Forex Calls Recap for 12/27/12

We closed out a 40 pip winner on the EURUSD from the prior session, and the new trade triggered and ended up stopping just under the entry. See that section below.

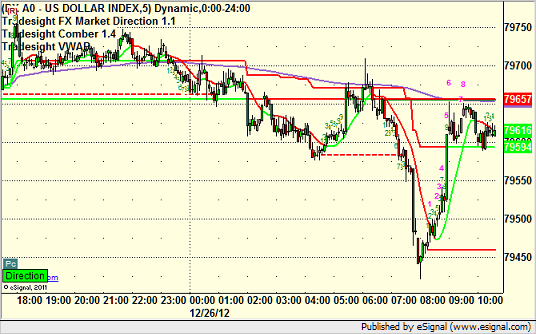

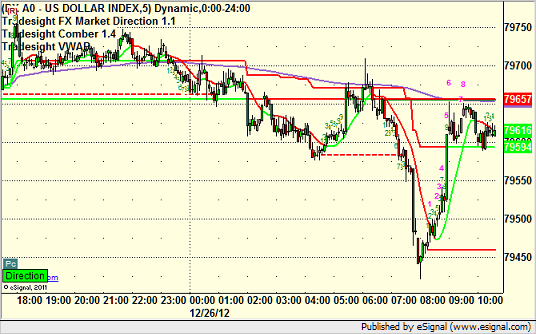

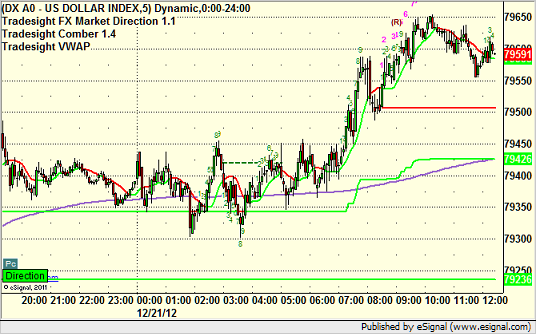

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

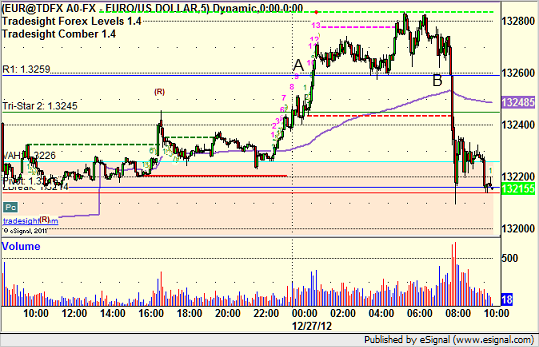

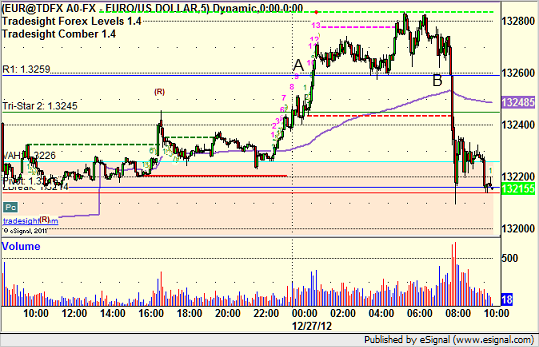

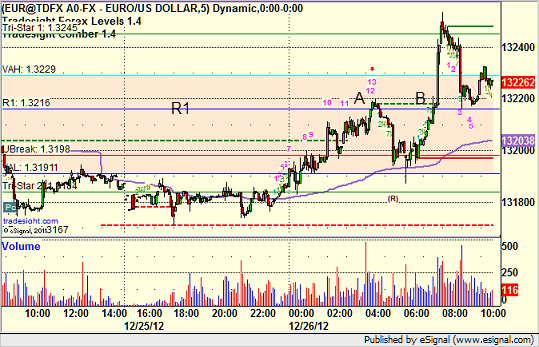

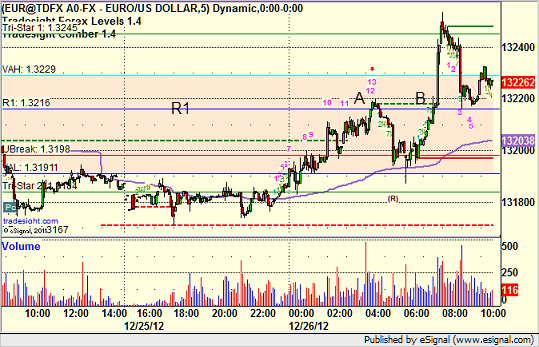

We came in long from the 1.3216 area from the prior session with a stop under that (which was the new Pivot). We ran up and hit the first target from that trade, and also triggered long at A the new trade over R1, then moved the stop under R1 on all of it in the morning and stopped at B:

Forex Calls Recap for 12/27/12

We closed out a 40 pip winner on the EURUSD from the prior session, and the new trade triggered and ended up stopping just under the entry. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

We came in long from the 1.3216 area from the prior session with a stop under that (which was the new Pivot). We ran up and hit the first target from that trade, and also triggered long at A the new trade over R1, then moved the stop under R1 on all of it in the morning and stopped at B:

Stock Picks Recap for 12/26/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's PXD triggered long (without market support) and didn't work:

His TIF triggered short (with market support) and worked:

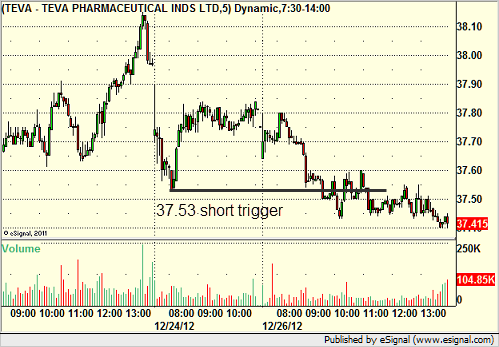

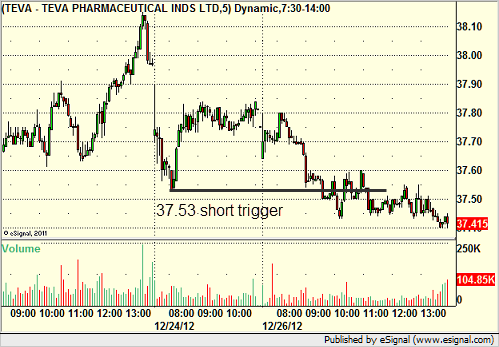

TEVA triggered short (with market support) and didn't go far but mostly held in the money:

Rich's EBAY triggered short (with market support) and didn't work:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Stock Picks Recap for 12/26/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's PXD triggered long (without market support) and didn't work:

His TIF triggered short (with market support) and worked:

TEVA triggered short (with market support) and didn't go far but mostly held in the money:

Rich's EBAY triggered short (with market support) and didn't work:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Futures Calls Recap for 12/26/12

NASDAQ volume was only 700 million shares again. This is going to be a wasted week. No futures calls were made due to the light volume. Maybe the volume will be a little better Thursday. Friday should be a waste as everyone heads out again for the long weekend.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Forex Calls Recap for 12/26/12

Better ranges than I would have thought, and we had a stop out on the EURUSD and then it triggered again and was working as I post this. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A and stopped (note the 13 Comber sell signal right at the trigger). Triggered long at B, didn't quite hit the first target of R2 just off the top of the screen. Still holding with a stop under the R1 entry:

Forex Calls Recap for 12/26/12

Better ranges than I would have thought, and we had a stop out on the EURUSD and then it triggered again and was working as I post this. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A and stopped (note the 13 Comber sell signal right at the trigger). Triggered long at B, didn't quite hit the first target of R2 just off the top of the screen. Still holding with a stop under the R1 entry:

Stock Picks Recap for 12/21/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, there were no calls.

From the Messenger/Tradesight_st Twitter Feed, Rich's ORCL triggered long (without market support due to opening 5 minutes) and worked:

His GOOG triggered long (with market support) and worked enough for a partial:

His AAPL triggered long (with market support) and worked:

His GLD triggered long (ETF, so no market support needed) and worked enough for a partial:

NFLX triggered long (with market support) and didn't work:

Rich's VXX triggered short (ETF, so no market support needed) and worked enough for a partial:

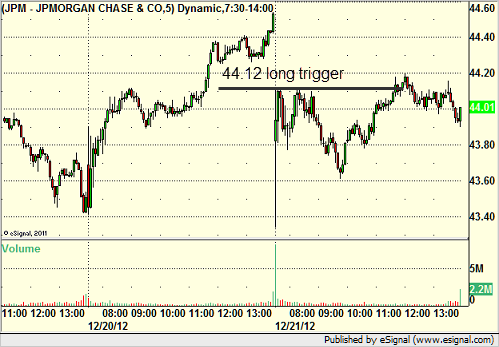

His JPM triggered long (with market support) and didn't work:

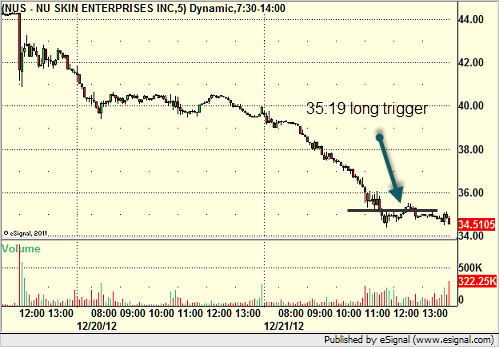

His NUS triggered long (with market support) and worked enough for a partial:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

Futures Calls Recap for 12/21/12

One loser that I didn't re-enter (it worked great the second time). The market gapped down on the "news" that the House failed to pass a second option for the Fiscal Cliff situation. Not that anyone should have been surprised and not that whatever they passed would have gone through the Senate. At any rate, we closed higher than we opened by a bit but left a huge gap above. At the same time, we had options expiration, which caused a lot of volume early, but we still only hit 2 billion NASDAQ shares.

Net ticks: -7 ticks.

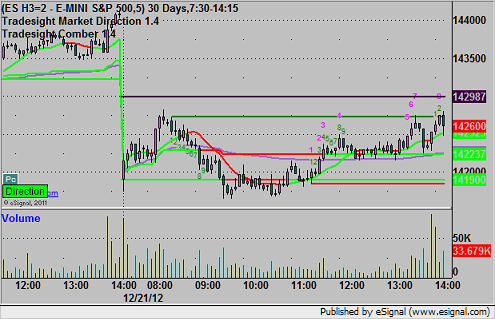

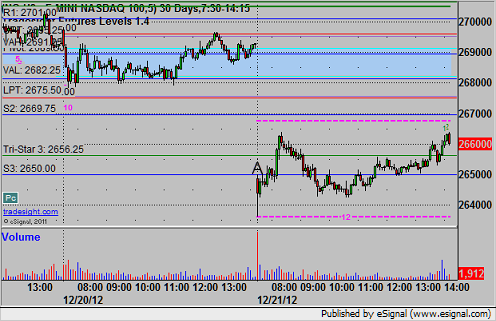

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long on a stop at 2651.00 at A and stopped for 7 ticks but just barely, almost a great play:

Forex Calls Recap for 12/21/12

A loser and a small winner to close out the week. See EURUSD below.

As usual with the Sunday reports, we will take a look at the action from Thursday night/Friday, then look at the daily charts heading into the new week (see EURUSD and GBPUSD in particular) and then discuss the US Dollar Index.

Last reminder: Levels and Calls Sunday (not expecting much), Tuesday, Wednesday, and Thursday. Nothing Monday as the Forex markets are closed.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered short early at A just barely and stopped. Triggered short again at B and closed at end of chart for end of week: