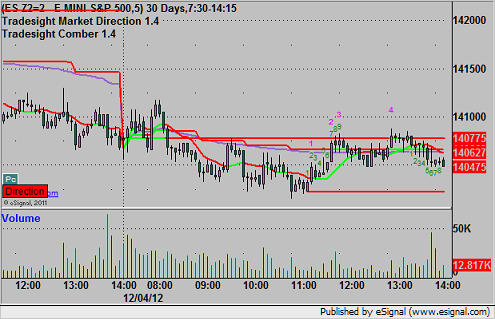

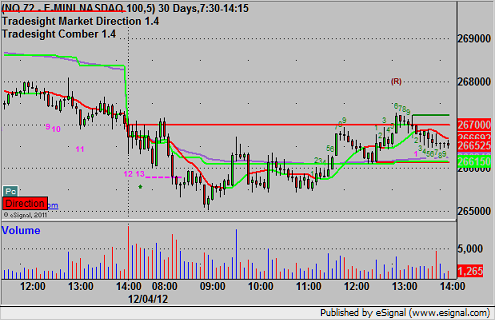

Futures Calls Recap for 12/4/12

A winner in the ES on a narrow market day where volume dropped back off early. We traded only 1.5 billion NASDAQ shares.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at 1406.00 at A, hit first target for 6 ticks and stopped the second half over the entry:

Forex Calls Recap for 12/4/12

Very interesting. After one day of good range and a nice easy winner for us, we go back to 40 pips of range on the GBPUSD and no triggers from our calls.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

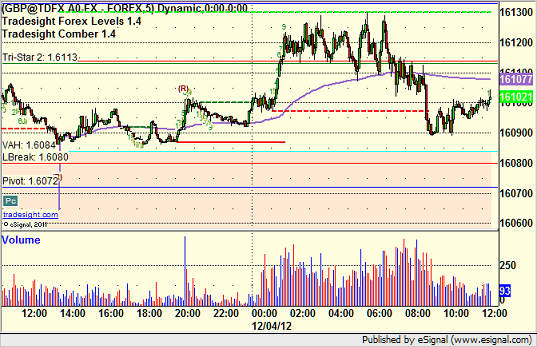

GBPUSD:

Trigger was long over R1, never hit:

Forex Calls Recap for 12/4/12

Very interesting. After one day of good range and a nice easy winner for us, we go back to 40 pips of range on the GBPUSD and no triggers from our calls.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

GBPUSD:

Trigger was long over R1, never hit:

Tradesight Market Preview for 12/4/12

The ES was lower by 8 on the day after completing the 9 bar Seeker setup on Friday. Price is still being rejected by the 50dma that we have been focusing on. Going forward this will be an important point of reference perhaps even more so than the intraday high that was put in place Monday. Note that the CCI has not yet crossed the zero line which is where lasting upside momentum lies.

The NQ’s were only down ½ as much as the SP side but the chart construction is identical. Price opened above the 50dma and as it should have failed. The MACD has the same condition with no penetration of the zero line. The ES, NQ and YM all have downside CPS signals.

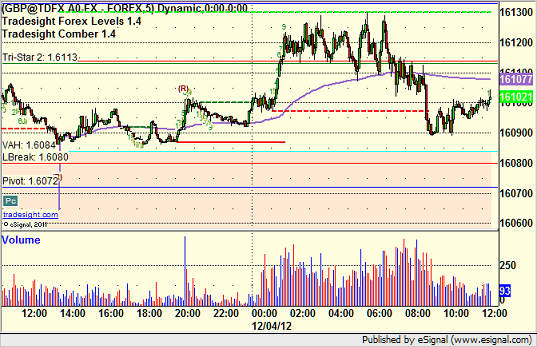

Multi sector daily chart:

The 10-day Trin is below the 1.00 level but not yet in the overbought area of 0.85-.

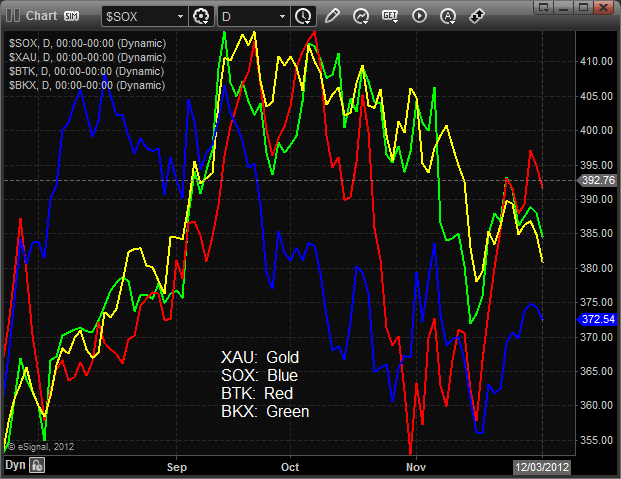

The total put/call ratio is still in the neutral zone.

The relative strength of the NDX/SPX cross has just turned back into the comfort channel. A little more penetration into the channel would be a nice bullish sign for the NDX

The SPX/TLT cross is stuck in the middle of the channel. This is the current midpoint of the risk-on/risk-off measure.

The XAU was the last laggard on the day and continues to bearishly ride the 10ema lower.

The BKX is still pinching between the two big moving averages.

The SOX completed 9 days up in the Seeker and bearishly closed back below the 4/8 level.

The OSX was stronger than the broad market:

Oil:

Gold:

Silver:

Stock Picks Recap for 12/3/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

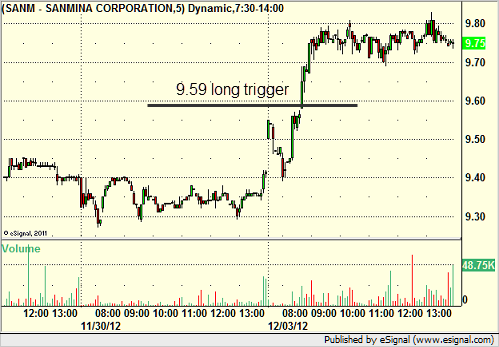

From the report, SANM triggered long (without market support) and worked enough for a partial:

IDCC triggered long (without market support due to opening 5 minutes) and worked enough for a partial:

SGMS triggered long (without market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered short (with market support) and didn't work:

His GS triggered long (without market support) and didn't work:

His CF triggered short (with market support) and worked:

GOOG triggered short (with market support) and worked:

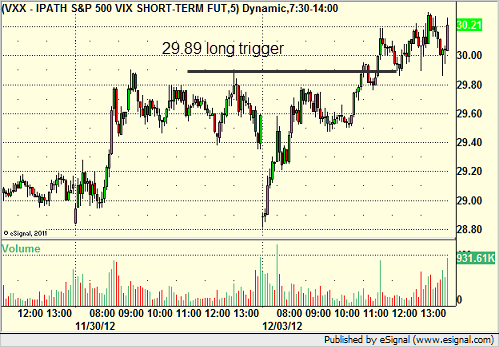

Rich's VXX triggered long (ETF, so no market support needed) and worked:

Rich's NFLX triggered short (with market support) and worked great:

AAPL triggered short (with market support) and didn't work the first time, worked later:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

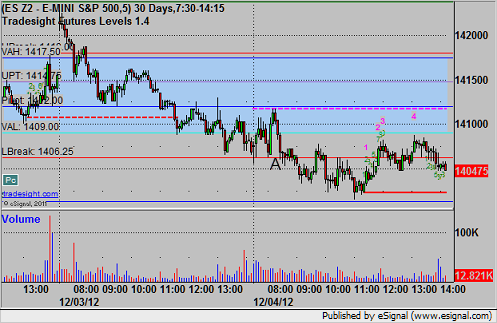

Futures Calls Recap for 12/3/12

A nice start to the month and week with two clean setups on the ES and both worked. See that section below.

Net ticks: +11.5 ticks.

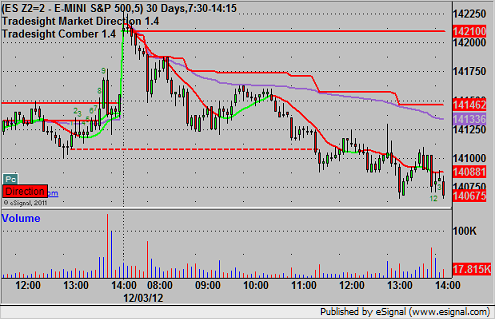

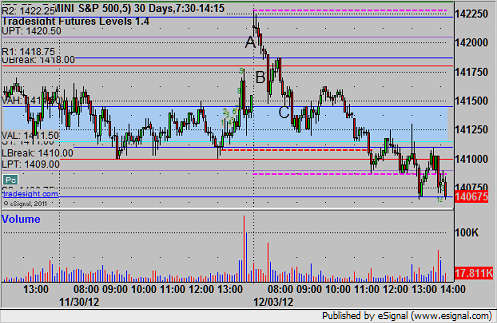

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

We gapped over the UPT and used it as the low of the first bar of the day, so an easy call is short under that at A at 1420.25. We hit the first target for 6 ticks and then accelerated on news and eventually stopped the final piece at 1417.25 for 12 ticks at B. Mark then called the setup against the Value Area High and Pivot, short at 1414.25 at C, and this hit the first target for 6 ticks and stopped the final piece over the entry:

Forex Calls Recap for 12/3/12

A nice start to the month as we got a clean trigger and nice move on the GBPUSD. See that section below, and we're still long as we end the session. It even traded average range finlly.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

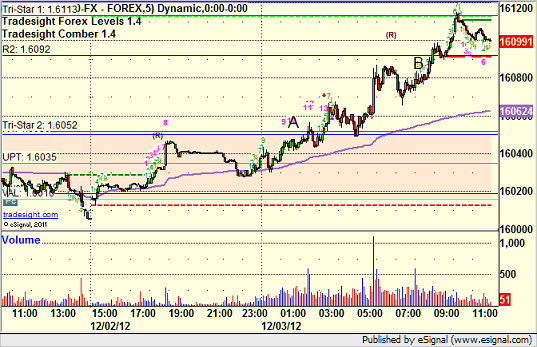

GBPUSD:

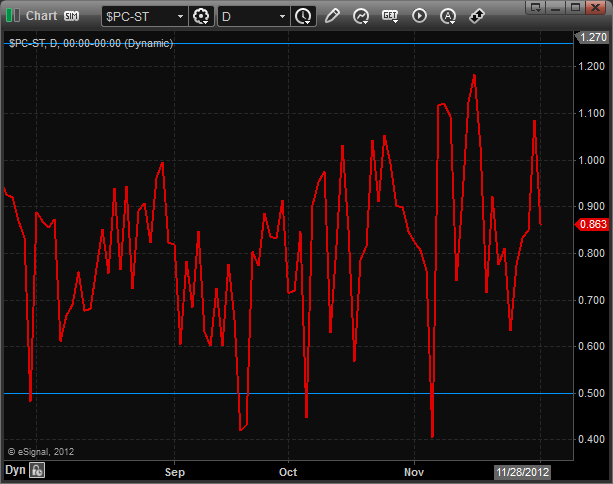

Triggered long at A, hit first target at B, and holding the second half with a stop under R2. Note that the high was the tri-star level and the Average Daily Range boundary:

Stock Picks Recap for 11/30/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

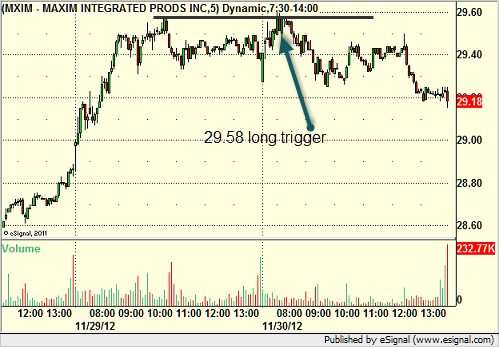

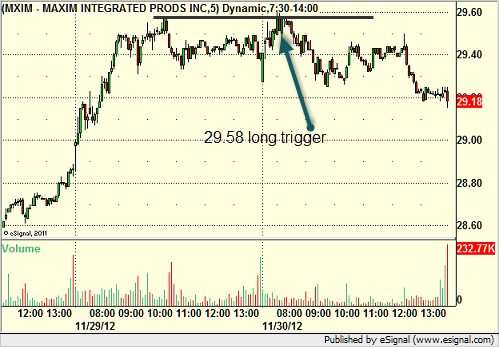

From the report, MXIM triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's BIDU triggered short (with market support) and worked:

His YUM triggered short (without market support) and didn't work:

His AMZN triggered short (with market support) and worked enough for a partial:

His AAPL triggered short (with market support) and didn't work:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

Stock Picks Recap for 11/30/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MXIM triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's BIDU triggered short (with market support) and worked:

His YUM triggered short (without market support) and didn't work:

His AMZN triggered short (with market support) and worked enough for a partial:

His AAPL triggered short (with market support) and didn't work:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

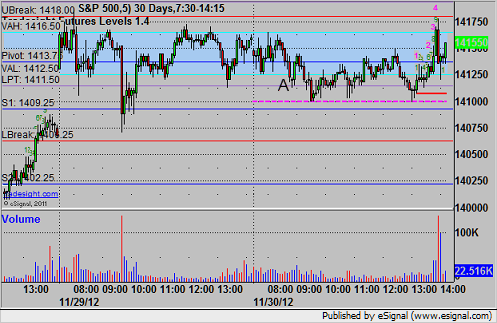

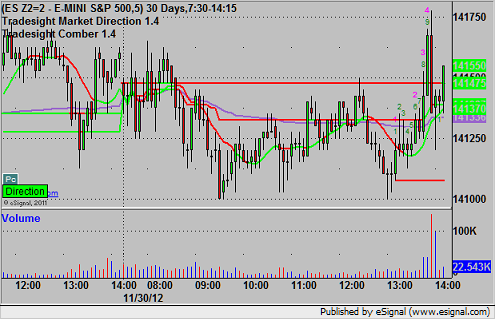

Futures Calls Recap for 11/30/12

It's end of month and Friday and the market was completely dead for the first hour. Despite my better judgement, I went ahead and put a breakdown short in the Messenger just in case. The results were predictable to close out the month. See ES below.

Net ticks: -7 ticks.

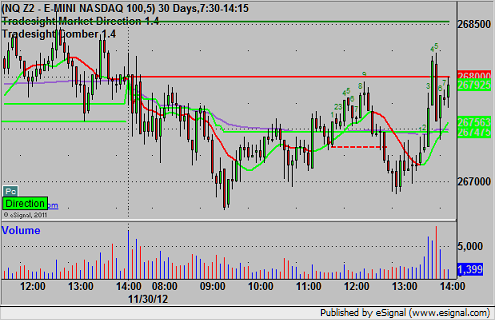

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1411.25 and stopped for 7 ticks: