Forex Calls Recap for 1/4/13

A winner to close out the week. See the EURUSD section below.

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts heading into the new week, and then glance at the US Dollar Index.

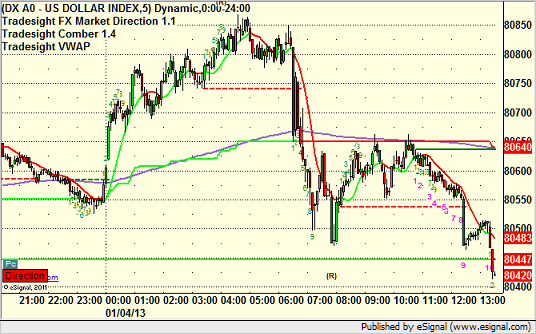

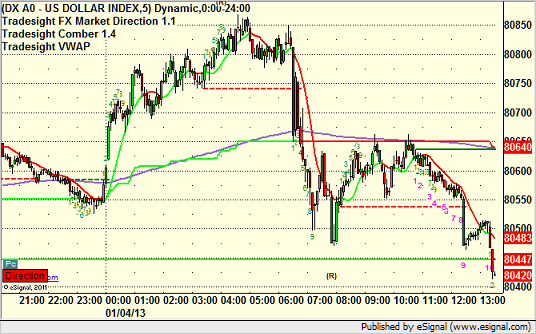

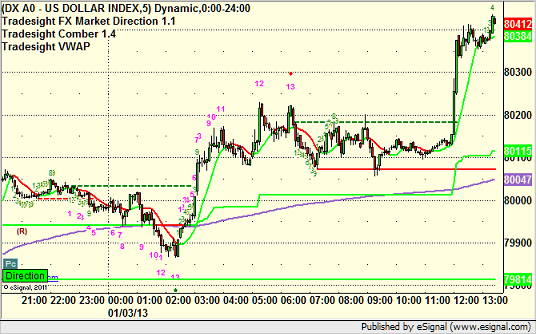

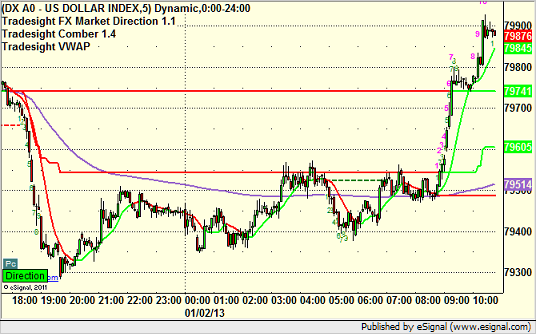

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

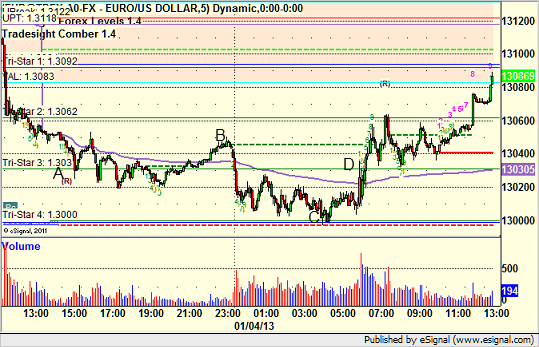

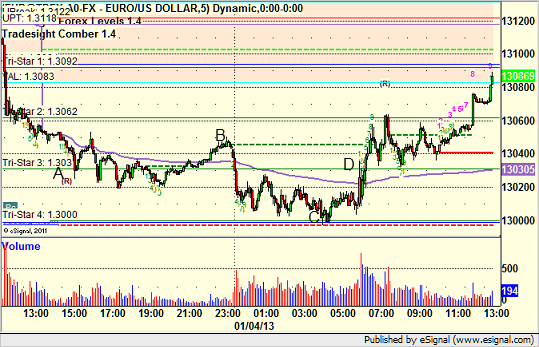

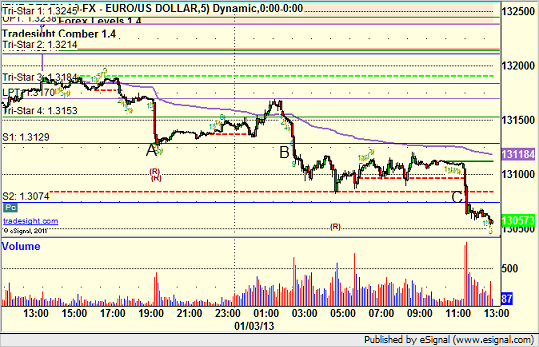

EURUSD:

Triggered short at A, gave you many opportunities for entry, including in the European session, and didn't quite stop at B, hit first target at C. Adjusted stop over entry and stopped at D:

Forex Calls Recap for 1/4/13

A winner to close out the week. See the EURUSD section below.

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts heading into the new week, and then glance at the US Dollar Index.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered short at A, gave you many opportunities for entry, including in the European session, and didn't quite stop at B, hit first target at C. Adjusted stop over entry and stopped at D:

Stock Picks Recap for 1/3/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SNTA triggered long (with market support) and didn't work:

SYMC triggered long (with market support) and worked enough for a partial:

TQNT gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's FDO triggered short (with market support) and worked:

His WLP triggered short (with market support) and worked:

AMZN triggered long (just barely with market support) and worked:

Rich's TJX triggered long (without market support) and didn't work:

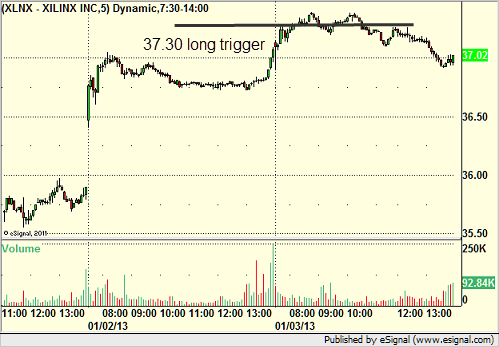

His XLNX triggered long (with market support) and didn't work:

His GE triggered short (with market support) and worked a little, no risk:

His VMW triggered short (with market support) and worked:

His AAPL triggered short (with market support) and didn't work:

In total, that's 9 trades triggering with market support, 6 of them worked, 3 did not.

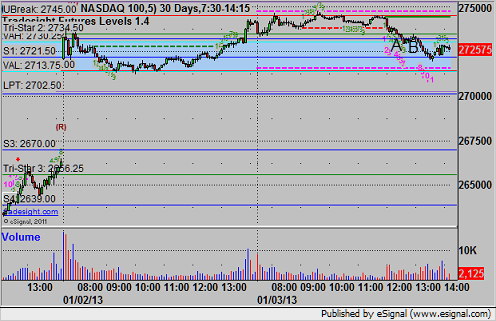

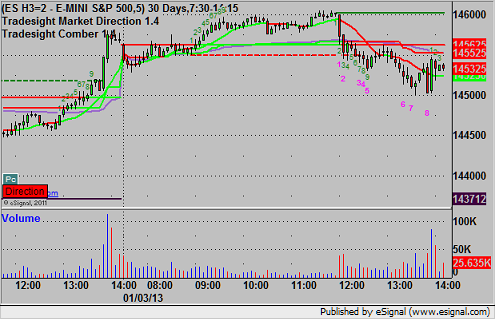

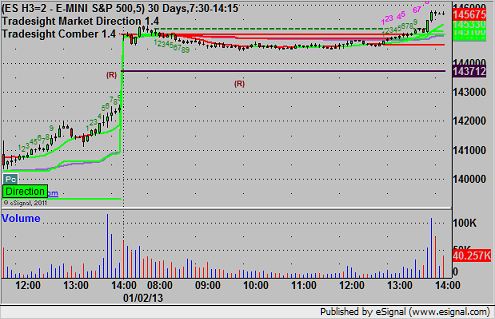

Futures Calls Recap for 1/3/13

Four triggered total, two on the NQ and two on the ES, both swept their entries exactly the first time and worked the second late in the session. See both sections below.

Net ticks: -2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

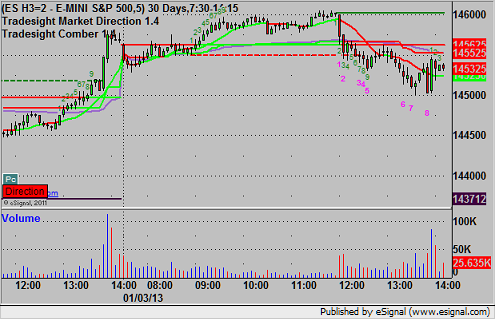

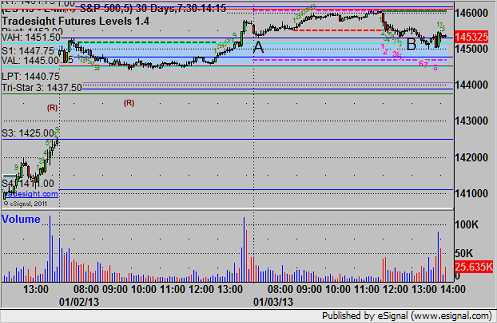

ES:

Triggered short at A under the trigger at 1452.75 and stopped for 7 ticks, then retriggered in the afternoon at B and I closed for 4 ticks as it was getting too late in the session to have both trades on:

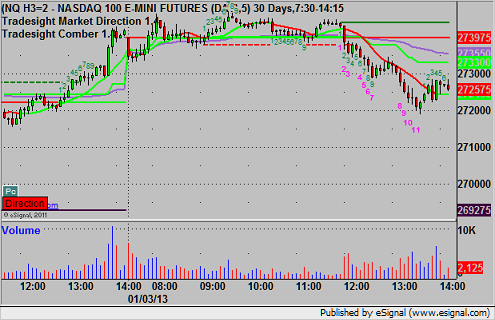

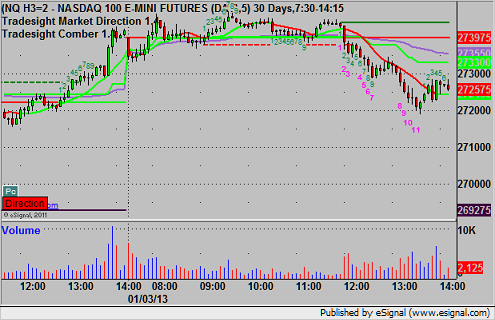

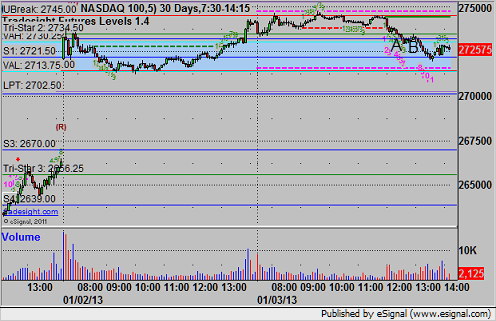

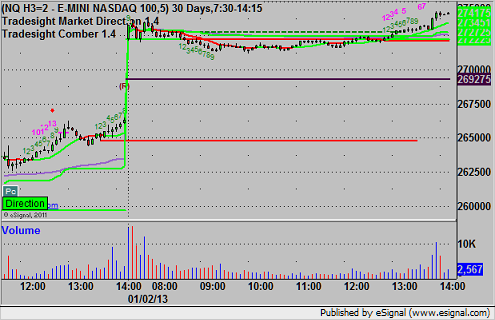

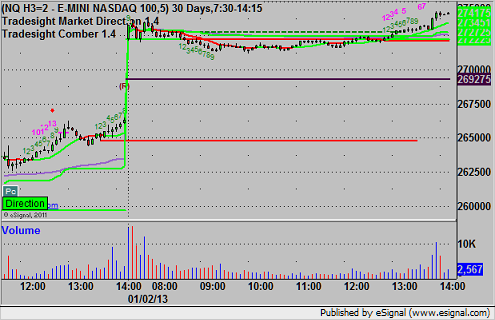

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short into the Value Area at A at 2729.75 and stopped for 7 ticks. Triggered short again at B, hit first target for six ticks, lowered stop and finally exited at 2725.25:

Futures Calls Recap for 1/3/13

Four triggered total, two on the NQ and two on the ES, both swept their entries exactly the first time and worked the second late in the session. See both sections below.

Net ticks: -2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A under the trigger at 1452.75 and stopped for 7 ticks, then retriggered in the afternoon at B and I closed for 4 ticks as it was getting too late in the session to have both trades on:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short into the Value Area at A at 2729.75 and stopped for 7 ticks. Triggered short again at B, hit first target for six ticks, lowered stop and finally exited at 2725.25:

Forex Calls Recap for 1/3/13

Got stopped out of an early trigger on the EURUSD, and then it triggered later and worked if you were up. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered short early (half size) at A and stopped for 25 pips before the European session began. Should have re-entered the trade under our rules, but I didn't post it to the Messenger, so we won't count it. Triggered short at B and hit first target at C if you did:

Stock Picks Recap for 1/2/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

No calls in the report due to the huge gap.

From the Messenger/Tradesight_st Twitter Feed, Rich's SINA triggered long (with market support) and didn't work:

His GDX triggered short (ETF, so no market support needed) and didn't work:

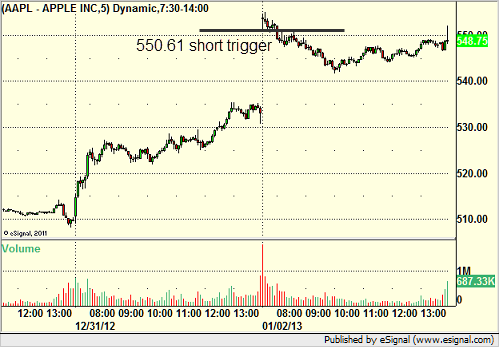

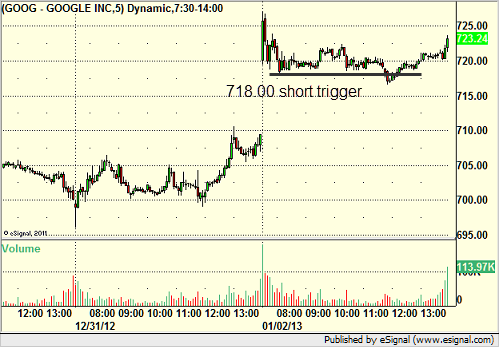

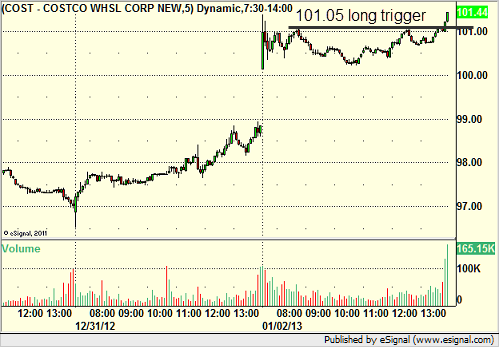

AAPL triggered short (with market support) and didn't work, but then triggered and worked great for us. Officially, we only count the first trigger:

MENT triggered long (with market support) and didn't go enough in either direction to count:

GOOG triggered short (with market support) and worked enough for a partial:

COST triggered long (with market support) late in the day and worked:

In total, that's 5 trades triggering with market support, 2 of them worked, 3 did not.

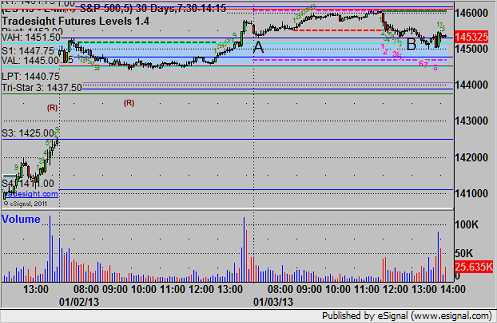

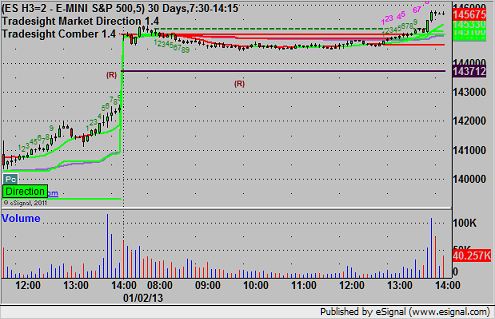

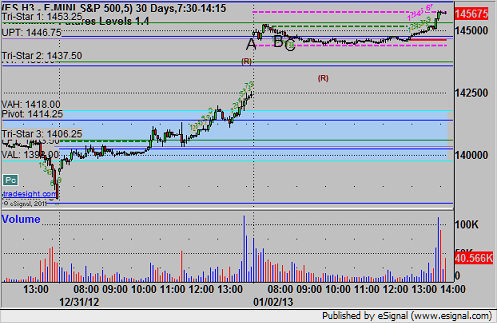

Futures Calls Recap for 1/2/13

Not the best start to the year for futures as the market gapped up so big, we didn't have much for Levels to use for setups. The same trade triggered three times, stopping twice, but working the third time. See ES below. Volume in the market was good though, so hopefully that holds and we can get back to normal trading.

Net ticks: -11.5 ticks.

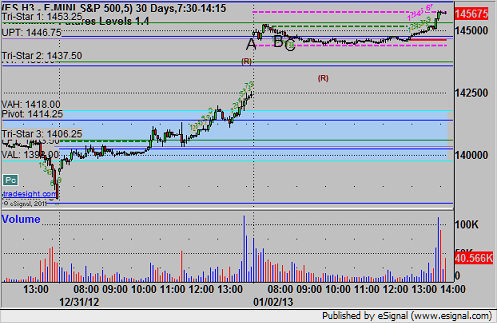

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1446.50 and stopped for 7 ticks. Triggered again at B and stopped. Triggered again at C, hit first target for 6 ticks, and stopped the second half over the entry:

Futures Calls Recap for 1/2/13

Not the best start to the year for futures as the market gapped up so big, we didn't have much for Levels to use for setups. The same trade triggered three times, stopping twice, but working the third time. See ES below. Volume in the market was good though, so hopefully that holds and we can get back to normal trading.

Net ticks: -11.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1446.50 and stopped for 7 ticks. Triggered again at B and stopped. Triggered again at C, hit first target for 6 ticks, and stopped the second half over the entry:

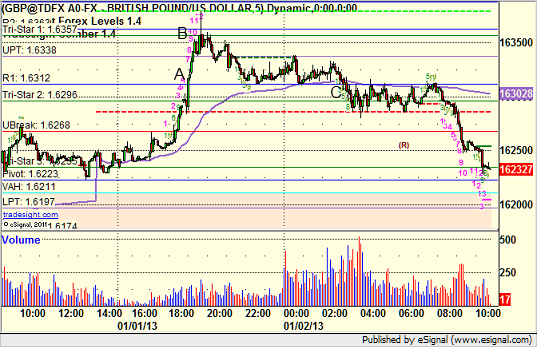

Forex Calls Recap for 1/2/13

A winner in the GBPUSD to start 2013. Always nice to start the year with a winner. See that section below for the recap.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

GBPUSD:

Triggered long at A, hit first target at B, moved stop under the entry and stopped at C: