Stock Picks Recap for 11/13/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, QLIK triggered short (without market support) and worked:

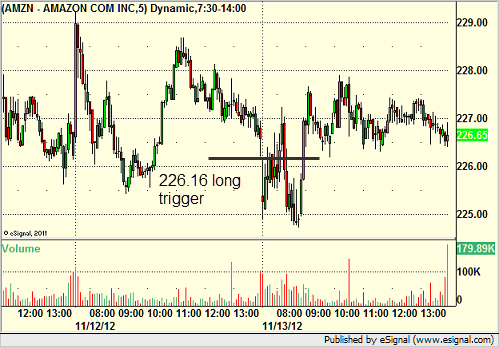

From the Messenger/Tradesight_st Twitter Feed, AMZN triggered long (with market support) and worked:

COST triggered long (with market support) and worked enough for a partial:

Rich's KLAC in the afternoon triggered short (without market support) and worked great:

In total, that's 2 trades triggering with market support, and both of them worked, as did the two that triggered without market support.

Futures Calls Recap for 11/13/12

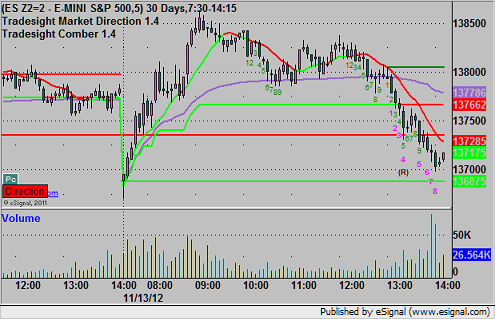

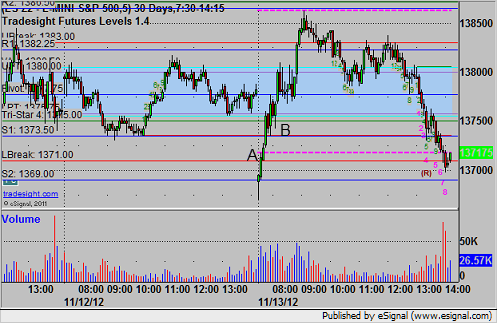

A nice winner on the ES as the market gapped down and set the S2 from underneath in the opening 2 minutes of play, so we took a long moving back through that and it worked quite well. See ES section below.

Net ticks: +15 ticks.

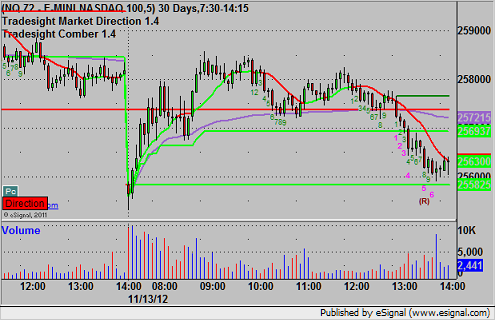

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

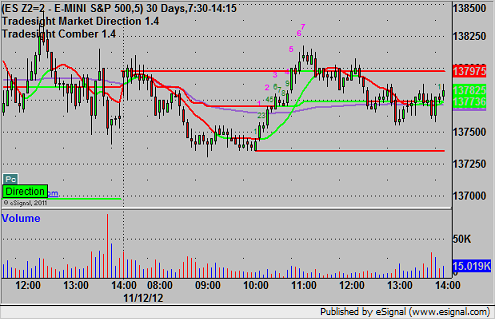

ES:

Triggered long at A at 1369.25, hit first target for 6 ticks, and we adjusted the stop five times and finally stopped at 1375.25 at B:

Forex Calls Recap for 11/13/12

Still no ranges, still half size, and two stops (and the EURUSD exactly set the short entry again but didn't retrigger). See EURUSD and GBPUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after the Levels are posted.

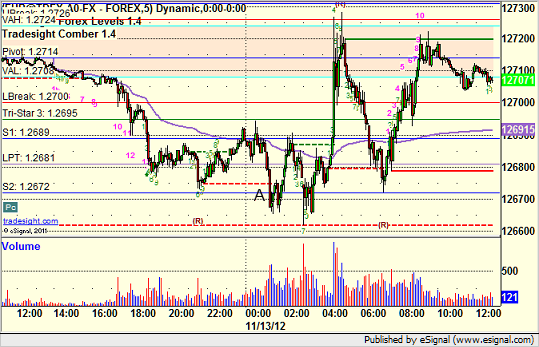

EURUSD:

Triggered short at A and stopped. Note how it hit S2 again in the morning:

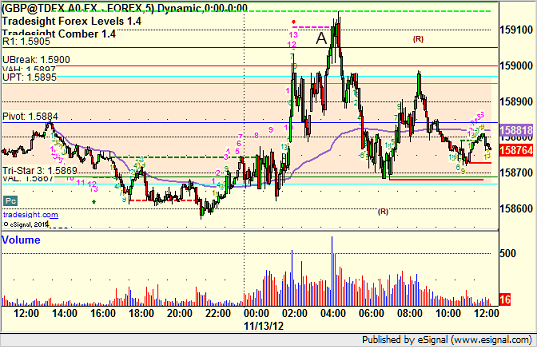

GBPUSD:

Triggered long at A and stopped:

Tradesight Market Preview for 11/13/12

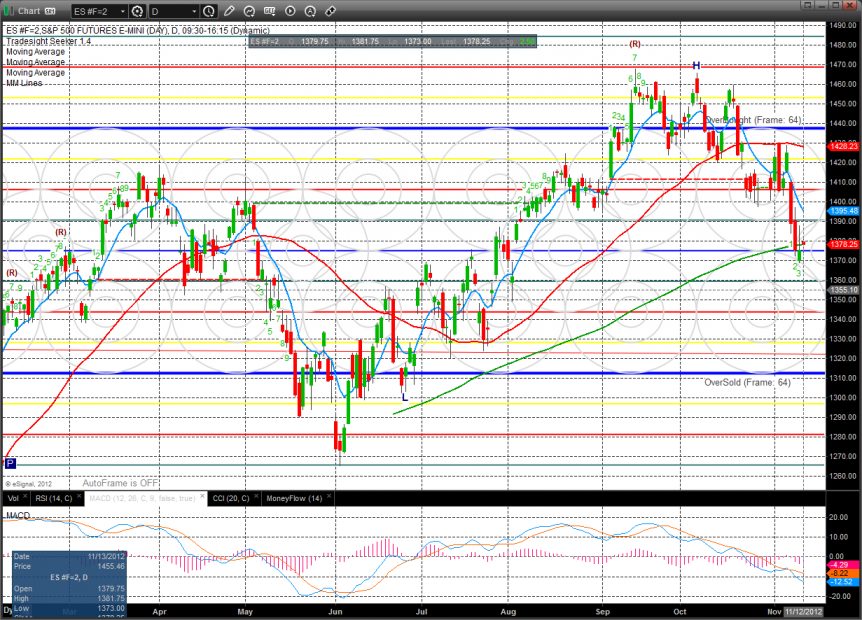

The ES was higher by 2 on the day after trading in a wide range. Price is feeling the pull of the 200dma, setting right at it. Expect more 200dma gaming until the expiration will force decisions.

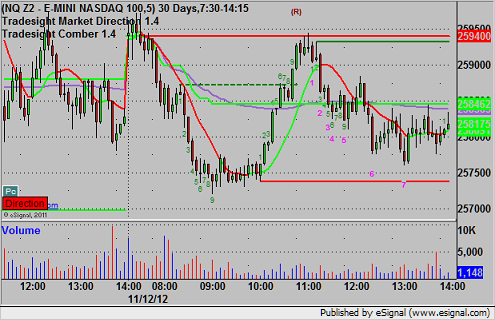

The NQ futures were flat on the day after gapping up and attempting higher prices. Price was contained within the prior day’s range so the resolution of the pattern will have some punch.

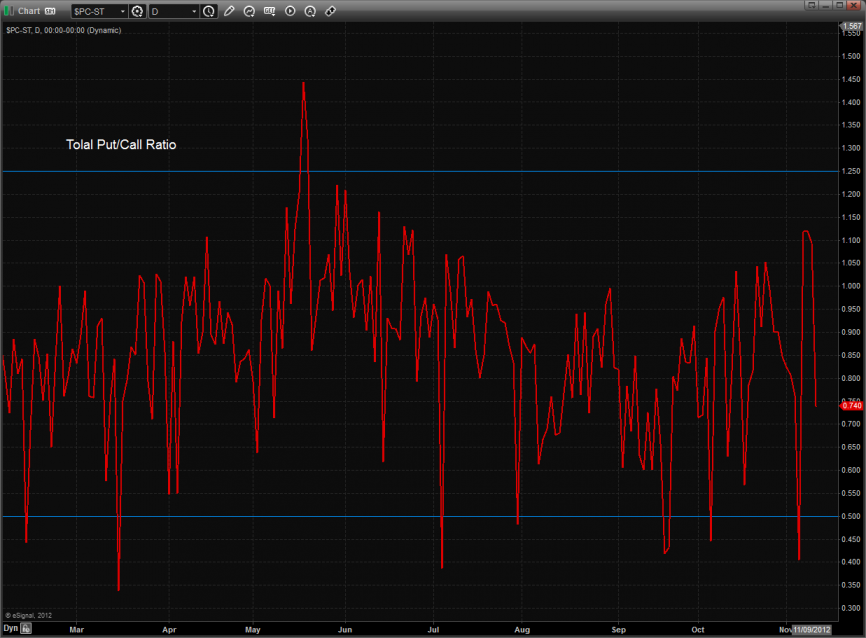

The total put/call ratio has retreated to neutral after recording climatic over sold reading.

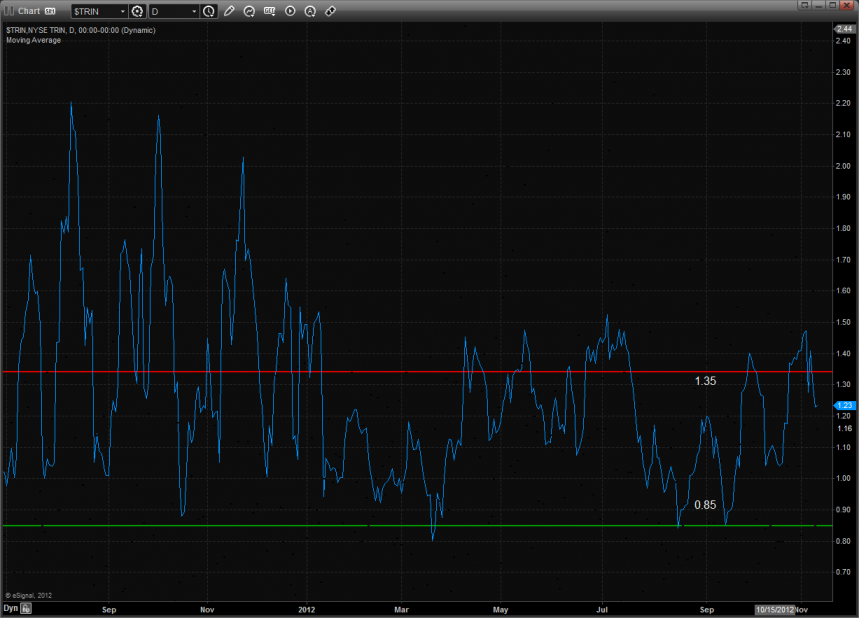

The 10-day Trin has pulled back to the neutral area.

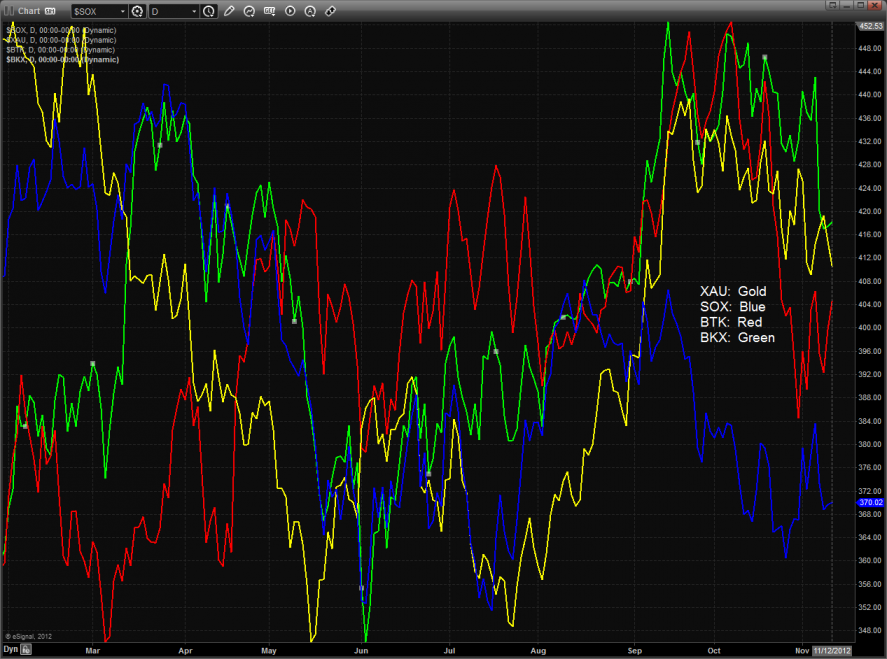

Multi sector daily chart:

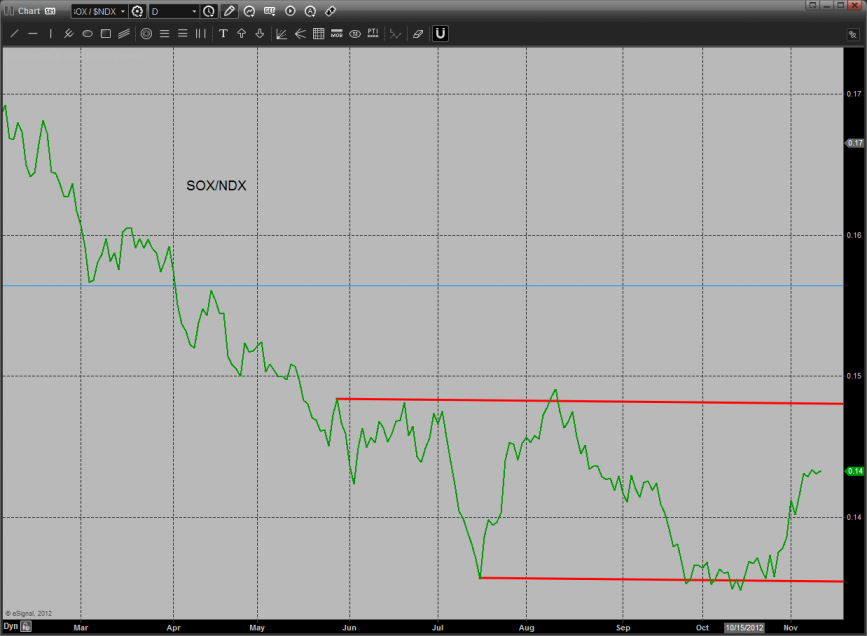

The bright point within the Naz universe is that the SOX is showing relative strength but until the range is broken it’s just a reflex move.

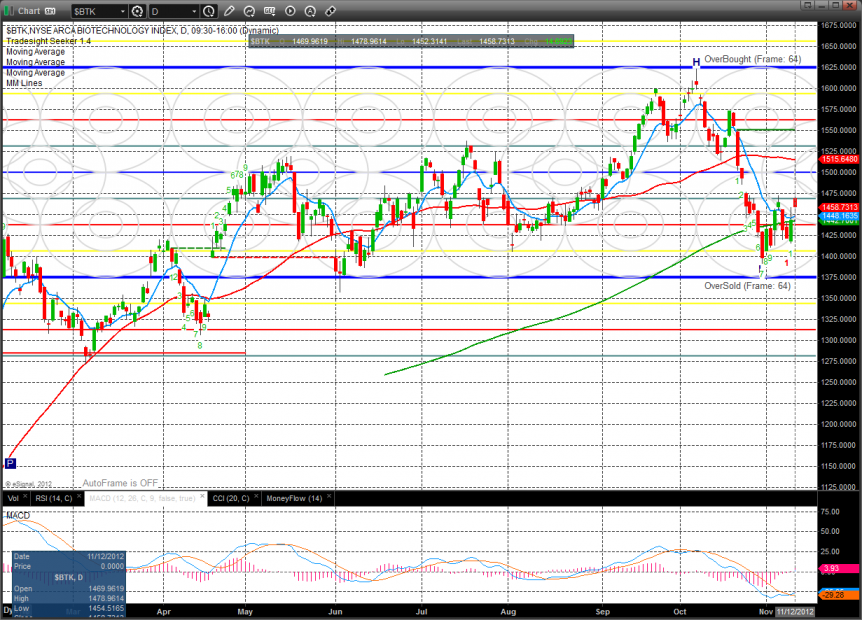

BTK was the top gun on the day:

OSX was stronger than the broad market.

The BKX was flat:

The SOX was also flat:

The HGX housing index was the last laggard on the day. Monday it bearishly settled below the 50dma and could be ready to turn lower. Keep a close eye on the MACD for the cross of the zero line which will accelerate the downside momentum.

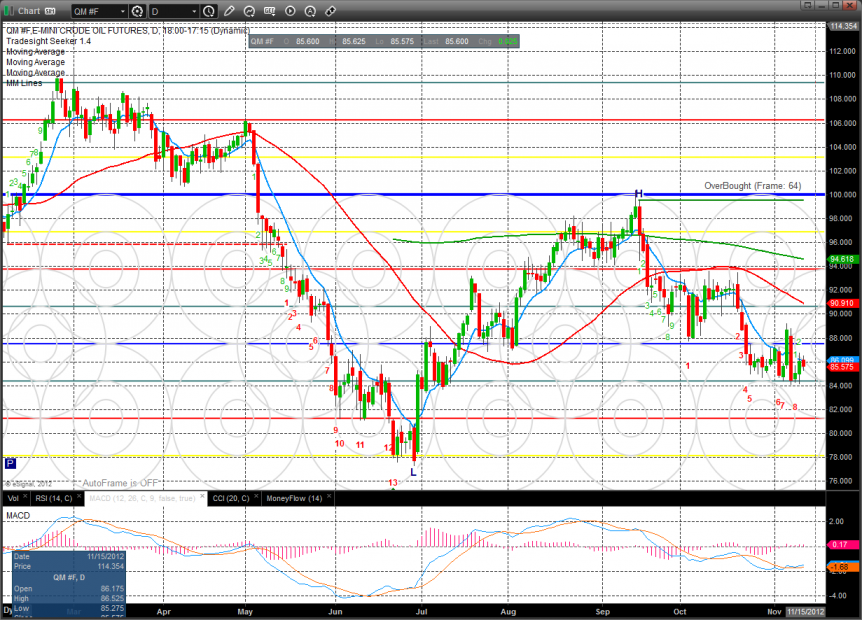

Oil:

Gold:

Silver:

Stock Picks Recap for 11/12/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (without market support due to opening 5 minutes) and worked some, early trigger:

His AMGN triggered long (without market support) and didn't work:

In total, no trades triggered with market support out of the few calls for the Holiday.

Futures Calls Recap for 11/12/12

No calls for the bank Holiday (Veteran's Day), but the market was open and the NASDAQ traded 1.2 billion shares. We resume tomorrow.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Forex Calls Recap for 11/12/12

No Forex calls for the US Veteran's Day bank holiday (and no movement either, only 40 pips of range on the EURUSD).

Calls resume tonight.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

Forex Calls Recap for 11/12/12

No Forex calls for the US Veteran's Day bank holiday (and no movement either, only 40 pips of range on the EURUSD).

Calls resume tonight.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

Tradesight October 2012 Futures Results

Before we get to October’s numbers, here is a short reminder of the results from September. The full report from September can be found here.

Tradesight Tick Results for September 2012

Number of trades: 31

Number of losers: 14

Winning percentage: 54.8%

Net ticks: +6.5

Reminder: Here are the rules.

1) Totals for the month are based on trades that occurred on trading days in the calendar month.

2) Trades are based on the calls in the Messenger exactly as we call them and manage them and do not count everything you could have done from taking our courses and using our tools.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 6 ticks on one half and 12 on the second, that’s a 9-tick winner.

4) Pure losers (trades that just stop out) are considered 7 tick losers. We don’t risk more than that in the Messenger calls.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Tick Results for October 2012

Number of trades: 39

Number of losers: 18

Winning percentage: 53.8%

Net ticks: -27 ticks

This has been a horrible time for the markets in terms of volume and range, and our futures calls have finally registered their first negative month because of it. This includes Hurricane Sandy, which meant a couple of days without trades at the end of the month due to the markets being closed. It is an exceptional time for trading, something we have never seen before, and I remain satisfied that our system encourages tight stops and less trading when volume and ranges are bad. These results don't reflect the fact (in the raw numbers) that our system suggests smaller size when ranges are bad.

Here's hoping November and December see some improvement as we work to resolve the fiscal cliff.

Tradesight October 2012 Forex Results

Before we get to October’s numbers, here is a short reminder of the results from September. The full report from September can be found here and you can get the last several months in a row vertically by clicking here and scrolling down.

Tradesight Pip Results for September 2012

Number of trades: 32

Number of losers: 21

Winning percentage: 28.1%

Worst losing streak: 5 in a row (middle of the month)

Net pips: -130

Reminder: Here are the rules.

1) Calls made in the calendar month count. In other words, a call made on August 31 that triggered the morning of September 1 is not part of September. Calls made on Thursday, September 30 that triggered between then and the morning of October 1 ARE part of September.

2) Trades that triggered before 8 pm EST / 5 pm PST (i.e. pre Asia) and NEVER gave you a chance to re-enter are NOT counted. Everything else is counted equally.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 40 pips on one half and 60 on the second, that’s a 50-pip winner. If we made 40 pips on one half, never adjusted our stop, and the second half stopped for the 25 pip loser, then that’s a 7 pip winner (15 divided by 2 is 7.5, and I rounded down).

4) Pure losers (trades that just stop out) are considered 25 pip losers. In some cases, this can be a few more or a few less, but it should average right in there, so instead of making it complicated, I count them as 25 pips.

5) Trade re-entries are valid if a trade stops except between 3 am EST and 9 am EST (when I’m sleeping). So in other words, even if you are awake in those hours and you could have re-entered, I’m only counting things that I would have done. This is important because otherwise the implication is that you need to be awake 24/6. Triggers that occur right on the Big Three news announcements each month don’t count as you shouldn’t have orders in that close at that time.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Pip Results for October 2012

Number of trades: 24

Number of losers: 16

Winning percentage: 33.3%

Worst losing streak: 5 in a row (middle of the month)

Net pips: -100

A record for the Tradesight service. Two months in a row with negative returns on Forex. This has never happened before, but I also like the fact that although the raw data doesn't reflect it, we have remained half size the last two months. This is an extraordinary time for the markets and certainly things are duller than we have ever seen them. Ranges continue to diminish across the board, but I do think that the fiscal cliff situation will be resolved and help with getting these markets back together. In the meantime, I'd rather be limited in size and trading less (only 24 triggers in October versus 36 in September) when things are light. Let's get through the next month or two and then things should improve.