Forex Calls Recap for 11/16/12

Another day with nothing. See EURUSD below.

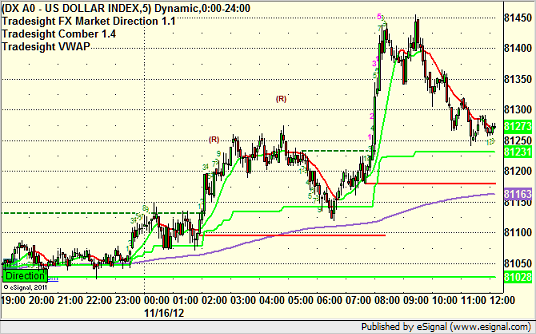

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts heading into the new week (see GBPUSD), and then glance at the US Dollar Index.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

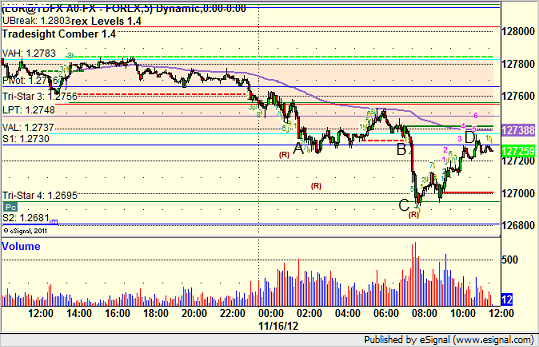

EURUSD:

Triggered short at A and stopped. Triggered short again at B, hit the tri-star level exactly at C (but not the S2 first target), and I stopped over the entry at D:

Stock Picks Recap for 11/15/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, KLAC triggered short (with market support) and worked:

EBAY triggered short (without market support due to opening 5 minutes) and worked enough for a partial:

SOHU triggered short (with market support) and didn't work initially, worked later:

SBGI triggered short (without market support due to opening 5 minutes) and worked eventually:

From the Messenger/Tradesight_st Twitter Feed, Rich's JPM triggered long (with market support) and didn't work:

His BIDU triggered long (with market support) and didn't work:

GS triggered long (with market support) and didn't work:

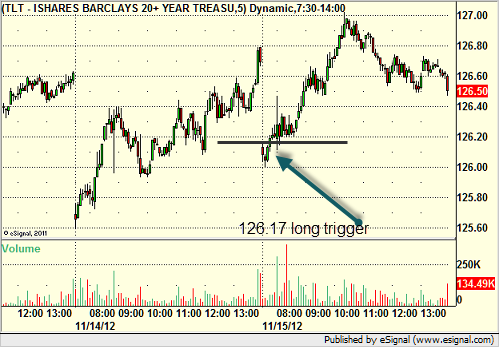

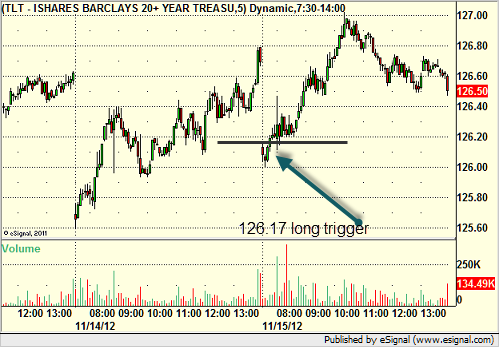

TLT triggered long (ETF, so no market support needed) and worked:

Rich's AKAM triggered short (with market support) and didn't work:

His AAPL triggered short (with market support) and worked:

GOOG triggered short (with market support) and didn't work:

AMZN triggered short (with market support) and worked:

Rich's GS triggered short in the afternoon (with market support) and worked enough for a partial:

His AAPL triggered short (without market support) in the afternoon and worked:

GOOG triggered short again in the afternoon (with market support) and worked enough for a partial:

In total, that's 12 trades triggering with market support, 6 of them worked, 6 did not.

Stock Picks Recap for 11/15/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, KLAC triggered short (with market support) and worked:

EBAY triggered short (without market support due to opening 5 minutes) and worked enough for a partial:

SOHU triggered short (with market support) and didn't work initially, worked later:

SBGI triggered short (without market support due to opening 5 minutes) and worked eventually:

From the Messenger/Tradesight_st Twitter Feed, Rich's JPM triggered long (with market support) and didn't work:

His BIDU triggered long (with market support) and didn't work:

GS triggered long (with market support) and didn't work:

TLT triggered long (ETF, so no market support needed) and worked:

Rich's AKAM triggered short (with market support) and didn't work:

His AAPL triggered short (with market support) and worked:

GOOG triggered short (with market support) and didn't work:

AMZN triggered short (with market support) and worked:

Rich's GS triggered short in the afternoon (with market support) and worked enough for a partial:

His AAPL triggered short (without market support) in the afternoon and worked:

GOOG triggered short again in the afternoon (with market support) and worked enough for a partial:

In total, that's 12 trades triggering with market support, 6 of them worked, 6 did not.

Futures Calls Recap for 11/15/12

A stop out and then the same trade triggered again and worked on the ES from Mark. See that section below. Range was back and forth and we closed flat, but volume has been improved this week nicely, hitting 2 billion shares on the NASDAQ again today. Friday should be dead for options expiration, so there might not be much to do.

Net ticks: -4.5 ticks.

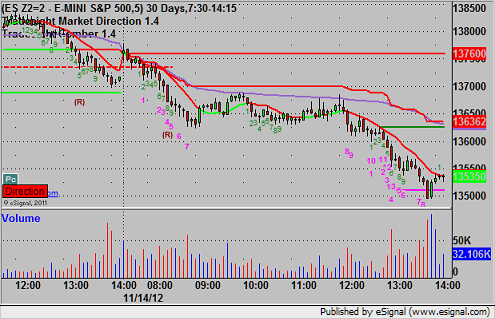

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

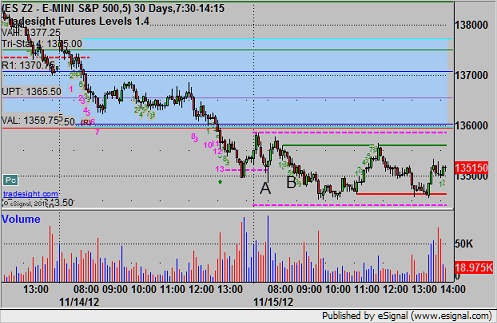

ES:

ES never even touched a level today, wow.

Mark's call triggered short at 1348.25 at A, stopped for 7 ticks, then triggered again at B, hit the first target, and stopped over the entry:

Forex Calls Recap for 11/15/12

A dead even trade on the EURUSD, but some interesting notes to comment about there. See that section below.

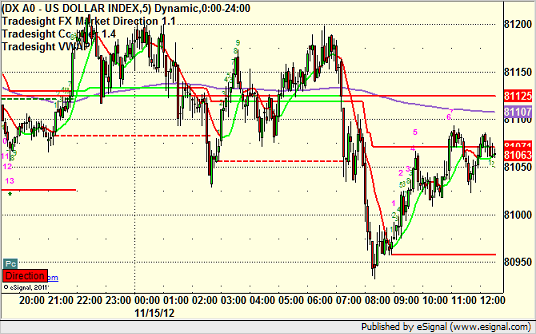

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

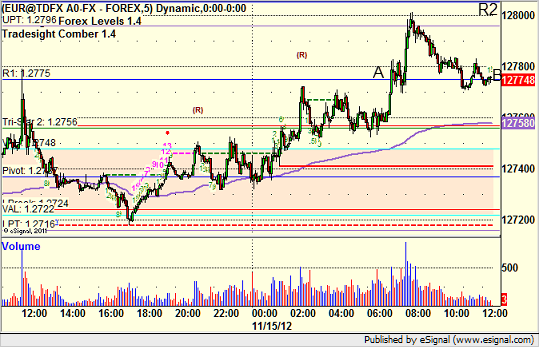

EURUSD:

Finally triggered long at A, didn't quite make it to the first target of R2 (top of the image below), and I eventually closed at the entry at B for an even trade. Note that the high and low of the session are basically the Pressure Thresholds:

Tradesight Market Preview for 11/15/12

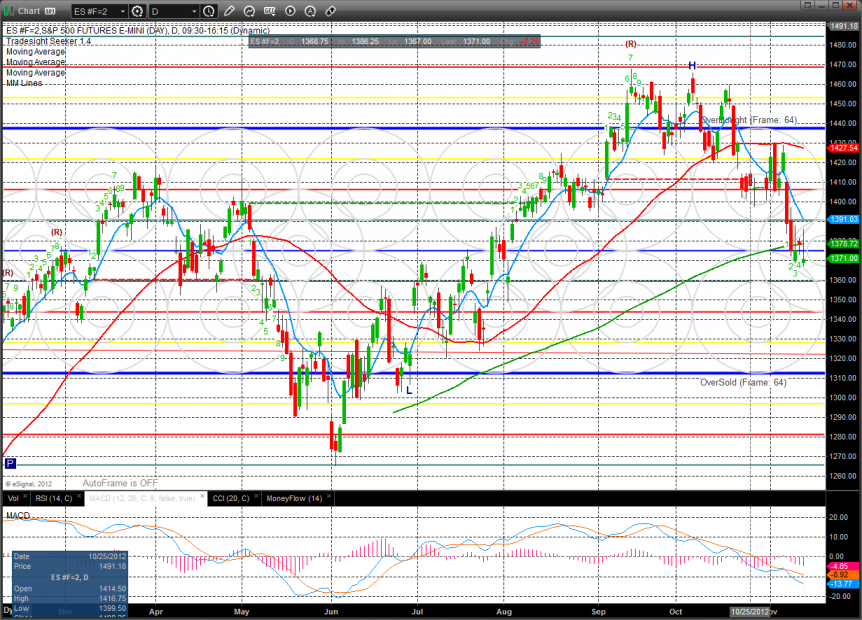

The ES lost 18 handles on the day and recorded a new low on the move. Price has broken below the 4/8 Murrey math level but is close to recording an oversold reading of -200 on the CCI. Next support is 1343.75.

The NQ futures also made a new low on the move, losing 31 on the day. The chart has broken below the 1/8 level and should find support at the 0/8 level in the 2500 area. Like the SP side, the CCI is very close to an oversold reading.

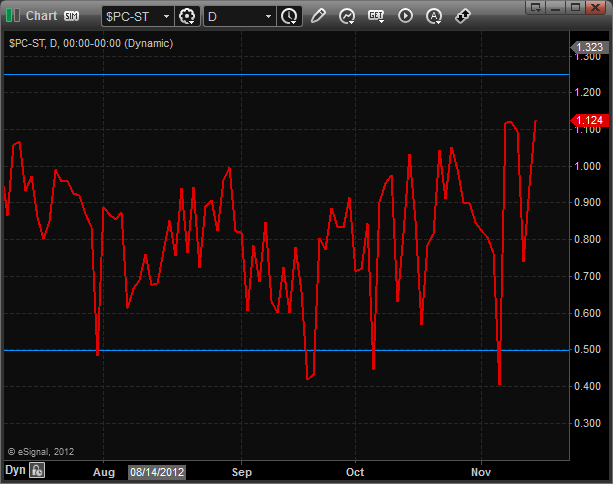

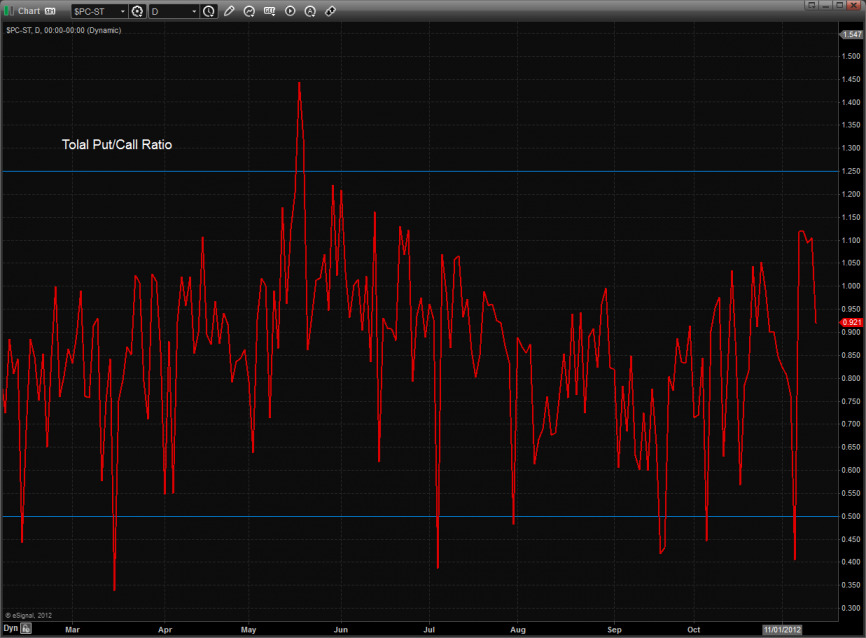

The total put/call ratio is close to an oversold reading but not quite yet…stay tuned.

The 10-day Trin is still in the neutral range.

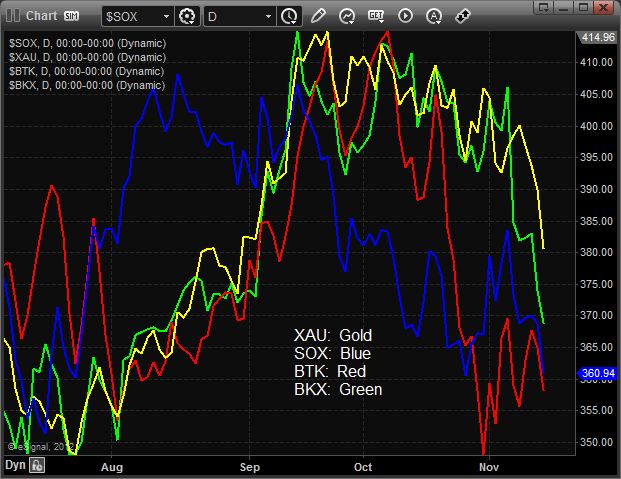

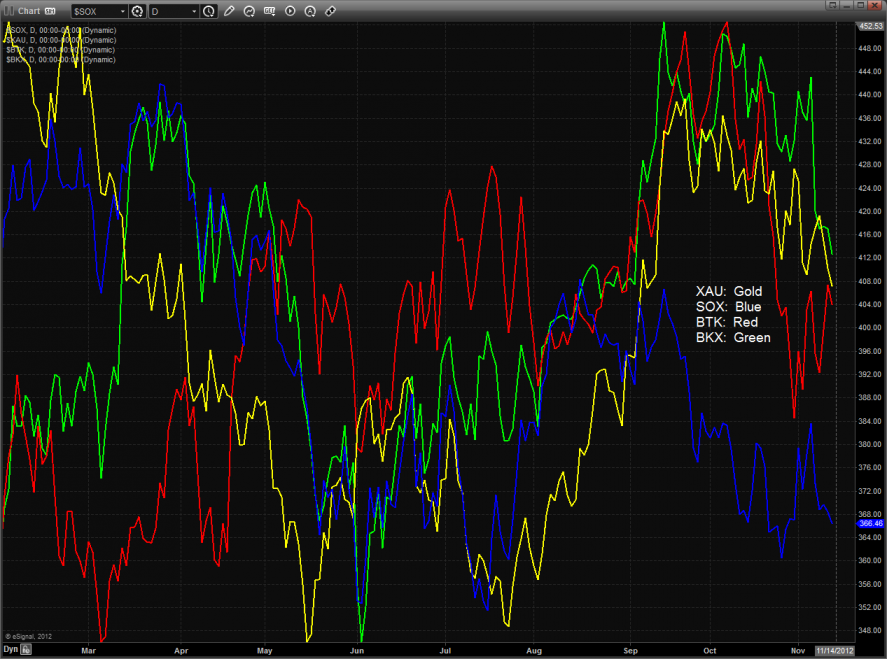

Multi sector daily chart:

The SOX/NDX cross chart is still in the trading range:

The Dow/gold ratio remains in a bearish trend with the hard asset favored over equities—weekly chart below.

The SOX was the top sector on the day. Note the key Murrey math level that is again being used for support.

The OSX traded in-line with the broad market but did make a new low on the move.

The BTK continues to game the 200dma so nothing new technically. Keep in mind that it still has relative strength.

The banking index broke below the key 200dma but expect it to at least find short term support here. The 200dma tends to be gammed when first tested.

The XAU was the last laggard on the day. Next important support will be the active static trend line.

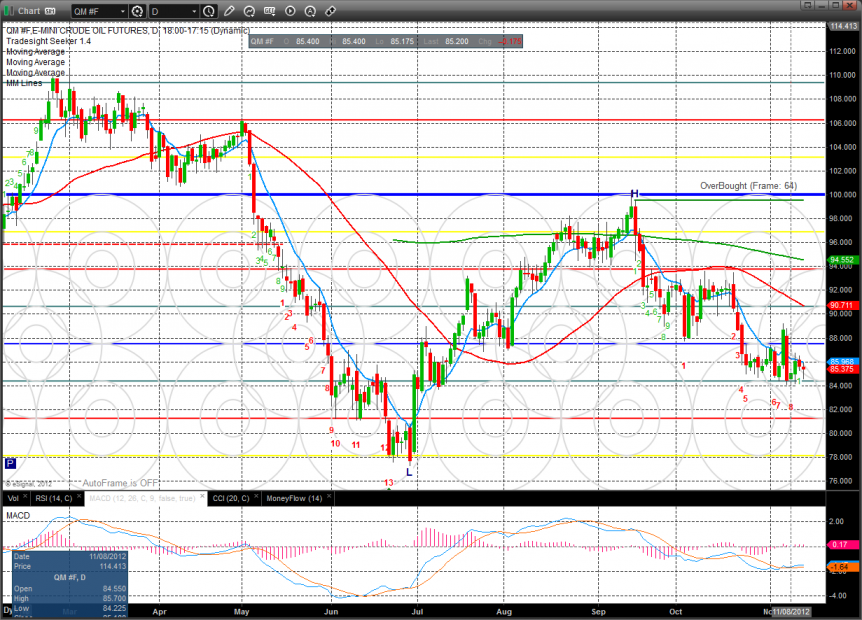

Oil:

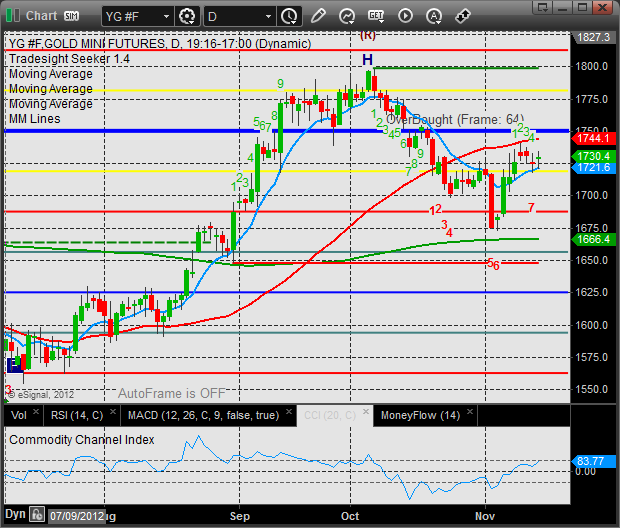

Gold:

Silver:

Stock Picks Recap for 11/14/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MLNX triggered long (without market support due to opening 5 minutes) and worked:

NVDA triggered late in the day short (with market support) and didn't work enough to count either way.

From the Messenger/Tradesight_st Twitter Feed, Rich's POT triggered short (with market support) and worked:

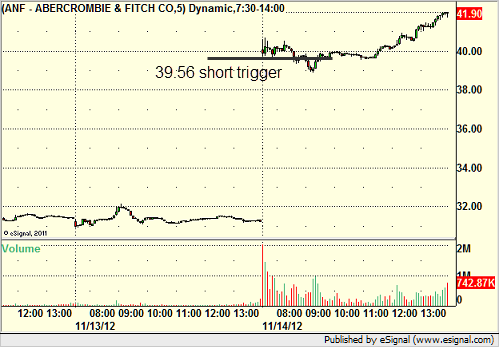

His ANF triggered short (with market support) and worked enough for a partial:

His GS triggered short (with market support) and worked:

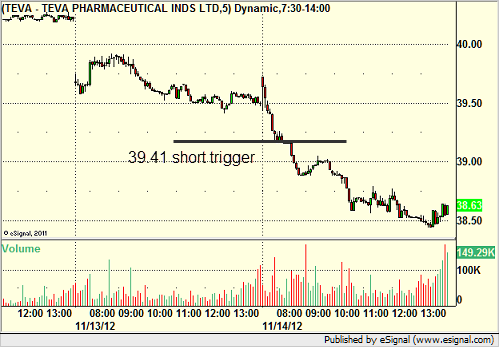

TEVA triggered short (with market support) and worked:

Rich's APA triggered short (with market support) and worked:

AAPL triggered short (with market support) and didn't work:

Rich's WYNN triggered short (with market support) and didn't have enough time to get going.

Rich's EBAY triggered short (with market support) and worked enough for a partial:

GOOG triggered short (with market support) and worked:

In total, that's 8 trades triggering with market support, 7 of them worked, 1 did not.

Futures Calls Recap for 11/14/12

The call that I was looking at on the NQ (short under Pivot), I ended up not putting in, and it would have stopped twice before working. We ended up filling the gaps early and going flat through lunch, then sliding again. I had some issues getting back to my desk for the last two hours.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Forex Calls Recap for 11/14/12

No triggers again on a dull session. I'll just run through the charts.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

Tradesight Market Preview for 11/14/12

The ES lost 7 on the day which made a new low on the move and matched the low close. Average prices are lower over the course of the expiring option cycle so traders shouldn’t be surprised by the lack of bids. Wednesday is the key day this week ahead of Friday’s expiration and be sure to be ready for a move after 60mins into the day and respect the direction of the move.

The NQ’s were weaker then the broad market futures and decisively made a new low on the move. Keep in mind that both the SP and NQ’s settled above the open which puts in place a camouflage buy condition.

Total put/call ratio:

10-day Trin:

Multi sector daily chart:

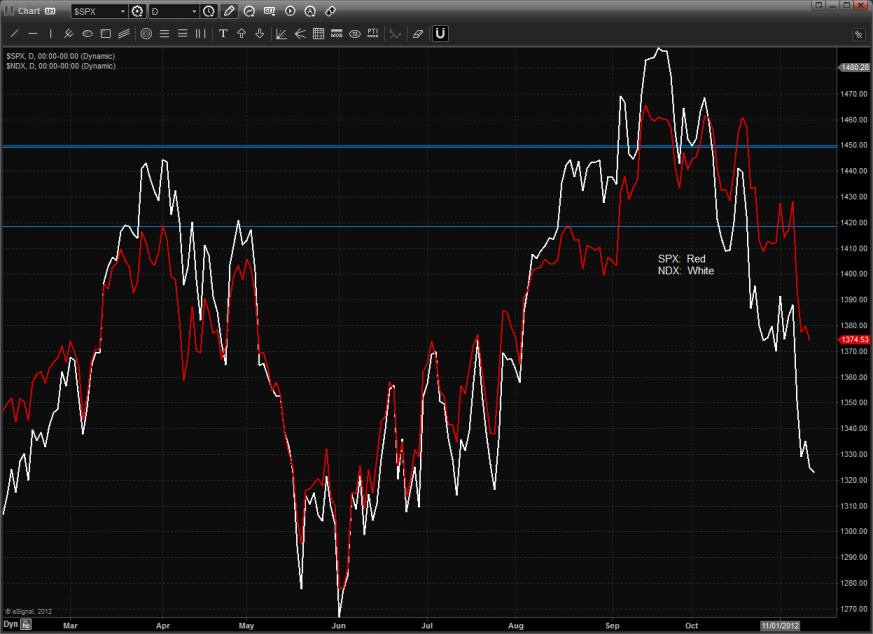

SPX vs. NDX daily comparison chart:

The relative performance chart still shows bearish action from the NDX side.

The BTK was the top performer on the day after recording a flat session.

The OSX posted and inside day with a small gain. Price remains bearishly below all of the major moving averages.

The SOX was weaker than the broad market. Keep a close eye on the MACD for a positive cross above the zero line which would be a game changer for the chart.

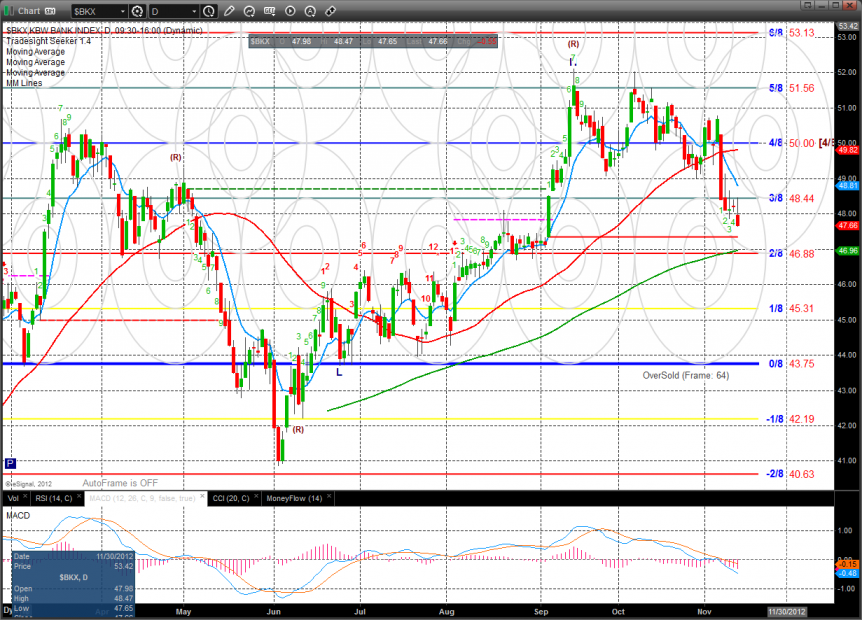

The BKX made a new low on the move. Key support is just below at the static trend line and 200dma. Option expiration could take price down to either level.

Oil:

Gold:

Silver: