Tradesight Market Preview for 12/6/12

The SP was higher by 3 on the day and really did very little technically. The day’s real body is almost exactly what yesterday’s was and price was little changed. The settlement remains pinched between the 10ema and 50sma. The range needs to be resolved and then new technicals will develop. Keep in mind that there is still a recent Seeker 9 bar setup that has just completed.

The NQ futures were lower on the day by a hefty 27 handles. This was undoubtedly because of the steep losses in AAPL which is the largest NDX member. It is what it is and this settled the futures below the 10ema which turns the chart back to short term negative. Another technical to beware of is the fact that price is now back below all of the important moving averages and 50dma may cross below the 200dma which some technicians believe accelerates the move. That’s not our technical perspective but moving average crosses are widely followed and can be a self-fulfilling event.

Multi sector daily chart:

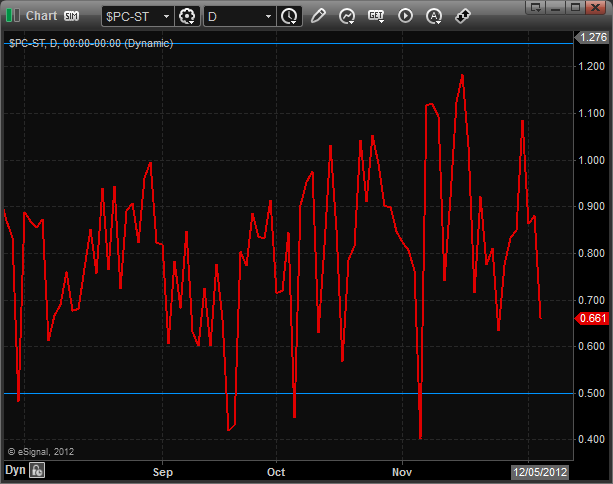

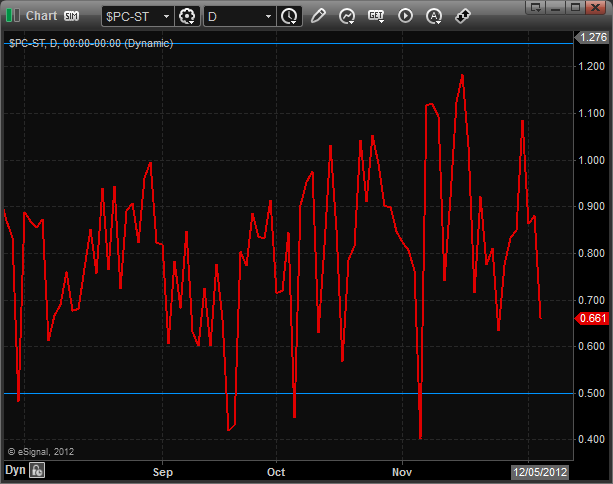

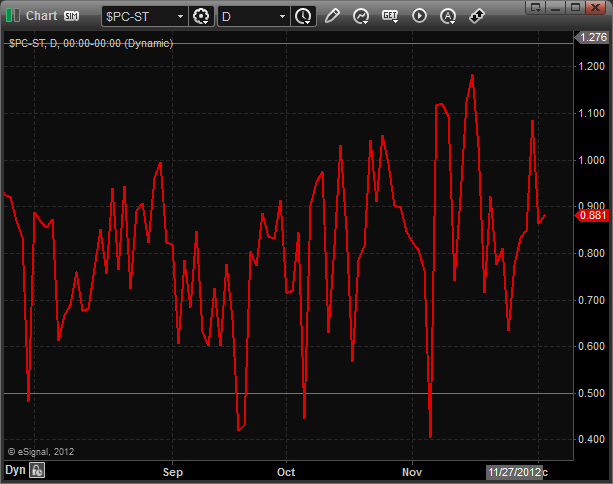

Total put/call ratio:

The 10-day Trin is staging but has not yet recorded an overbought reading.

The NDX very weak vs. the SPX and this condition is always worrisome for the broad market bulls.

The BKX was the top gun on the day but was unable to break out of the recent trading range. Keep in mind that the 50dma is a key level.

The OSX was slightly higher and is approaching a major break out/resistnace level where the moving average meets the trend line.

The SOX was flat on the day with no new technical developments.

The BTK was inside yesterday’s candle and unchanged on the day.

The housing index, HGX, finally is feeling the effect of the Seeker. This break should have been expected and is likely just starting a move.

While the HGX got smashed, it was not the weakest sector on the day, that place was taken by the XAU. This broke the XAU to a new low, be sure to see the comments on gold futures below.

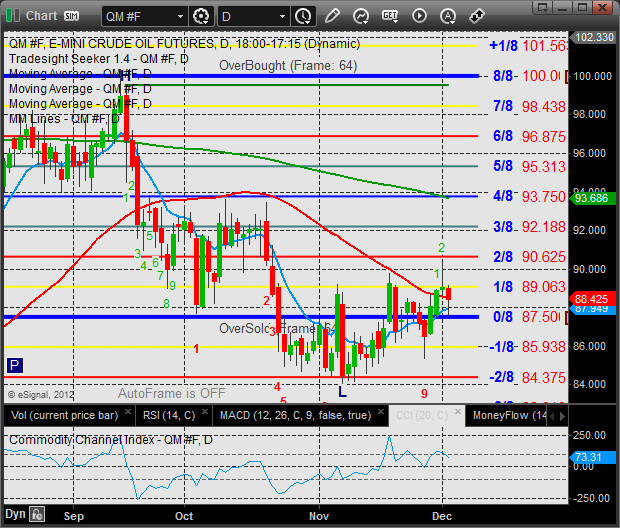

Oil:

Gold recorded a Seeker exhaustion signal and should find support. Keep an eye on the YG, GLD and XAU for signs of reversal.

Silver:

Tradesight Market Preview for 12/6/12

The SP was higher by 3 on the day and really did very little technically. The day’s real body is almost exactly what yesterday’s was and price was little changed. The settlement remains pinched between the 10ema and 50sma. The range needs to be resolved and then new technicals will develop. Keep in mind that there is still a recent Seeker 9 bar setup that has just completed.

The NQ futures were lower on the day by a hefty 27 handles. This was undoubtedly because of the steep losses in AAPL which is the largest NDX member. It is what it is and this settled the futures below the 10ema which turns the chart back to short term negative. Another technical to beware of is the fact that price is now back below all of the important moving averages and 50dma may cross below the 200dma which some technicians believe accelerates the move. That’s not our technical perspective but moving average crosses are widely followed and can be a self-fulfilling event.

Multi sector daily chart:

Total put/call ratio:

The 10-day Trin is staging but has not yet recorded an overbought reading.

The NDX very weak vs. the SPX and this condition is always worrisome for the broad market bulls.

The BKX was the top gun on the day but was unable to break out of the recent trading range. Keep in mind that the 50dma is a key level.

The OSX was slightly higher and is approaching a major break out/resistnace level where the moving average meets the trend line.

The SOX was flat on the day with no new technical developments.

The BTK was inside yesterday’s candle and unchanged on the day.

The housing index, HGX, finally is feeling the effect of the Seeker. This break should have been expected and is likely just starting a move.

While the HGX got smashed, it was not the weakest sector on the day, that place was taken by the XAU. This broke the XAU to a new low, be sure to see the comments on gold futures below.

Oil:

Gold recorded a Seeker exhaustion signal and should find support. Keep an eye on the YG, GLD and XAU for signs of reversal.

Silver:

Stock Picks Recap for 12/5/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, GNTX triggered long (without market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's FCX triggered long (with market support) and worked:

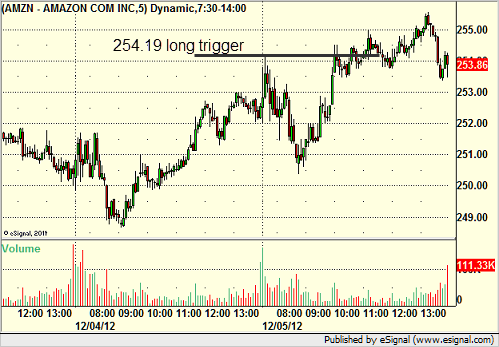

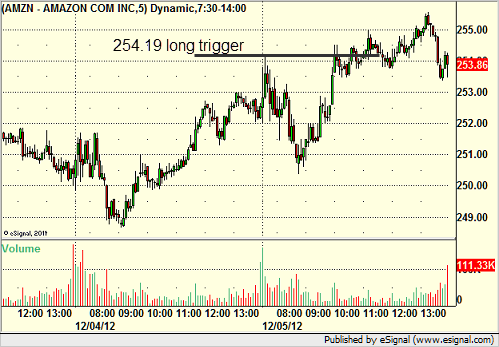

AMZN triggered long (with market support) and worked:

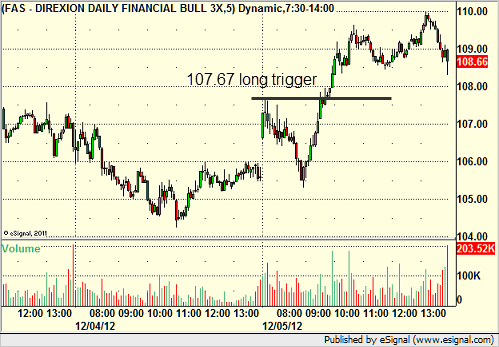

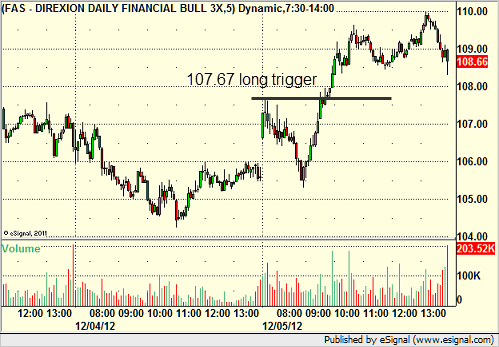

Rich's FAS triggered long (ETF, so no market support needed) and worked:

His GOOG triggered short (with market support) and worked:

His CAT triggered long (with market support) and didn't work:

His FIRE triggered short (without market support) and worked great:

His AAPL triggered short (without market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Stock Picks Recap for 12/5/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, GNTX triggered long (without market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's FCX triggered long (with market support) and worked:

AMZN triggered long (with market support) and worked:

Rich's FAS triggered long (ETF, so no market support needed) and worked:

His GOOG triggered short (with market support) and worked:

His CAT triggered long (with market support) and didn't work:

His FIRE triggered short (without market support) and worked great:

His AAPL triggered short (without market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

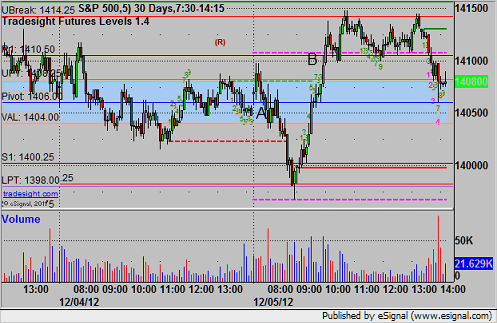

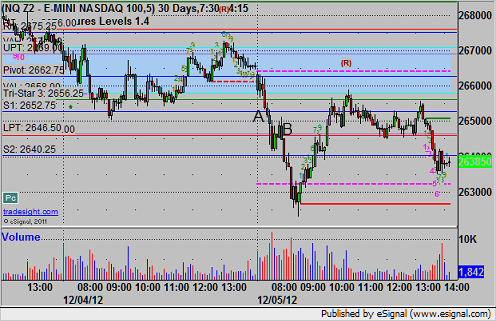

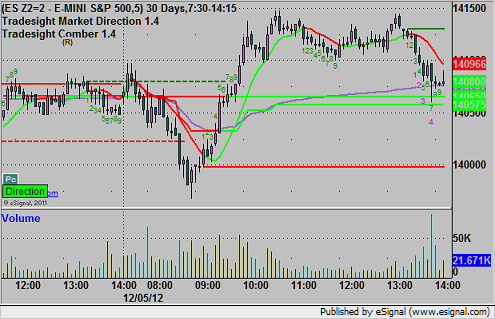

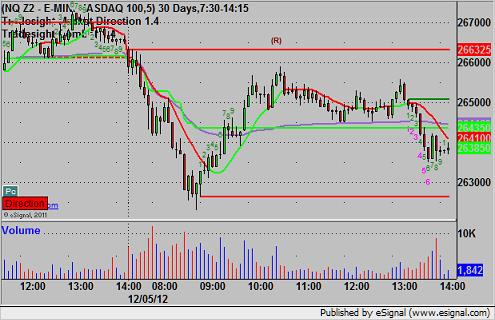

Futures Calls Recap for 12/5/12

A winner on the NQ and a loser and winner on the ES for the session. See both sections below.

Net ticks: +4.5 ticks.

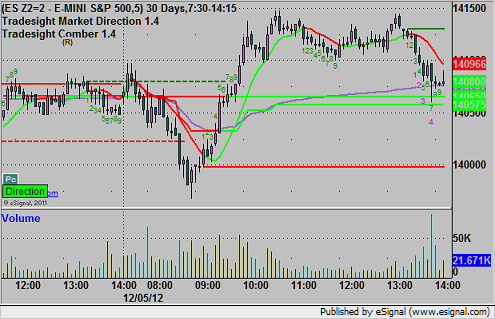

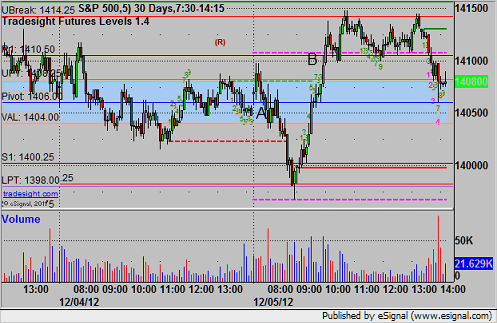

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's short triggered at A at 1405.75 and stopped for 7 ticks and he did not re-enter. His long triggered at B at 1410.00, hit first target for 6 ticks, and stopped the second half under the entry:

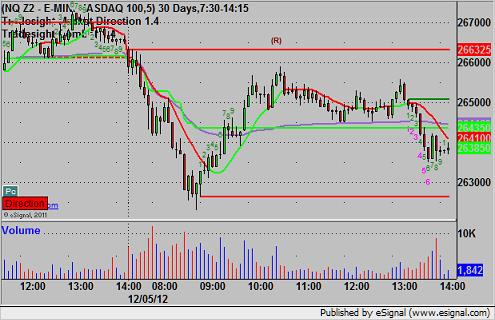

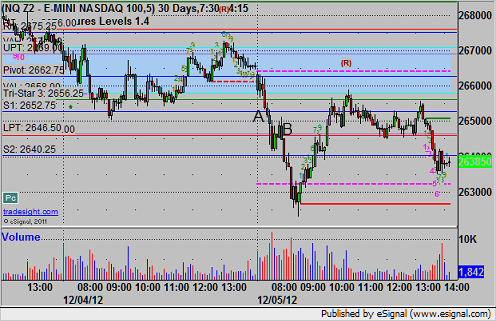

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My short triggered at A at 2652.50, hit first target for 6 ticks, and I lowered the stop several times and stopped the final piece at 2646.50 at B:

Futures Calls Recap for 12/5/12

A winner on the NQ and a loser and winner on the ES for the session. See both sections below.

Net ticks: +4.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's short triggered at A at 1405.75 and stopped for 7 ticks and he did not re-enter. His long triggered at B at 1410.00, hit first target for 6 ticks, and stopped the second half under the entry:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My short triggered at A at 2652.50, hit first target for 6 ticks, and I lowered the stop several times and stopped the final piece at 2646.50 at B:

Forex Calls Recap for 12/5/12

One stop out and that's it on the EURUSD. See that section below.

GBPUSD in a 30 pip range now. Ouch.

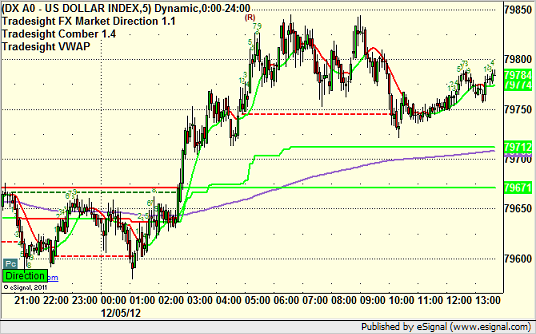

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

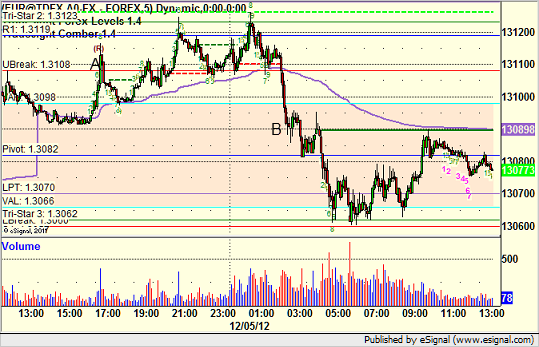

EURUSD:

Triggered long at A early, gave you until the European session to take it, then stopped for 25 pips at B. The short never triggered, although it came close:

Tradesight Market Preview for 12/5/12

The SP was little changed on the day still unable to get above the key 50dma. Price used the 10ema for support and the resolution of this mini-range should extra punch.

The NQ futures were lower on the day by 5 and has the same range condition as the SP side. Beware that the 4/8 Murrey math levels is the third strongest of the box.

Multi sector daily chart:

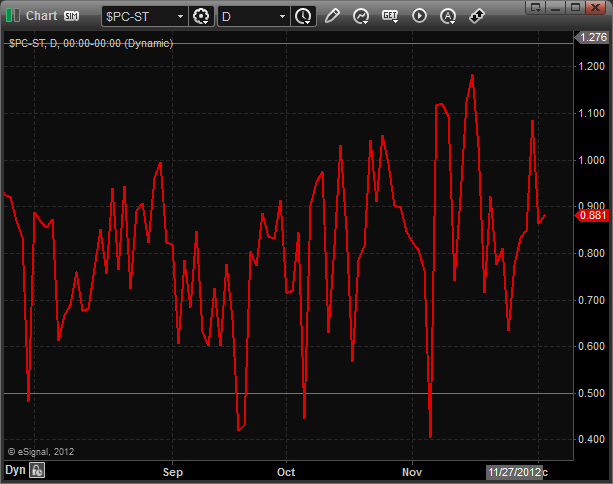

The total put/call ratio remains neutral:

10-day Trin:

The SPX/TLT ratio took a turn in favor of risk off and is still unable to challenge the upper half of the trading range.

The OSX was top gun on the day and closed at a new high on the move. Note that the 50 and 200dma’s will be strong overhead.

The SOX was notable stronger than the overall NAZ.

The XAU was flat on the day after recouping a big loss. This has the potential to be an important higher low.

The BTK is still contained by the active static trend line but above all the major moving averages.

The BKX was the last laggard on the day and has troubling looking construction. Note that there has been no 9 bar seeker setup buy to support it.

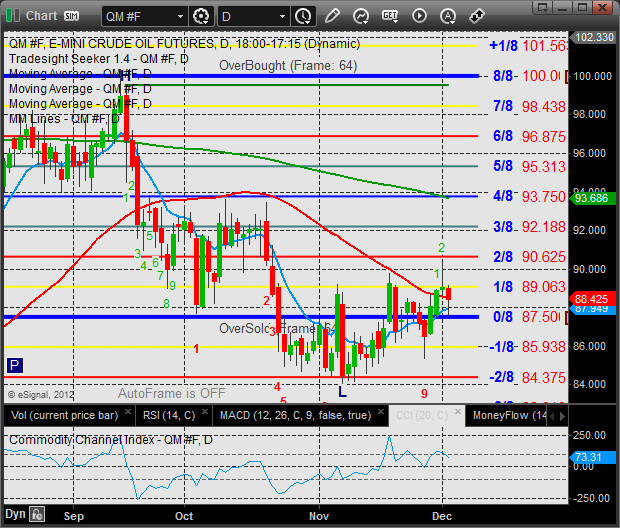

Oil:

Gold:

Silver:

Tradesight Market Preview for 12/5/12

The SP was little changed on the day still unable to get above the key 50dma. Price used the 10ema for support and the resolution of this mini-range should extra punch.

The NQ futures were lower on the day by 5 and has the same range condition as the SP side. Beware that the 4/8 Murrey math levels is the third strongest of the box.

Multi sector daily chart:

The total put/call ratio remains neutral:

10-day Trin:

The SPX/TLT ratio took a turn in favor of risk off and is still unable to challenge the upper half of the trading range.

The OSX was top gun on the day and closed at a new high on the move. Note that the 50 and 200dma’s will be strong overhead.

The SOX was notable stronger than the overall NAZ.

The XAU was flat on the day after recouping a big loss. This has the potential to be an important higher low.

The BTK is still contained by the active static trend line but above all the major moving averages.

The BKX was the last laggard on the day and has troubling looking construction. Note that there has been no 9 bar seeker setup buy to support it.

Oil:

Gold:

Silver:

Stock Picks Recap for 12/4/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SINA triggered short (with market support) and worked great:

From the Messenger/Tradesight_st Twitter Feed, Rich's LVS triggered short (without market support) and didn't work:

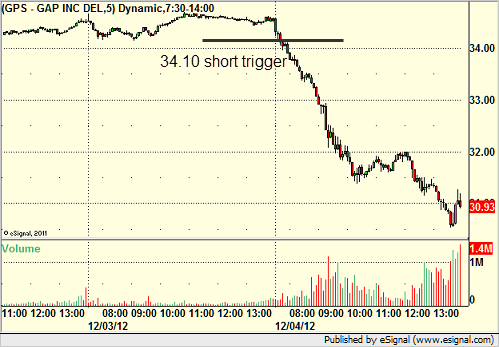

His GPS triggered short (without market support) and worked great:

COST triggered short (with market support) and didn't work:

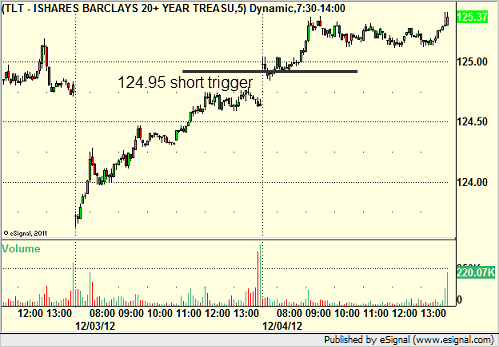

TLT triggered short (ETF, so no market support needed) and didn't work:

Rich's AAPL triggered short (without market support) and didn't work, worked later:

His CAKE triggered short (with market support) and worked:

His ARUN triggered long (without market support) and didn't work enough either way to count:

BIIB triggered long (without market support) and didn't work enough either way to count:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not, but strangely despite those raw numbers, it was a big day.