Stock Picks Recap for 11/26/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FB gapped over the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's SPY triggered short (without market support due to opening 5 minutes) and didn't work:

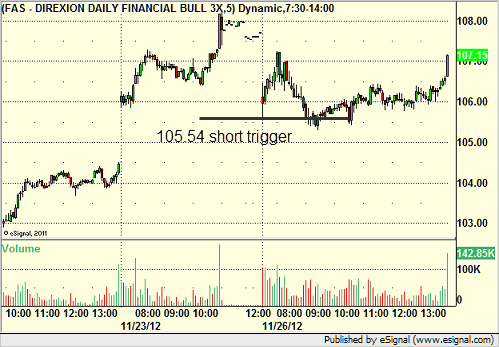

His FAS triggered short (ETF, so no market support needed) and didn't work:

His NFLX triggered short (with market support) and worked:

His CRM triggered long (with market support) and worked:

SINA triggered long (with market support) and didn't work:

TLT triggered short (ETF, so no market support needed) and worked, although never went far:

Rich's LRCX triggered long (with market support) and didn't work:

Mark's XLNX triggered long (without market support) and didn't work:

AMZN triggered long (with market support) and worked:

In total, that's 7 trades triggering with market support, 4 of them worked, 3 did not.

Futures Calls Recap for 11/26/12

As expected, market volume was incredibly light starting back up from the Thanksgiving weekend, and the futures were barely ticking most of the session. One nice setup in particular did nothing, showing how bad it was. See ES section below.

Net ticks: -14 ticks.

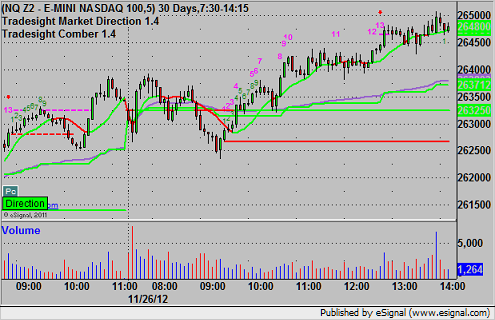

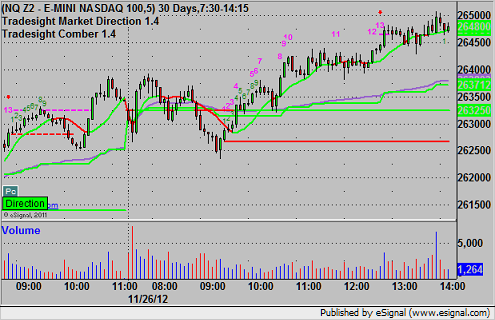

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

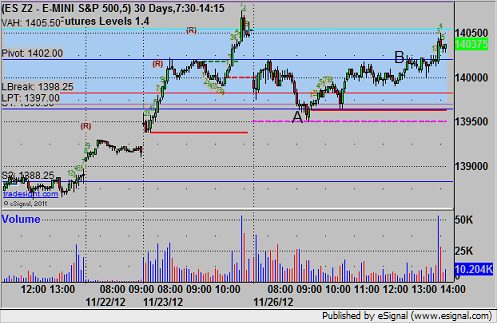

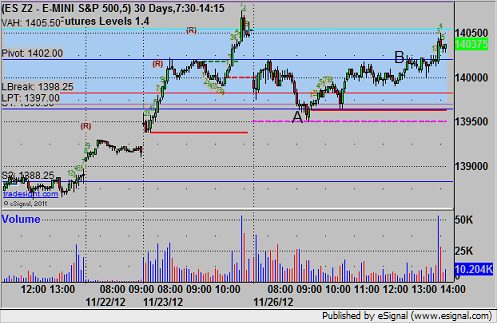

ES:

Mark's short triggered at A at 1396.25 and stopped for 7 ticks. His long, which was a beautiful setup against the Pivot, triggered at B at 1402.25, but stopped for 7 ticks. Most days, that would have worked:

Futures Calls Recap for 11/26/12

As expected, market volume was incredibly light starting back up from the Thanksgiving weekend, and the futures were barely ticking most of the session. One nice setup in particular did nothing, showing how bad it was. See ES section below.

Net ticks: -14 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's short triggered at A at 1396.25 and stopped for 7 ticks. His long, which was a beautiful setup against the Pivot, triggered at B at 1402.25, but stopped for 7 ticks. Most days, that would have worked:

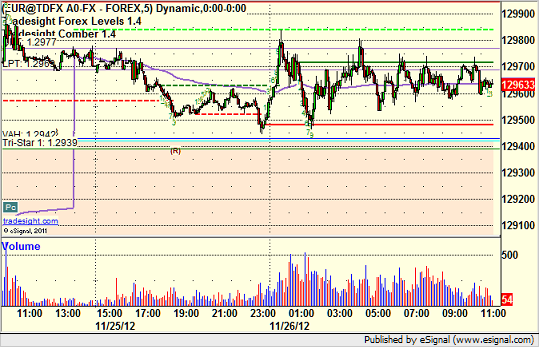

Forex Calls Recap for 11/26/12

Interesting first day back. Our Forex triggers weren't very far away, and yet, neither triggered as all pairs were fairly flat. EURUSD was barely 35 pips, the smallest range I can remember. Seems odd considering even Friday saw 100 pips.

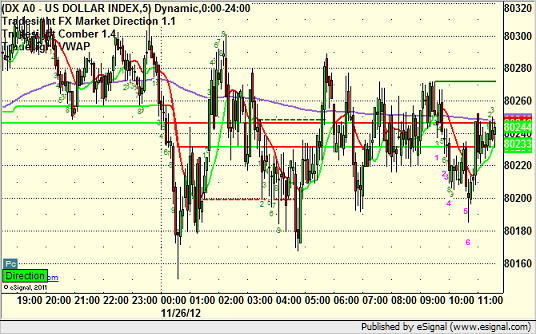

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Stock Picks Recap for 11/21/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CLSN triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered long (with market support) and didn't work:

His DE triggered short (without market support) and worked:

His CRM triggered long (with market support) and worked:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Stock Picks Recap for 11/21/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CLSN triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered long (with market support) and didn't work:

His DE triggered short (without market support) and worked:

His CRM triggered long (with market support) and worked:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

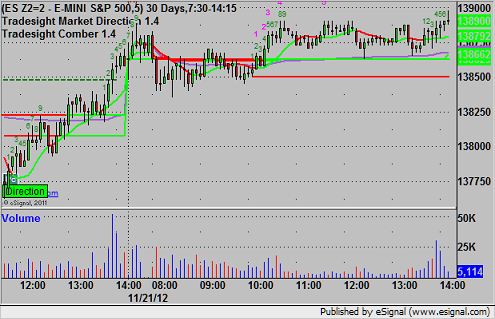

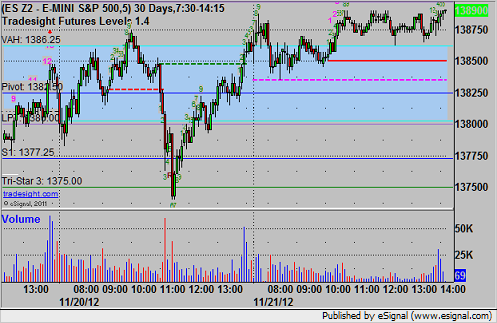

Futures Calls Recap for 11/21/12

No futures calls for the very light session on the busiest travel day of the year. We will post Levels based on today's ranges for Friday, but no one trades the half day. Monday's levels will be based on Friday's limited activity, which means they will be bunched together if Friday is flat like it should be. Happy Thanksgiving.

Net ticks: +0 ticks.

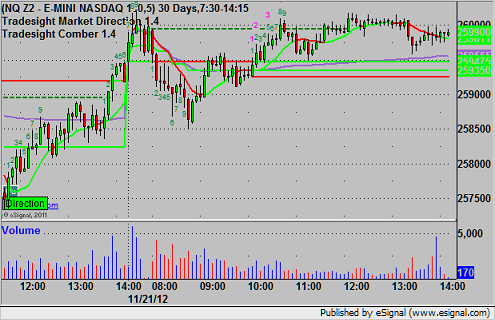

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

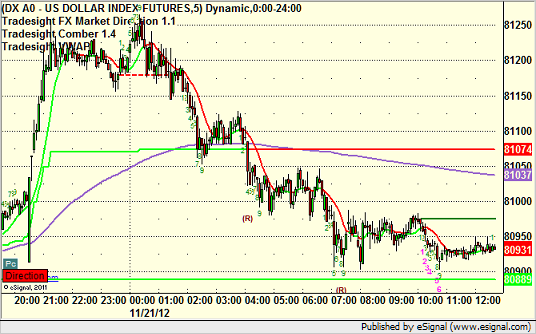

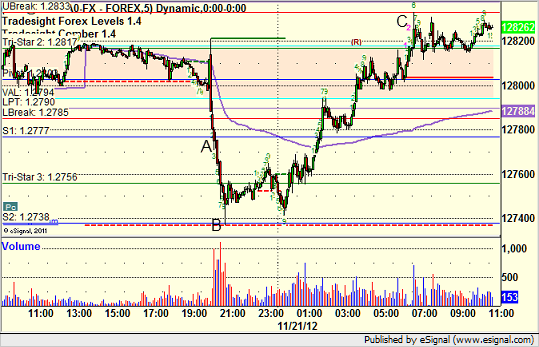

Forex Calls Recap for 11/21/12

Three winners for the week. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered short at A, hit first target exactly at B, second half stopped over entry. Note that we set the long trigger exactly at C (stopped right at UBreak):

Tradesight Market Overview for 11/21/12

The ES was higher by 4 on the day after posing a measuring day. Probability favors a continuation tomorrow.

The NQ was higher by 8 on the day:

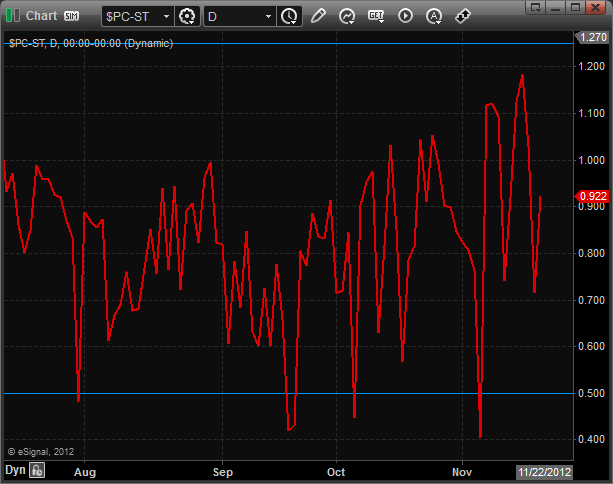

Total put/call ratio:

NYSE 10-day Trin:

The BTK outperformed the broad market:

Oil:

Gold:

Silver:

Stock Picks Recap for 11/20/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PDCO triggered long (with market support) and eventually worked enough for a partial:

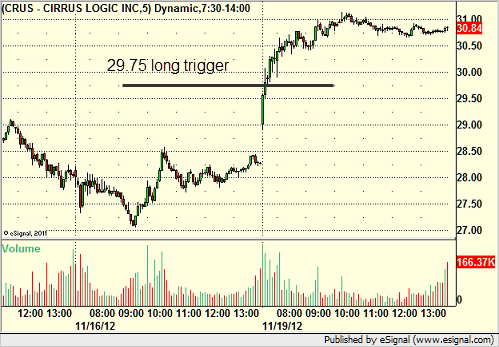

From the Messenger/Tradesight_st Twitter Feed, Rich's CRUS triggered long (with market support) and worked:

His AMZN triggered long (with market support) and worked:

AAPL triggered long (with market support) and didn't work initially, but worked great on the retrigger a few minutes later:

Rich's VXX triggered short (ETF, so no market support needed) and worked:

His CSTR triggered long (with market support) and worked enough for a partial:

His FAZ triggered short (ETF, so no market support needed) and didn't work:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.