Stock Picks Recap for 12/20/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PAAS gapped under, no play, although it filled the gap and then worked fine.

From the Messenger/Tradesight_st Twitter Feed, NFLX triggered short (without market support due to opening 5 minutes) and worked:

Rich's AAPL triggered short (with market support) and worked:

His HLF triggered short (with market support) and worked:

His CF triggered short (without market support) and didn't work:

AMZN triggered long (with market support) and didn't work the first time, worked great later:

Rich's RAX triggered long (with market support) and worked:

His MA triggered long (with market support) and worked:

His FAS triggered long (ETF, so no market support needed) and worked:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.

Stock Picks Recap for 12/20/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PAAS gapped under, no play, although it filled the gap and then worked fine.

From the Messenger/Tradesight_st Twitter Feed, NFLX triggered short (without market support due to opening 5 minutes) and worked:

Rich's AAPL triggered short (with market support) and worked:

His HLF triggered short (with market support) and worked:

His CF triggered short (without market support) and didn't work:

AMZN triggered long (with market support) and didn't work the first time, worked great later:

Rich's RAX triggered long (with market support) and worked:

His MA triggered long (with market support) and worked:

His FAS triggered long (ETF, so no market support needed) and worked:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.

Futures Calls Recap for 12/20/12

Two winners on the ES, although no real follow-through once again as volume started to dip and we really didn't get an options unraveling move, which is interesting. Doubtful that we will get one Friday, and there might not even be any calls.

Net ticks: +7.5 ticks.

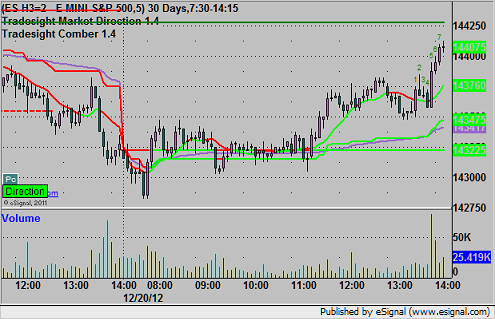

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

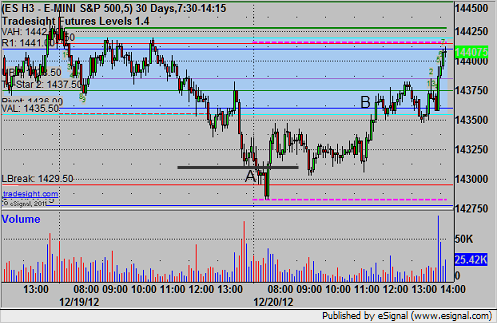

My call triggered short at A at 1430.75, hit first target for 6 ticks, and stopped final piece 4 ticks in the money. Mark's long triggered at B at 1436.25, hit first target for 6 ticks eventually, and stopped second half under the entry:

Futures Calls Recap for 12/20/12

Two winners on the ES, although no real follow-through once again as volume started to dip and we really didn't get an options unraveling move, which is interesting. Doubtful that we will get one Friday, and there might not even be any calls.

Net ticks: +7.5 ticks.

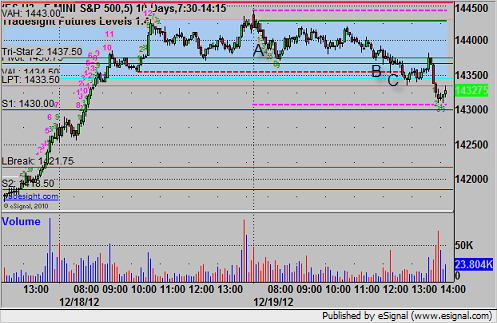

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

My call triggered short at A at 1430.75, hit first target for 6 ticks, and stopped final piece 4 ticks in the money. Mark's long triggered at B at 1436.25, hit first target for 6 ticks eventually, and stopped second half under the entry:

Forex Calls Recap for 12/20/12

Another winner in the EURUSD, see that section below.

Tonight is likely to be slow, as we have triple expiration Friday ahead, which includes currency futures. Less than half size.

Levels will go up every day next week, and we will have calls on Sunday, Tuesday, Wednesday, and Thursday, but with low expectations. Tuesday is a US bank holiday.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A, hit first target at B, moved stop under UPT and stopped at C:

Stock Picks Recap for 12/19/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

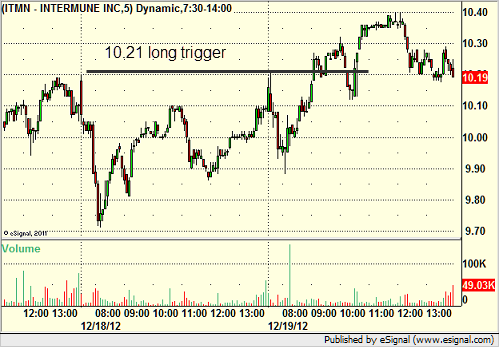

From the report, ITMN triggered long (with market support) and worked enough for a partial:

DNKN, SOHU, and FLIR gapped over, no plays. RGLD gapped under the short trigger, no play.

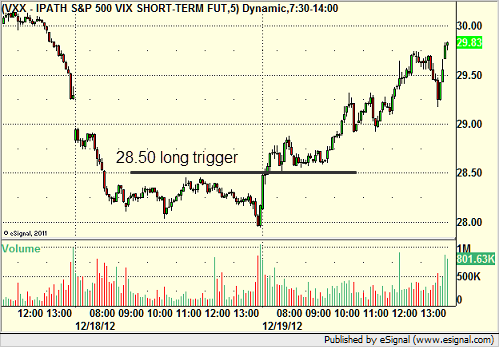

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered long (ETF, so no market support needed) and worked:

His EBAY triggered short (without market support due to opening 5 minutes) and didn't work:

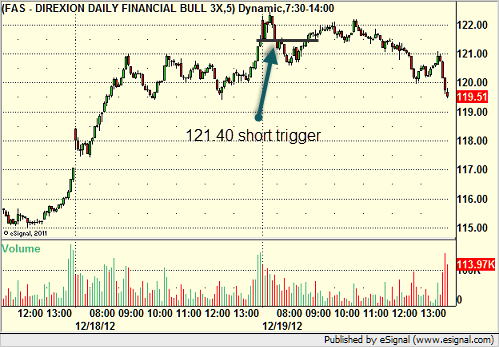

His FAS triggered short (ETF, so no market support needed) and worked:

GOOG triggered short (with market support) and worked:

Rich's AMZN triggered short (with market support) and worked:

His DISH triggered short (with market support) and worked:

His VMW triggered short (with market support) and didn't work:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.

Futures Calls Recap for 12/19/12

Three triggers on the ES, one worked and two didn't. See ES section below.

Net ticks: -8.5 ticks.

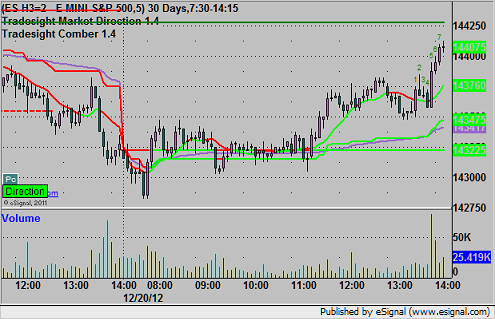

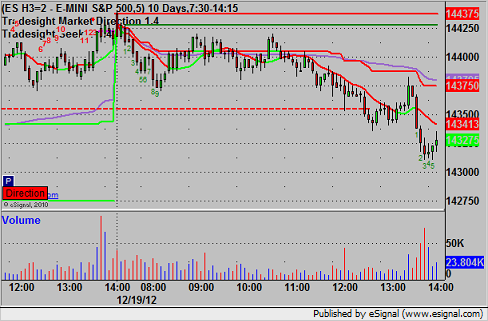

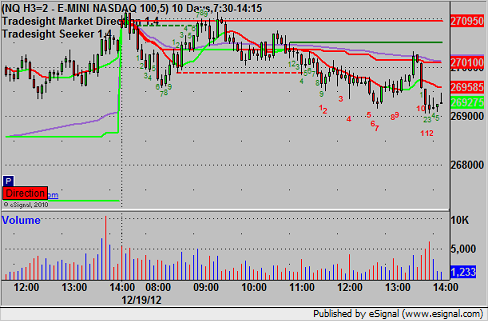

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

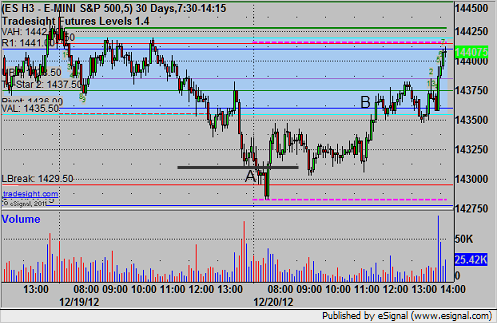

Mark's short triggered at A at 1438.25 in the morning and stopped. A later call triggered short at B at 1436.50 and stopped quickly, then retriggered at C, worked to the first target for 6 ticks, and stopped the final piece also in the money by 5 ticks:

Forex Calls Recap for 12/19/12

Clean winner for the session in the EURUSD. See that section below.

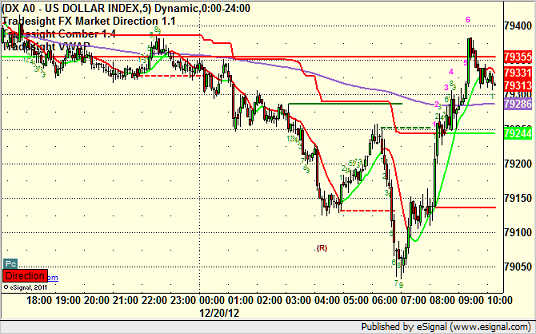

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

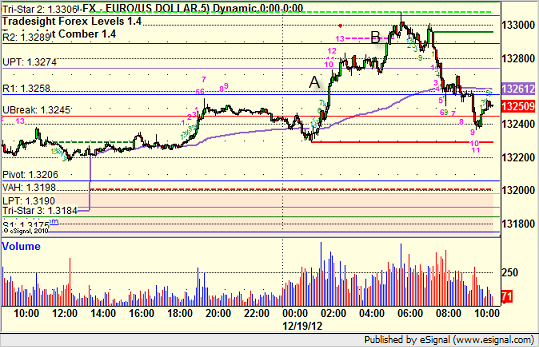

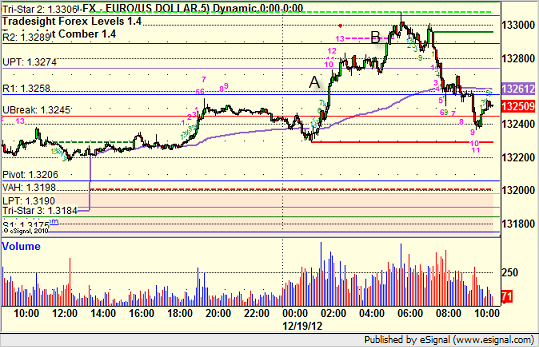

EURUSD:

Triggered long at A, hit first target at B, second half stopped under the R1 entry in the morning:

Forex Calls Recap for 12/19/12

Clean winner for the session in the EURUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A, hit first target at B, second half stopped under the R1 entry in the morning:

Stock Picks Recap for 12/18/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Nothing triggered off of the report.

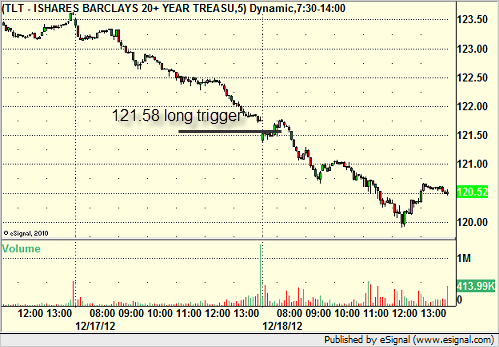

From the Messenger/Tradesight_st Twitter Feed, TLT triggered long (ETF, so no market support needed) and worked enough for a partial while filling the gap:

Rich's AMZN triggered long (with market support) and worked:

TRIP triggered short (without market support) and didn't work:

In total, that's 2 trades triggering with market support, both of them worked.