Stock Picks Recap for 12/31/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

No calls in the report.

From the Messenger/Tradesight_st Twitter Feed, NFLX triggered long (with market support) and worked:

AMZN triggered long (with market support) and worked:

In total, that's 2 trades triggering with market support, both of them worked.

Futures Calls Recap for 12/31/12

No trades for the last session of the year. Volume was actually decent at 1.5 billion NASDAQ shares and there was some movement as it looks like the fiscal cliff talks are at least moving. See you Wednesday, and calls will resume!

Net ticks: +0 ticks.

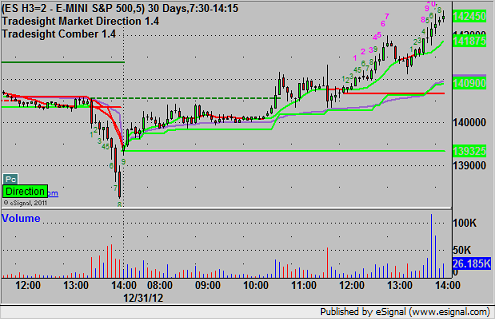

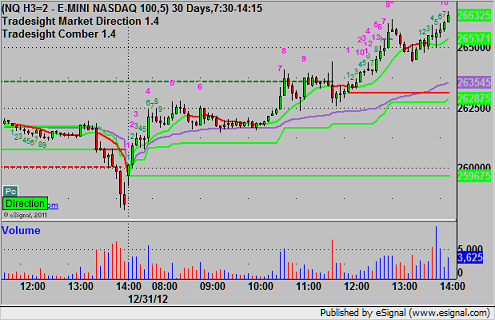

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Forex Calls Recap for 12/31/12

A loser and a bigger winner, both on the GBPUSD, to close out the year. See that section below.

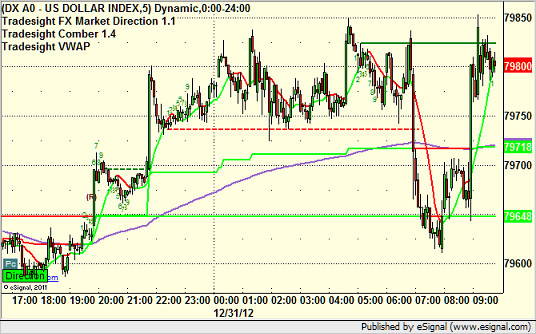

Here's a look at the US Dollar Index intraday with our market directional lines:

No calls or Levels tonight for the New Year's Holiday. New calls and Chat tomorrow after 5 pm EST when the new levels come out after global rollover.

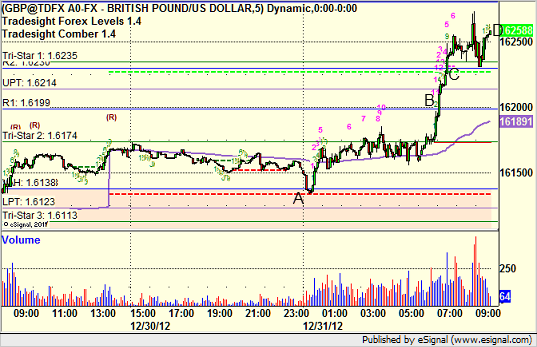

GBPUSD:

Triggered short at A and stopped for 25 pips. Triggered long at B, hit first target at C, and closed final piece for 50 pips at D at end of the chart. Didn't want to hold through the Holiday:

Stock Picks Recap for 12/28/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

No calls from the report.

From the Messenger/Tradesight_st Twitter Feed, Rich's JPM triggered long (with market support) and didn't work:

His BIDU triggered long (with market support) and worked:

His FAS triggered long (ETF, so no market support needed) and worked:

His VXX triggered long (ETF, so no market support needed) and didn't work:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

Futures Calls Recap for 12/28/12

Another day of poor action and volume, retreating again from Thursday's uptick in volume to only 750 million NASDAQ shares. The whole session was a flatline except for one 10 minute spike when rumors circulated that the White House and Congress might cut a short term deal to avert the cliff. Shocking.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Forex Calls Recap for 12/28/12

Two stop outs and a winner so almost a wash to close out the week and almost the quarter and year (one more session of calls Sunday).

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts heading into the new week, and then glance at the US Dollar Index.

The schedule will be the same this week as last. Levels and calls Sunday, although low expectations to close out the year unless the Fiscal Cliff is resolved. No Levels or calls Monday as most Forex brokers are closed from rollover to rollover Monday to Tuesday. New Levels and calls Tuesday, Wednesday, and Thursday to start the year.

As we do every year, there will be a lengthy end of year report posted recapping the markets for the year (stocks, futures, and forex).

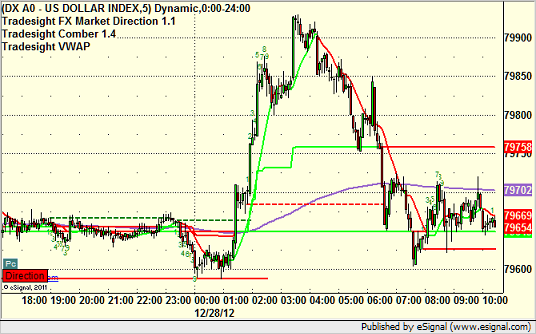

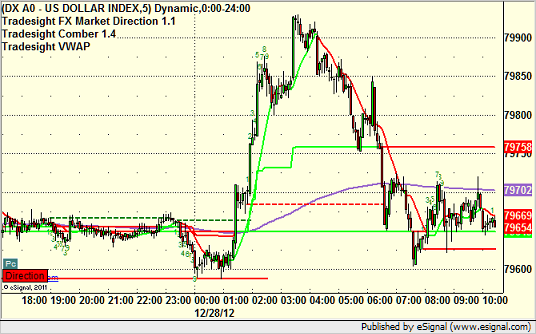

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

Forex Calls Recap for 12/28/12

Two stop outs and a winner so almost a wash to close out the week and almost the quarter and year (one more session of calls Sunday).

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts heading into the new week, and then glance at the US Dollar Index.

The schedule will be the same this week as last. Levels and calls Sunday, although low expectations to close out the year unless the Fiscal Cliff is resolved. No Levels or calls Monday as most Forex brokers are closed from rollover to rollover Monday to Tuesday. New Levels and calls Tuesday, Wednesday, and Thursday to start the year.

As we do every year, there will be a lengthy end of year report posted recapping the markets for the year (stocks, futures, and forex).

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

Stock Picks Recap for 12/27/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

No calls from the report. The calls from the prior day's report were still good, but none of them triggered.

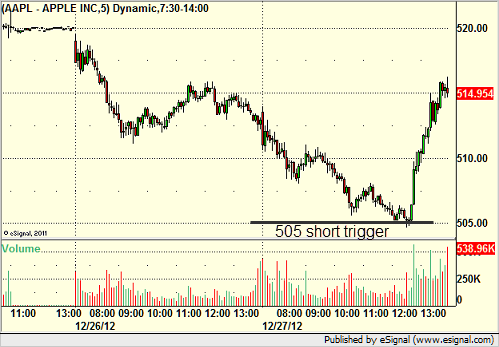

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short in the morning (without market support due to opening 5 minutes) and didn't work:

COST triggered short (with market support) and worked:

SINA triggered short (with market support) and worked:

Rich's AAPL triggered short (with market support) in the afternoon and didn't work:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Futures Calls Recap for 12/27/12

No calls again as volume was way too light, although we did get a spike down on concerns about the Fiscal Cliff and then a spike up in the afternoon when rumors circulated that Congress would be back December 30. Not that that means anything is solved. In the end, the S&P lost a point for the session.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Futures Calls Recap for 12/27/12

No calls again as volume was way too light, although we did get a spike down on concerns about the Fiscal Cliff and then a spike up in the afternoon when rumors circulated that Congress would be back December 30. Not that that means anything is solved. In the end, the S&P lost a point for the session.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session: