Futures Calls Recap for 11/30/12

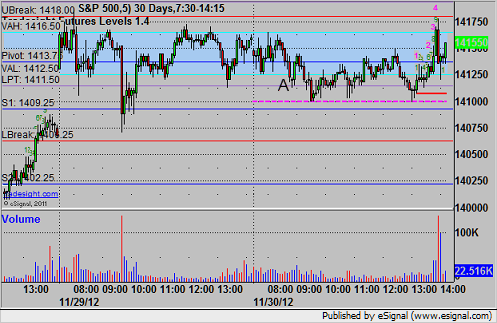

It's end of month and Friday and the market was completely dead for the first hour. Despite my better judgement, I went ahead and put a breakdown short in the Messenger just in case. The results were predictable to close out the month. See ES below.

Net ticks: -7 ticks.

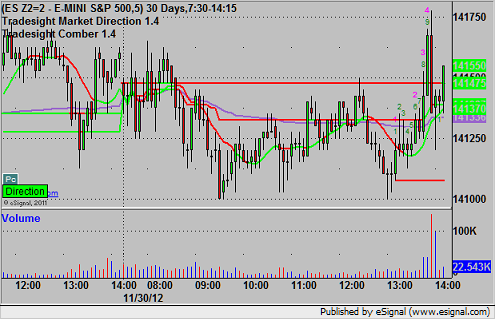

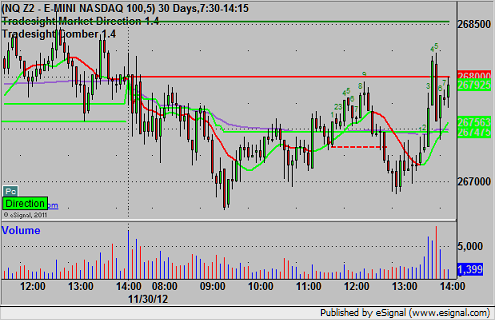

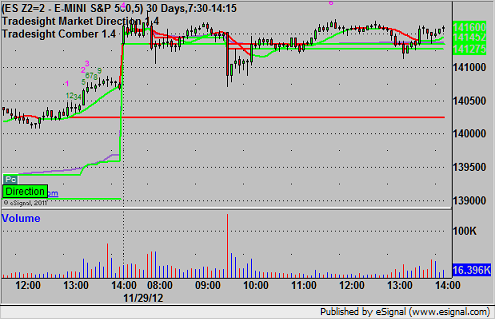

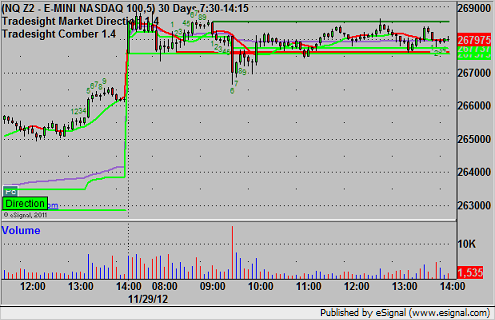

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1411.25 and stopped for 7 ticks:

Forex Calls Recap for 11/30/12

Two more stops to close out a miserable week. See EURUSD below.

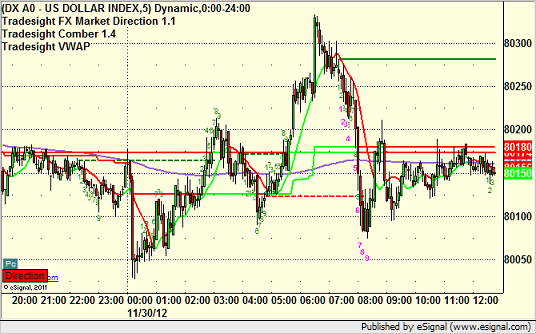

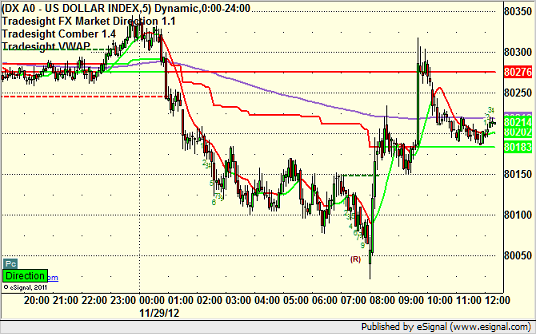

As usual on the Sunday report, we will take a look at the action from Thursday night/Friday, then look at the daily charts heading into the new week with the Seeker and Comber separately, and then look at the US Dollar Index.

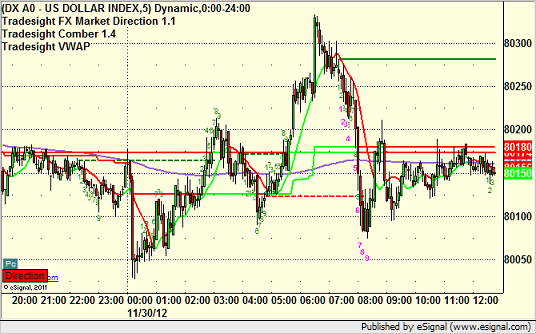

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

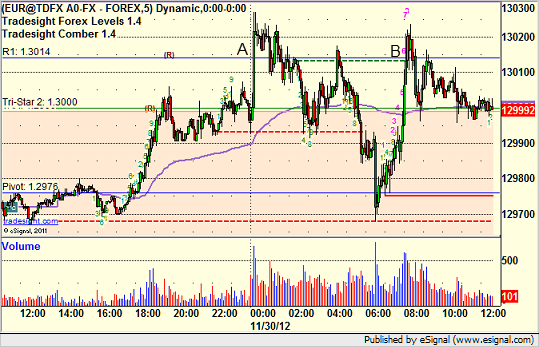

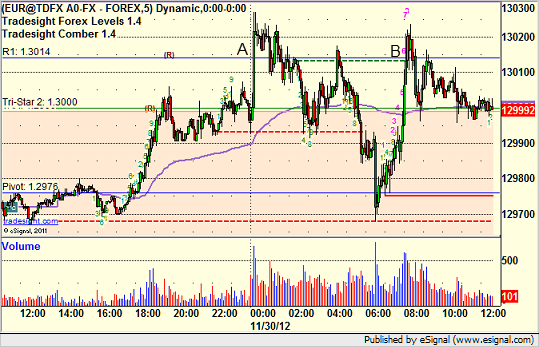

EURUSD:

Triggered long at A and stopped. Triggered long at B and stopped:

Forex Calls Recap for 11/30/12

Two more stops to close out a miserable week. See EURUSD below.

As usual on the Sunday report, we will take a look at the action from Thursday night/Friday, then look at the daily charts heading into the new week with the Seeker and Comber separately, and then look at the US Dollar Index.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A and stopped. Triggered long at B and stopped:

Stock Picks Recap for 11/29/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ONNN gapped up and opened at the trigger, so technically no play even though it worked.

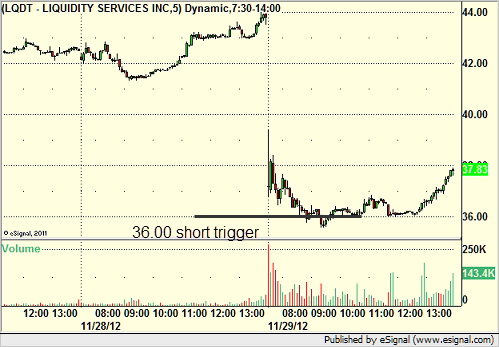

From the Messenger/Tradesight_st Twitter Feed, Rich's LQDT triggered short (without market support) and didn't work:

His CAP triggered short (without market support) and worked enough for a partial:

NFLX triggered short (just barely without market support) and worked:

In total, that's NO trades that triggered with market support, a first.

Futures Calls Recap for 11/29/12

Well, an unfortunate day after a good one as three trades stopped in narrow choppy range early. Looks like the new rule of the day is going to be that the market will spike either way as various members of Congress and the White House come out and say whether or not progress has been made on the Fiscal Cliff. Should be fun. See ES and ER sections below.

Net ticks: -23 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's long triggered at 1416.75 at A and he called off any retriggers:

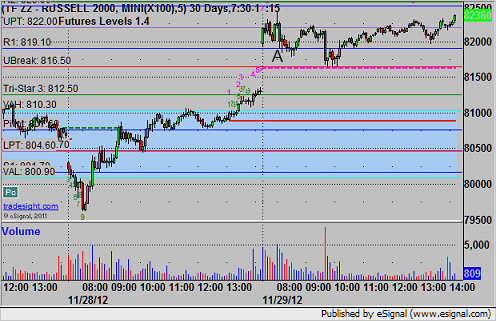

ER:

Triggered short at 818.90 at A on one note out of Congress and stopped, then triggered again 5 minutes later and stopped. I called off additional triggers:

Forex Calls Recap for 11/29/12

Almost a dead flat trade for the session as we again had contained ranges, although the EURUSD was about 100 pips so there will be decent Levels spacing for tonight's last day of the month. See GBPUSD below for last night's review.

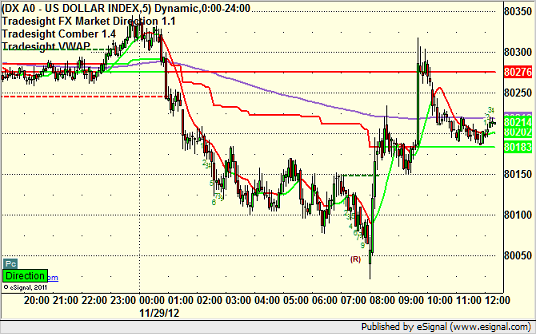

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

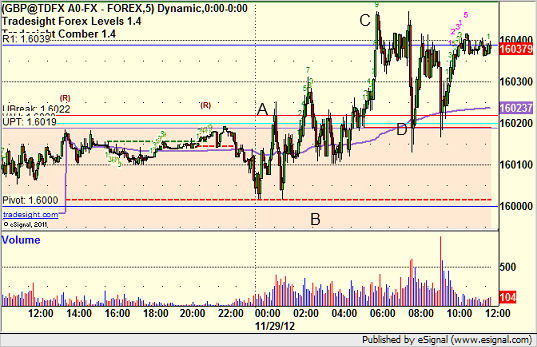

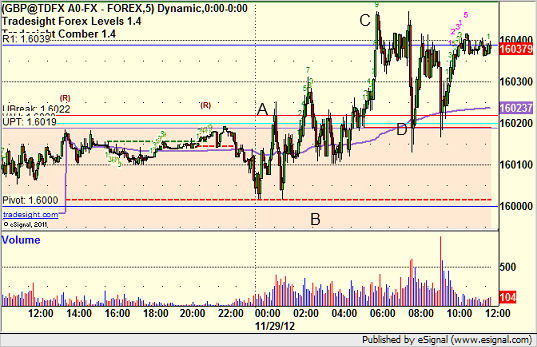

GBPUSD:

Triggered long at A, never stopped because that would have been under the Pivot at B, didn't quite hit the first target at C, and adjusted the stop in the morning just under the entry and stopped at D:

Forex Calls Recap for 11/29/12

Almost a dead flat trade for the session as we again had contained ranges, although the EURUSD was about 100 pips so there will be decent Levels spacing for tonight's last day of the month. See GBPUSD below for last night's review.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

GBPUSD:

Triggered long at A, never stopped because that would have been under the Pivot at B, didn't quite hit the first target at C, and adjusted the stop in the morning just under the entry and stopped at D:

Tradesight Market Preview for 11/29/12

The ES was higher by 9 on the day racing back up to the top of the recent range. The bad news is that the range is still holding and has not yet been resolved.

The NQ futures tested the 200dma and settle up on the day by 19. Keep in mind that this is a key area of resistance at the 4/8 Gann level.

The 10-day Trin is getting very close to the overbought threshold of 0.85:

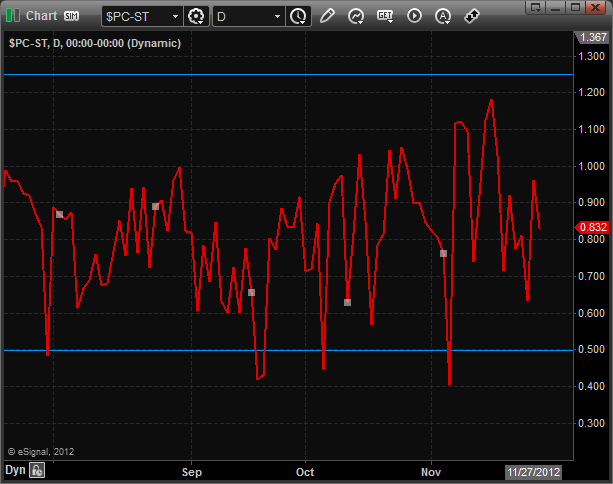

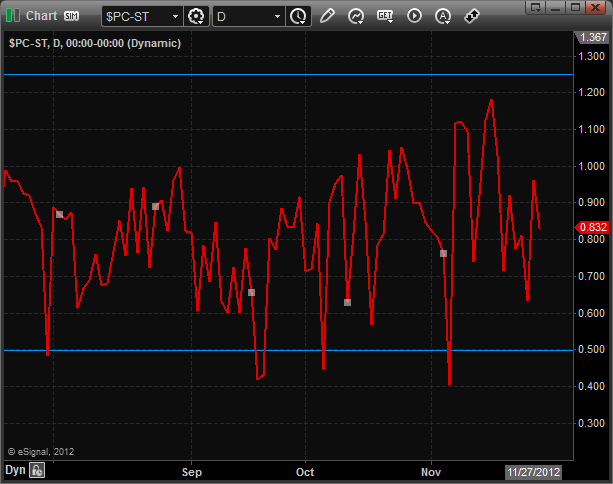

The put/call ratio remains neutral:

Multi sector daily chart:

The NDX/SPX cross is getting close to bullishly challenging the former breakdown:

The broker-dealer index aggressively broke to a new high. Expect resistance at the 8/8 level.

The SOX was stronger than the overall NDX. Layered overhead begins at the 4/8 level.

The OSX is now 12 days down on the Seeker count.

The XAU recouped very steep losses mid-day to finish stronger than the overall market.

Oil:

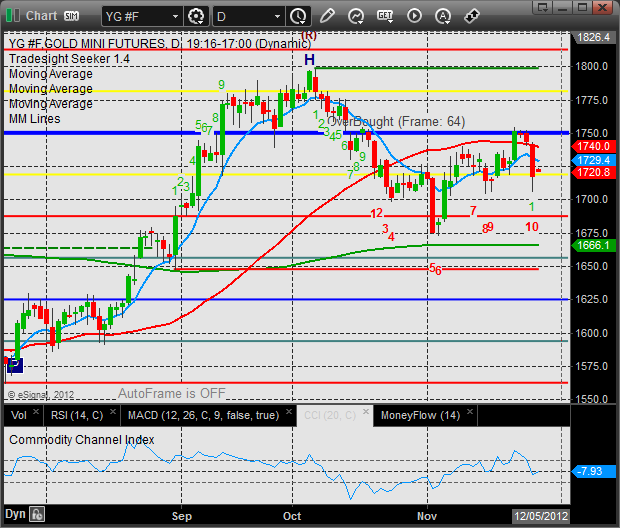

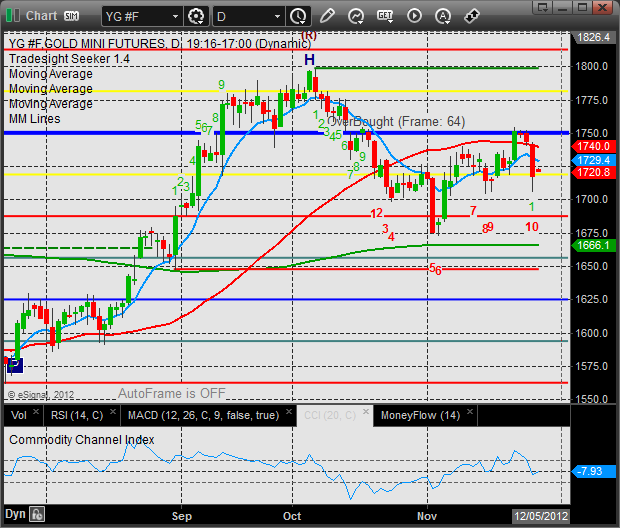

Gold

Tradesight Market Preview for 11/29/12

The ES was higher by 9 on the day racing back up to the top of the recent range. The bad news is that the range is still holding and has not yet been resolved.

The NQ futures tested the 200dma and settle up on the day by 19. Keep in mind that this is a key area of resistance at the 4/8 Gann level.

The 10-day Trin is getting very close to the overbought threshold of 0.85:

The put/call ratio remains neutral:

Multi sector daily chart:

The NDX/SPX cross is getting close to bullishly challenging the former breakdown:

The broker-dealer index aggressively broke to a new high. Expect resistance at the 8/8 level.

The SOX was stronger than the overall NDX. Layered overhead begins at the 4/8 level.

The OSX is now 12 days down on the Seeker count.

The XAU recouped very steep losses mid-day to finish stronger than the overall market.

Oil:

Gold

Stock Picks Recap for 11/28/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

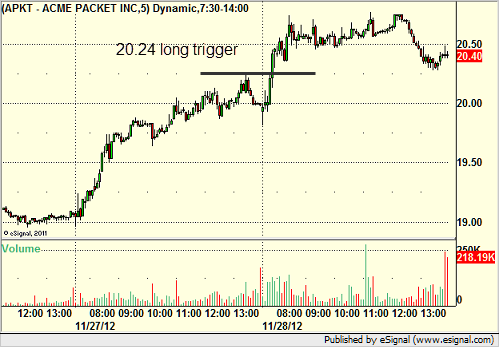

From the report, APKT triggered long (without market support) and worked:

ABFS triggered long (without market support) and didn't work:

VRTX gapped under, no trigger.

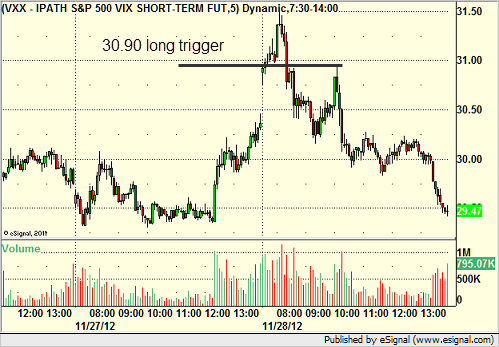

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered long (ETF, so no market support needed) and worked:

His MON triggered short (with market support) and worked enough for a partial:

His EOG triggered short (with market support) and didn't work:

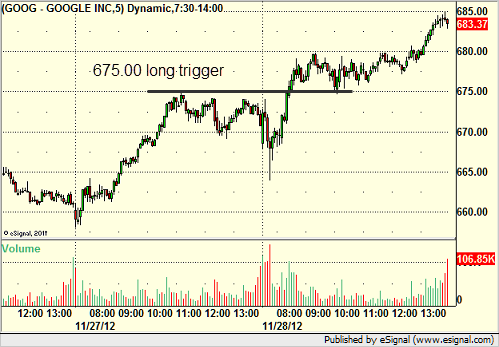

GOOG triggered long (with market support) and worked great:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.