Stock Picks Recap for 11/20/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PDCO triggered long (with market support) and eventually worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's CRUS triggered long (with market support) and worked:

His AMZN triggered long (with market support) and worked:

AAPL triggered long (with market support) and didn't work initially, but worked great on the retrigger a few minutes later:

Rich's VXX triggered short (ETF, so no market support needed) and worked:

His CSTR triggered long (with market support) and worked enough for a partial:

His FAZ triggered short (ETF, so no market support needed) and didn't work:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

Futures Calls Recap for 11/20/12

I thought we might get one good trading day, but instead, volume dropped sharply, only hitting 326 million NASDAQ shares after an hour, and closing at only 1.5 billion. So, nothing worked. See ES below.

Net ticks: -10 ticks.

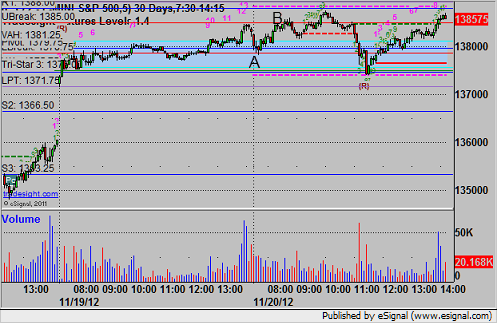

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A under LBreak at 1378.50 and stopped for only 3 ticks based on the call as typed. Set the UBreak at B and then triggered long at 1385.25 and stopped:

Forex Calls Recap for 11/20/12

Another winner despite narrow range and an early move that took us under the LBreak on the EURUSD before the Asian session. See that section below.

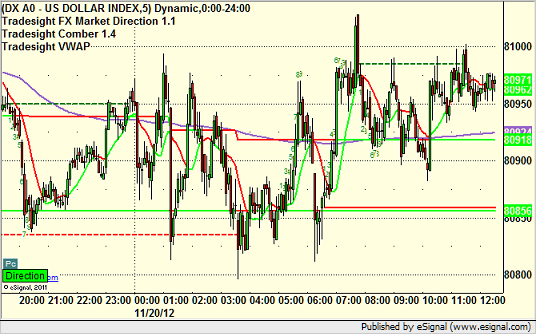

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

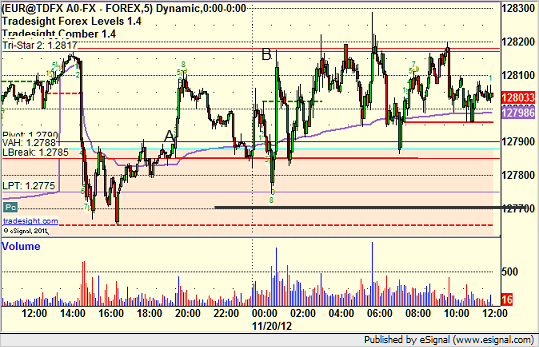

EURUSD:

Triggered long at A, stop would have been under the black line so it never stopped, and you had plenty of times to enter. Hit first target at B, moved stop under the entry and stopped at C:

Tradesight Market Overview for 11/20/12

The ES gapped higher and added onto the gains to close up 23 handles. Price is now above the 10ema which changes the short-term trend to positive. The advance today also cleared the 4/8 Murrey math level which is also bullish. Since the NYSE Trin closed around 0.50 a measuring day rather than more range expansion is likely.

The NQ futures were higher by 56 on the day. Though the levels are different the technical setup is very similar to the ES. As it should, the chart pattern found initial support at the 0/8 level. If the chart follows through either Tuesday or Wednesday then the 4/8 level that is coincident with eh 200dma will be in play.

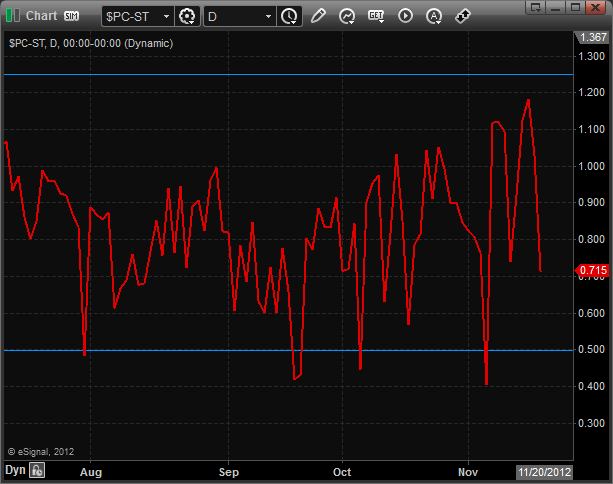

The total put/call ratio has moved back to the neutral area but is well away from overbought.

The 10-day Trin still has plenty of room before it recorded a reversal signal.

Multi sector daily chart:

On the strength of AAPL the NDX/SPX cross has blasted back into the comfort zone of the trading zone.

The BKX had a very strong session showing good relative strength vs. the overall broad market SPX. If the relative strength can persist it will be very bullish for the overall market.

The OSX was the top sector on the day, nicely closing above the 10 ema.

The US$ was weak on the day and the XAU took a healthy reflexive bounce. Price remains below all of the major moving averages.

The BKX banking index was stronger than the broad market and NAZ. Keep in mind that this has been one of the stronger sectors on the day and in the larger time frames still bullishly has the 200dma below.

The SOX traded in line with the Naz.

The BTK was the last laggard on the day and is back into the heart of the recent range.

Oil:

Gold:

Stock Picks Recap for 11/19/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PDCO triggered long (with market support) and eventually worked enough for a partial:

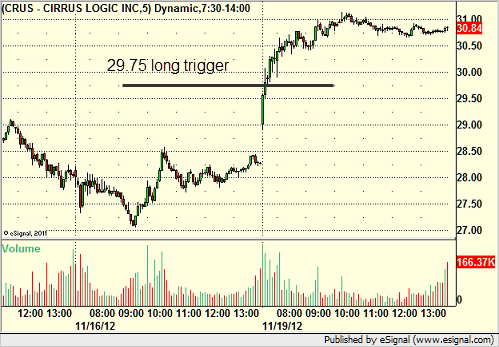

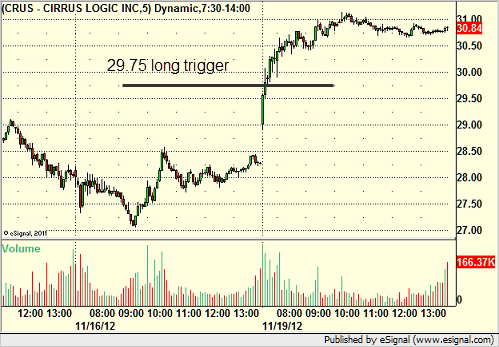

From the Messenger/Tradesight_st Twitter Feed, Rich's CRUS triggered long (with market support) and worked:

His AMZN triggered long (with market support) and worked:

AAPL triggered long (with market support) and didn't work initially, but worked great on the retrigger a few minutes later:

Rich's VXX triggered short (ETF, so no market support needed) and worked:

His CSTR triggered long (with market support) and worked enough for a partial:

His FAZ triggered short (ETF, so no market support needed) and didn't work:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

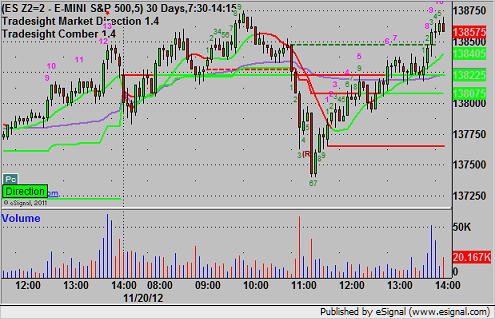

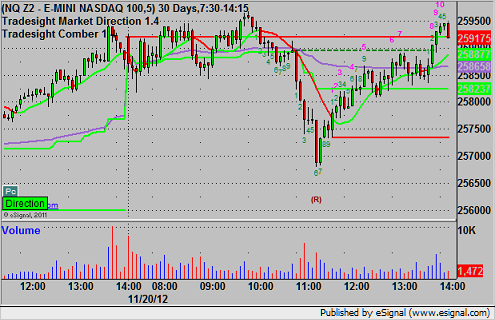

Futures Calls Recap for 11/19/12

We had a big gap up and then a little push early with a winning ES trade and then things went flat for the rest of the session, which isn't uncommon on the first day of a new options cycle.

Net ticks: +6.5 ticks.

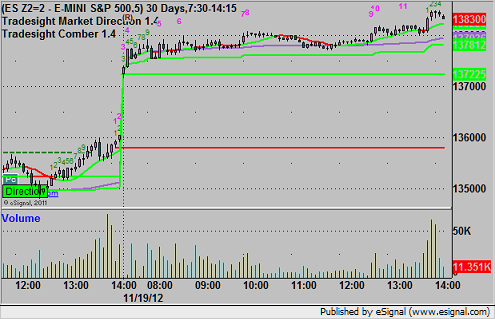

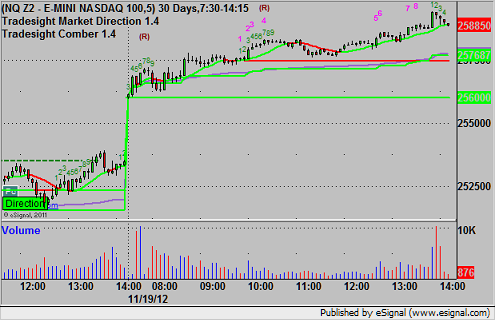

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1373.75, hit first target for 6 ticks, and after raising the stop, stopped the second half 7 ticks in the money:

Forex Calls Recap for 11/19/12

Ranges improved AND we got a perfect technical setup, trigger, and move in the EURUSD. One day doesn't prove anything, but let's hope it is the start of something. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

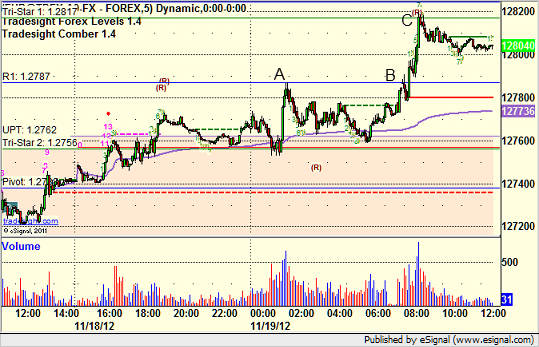

EURUSD:

Hit the trigger perfectly at A to set the level, triggered long at B, hit first target perfectly at C, and still holding the second half with a stop under R1:

The Fiscal Cliff Looms

The election is behind us and market volume appears to be picking up finally, although current market direction is down. Is it because Obama won? Is it because the Middle East is heating up? Is it because of the Fiscal Cliff?

All good questions. As traders, we like to deal in facts. It makes it easier to make money. When you put your personal whims ahead of reality, success doesn't come easy.

So is the market down because Obama won? Well, the market doubled in the last four years under Obama, so that doesn't quite make sense. Is it possible that people that felt strongly that Romney would win and had invested in stocks that would perform well under a potential Romney Administration sold those stocks after the election? Yes, that is possible. That could account for a couple of days of selling after the election very easily and is in the realm of reality.

If you look at the days since the election, we were down the two days after, then flat to two, and then down two more days (keep in mind that the aftermath of Hurricane Sandy was in the middle of all of this, and played a role in volume and probably had a real economic impact). Then we had two more down days on Tuesday and Wednesday.

Is this about things heating up in the Middle East? Well, those two days match off with when the shooting started, as they say, but it also lines up with options unraveling, which definitely played a role in Wednesday's decline. Then we were flat Thursday and ended up dead even Friday (as usual for options expiration). So the fact is that while the situation in the Middle East has to be watched carefully and isn't helping, I don't see anything that says that it is having a big impact on the markets at this time. If it were, oil would probably be running up sharply, and it isn't. It's hovering in the mid to high $80s.

So what is the market gearing up for, and what is the focus going forward as we head into the end of the year and what is typically a great time for trading (and should continue to be as volume continues to improve, no matter which way the market goes...up or down beats FLAT)?

First, if you haven't seen it already, take a moment and watch Rich's terrific video about the bull/bear numbers that came out this week. You can see it here. Pass that one on to your friends as well.

Second, I think it's time we had an honest discussion about the Fiscal Cliff and what it means for those that don't know. It might also help explain the last six months or so of the markets (Stocks, Futures, and Forex) and the lack of volume and range that we have seen for much of that period across the board. Let the Fiscal Cliff serve as an example of exactly what governments should NEVER do. The markets are doing exactly what you would expect when you give them no certainty about just about anything across the board from a fiscal perspective.

So, let's start with, What is the Fiscal Cliff?

In simple terms, it is a deadline of December 31 of this year where a bunch of things are going to happen at once, and if they all happened, there could be dramatic and (mostly) negative effects on the economy. What are the "things" that are set to happen?

1) The expiration of the Bush Tax Cuts (both of them). One is for just about everyone, which would raise taxes on just about everyone on income, and one is for that piece of income that is over $250,000. Now, just to be clear in regard to that second item: That doesn't mean that if you make $300,000, you will pay a higher tax rate on all of it. It means that you would pay a higher rate than you would have prior on the $50,000 above $250,000. So if your tax rate there was 32%, now it becomes 36%. So out of your $300,000 in income, you'd pay an extra $2000 (not exactly the doomsday scenario some would paint).

2) Two sets of extreme spending cuts. The first comes in about $600 billion over ten years OFF the current levels of defense spending, and the second comes in about the same amount from domestic elective spending (programs, etc.). Say good-bye to Federally-funded Big Bird, yes, but that's about 0.01% of it.

Next question. Why is this all happening at once?

We will take the two items separately first. There is something called the Byrd Law that the Senate passed long ago. It states that the Federal government can't pass anything that intentionally throws the budget out of balance in the long-term (i.e. permanently). This was put in place for a good reason. Want to add something that requires annual spending forever? Gotta figure out how to pay for it forever first. Want to cut taxes? No problem, gotta find some spending to cut to pay for it. It was largely designed to prevent the Federal government's books from falling out of balance too far. Obviously, it didn't work well enough.

The reason is that there is an exception to the Byrd Act. Basically, since recessions can happen, the Government needs to have flexibility in the short run to spend more or tax less to stimulate the economy. It is, in the end, the Federal government's role not to manage the economy, but to broadly steer, as I like to say. So, the exception is that Congress can pass things that have a short-term (viewed as up to ten years) negative impact on the books. So, when both sets of Bush Tax Cuts were enacted in 2001 and 2003, they were set up under the Byrd exemption, meaning that they had to expire in ten years. By definition, a tax cut means less revenue for the government and those is a violation of the Byrd Act unless spending is cut to match (it wasn't, which is why they used the exemption). Obviously, if the right players were still in power, they could "renew" the tax cuts as new ones for another ten years, but they can not make them permanent in the tax code without cuts.

The tax cut that was put in place in 2001 expired in 2011, but Obama and Congress gave it two more years to December 31, 2012. The other one was always set to expire December 31, 2012. In other words, all of the big decisions about this stuff over the last few years have intentionally been put off by both parties until after this election. Obama didn't want to raise taxes in the middle of the Great Recession, and the Republicans wanted to have the decisions made after 2012, thinking that they could blame everything on Obama enough to win the election.

Meanwhile, a political battle has been waged over the last four years about how to "fix the deficit" problem, which occurs from the recession as the government took in less money, but also had a few big expenditures like TARP and the stimulus. Remember that when the Recession occurred, tax revenue to the government dropped more as people lost their jobs, which widens the deficit each month (the difference between what the government takes in and what it spends). I won't get into all of the junk that went with that, but basically, instead of doing what we always do as a country, raising the debt limit (something that has happened multiple times under every President) and working out a combination of tax revenue increases and spending cuts, the Congress and White House couldn't get it done, and instead, they pushed all of this to December 31. And in their wisdom, they decided to impose what is called a mandatory sequestration on December 31, 2012 (again, after the election) if they couldn't reach a deal. And they didn't reach a deal. And so the $600 billion off defense and domestic spending (each) has been set to take place December 31.

And it turns out, when you don't let the economy and markets know if $1.2 trillion in spending is really going to not happen (which would be a big hit to GDP and raise unemployment for all of the jobs that people wouldn't be working when that is cut out of the budget) and at the same time don't let the economy and markets have any idea what you plan to do for tax policy, bad things happen. Middle-income people who might notice a big difference over a couple of thousand dollars don't spend any extra. Businesses don't hire. Businesses don't invest. Add that to already high unemployment from the massive job losses in 2007 to 2009, and you have just a complete recipe for disaster. Never mind that Japan is recovering from the tsunami and Europe is still a mess over the Euro. And, yeah, never mind that the Middle East is still a mess. You have a completely frozen, locked out economy, and you can largely blame the clowns in Washington (both parties, but please recognize the truth about each's role, as the truth is always important) for their genius. Instead of fixing it almost two years ago, where the US economy could be in much better shape, we get to do it now. And guess what? It's still mostly the same parties at the table.

I'm actually quite confident (and have been for some time) that a deal will be reached finally. They have played their game. You can maybe call it a draw, or you can maybe say that the Democrats and Obama won by a slight margin because they didn't lose, but either way, it's over. Obama can't be reelected, so the Republicans have no reason to try to push this out, and Obama can't be reelected, so Obama has no reason to try to pull an extreme left-wing agenda here.

But make no mistake.

Tax revenue needs to go up for the government to bring its books back into balance over the next ten years or so, and spending needs to be cut to do the same. Both are going to happen. Maybe some entitlement reform will go along with it to make the deal work for both sides, although I expect little movement there, and none when it comes to Social Security, which is not a weight on the actual Federal books. With the wars ending and that money saved, and with the US defense budget already bigger than the next 13 largest nations combined, I don't see much in terms of defense spending INCREASES, and maybe there is some room for decreases. But what some are about to learn is that the discretionary side isn't nearly as bloated as some people think. There isn't nearly as much to cut there as conservatives would like.

But the specifics aren't really important. What is important is that the odds of them working it out this time, with everything pointing to December 31 (and yes, they could easily all agree to a two month extension to hammer out the details if needed, and that would be fine) are pretty good. I would say that I feel fairly confident that it will happen. And once it does, the certainty of knowing the tax and spending sides of the equation (even if it means higher taxes slightly for someone somewhere or less spending) will be enough to shake the markets loose and get the economy back on better footing.

We live in extraordinary times. We've seen one of the biggest financial meltdowns in history followed by one of the most gridlocked political environments our country has ever known. I understand when the cynics say that just because the election is over doesn't mean that these guys will grow up any and fix things. But I think they will because there isn't as much upside to not getting it done any more. And if you want more proof that something should get done, go back and watch Rich's video that I linked earlier in the article, because it says it all the way we like to see it: Factually, and by the numbers.

Stock Picks Recap for 11/16/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TRIP triggered long (without market support) and worked:

FNSR triggered short (with market support) and worked:

AVGO triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOG triggered short (with market support) and worked:

His SHLD triggered short (with market support) and worked:

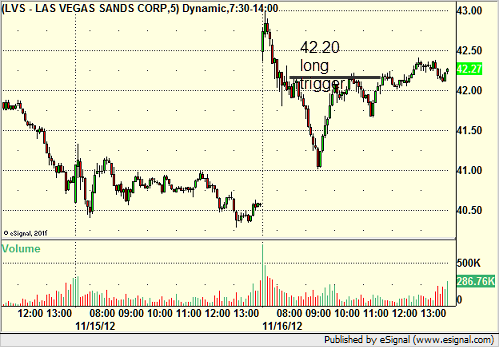

His LVS triggered long (without market support) and didn't work:

His AAPL triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, all 5 of them worked great.

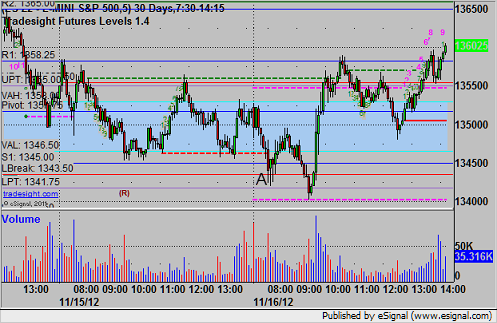

Futures Calls Recap for 11/16/12

Well, I have to apologize for this one. I made a mistake in the entry and didn't notice until after the trade triggered. See ES below.

Net ticks: -7 ticks.

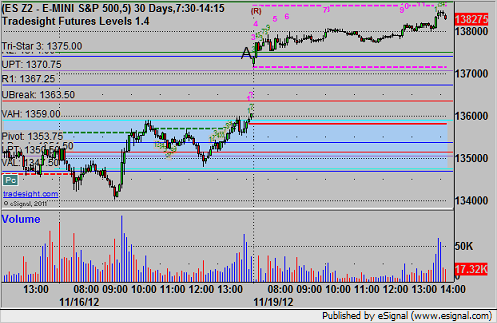

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

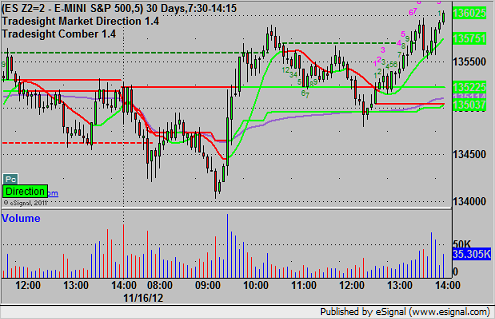

ES:

On the chart, I liked the way that the ES was basing just over S1 from Thursday into Friday (basically the Thursday low was Friday's S1 blue line). I wanted to go short under that (1345.00), which worked to the 6 tick partial. However, I put the numbers into the Messenger to go short under LBreak (1343.25 at A), which was a little lower and triggered and stopped. Anyone that took the course should have recognized the difference (the S1 was both calculated and conventional charting combined, as we teach), but I blew it. Never done that before, so I apologize: