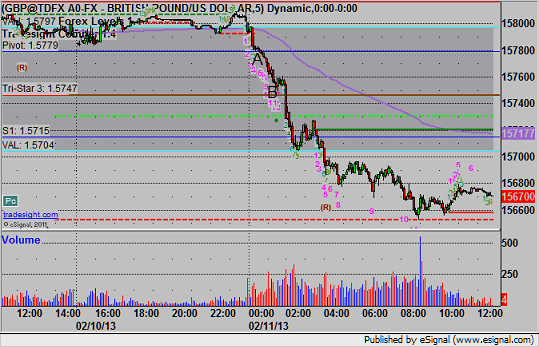

GBPUSD:

Triggered short at A, hit first target at B, lowered stop over VAL and still holding second half:

Forex Calls Recap for 2/11/13

Nice winner...over 100 pips and still going...for the session. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

GBPUSD:

Triggered short at A, hit first target at B, lowered stop over VAL and still holding second half:

Stock Picks Recap for 2/8/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, DECK triggered long (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, AMZN triggered long (with market support) and worked:

In total, that's 2 trades triggering with market support, both of them worked.

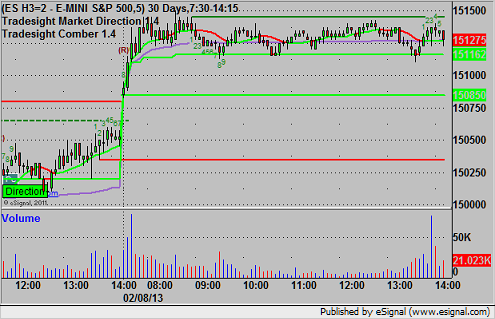

Futures Calls Recap for 2/8/13

Nothing triggered off our calls, and the market established its entire range for the session in the first 30 minutes or so as everyone on the East Coast turned their focus to the snowstorm. Volume was still decent early but then slipped off and only got to 1.7 billion for the close.

Net ticks: +0 ticks.

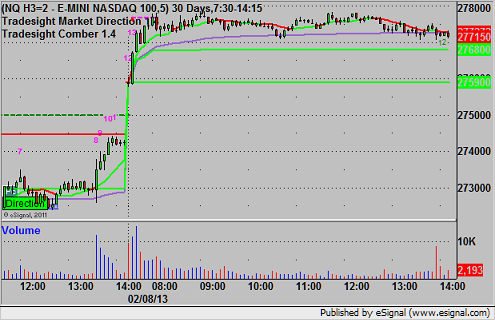

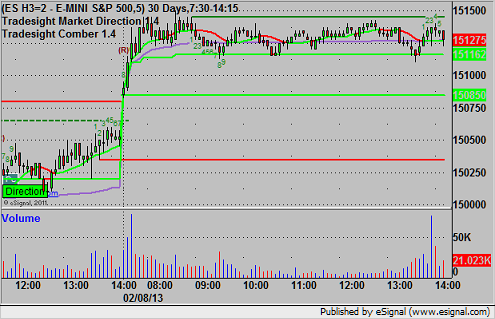

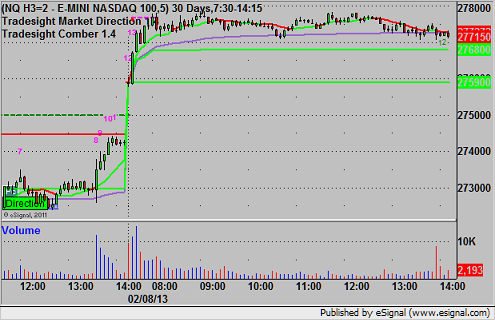

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Futures Calls Recap for 2/8/13

Nothing triggered off our calls, and the market established its entire range for the session in the first 30 minutes or so as everyone on the East Coast turned their focus to the snowstorm. Volume was still decent early but then slipped off and only got to 1.7 billion for the close.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

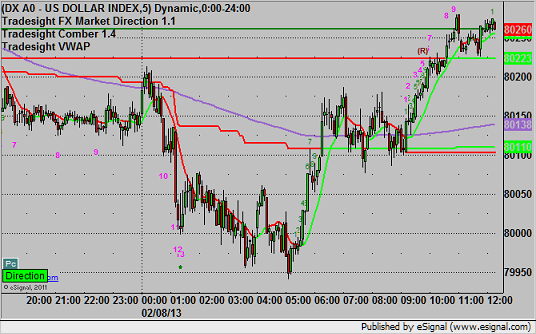

Forex Calls Recap for 2/8/13

Stopped out of the second half of the prior day's trade in the money, and then triggered short a new trade and stopped. See EURUSD below.

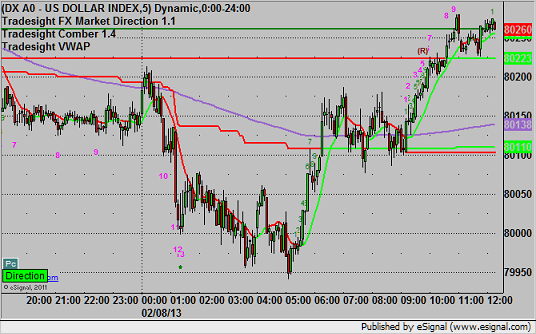

As usual on the Sunday report, we will take a look at the action from Thursday night/Friday, then look at the daily charts heading into the new week, and then glance at the US Dollar Index, which is interesting to look at currently.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

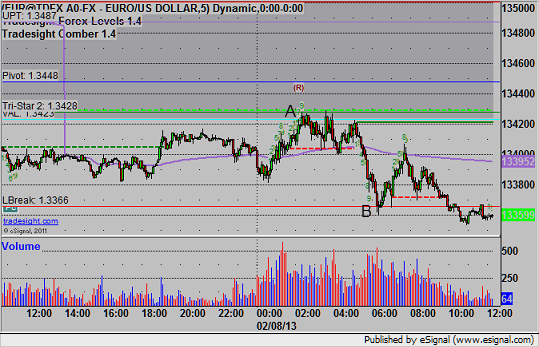

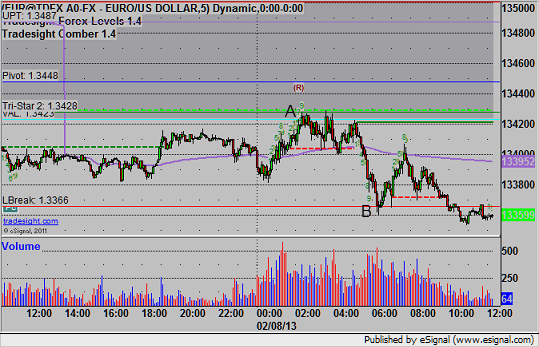

EURUSD:

The second half of the short from the prior session stopped in the money at A, just barely. The new short triggered at B and stopped:

Forex Calls Recap for 2/8/13

Stopped out of the second half of the prior day's trade in the money, and then triggered short a new trade and stopped. See EURUSD below.

As usual on the Sunday report, we will take a look at the action from Thursday night/Friday, then look at the daily charts heading into the new week, and then glance at the US Dollar Index, which is interesting to look at currently.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

The second half of the short from the prior session stopped in the money at A, just barely. The new short triggered at B and stopped:

Stock Picks Recap for 2/7/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CRZO triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered long (ETF, so no market support needed) and worked:

His CAT triggered short (with market support) and worked:

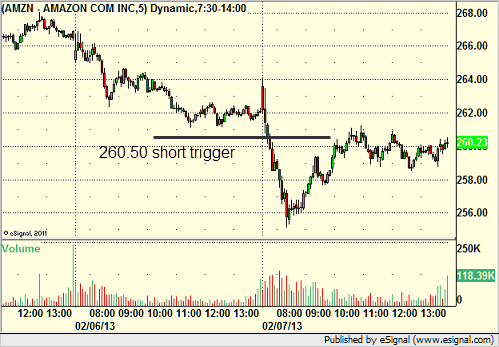

His AMZN triggered short (with market support) and worked:

His FDX triggered short (with market support) and didn't work:

His GOOG triggered long (without market support) and worked, and the high of the session was the UPT exactly:

NTAP triggered short (with market support) and worked:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.