Stock Picks Recap for 10/25/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, top pick SHLD triggered long (without market support) and worked great:

From the Messenger/Tradesight_st Twitter Feed, Rich's GS triggered long (without market support due to opening 5 minutes) and worked:

His AAPL triggered short (with market support) and worked:

His UA triggered short (with market support) and worked:

His CAB triggered short (with market support) and worked:

TEVA triggered short (with market support) and worked enough for a partial:

Rich's WYNN triggered long (without market support) and worked:

Rich's OSTK triggered long (without market support) and worked:

His AAPL triggered long (without market support) and worked enough for a partial:

In total, that's 4 trades triggering with market support, all 4 worked, plus the top pick SHLD.

Stock Picks Recap for 10/25/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, top pick SHLD triggered long (without market support) and worked great:

From the Messenger/Tradesight_st Twitter Feed, Rich's GS triggered long (without market support due to opening 5 minutes) and worked:

His AAPL triggered short (with market support) and worked:

His UA triggered short (with market support) and worked:

His CAB triggered short (with market support) and worked:

TEVA triggered short (with market support) and worked enough for a partial:

Rich's WYNN triggered long (without market support) and worked:

Rich's OSTK triggered long (without market support) and worked:

His AAPL triggered long (without market support) and worked enough for a partial:

In total, that's 4 trades triggering with market support, all 4 worked, plus the top pick SHLD.

Futures Calls Recap for 10/25/12

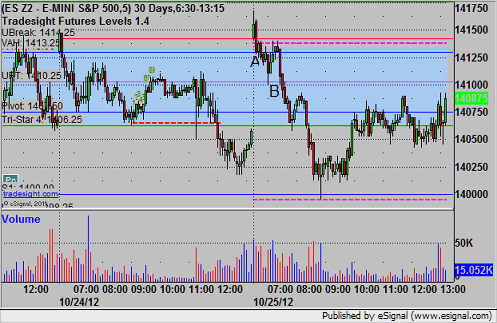

Two calls, two winners on the ES. See that section below.

Net ticks: +9 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1412.25, hit first target for 6 ticks, and stopped second half two ticks over the entry. Triggered short at B at 1409.75, hit first target for 6 ticks, and lowered stop twice and stopped 8 ticks in the money:

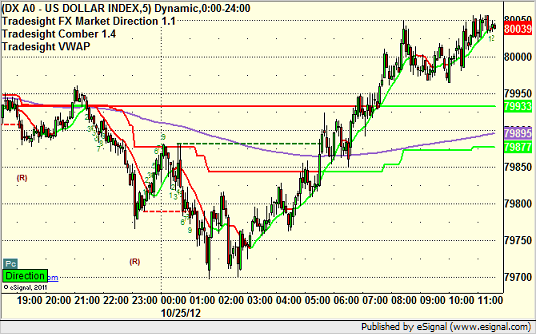

Forex Calls Recap for 10/25/12

Another day, another 80 pip range on the EURUSD that tried both directions. One stop out. See that section below.

I will be less than half size tonight ahead of the first look at GDP for Q3.

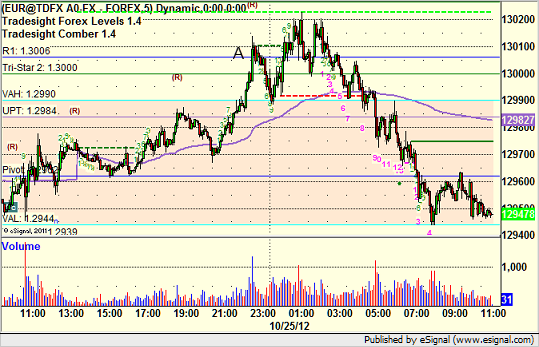

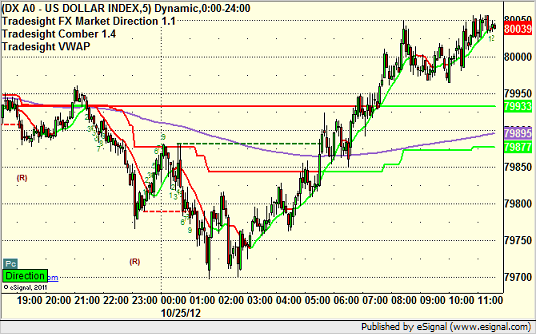

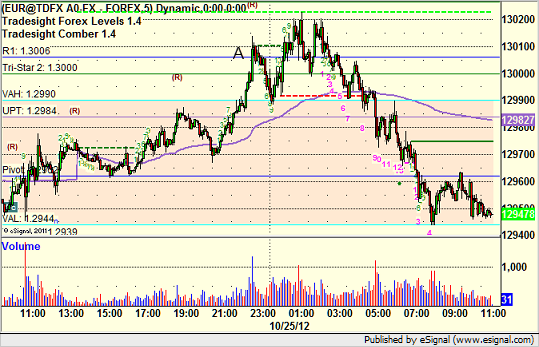

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A and stopped:

Forex Calls Recap for 10/25/12

Another day, another 80 pip range on the EURUSD that tried both directions. One stop out. See that section below.

I will be less than half size tonight ahead of the first look at GDP for Q3.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A and stopped:

Tradesight Market Preview for 10/25/12

The ES logged a pretty flat day but expanded the downside range and made a second close below the static trend line which will now break it. Key support remains at 1406.

The NQ futures were lower by 10 on the day settling right at the key 200dma. Keep in mind that the 200dma tends to get gamed when first tested so be prepared.

The 10-day Trin is still carrying oversold energy.

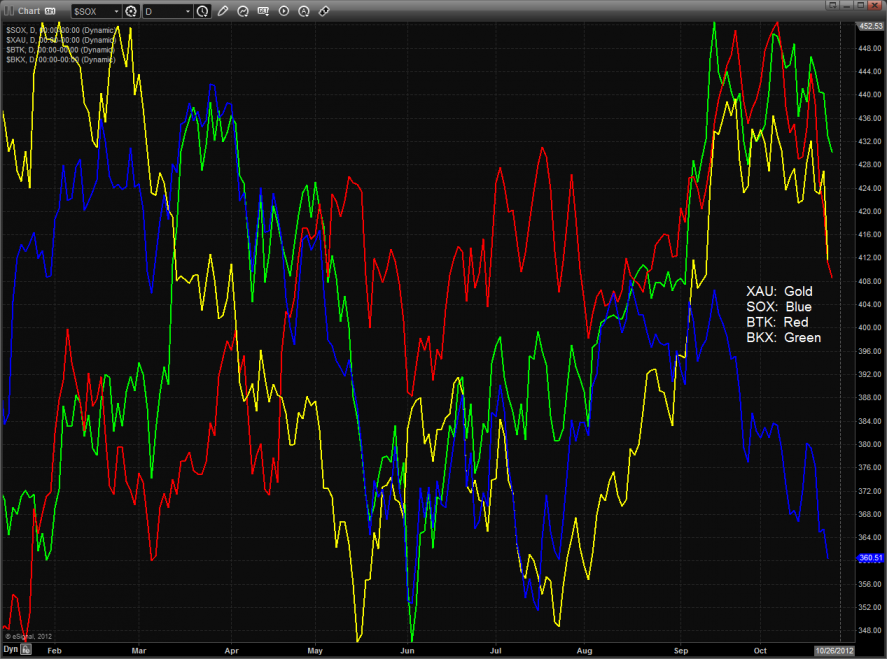

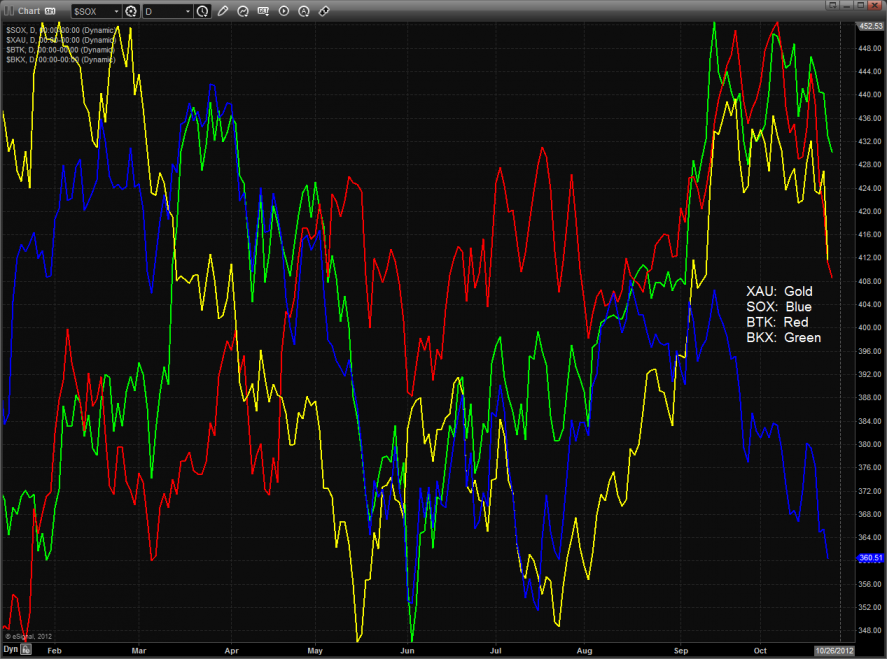

Multi sector daily chart:

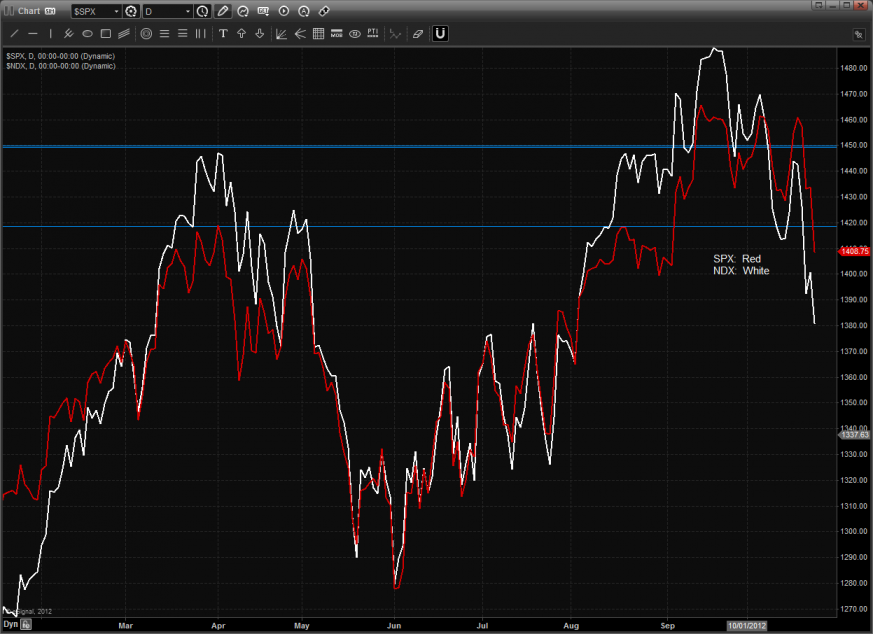

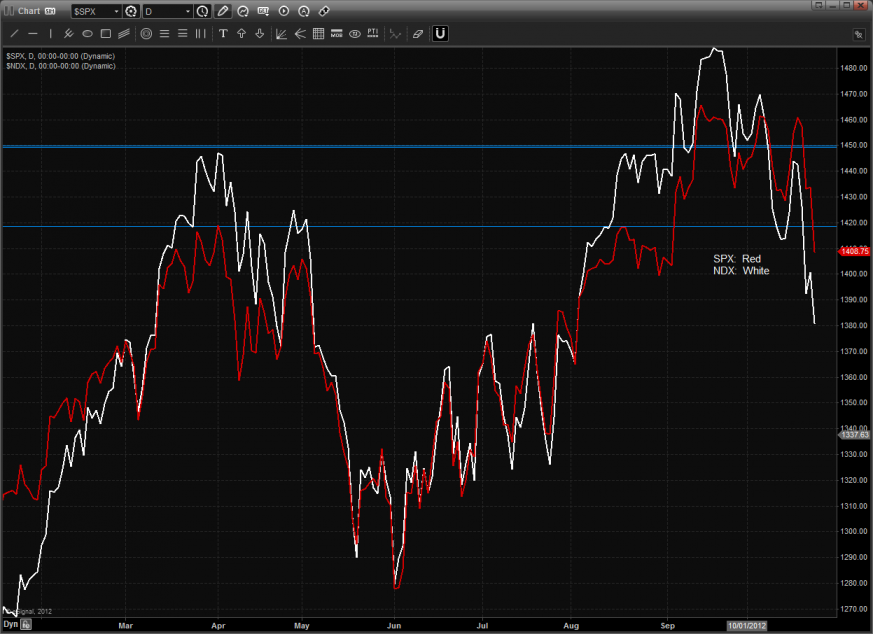

The NDX vs. SPX shows the troublesome relative weakness in the NDX. There is some separation in the chart and traders should be prepared for a window where the SPX has some relative weakness while the Naz side uses the 200dma for support. This won’t change anything but after this window closes then the relative behavior again becomes front and center.

Copper, affectionately known as the PhD of commodities, has broken decisively below all major moving averages. In the chart of the copper tracking JJC etf, there is now no noticeable support until the Seeker static trend line at 43.75. Careful examination of the chart patter will show a multi month island in place.

The HGX housing index was the top gun on the day. The pattern has had a very nice run and is only one strong day away from a Seeker 13 exhaustion signal.

The BKX was lower on the day but outperformed the NDX. Price has yet to violate the Sep low and the 50dma—this is the key area.

The BTK is breaking with the 200dma in sight. Note that the MACD is in a very bearish position with downside momentum gathering.

The SOX index has bearishly made a new low on the move asd is now to the last real area of support before the prior lows.

The OSX was weaker than the broad market and is back down to key support.

The XAU was the last laggard and has settled below the low of the recent trading range. Keep a close eye on the key 175, 4/8 level for the next area of support.

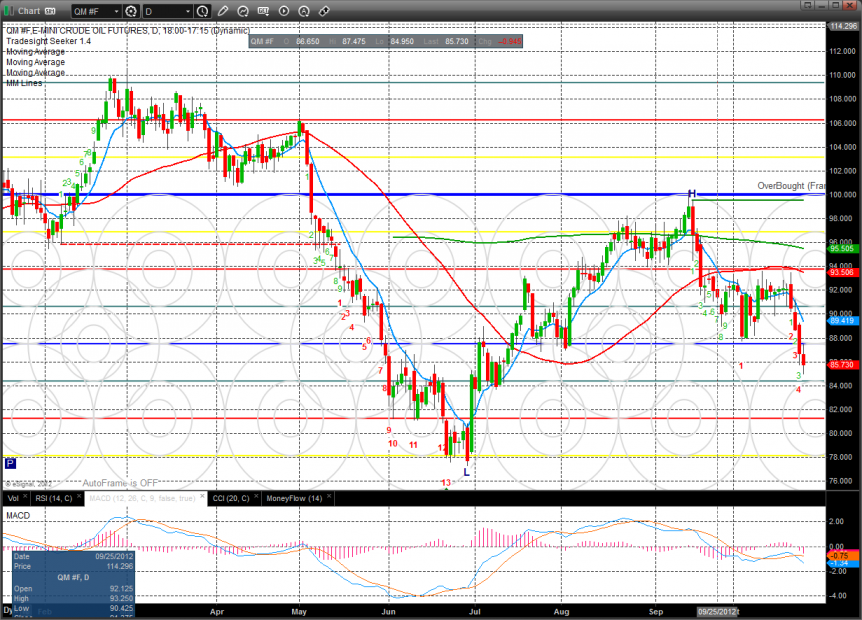

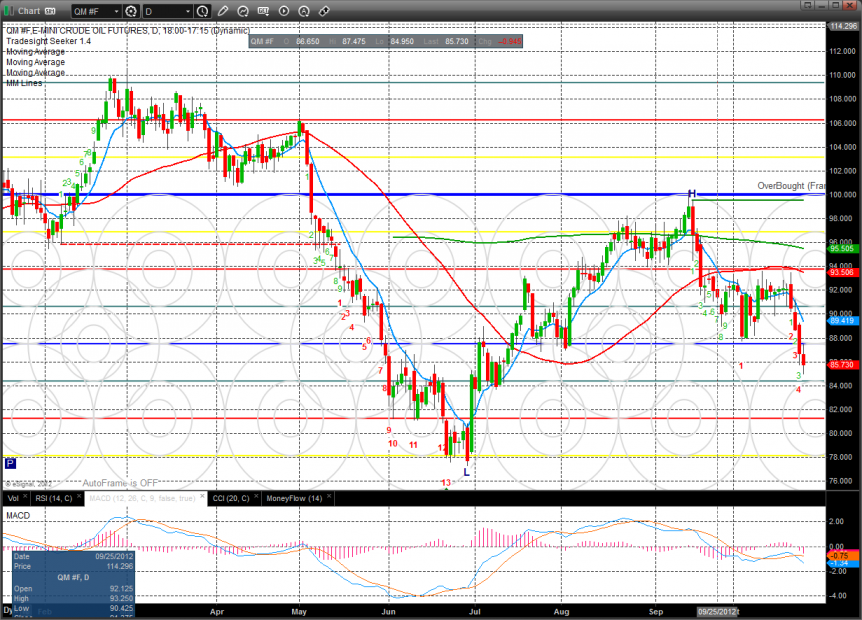

Oil:

Gold:

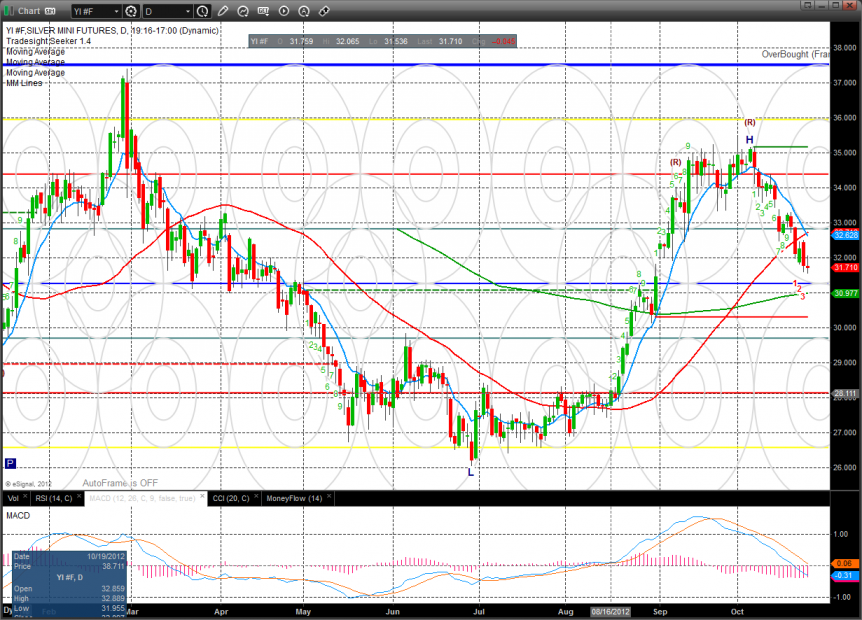

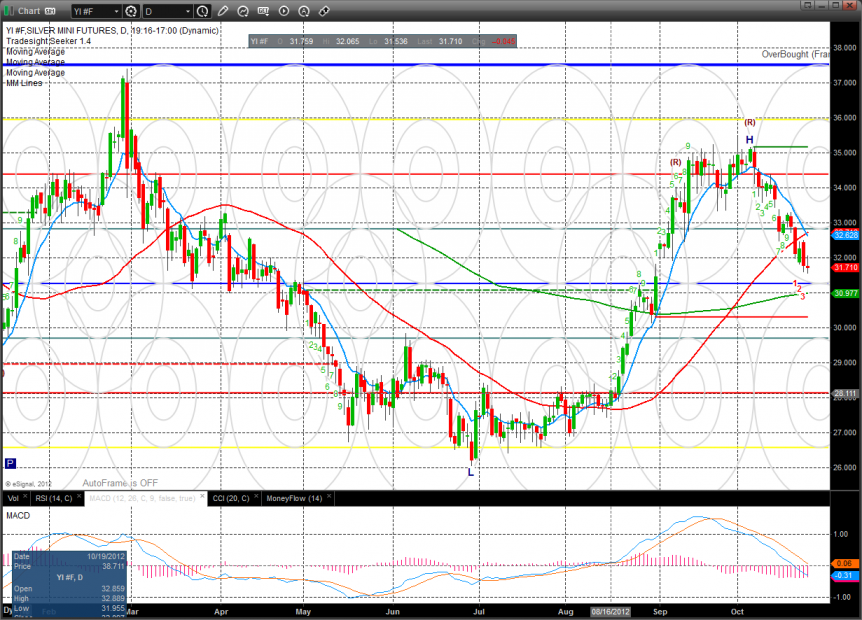

Silver:

Tradesight Market Preview for 10/25/12

The ES logged a pretty flat day but expanded the downside range and made a second close below the static trend line which will now break it. Key support remains at 1406.

The NQ futures were lower by 10 on the day settling right at the key 200dma. Keep in mind that the 200dma tends to get gamed when first tested so be prepared.

The 10-day Trin is still carrying oversold energy.

Multi sector daily chart:

The NDX vs. SPX shows the troublesome relative weakness in the NDX. There is some separation in the chart and traders should be prepared for a window where the SPX has some relative weakness while the Naz side uses the 200dma for support. This won’t change anything but after this window closes then the relative behavior again becomes front and center.

Copper, affectionately known as the PhD of commodities, has broken decisively below all major moving averages. In the chart of the copper tracking JJC etf, there is now no noticeable support until the Seeker static trend line at 43.75. Careful examination of the chart patter will show a multi month island in place.

The HGX housing index was the top gun on the day. The pattern has had a very nice run and is only one strong day away from a Seeker 13 exhaustion signal.

The BKX was lower on the day but outperformed the NDX. Price has yet to violate the Sep low and the 50dma—this is the key area.

The BTK is breaking with the 200dma in sight. Note that the MACD is in a very bearish position with downside momentum gathering.

The SOX index has bearishly made a new low on the move asd is now to the last real area of support before the prior lows.

The OSX was weaker than the broad market and is back down to key support.

The XAU was the last laggard and has settled below the low of the recent trading range. Keep a close eye on the key 175, 4/8 level for the next area of support.

Oil:

Gold:

Silver:

Stock Picks Recap for 10/24/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, RVBD triggered long (without market support due to opening 5 minutes) and didn't really work:

CREE triggered long (without market support due to opening 5 minutes) and worked:

NTAP triggered short (with market support) and didn't work:

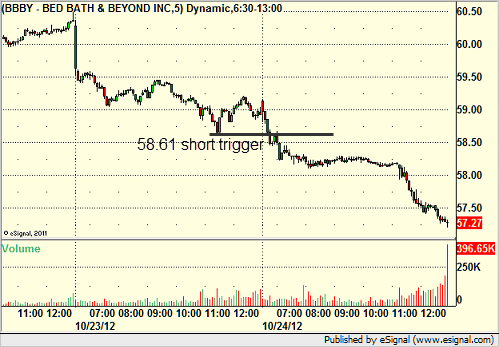

BBBY triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's GILD triggered short (without market support due to opening 5 minutes) and didn't work:

His FB triggered short (without market support due to opening 5 minutes) and didn't work:

SINA triggered short (with market support) and didn't work, worked later:

Rich's SLB triggered short (with market support) and worked:

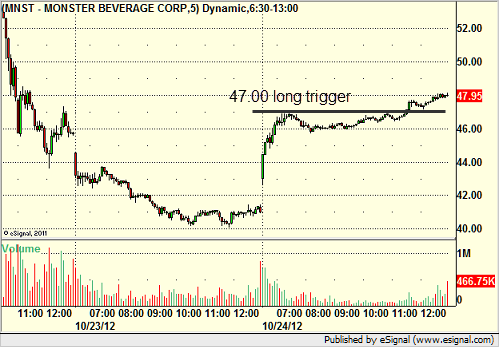

His MNST triggered long (with market support, which was green only for a 10 minute window) and worked:

His NFX triggered short (with market support) and worked:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

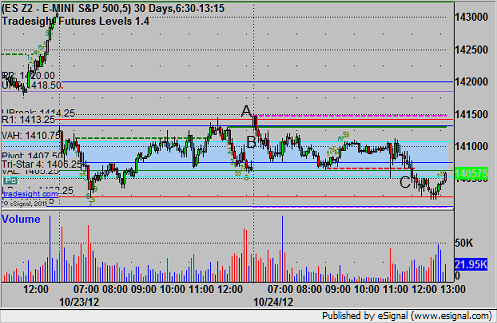

Futures Calls Recap for 10/24/12

Two losers early after two nice setups, and a winner after the Fed announcement later in the session. All of it on the ES, see that section below.

Net ticks: -10 ticks.

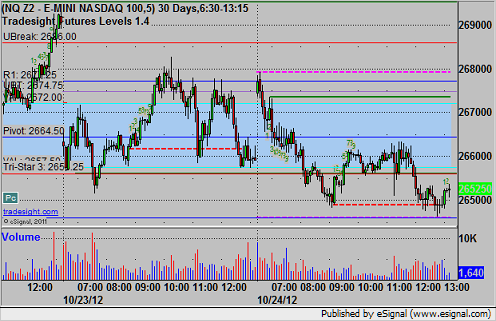

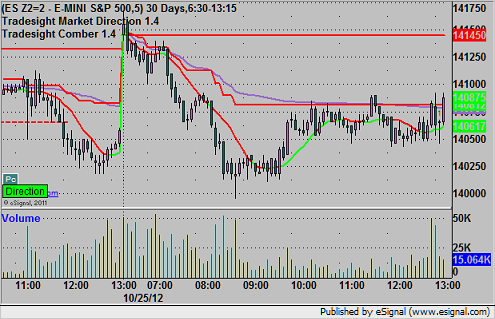

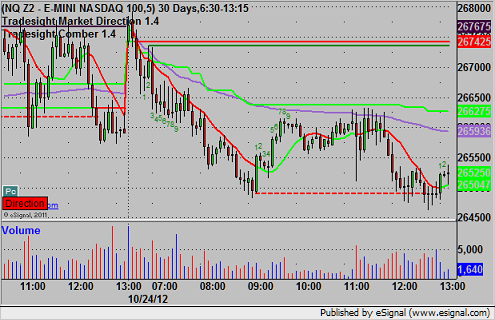

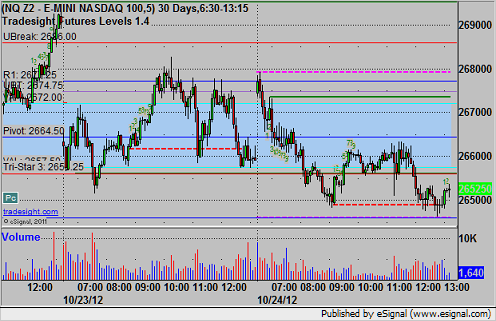

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

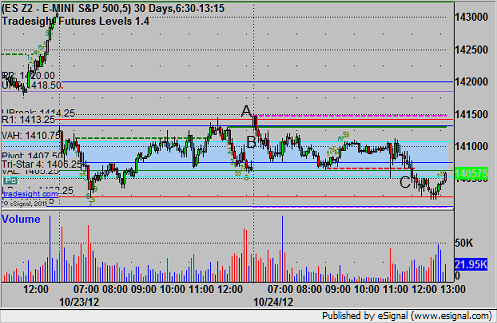

ES:

Triggered long at A at 1414.50 and stopped for 7 ticks. That was an opening bar trade, which I usually don't do, but it was a nice breakout over yesterday's action. Triggered short at B after setting the Value Area High at 1410.25, which also stopped for 7 ticks. I didn't re-enter because it spent 10 minutes in the Value Area, but the re-trigger would have worked. Also triggered short at C at 1404.75 after the Fed, hit first target for six ticks, and closed the final at 1404.25 as it got late in the session:

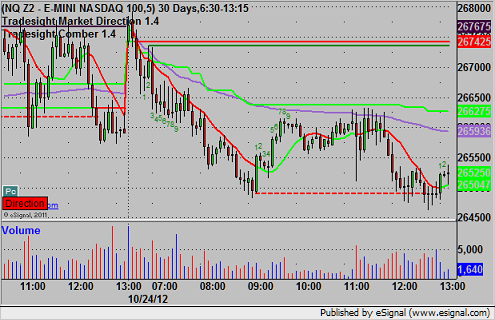

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Futures Calls Recap for 10/24/12

Two losers early after two nice setups, and a winner after the Fed announcement later in the session. All of it on the ES, see that section below.

Net ticks: -10 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1414.50 and stopped for 7 ticks. That was an opening bar trade, which I usually don't do, but it was a nice breakout over yesterday's action. Triggered short at B after setting the Value Area High at 1410.25, which also stopped for 7 ticks. I didn't re-enter because it spent 10 minutes in the Value Area, but the re-trigger would have worked. Also triggered short at C at 1404.75 after the Fed, hit first target for six ticks, and closed the final at 1404.25 as it got late in the session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.