Stock Picks Recap for 10/16/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, WYNN triggered long (with market support) and worked:

CSTR triggered short (without market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's UNH triggered short (without market support) and worked enough for a partial:

AMZN triggered long (with market support) and didn't work:

Rich's NKE triggered long (with market support) and worked:

FB triggered short (without market support) and worked:

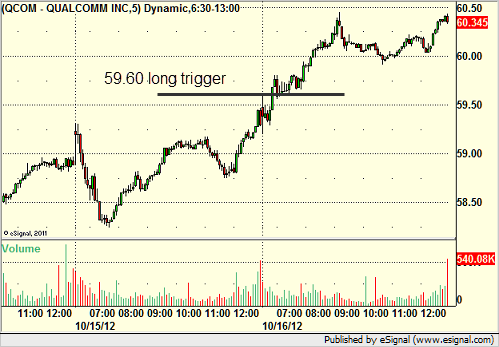

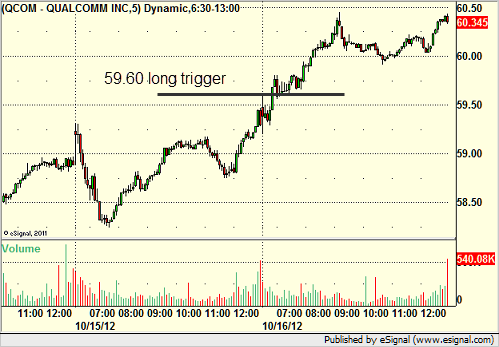

Mark's QCOM triggered long (with market support) and worked:

AAPL triggered long (with market support) and worked great:

Rich's KORS triggered long (with market support) and worked:

His FSLR triggered long (with market support) and didn't work:

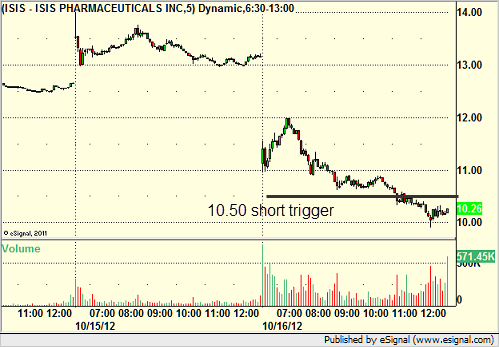

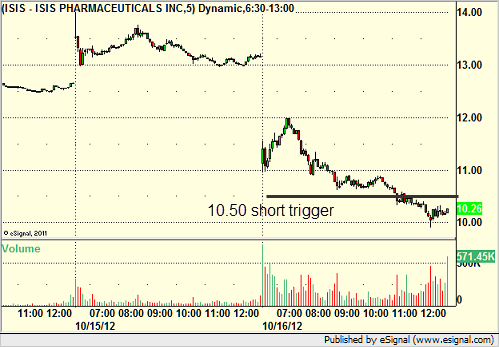

His ISIS triggered short (without market support) and worked:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

Stock Picks Recap for 10/16/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, WYNN triggered long (with market support) and worked:

CSTR triggered short (without market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's UNH triggered short (without market support) and worked enough for a partial:

AMZN triggered long (with market support) and didn't work:

Rich's NKE triggered long (with market support) and worked:

FB triggered short (without market support) and worked:

Mark's QCOM triggered long (with market support) and worked:

AAPL triggered long (with market support) and worked great:

Rich's KORS triggered long (with market support) and worked:

His FSLR triggered long (with market support) and didn't work:

His ISIS triggered short (without market support) and worked:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

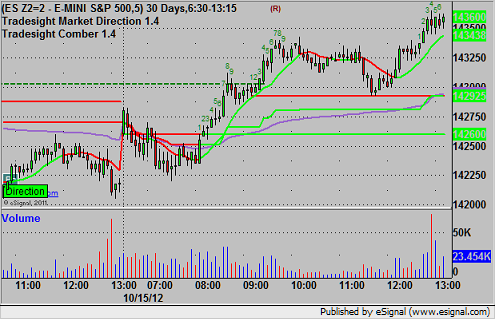

Futures Calls Recap for 10/16/12

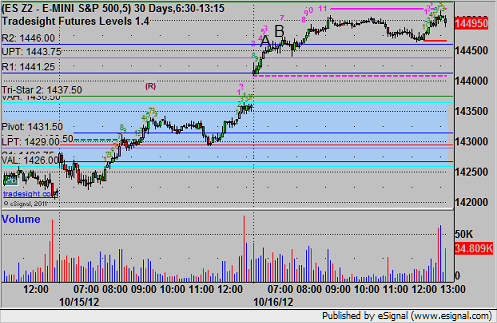

Mark's ES call stopped out twice, worked the third time, although he called off the third trigger heading into lunch. See ES section below.

Net ticks: -14 ticks.

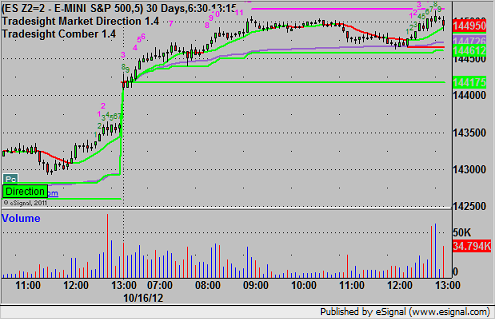

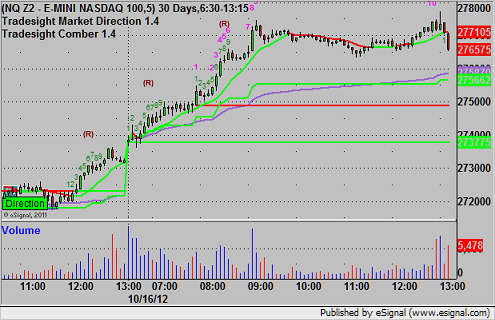

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's long triggered at A at 1446.25 and stopped for 7 ticks, and then triggered again at B and did the same:

Forex Calls Recap for 10/16/12

A clean winner in the EURUSD for the session. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

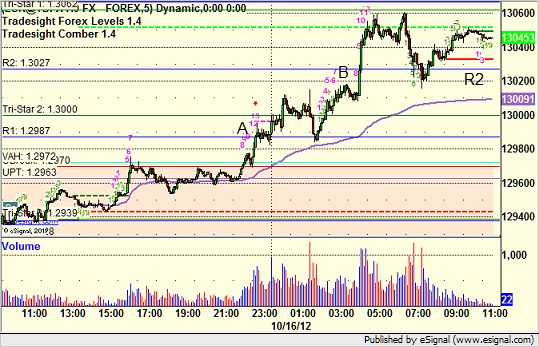

EURUSD:

Triggered long at A, hit first target at B, and holding with a stop under R2 on the second half:

Tradesight Market Preview for 10/16/12

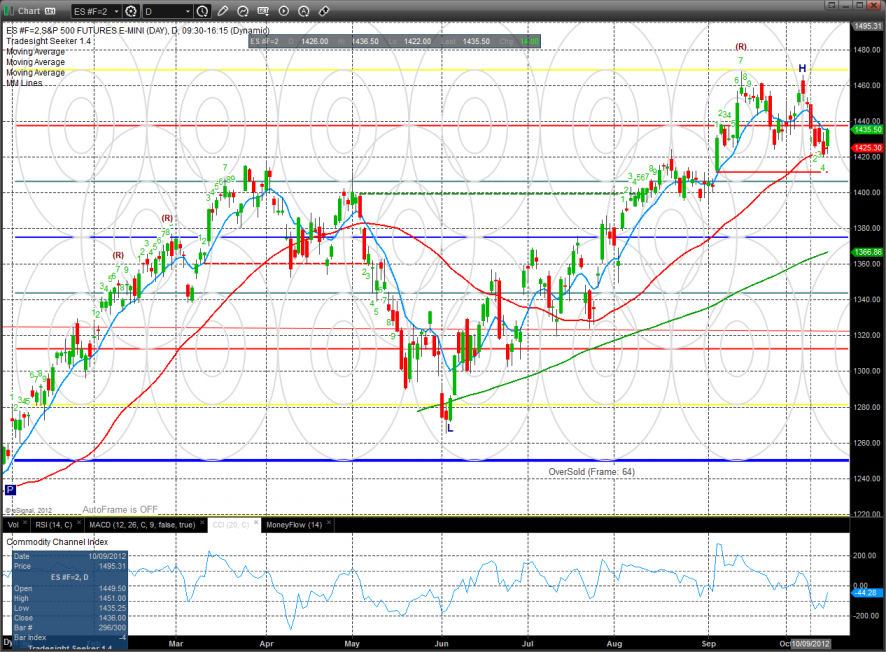

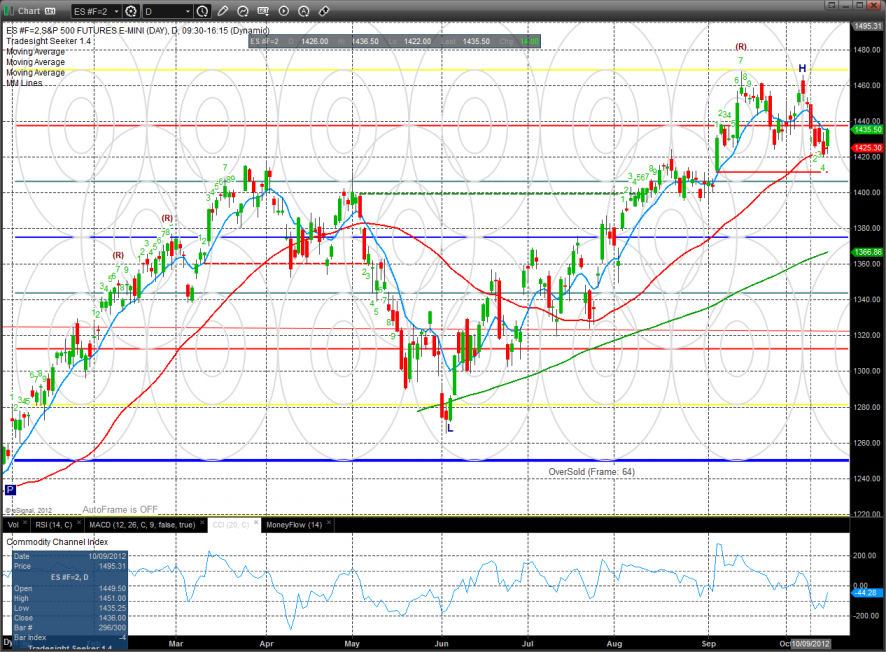

The ES was higher on the day by 14 handles. This was the best close in 4 sessions but did not change the trend back to short-term positive because price remains below the 10ema. If the pattern turns back lower then look to the static trend line for support.

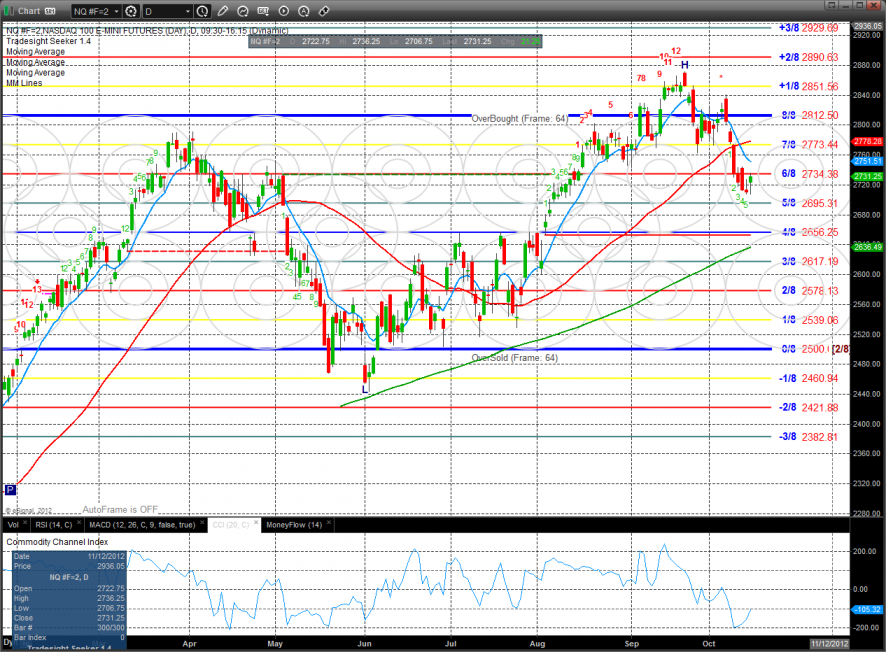

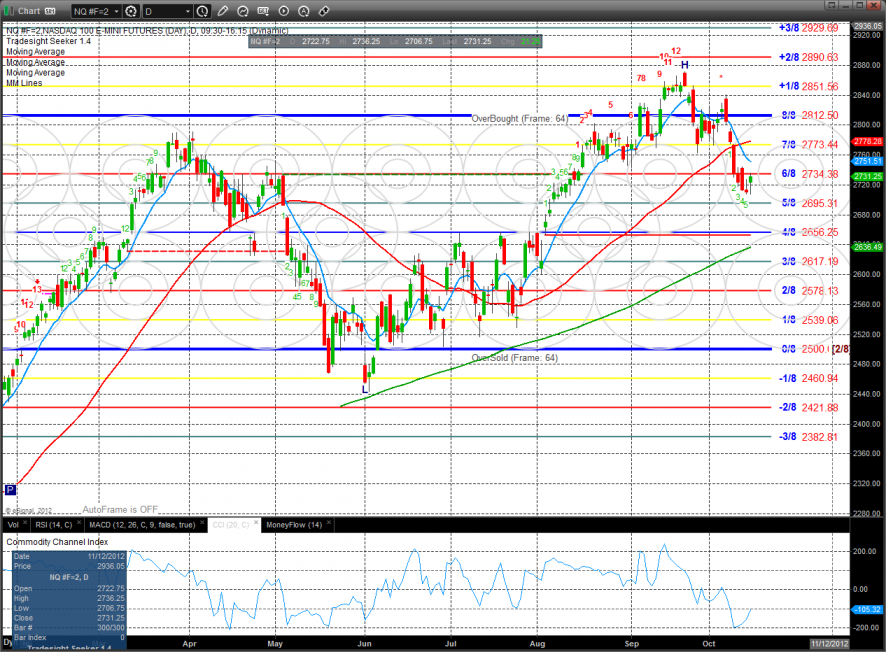

The NQ was higher by 21 on the day but still has relative weakness vs. the SP side. The pattern is still below the 10 and 50 period moving averages. Keep in mind that on a bounce and a retest of the YTD highs the Seeker could still record a sell signal.

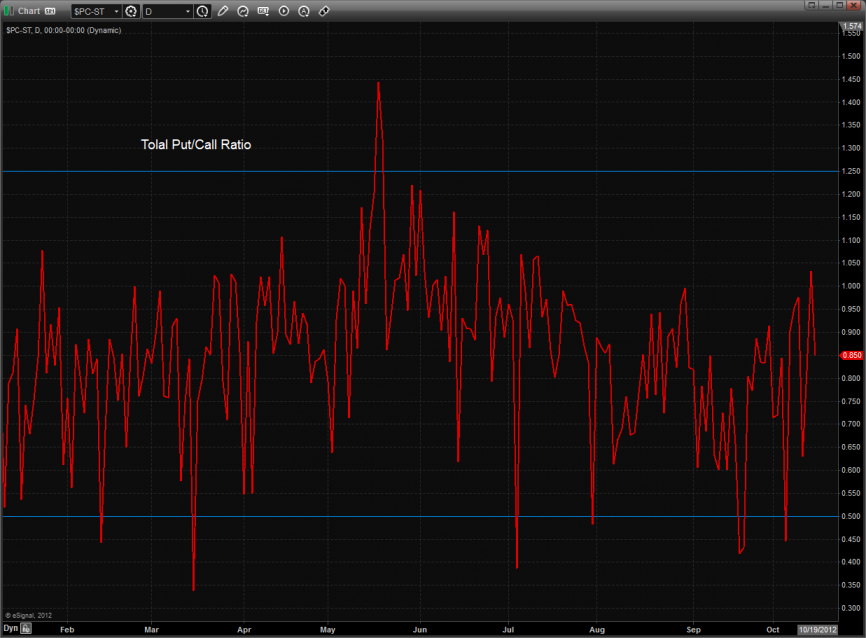

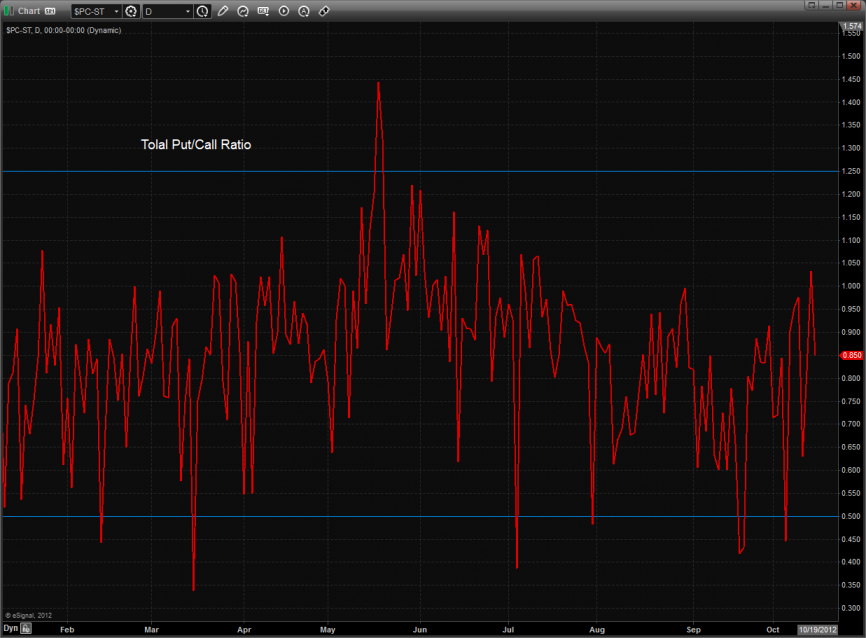

The total put/call ratio is still in the normal trading range.

The 10-day Trin is still neutral:

Multi sector daily chart:

The relative weakness in the NDX vs. SPX is painfully clear in the cross ratio chart. Keep a close eye on a break below the recent support level which will be a key inflection point.

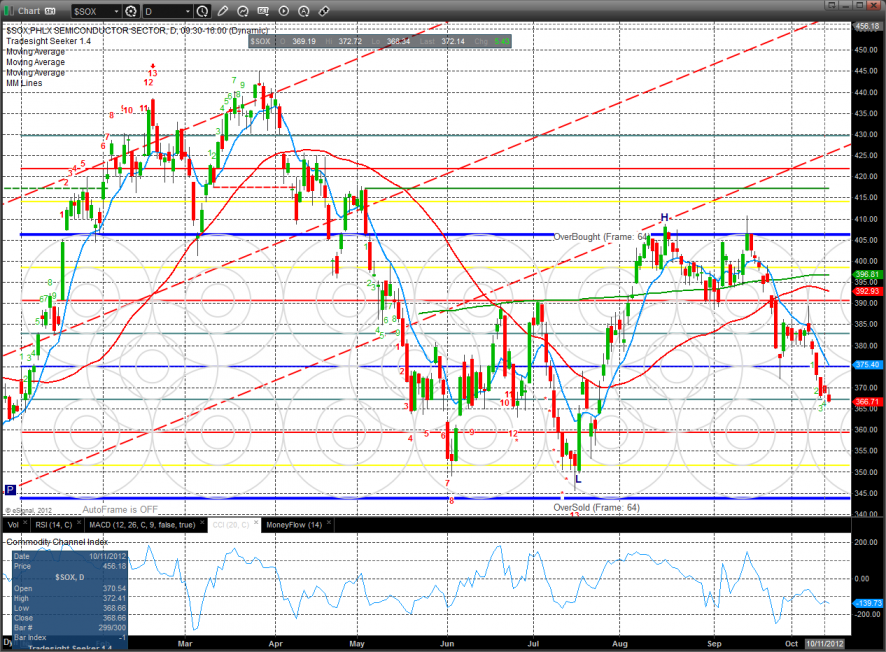

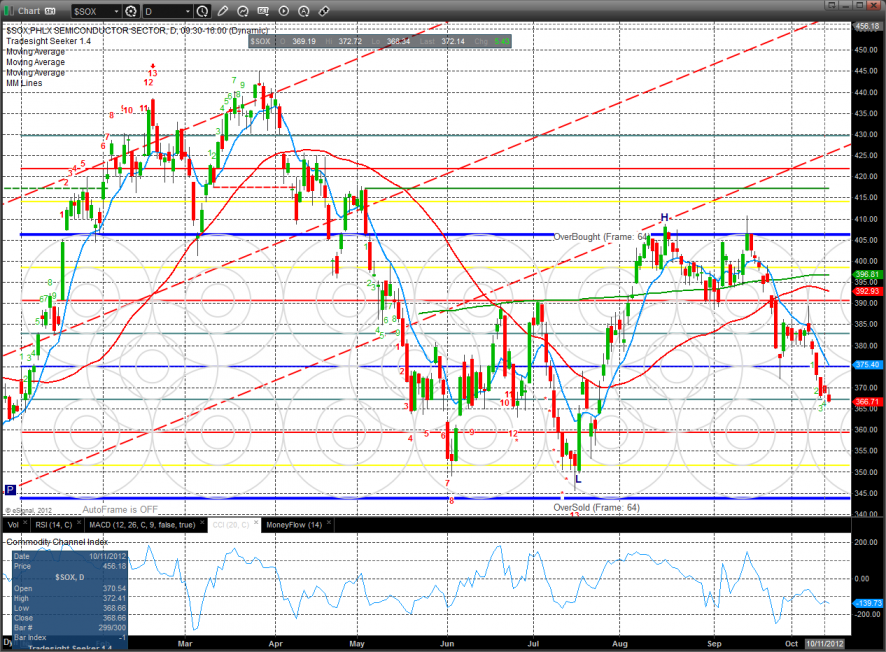

The SOX closed at a new low on the move and does not yet have any support from the Seeker for a reversal.

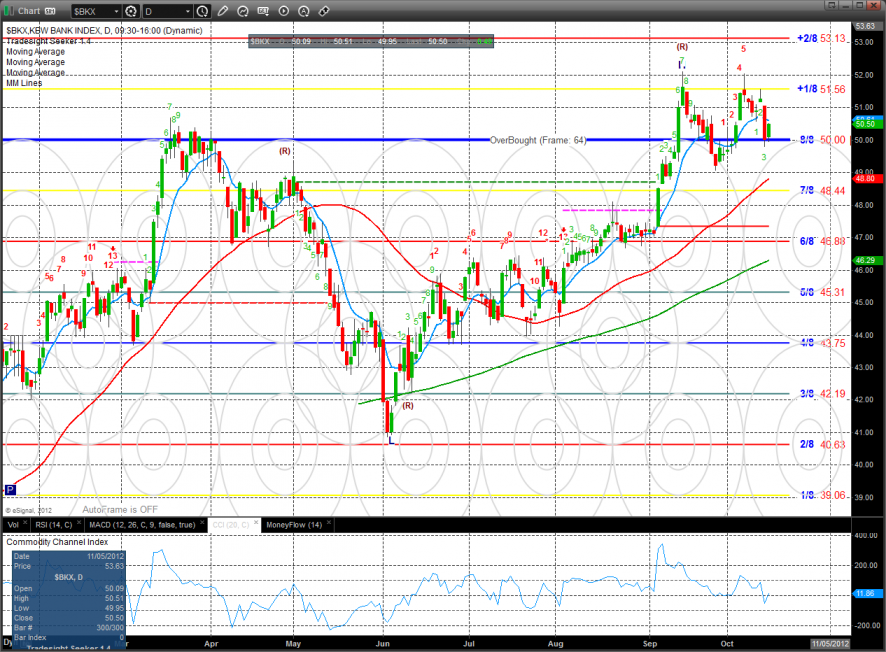

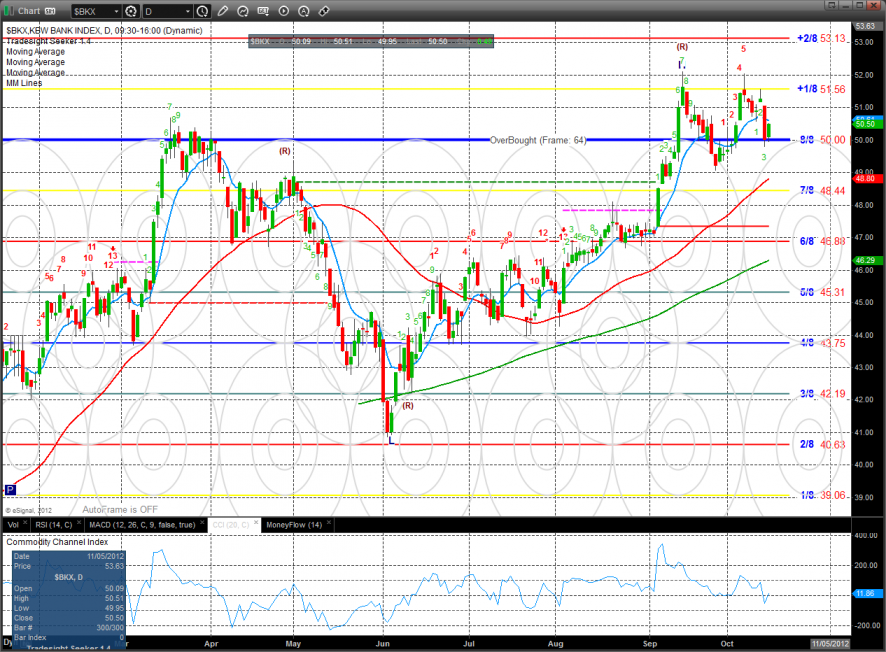

The BKX posted an indecisive inside day. It will take until the range is resolved to have a technical development. Keep in mind that the 8/8 level is very strong.

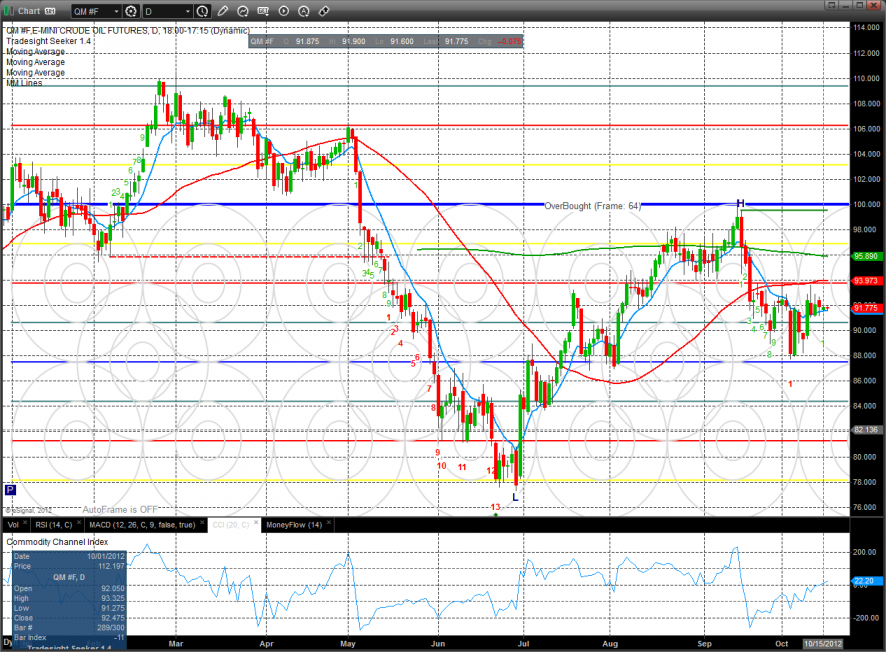

The OSX is still range bound and below all of the major moving averages.

BTK was the weakest sector on the day. It was flat and is still above the key 50 and 200 period moving averages.

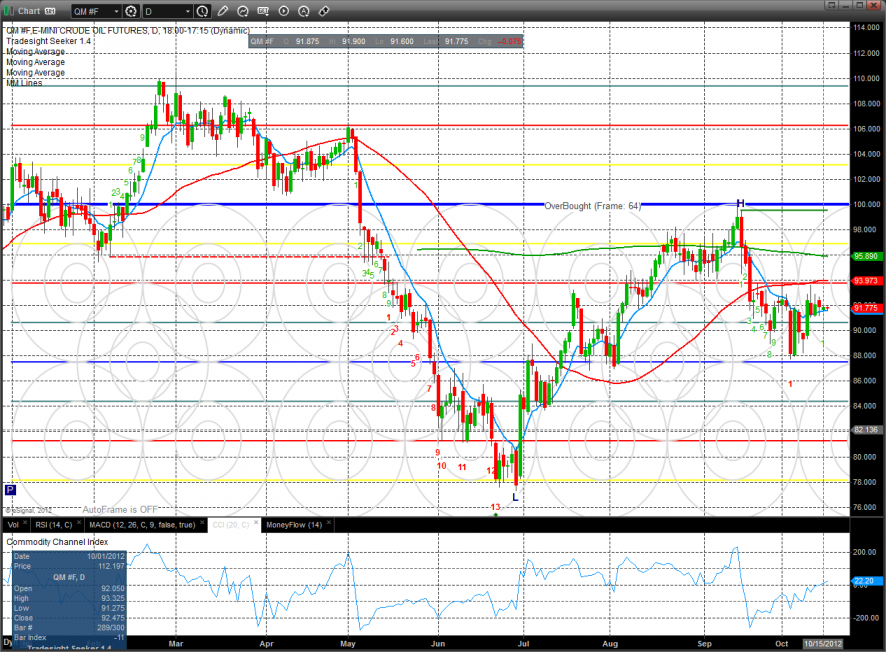

Oil:

Gold:

Silver:

Tradesight Market Preview for 10/16/12

The ES was higher on the day by 14 handles. This was the best close in 4 sessions but did not change the trend back to short-term positive because price remains below the 10ema. If the pattern turns back lower then look to the static trend line for support.

The NQ was higher by 21 on the day but still has relative weakness vs. the SP side. The pattern is still below the 10 and 50 period moving averages. Keep in mind that on a bounce and a retest of the YTD highs the Seeker could still record a sell signal.

The total put/call ratio is still in the normal trading range.

The 10-day Trin is still neutral:

Multi sector daily chart:

The relative weakness in the NDX vs. SPX is painfully clear in the cross ratio chart. Keep a close eye on a break below the recent support level which will be a key inflection point.

The SOX closed at a new low on the move and does not yet have any support from the Seeker for a reversal.

The BKX posted an indecisive inside day. It will take until the range is resolved to have a technical development. Keep in mind that the 8/8 level is very strong.

The OSX is still range bound and below all of the major moving averages.

BTK was the weakest sector on the day. It was flat and is still above the key 50 and 200 period moving averages.

Oil:

Gold:

Silver:

Stock Picks Recap for 10/15/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, VRA gapped over the trigger, no play.

TTWO triggered long (with market support) and worked enough for a partial:

FLIR triggered short (with market support) and didn't work:

TSLA triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Mark's GILD triggered long (without market support) and worked:

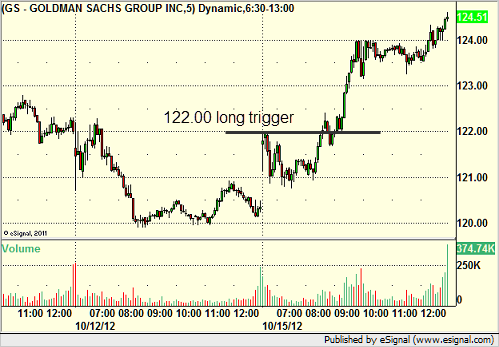

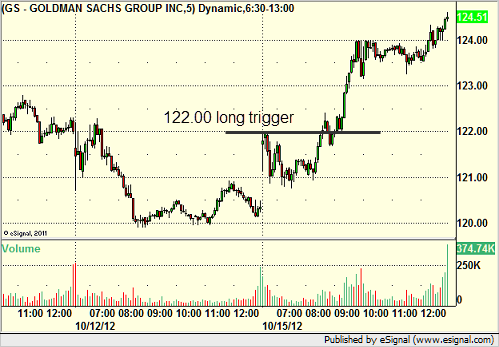

Rich's GS triggered long (with market support) and worked:

His GOOG triggered short (with market support) and worked:

His AMZN triggered short (with market support) and worked:

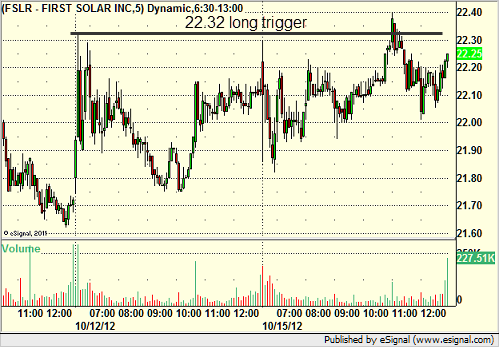

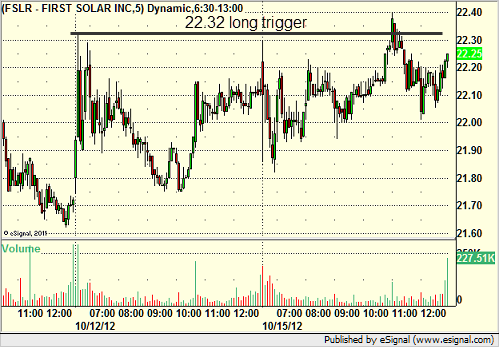

FSLR triggered long (with market support) and didn't work:

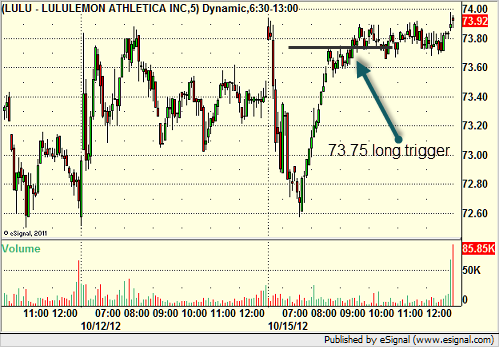

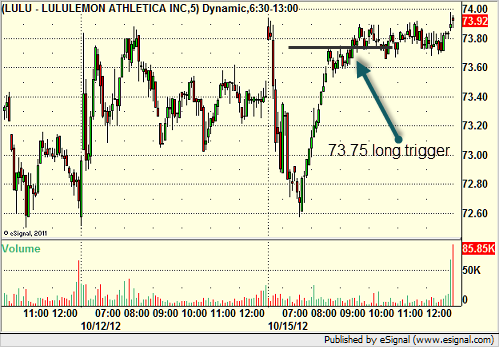

Rich's LULU triggered long (with market support) and didn't do enough in either direction to count:

His AMT triggered long (with market support) and didn't work:

Mark's AMGN triggered long (with market support) and worked:

NFLX triggered short (without market support) and worked enough for a partial:

In total, that's 8 trades triggering with market support, 5 of them worked, 3 did not.

Stock Picks Recap for 10/15/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, VRA gapped over the trigger, no play.

TTWO triggered long (with market support) and worked enough for a partial:

FLIR triggered short (with market support) and didn't work:

TSLA triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Mark's GILD triggered long (without market support) and worked:

Rich's GS triggered long (with market support) and worked:

His GOOG triggered short (with market support) and worked:

His AMZN triggered short (with market support) and worked:

FSLR triggered long (with market support) and didn't work:

Rich's LULU triggered long (with market support) and didn't do enough in either direction to count:

His AMT triggered long (with market support) and didn't work:

Mark's AMGN triggered long (with market support) and worked:

NFLX triggered short (without market support) and worked enough for a partial:

In total, that's 8 trades triggering with market support, 5 of them worked, 3 did not.

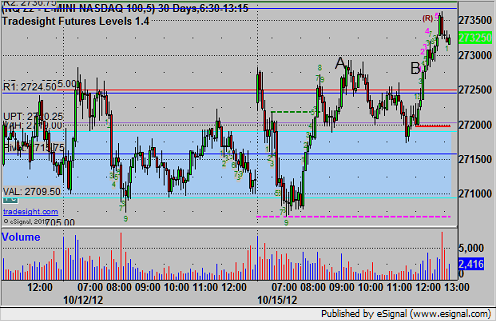

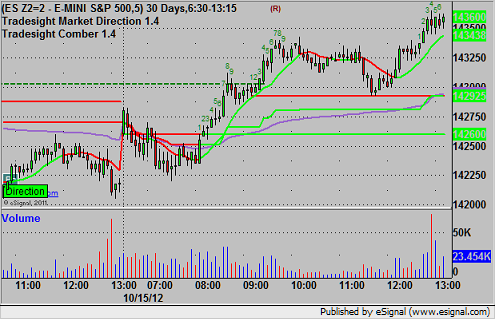

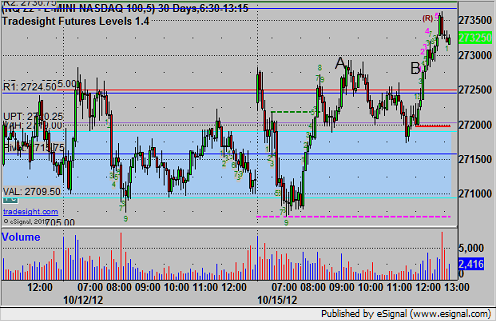

Futures Calls Recap for 10/15/12

A really great setup in the NQ triggered over lunch and stopped. I put it back in for the last two hours (which was really the original intent) and it at least triggered and ran to the first target. See NQ section below.

Net ticks: -4 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Nice two day breakout triggered long at A at 2728.50 and stopped for 7 ticks. I posted that the trade would be valid again in the last two hours, and that triggered at B, hit first target for 6 ticks, and stopped the second half at the entry:

Futures Calls Recap for 10/15/12

A really great setup in the NQ triggered over lunch and stopped. I put it back in for the last two hours (which was really the original intent) and it at least triggered and ran to the first target. See NQ section below.

Net ticks: -4 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Nice two day breakout triggered long at A at 2728.50 and stopped for 7 ticks. I posted that the trade would be valid again in the last two hours, and that triggered at B, hit first target for 6 ticks, and stopped the second half at the entry: