Futures Calls Recap for 10/11/12

A winner in the ES on a light volume day that traded just over half of average daily range. NASDAQ volume was 1.4 billion shares.

Net ticks: +2.5 ticks.

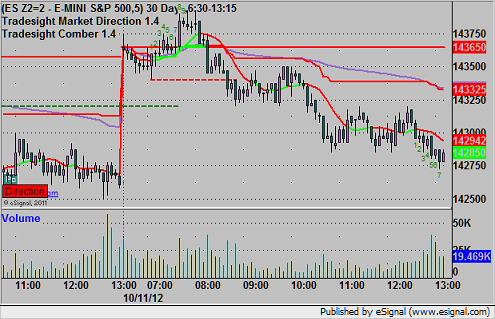

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at 1433.75 at A and hit the first target for six ticks, then stopped the second half over the entry:

Forex Calls Recap for 10/11/12

A winner (still going) and a loser overnight on the EURUSD. See that section below.

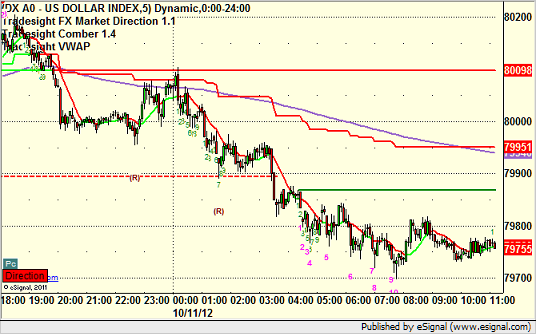

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

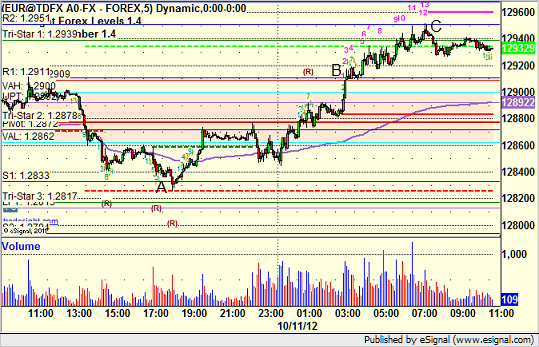

EURUSD:

Triggered short at A and stopped. Triggered long at B, hit first target at C, and holding with a stop under the entry. Note the 13 Comber sell signal right at the high of the session:

Stock Picks Recap for 10/10/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FOSL triggered short (with market support) and worked:

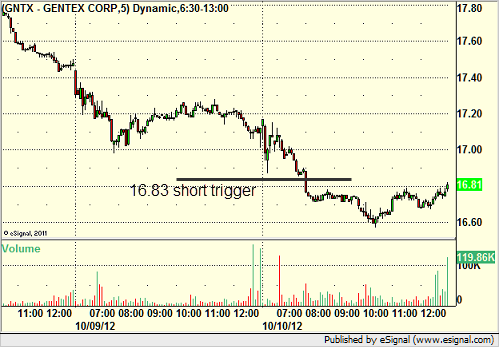

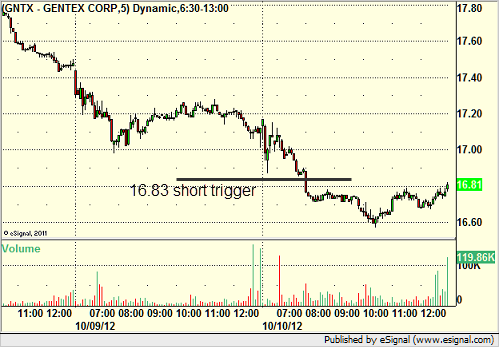

GNTX triggered short (with market support) and worked:

SFLY triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOG triggered short (with market support) and didn't work:

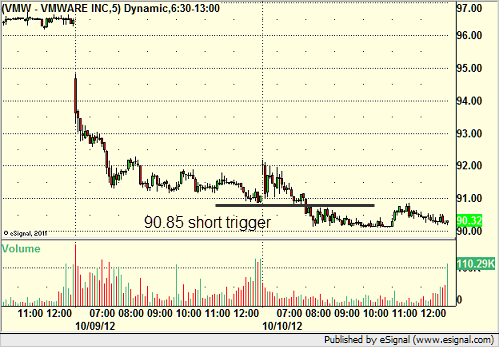

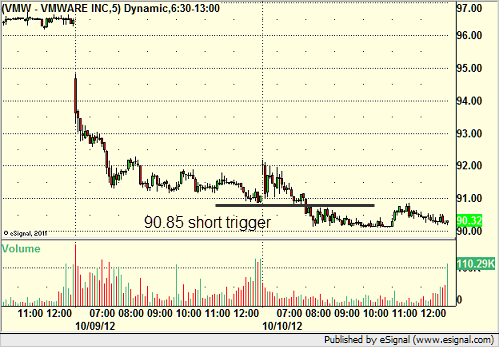

His VMW triggered short (with market support) and worked:

His COST triggered long (without market support) and worked some:

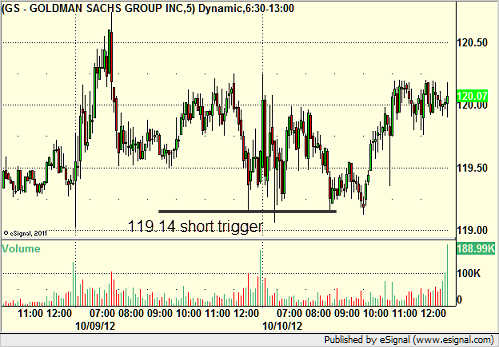

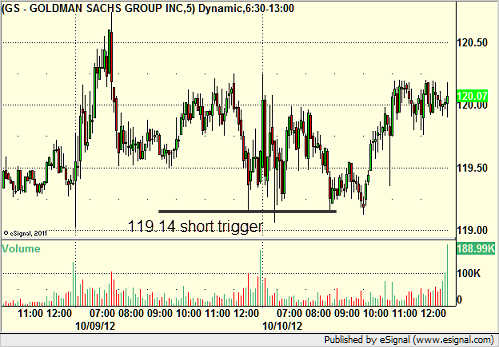

GS triggered short (with market support) and didn't work:

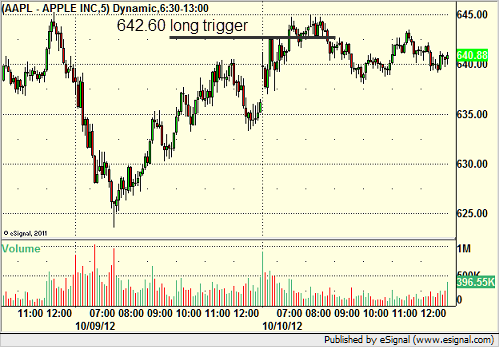

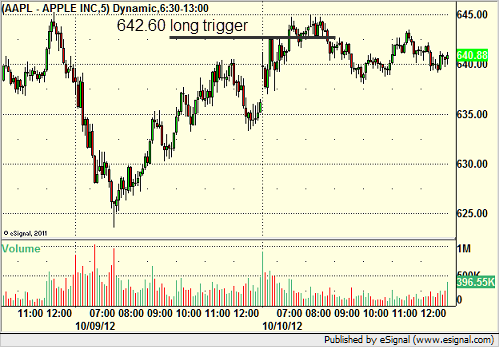

AAPL triggered long (with market support) and worked:

Mark's LOW triggered short (without market support) and didn't work:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

Stock Picks Recap for 10/10/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FOSL triggered short (with market support) and worked:

GNTX triggered short (with market support) and worked:

SFLY triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOG triggered short (with market support) and didn't work:

His VMW triggered short (with market support) and worked:

His COST triggered long (without market support) and worked some:

GS triggered short (with market support) and didn't work:

AAPL triggered long (with market support) and worked:

Mark's LOW triggered short (without market support) and didn't work:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

Futures Calls Recap for 10/10/12

None of our calls actually triggered in what ended up being a better volume day, but a worse day in terms of movement and action for some reason. Very narrow and choppy.

Net ticks: +0 ticks.

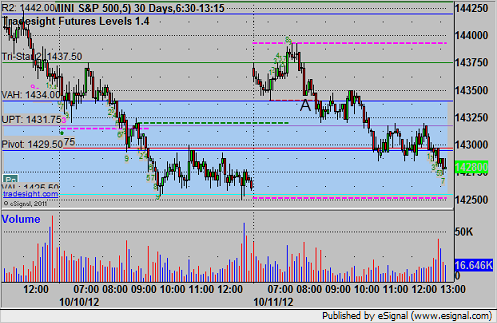

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Forex Calls Recap for 10/10/12

Wow, 70 pips of range on the EURUSD again. Barely swept one of our triggers after a long overnight session doing nothing. See EURUSD below.

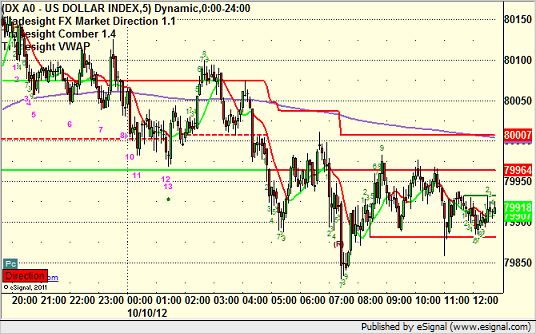

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

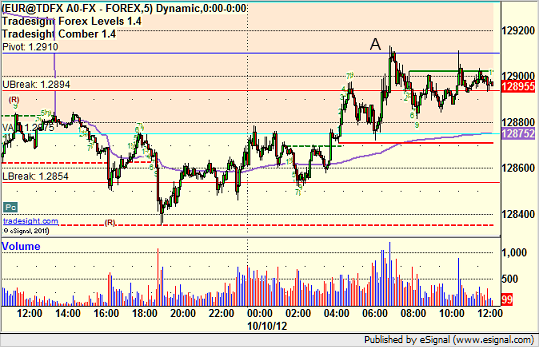

EURUSD:

Early on, it looked like we might head down and trigger the short under S1, but that didn't happen. After a slow, meandering session overnight, we swept the long trigger over the Pivot at A and stopped:

Tradesight Market Preview for 10/10/12

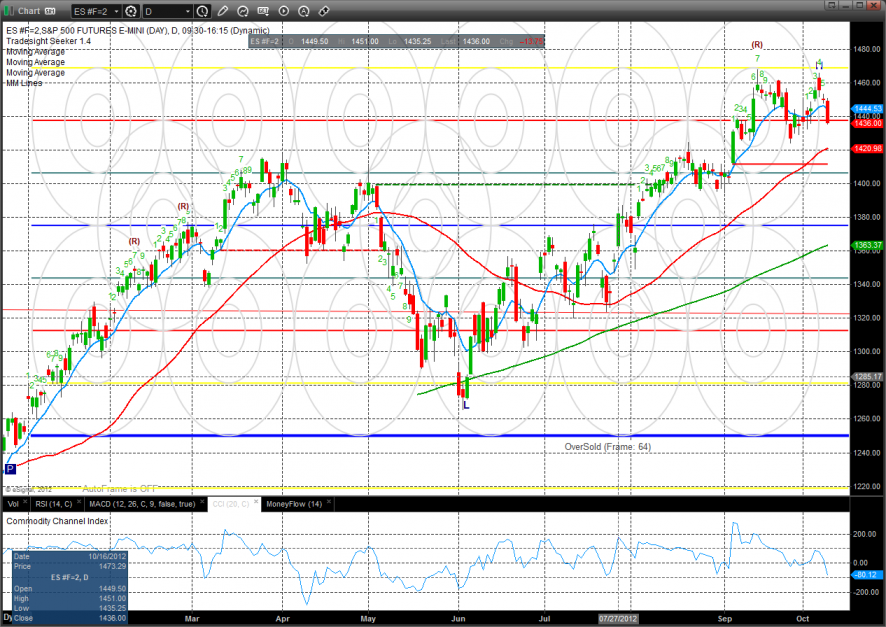

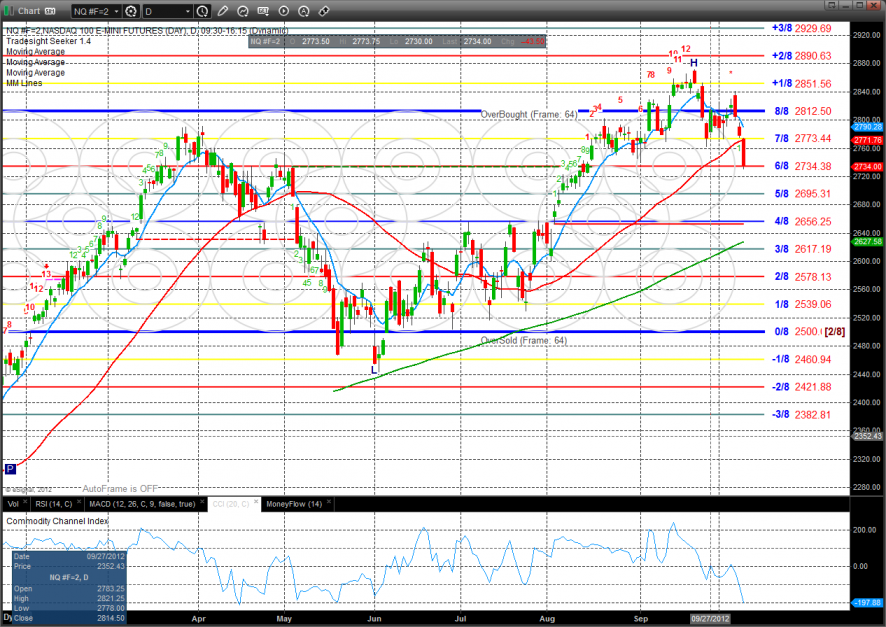

The ES lost 14 on the day, closing decisively back below the 10ema. The double top potential is there but cannot be called so until the September lows are undercut. Note that he September lows will have critical support from the rising 50dma if traded.

The NQ was relatively weak vs. the SP by losing a full 43 handles. The pattern is now below the 10ema and 50sma. The CCI is just above the oversold threshold of -200.

10-day Trin:

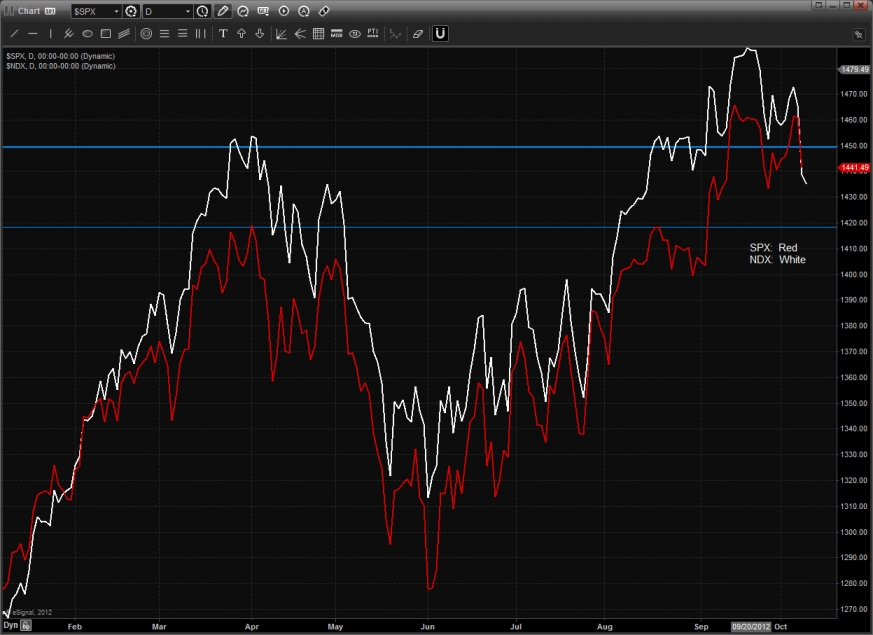

Multi sector daily chart:

Note the relative weakness in the NDX which is always bearish.

The OSX was the only major sector that was higher on the day though price remains bearishly below all of the major moving averages.

The BKX continues to have potential for a double top but the pattern is still positive with price above the 10ema.

The SOX gapped to close at a multi month low. Next support is the Murrey math 3/8 level.

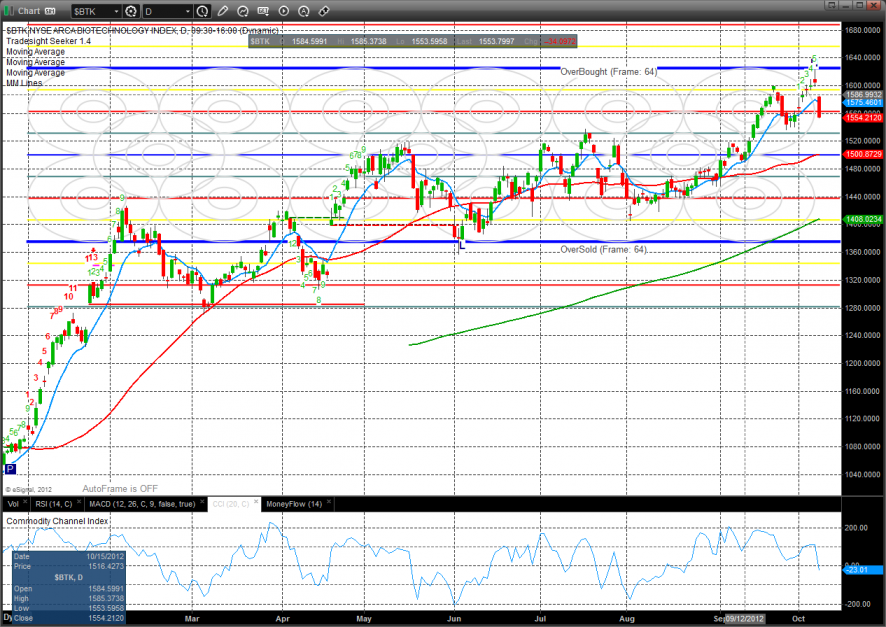

The BTK got slammed, closing weaker than the Naz and broad market. Key support and a break level is the July high.

The computer hardware index was the weakest sector on the day. The recent weakness in HPQ and AAPL are pulling heavily on this index. Note the open gap that is in the sights of the bears to close. The next level to watch after that will be the 0/8 level.

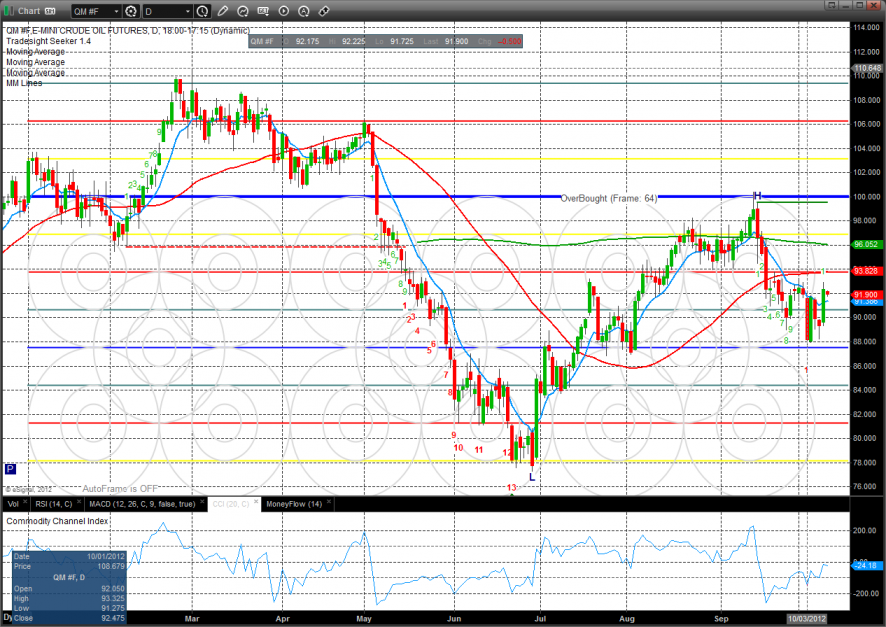

Oil:

Gold:

Silver:

Stock Picks Recap for 10/9/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ACTG gapped under the trigger, no play.

CRUS triggered short (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's GILD triggered short (without market support due to opening 5 minutes) and didn't work:

His FCX triggered long (with market support) and worked enough for a partial:

His AAPL triggered short (with market support) and worked great:

COST triggered long (with market support) and didn't work:

AMZN triggered short (with market support) and worked great:

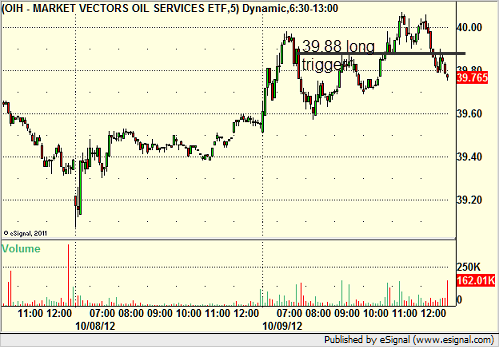

Rich's OIH triggered long (ETF, so no market support needed) and worked enough for a partial:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Futures Calls Recap for 10/9/12

A nice winner on the ES and a stop out on the ER despite light volume in the market. These were both in the morning, as the afternoon was a joke. See both sections below.

Net ticks: +4.5 ticks.

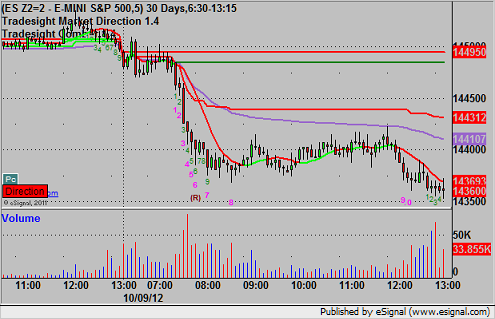

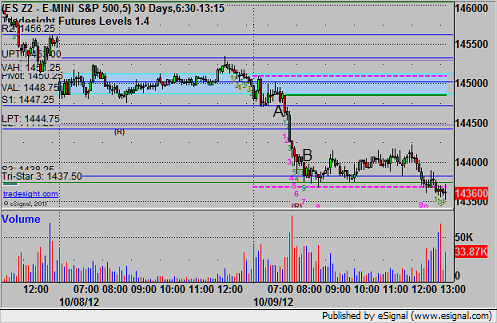

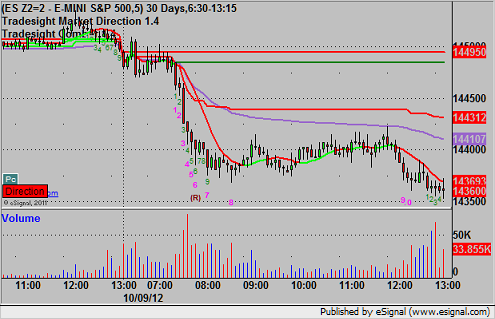

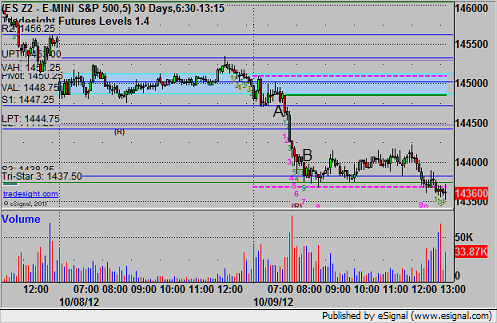

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's short triggered at A at 1446.75, hit first target for 6 ticks, and after several adjustments, stopped the final at 1441 at B:

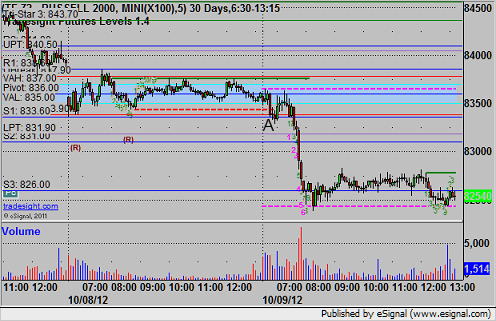

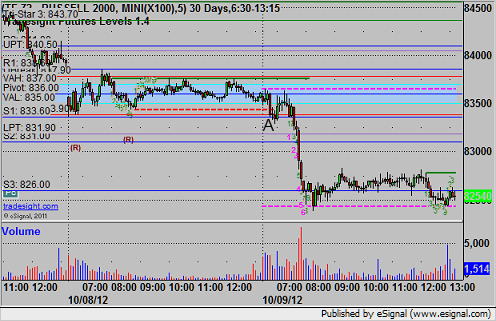

ER:

Mark's short triggered at 833.50 at A and stopped for 8 ticks. He did not re-enter, although that worked:

Futures Calls Recap for 10/9/12

A nice winner on the ES and a stop out on the ER despite light volume in the market. These were both in the morning, as the afternoon was a joke. See both sections below.

Net ticks: +4.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's short triggered at A at 1446.75, hit first target for 6 ticks, and after several adjustments, stopped the final at 1441 at B:

ER:

Mark's short triggered at 833.50 at A and stopped for 8 ticks. He did not re-enter, although that worked: