Tradesight Market Preview for 10/4/12

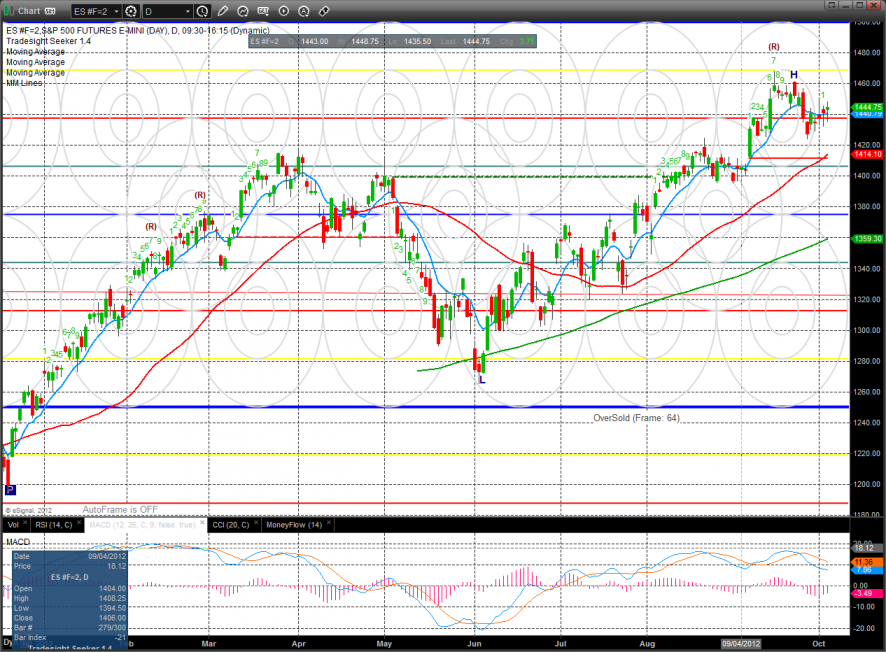

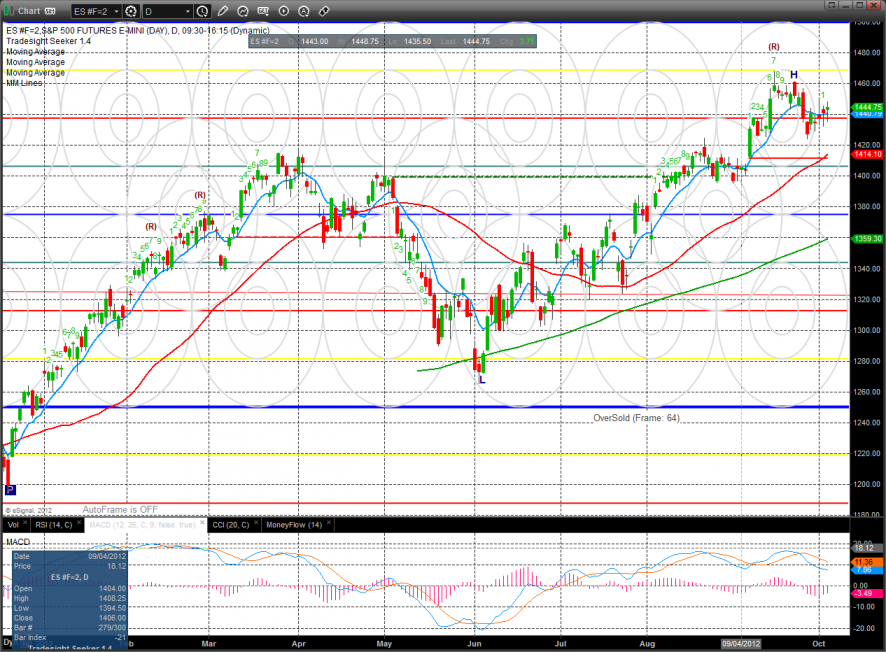

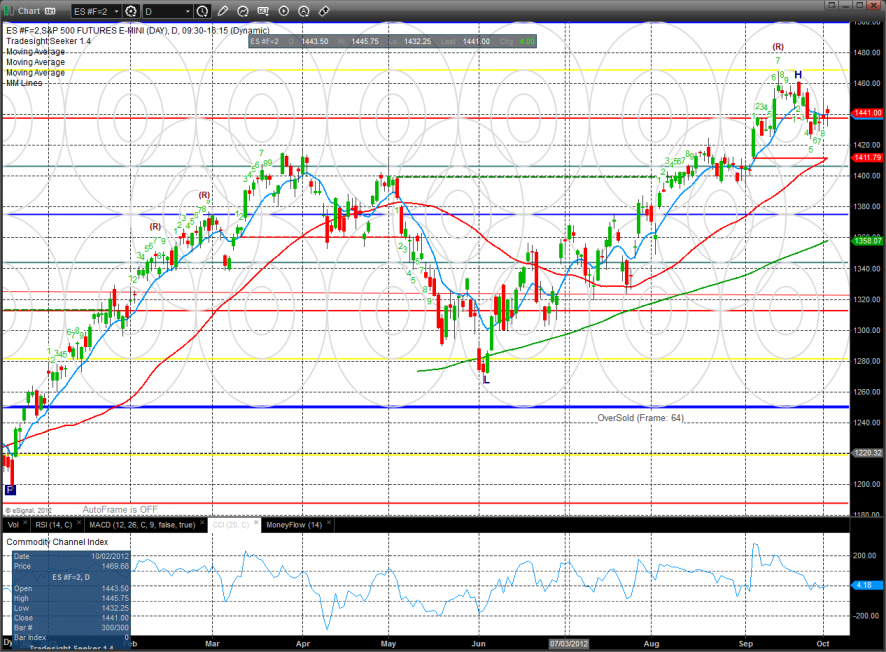

The ES gained 4 on the day and remains in an upwardly drifting pattern. Price is still contained within last week’s range.

The NQ futures are still staging under the key 8/8 level. The Seeker pattern is still 12 days up with an exhaustion signal on deck.

Total put/call ratio:

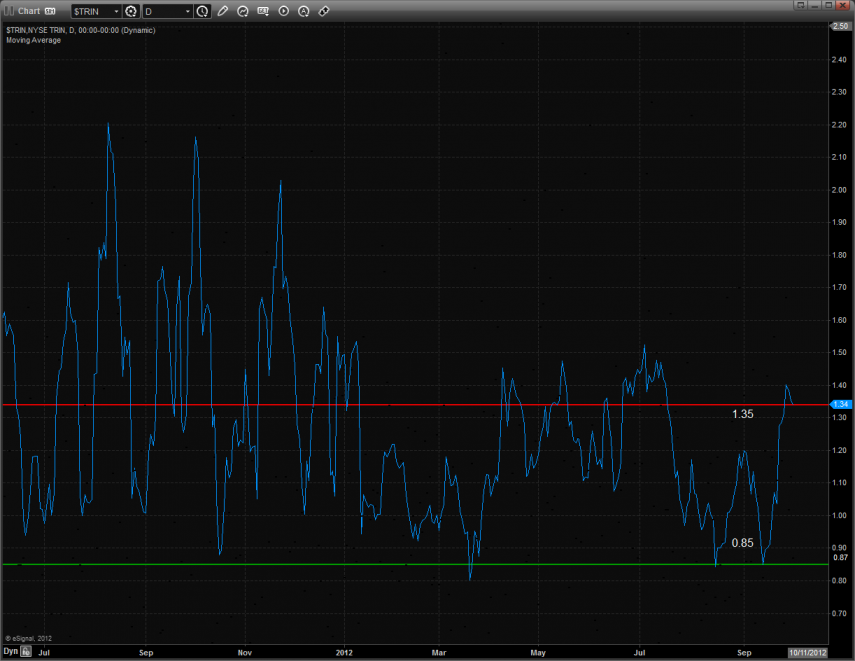

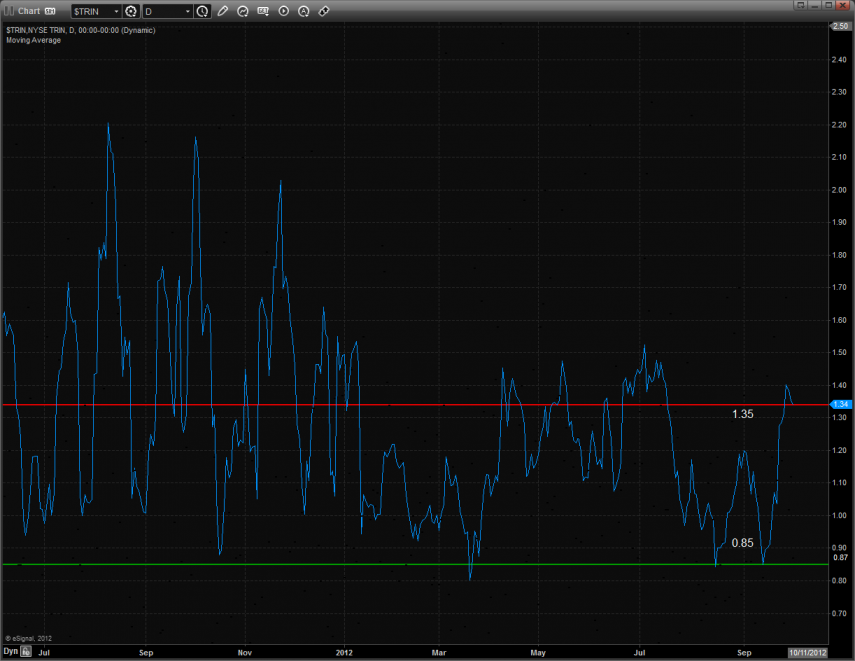

The 10-day Trin is still oversold and has upside energy that hasn’t yet been released.

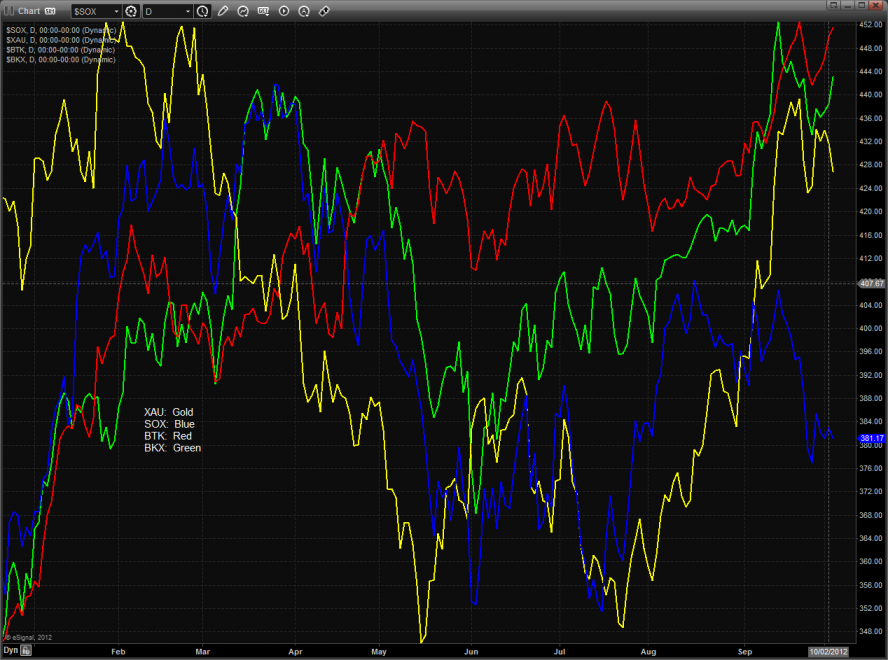

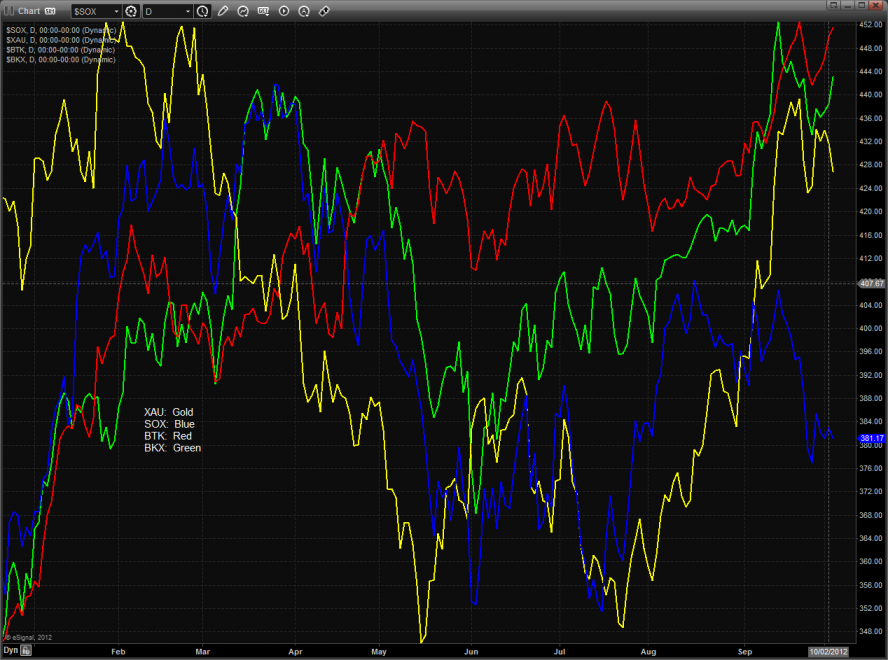

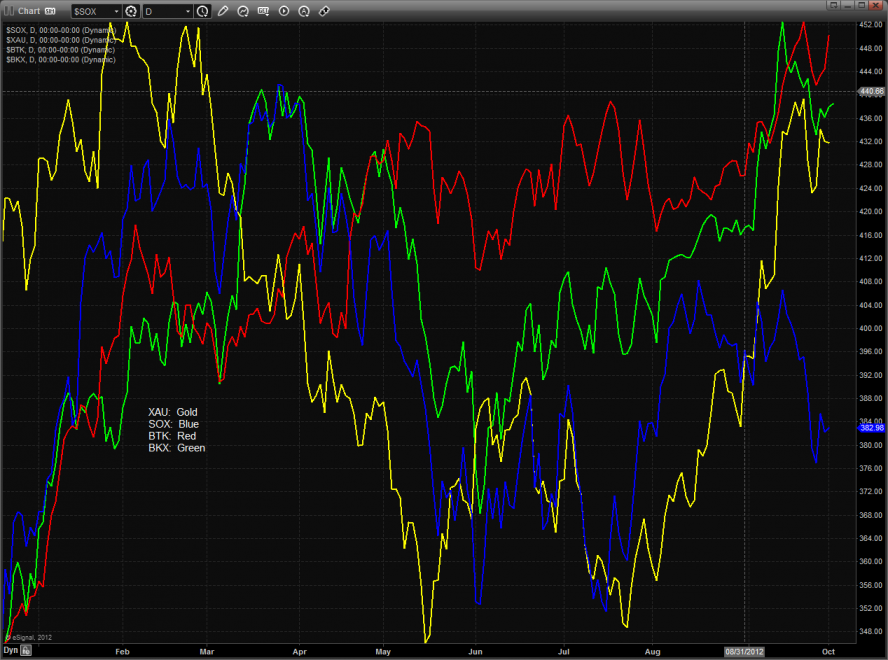

Multi sector daily chart:

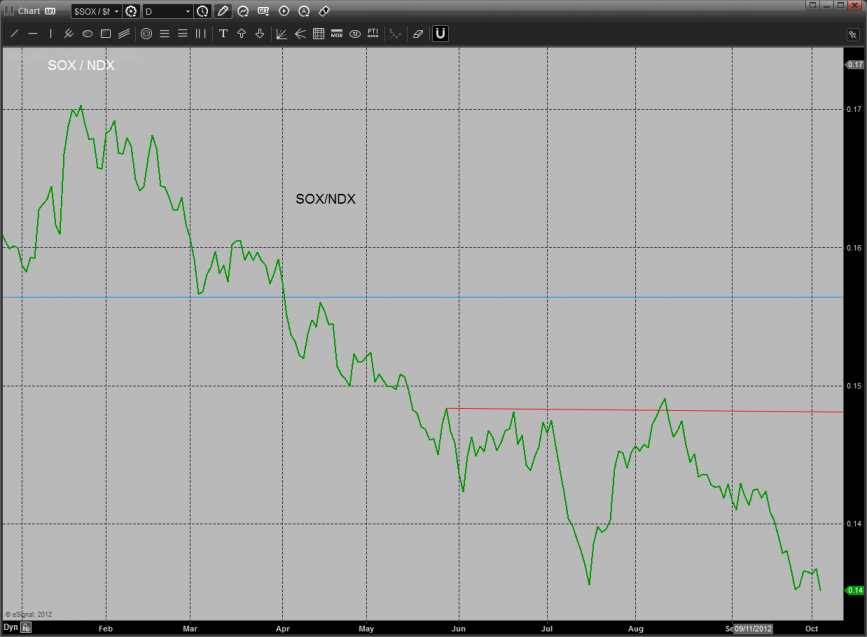

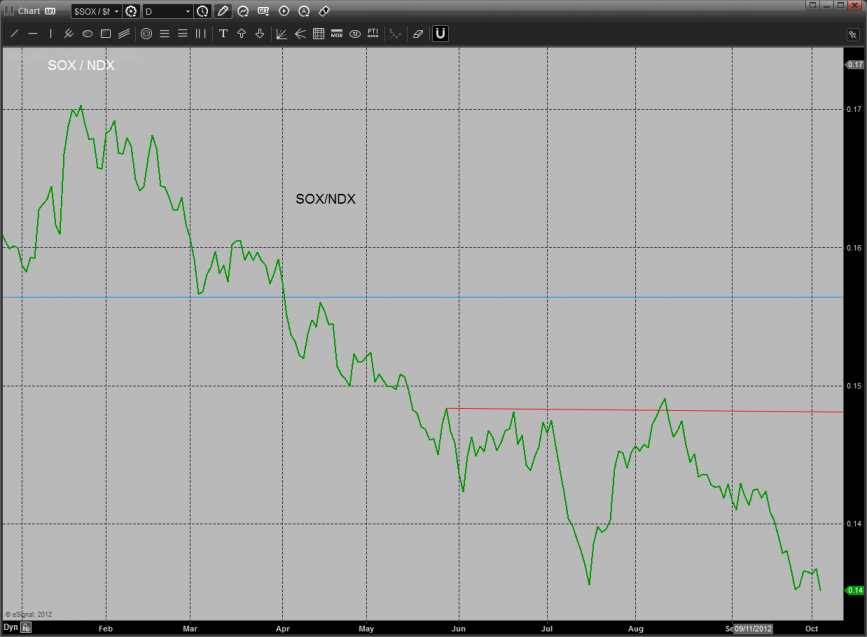

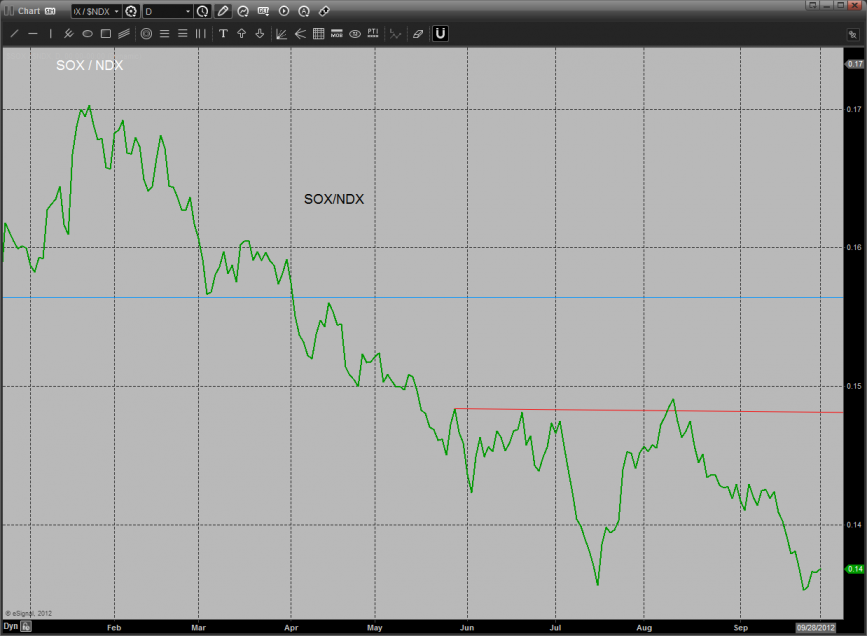

The SOX/NDX cross needs to stop right here or a real break down and new lows for the SOX are in the cards.

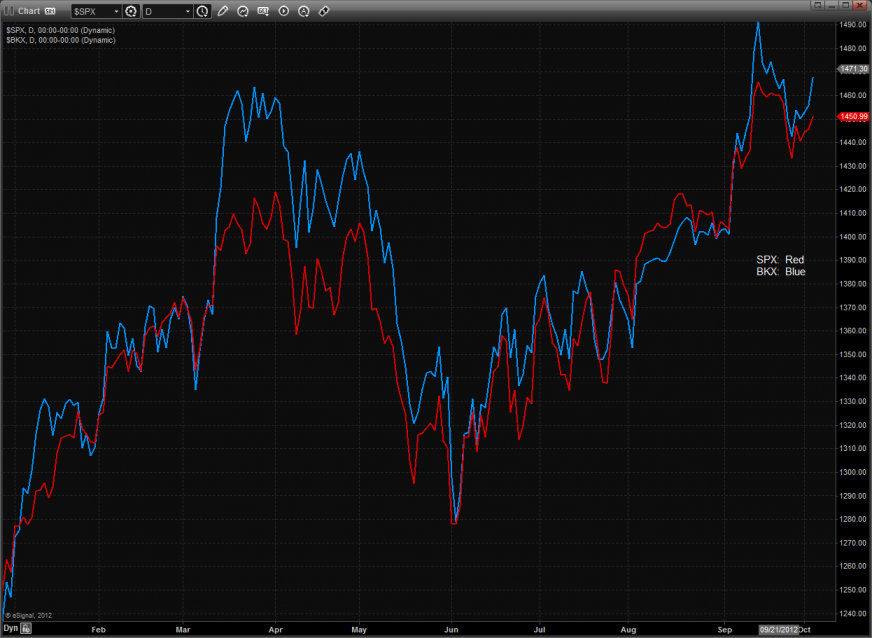

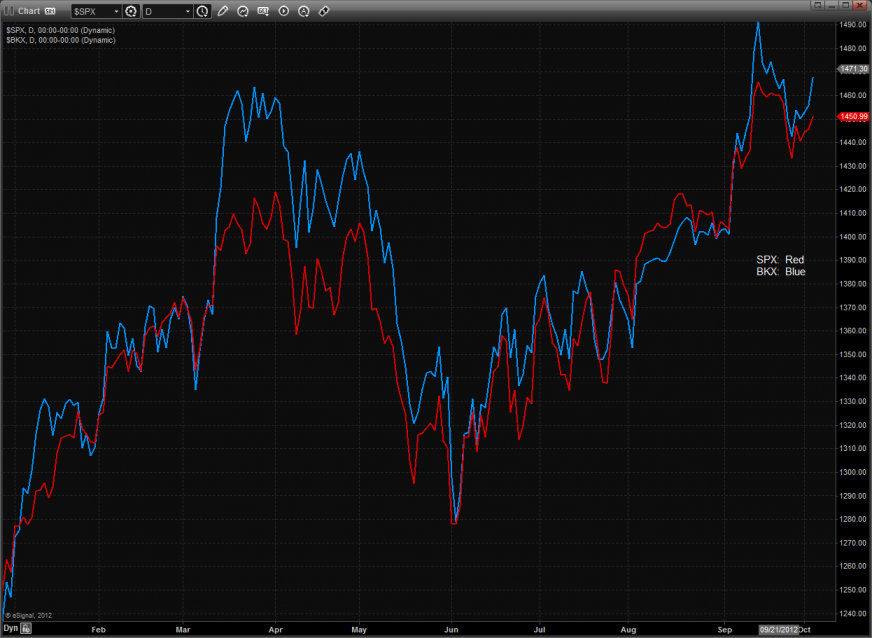

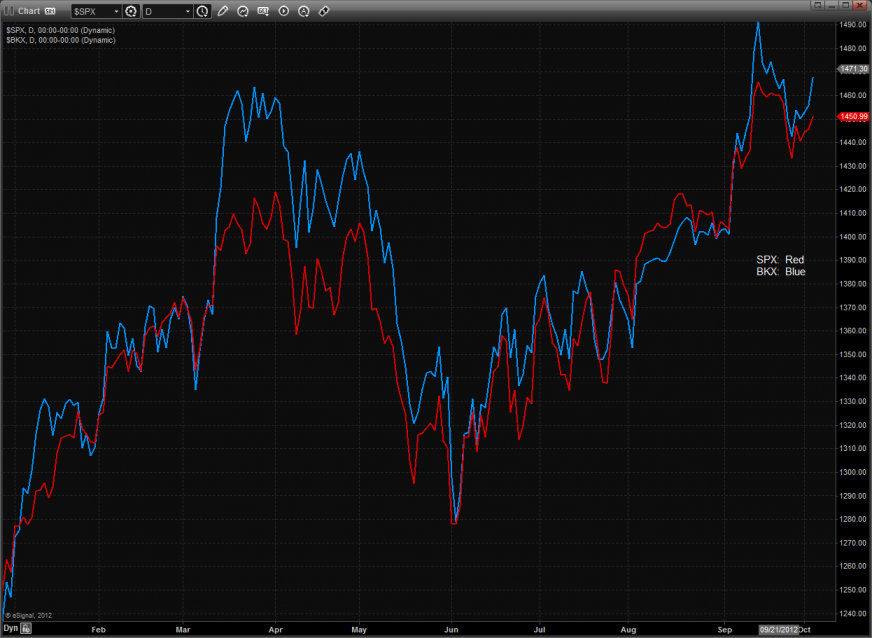

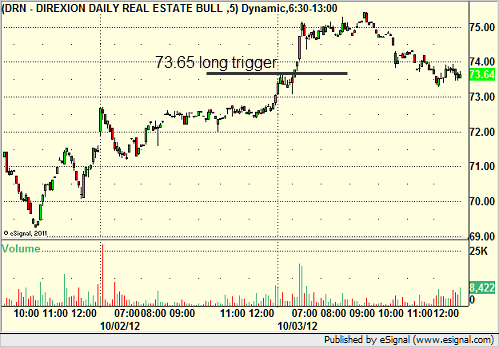

Watch the BKX closely here to see if the financials can exert themselves and provide leadership.

The BKX was again the top gun on the day setting above the key 8/8 level. This close above the 10ema turns the chart short-term bullish.

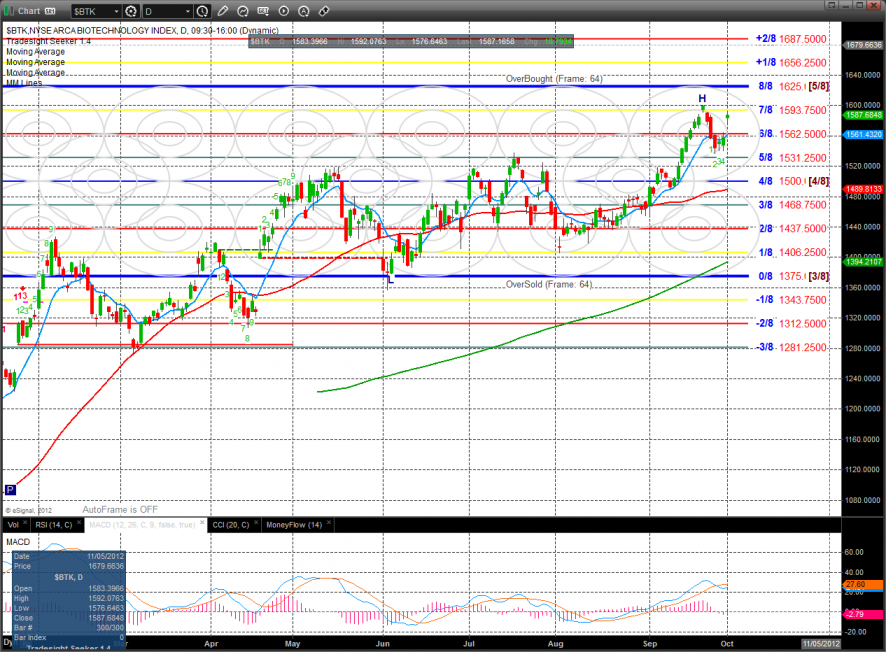

The BTK was relatively strong and settled just below the prior high. Be sure to look at stocks in this sector for 52 week breakouts.

The SOX was weaker than the NQ’s on the day and remains below all of the key moving averages.

The XAU is used the 6/8 level for support and needs to hold here since there is a potential for a lower high. 181 is the next level of support and a close below 188 will qualify the lower high in the pattern.

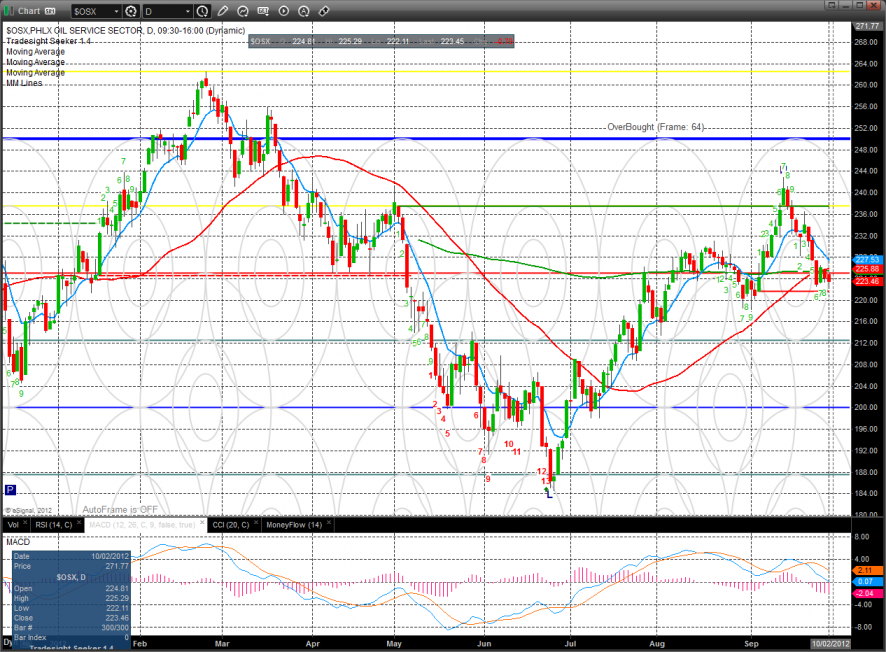

The OSX broke and closed at a new low on the move. This chart looks like trouble for the bulls and should be fuel for the bears to look for shorts. Price broke the static trend line and the MACD breeched the zero line.

Oil put in a notable break and may have trouble holding at the 4/8 level because the MACD has crossed the zero level.

Gold:

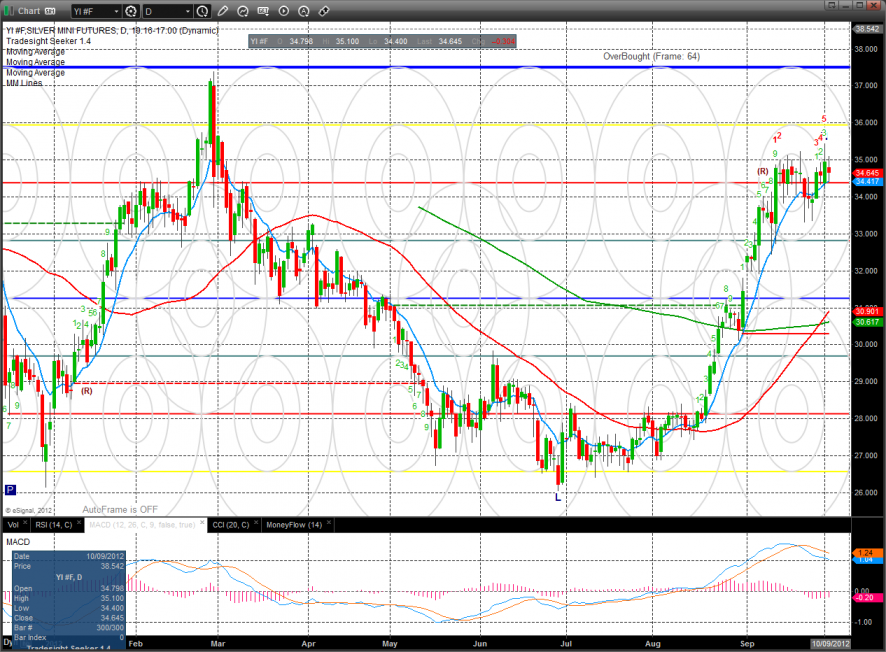

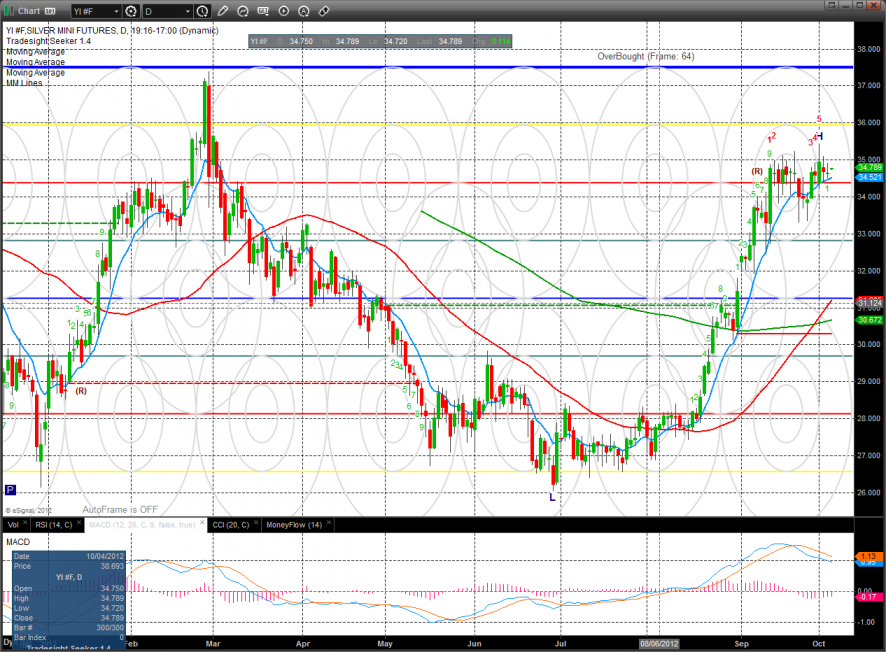

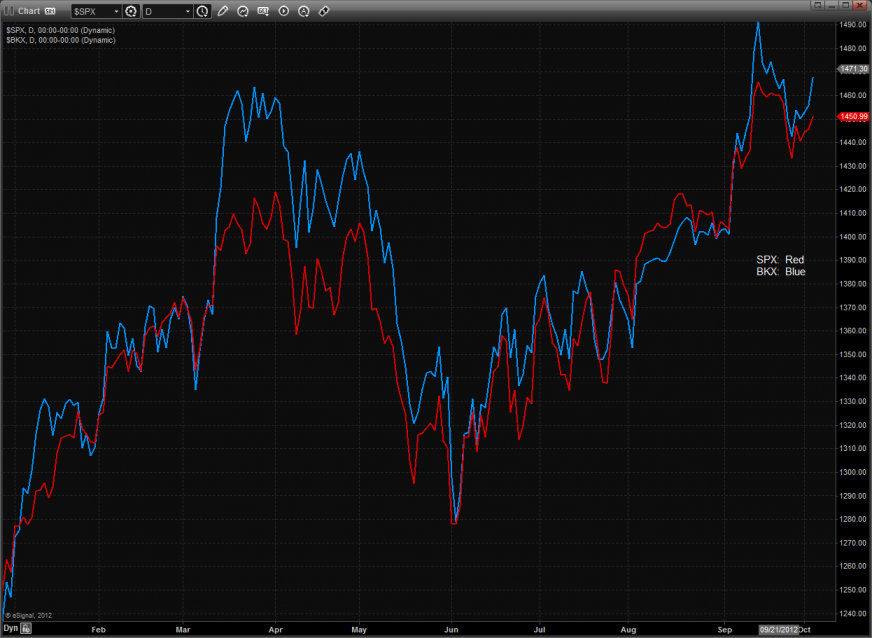

Silver:

Copper:

Tradesight Market Preview for 10/4/12

The ES gained 4 on the day and remains in an upwardly drifting pattern. Price is still contained within last week’s range.

The NQ futures are still staging under the key 8/8 level. The Seeker pattern is still 12 days up with an exhaustion signal on deck.

Total put/call ratio:

The 10-day Trin is still oversold and has upside energy that hasn’t yet been released.

Multi sector daily chart:

The SOX/NDX cross needs to stop right here or a real break down and new lows for the SOX are in the cards.

Watch the BKX closely here to see if the financials can exert themselves and provide leadership.

The BKX was again the top gun on the day setting above the key 8/8 level. This close above the 10ema turns the chart short-term bullish.

The BTK was relatively strong and settled just below the prior high. Be sure to look at stocks in this sector for 52 week breakouts.

The SOX was weaker than the NQ’s on the day and remains below all of the key moving averages.

The XAU is used the 6/8 level for support and needs to hold here since there is a potential for a lower high. 181 is the next level of support and a close below 188 will qualify the lower high in the pattern.

The OSX broke and closed at a new low on the move. This chart looks like trouble for the bulls and should be fuel for the bears to look for shorts. Price broke the static trend line and the MACD breeched the zero line.

Oil put in a notable break and may have trouble holding at the 4/8 level because the MACD has crossed the zero level.

Gold:

Silver:

Copper:

Stock Picks Recap for 10/3/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PRGO triggered long (without market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, GS triggered short (with market support) and worked:

Rich's SODA triggered short (with market support) and didn't work:

His RGLD triggered short (with market support) and didn't work:

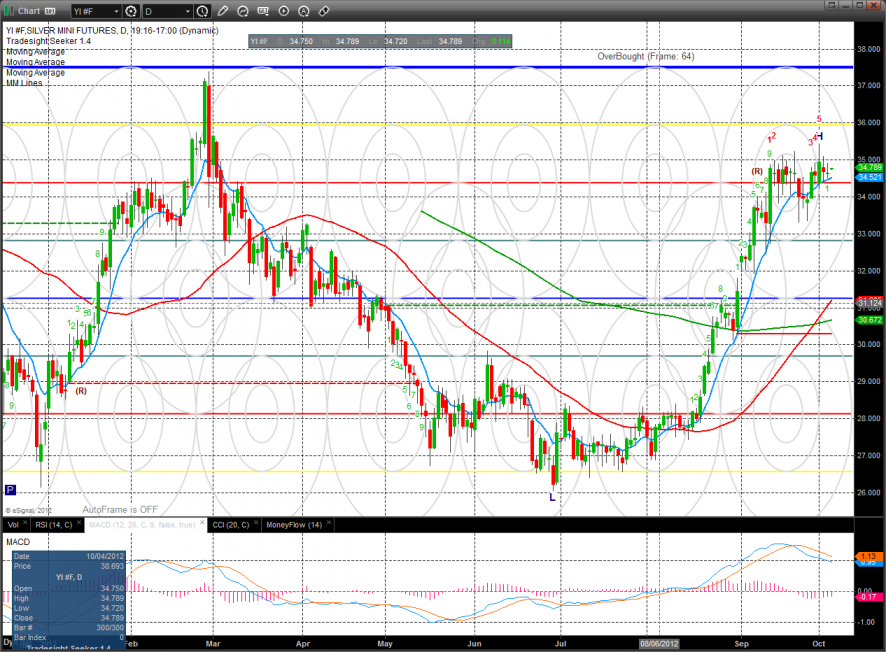

His DRN triggered long (ETF, so no market support needed) and worked:

Rich's GDX triggered short and didn't go enough in either direction to count.

AAPL triggered long (with market support) and worked enough for a partial:

Rich's AAPL triggered long later (with market support) and worked enough for a partial:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

Futures Calls Recap for 10/3/12

Wow. Three stop outs, all of them great setups that failed on light volume, and then a decent winner later. See ES and NQ below.

Net ticks: -12 ticks.

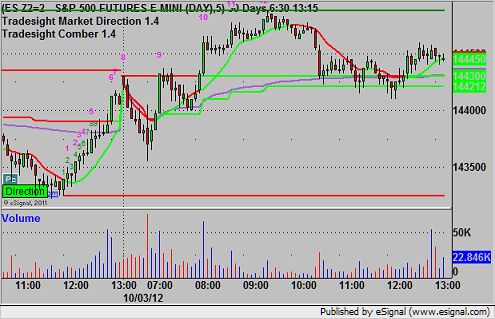

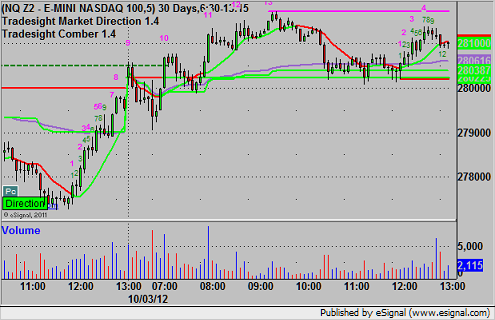

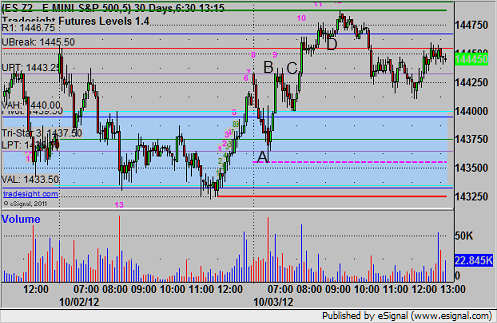

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's short triggered at 1436.25 at A and stopped for 7 ticks. My long triggered at B at 1443.50 and stopped for 7 ticks. The re-triggered hit at C, hit first target for 6 ticks and I raised the stop twice and stopped at 1446.50 at D:

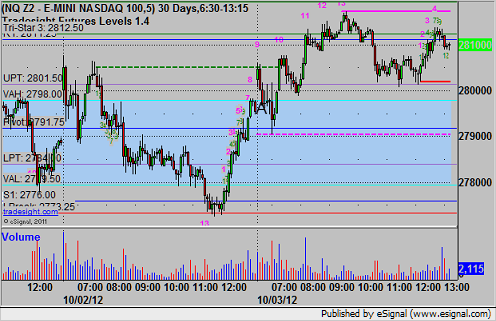

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My call triggered short at 2797.50 at A and stopped for 7 ticks:

Forex Calls Recap for 10/3/12

Ranges so bad, nothing triggered. See EURUSD below to see how bad it was.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

Forex Calls Recap for 10/3/12

Ranges so bad, nothing triggered. See EURUSD below to see how bad it was.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

Stock Picks Recap for 10/2/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FAST triggered long (without market support) and worked enough for a partial:

INWK triggered long (with market support) too late in the day to have time to work:

SODA triggered short (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (with market support) and worked:

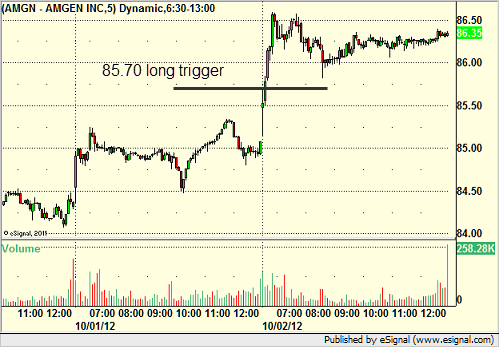

His AMGN triggered long (with market support) and worked:

His PXD triggered short (with market support) and didn't work:

His GOOG triggered short (with market support) and didn't work:

BIDU triggered long (with market support) and didn't work:

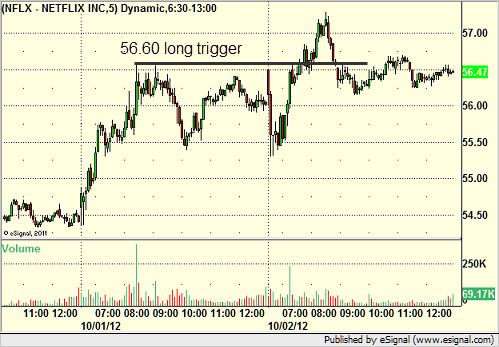

NFLX triggered long (with market support) and worked:

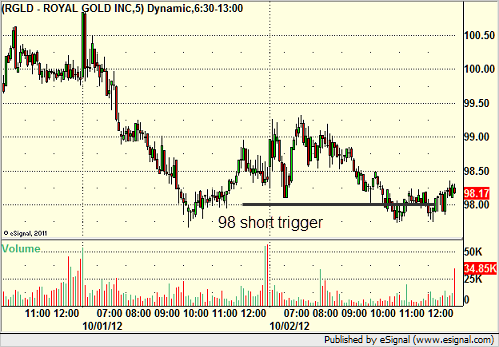

Rich's RGLD triggered short (with market support) and worked enough for a partial:

His FEIC triggered short (with market support) and worked:

Mark's EBAY triggered short (with market support) and didn't work:

GOOG triggered short in the afternoon (with market support) and worked:

Mark's NTAP triggered short (with market support) and didn't work:

In total, that's 11 trades triggering with market support, 6 of them worked, 5 did not.

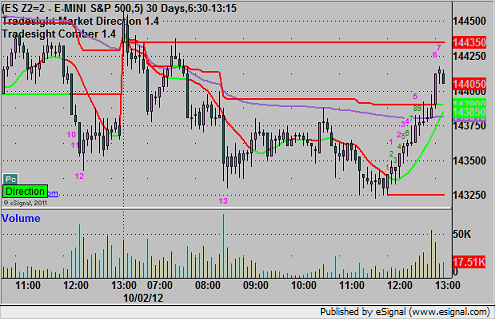

Futures Calls Recap for 10/2/12

One winner, one loser, and one trade closed at breakeven late in the session. See ES and NQ sections below.

Net ticks: -3.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

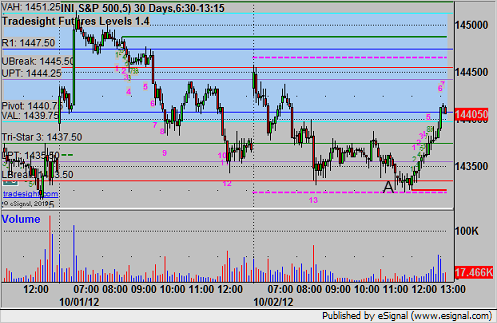

ES:

Mark's short triggered at 1432.75 at A and stopped for 7 ticks. Triggered again shortly after and then closed it in the last hour at the entry price (there was a Seeker 13 buy signal at the time on the NQ):

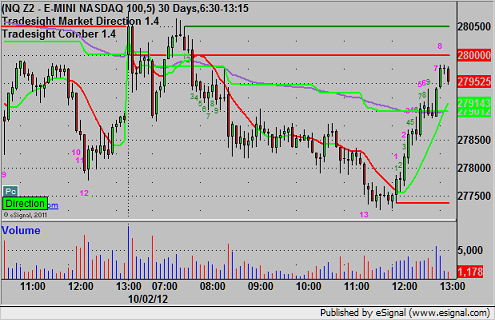

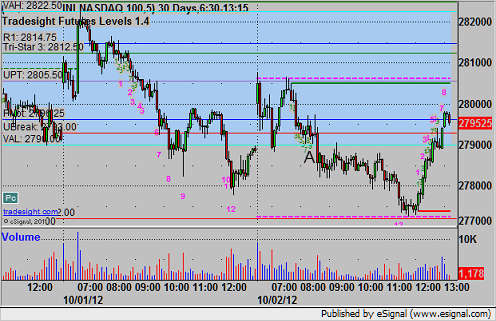

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's short triggered at A at 2787.50 and hit first target for 6 ticks, second half stopped a tick in the money:

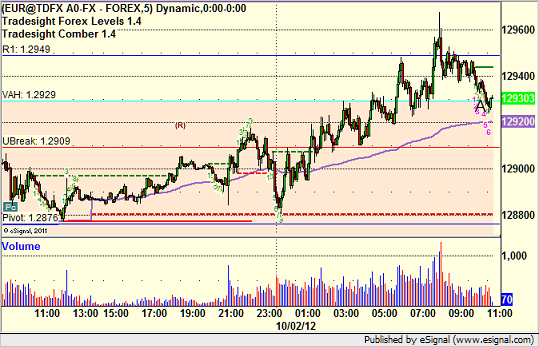

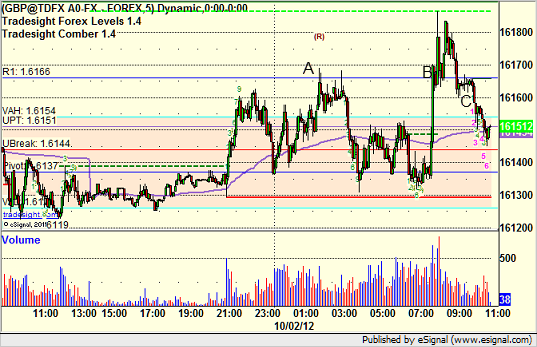

Forex Calls Recap for 10/2/12

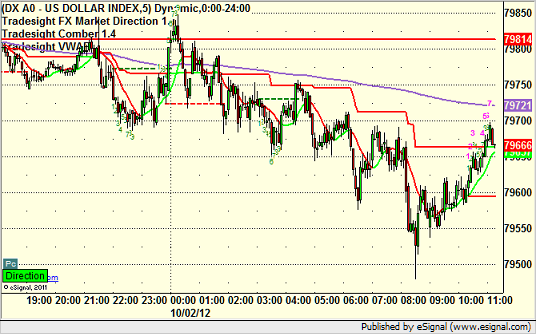

Our EURUSD trade from the prior session stopped 45 pips in the money, but we had a loser in the GBPUSD in this session. See both sections below. Ranges remain light.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Raised stop twice and stopped final piece of prior day's trade at A:

GBPUSD:

Triggered long at A and stopped for 25 pips. Triggered long again at B, raised stop when it hadn't gone anywhere by late in the session, and stopped at C for 10 pips:

Tradesight Market Preview for 10/3/12

The ES was higher by 4 on the day but settled below the opening level. This marks yet another indecisive day for the SPX futures. The Seeker setup count is now 9 days down but bars 8 & 9 are too high to qualify a bounce.

The NQ futures are still below the 10ema and the key 8/8 Murrey math level. This is the 5th candle in basically the same range so when this mini-pattern breaks out it should have some punch. Note that the MACD is negative but still above the zero line.

The 10-day Trin is still in the oversold area:

Multi sector daily chart:

The SOX/NDX cross is still hovering at range low but has yet to definitively breakdown.

The SPX/TLT cross is still well below the high and is showing a defensive posture from the larger investors.

The NDX continues to lose relative strength. AAPL is the key here and if it breaks down then the NDX and by association the SPX is doomed.

The BTK was the top gun on the day and is poised to challenge the prior high. There is no Seeker count to stand in the way of it taking a shot at the 8/8 level or even the overbought Murrey math levels.

The SOX was stronger than the NDX but posted an inside day. Keep in mind that the close was below all of the major moving averages and the MACD is below the zero line.

The BKX remains below the 8/8 level and needs to get something going.

The OSX made a new low on the move and is using he active static trend line for support. There is a window of opportunity for the bulls to make a move before the MACD loses the zero line. Time is short and if energy is moving lower the overall market will feel the pull.

Oil:

Gold:

Silver: