Forex Calls Recap for 10/22/12

Another non-event session. See the EURUSD section below for the trade recaps. However, note the EURJPY and GBPJPY Value Area moves below that I pointed out in the early calls Sunday.

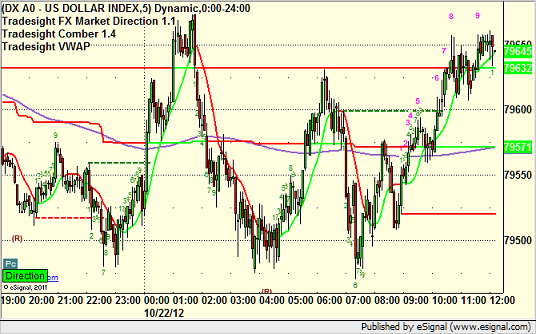

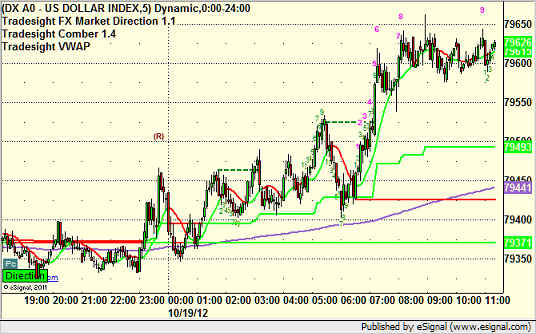

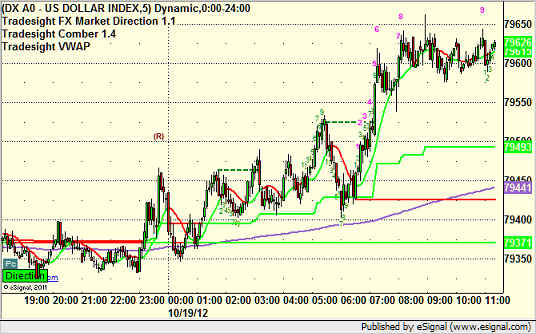

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

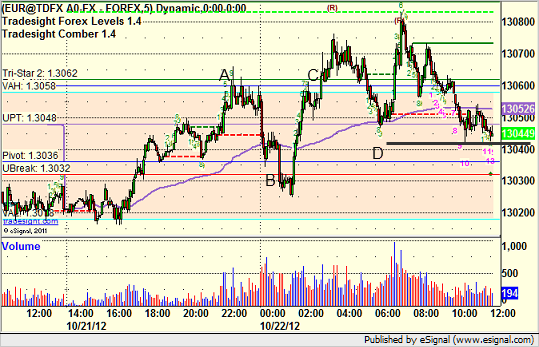

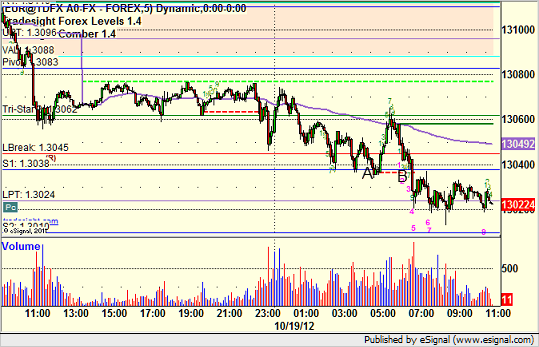

EURUSD:

Triggered long at A and stopped. Triggered short at B and stopped. Triggered long in the morning at C. This would have stopped under the black line D and never did, but I closed it for end of session:

Stock Picks Recap for 10/19/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CERN triggered short (with market support) and worked:

FLIR triggered short (with market support) and held in the money the whole session but never even went a dime:

PMTC triggered short (without market support due to opening five minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered long (ETF, so no market support needed) and didn't work, although it worked great later:

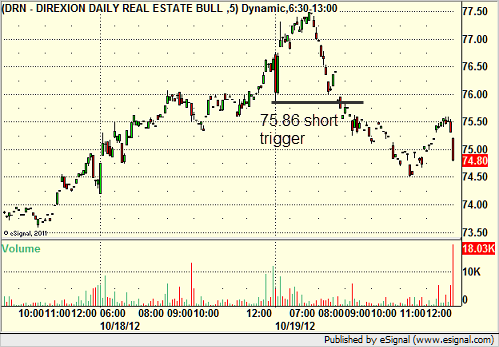

His DRN triggered short (ETF, so no market support needed) and worked:

His LULU triggered short (with market support) and worked:

COST triggered short (with market support) and worked:

Rich's ADSK triggered short (with market support) and worked:

His COF triggered long (without market support) and worked:

His GOOG triggered short (with market support) and worked:

His AAPL triggered short (with market support) and worked:

In total, that's 8 trades triggering with market support, 7 of them worked, 1 did not.

Stock Picks Recap for 10/19/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CERN triggered short (with market support) and worked:

FLIR triggered short (with market support) and held in the money the whole session but never even went a dime:

PMTC triggered short (without market support due to opening five minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered long (ETF, so no market support needed) and didn't work, although it worked great later:

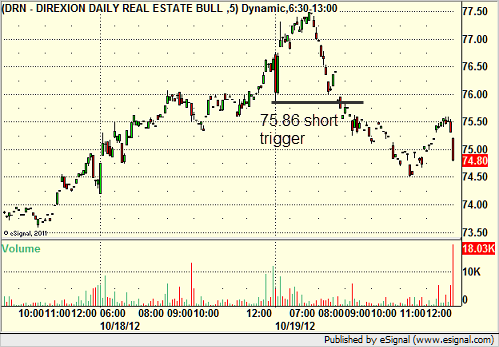

His DRN triggered short (ETF, so no market support needed) and worked:

His LULU triggered short (with market support) and worked:

COST triggered short (with market support) and worked:

Rich's ADSK triggered short (with market support) and worked:

His COF triggered long (without market support) and worked:

His GOOG triggered short (with market support) and worked:

His AAPL triggered short (with market support) and worked:

In total, that's 8 trades triggering with market support, 7 of them worked, 1 did not.

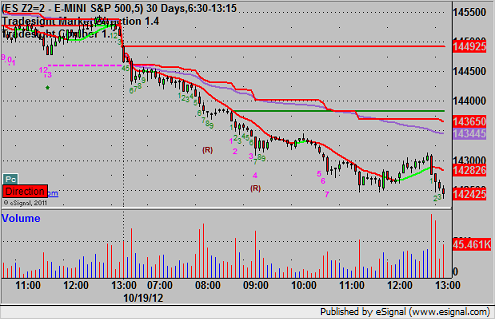

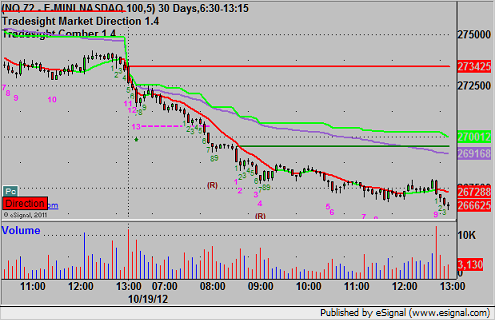

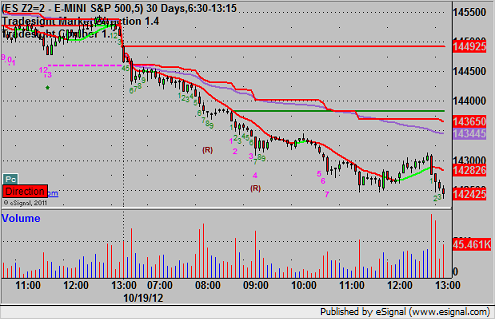

Futures Calls Recap for 10/19/12

Our typical policy is not to make futures calls on options expiration Fridays as there is typically no movement to be found and you just get stopped out. Today ended up being the exception for the year, though, and the market made a big move but we did not have any calls.

Net ticks: +0 ticks.

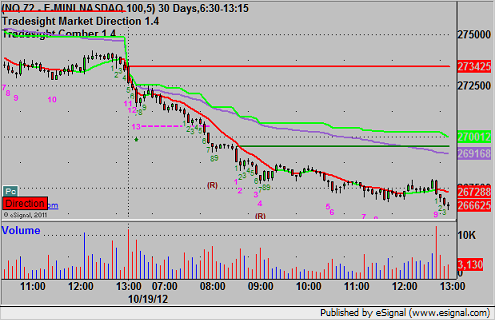

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Futures Calls Recap for 10/19/12

Our typical policy is not to make futures calls on options expiration Fridays as there is typically no movement to be found and you just get stopped out. Today ended up being the exception for the year, though, and the market made a big move but we did not have any calls.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Forex Calls Recap for 10/19/12

As usual on the Sunday report, we will take a look at the action from Thursday night/Friday, then look at the daily charts heading into the new week (nothing specific nearby on any of them), and then glance at the US Dollar Index (nothing to see there).

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

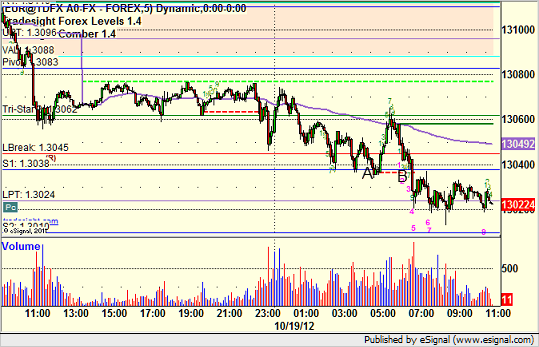

EURUSD:

Triggered short at A and stopped. Triggered short again at B and eventually closed in the money for end of week:

Forex Calls Recap for 10/19/12

As usual on the Sunday report, we will take a look at the action from Thursday night/Friday, then look at the daily charts heading into the new week (nothing specific nearby on any of them), and then glance at the US Dollar Index (nothing to see there).

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered short at A and stopped. Triggered short again at B and eventually closed in the money for end of week:

Stock Picks Recap for 10/18/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

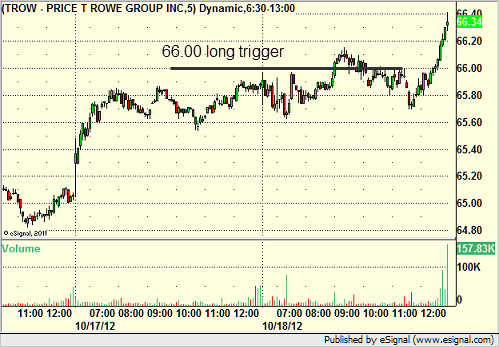

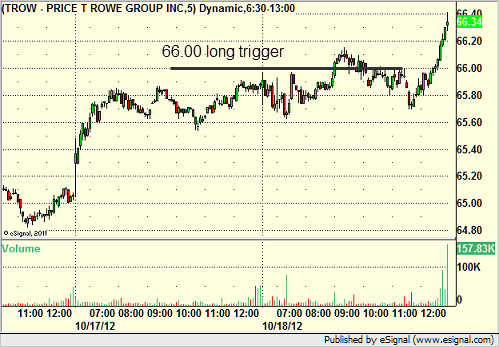

From the report, TROW triggered long (with market support) and didn't work:

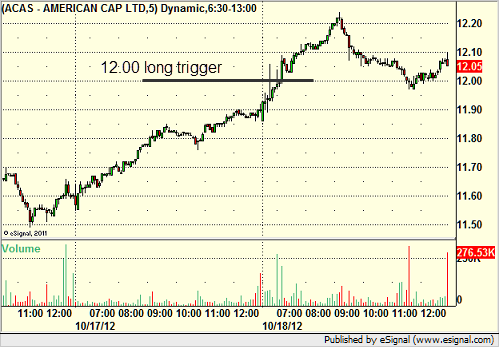

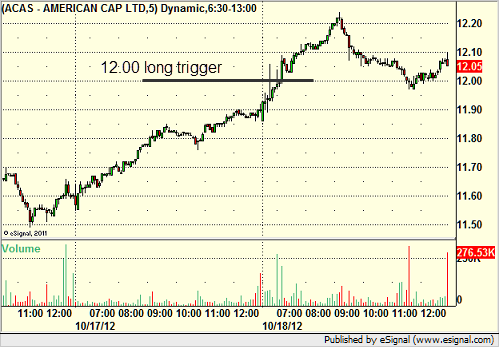

ACAS triggered long (with market support) and worked:

NDAQ triggered and didn't go enough to count either way.

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (with market support) and worked:

His GS triggered long (with market support) and worked great:

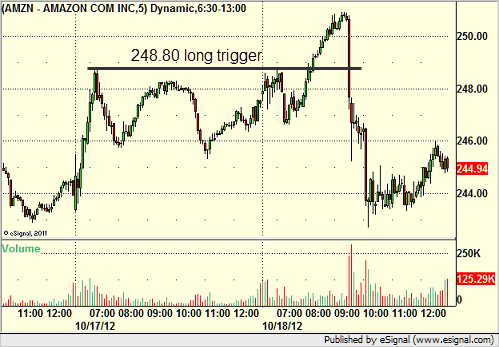

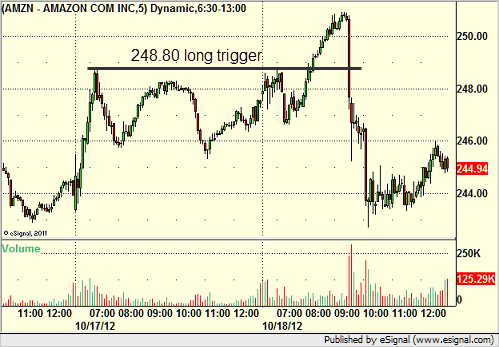

His AMZN triggered long (with market support) and worked great:

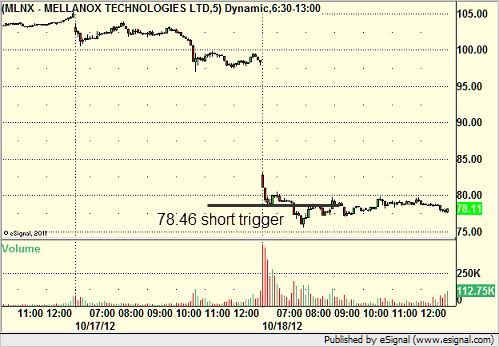

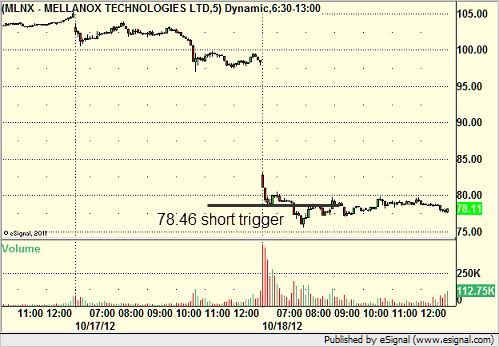

His MLNX triggered short (without market support) and worked:

His AMGN triggered long (with market support) and worked:

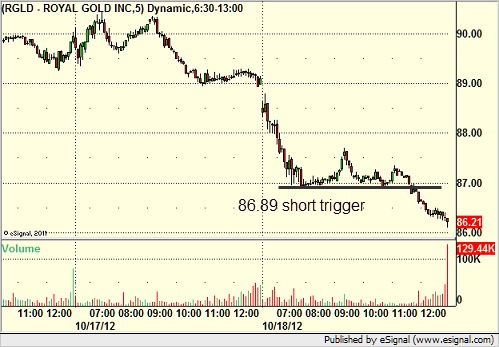

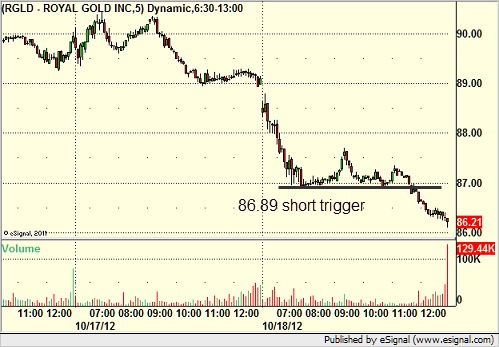

His RGLD triggered short (with market support) and worked great:

His afternoon AAPL triggered short (with market support) and worked enough for a partial:

In total, that's 8 trades triggering with market support, 7 of them worked, 1 did not.

Stock Picks Recap for 10/18/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TROW triggered long (with market support) and didn't work:

ACAS triggered long (with market support) and worked:

NDAQ triggered and didn't go enough to count either way.

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (with market support) and worked:

His GS triggered long (with market support) and worked great:

His AMZN triggered long (with market support) and worked great:

His MLNX triggered short (without market support) and worked:

His AMGN triggered long (with market support) and worked:

His RGLD triggered short (with market support) and worked great:

His afternoon AAPL triggered short (with market support) and worked enough for a partial:

In total, that's 8 trades triggering with market support, 7 of them worked, 1 did not.

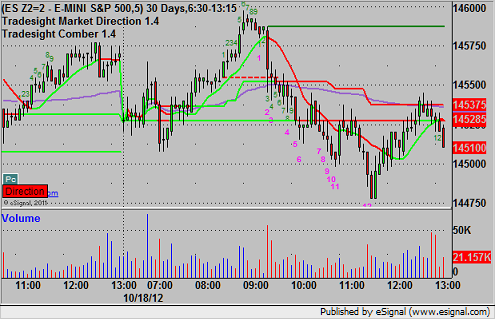

Futures Calls Recap for 10/18/12

One winner and two losers for the session as the GOOG accidental release of earnings messed up the trading day. See ES and NQ below.

Net ticks: -11.5 ticks.

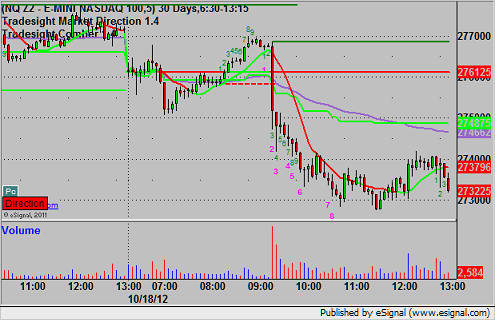

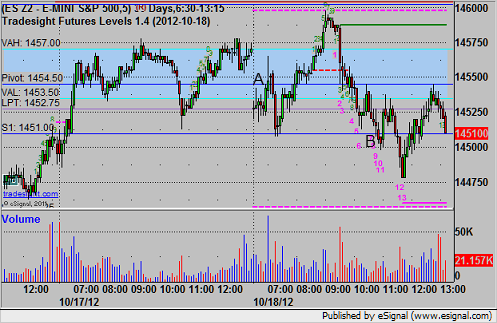

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

ES triggered long at A at 1454.75, hit first target for 6 ticks, and stopped second half under entry. Mark's short triggered at B at 1450.50 and stopped for 7 ticks:

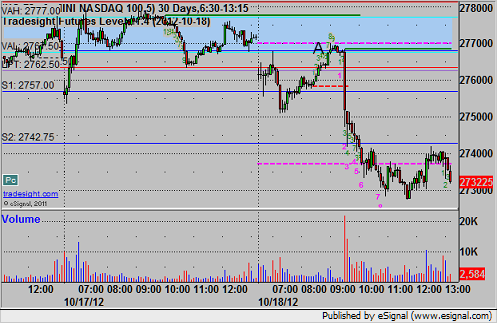

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Long triggered at A into Value Area at 2768.50 and stopped: