Futures Calls Recap for 1/28/13

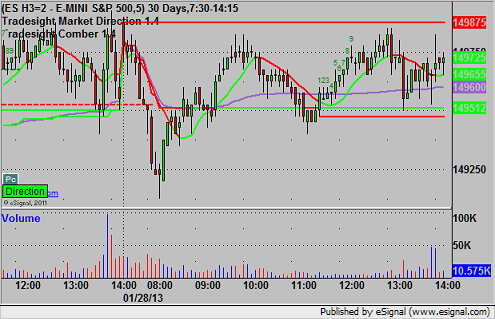

Three calls but only one triggered on a flat day in the market to start the week. Volume looked good early but never came back in the afternoon.

Net ticks: -7 ticks.

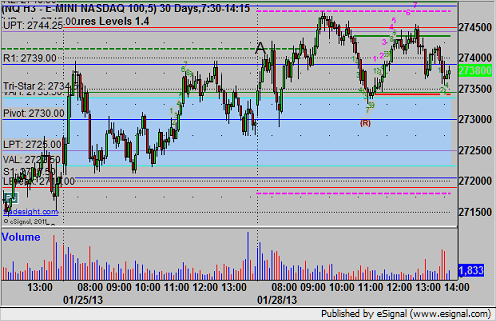

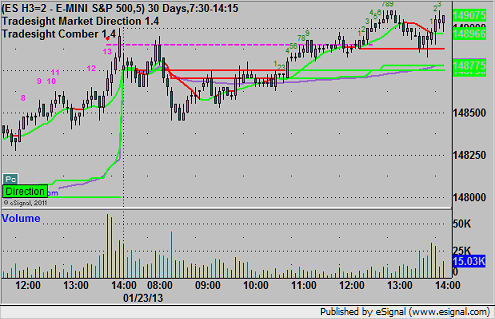

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

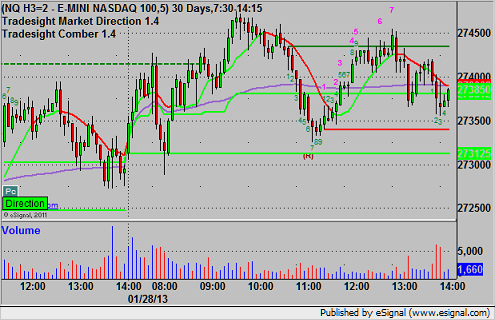

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered long at A at 2740.00 and stopped for 7 ticks:

Forex Calls Recap for 1/28/13

The GBPUSD traded average range, which was good, but the EURUSD traded only 40 pips of range for the session and didn't trigger either of our calls.

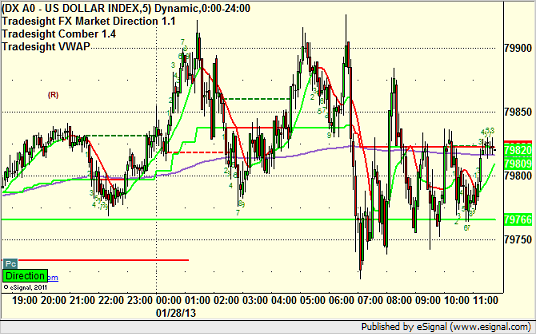

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

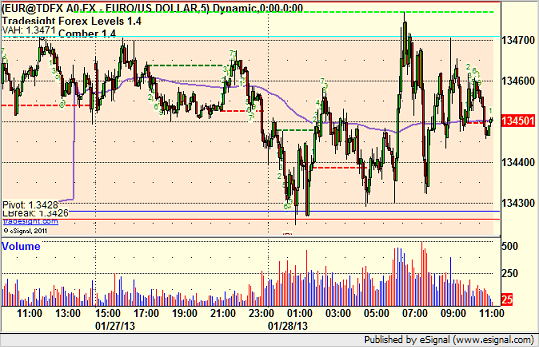

EURUSD:

Neither our short nor long triggered or came close in very narrow range:

Stock Picks Recap for 1/24/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Nothing triggered off of the report.

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (without market support) and worked for 6 points:

His QQQ triggered long (ETF, so no market support needed) and worked:

CERN triggered long (with market support) and worked:

Rich's GDX triggered short (ETF, so no market support needed) and worked:

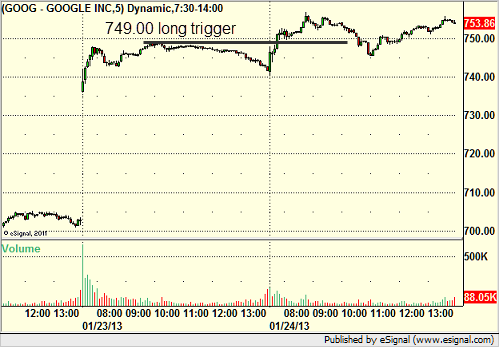

GOOG triggered long (with market support) and worked:

Rich's NFLX triggered short (without market support) and didn't work (went almost a point for a partial, but not quite):

In total, that's 4 trades triggering with market support, all 4 of them worked. The AAPL energy play also worked well.

Futures Calls Recap for 1/24/13

Nothing triggered from the calls as we wrapped up core earnings. Back to work.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Forex Calls Recap for 1/24/13

A loser on the EURUSD, and a winner on the GBPUSD (still going). See both sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

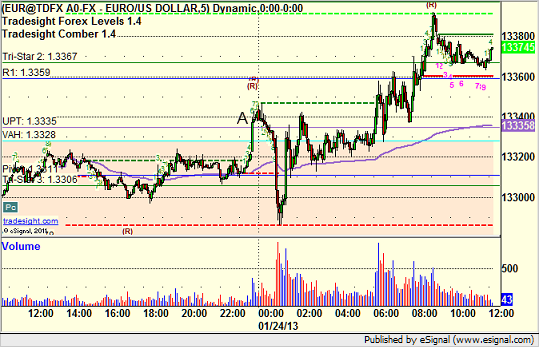

EURUSD:

Triggered long at A and stopped, would have worked later:

GBPUSD:

Triggered short at A, hit first target at B, still holding second half with a stop over S1:

Stock Picks Recap for 1/23/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

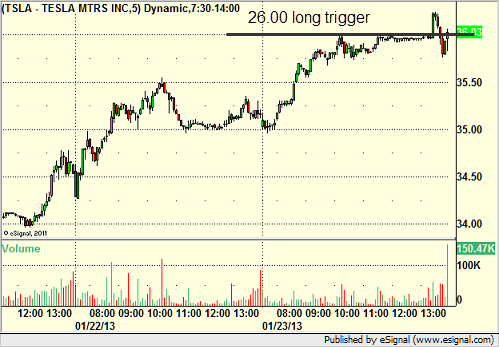

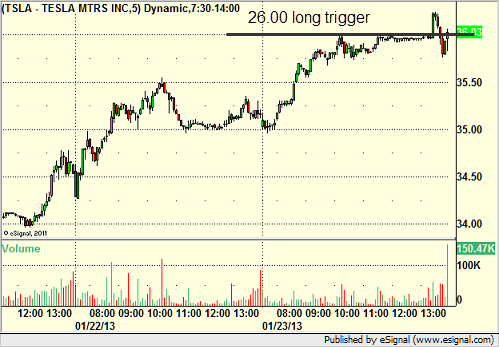

From the report, TSLA triggered long (with market support) and worked enough for a partial. Bummer that it had to trigger so late in the day during earnings after setting the trigger so nicely:

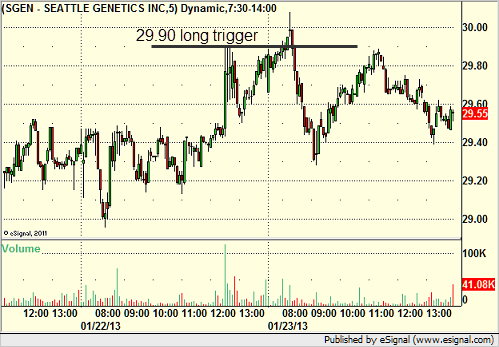

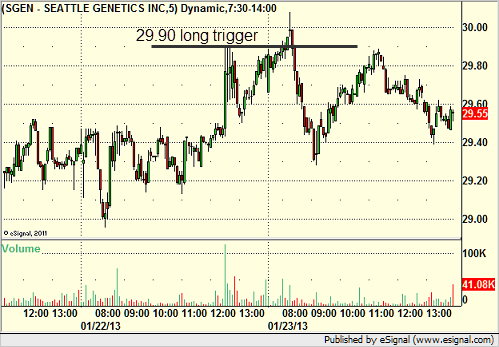

SGEN triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, NFLX triggered long (with market support) and worked:

Rich's VMW triggered long (with market support) and worked:

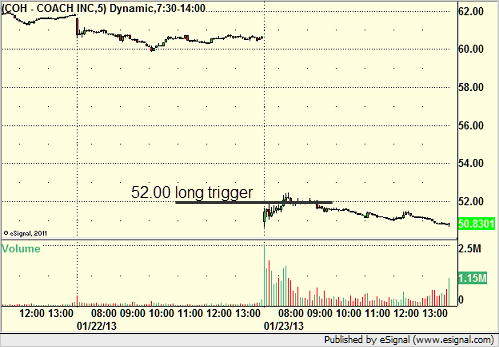

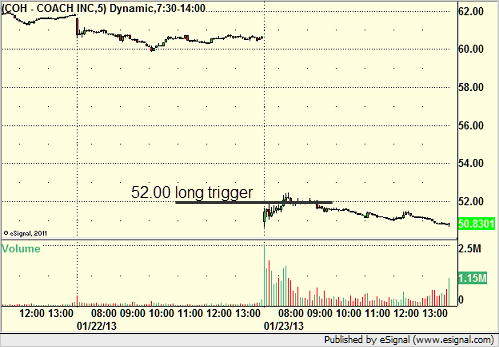

His COH triggered long (with market support) and worked enough for a partial:

His AMZN triggered short (with market support) and worked:

His FAS triggered short (ETF, so no market support needed) and didn't work:

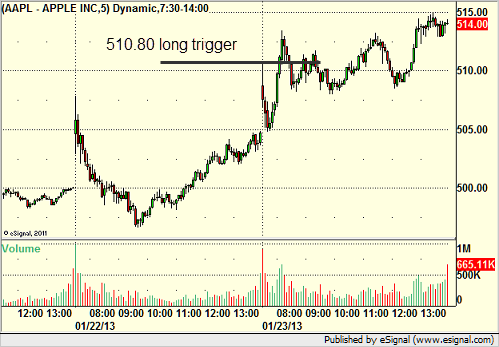

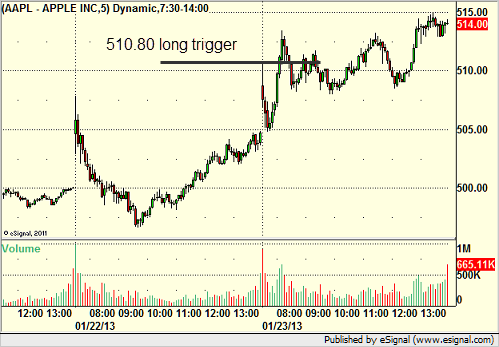

His AAPL triggered long (with market support) and worked:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not.

Stock Picks Recap for 1/23/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TSLA triggered long (with market support) and worked enough for a partial. Bummer that it had to trigger so late in the day during earnings after setting the trigger so nicely:

SGEN triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, NFLX triggered long (with market support) and worked:

Rich's VMW triggered long (with market support) and worked:

His COH triggered long (with market support) and worked enough for a partial:

His AMZN triggered short (with market support) and worked:

His FAS triggered short (ETF, so no market support needed) and didn't work:

His AAPL triggered long (with market support) and worked:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not.

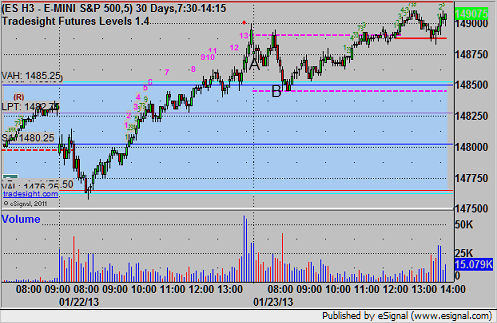

Futures Calls Recap for 1/23/13

Two stop outs on the ES as we continue through earnings season and a lot of dull activity (until the last part of the day when the rumors fly). See ES below. NASDAQ volume was 1.7 billion shares.

Net ticks: -14 ticks.

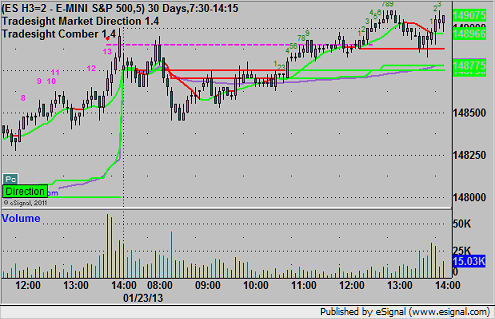

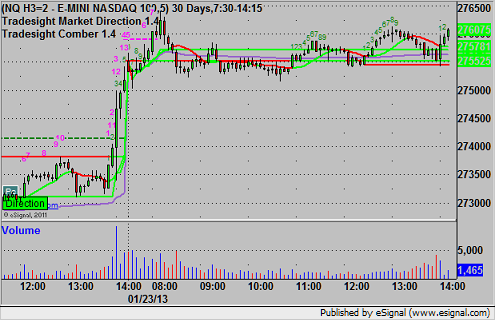

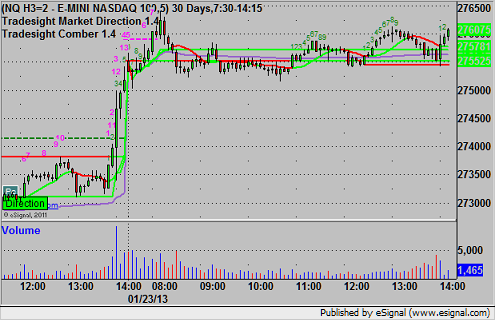

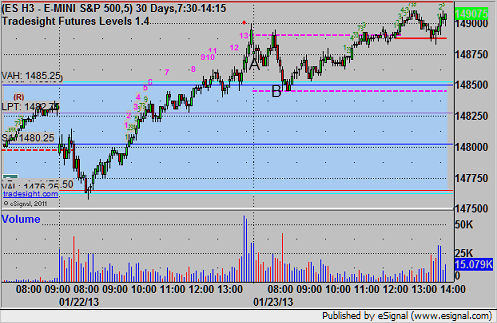

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

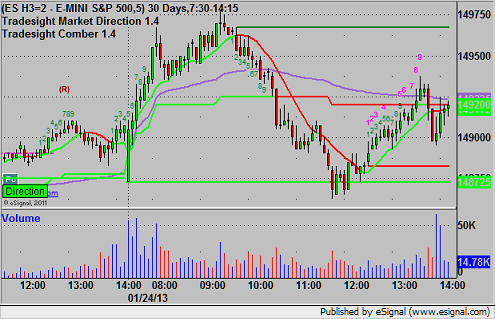

ES:

Triggered short at A at 1486.50 and stopped, that would have worked on a retrigger but the range was too narrow at the time. Mark's call triggered short into the Value Area at B at 1484.75 and stopped for 7 ticks, would have been valid again but never triggered:

Futures Calls Recap for 1/23/13

Two stop outs on the ES as we continue through earnings season and a lot of dull activity (until the last part of the day when the rumors fly). See ES below. NASDAQ volume was 1.7 billion shares.

Net ticks: -14 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1486.50 and stopped, that would have worked on a retrigger but the range was too narrow at the time. Mark's call triggered short into the Value Area at B at 1484.75 and stopped for 7 ticks, would have been valid again but never triggered:

Forex Calls Recap for 1/23/13

What looked like a boring night with no triggers finally moved a bit but turned into nothing anyway, sweeping one piece of our short entry. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

One piece of out of three would have triggered at A if you follow our order staggering rules as it didn't even get 3 pips beyond the S1 level. This is a good example of why we stagger trades, as a big news move like that still stalled right at the level, but you can't expect it to stop to the pip: