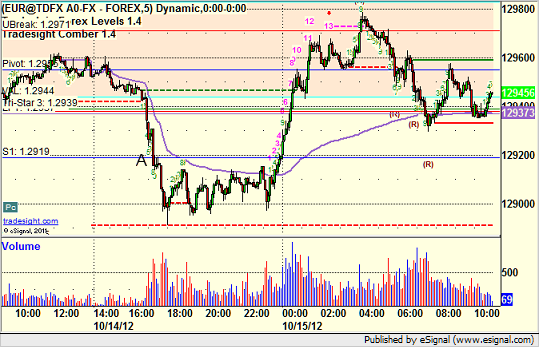

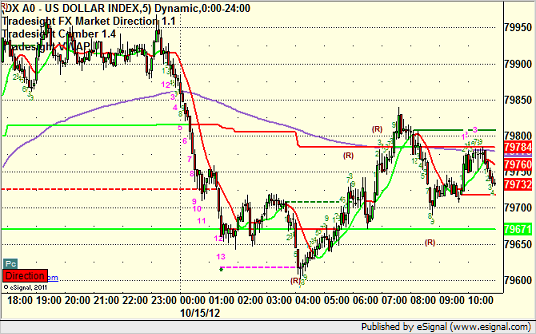

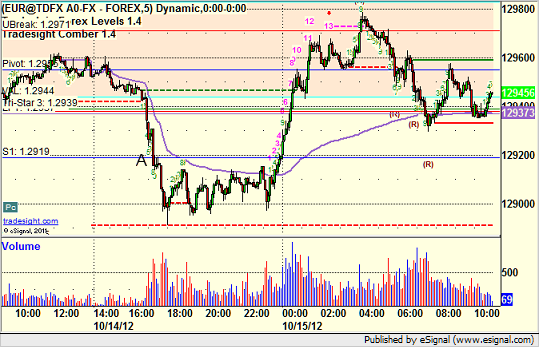

Forex Calls Recap for 10/15/12

One very early trigger on the EURUSD stopped, and other than that, the session was spent in a narrow range. See EURUSD section below.

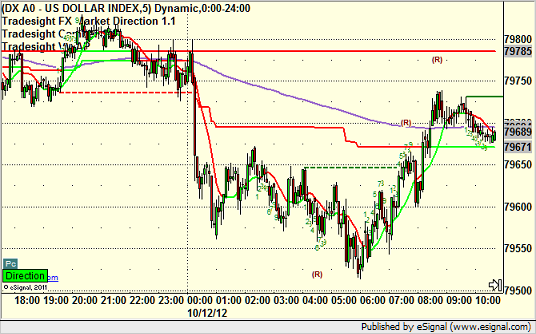

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered short at A and stopped for 25 pips:

Forex Calls Recap for 10/15/12

One very early trigger on the EURUSD stopped, and other than that, the session was spent in a narrow range. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered short at A and stopped for 25 pips:

Stock Picks Recap for 10/12/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

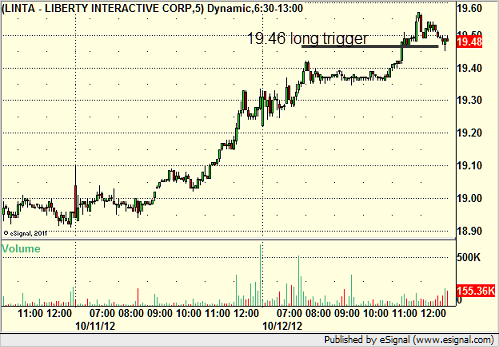

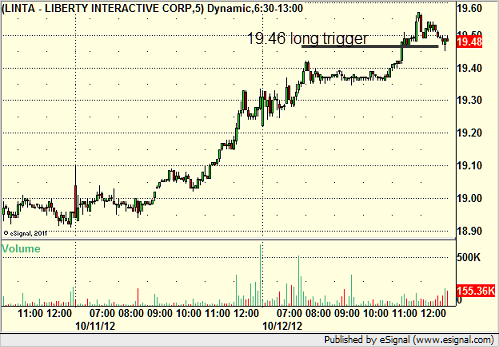

From the report, LINTA triggered long (without market support) and worked a little before the day ended:

TRMB triggered short (with market support) and didn't work:

PAYX triggered short (with market support) and didn't go a dime in either direction, so we don't count it either way:

NXPI triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's FAS triggered short (ETF, so no market support needed) and didn't work (although it worked later):

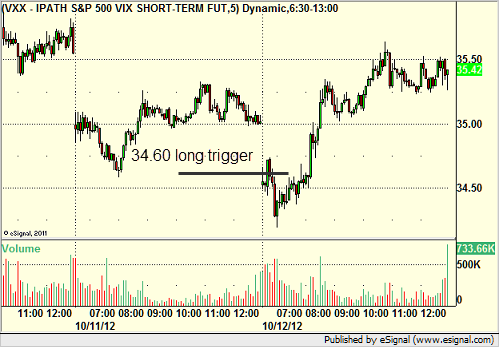

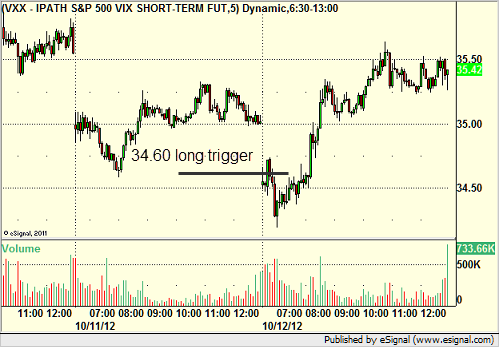

His VXX triggered long (ETF, so no market support needed) and didn't work (although it worked later):

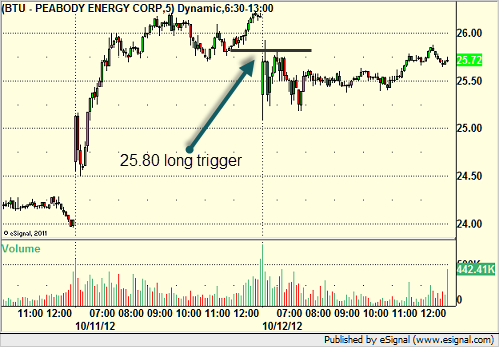

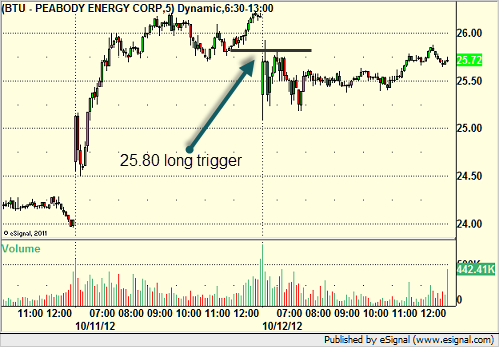

His BTU triggered long (with market support) and didn't work:

GOOG triggered short (with market support) and worked enough for a partial:

AMZN triggered long (with market support) and didn't work:

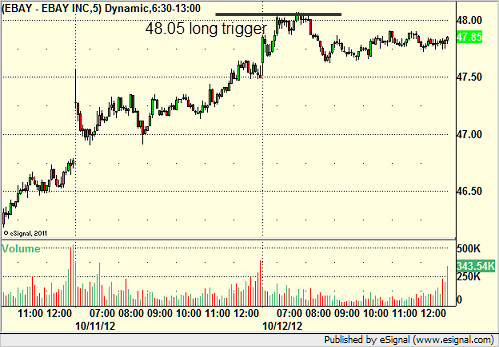

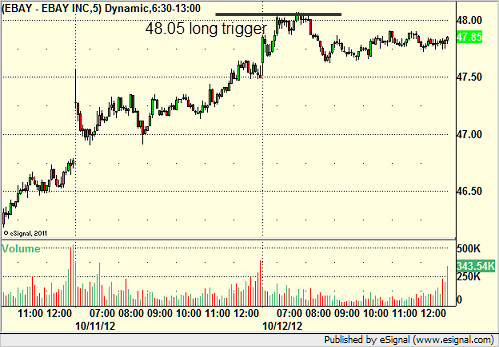

Mark's EBAY triggered long (without market support) and didn't work:

Rich's NFLX triggered short (with market support) and didn't work:

His VRTX triggered short (with market support) and worked enough for a partial:

In total, that's 10 trades triggering with market support, 7 of them worked, 3 did not. One of our worst win ratios in a long time.

Stock Picks Recap for 10/12/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, LINTA triggered long (without market support) and worked a little before the day ended:

TRMB triggered short (with market support) and didn't work:

PAYX triggered short (with market support) and didn't go a dime in either direction, so we don't count it either way:

NXPI triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's FAS triggered short (ETF, so no market support needed) and didn't work (although it worked later):

His VXX triggered long (ETF, so no market support needed) and didn't work (although it worked later):

His BTU triggered long (with market support) and didn't work:

GOOG triggered short (with market support) and worked enough for a partial:

AMZN triggered long (with market support) and didn't work:

Mark's EBAY triggered long (without market support) and didn't work:

Rich's NFLX triggered short (with market support) and didn't work:

His VRTX triggered short (with market support) and worked enough for a partial:

In total, that's 10 trades triggering with market support, 7 of them worked, 3 did not. One of our worst win ratios in a long time.

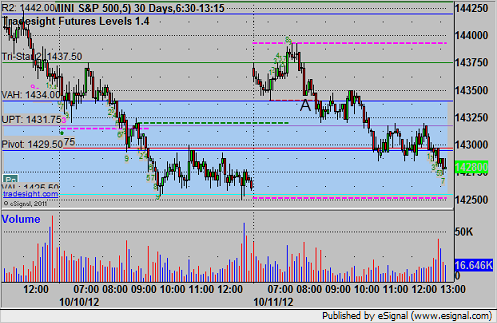

Futures Calls Recap for 10/12/12

One trigger, one winner to close out the week. NASDAQ volume was a light 1.5 billion shares. See ES section below.

Net ticks: +5.5 ticks.

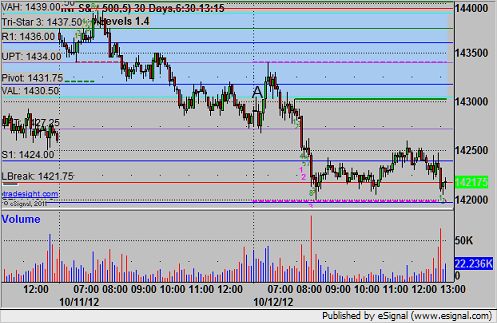

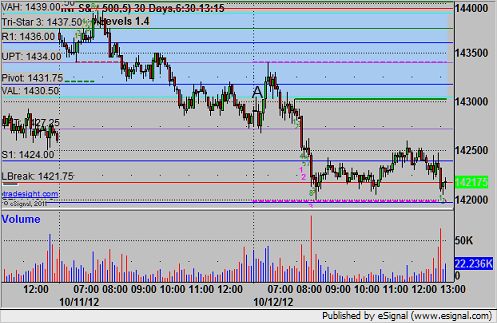

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's called triggered long at A at 1430.75, hit first target for 6 ticks, and stopped the final piece in the money at 1432.00:

Futures Calls Recap for 10/12/12

One trigger, one winner to close out the week. NASDAQ volume was a light 1.5 billion shares. See ES section below.

Net ticks: +5.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's called triggered long at A at 1430.75, hit first target for 6 ticks, and stopped the final piece in the money at 1432.00:

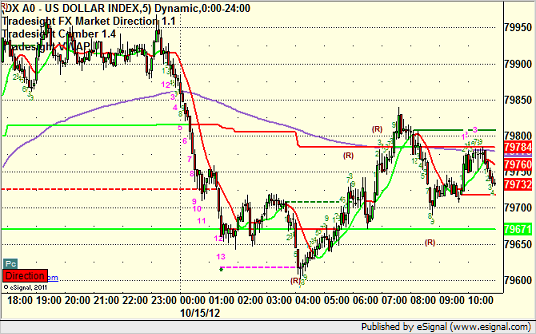

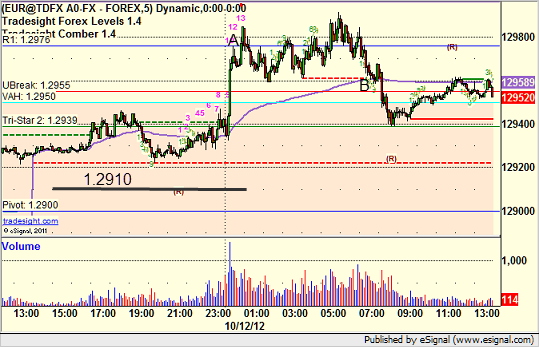

Forex Calls Recap for 10/12/12

Our call from the prior session continued and eventually closed 50 pips in the money. A new call triggered and stopped out at an adjusted stop for 20 pips. See EURUSD section below.

As usual with the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts heading into the new week with the Seeker and Comber separately, and then glance at the US Dollar Index.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Came in long from 1.2910 area, stop was under that level, never stopped, new call triggered at A over R1 (right on a Comber 13 sell signal), and in the morning, I moved the stop for all of it under 1.2960 which stopped at B:

Tradesight Market Preview for 10/11/12

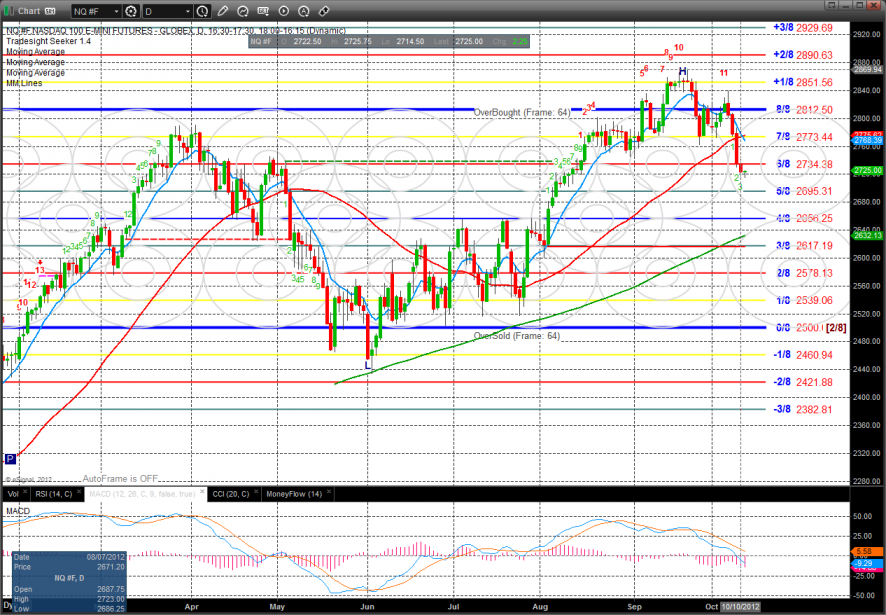

The ES was lower by 10 on the day settling right near key support at the September low. Also note that the 50dma is just below and is the nest area of key support or breakdown.

The NQ futures remain much weaker than the broad market tracking SP. Price is below the September lows and 50dma. Next support is the 5/8 Murrey math level. Technically the MACD is negative since is has crossed below the zero line.

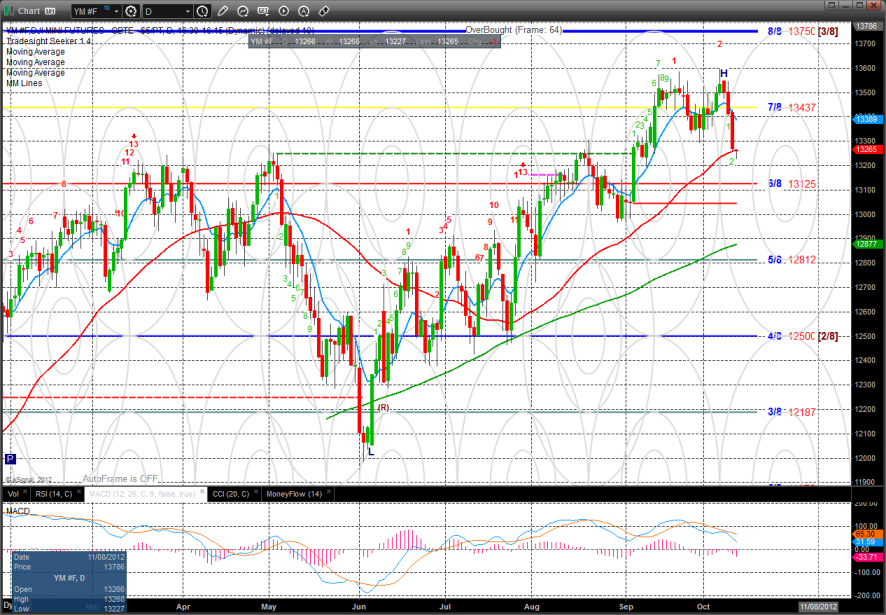

The YM futures are at a key level, closing right at the 50dma. The overall equity market is a 3 legged stool consisting of the SP, NQ and YM futures. If two of the stool’s legs close below the 50dma, than the overall pattern can be considered intermediate-term negative which makes the next few candles in the YM very important.

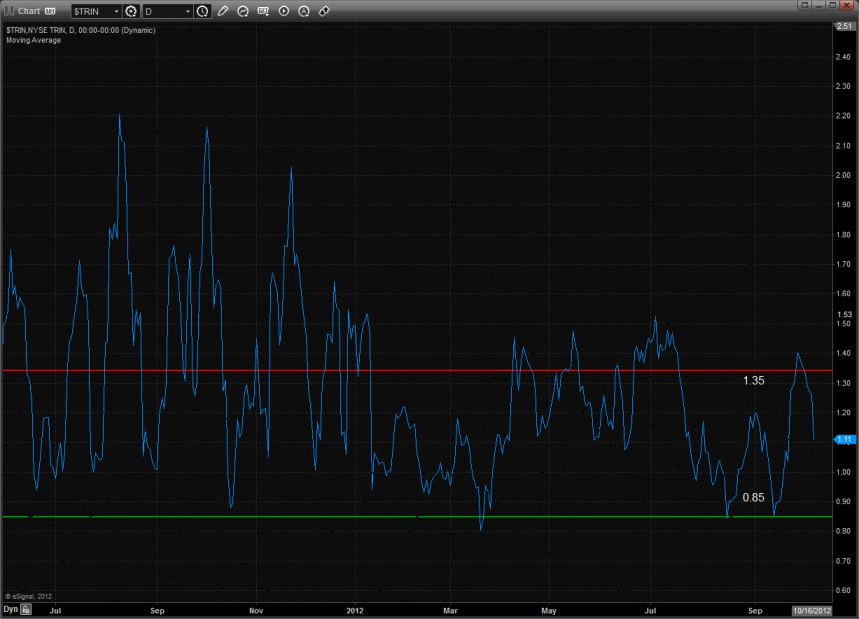

10-day Trin:

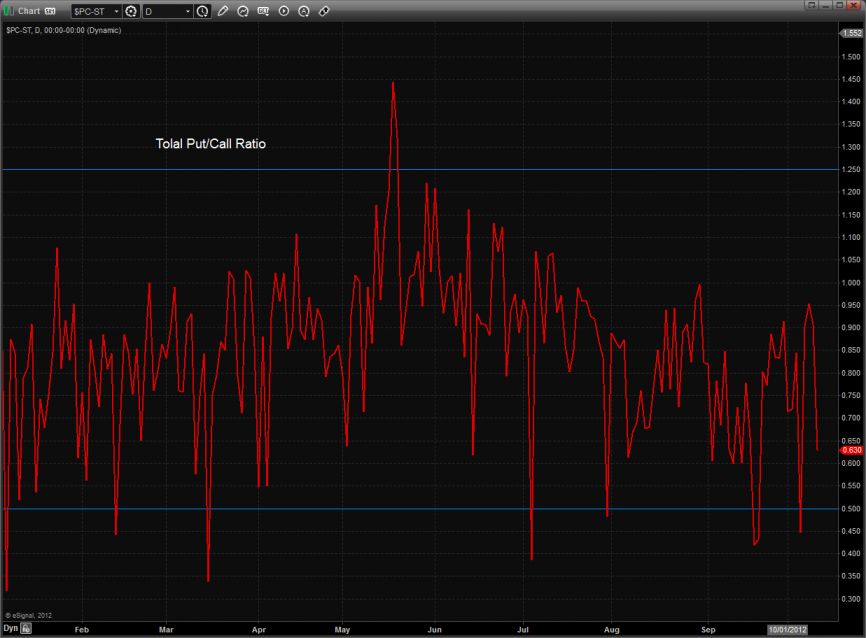

Total put/call ratio:

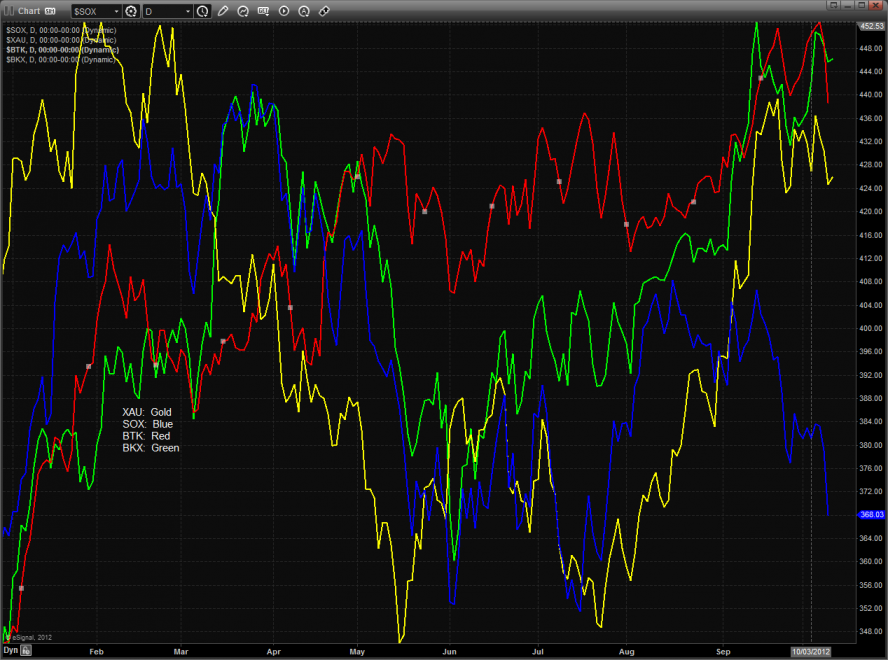

Multi sector daily chart:

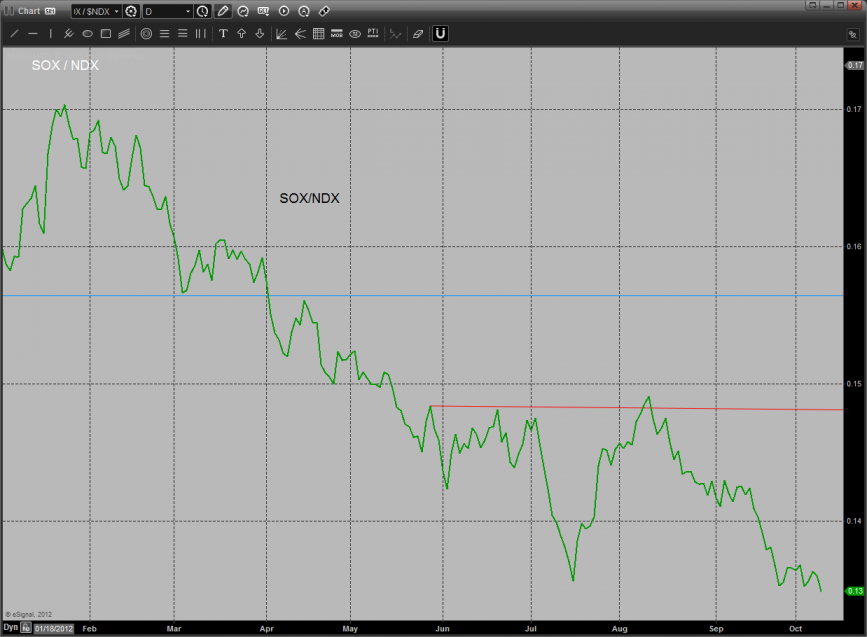

The SOX/NDX cross is leaking to new lows which indicates relative weakness in the SOX.

The NDX/SPX cross chart has declined to an area of key support. A break below the summer lows would be very bearish for the overall market.

The defensive XAU was the top gun on the day

The BKX outperformed the NAZ and is still above the short-term trend defining 10ema.

The SOX broke to a new decisive low. The pattern is now below the 4/8 level and will have layered support at the next Murrey math level.

The OSX remains boxed up and could really get ugly if it loses the support in the 217 area. If this happens than the seeker countdown will become very important.

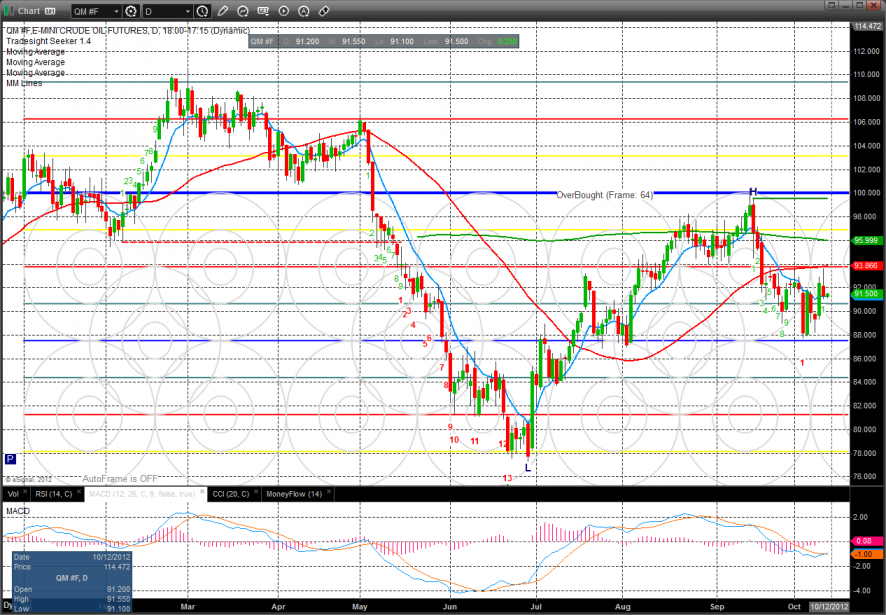

Oil:

Gold:

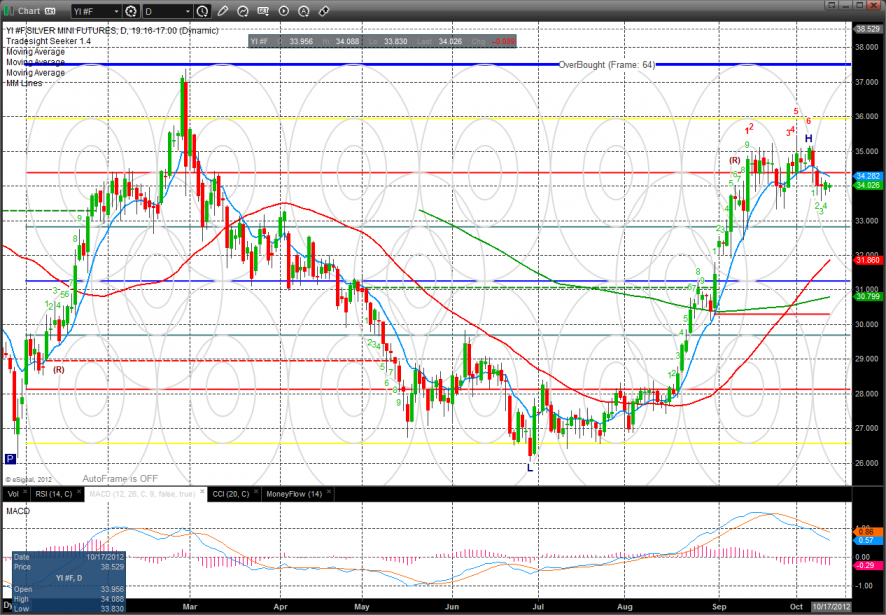

Silver:

Stock Picks Recap for 10/11/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ARNA triggered long (without market support) and didn't work:

GPOR gapped over the trigger, no play.

INCY triggered short (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's GS triggered long (without market support due to opening 5 minutes) and worked:

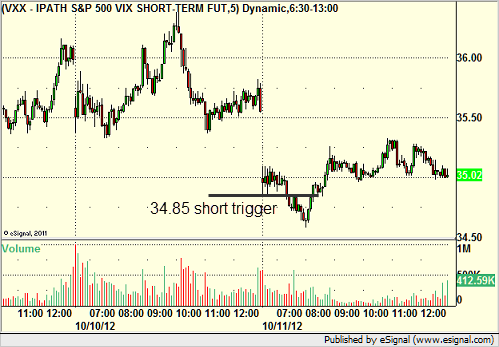

His VXX triggered short (ETF, so no market support needed) and worked enough for a partial:

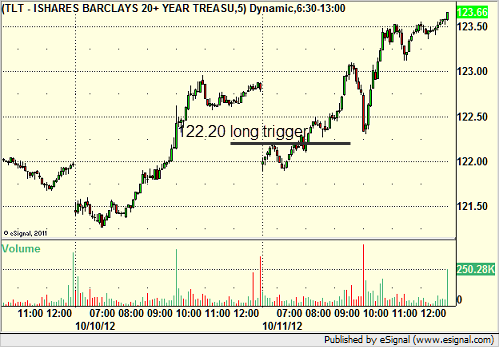

TLT triggered long (ETF, so no market support needed) and worked great:

GOOG triggered short (with market support) and worked:

Rich's PCLN triggered long (without market support) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked.

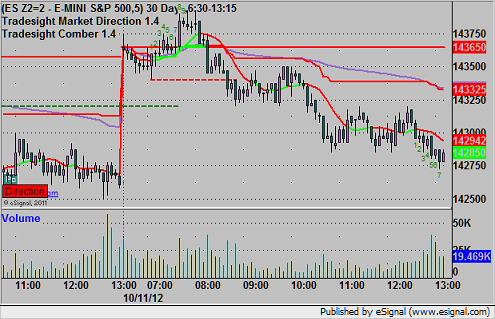

Futures Calls Recap for 10/11/12

A winner in the ES on a light volume day that traded just over half of average daily range. NASDAQ volume was 1.4 billion shares.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at 1433.75 at A and hit the first target for six ticks, then stopped the second half over the entry: