Forex Calls Recap for 10/24/12

Closed out the second half of the GBPUSD short from the prior session in the money in the afternoon yesterday. One new trigger on the EURUSD triggered short and stopped, see that section below. Boring session as expected, even after the Fed.

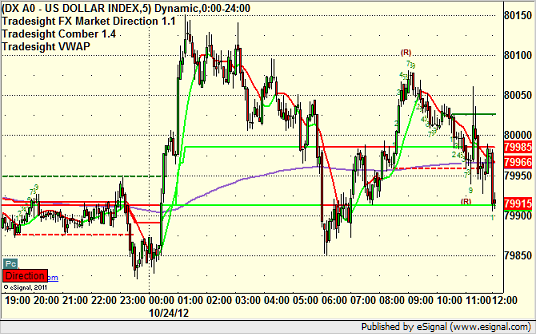

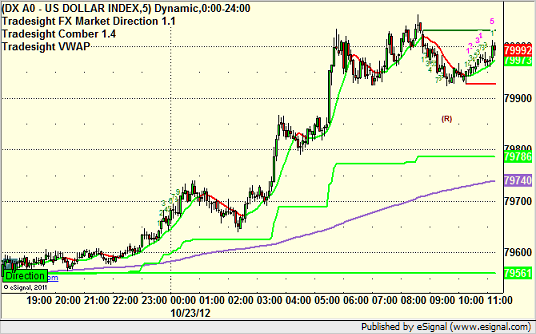

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

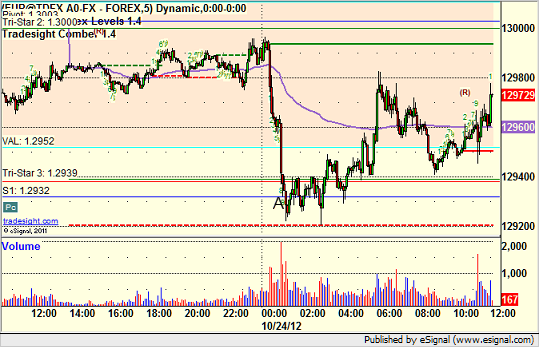

EURUSD:

Triggered short at A and stopped:

Tradesight Market Overview for 10/24/12

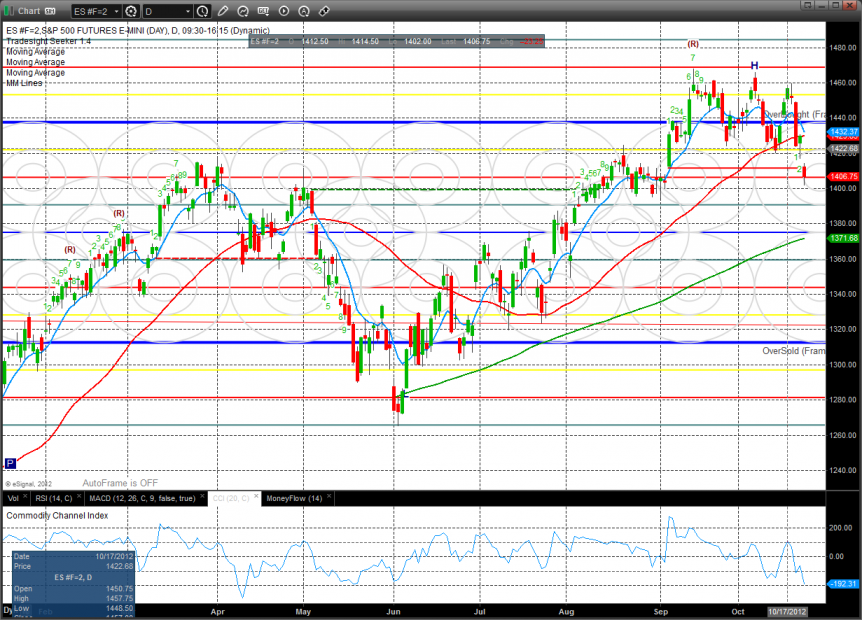

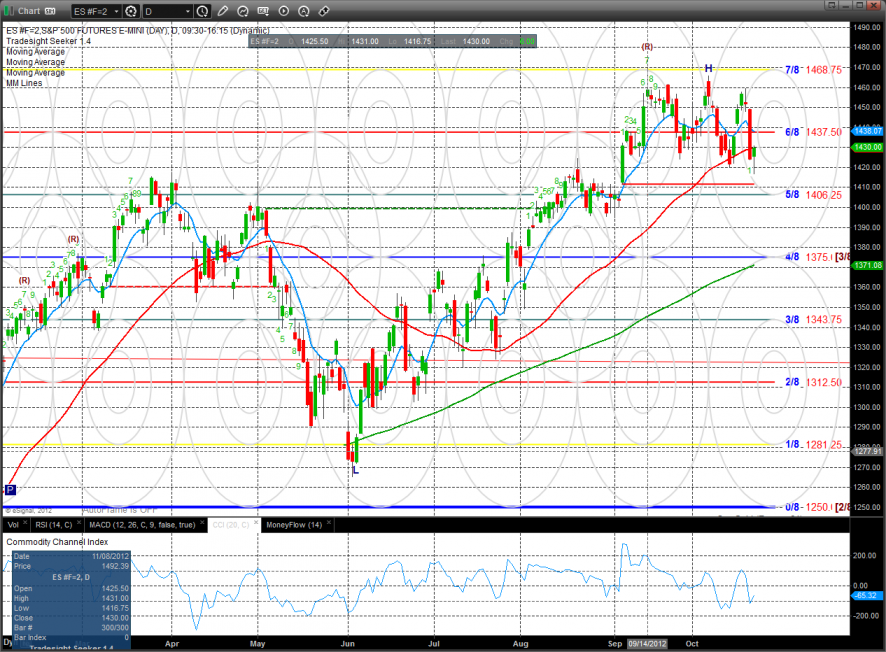

As we talked about yesterday, the small bounce in the ES was relatively meaningless because it did not penetrate the upper half of Friday’s steep decline today’s price action was more notable. Two key things happened because the static trend line was undercut and 9/5/12 breakaway gap was filled. The technical damage already seen in the NDX side of the market is now present in the SPX side.

The NQ was much more contained than the SP side because of the 3 key levels that are converging. The 4/8 Murrey math level, the active static trend line and the 200dma provided support to arrest the slide in the NQ. Although the NQ lost 27 on the day it greatly outperformed the SP side and the Naz should find support enough to either consolidate or put in a short-term reversal here.

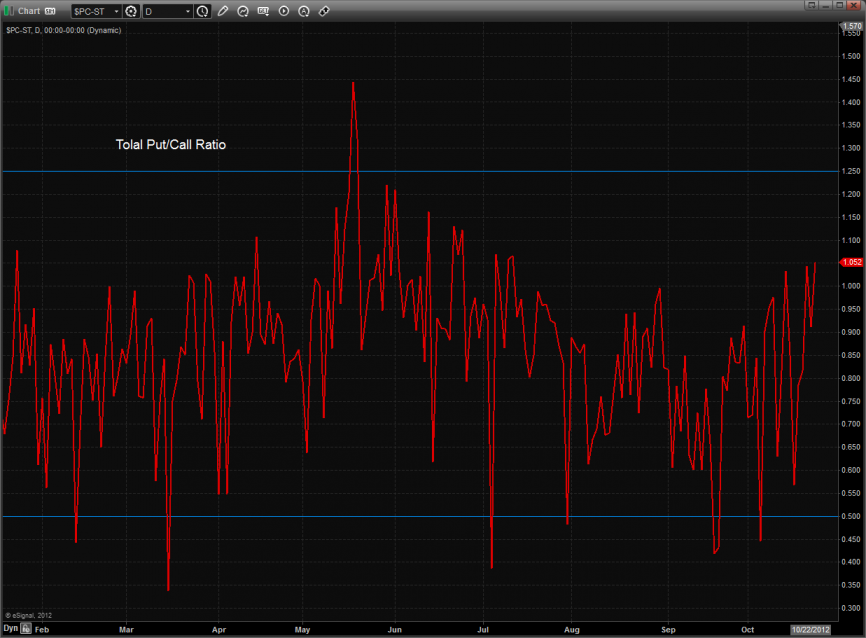

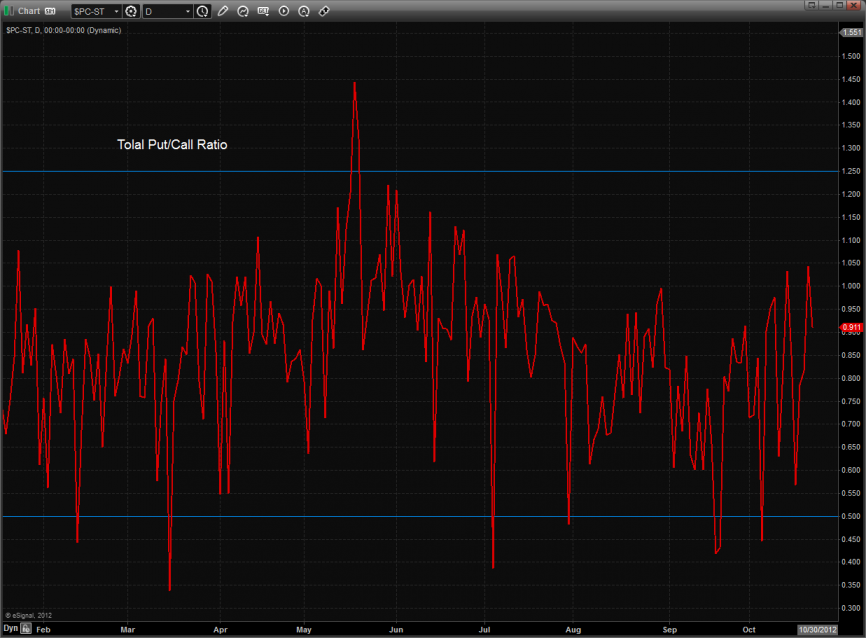

The total put/call ratio has put in a multi month high but didn’t yet record a climatic readaing.

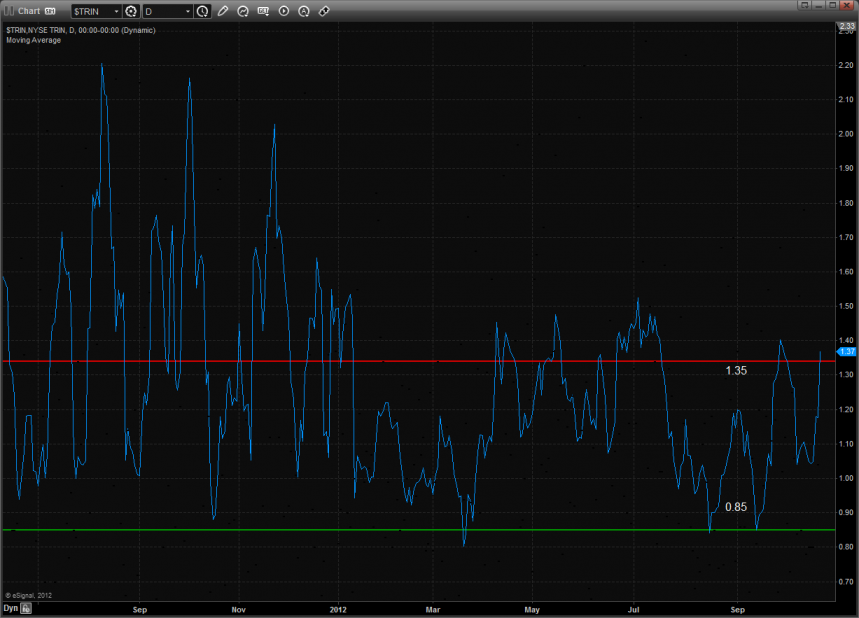

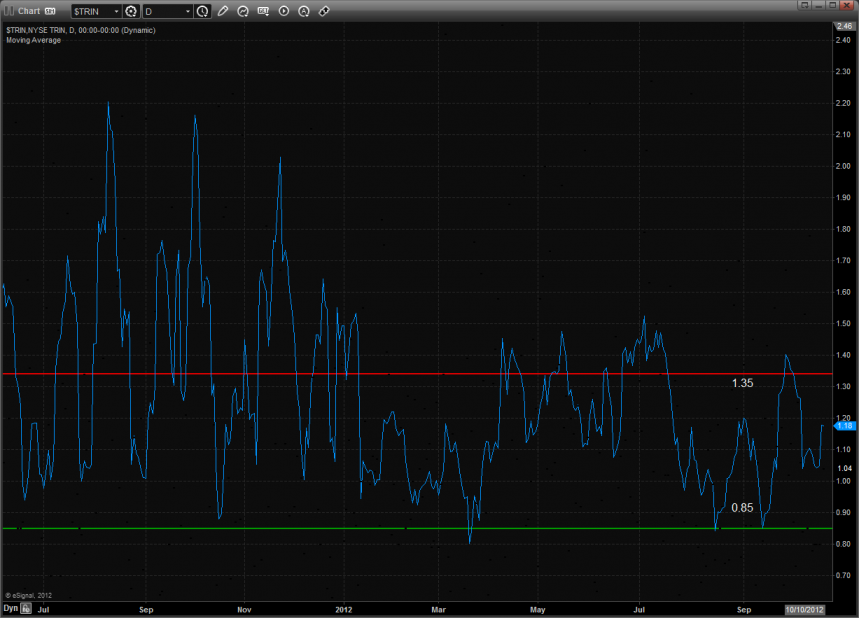

The 10-day Trin is oversold and has upside reversal energy for the overall market.

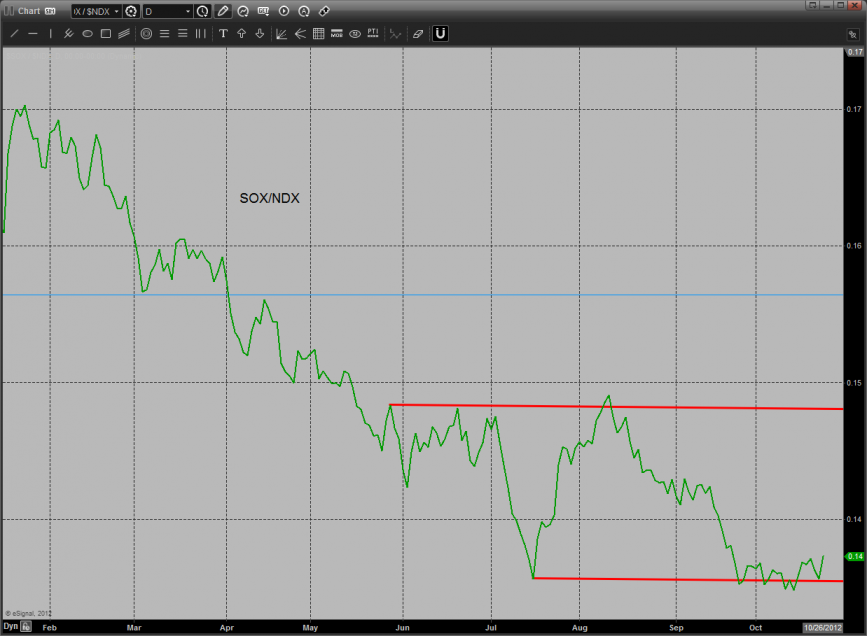

The NDX cross bounced off of a very oversold reading but needs to reclaim the trend channel before there is a new technical development.

The SOX/NDX cross is still hanging onto the prior low and has yet to decisively break. This might be the one bright point for the bulls in the NDX.

The SPX/TLT cross has not recorded a new low which indicates that so far there has been no detectable flight to safety in favor of US treasuries over equities.

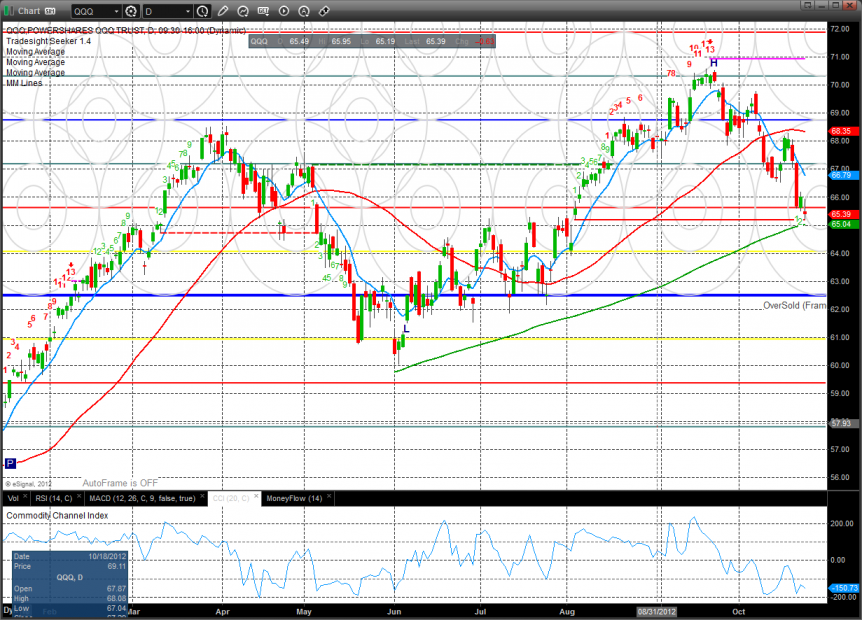

The QQQ’s have declined to the key support area of the static trend line and 200dma. This is a make-or-break area where a loss and a qualified follow through will put a Seeker 9 bar buy setup in motion.

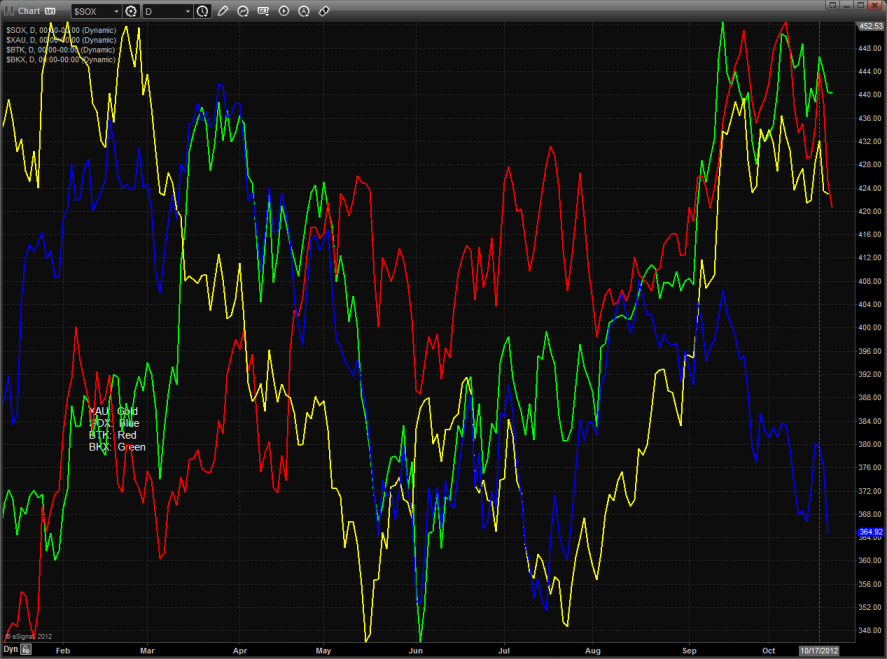

The SOX was the top gun and the only important sector up on the day. Note that in June the 2/8 level was a key area that reversed the trend.

The BKX broke but found support at the 50dma and September low—49 is key support.

The OSX was boxed up and still drawn by the major moving averages.

The BTK was much weaker than the NAZ and has experienced rapid profit taking. Look for key support at the 2/8 Murrey math level where the 200dma comes into play.

The XAU was the last laggard on the day and has key support at the 181 area. Note that the Seeker is 11 days up in the sell countdown.

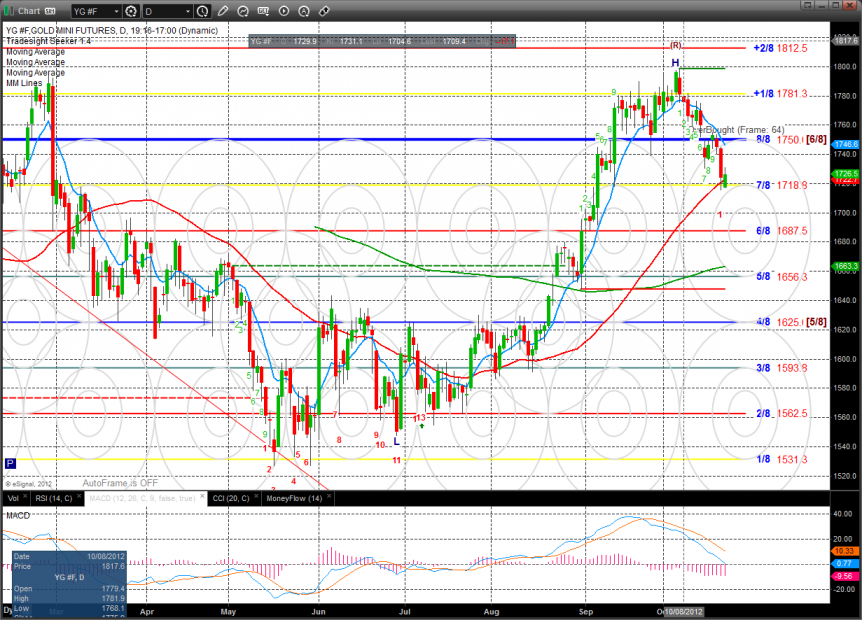

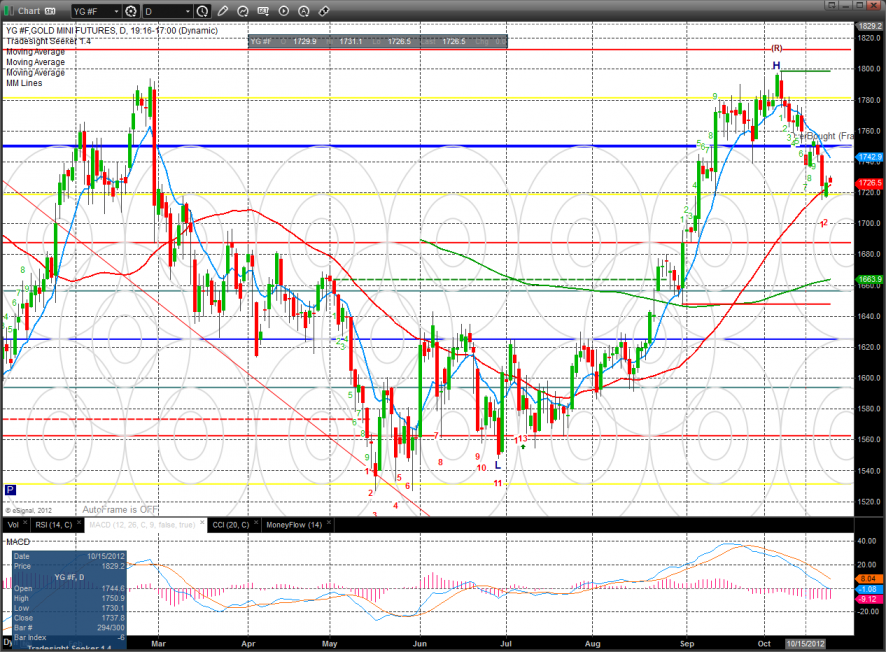

Gold:

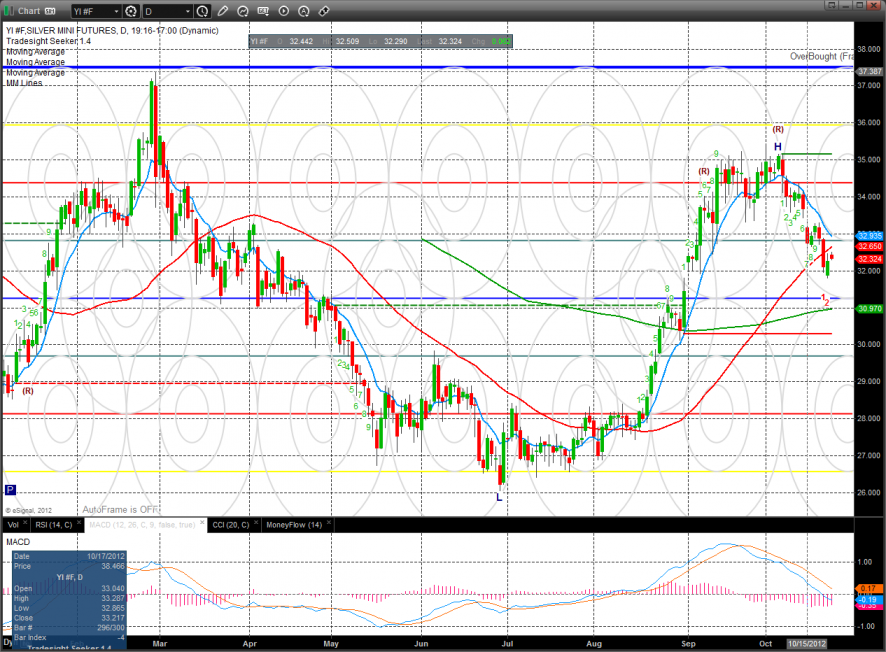

Silver:

Oil:

Stock Picks Recap for 10/23/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, IMGN gapped to the trigger, no play.

URBN triggered short (without market support due to opening 5 minutes) and worked:

PETM gapped past the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered long (with market support) and worked enough for a partial although it was quick:

His GDX triggered short (ETF, so no market support needed) and didn't work:

His NFLX triggered long (without market support due to opening 5 minutes) and didn't work:

His MNST triggered short (without market support due to opening 5 minutes) and worked:

His APKT triggered short (with market support) and worked enough for a partial:

His IBM triggered short (with market support) and didn't work (worked later):

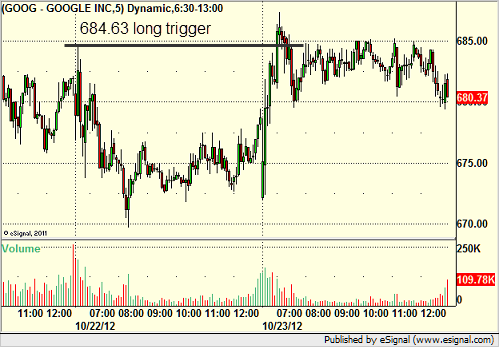

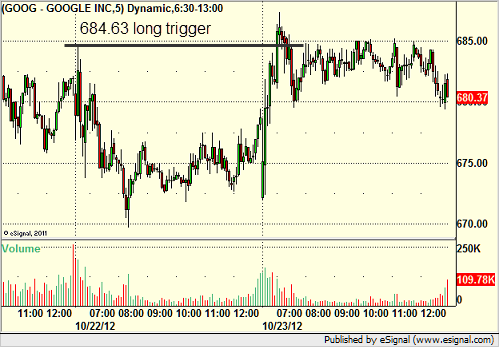

GOOG triggered long (with market support) and worked:

Rich's SINA triggered long (with market support) and didn't work:

His SLB triggered short (with market support) and worked:

Rich's AAPL triggered short in the afternoon (with market support) and worked:

His OIH triggered long (ETF so no market support needed) and didn't go enough in either direction to count.

In total, that's 8 trades triggering with market support, 5 of them worked, 3 did not, but it was a choppy day.

Stock Picks Recap for 10/23/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, IMGN gapped to the trigger, no play.

URBN triggered short (without market support due to opening 5 minutes) and worked:

PETM gapped past the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered long (with market support) and worked enough for a partial although it was quick:

His GDX triggered short (ETF, so no market support needed) and didn't work:

His NFLX triggered long (without market support due to opening 5 minutes) and didn't work:

His MNST triggered short (without market support due to opening 5 minutes) and worked:

His APKT triggered short (with market support) and worked enough for a partial:

His IBM triggered short (with market support) and didn't work (worked later):

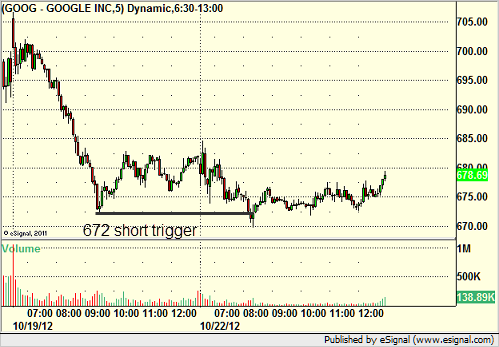

GOOG triggered long (with market support) and worked:

Rich's SINA triggered long (with market support) and didn't work:

His SLB triggered short (with market support) and worked:

Rich's AAPL triggered short in the afternoon (with market support) and worked:

His OIH triggered long (ETF so no market support needed) and didn't go enough in either direction to count.

In total, that's 8 trades triggering with market support, 5 of them worked, 3 did not, but it was a choppy day.

Futures Calls Recap for 10/23/12

Three losers and a winner on a choppy session that was flatter on the ES than the NQ due to the AAPL news. Volume was 1.75 billion NASDAQ share.

Net ticks: -15 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

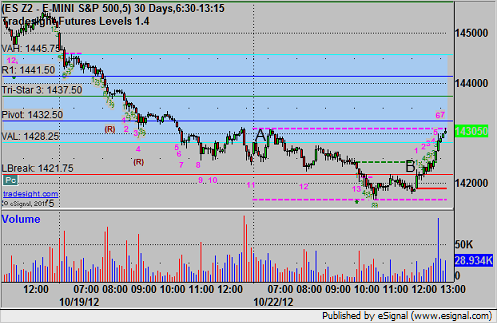

ES:

A nice afternoon setup triggered long at A at 1413.50 and stopped for 7 ticks. I put it in again as it set up a bull flag and it stopped again:

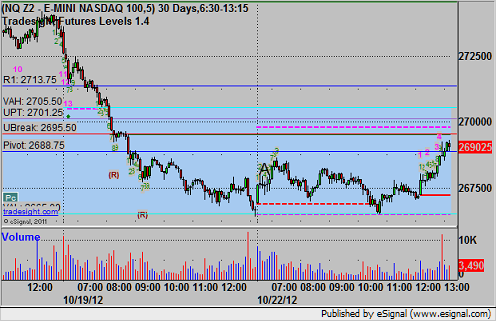

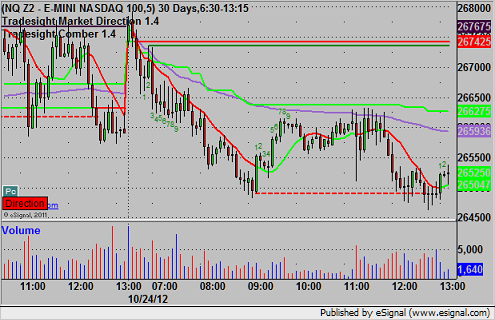

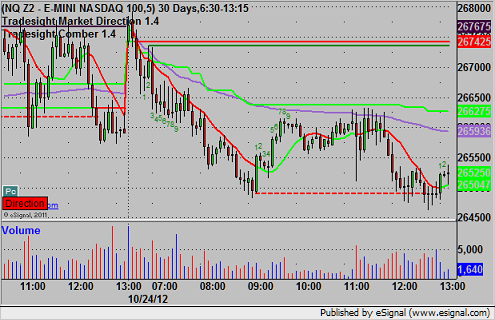

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered short at A at 2654.00 and stopped. His long triggered at B at 2672.50, hit first target for 6 ticks, and should have stopped at the same price level. Note that it exactly moved across the Value Area to C:

Futures Calls Recap for 10/23/12

Three losers and a winner on a choppy session that was flatter on the ES than the NQ due to the AAPL news. Volume was 1.75 billion NASDAQ share.

Net ticks: -15 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

A nice afternoon setup triggered long at A at 1413.50 and stopped for 7 ticks. I put it in again as it set up a bull flag and it stopped again:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered short at A at 2654.00 and stopped. His long triggered at B at 2672.50, hit first target for 6 ticks, and should have stopped at the same price level. Note that it exactly moved across the Value Area to C:

Forex Calls Recap for 10/23/12

A loser and a winner (still going) on the GBPUSD. See that section below. Better ranges too, but we have a Fed announcement tomorrow.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

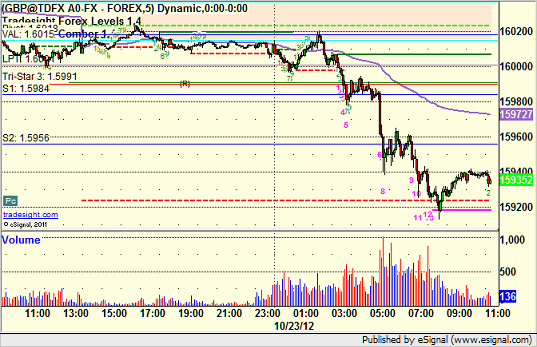

GBPUSD:

Triggered long very early at A and stopped. Triggered short at B, hit first target at C at S2, still holding the second half with a stop over S2:

Tradesight Market Preview for 10/23/12

The ES was higher by 6 on the day after a strong afternoon rally. While the end of the day may have “felt good” to the bulls, it is still below the midpoint of Friday’s break which remains a technical negative and keeps the bears in charge. 1435 is key overhead and the active static trend line is near-term support.

The NQ futures were twice as strong as the ES but still leave the bears in charge. The combination of the static trend line and 4/8 level are near-term support and the 2706 is the key resistance level. The MACD is negative but in no way oversold.

The total put/call ratio remains neutral:

The 10-day Trin is also neutral being neither overbought nor oversold.

Multi sector daily chart:

The NDX has broken decisively below the support line indicating weakness in the Naz stocks which will likely be an anchor on the overall broad market.

The HWI hardware index posted an inside day and could be trying for a double bottom.

The defensive XAU put in a strong showing and could be building a handle below the 8/8 level.

The SOX was about flat on the day but remains below all of the key moving averages.

The BKX is winding up in a triangle and poised to breakout because it’s getting closer to the apex of the pattern.

The OSX was weaker than the broad market and has key overhead at the static trendline.

The BTK was the last laggard on the day and is in a confirmed short-term down trend. Note that the MACD has crossed below the zero line.

Oil followed through the 50dma:

Gold:

Silver:

Stock Picks Recap for 10/22/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, COST triggered short (without market support due to opening 5 minutes) and didn't work:

FWLT triggered short (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's GS triggered long (with market support) and didn't work:

His FCX triggered long (with market support) and worked enough for a partial:

His BTU triggered long (without market support) and worked enough for a partial:

His JPM triggered short (with market support) and worked:

His CMG triggered short (with market support) and worked:

His APC triggered short (with market support) and worked:

His AMZN triggered short (without market support) and worked:

GOOG triggered short (with market support) and worked enough for a couple of points:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

Futures Calls Recap for 10/22/12

Three trades, three winners, although none of them did much for follow through. See ES and NQ sections below.

Net ticks: +9 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's long triggered at A at 1429.00, hit first target for six ticks, stopped second half under the entry. My afternoon call was made long after the ES based against the LBreak and entered at B at 1422.00, hit first target for 6 ticks, and I tightened up the stop and locked in the final piece at 1422.50 because it was getting late:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My morning call triggered long at A at 2680.50, hit first target for 6 ticks, and stopped the second piece under the entry: