Forex Calls Recap for 1/14/13

One stop out to start the week. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

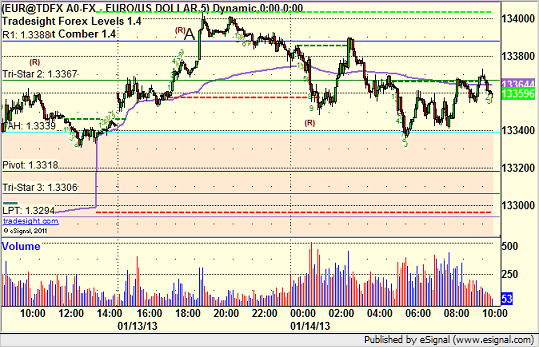

EURUSD:

Triggered long at A and stopped:

Stock Picks Recap for 1/11/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

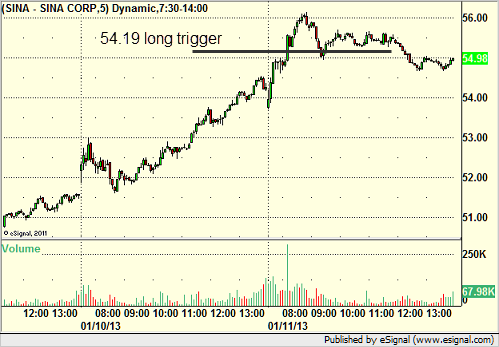

From the report, SINA triggered long (without market support) and worked:

LINTA didn't do enough to count either way.

From the Messenger/Tradesight_st Twitter Feed, Rich's BBY triggered long (without market support) and worked:

Rich's SINA trigger (an early entry to our main call) triggered long (without market support) and worked:

GOOG triggered short (with market support) and didn't work:

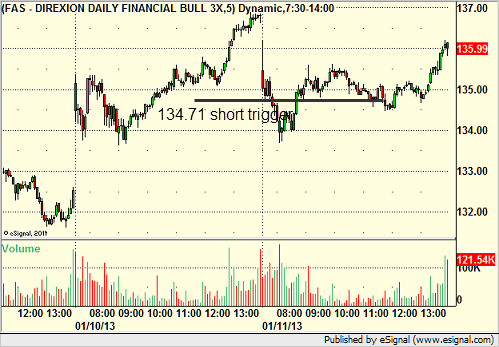

Rich's FAS triggered short (ETF, so no market support needed) and worked:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not. However, Rich had some big winners that triggered with the market right on neutral.

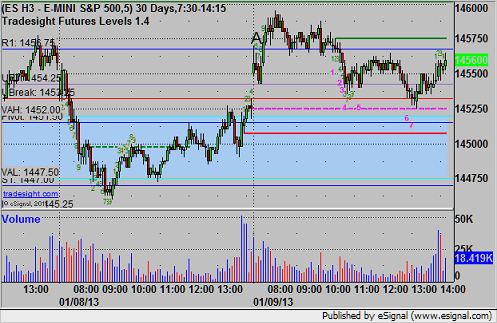

Futures Calls Recap for 1/11/13

A horrible session on light volume covering only 5 points of ES range, but Mark pulled out a small winner in the morning. See ES below.

Net ticks: +2.5 ticks.

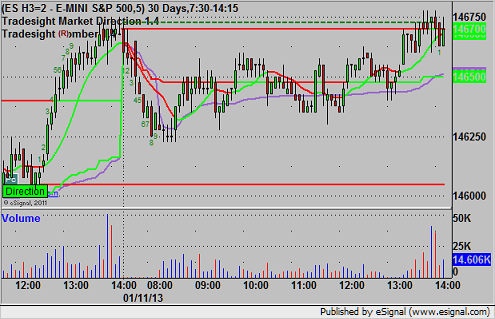

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at A at 1465.00, hit the first target for 6 ticks, and stopped the second half over the entry:

Forex Calls Recap for 1/11/13

A stop out on the new GBPUSD trade, but we closed out a 270 pip winner on the EURUSD from the prior session. This was our first week back to full size, and it looks like a good call so far.

As usual on the Sunday report, we will take a look at the action from Thursday night/Friday, then take a look at the daily charts with the Seeker and Comber separately heading into the new week, and then look at the US Dollar Index.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

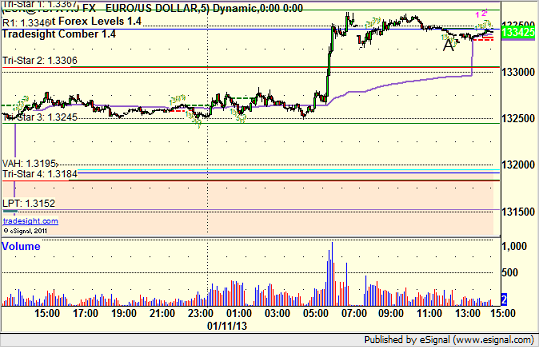

EURUSD:

We had adjusted the stop up on the existing call Thursday evening, then raised it under 1.3325 Friday morning, and I finally closed it at 1.3360 for end of week at A. You could also have held that one over, but I'm good with the close out for almost a 270 pip winner to the final exit:

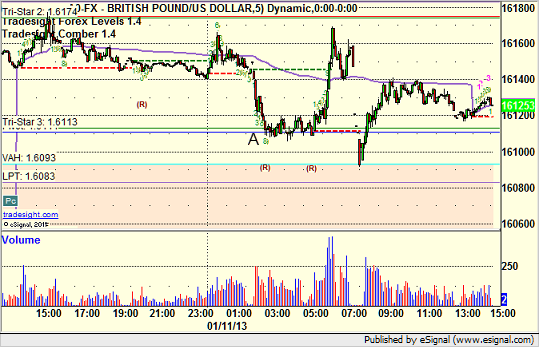

GBPUSD:

Triggered short at A and stopped for 25 pips:

Stock Picks Recap for 1/10/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AIRM triggered in the last few minutes, didn't have enough time to do anything.

From the Messenger/Tradesight_st Twitter Feed, Rich's MCP triggered short (with market support) and worked:

His BIDU triggered long (without market support) and worked great:

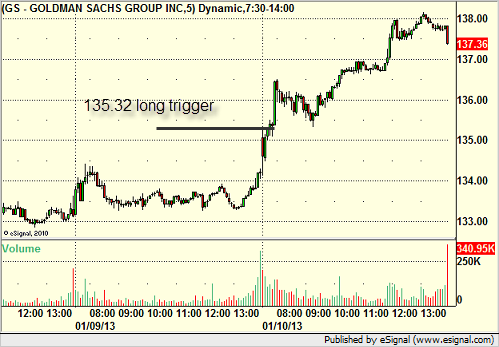

His GS triggered long (without market support) and worked:

AMGN triggered short (with market support) and worked:

BIIB triggered short (with market support) and worked big:

NTAP triggered short (with market support) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked nicely, as did the two that triggered without market support.

Futures Call Recap for 1/10/13

ES call triggered twice, stopped once and worked the other. See below.

Net ticks: -4.5 ticks.

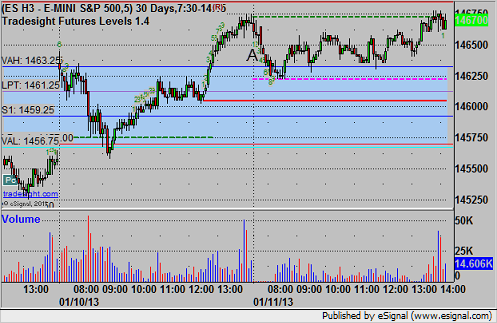

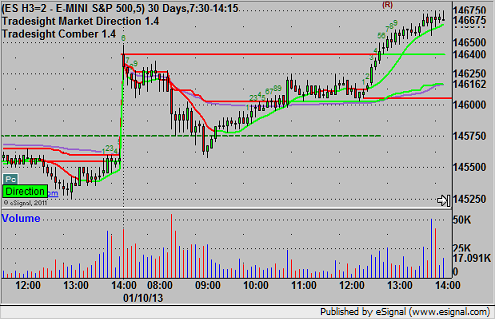

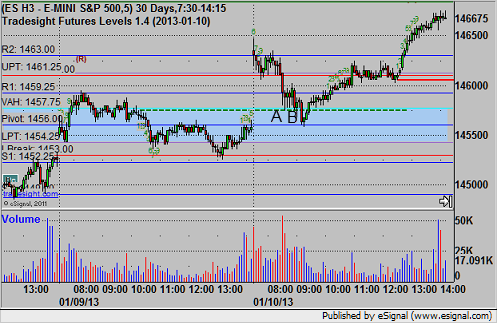

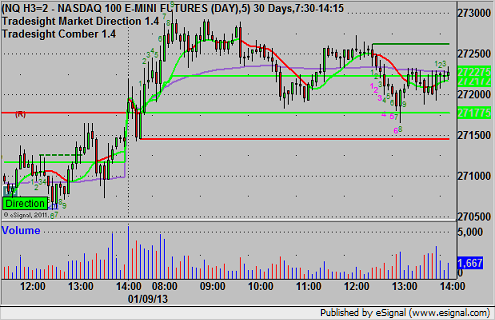

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's ES call triggered short at A at 1457.25 and stopped for 7 ticks. It retriggered at B, hit first target for 6 ticks, and stopped over the entry:

Forex Calls Recap for 1/10/13

A stop out on the new GBPUSD trade, but we closed out a 270 pip winner on the EURUSD from the prior session. This was our first week back to full size, and it looks like a good call so far.

As usual on the Sunday report, we will take a look at the action from Thursday night/Friday, then take a look at the daily charts with the Seeker and Comber separately heading into the new week, and then look at the US Dollar Index.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

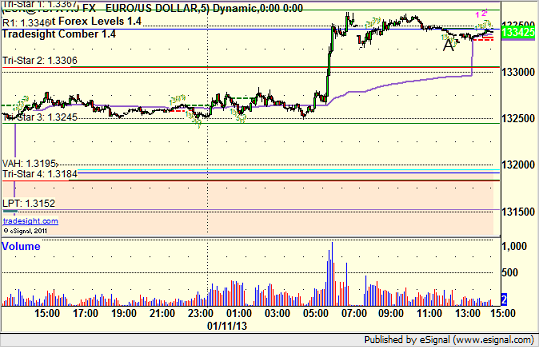

EURUSD:

We had adjusted the stop up on the existing call Thursday evening, then raised it under 1.3325 Friday morning, and I finally closed it at 1.3360 for end of week at A. You could also have held that one over, but I'm good with the close out for almost a 270 pip winner to the final exit:

Stock Picks Recap for 1/9/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TNGO triggered long (without market support) and worked enough for a partial:

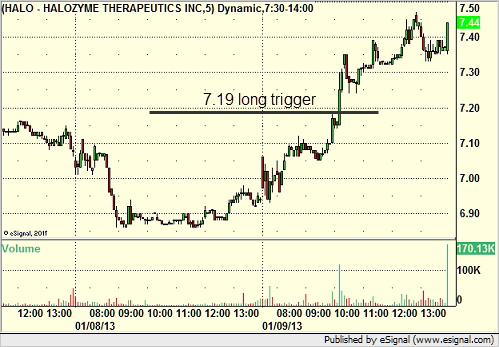

HALO triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (without market support due to triggering barely in the opening 5 minutes) and worked:

EBAY triggered short (without market support) and didn't work:

Rich's FAS triggered long (ETF, so no market support needed) and worked:

His NFLX triggered short (with market support) and didn't work:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Futures Calls Recap for 1/9/13

Two triggers, two winners for the session. See ES and ER sections below.

Net ticks: +11.5 ticks.

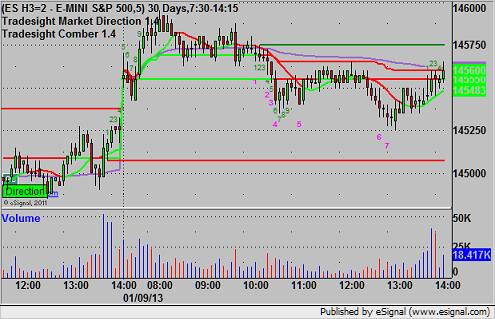

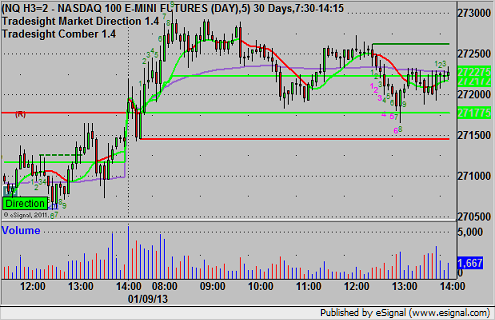

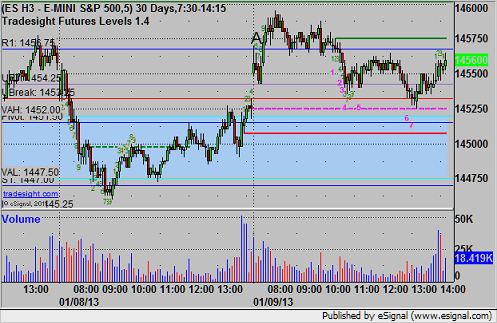

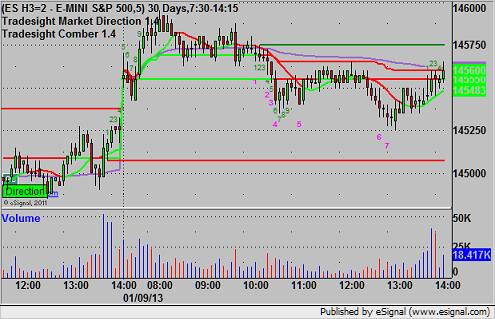

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's long triggered at 1457.25 at A, hit first target for 6 ticks, second half stopped under the entry:

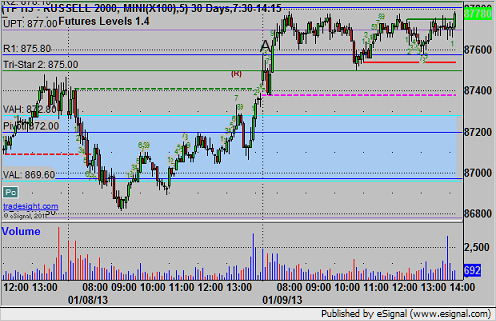

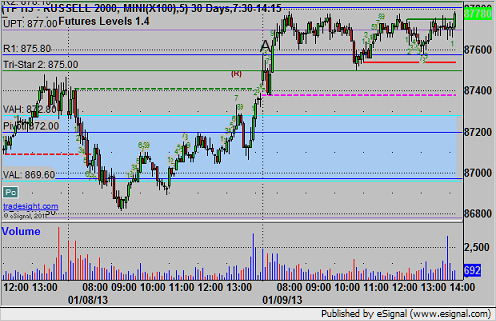

ER:

My long triggered at 875.90 over R1 at A, hit first target for 8 ticks, adjusted the stop twice and stopped at 876.90 for 10 ticks:

Futures Calls Recap for 1/9/13

Two triggers, two winners for the session. See ES and ER sections below.

Net ticks: +11.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's long triggered at 1457.25 at A, hit first target for 6 ticks, second half stopped under the entry:

ER:

My long triggered at 875.90 over R1 at A, hit first target for 8 ticks, adjusted the stop twice and stopped at 876.90 for 10 ticks: