Stock Picks Recap for 12/18/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Nothing triggered off of the report.

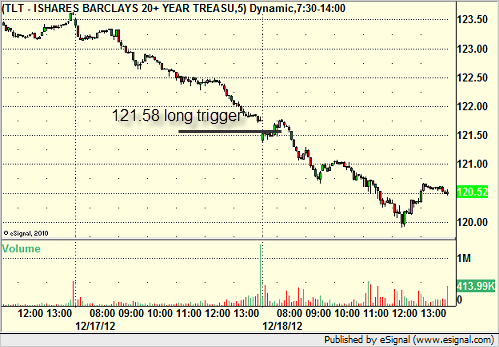

From the Messenger/Tradesight_st Twitter Feed, TLT triggered long (ETF, so no market support needed) and worked enough for a partial while filling the gap:

Rich's AMZN triggered long (with market support) and worked:

TRIP triggered short (without market support) and didn't work:

In total, that's 2 trades triggering with market support, both of them worked.

Futures Calls Recap for 12/18/12

No trades triggered from the calls today.

Net ticks: +0 ticks.

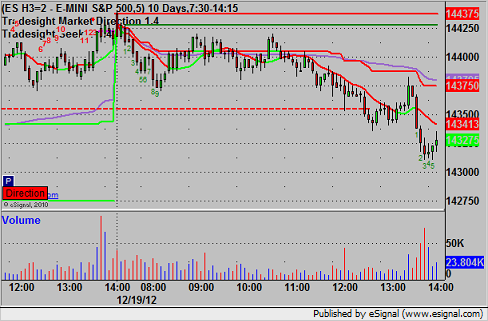

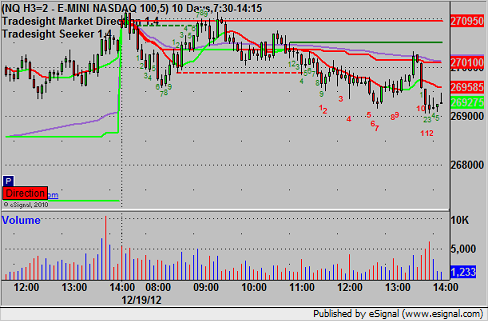

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Forex Calls Recap for 12/18/12

A small winner late in the session after a flat overnight. See EURUSD below.

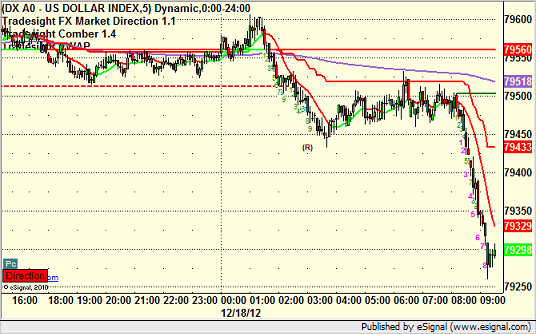

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

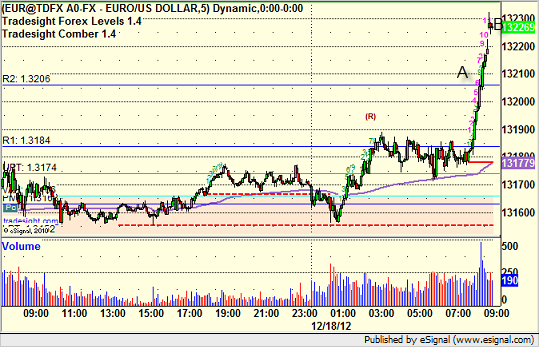

EURUSD:

Finally triggered long at A, and I closed it at B 20 pips in the money because we were getting late in the session and I was heading out (usually not a reason, but good enough in this environment):

Tradesight Market Preview for 12/18/12

The ES was higher by 18 on the day. This was expected after our 10-day Trin recorded an oversold reading. Note that price is above all of the major moving averages.

The NQ futures were higher by 39 full handles on the day. Again price is back above all the major moving averages but needs to prove itself by clearing the 5/8 level.

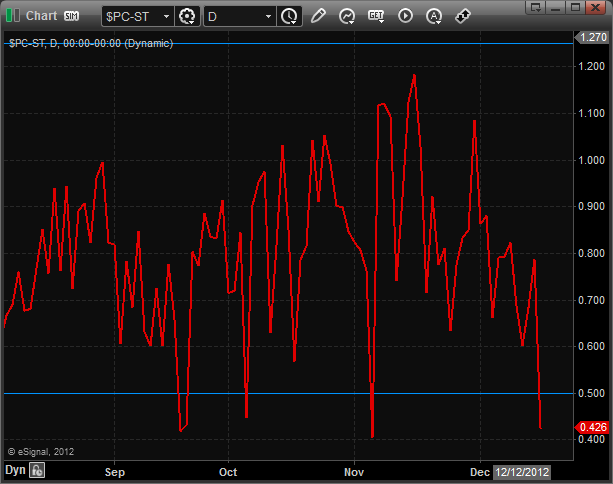

The total put/call ratio recorded an extreme downside reading which is a serious cause for concern for the bulls.

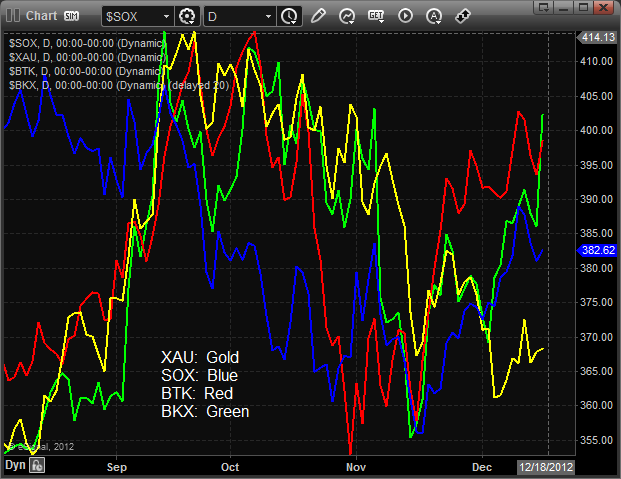

Multi sector daily chart:

The 10-day Trin is even more overbought and climatically reading that the overall market is out of upside gas.

The BKX was the top gun on the day, exploding past the recent high and decisively closing above the 4/8 level.

The OSX is still technically challenged and traded in-line with the market. Keep in mind that it is still below the DTL.

The BTK was higher on the day but did not make a new high on the move.

The SOX lagged the NAZ and remains below the 200dma.

Oil:

Gold:

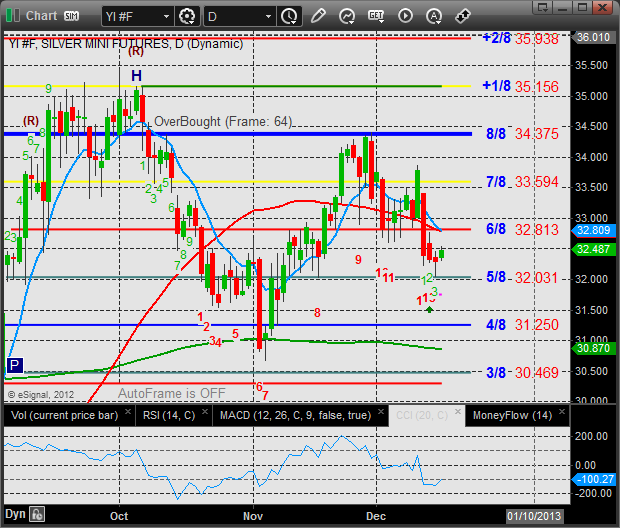

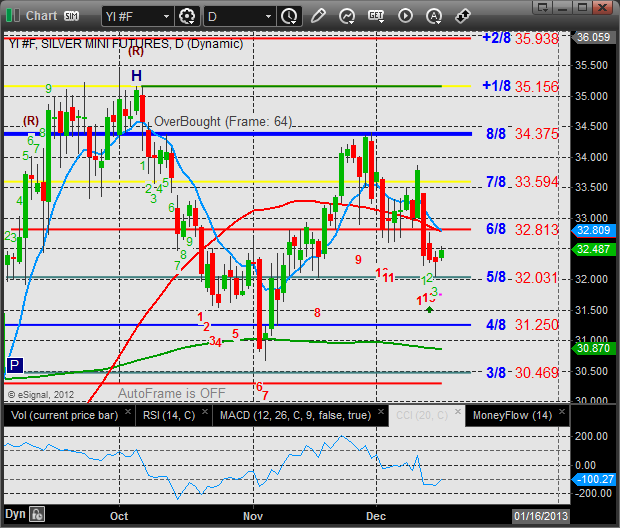

Silver:

Stock Picks Recap for 12/17/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CTRP triggered long (without market support due to opening 5 minutes) and worked:

INFA gapped over, no play.

MDRX triggered short (without market support) and didn't go enough in either direction to count:

From the Messenger/Tradesight_st Twitter Feed, Rich's X triggered long (with market support) and didn't work:

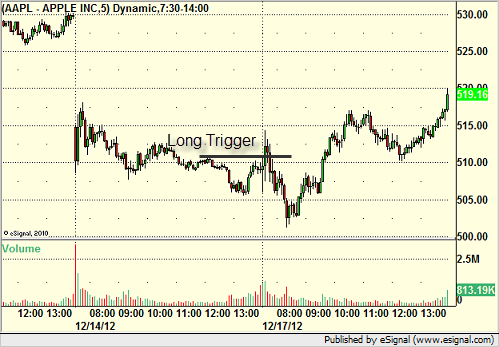

His AAPL triggered long (with market support) and worked for a couple of points:

His GS triggered long (with market support) and worked great:

His BIIB triggered long (with market support) and didn't work:

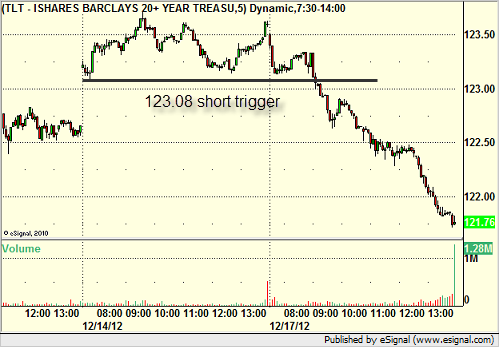

TLT triggered short (ETF, so no market support needed) and worked great:

NFLX triggered short (without market support) and didn't work:

NTAP triggered short (without market support) and didn't work:

Rich's GOOG triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

Futures Calls Recap for 12/17/12

One loser on the ES and Mark chose not to take it again (second trigger worked).

Net ticks: -7 ticks.

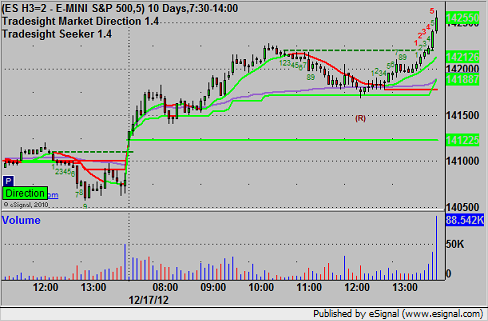

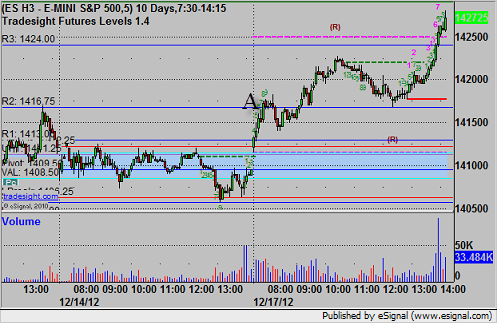

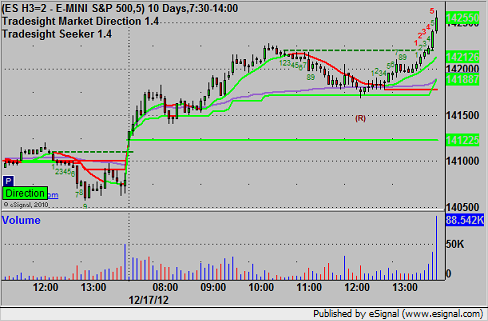

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1417.00 and stopped for 7 ticks:

Futures Calls Recap for 12/17/12

One loser on the ES and Mark chose not to take it again (second trigger worked).

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1417.00 and stopped for 7 ticks:

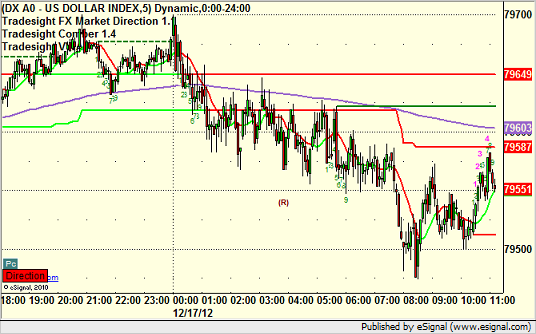

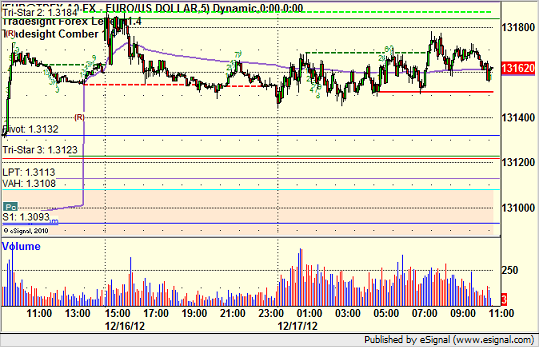

Forex Calls Recap for 12/17/12

None of our calls triggered as the EURUSD was amazingly flat for the session. I'll just recap the charts below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Stock Picks Recap for 12/14/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered short (with market support) and worked:

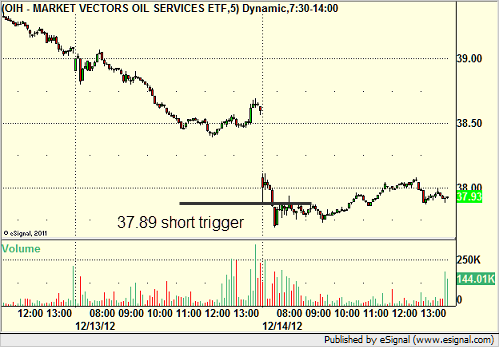

His OIH triggered short (ETF, so no market support needed) and worked enough for a partial:

His AAPL triggered long (with market support) and worked for a couple of points:

GOOG triggered long (with market support) and didn't work:

His JOY triggered long (with market support) and worked enough for a partial:

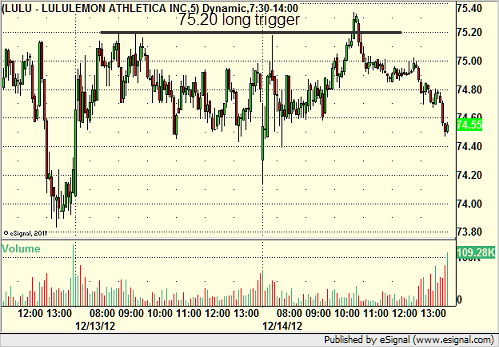

His LULU triggered long (with market support) and didn't work:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

Futures Calls Recap for 12/14/12

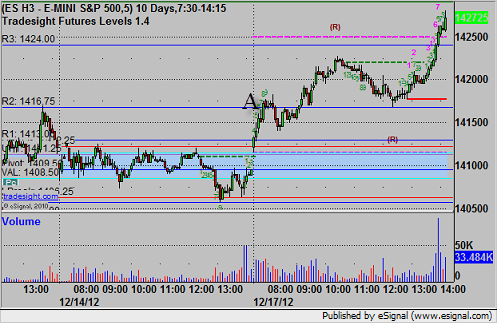

No calls on a Friday for the futures contract roll. This day every quarter tends to be very dangerous as the big players are just moving their trading to the new (H3 - March 2013) contract. Given that it is also a Friday in December, things were very dull. The ES traded in a 5-point range until the last hour when things finally slipped. You'll note in the charts that we barely touched any key levels.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Late in the day, we had a 9-bar setup move down to S1 that led to a bounce: