Futures Calls Recap for 11/28/12

A great trading session for futures, tarred only by the one stop out, but two nice winners beyond that as we finally got some action (even though NASDAQ volume was only 1.6 billion shares still).

Net ticks: +12.5 ticks.

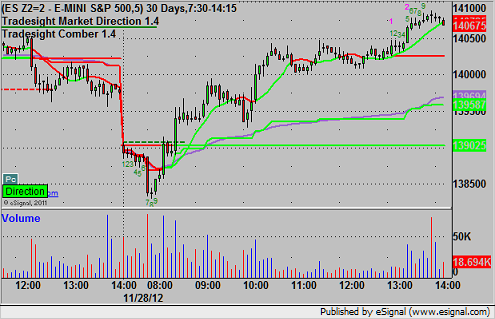

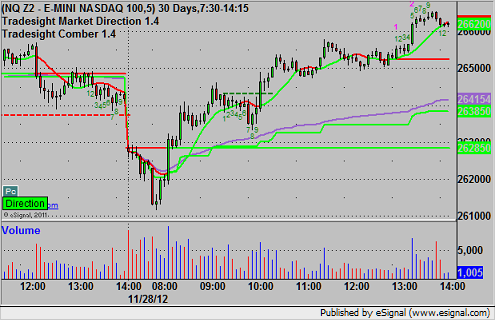

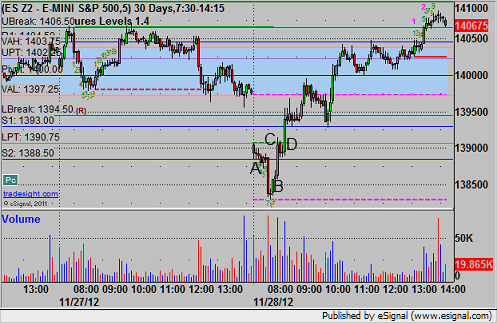

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1388.25, hit first target for six ticks, adjusted the stop a few times and finally stopped at B at 1385.25. Triggered long at C at 1391.00 and stopped for 7 ticks. Re-triggered at D, hit first target for 6 ticks, and closed final piece at 1394.25 heading into lunch (unfortunately, it shot up right after):

Forex Calls Recap for 11/28/12

Not much of a session again. A trigger on the EURUSD that took forever, and then we were able to move the stop to keep it tight after it took too long.

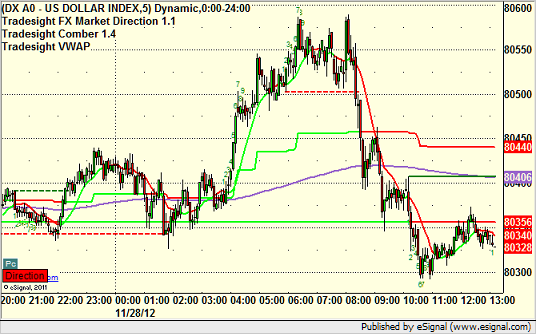

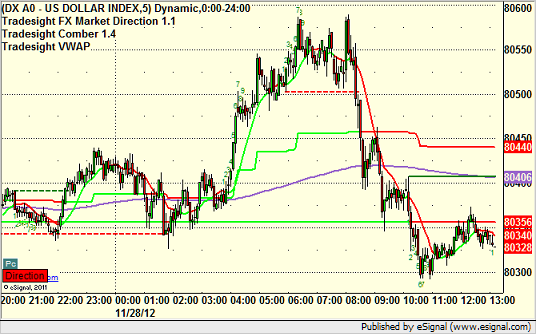

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

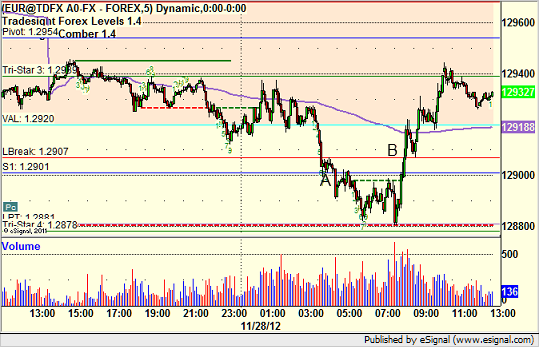

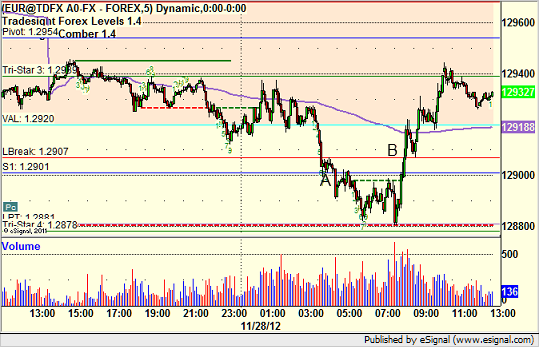

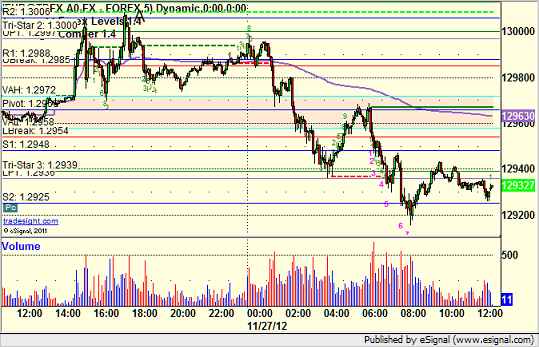

EURUSD:

Triggered short at A, started to work but took hours and never hit S2 first target. Adjusted the stop over LBreak for a much tighter stop and stopped at B:

Forex Calls Recap for 11/28/12

Not much of a session again. A trigger on the EURUSD that took forever, and then we were able to move the stop to keep it tight after it took too long.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered short at A, started to work but took hours and never hit S2 first target. Adjusted the stop over LBreak for a much tighter stop and stopped at B:

Tradesight Market Preview for 11/28/12

The ES posted another inside day, losing a net 6 handles. The mini-pattern is still contained within Friday’s range expansion candle so the resolution of the range should have good punch.

The NQ side had a little relative strength vs. the SP side. As expected the dual overhead of the 4/8 Gann level and 200dma are going to give the trend at least some initial trouble.

Multi sector daily chart:

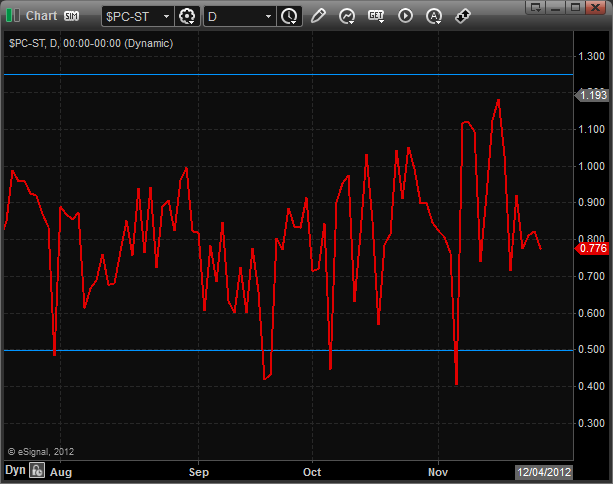

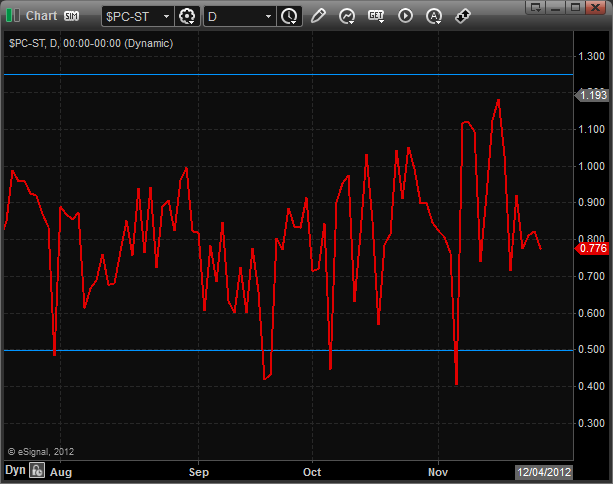

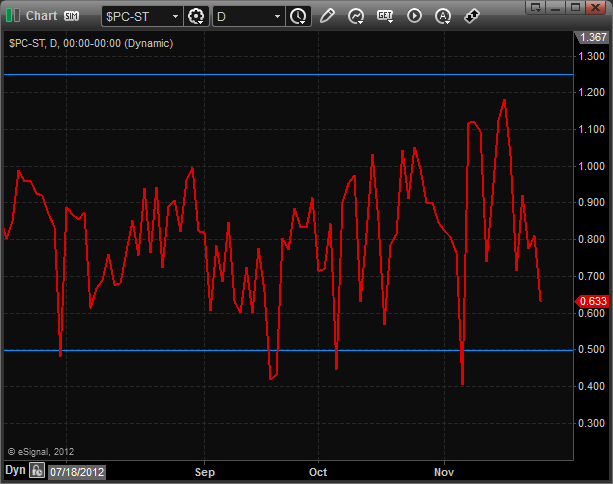

The total put/call ratio remains neutral:

The SPX/TLT cross has rebounded back into the trend channel but the posture remains risk-off until the ratio crosses back above the upper channel boundary.

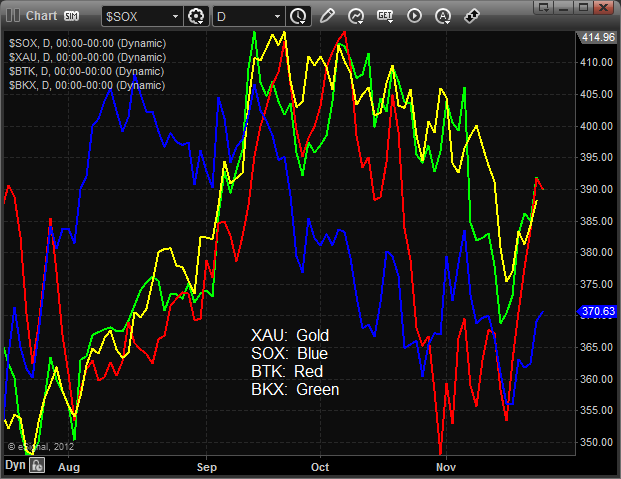

The SOX was the top major sector on the day but left a gravestone doji on the chart. The intermediate trend remains neutral until the trend line is broken.

The OSX was lower by 2 and used the 10ema for support.

The BKX was much weaker than the broad market and settled below the 10ema.

Oil:

Gold:

Silver:

Tradesight Market Preview for 11/28/12

The ES posted another inside day, losing a net 6 handles. The mini-pattern is still contained within Friday’s range expansion candle so the resolution of the range should have good punch.

The NQ side had a little relative strength vs. the SP side. As expected the dual overhead of the 4/8 Gann level and 200dma are going to give the trend at least some initial trouble.

Multi sector daily chart:

The total put/call ratio remains neutral:

The SPX/TLT cross has rebounded back into the trend channel but the posture remains risk-off until the ratio crosses back above the upper channel boundary.

The SOX was the top major sector on the day but left a gravestone doji on the chart. The intermediate trend remains neutral until the trend line is broken.

The OSX was lower by 2 and used the 10ema for support.

The BKX was much weaker than the broad market and settled below the 10ema.

Oil:

Gold:

Silver:

Stock Picks Recap for 11/27/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FSLR triggered long (without market support) and worked great:

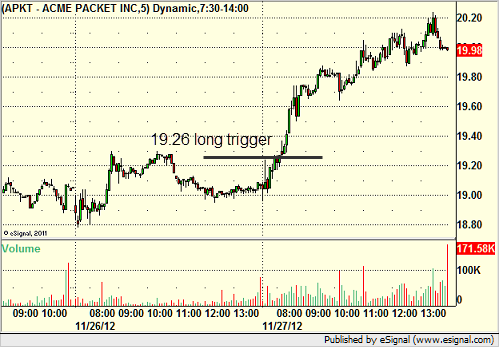

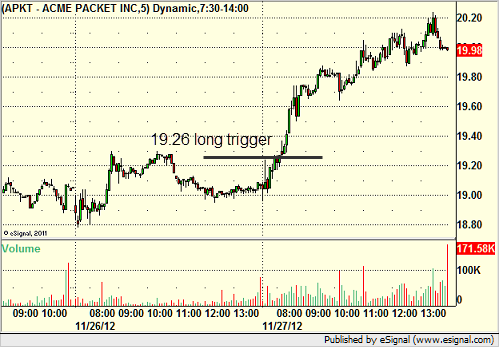

APKT triggered long (with market support) and worked great:

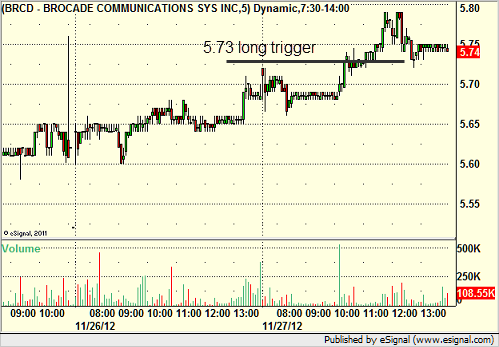

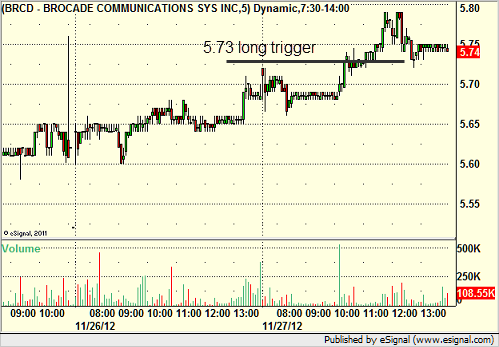

BRCD triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's FB triggered short (with market support) and worked enough for a partial:

His PXP triggered short (without market support) and didn't work:

His RIMM triggered short (with market support) and worked:

There were a couple of nice setups in the afternoon, but the market rolled.

In total, that's 4 trades triggering with market support, all 4 of them worked.

Stock Picks Recap for 11/27/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FSLR triggered long (without market support) and worked great:

APKT triggered long (with market support) and worked great:

BRCD triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's FB triggered short (with market support) and worked enough for a partial:

His PXP triggered short (without market support) and didn't work:

His RIMM triggered short (with market support) and worked:

There were a couple of nice setups in the afternoon, but the market rolled.

In total, that's 4 trades triggering with market support, all 4 of them worked.

Futures Calls Recap for 11/27/12

Couple of calls on another choppy session. Volume was better at 1.65 billion NASDAQ shares. Only one trade triggered, and it worked, but no follow through. See NQ section below.

Net ticks: +3 ticks.

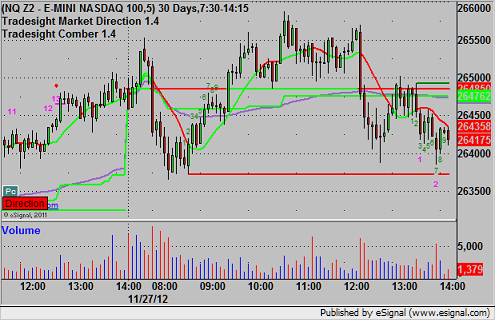

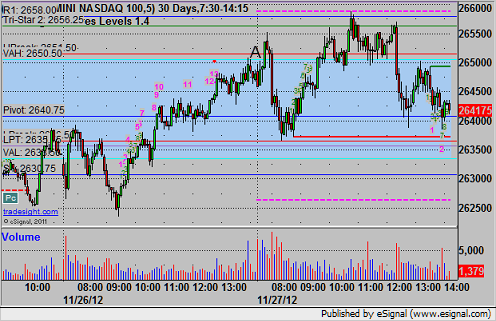

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's long idea triggered at A at 2651.75, hit first target for 6 ticks, and stopped the second half at the entry:

Forex Calls Recap for 11/27/12

Another dull session, although the EURUSD at least traded 100 pips of range, so the Levels spacing will be better there tonight. We had one very early trigger for less than half size, and that's it. See EURUSD below. GBPUSD trade never triggered in a narrow range.

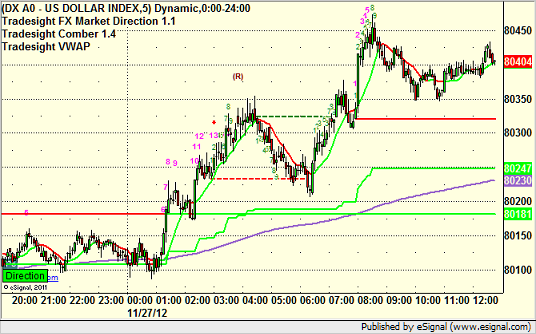

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long early in the Asian session at A, so would be less than half size, and stopped:

Tradesight Market Preview for 11/27/12

The ES was lower on the after posting an inside day. The light volume advance on the shortened Friday session likely kept trader’s european wallets in their pockets to measure off the half session. The resolution of the inside day should have some punch, especially it is to the upside and keeps short from the initial breakaway gap trapped. The next important level is the 50dma overhead.

The NQ’s had relative strength vs. the broad market all session on the strength of mega-member AAPL. The Naz was higher by 12 on the day, which unlike the SP side, was range expansion rather than a measuring day. There is a big level overhead where the 4/8 Gann line meets the 200dma.

Keep a close eye on the 10-day Trin which is quickly approaching an overbought reading.

The total put/call ratio is still neutral:

Multi sector daily chart:

The NDX/SPX cross is still bearishly below the breakdown level. The overall market will not find confirmed upside momentum until this level is reclaimed by the NDX coming on with sustained relative strength.

With the strength in AAPL it’s no surprise that the Computer Hardware index was the top gun on the day. Expect overhead at the 4/8 level.

The SOX will have overhead where the 50dma, 4/8 level and trend channel meet.

The XAU was mid-range performance wise. Note the 4/8 level just overhead.

The BTK posted an inside day. Price is back above all of tte major moving averages. The active static trend line is the next upside level.

The OSX was the last laggard on the day. Price touched but didn’t break below the 10ema. If price crosses back below the 10ema it will turn the chart back to short-term negative and be in position to complete the unfinished Seeker buy countdown.

Oil:

Gold:

Silver: