Forex Calls Recap for 1/23/13

What looked like a boring night with no triggers finally moved a bit but turned into nothing anyway, sweeping one piece of our short entry. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

One piece of out of three would have triggered at A if you follow our order staggering rules as it didn't even get 3 pips beyond the S1 level. This is a good example of why we stagger trades, as a big news move like that still stalled right at the level, but you can't expect it to stop to the pip:

Stock Picks Recap for 1/22/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, IMGN triggered long (with market support) and didn't work:

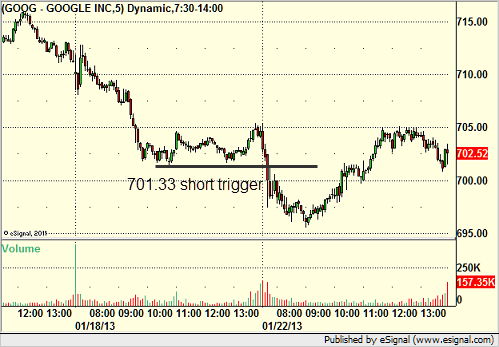

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOG triggered short (with market support) and worked:

NFLX triggered short (with market support) and worked:

EBAY triggered short (with market support) and worked:

GS triggered long (with market support) and didn't work, worked later:

COST triggered long (with market support) and dind't work, worked later:

AMZN triggered short (without market support) and didn't work:

Rich's FB triggered short (without market support) and didn't work:

His AMGN triggered long (with market support) and worked:

BIDU triggered long (with market support) and didn't go enough in either direction to count for a $100 stock, although in the room, we closed it near the high for a small gain:

In total, that's 7 trades triggering with market support, 4 of them worked, 3 did not.

Stock Picks Recap for 1/22/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, IMGN triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOG triggered short (with market support) and worked:

NFLX triggered short (with market support) and worked:

EBAY triggered short (with market support) and worked:

GS triggered long (with market support) and didn't work, worked later:

COST triggered long (with market support) and dind't work, worked later:

AMZN triggered short (without market support) and didn't work:

Rich's FB triggered short (without market support) and didn't work:

His AMGN triggered long (with market support) and worked:

BIDU triggered long (with market support) and didn't go enough in either direction to count for a $100 stock, although in the room, we closed it near the high for a small gain:

In total, that's 7 trades triggering with market support, 4 of them worked, 3 did not.

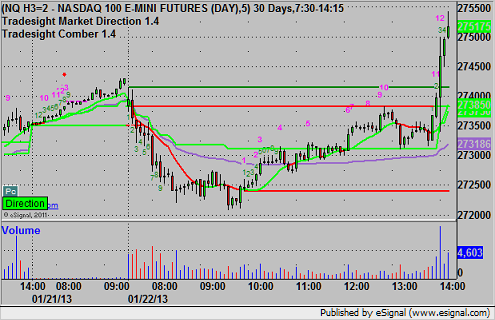

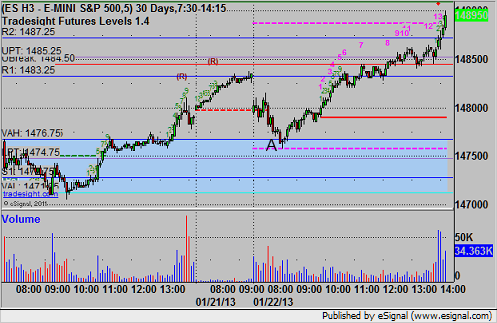

Futures Calls Recap for 1/22/13

One stop out on a clean Value Area setup on the ES, and that was it to start the short week. Volume was decent earely but ended up around the usual 1.7 billion NASDAQ shares. The futures spiked in the minutes after the close on some earnings.

Net ticks: -7 ticks.

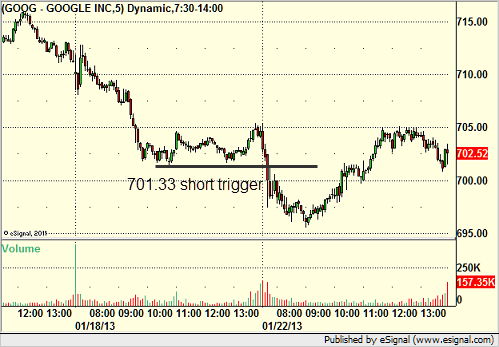

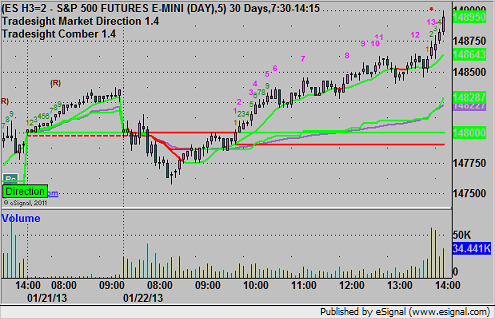

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

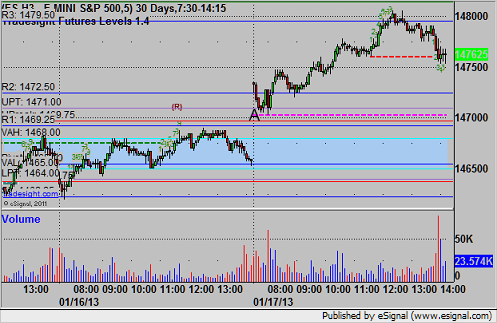

Mark's call was a nice setup with the Pivot and Value Area High lined up at the same place. Triggered short under that at A at 1476.50 and stopped:

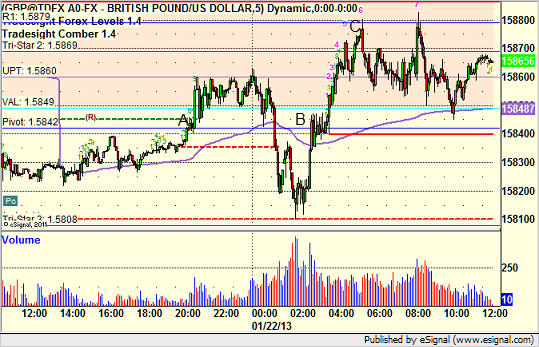

Forex Calls Recap for 1/22/13

A disappointing session, as one trade that ultimately worked perfectly to its first target got stopped first on some news. See EURUSD and GBPUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered short at A on the news. Also, in the morning, at least a leg or two of the trade triggered at B and stopped:

GBPUSD:

Triggered long at A, ended up stopping on the plunge down on news (which triggered the EURUSD short). Note that if you were awake, the retrigger at B worked perfectly to our target at C:

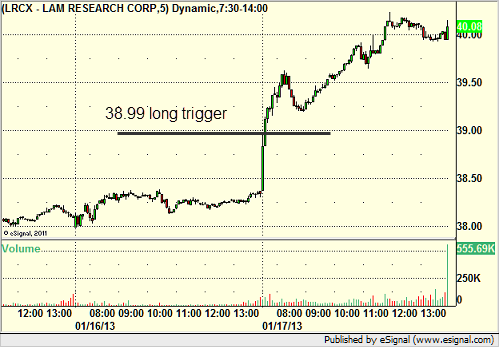

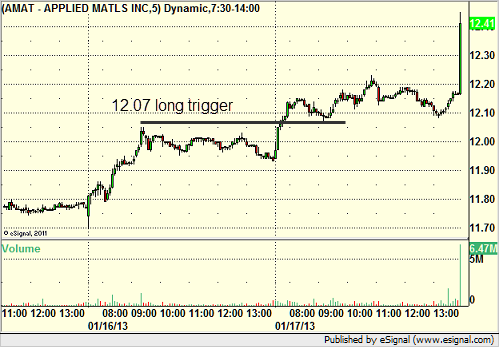

Stock Picks Recap for 1/17/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, LRCX (top pick for several days) finally triggered long (without market support) and worked. No surprise that this big long 8-month cup and handle that we have been waiting for ran big once it triggered:

AMAT triggered long (without market support) and worked:

SPLS triggered long (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's HLF triggered short (with market support) and worked:

NFLX triggered short (with market support) and didn't work, worked later:

Rich's GOOG triggered short (without market support) and didn't work:

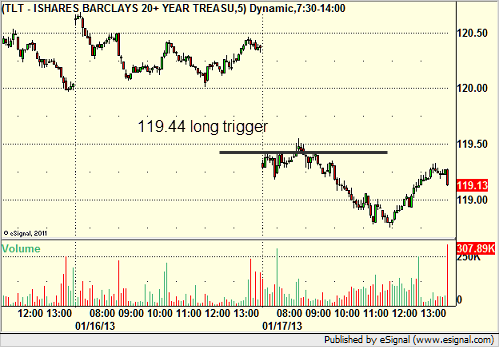

TLT triggered long (ETF, so no market support needed) and didn't work:

Rich's SHLD triggered long (with market support) and didn't work:

BIIB triggered long (with market support) and didn't work (worked later):

FB triggered long (with market support) and didn't work:

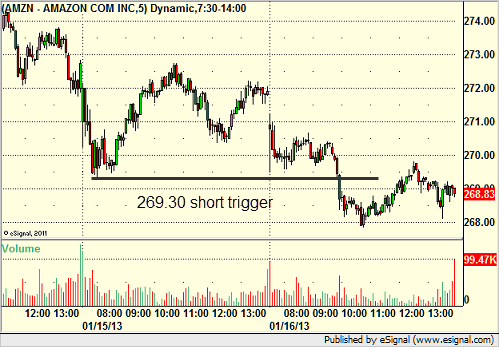

AMZN triggered long (with market support) and didn't work:

In total, that's 6 trades triggering with market support, 1 of them worked, 5 did not. Again, the ratio is down during earnings season, although NFLX and LRCX should have been taken.

Futures Calls Recap for 1/17/13

A winner on the ER and a loser on the ES that washed exactly. See both sections below. Market volume was 1.6 billion NASDAQ shares again, and we ended up with a drift higher even though the initial direction for the options unraveling move looked lower. We also left a gap behind.

Net ticks: +0 ticks.

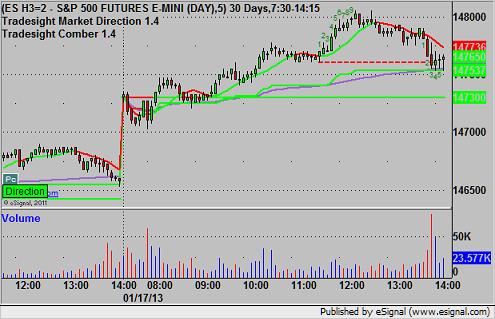

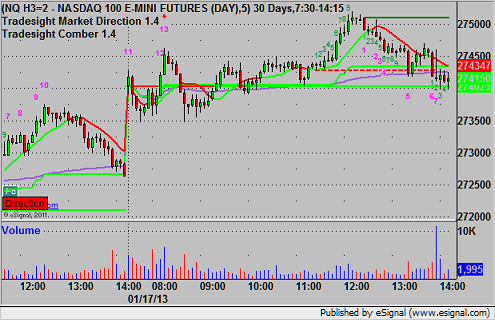

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1470.75 and stopped for 7 ticks:

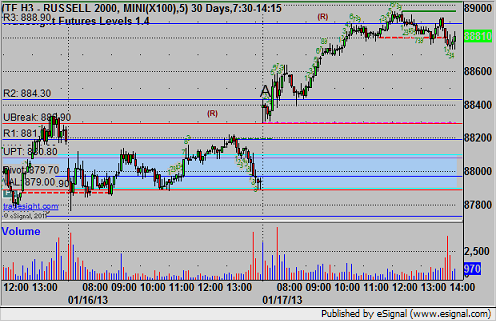

ER:

Triggered long at A at 884.30, hit first target for 7 ticks and stopped at the same in the money:

Forex Calls Recap for 1/17/13

A nice clean trigger and winner still going on the EURUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

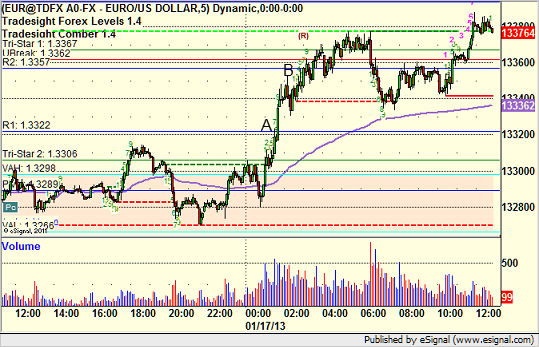

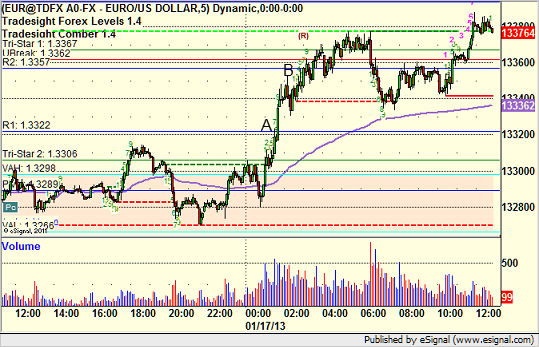

EURUSD:

Triggered long at A, hit first target at B, holding second half currently with a stop under the R2 level:

Forex Calls Recap for 1/17/13

A nice clean trigger and winner still going on the EURUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A, hit first target at B, holding second half currently with a stop under the R2 level:

Stock Picks Recap for 1/16/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, this was one of those rare days where nothing triggered off of the report.

From the Messenger/Tradesight_st Twitter Feed, Rich's CRUS triggered short (with market support) and didn't work:

AMZN triggered short (without market support) and worked great:

Rich's JPM triggered short (without market support) and didn't work:

His ALNY triggered long (with market support) and worked:

His HLF triggered short (without market support) and worked:

His AMGN triggered long (with market support) and didn't work:

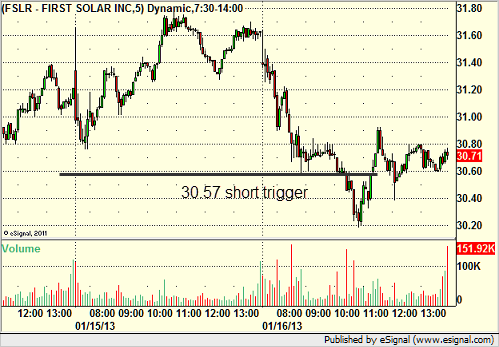

FSLR triggered short (without market support) and worked:

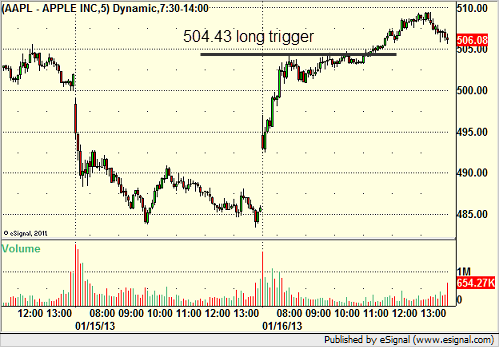

His AAPL triggered long (with market support) and didn't work, worked later:

COST triggered too late in the session.

In total, that's 4 trades triggering with market support, 1 of them worked, 3 did not. A rare day with an under 50% win ratio, but few triggers, and the ones that worked just didn't have market support at the time.