Forex Calls Recap for 10/9/12

Closed out a nice winner and then two stop outs for the new session. See EURUSD below.

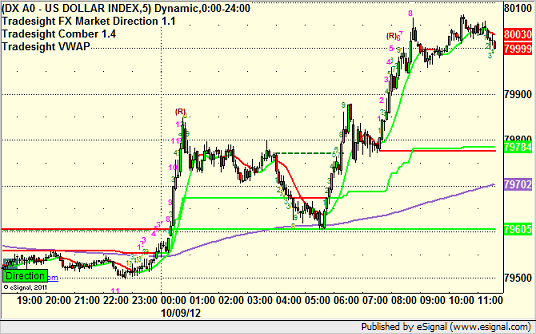

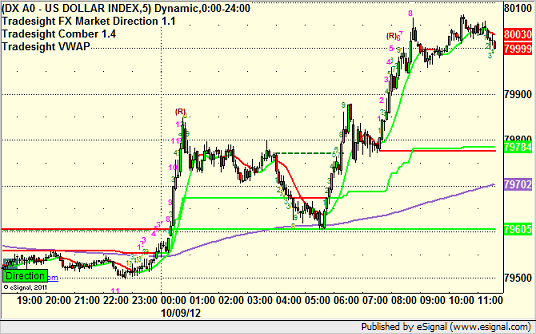

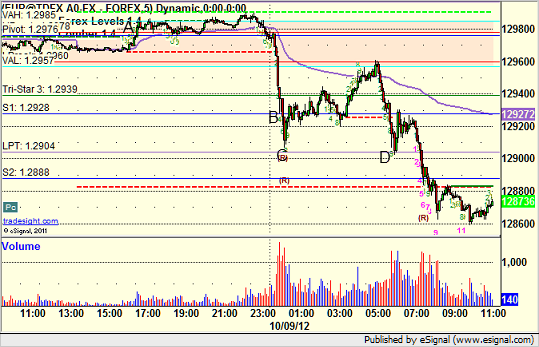

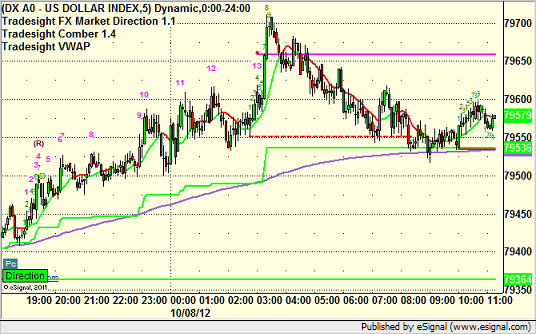

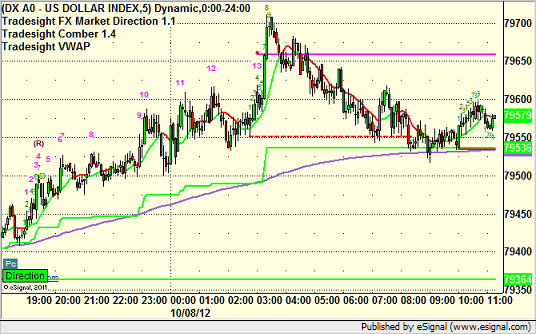

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

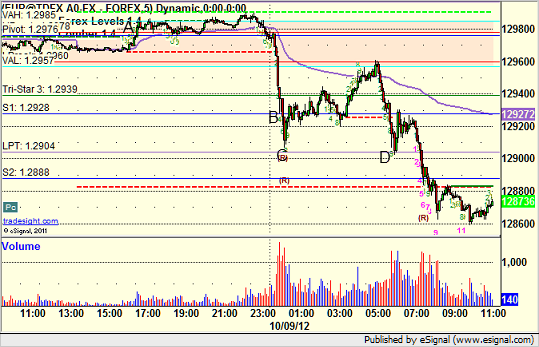

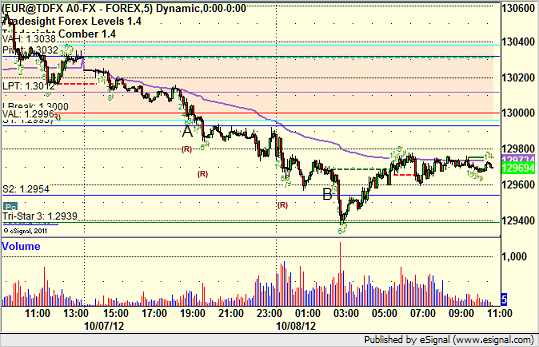

EURUSD:

The second half of our short from the prior session stopped at A and that also triggered out new long very early, which eventually stopped for 25 pips. Also, triggered short at B and stopped. This retriggered and worked, but too early for us:

Forex Calls Recap for 10/9/12

Closed out a nice winner and then two stop outs for the new session. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

The second half of our short from the prior session stopped at A and that also triggered out new long very early, which eventually stopped for 25 pips. Also, triggered short at B and stopped. This retriggered and worked, but too early for us:

Tradesight Market Preview for 10/8/12

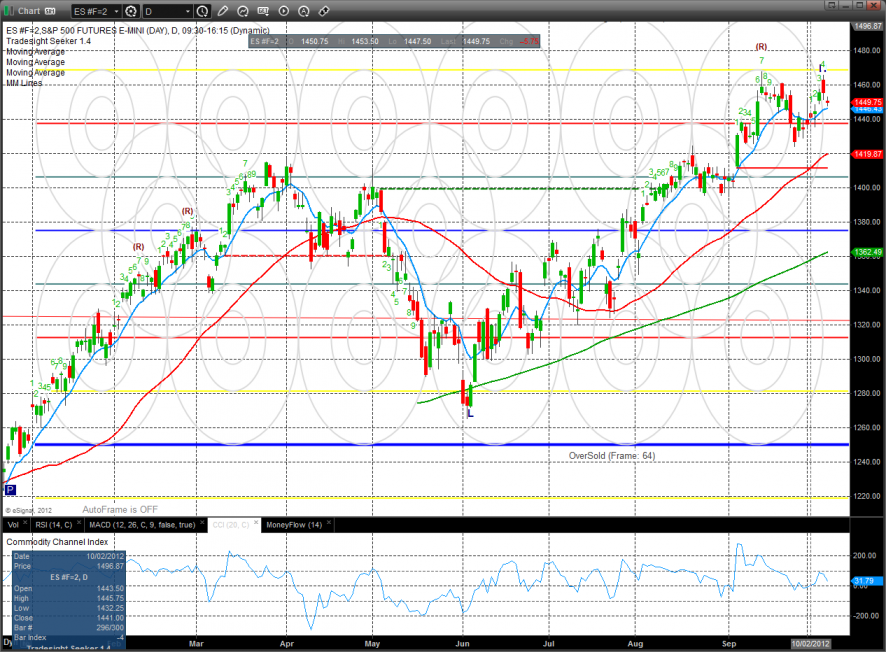

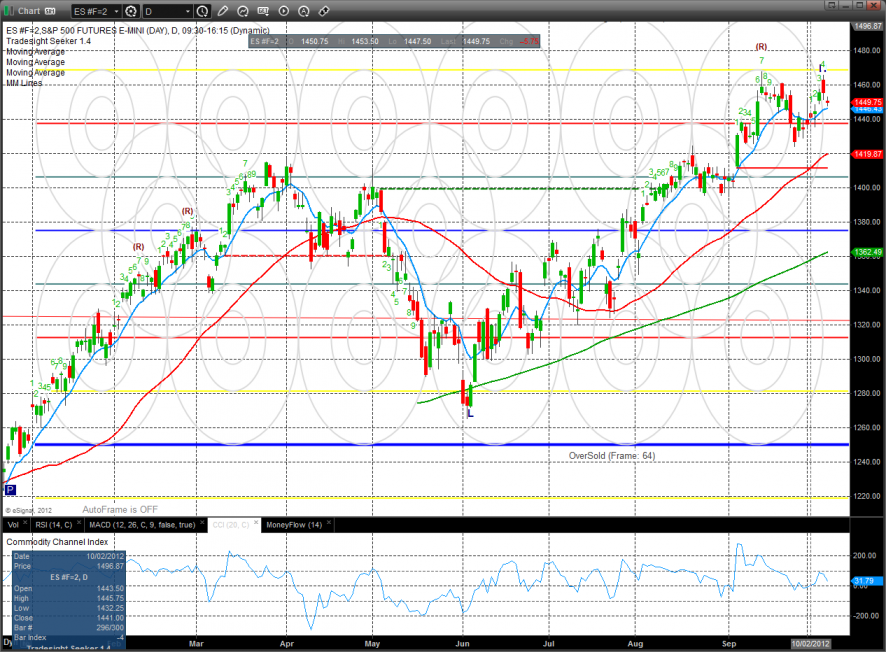

On light, quasi-holiday, trade the ES gapped down and ultimately lost 6 on the day. The gap remains open which leaves an unfavorable 2 day pattern. The old high was tested, leaving a range high camo sell candle on the chart and today a slight follow through.

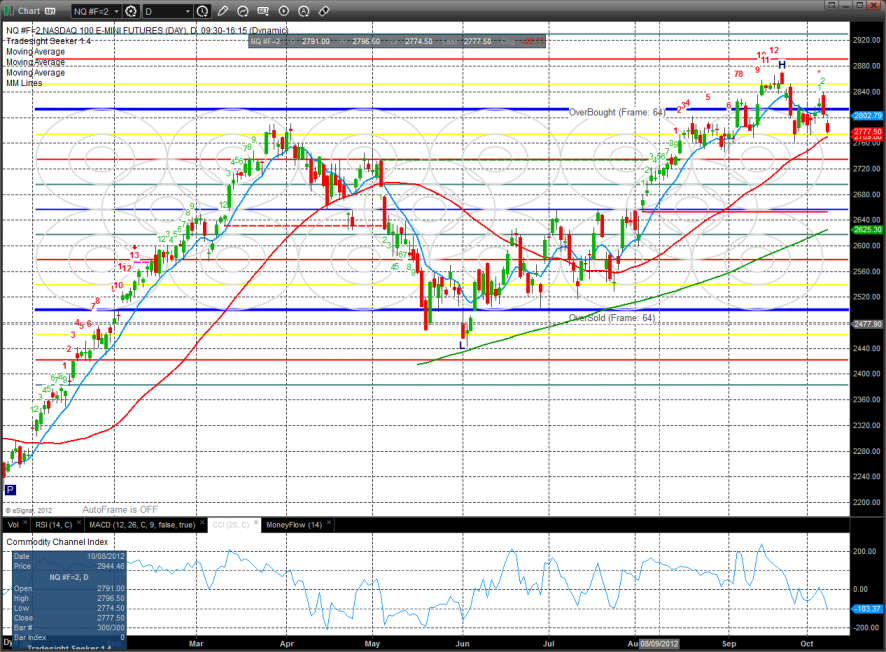

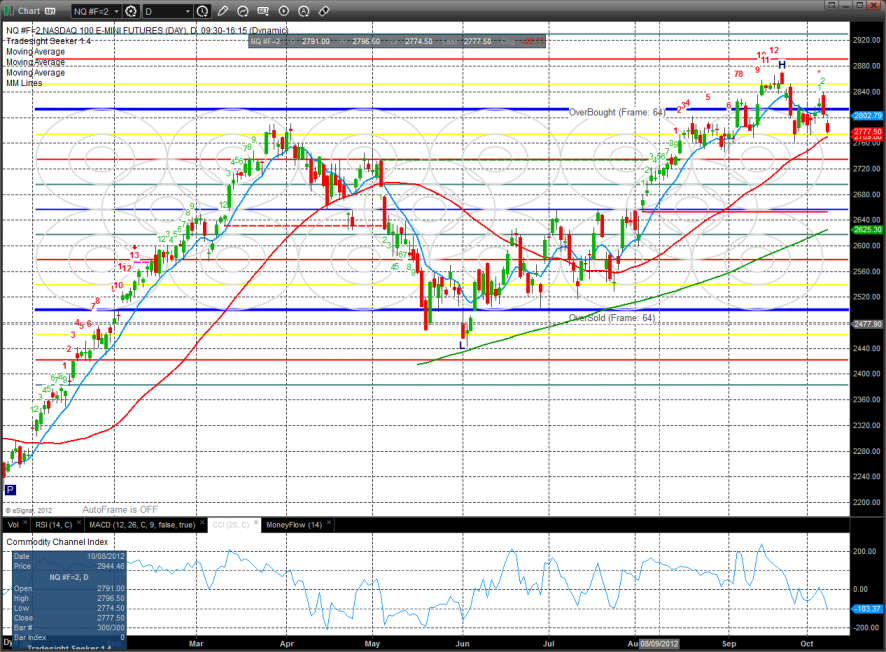

The NQ futures were much, much weaker than the broad market losing 27 on the day. Key support/breakdown level is just below at the 50dma and last month’s low.

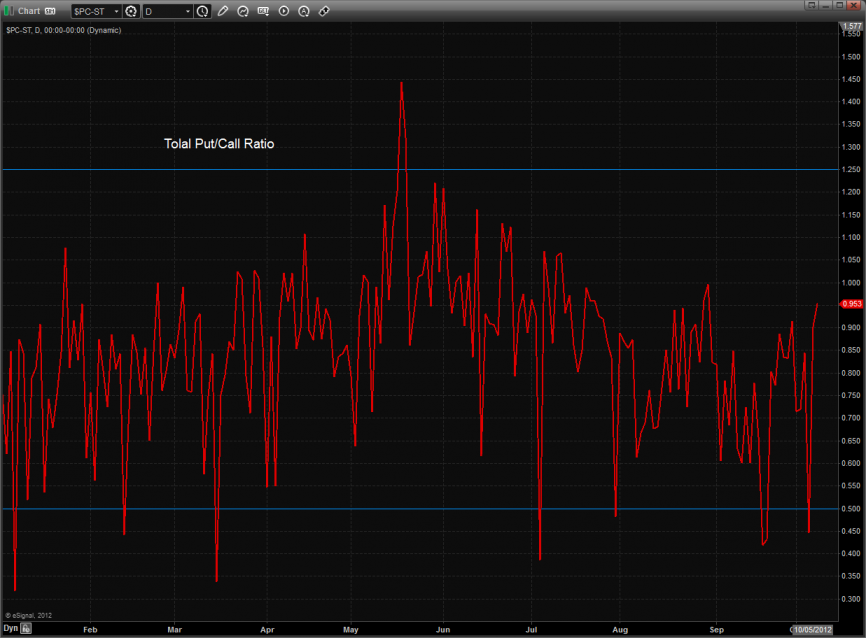

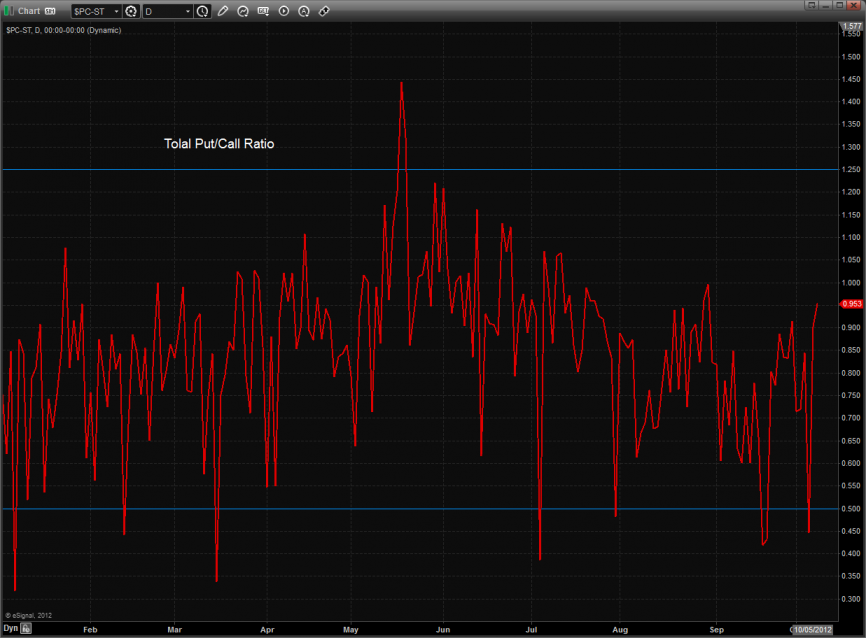

The put/call ratio that is on the rise should raise some eyebrows. The closing reading wasn’t climatic but this is often how you get to one.

The 10-day Trin still has oversold energy to be released.

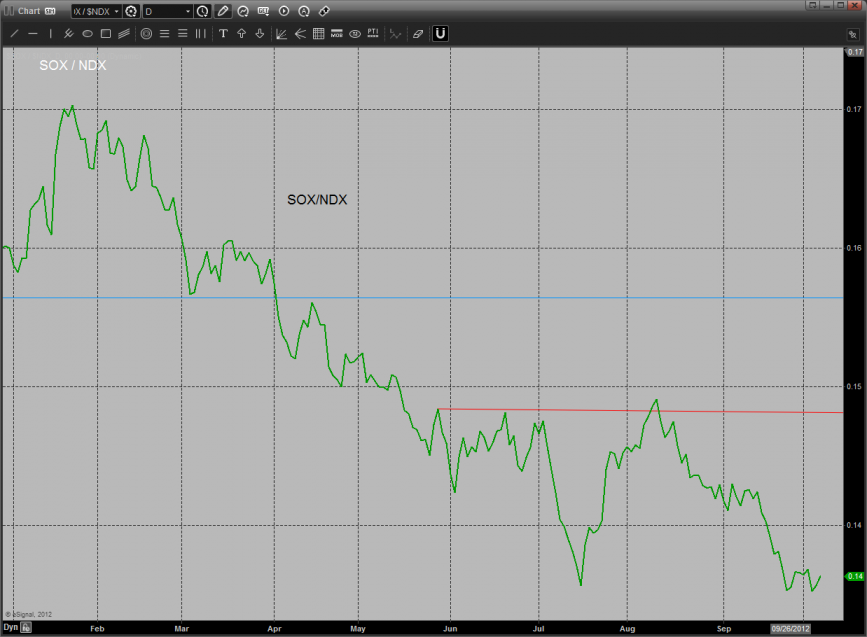

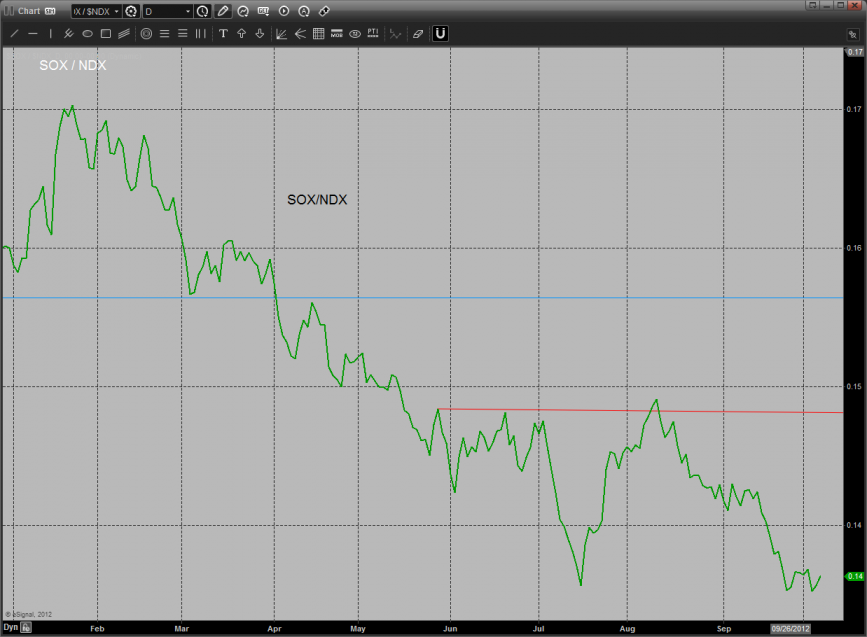

If there is any good news for the bulls form the day’s action it’s that the Sox/Ndx cross didn’t yet break. Stay tuned.

The relative weakness in the NDX vs. the SPX is very bearish. This is exactly what is usually observed before the market moving to short term then intermediate term negative.

The OSX was the top gun on the day but was only marginally positive. Price remains below the important MA’s.

The BKX traded in-line with the broad market. The chart is positive but traders will need to pay close attention to the Sept. lows which would qualify a double top if they are undercut.

The market leading BTK hit the key 8/8 level. We will have to pay close attention to how price interacts with the 10ema.

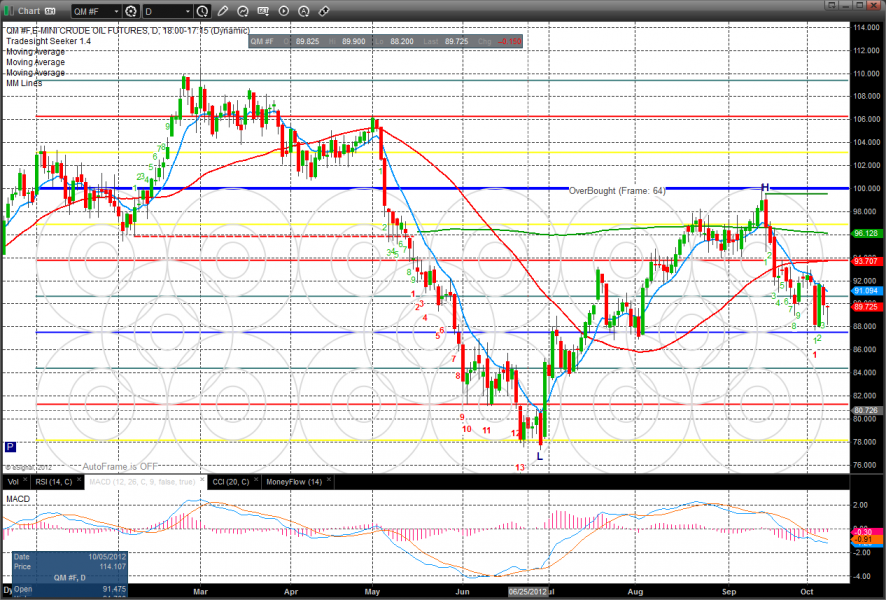

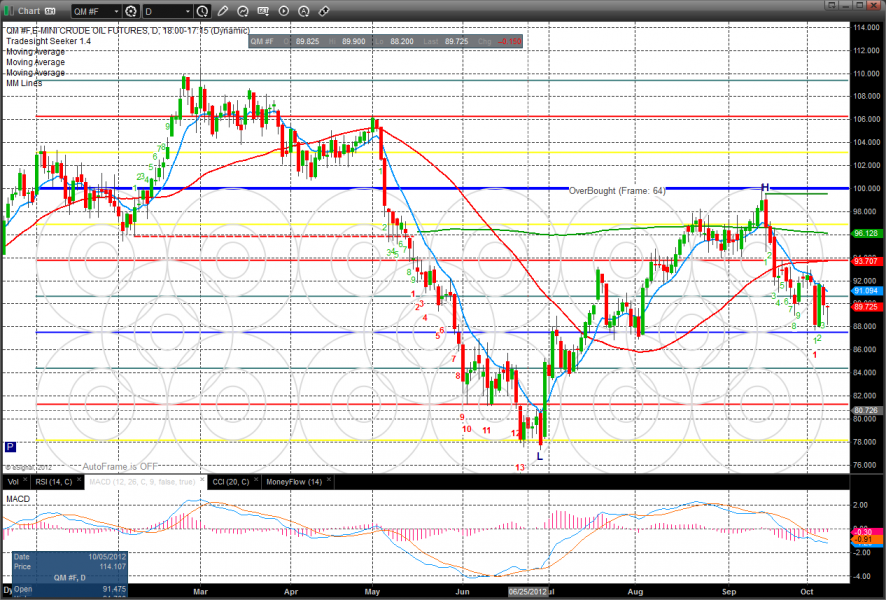

Oil:

Gold:

Silver:

Tradesight Market Preview for 10/8/12

On light, quasi-holiday, trade the ES gapped down and ultimately lost 6 on the day. The gap remains open which leaves an unfavorable 2 day pattern. The old high was tested, leaving a range high camo sell candle on the chart and today a slight follow through.

The NQ futures were much, much weaker than the broad market losing 27 on the day. Key support/breakdown level is just below at the 50dma and last month’s low.

The put/call ratio that is on the rise should raise some eyebrows. The closing reading wasn’t climatic but this is often how you get to one.

The 10-day Trin still has oversold energy to be released.

If there is any good news for the bulls form the day’s action it’s that the Sox/Ndx cross didn’t yet break. Stay tuned.

The relative weakness in the NDX vs. the SPX is very bearish. This is exactly what is usually observed before the market moving to short term then intermediate term negative.

The OSX was the top gun on the day but was only marginally positive. Price remains below the important MA’s.

The BKX traded in-line with the broad market. The chart is positive but traders will need to pay close attention to the Sept. lows which would qualify a double top if they are undercut.

The market leading BTK hit the key 8/8 level. We will have to pay close attention to how price interacts with the 10ema.

Oil:

Gold:

Silver:

Stock Picks Recap for 10/8/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, VECO triggered short (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (with market support) and didn't work, worked later:

His NFLX triggered long (with market support) and worked:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

Stock Picks Recap for 10/8/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, VECO triggered short (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (with market support) and didn't work, worked later:

His NFLX triggered long (with market support) and worked:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

Futures Calls Recap for 10/8/12

One call that didn't trigger and really we shouldn't have put that up either on what was essentially a Holiday session. NASDAQ volume barely hit 1 billion shares.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Futures Calls Recap for 10/8/12

One call that didn't trigger and really we shouldn't have put that up either on what was essentially a Holiday session. NASDAQ volume barely hit 1 billion shares.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

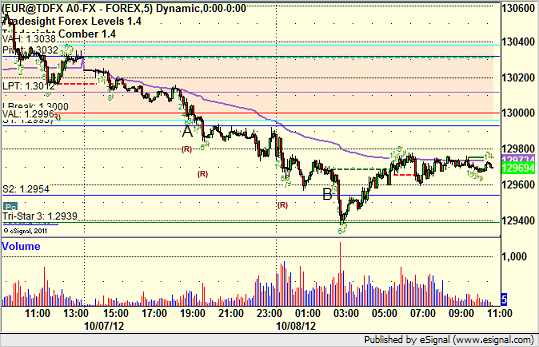

Forex Calls Recap for 10/8/12

A winner to start the week on a Holiday session. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD;

Triggered short at A under S1, hit S2 first target at B, holding second half with a stop over S1:

Forex Calls Recap for 10/8/12

A winner to start the week on a Holiday session. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD;

Triggered short at A under S1, hit S2 first target at B, holding second half with a stop over S1: