Stock Picks Recap for 2/7/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CRZO triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered long (ETF, so no market support needed) and worked:

His CAT triggered short (with market support) and worked:

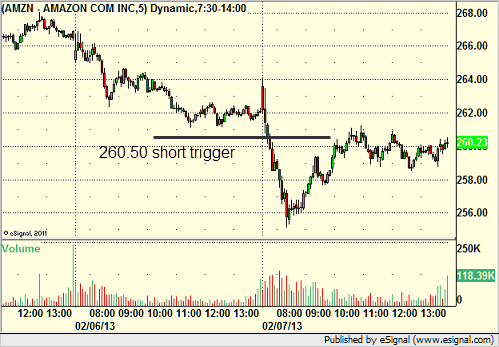

His AMZN triggered short (with market support) and worked:

His FDX triggered short (with market support) and didn't work:

His GOOG triggered long (without market support) and worked, and the high of the session was the UPT exactly:

NTAP triggered short (with market support) and worked:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

Futures Calls Recap for 2/7/13

Volume is back. The NASDAQ traded 1.9 billion shares again, and we had another nice day in futures. Could have been a perfect week if the ER had gone an extra tick yesterday. See the ES section below for today's recap.

Net ticks: +16.5 ticks.

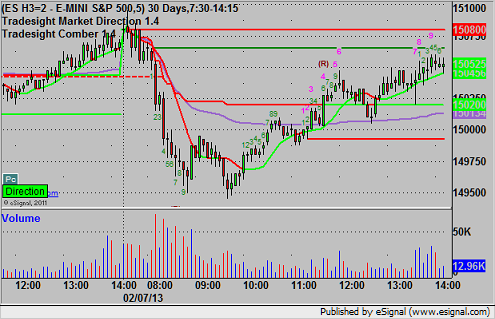

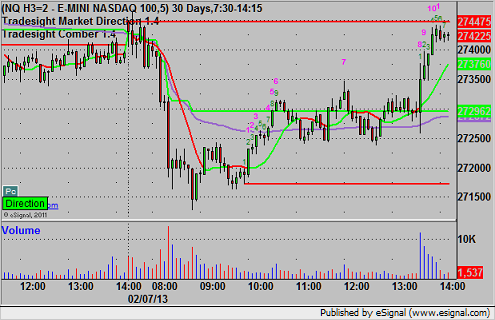

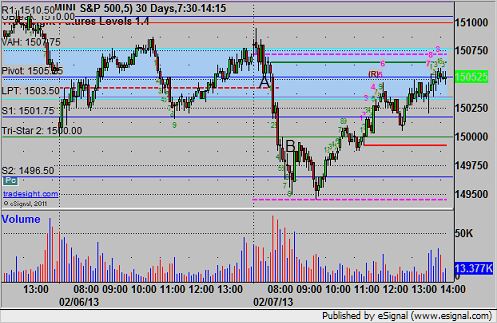

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Set the Pivot and then triggered short at 1505.00 at A, hit first target for 6 ticks, and then lowered the stop several times and stopped the final piece at 1498.25 for 27 ticks at B:

Forex Calls Recap for 2/7/13

Closed out the second half of the prior day's short at the entry, and then had a new winner on the EURUSD. See that section below.

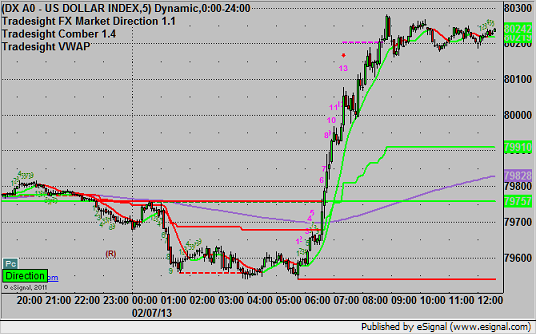

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

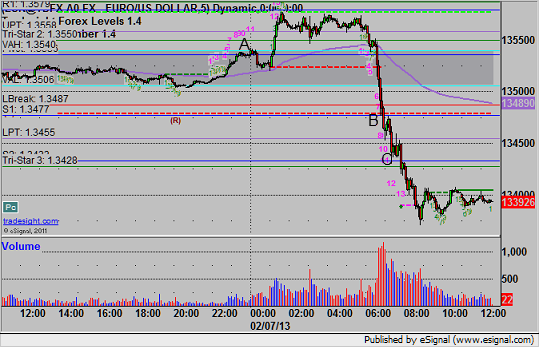

EURUSD:

Closed the second half of the trade at the entry from the prior session at A, went up and stopped just before the long trigger (over R1), then rolled hard, triggered short at B and hit first target at C, currently holding with a stop over S2:

Stock Picks Recap for 2/6/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SNPS triggered long (with market support but late in the session) and worked enough to give you something:

From the Messenger/Tradesight_st Twitter Feed, Rich's BIIB triggered long (with market support) and didn't work:

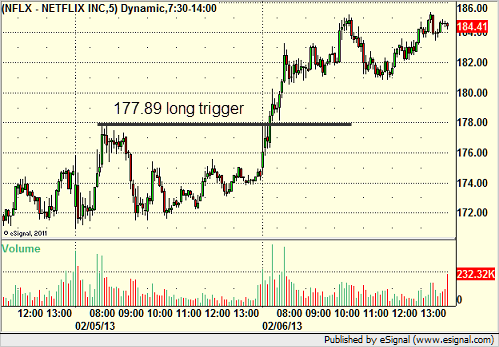

Rich stole my NFLX call and it triggered long (with market support) and worked great:

His AAPL triggered long (with market support) and worked great:

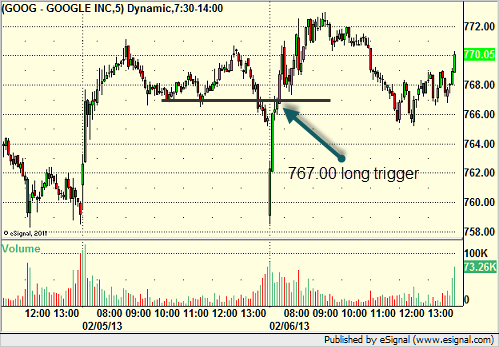

His GOOG triggered long (with market support) and worked:

His FSLR triggered long (with market support) and worked enough for a partial:

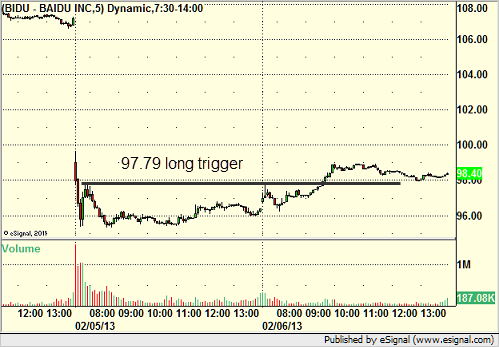

BIDU triggered long (with market support) and worked:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.

Futures Calls Recap for 2/6/13

One trade that just missed the first target by a tick and then stopped (before working), and one trade that worked, leads to almost a wash for the session. See ES and ER sections below.

Net ticks: -2 ticks.

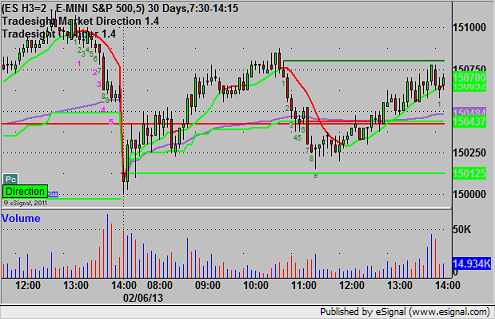

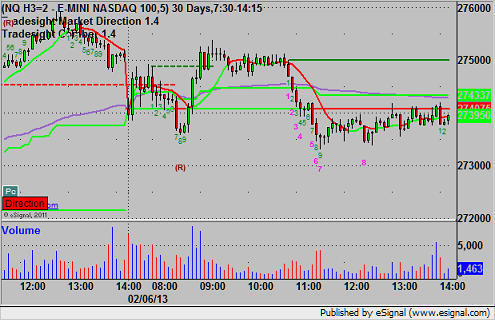

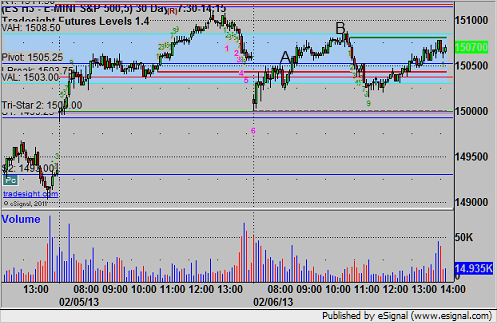

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1505.50, hit first target for 6 ticks, and closed out the final piece at B at 1507.50 near the Value Area High over lunch:

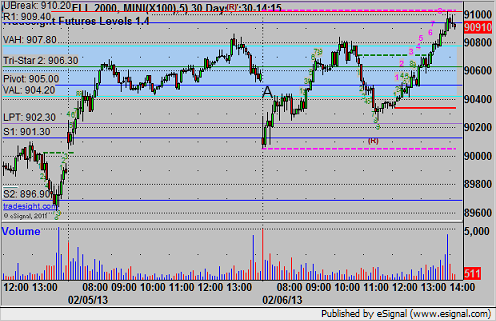

ER:

Triggered long at A at 902.40 and stopped for 9 ticks after just missing the first target by a tick:

Forex Calls Recap for 2/6/13

A winner on the EURUSD, still going, and that was it for the session. Amazing how the GBPUSD goes from over 200 pips Tuesday to just 45 on Wednesday. You can't even see a Level line looking at the 24 hour chart on the GBPUSD.

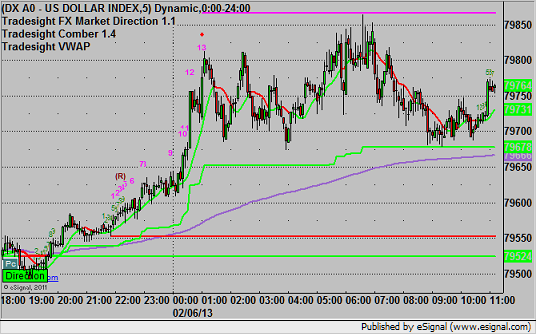

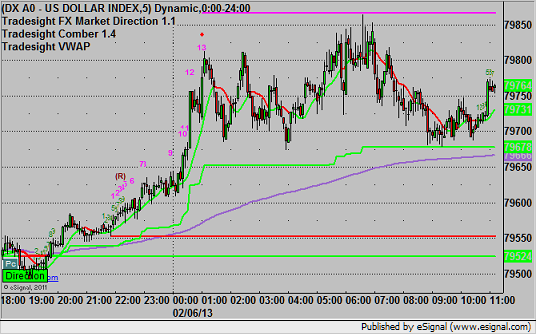

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

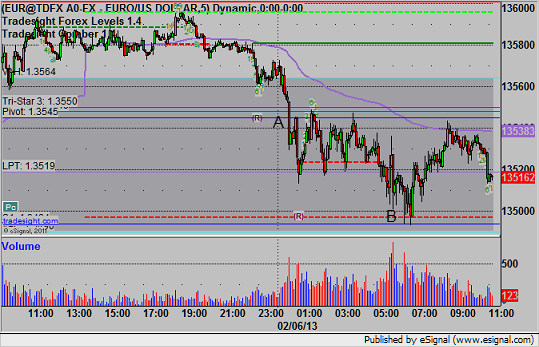

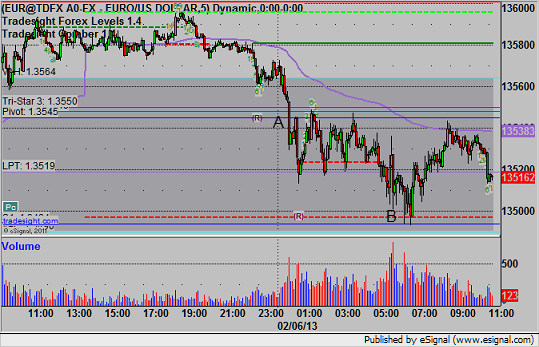

EURUSD:

Triggered short at A, hit first target at B, and holding second half with a stop over the Pivot into the new session:

Forex Calls Recap for 2/6/13

A winner on the EURUSD, still going, and that was it for the session. Amazing how the GBPUSD goes from over 200 pips Tuesday to just 45 on Wednesday. You can't even see a Level line looking at the 24 hour chart on the GBPUSD.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered short at A, hit first target at B, and holding second half with a stop over the Pivot into the new session:

Stock Picks Recap for 2/5/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOG triggered long (with market support) and didn't work:

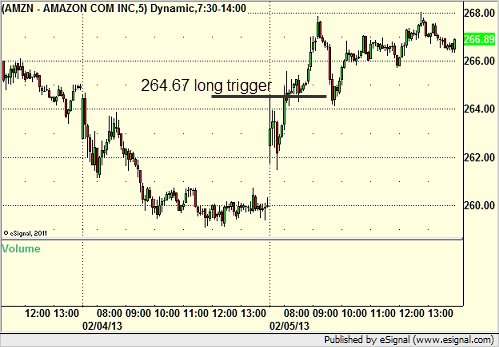

His AMZN triggered long (with market support) and worked great:

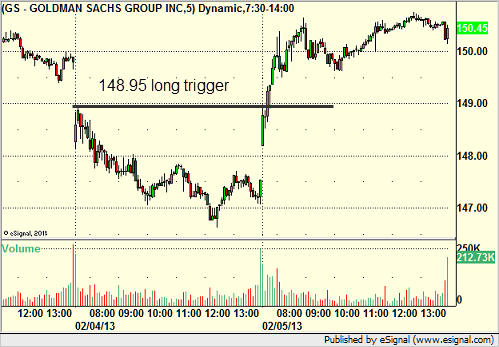

His GS triggered long (with market support) and worked:

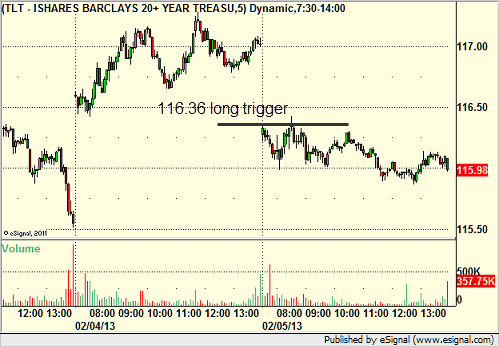

TLT triggered long (ETF, so no market support needed) and didn't work:

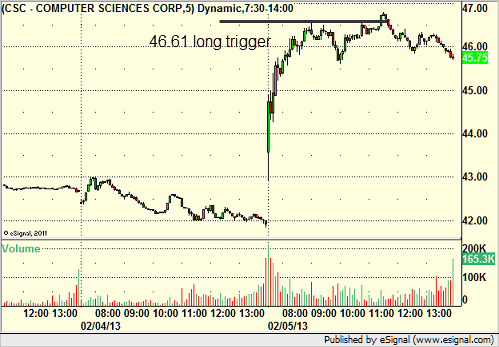

Rich's CSC triggered long (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 2 of them worked, 3 did not.

Futures Calls Recap for 2/5/13

A clean winner on the ES for the session and nothing else. See that section below.

Net ticks: +6 ticks.

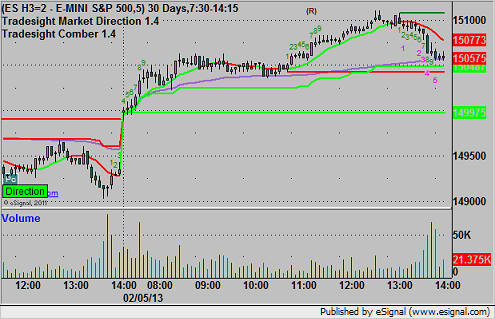

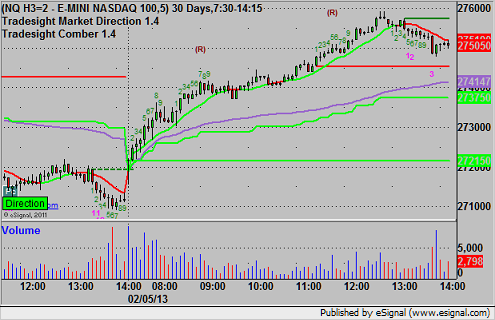

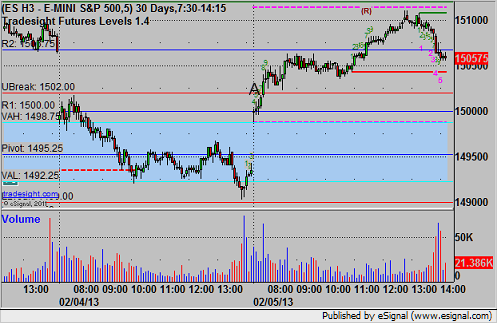

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1502.25, hit first target for 6 ticks, and stopped the second half at the same 6 tick gain:

Forex Calls Recap for 2/5/13

Almost a trifecta as we closed out a winner from the prior session on the EURUSD for over 100 pips, then had another winner on the EURUSD, but also a stop out on the GBPUSD, which triggered again later and worked perfect. See both sections below.

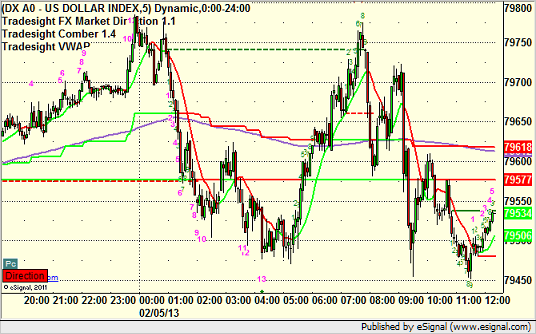

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

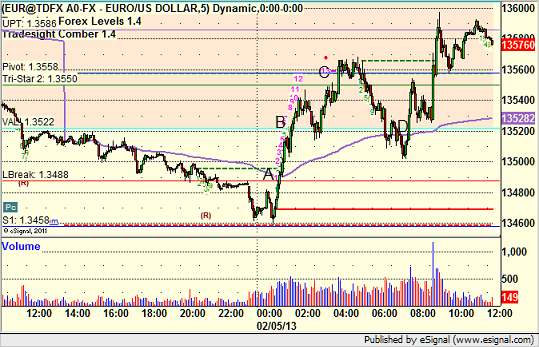

EURUSD:

After lowering the stop a couple of times, we stopped out the final piece of the short from the prior day at A for about 110 pips. The new call triggered long at B, hit first target at C, and I closed the final piece at the entry at D in the morning:

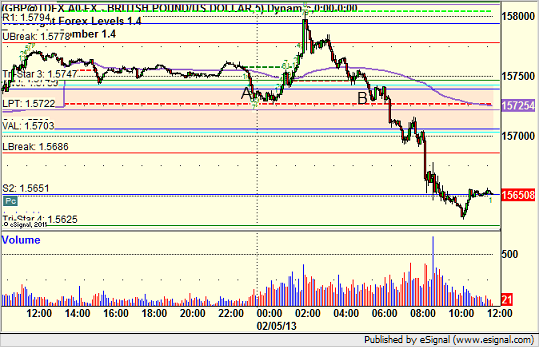

GBPUSD:

Triggered short at A and stopped. If you woke up in time, the re-entry at B would have worked extremely well: