Futures Calls Recap for 10/18/12

One winner and two losers for the session as the GOOG accidental release of earnings messed up the trading day. See ES and NQ below.

Net ticks: -11.5 ticks.

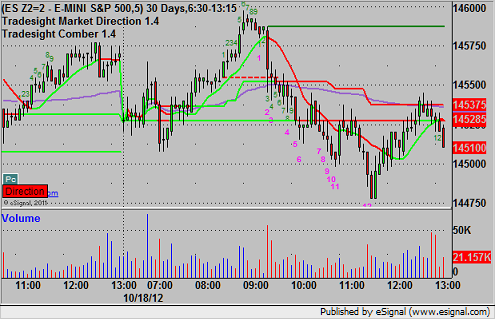

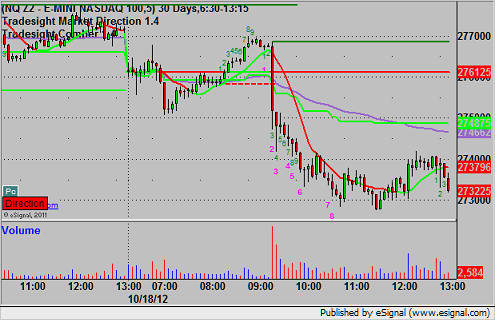

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

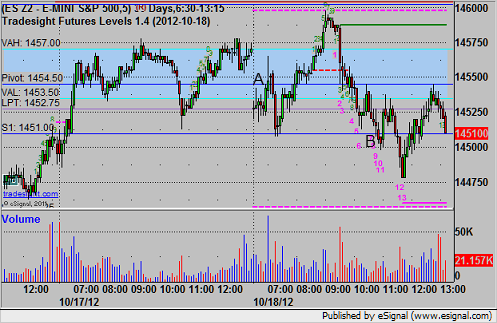

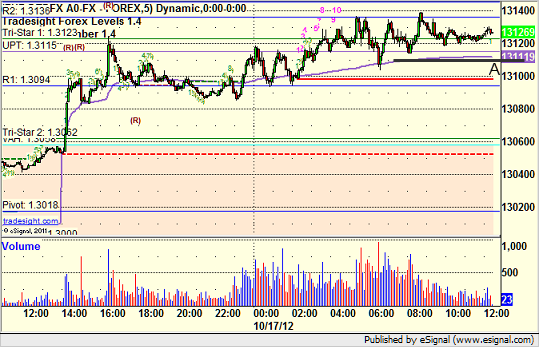

ES:

ES triggered long at A at 1454.75, hit first target for 6 ticks, and stopped second half under entry. Mark's short triggered at B at 1450.50 and stopped for 7 ticks:

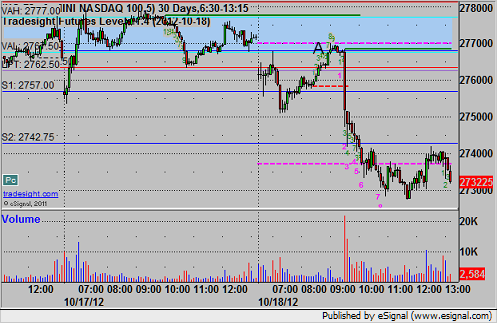

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Long triggered at A into Value Area at 2768.50 and stopped:

Forex Calls Recap for 10/18/12

Wow, 50 pips of range on the EURUSD. No new triggers, but we closed out our EURUSD long from two days ago finally over 100 pips in the money. See that section below.

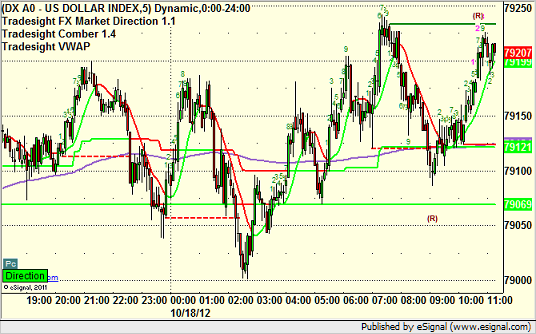

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

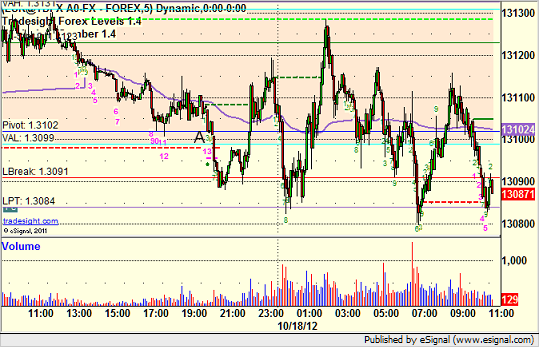

EURUSD:

Finally stopped out of the long trade from two nights ago at A for just over 100 pips:

Tradesight Market Preview for 10/18/12

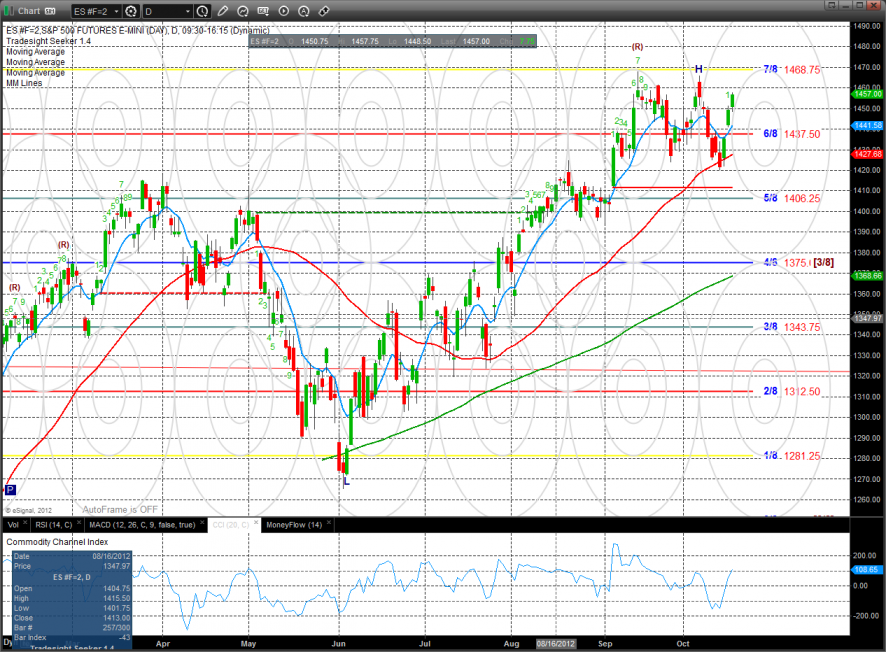

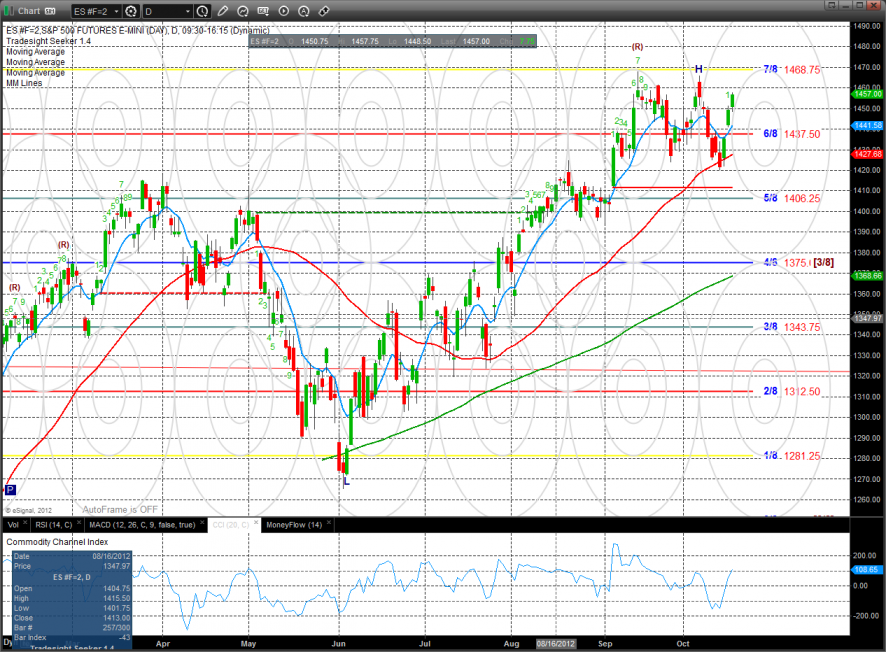

The ES was higher by 8 on the day and is just under the best close of the YTD. 1468 is the next key overhead if it can continue to build on the recent pivot off the 50dma.

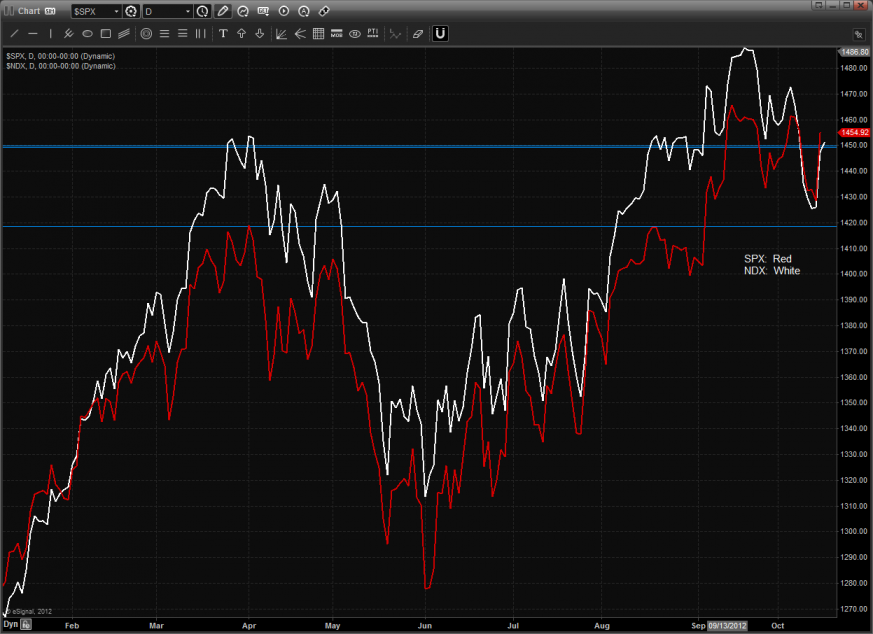

The NQ futures were higher on the day but only by 5 handles. The NQ’s remain relatively weak vs. the SP futures and are still below the recent breakdown level of 2775. Also note that price is still below the 50dma and the key 8/8 Murrey math level.

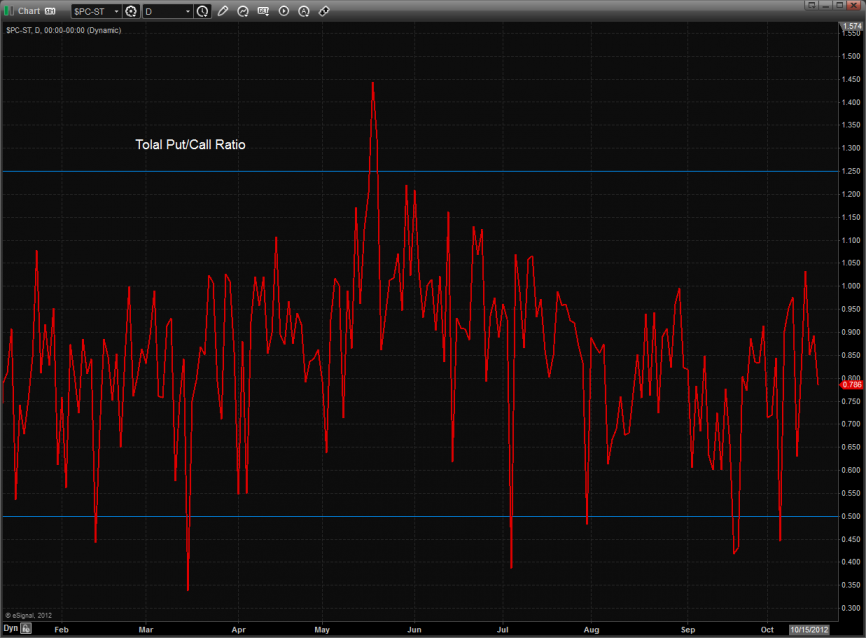

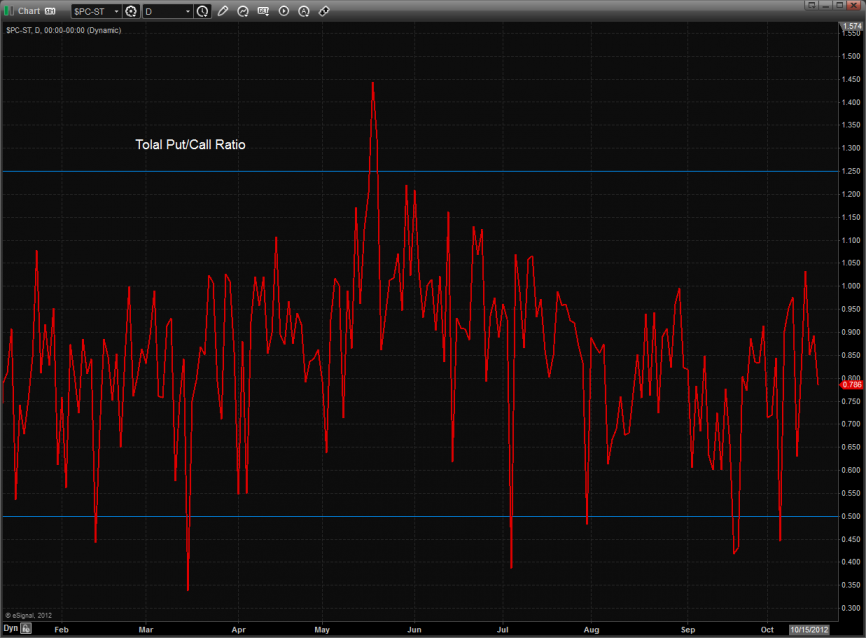

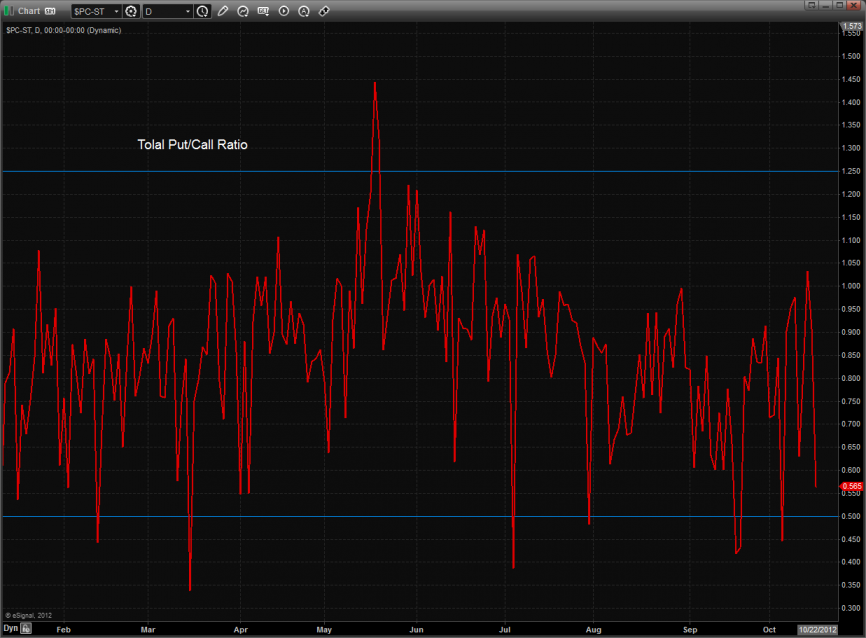

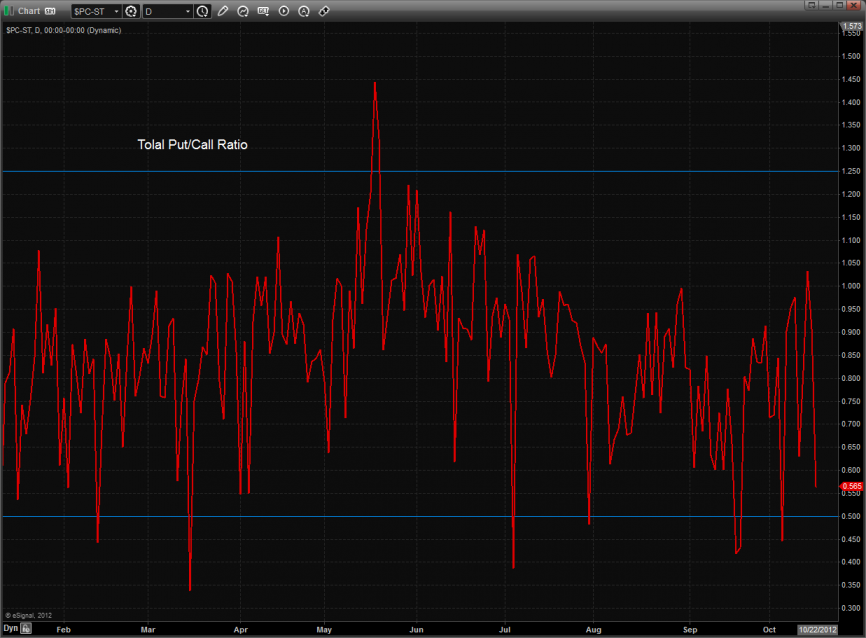

The total put/call ratio is neutral:

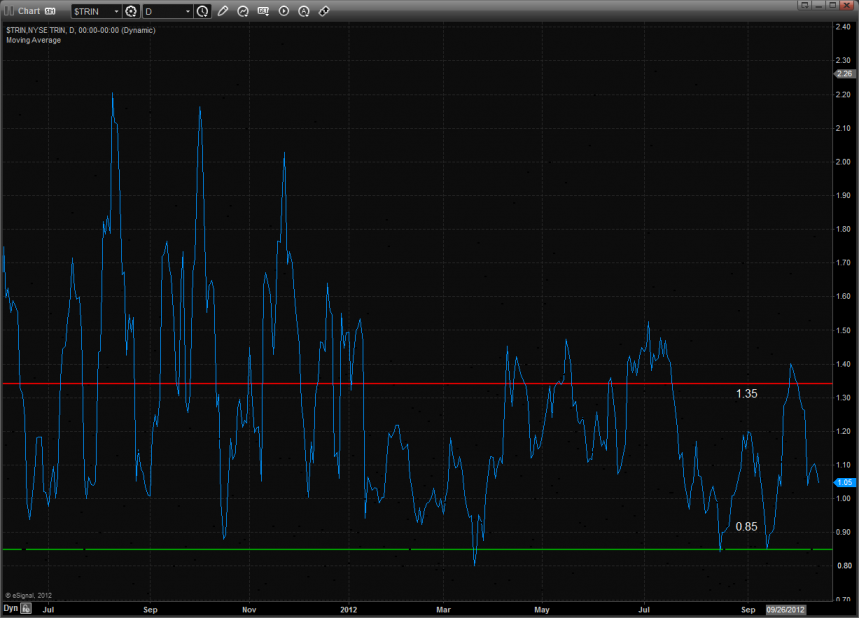

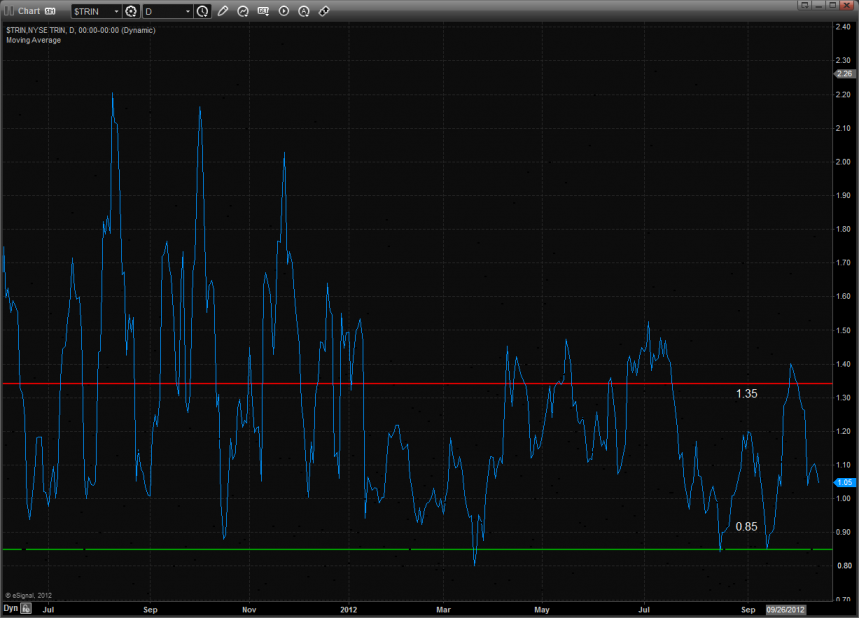

The 10-day Trin is still in the neutral area:

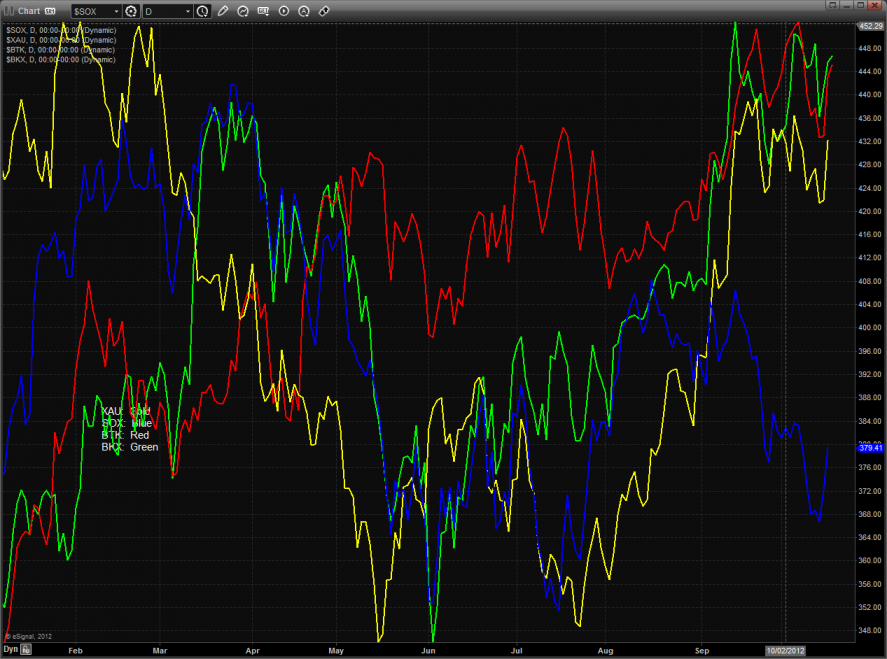

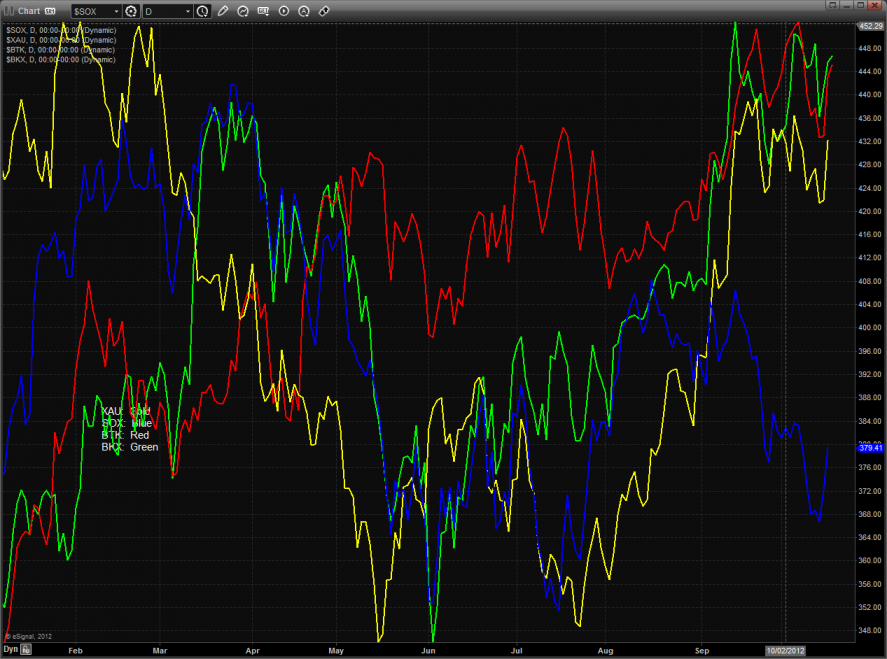

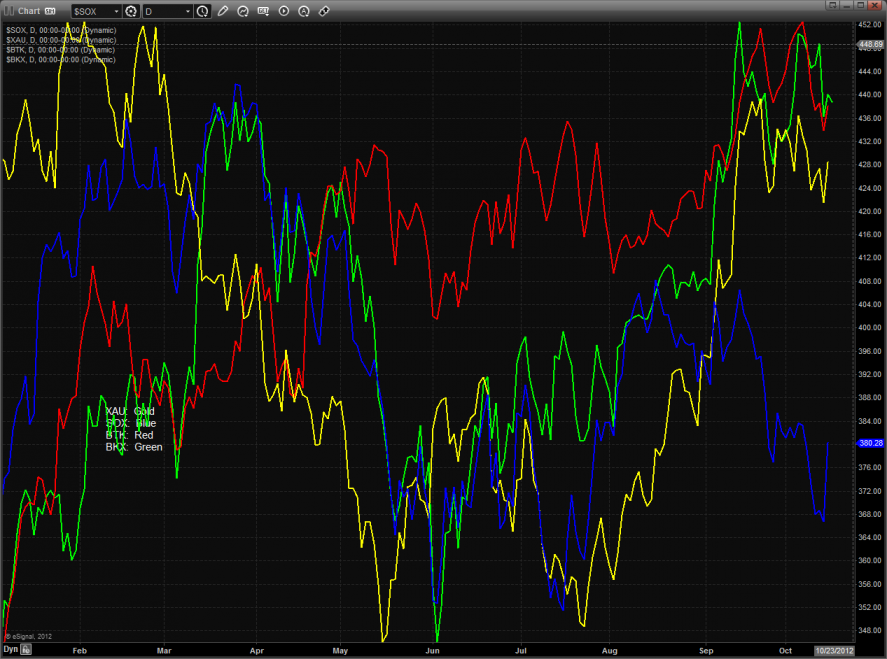

Multi sector daily chart:

The NDX lost more ground vs. the SPX but did not yet make a fatal decisive break.

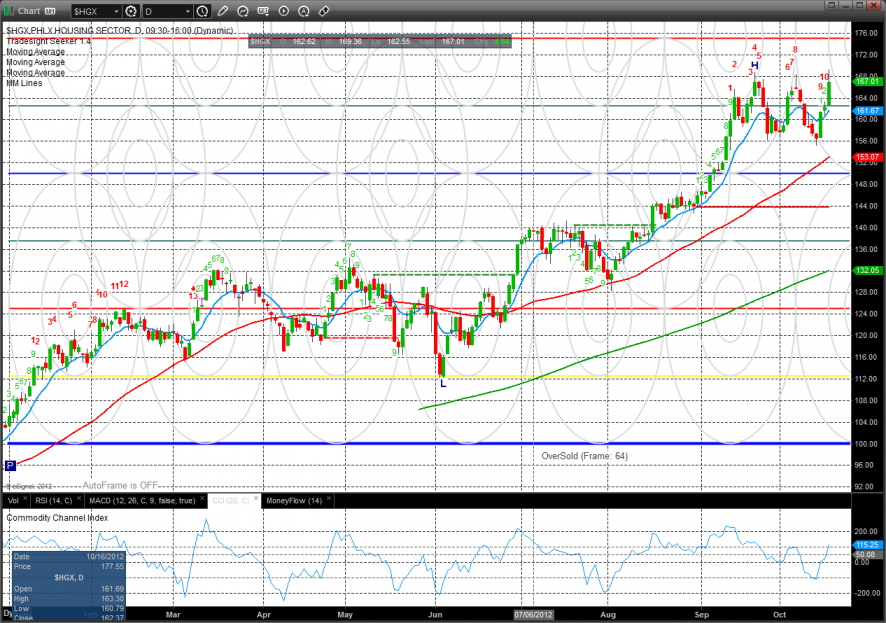

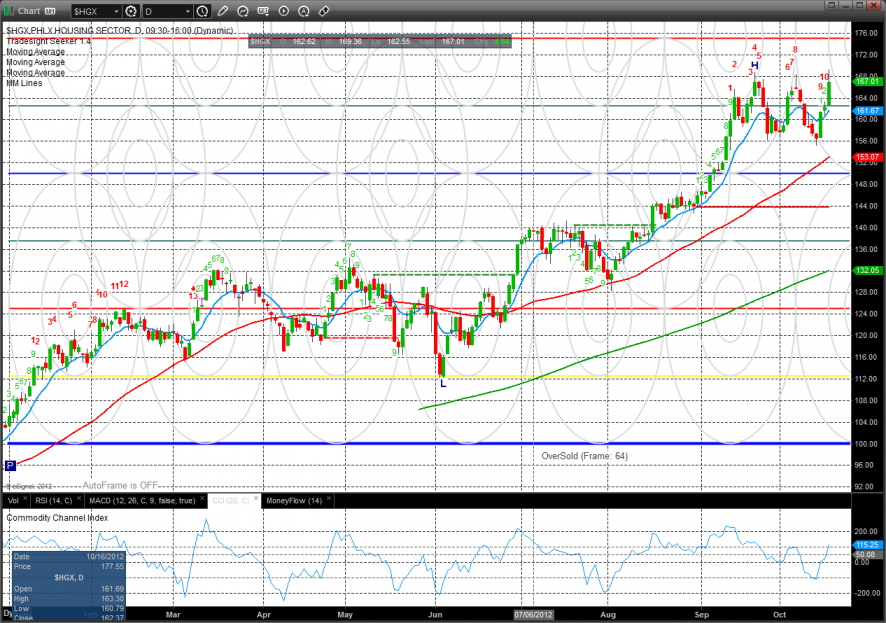

The HGX housing index was the top gun on the day and is close to breaking out but is 11 days up in the Seeker count.

The BTK was stronger than the broad market and could take a run at the 8/8 level.

The OSX has broken out of the recent range and is now above all of the major moving averages. The static trend line is the near-term target.

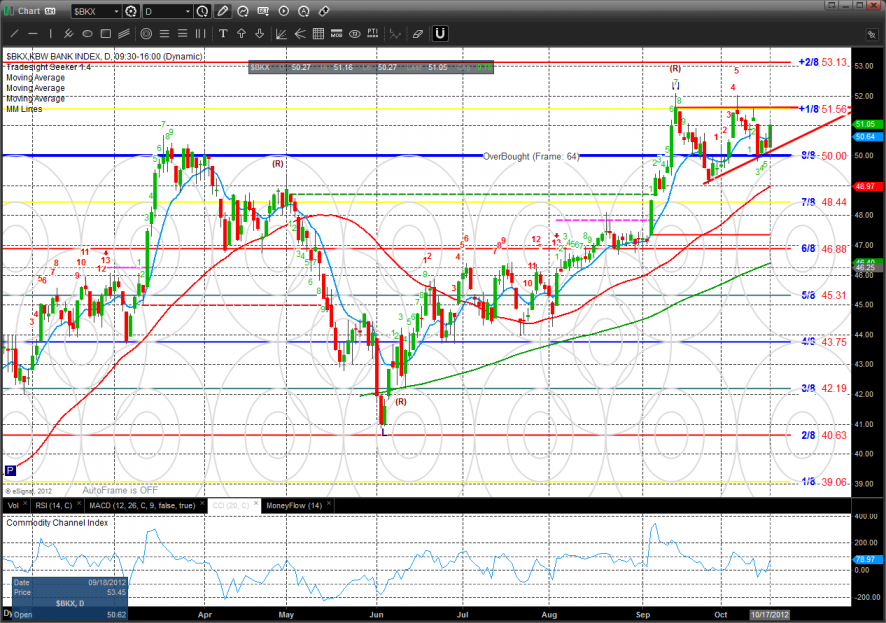

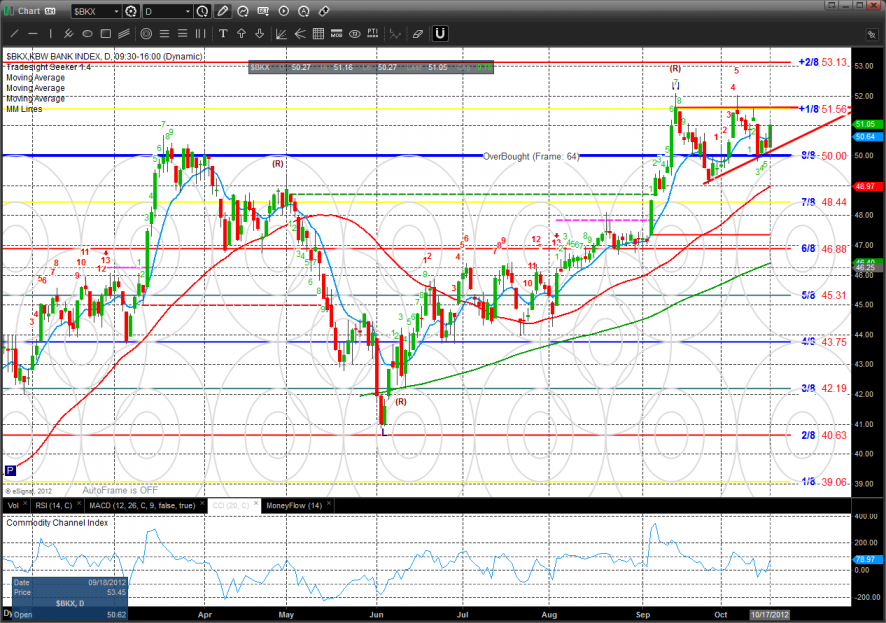

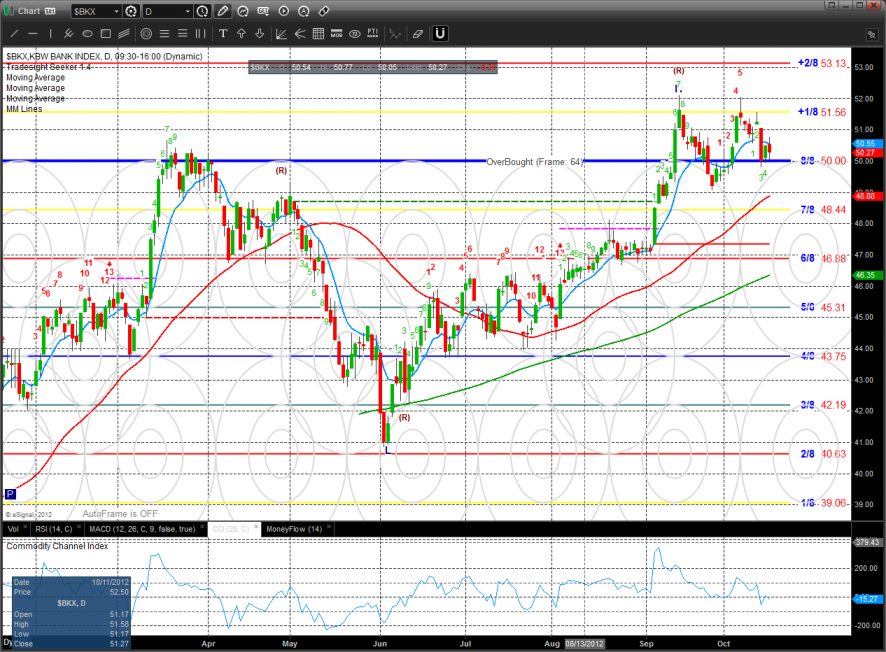

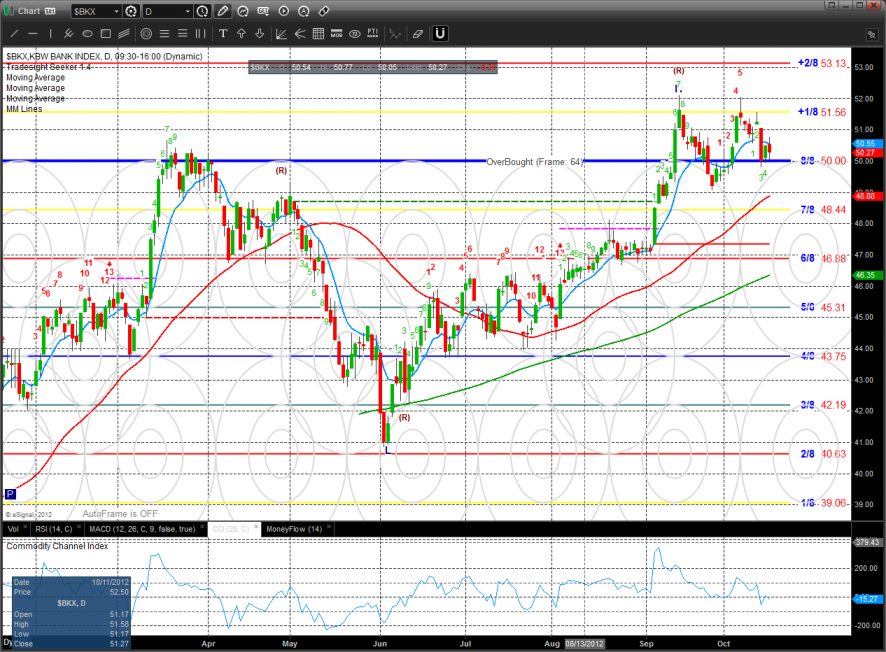

The BKX was positive on the day but is tracing out a bearish rising wedge. Key support is at the 8/8 Murrey math level.

The SOX did not build on yesterday’s gains and posted an inside real body candle.

Oil:

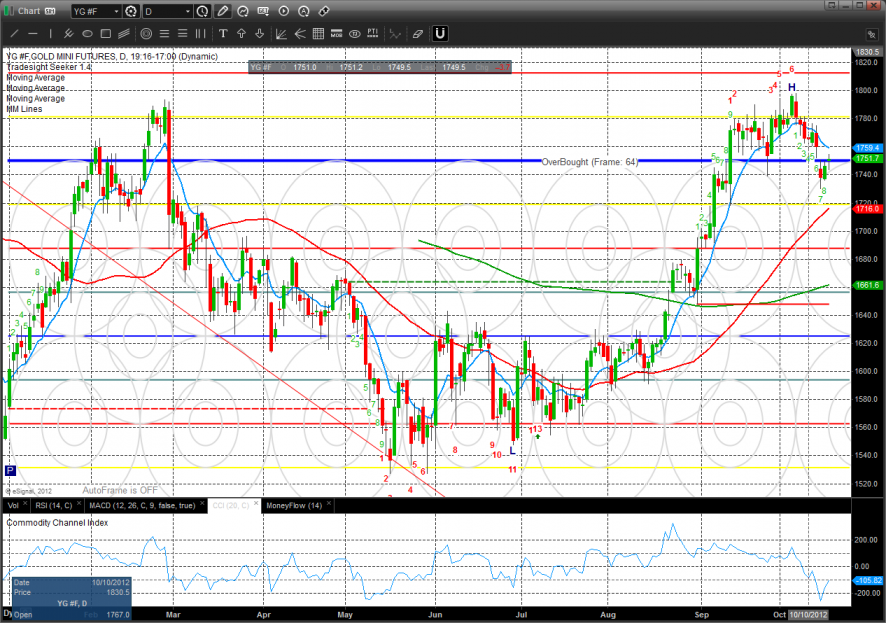

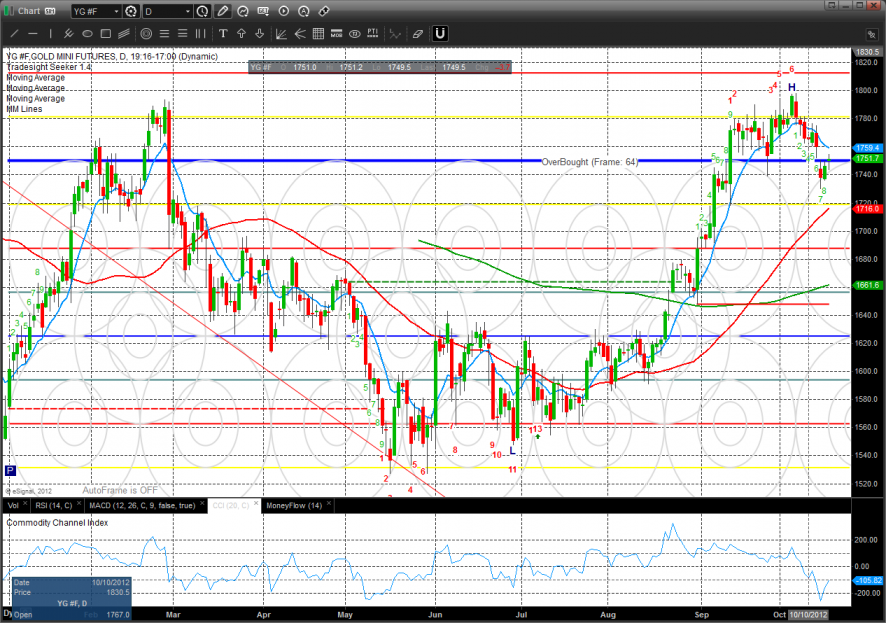

Gold:

Silver:

Tradesight Market Preview for 10/18/12

The ES was higher by 8 on the day and is just under the best close of the YTD. 1468 is the next key overhead if it can continue to build on the recent pivot off the 50dma.

The NQ futures were higher on the day but only by 5 handles. The NQ’s remain relatively weak vs. the SP futures and are still below the recent breakdown level of 2775. Also note that price is still below the 50dma and the key 8/8 Murrey math level.

The total put/call ratio is neutral:

The 10-day Trin is still in the neutral area:

Multi sector daily chart:

The NDX lost more ground vs. the SPX but did not yet make a fatal decisive break.

The HGX housing index was the top gun on the day and is close to breaking out but is 11 days up in the Seeker count.

The BTK was stronger than the broad market and could take a run at the 8/8 level.

The OSX has broken out of the recent range and is now above all of the major moving averages. The static trend line is the near-term target.

The BKX was positive on the day but is tracing out a bearish rising wedge. Key support is at the 8/8 Murrey math level.

The SOX did not build on yesterday’s gains and posted an inside real body candle.

Oil:

Gold:

Silver:

Stock Picks Recap for 10/17/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

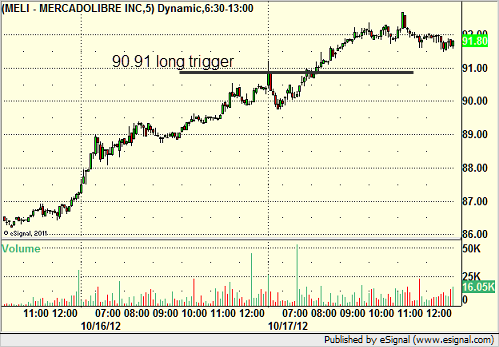

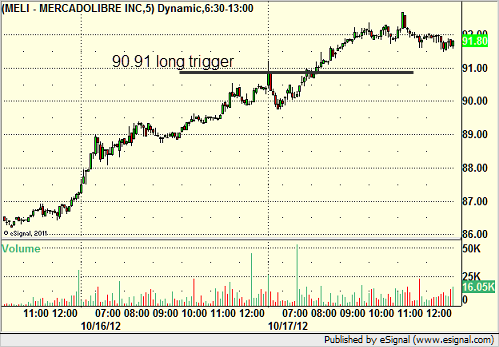

From the report, MELI triggered long (without market support due to opening 5 minutes) and didn't work, although we did take it later when it triggered and had a nice winner, but we don't count the retriggers officially:

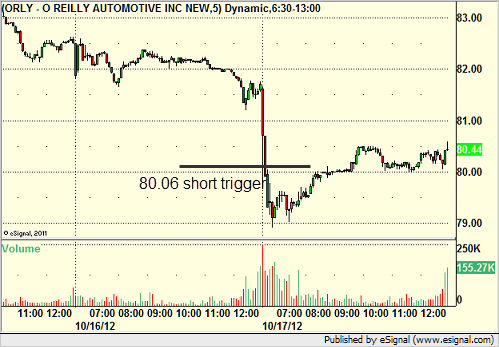

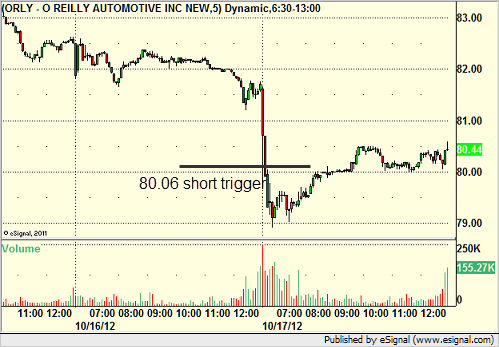

ORLY triggered short (without market support due to opening 5 minutes) and might have worked, or not, depending on how tight you kept the wild opening trigger:

From the Messenger/Tradesight_st Twitter Feed, Rich's CHKP triggered short (without market support) and worked:

His FTNT triggered short (without market support) and worked:

His AAPL triggered long (with market support) and worked enough for an easy partial:

AMZN triggered long (with market support) and worked great:

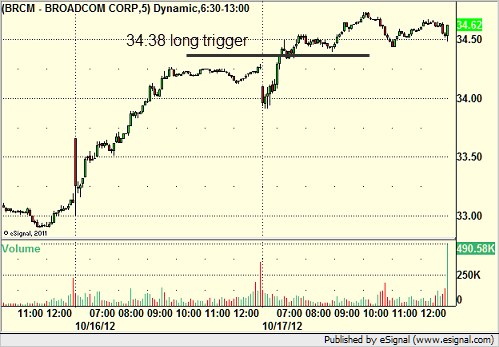

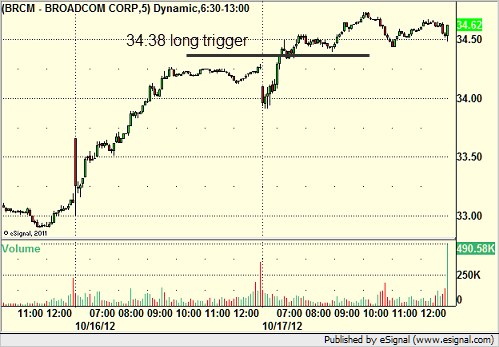

Mark's BRCM triggered long (with market support) and worked:

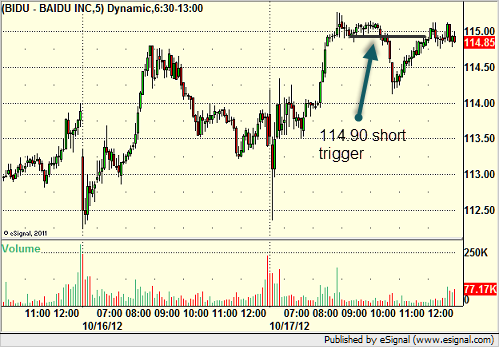

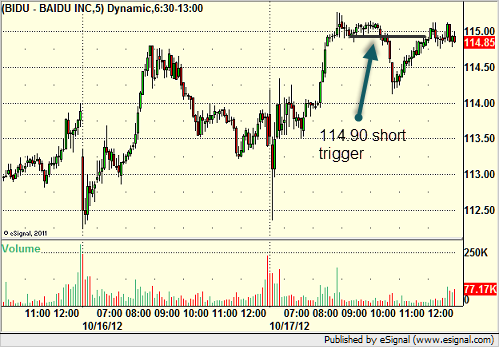

Rich's BIDU triggered short (without market support) and worked:

His afternoon AAPL triggered short (without market support) and worked:

In total, that's 3 trades triggering with market support; all 3 of them worked. We had other great winners, but without market support. Several of them.

Stock Picks Recap for 10/17/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MELI triggered long (without market support due to opening 5 minutes) and didn't work, although we did take it later when it triggered and had a nice winner, but we don't count the retriggers officially:

ORLY triggered short (without market support due to opening 5 minutes) and might have worked, or not, depending on how tight you kept the wild opening trigger:

From the Messenger/Tradesight_st Twitter Feed, Rich's CHKP triggered short (without market support) and worked:

His FTNT triggered short (without market support) and worked:

His AAPL triggered long (with market support) and worked enough for an easy partial:

AMZN triggered long (with market support) and worked great:

Mark's BRCM triggered long (with market support) and worked:

Rich's BIDU triggered short (without market support) and worked:

His afternoon AAPL triggered short (without market support) and worked:

In total, that's 3 trades triggering with market support; all 3 of them worked. We had other great winners, but without market support. Several of them.

Futures Calls Recap for 10/17/12

Mark's ES long turned into a nice winner, see that section below, as the market opened flat and headed up early on much better volume. His YM in the afternoon triggered and stopped, see that section below too.

Net ticks: -2.5 ticks.

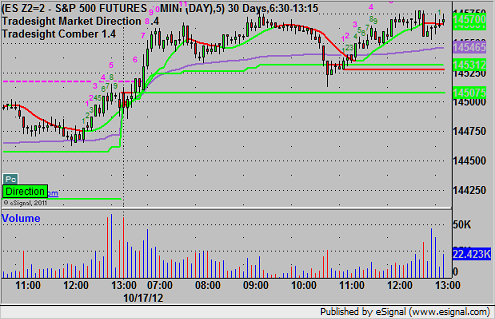

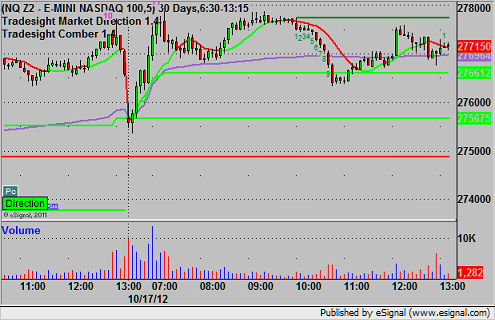

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

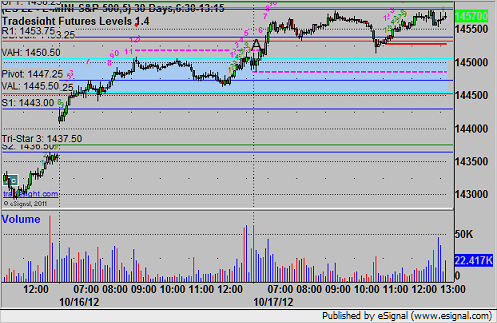

ES:

Mark's call triggered long at A at 1451.75, hit first target for 6 ticks, and he raised the stop twice and finally stopped at 1454.50:

YM:

Mark's call triggered long at 13494 at A and stopped for 11 ticks:

Forex Calls Recap for 10/17/12

An interesting session. The EURUSD, which we were long coming in, spiked up really early (before the Asian session). I did have a short entry I liked if it headed back down, but not much to the upside once it got extended, so instead of forcing a new call, I ended up just holding the piece we had and raising the stop. See that section below for how it went. Technically, I could have turned to the GBPUSD over the UBreak, and that would have worked too, but the GBPUSD has been very narrow lately. See that section below as well for a conversation.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

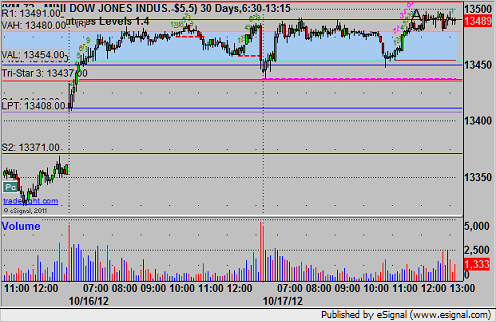

EURUSD:

See that early move right after the Levels were posted? We never came back from that, and the rest of the session range was only about 45 pips, which wouldn't have gone well for us on a new trade. Instead, we're still long and about 150 pips in the money with a stop a few pips under the 1.3100 black line at A:

Tradesight Market Preview for 10/17/12

The ES sprinted higher by 14 handles leaving an open gap. The 10ema has been reclaimed by the bulls and the chart is now above all the major moving averages.

The NQ futures were higher by 34 on the day and finally shook off, at least for a day, the persistent relative weakness. If the up move continues, the 50dma and 8/8 levels overhead are all big.

The total put/call ratio is moving towards but not yet at a climatic reading.

The 10-day Trin is neutral:

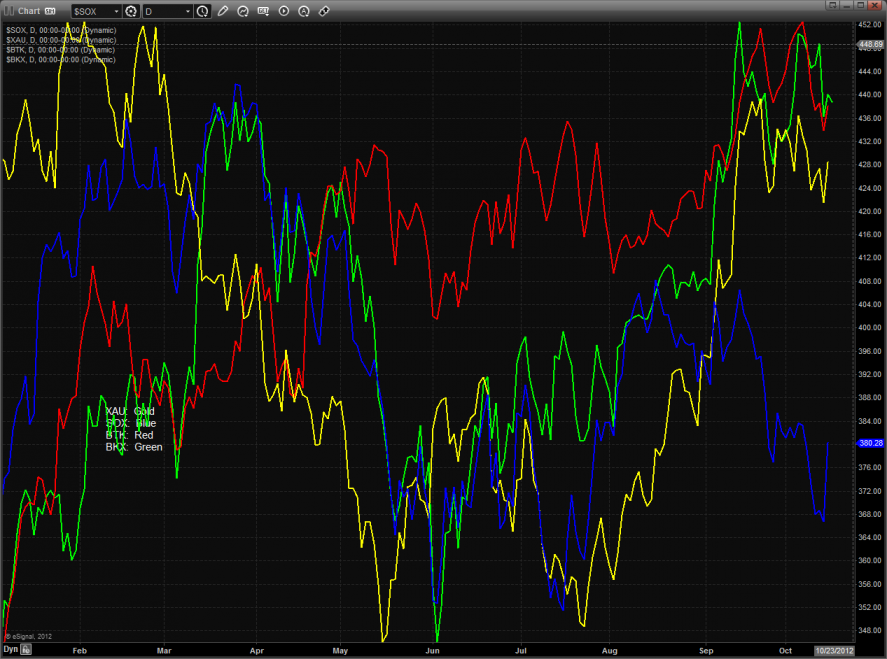

Multi sector daily chart:

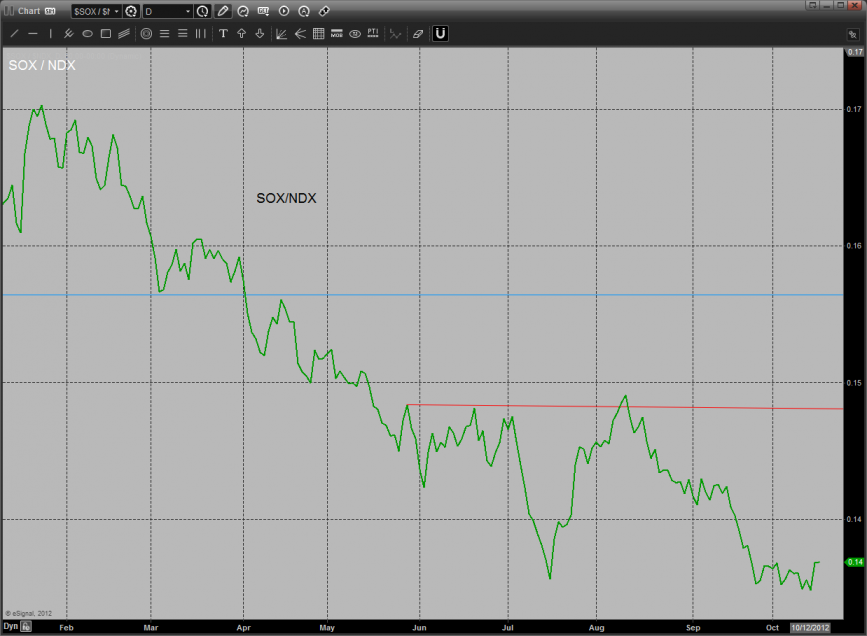

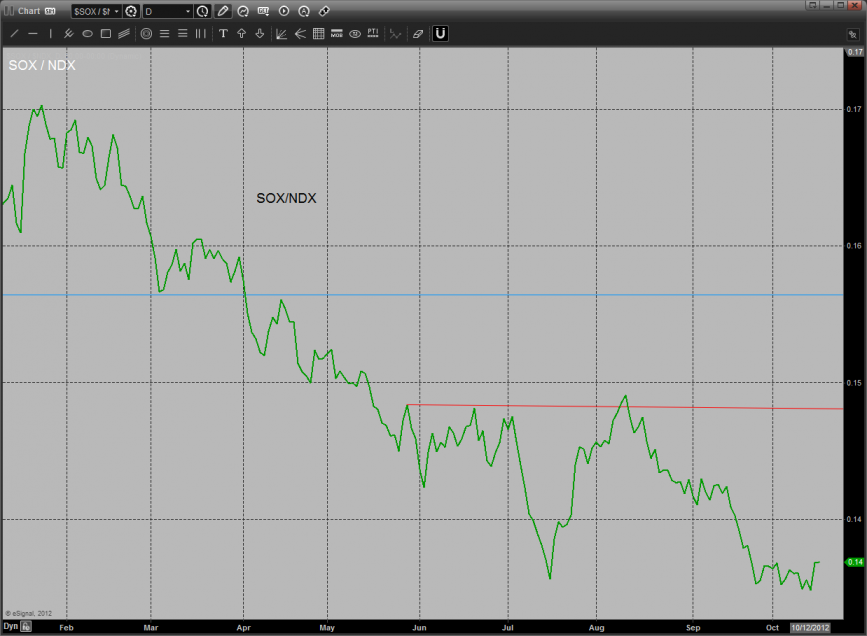

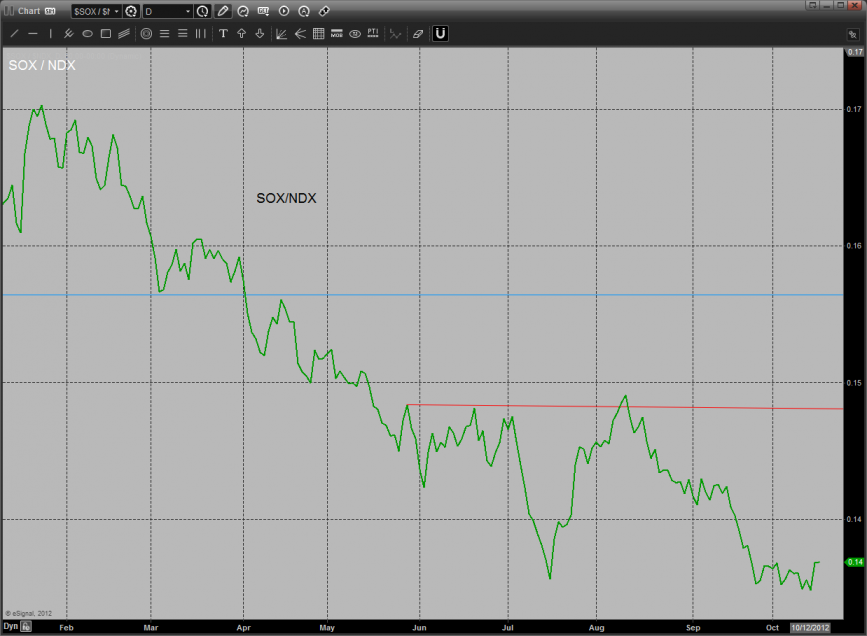

The SOX finally showed some relative strength and has yet to break.

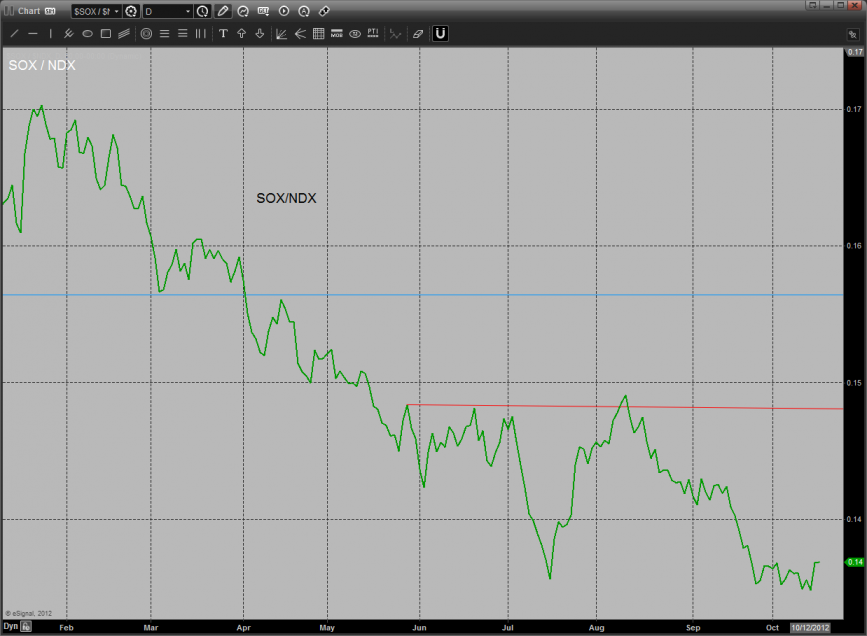

The NDX/SPX cross is still holding onto key support.

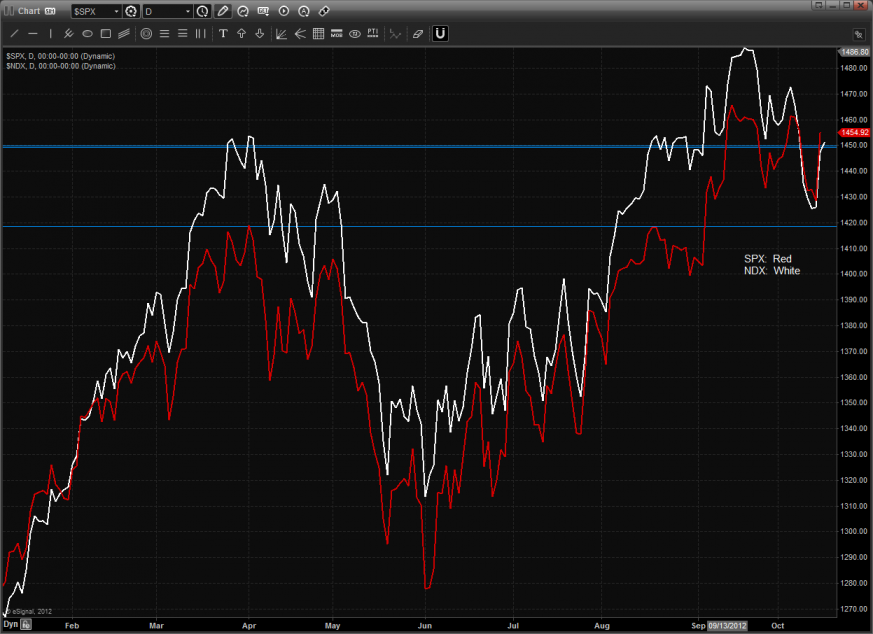

Note in the SPX/NDX comparison chart that the NDX is back at the key breakout level. This could provide resistance in the next couple of sessions and is the first area that qualifies as a retest of the current high.

The SOX was the top gun on the day and closed above the 10ema for the first time in weeks.

The defensive XAU was suspiciously strong. Yes this index is seasonally strong now but the underperformance in the banks is not what the bulls were hoping for.

The OSX is trying to pivot but will need another day to prove itself.

The BTK posted an indecisive inside day.

The BKX was the last laggard by a wide margin and was the only major sector down on the day. Key support remains at the 8/8 level.

Oil:

Gold:

Silver:

Tradesight Market Preview for 10/17/12

The ES sprinted higher by 14 handles leaving an open gap. The 10ema has been reclaimed by the bulls and the chart is now above all the major moving averages.

The NQ futures were higher by 34 on the day and finally shook off, at least for a day, the persistent relative weakness. If the up move continues, the 50dma and 8/8 levels overhead are all big.

The total put/call ratio is moving towards but not yet at a climatic reading.

The 10-day Trin is neutral:

Multi sector daily chart:

The SOX finally showed some relative strength and has yet to break.

The NDX/SPX cross is still holding onto key support.

Note in the SPX/NDX comparison chart that the NDX is back at the key breakout level. This could provide resistance in the next couple of sessions and is the first area that qualifies as a retest of the current high.

The SOX was the top gun on the day and closed above the 10ema for the first time in weeks.

The defensive XAU was suspiciously strong. Yes this index is seasonally strong now but the underperformance in the banks is not what the bulls were hoping for.

The OSX is trying to pivot but will need another day to prove itself.

The BTK posted an indecisive inside day.

The BKX was the last laggard by a wide margin and was the only major sector down on the day. Key support remains at the 8/8 level.

Oil:

Gold:

Silver: