Stock Picks Recap for 11/7/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls due to the gap.

From the Messenger/Tradesight_st Twitter Feed, NTAP triggered short (with market support) and worked:

COST triggered short (with market support) and worked:

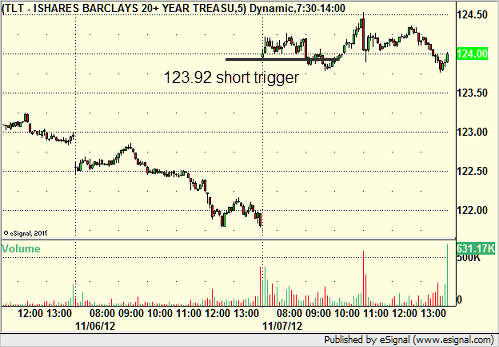

TLT triggered short (ETF, so no market support needed) and didn't work:

GS triggered short (with market support) and worked:

GOOG triggered short (with market support) and worked:

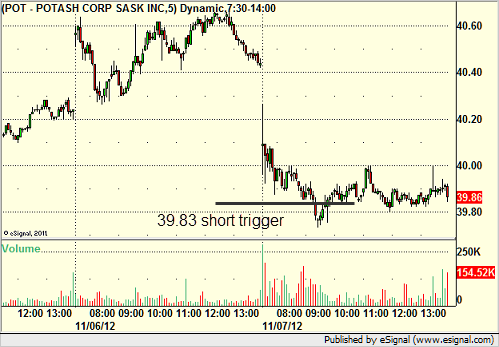

Mark's POT triggered short (with market support) and didn't work:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

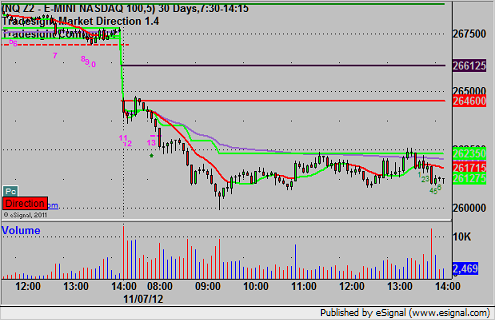

Futures Calls Recap for 11/7/12

Unfortunately, with the gap down and the push lower, the futures barely touched (and certainly didn't set up with) any of our key levels, so no calls were made. But, volume was back up at 2 billion NASDAQ shares, so hopefully that is what we see going forward, just without the gap and go days.

Net ticks: +0 ticks.

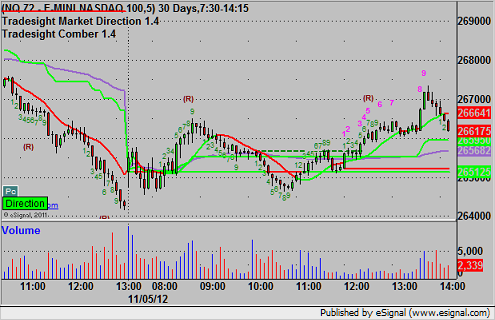

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

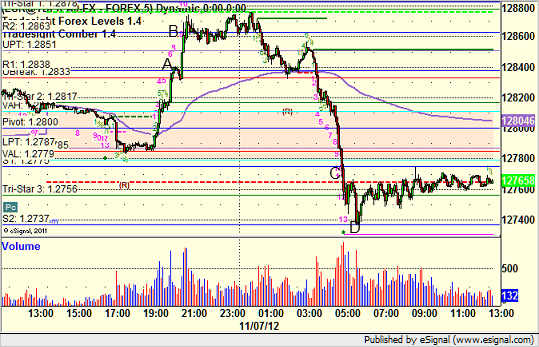

Forex Calls Recap for 11/7/12

There we go. Signs of life. More than average range, enough to get us two triggers and two winners. Let's hope that is representative of what is to come.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A, hit first target at B, second half stopped. Triggered short at C, hit first target at D, currently holding with a stop over S1:

Stock Picks Recap for 11/6/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PWRD triggered long (with market support) and didn't go enough in either direction to count all day:

CERN triggered long (with market support) and worked:

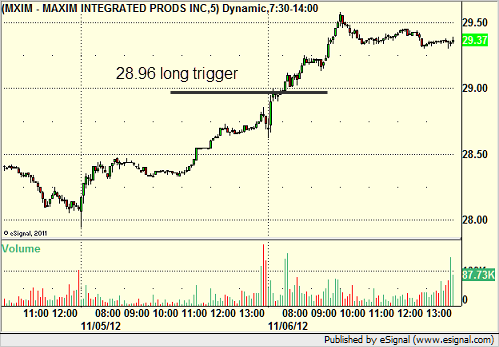

MXIM triggered long (with market support) and worked:

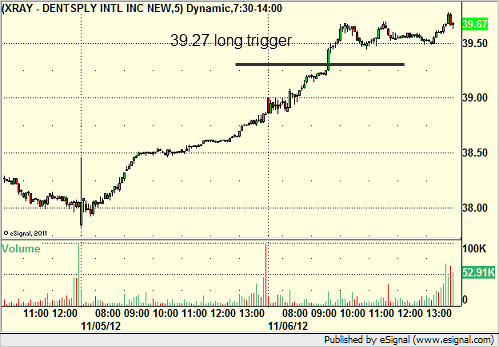

XRAY triggered long (with market support) and worked:

TRMB triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, GOOG triggered long (with market support) and didn't work:

Mark's CREE triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Futures Calls Recap for 11/6/12

A nice winner on the long side of the ES. See that section below. Market volume was back up after Monday's light session.

Net ticks: +15 ticks.

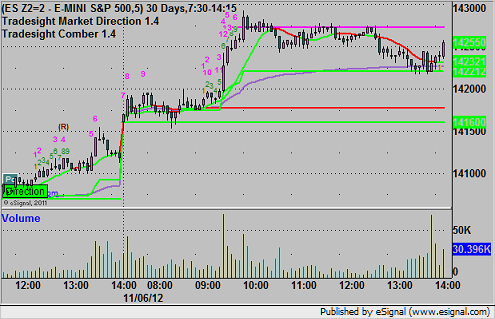

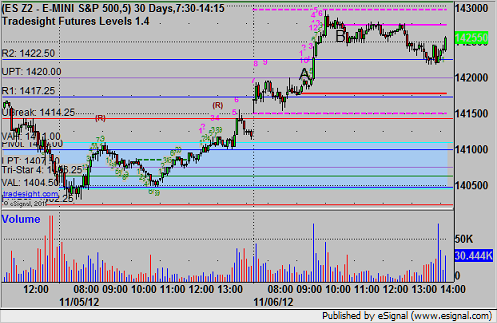

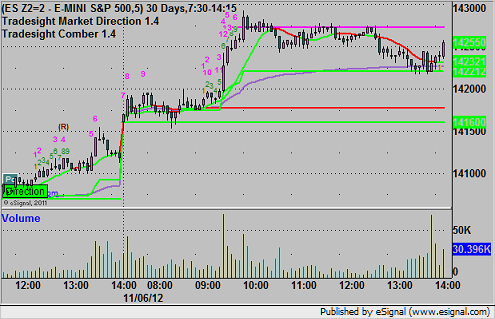

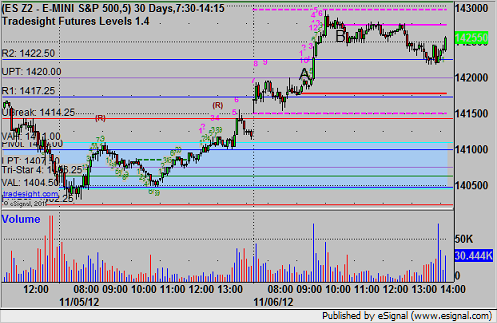

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Set the UPT perfectly and then Mark's call triggered long at A at 1420.25 moving through it, got a partial for 6 ticks, and after a few stop adjustments, stopped at B at 1426.25:

Futures Calls Recap for 11/6/12

A nice winner on the long side of the ES. See that section below. Market volume was back up after Monday's light session.

Net ticks: +15 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Set the UPT perfectly and then Mark's call triggered long at A at 1420.25 moving through it, got a partial for 6 ticks, and after a few stop adjustments, stopped at B at 1426.25:

Forex Calls Recap for 11/6/12

A winner and a loser on the EURUSD for almost a wash again as the markets did nothing ahead of today's election in the US.

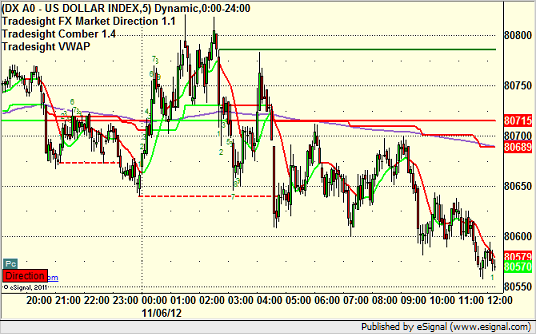

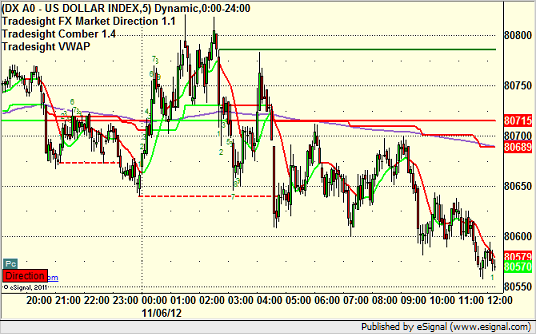

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

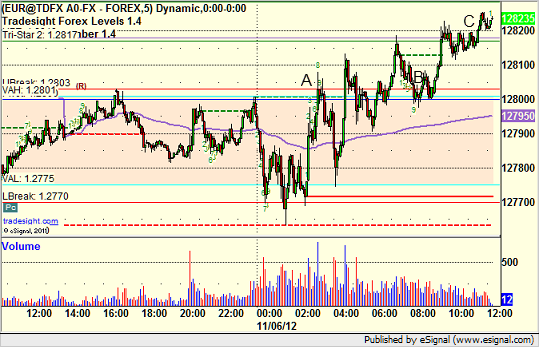

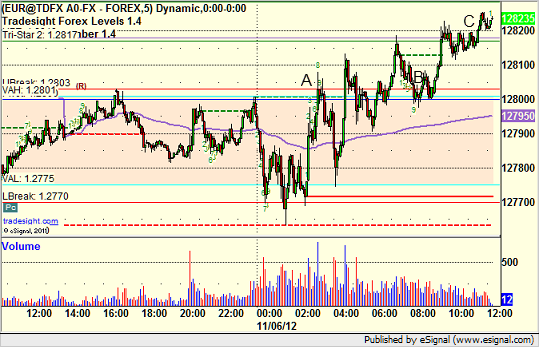

EURUSD:

Triggered long at A and stopped. Retriggered at B and closed at C for almost as much as we lost on the first:

Forex Calls Recap for 11/6/12

A winner and a loser on the EURUSD for almost a wash again as the markets did nothing ahead of today's election in the US.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A and stopped. Retriggered at B and closed at C for almost as much as we lost on the first:

Stock Picks Recap for 11/5/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BCOV triggered short (without market support) and worked enough for a partial but it was very fast:

From the Messenger/Tradesight_st Twitter Feed, AMZN triggered short (with market support) and didn't work:

Nothing else triggered.

In total, that's only one trade that triggered with market support, and it didn't work.

Futures Call Recap for 11/5/12

Volume was tracking for the lightest day of the year very early with much of the East Coast still closed and the election tomorrow, so we made no calls in a narrow environment.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session: