Stock Picks Recap for 10/31/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ENDP triggered short (without market support due to opening 5 minutes) and didn't work:

VVUS triggered short (without market support due to opening 5 minutes) and worked great:

From the Messenger/Tradesight_st Twitter Feed, we had several calls, but the only one that triggered was AMZN short (with market support) and that worked:

In total, that's 1 trade triggering with market support, and it worked.

Futures Calls Recap for 10/31/12

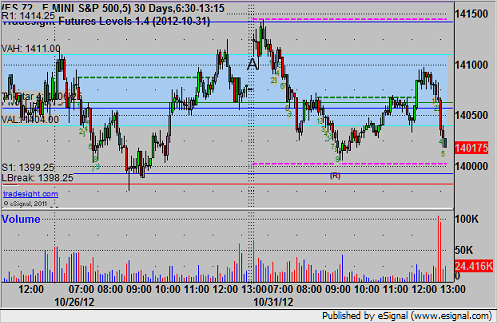

The volume was heavy early on, but we knew that trading would be sketchy at best with most of New York still reeling from Sandy. I tried one ES short into the Value Area that stopped and I nixed taking it a second time (would have worked). This could be a little slow until Monday, and maybe even after Tuesday's election.

Net ticks: -7 ticks.

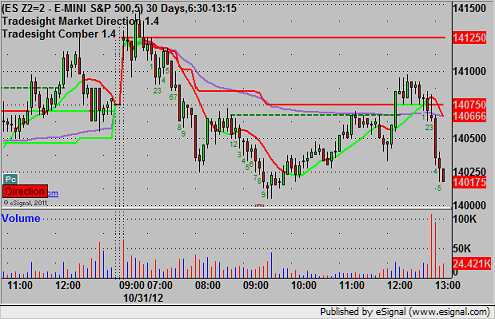

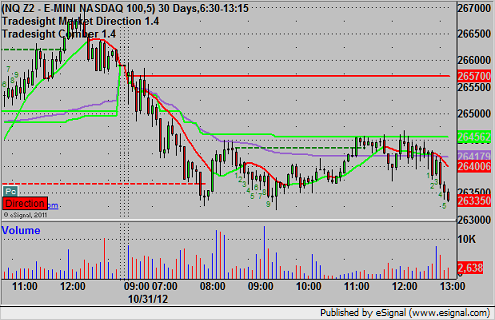

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1410.50 and stopped for 7 ticks:

:

:

Forex Calls Recap for 10/31/12

Lost 10 pips on a new trade and closed out the second half of the prior day's trade for a 50 pip gain. See EURUSD section below.

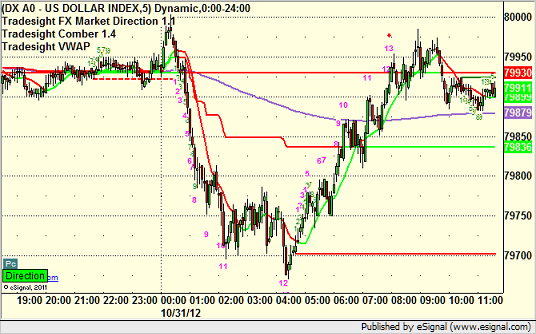

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

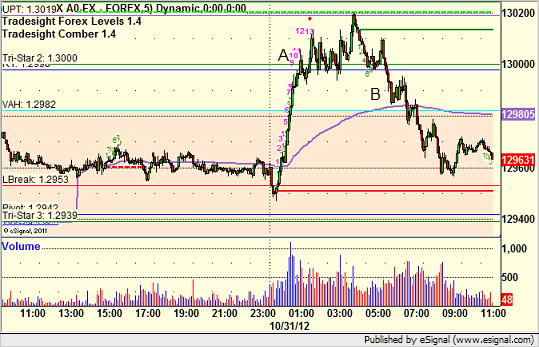

We came into the day still long from around 1.2940. That didn't stop overnight. The new long triggered at A, ran into a wall at the UPT exactly, and then I raised the stop in the morning for all of it and stopped at B:

Forex Calls Recap for 10/30/12

A winner despite the light activity. See EURUSD below. We are still long the second half of the trade as well.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

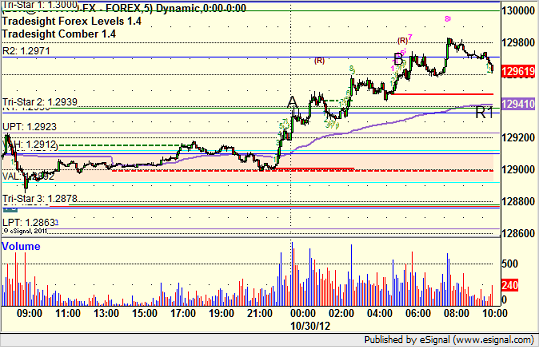

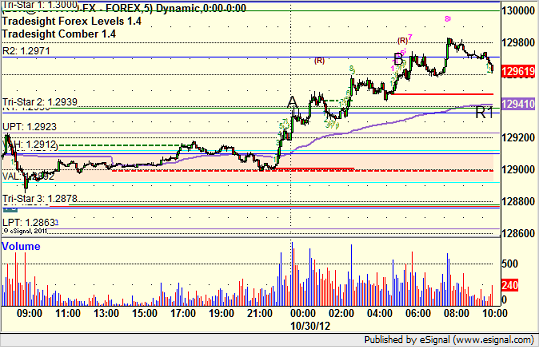

Triggered long at A, hit first target at B, holding the second half with a stop under R1:

Forex Calls Recap for 10/30/12

A winner despite the light activity. See EURUSD below. We are still long the second half of the trade as well.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A, hit first target at B, holding the second half with a stop under R1:

Stock Picks Recap for 10/26/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ODFL triggered long (with market support) and didn't work:

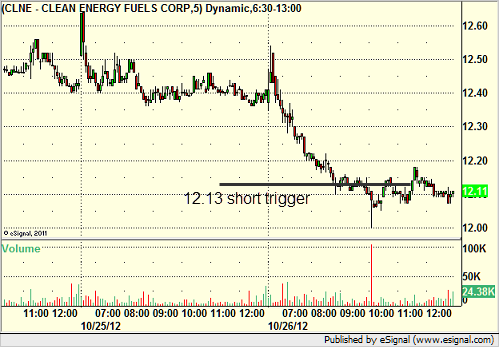

CLNE triggered short (with market support) and didn't go enough in either direction to count:

DECK gapped well below the trigger, no play.

TIBX triggered short (with market support) and didn't work:

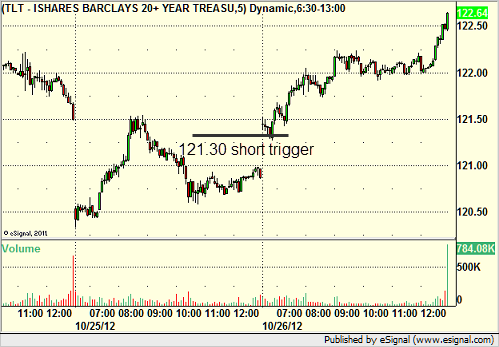

From the Messenger/Tradesight_st Twitter Feed, Rich's TLT triggered short (ETF, so no market support needed) and didn't work:

His AAPL triggered short (without market support due to opening 5 minutes) and didn't work:

GS triggered long (with market support) and worked enough for a partial:

Rich's IBM triggered long (with market support) and didn't work:

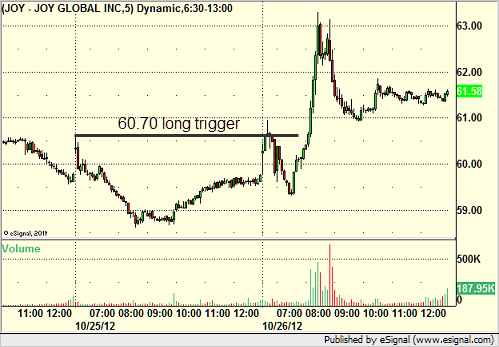

His JOY triggered long (with market support) and worked enough for a partial:

His BTU triggered long (with market support) and didn't work:

BIDU triggered short (with market support) and worked enough for a partial:

In total, that's 8 trades triggering with market support, 3 of them worked, 5 did not.

Futures Calls Recap for 10/26/12

I ended up making no calls (and Mark returns from vacation this Sunday) as we didn't get the gap I was expecting and volume looked light on a Friday. Might have been a mistake in retrospect, as I did have a trade fired up and ready after the ES set the LPT the first time (short under that low), but I didn't press the button given the volume. Would have worked. Hopefully, we're on the brink of things getting back to normal.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Futures Calls Recap for 10/26/12

I ended up making no calls (and Mark returns from vacation this Sunday) as we didn't get the gap I was expecting and volume looked light on a Friday. Might have been a mistake in retrospect, as I did have a trade fired up and ready after the ES set the LPT the first time (short under that low), but I didn't press the button given the volume. Would have worked. Hopefully, we're on the brink of things getting back to normal.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Forex Calls Recap for 10/26/12

No calls for the night ahead of the GDP data as there were no great setups based on the Levels spacing. This ended up being a good thing as GBPUSD and EURUSD were basically stuck in 50-60 pip ranges even with the data. So, we close out the week with a rare day with no calls.

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts heading into the new week with the Seeker and Comber separately (check the GBPJPY), and then glance at the US Dollar Index (nothing to see there).

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

Forex Calls Recap for 10/26/12

No calls for the night ahead of the GDP data as there were no great setups based on the Levels spacing. This ended up being a good thing as GBPUSD and EURUSD were basically stuck in 50-60 pip ranges even with the data. So, we close out the week with a rare day with no calls.

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts heading into the new week with the Seeker and Comber separately (check the GBPJPY), and then glance at the US Dollar Index (nothing to see there).

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.