Tradesight Market Preview for 10/2/12

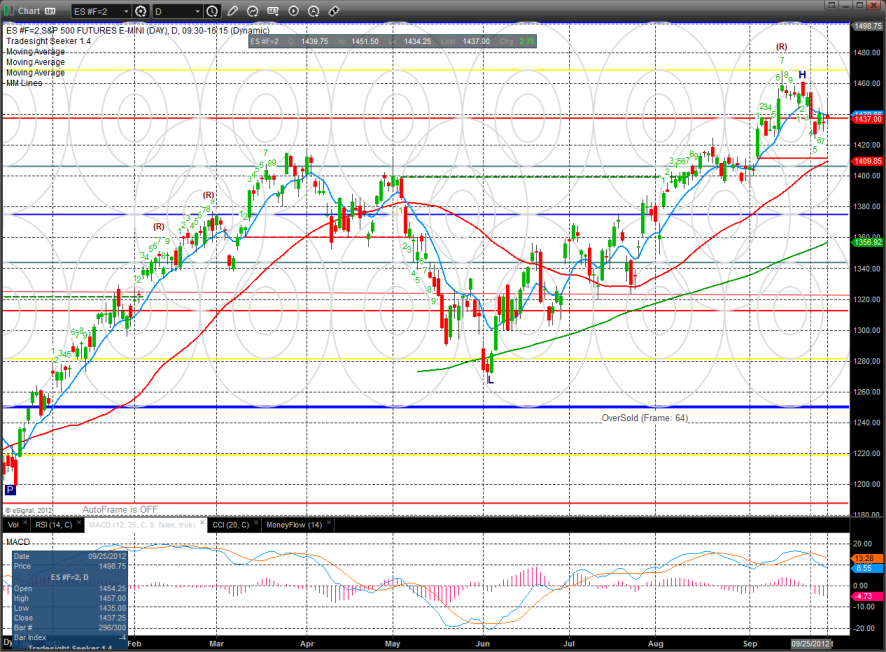

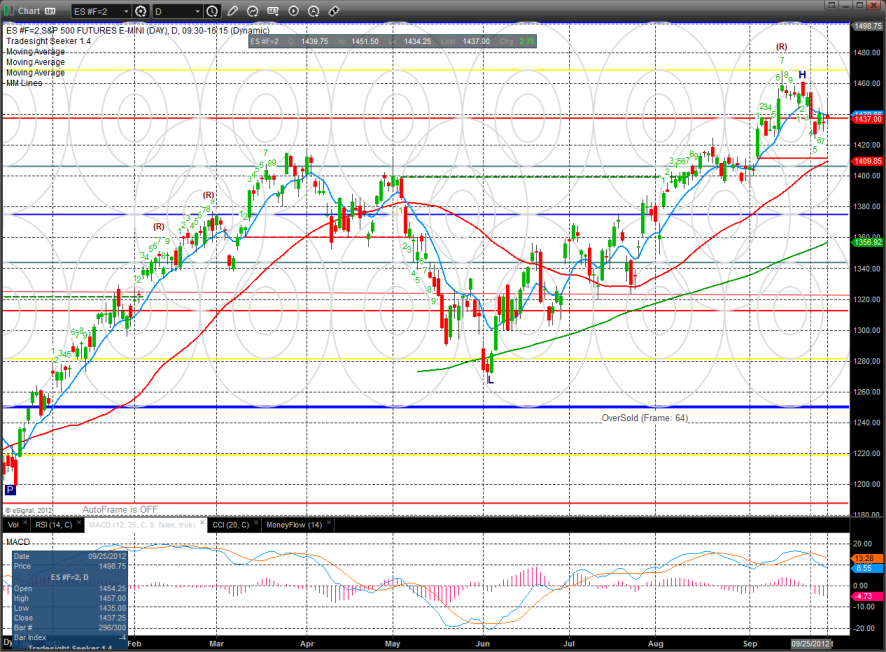

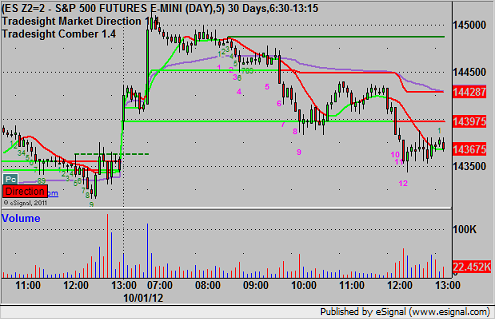

The ES settled higher on the day by 3. Since price settled below the open but up on the day it is a camouflage sell signal. Also on the chart is very tall tail which is never bullish at range high.

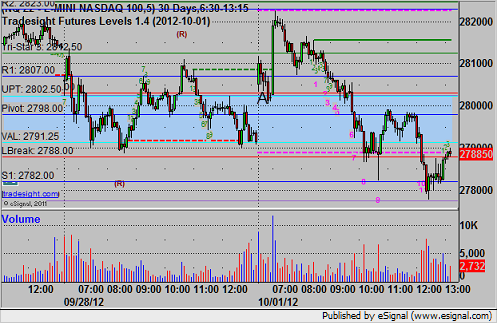

The NQ futures were much weaker than the broad market all day. Price closed below the open and lost a net 4 handles on the day. Keep in mind that the Seeker sell count is 12 days up.

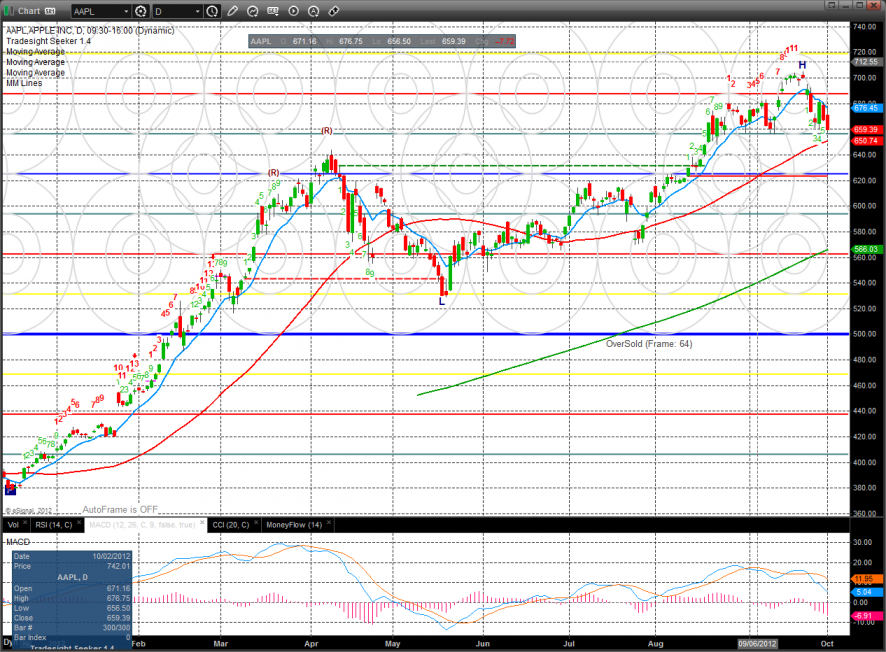

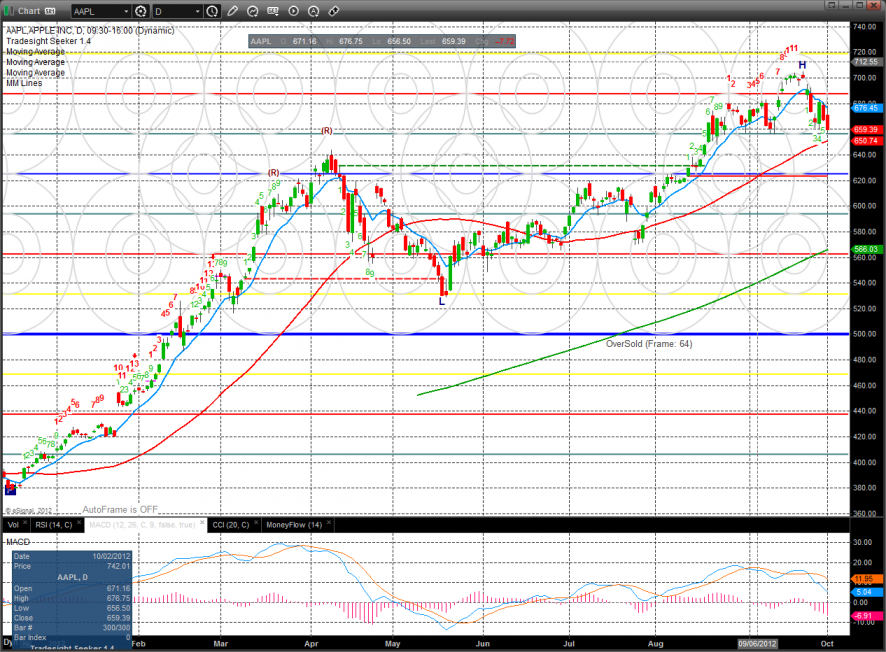

AAPL is the locomotive engine that drives the NQ and today it closed below last week’s low and in fact it made a new low monthly close. We usually don’t talk about individual stocks in this part of the report but since AAPL has such a heavy weighting in the NQ’s and with its supply chain can really dictate which track the NQ train takes.

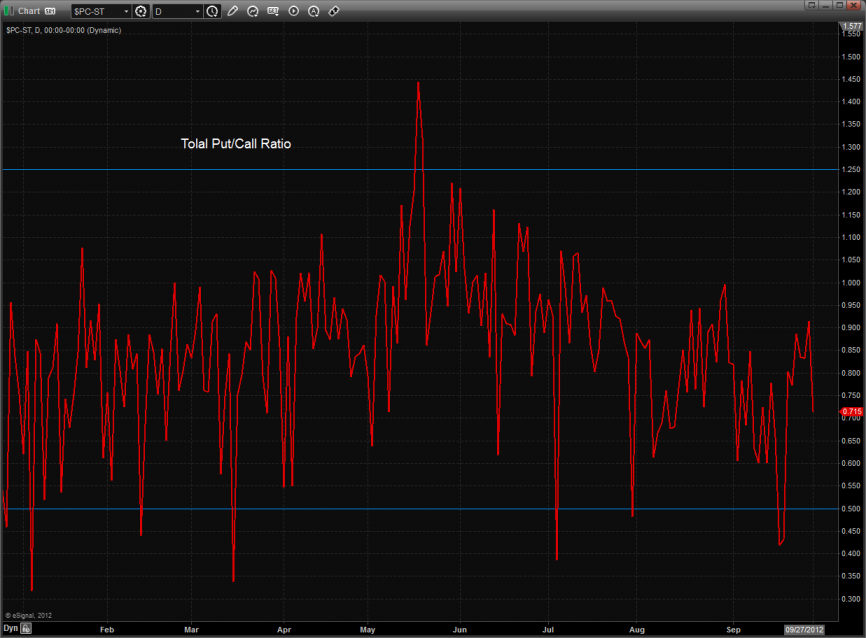

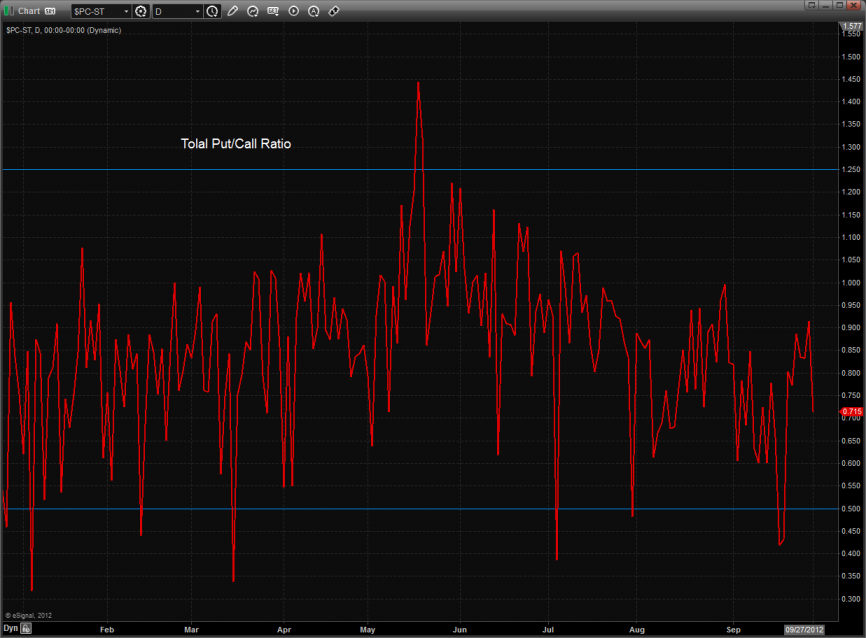

Total put/call ratio:

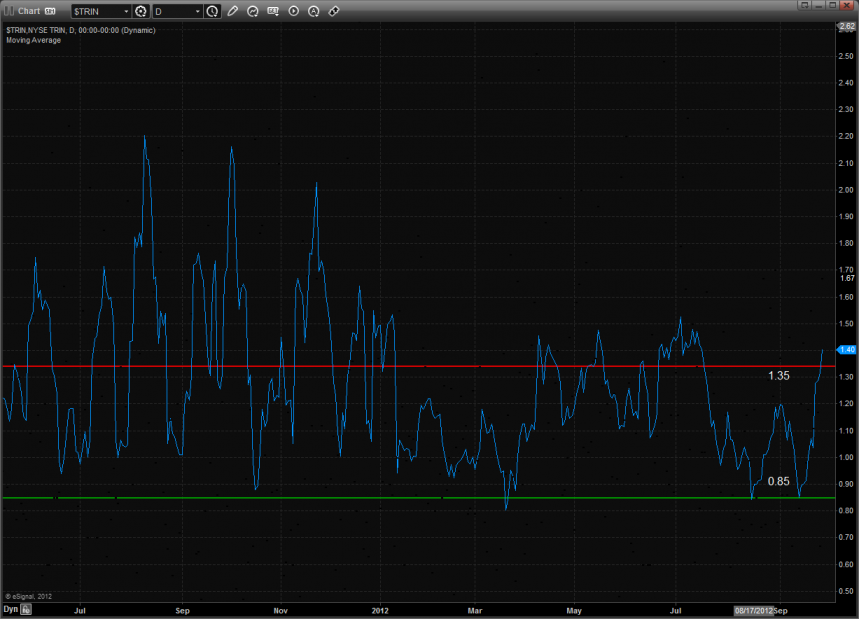

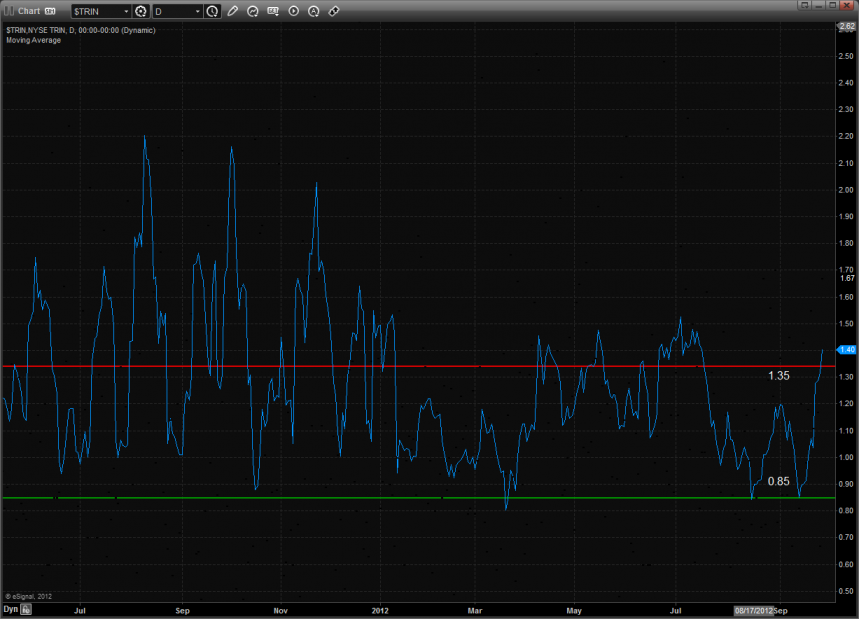

The 10-day Trin is still oversold which will provide the market upside fuel when it turns.

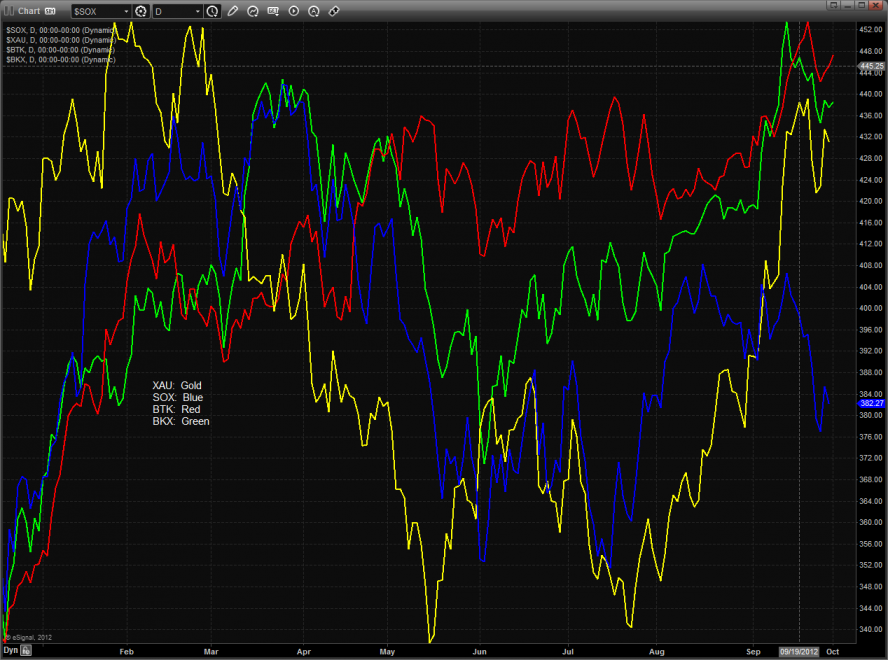

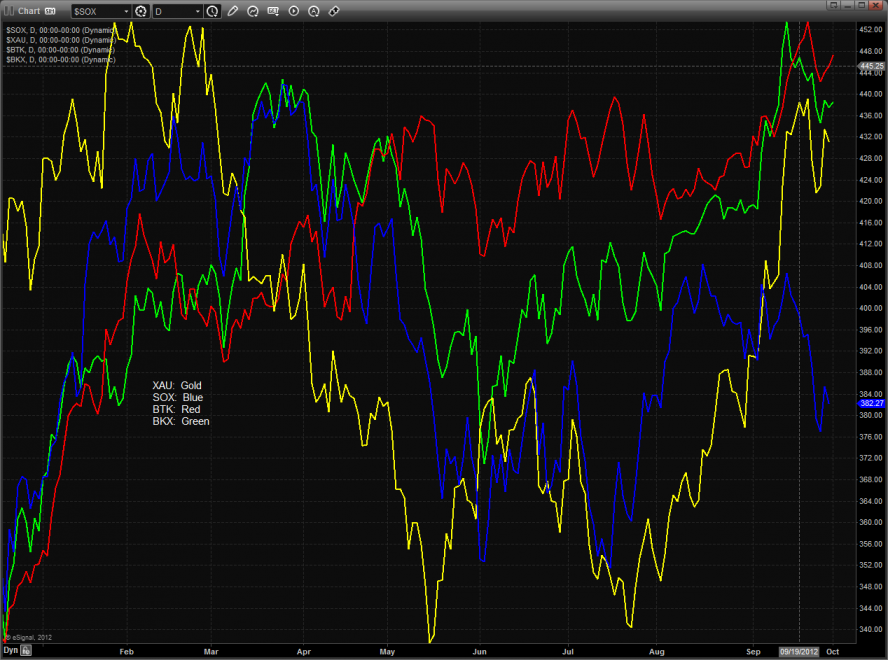

Multi sector daily chart:

The SOX was the last laggard on the day but posted an inside candle so we’ll have to defer to a break of Friday’s candle for any new technical development.

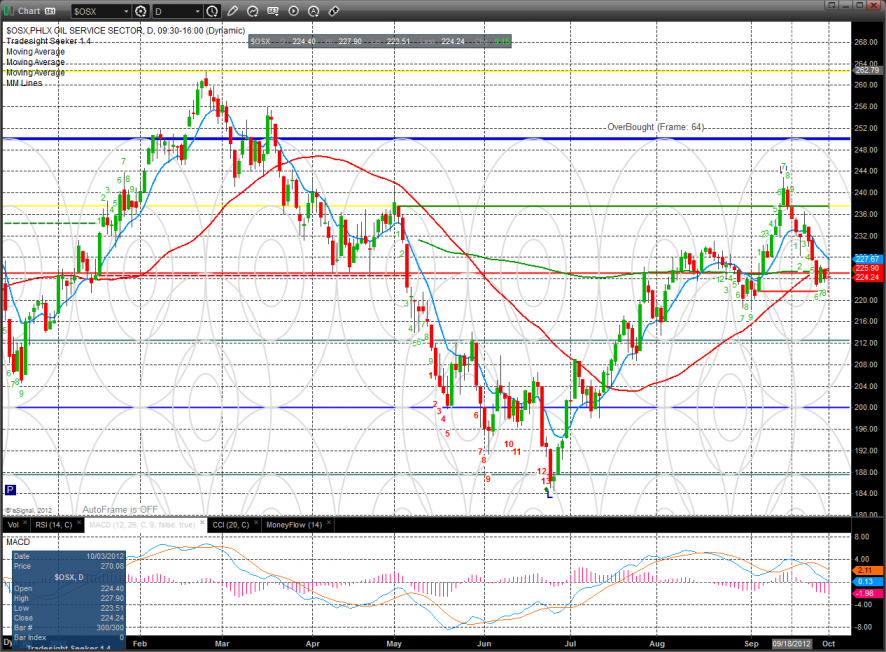

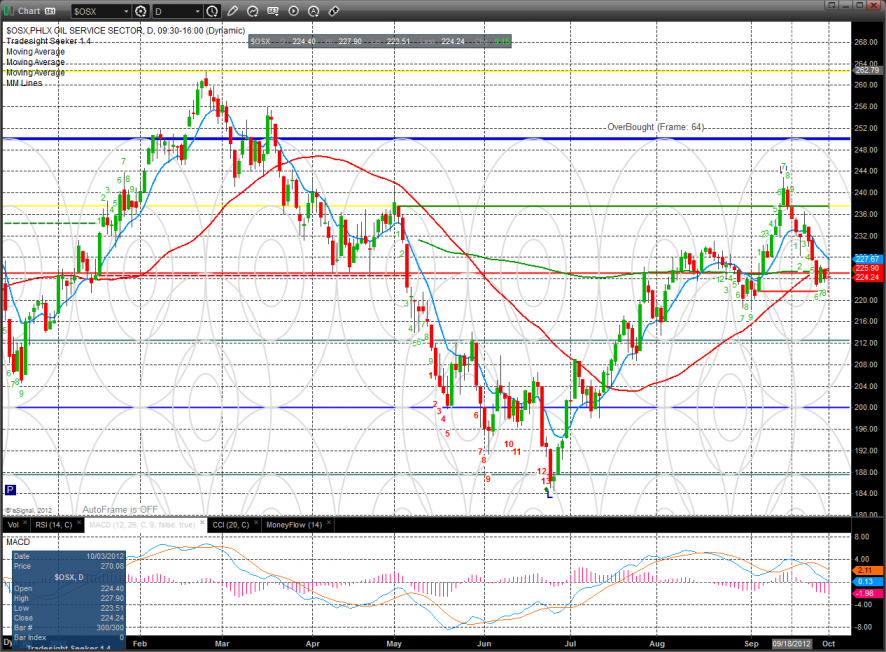

The OSX was unchanged:

The BKX posted a very narrow range day, staging below the 8/8 level.

The BTK was the strongest sector and still has a bullish formation with price above all major moving averages.

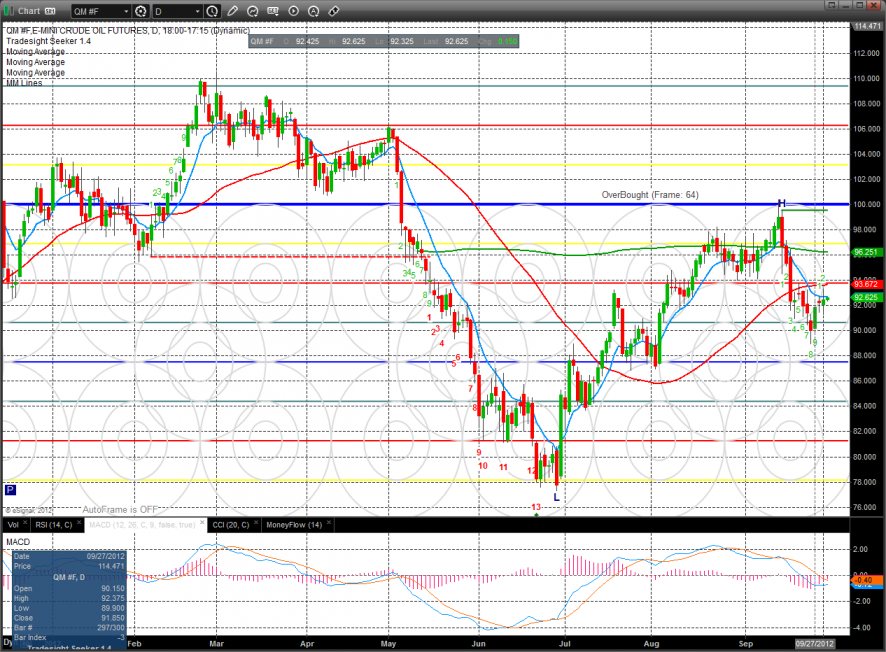

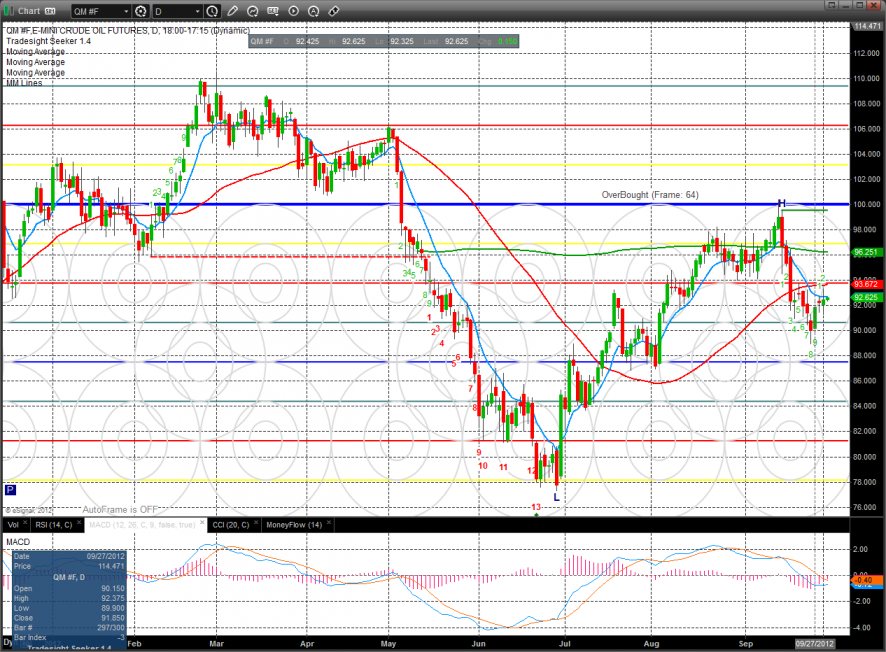

Oil:

Gold:

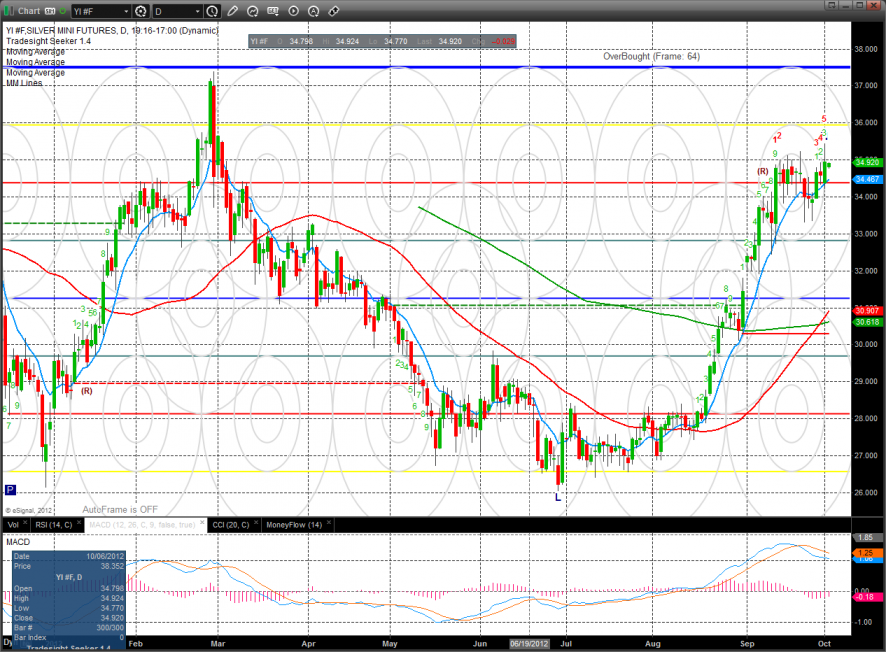

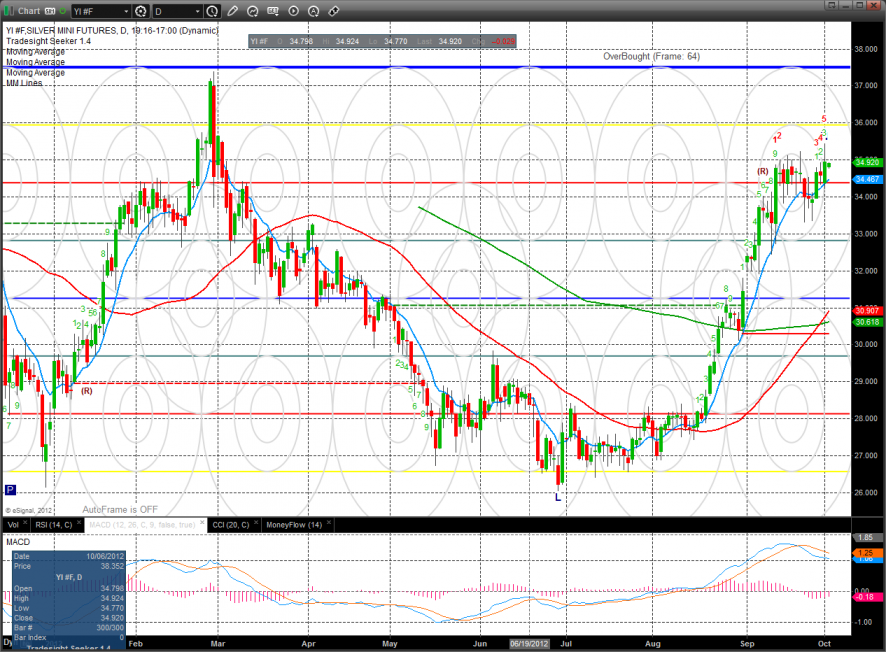

Silver:

Tradesight Market Preview for 10/2/12

The ES settled higher on the day by 3. Since price settled below the open but up on the day it is a camouflage sell signal. Also on the chart is very tall tail which is never bullish at range high.

The NQ futures were much weaker than the broad market all day. Price closed below the open and lost a net 4 handles on the day. Keep in mind that the Seeker sell count is 12 days up.

AAPL is the locomotive engine that drives the NQ and today it closed below last week’s low and in fact it made a new low monthly close. We usually don’t talk about individual stocks in this part of the report but since AAPL has such a heavy weighting in the NQ’s and with its supply chain can really dictate which track the NQ train takes.

Total put/call ratio:

The 10-day Trin is still oversold which will provide the market upside fuel when it turns.

Multi sector daily chart:

The SOX was the last laggard on the day but posted an inside candle so we’ll have to defer to a break of Friday’s candle for any new technical development.

The OSX was unchanged:

The BKX posted a very narrow range day, staging below the 8/8 level.

The BTK was the strongest sector and still has a bullish formation with price above all major moving averages.

Oil:

Gold:

Silver:

Stock Picks Recap for 10/1/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

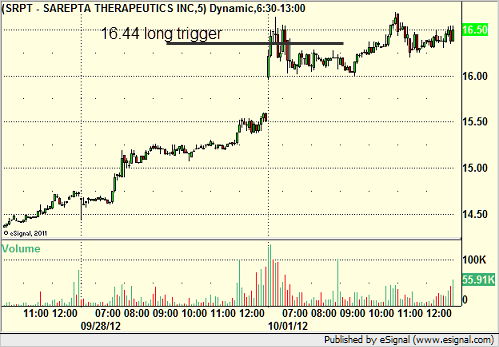

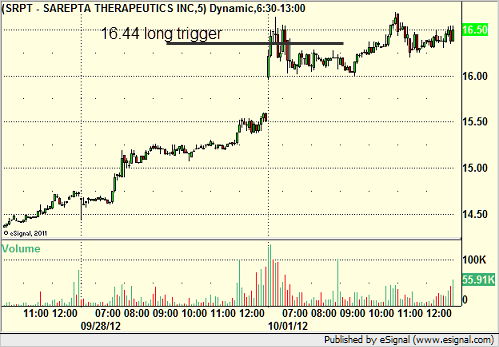

From the report, SRPT triggered long (with market support) and worked enough for a partial:

MPEL gapped over the trigger, no play.

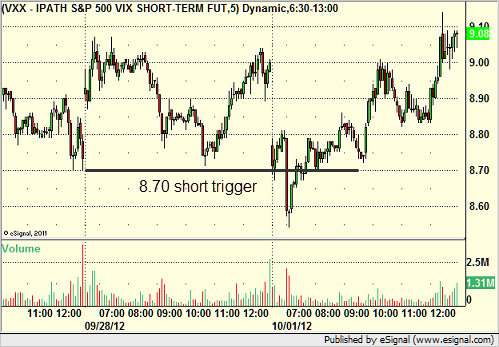

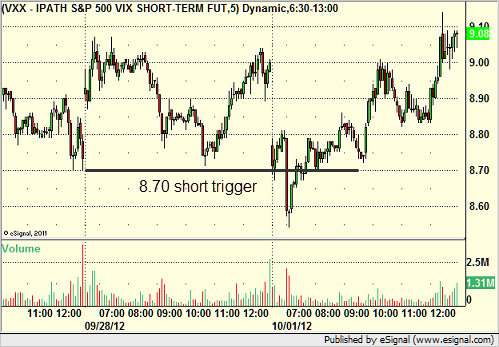

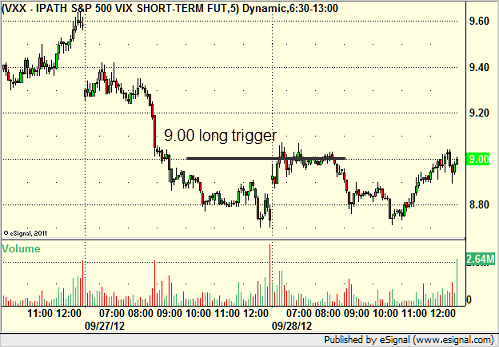

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered short (ETF, so no market support needed) and didn't work:

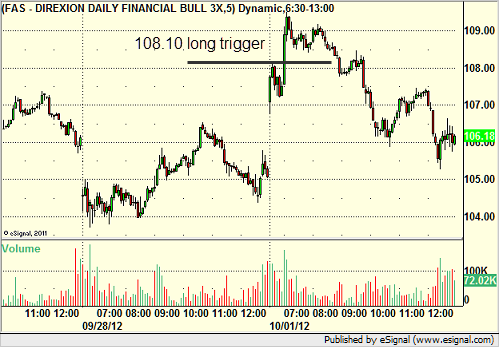

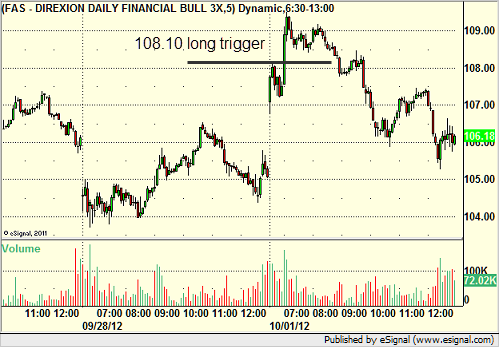

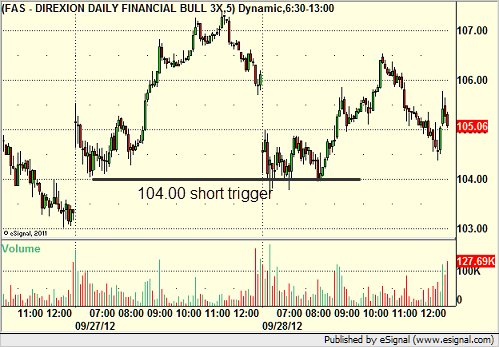

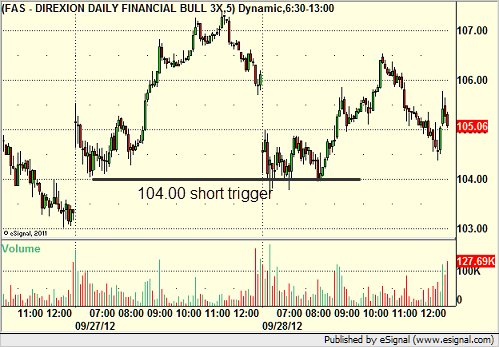

His FAS triggered long (ETF, so no market support needed) and worked great:

His AAPL triggered short (with market support) and worked:

TEVA triggered long (with market support) and didn't work:

Rich's IBM triggered long (with market support) and worked:

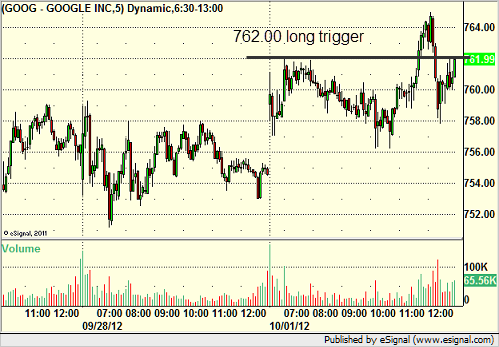

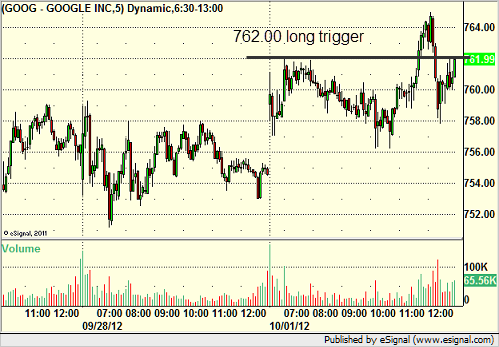

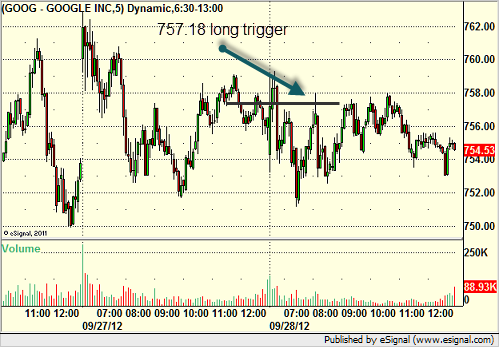

GOOG triggered long (with market support) and worked:

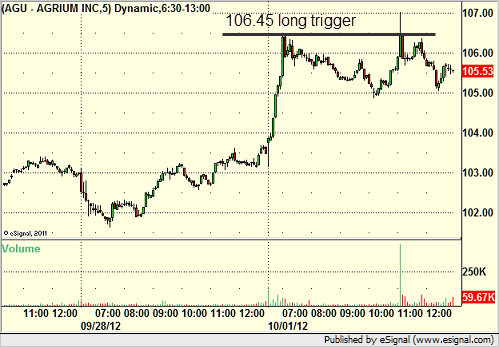

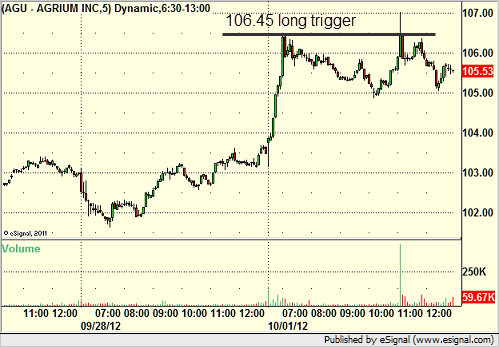

Rich's AGU triggered long (with market support) and worked enough for a quick partial:

His NSM triggered long (with market support) and worked:

AMZN triggered short (with market support) and worked:

Rich's SODA triggered short (with market support) and worked:

In total, that's 11 trades triggering with market support, 9 of them worked, 2 did not.

Stock Picks Recap for 10/1/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SRPT triggered long (with market support) and worked enough for a partial:

MPEL gapped over the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered short (ETF, so no market support needed) and didn't work:

His FAS triggered long (ETF, so no market support needed) and worked great:

His AAPL triggered short (with market support) and worked:

TEVA triggered long (with market support) and didn't work:

Rich's IBM triggered long (with market support) and worked:

GOOG triggered long (with market support) and worked:

Rich's AGU triggered long (with market support) and worked enough for a quick partial:

His NSM triggered long (with market support) and worked:

AMZN triggered short (with market support) and worked:

Rich's SODA triggered short (with market support) and worked:

In total, that's 11 trades triggering with market support, 9 of them worked, 2 did not.

Futures Calls Recap for 10/1/12

One call early that stopped and that was it for the session. Market took until late in the day to reach down and fill the gap on the ES. NASDAQ volume was 1.65 billion shares.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered short at 2802 at A and stopped for 7 ticks. Re-entry was cancelled:

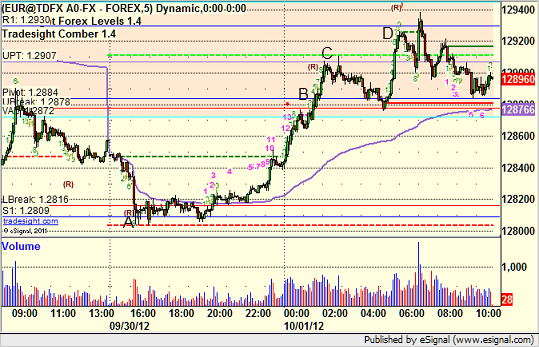

Forex Calls Recap for 10/1/12

A very early trigger on the EURUSD that stopped, and then a more normal trigger that worked and we are holding long. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered short very early at A and stopped. Triggered long at B, note how it hit the new UPT at C and stopped there first, then first target at D, and we are holding the second half with a stop under UBreak:

Tradesight September 2012 Futures Results

Before we get to September’s numbers, here is a short reminder of the results from July. The full report from August can be found here.

Tradesight Tick Results for August 2012

Number of trades: 31

Number of losers: 14

Winning percentage: 54.8%

Net ticks: +6.5

Reminder: Here are the rules.

1) Totals for the month are based on trades that occurred on trading days in the calendar month.

2) Trades are based on the calls in the Messenger exactly as we call them and manage them and do not count everything you could have done from taking our courses and using our tools.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 6 ticks on one half and 12 on the second, that’s a 9-tick winner.

4) Pure losers (trades that just stop out) are considered 7 tick losers. We don’t risk more than that in the Messenger calls.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Tick Results for September 2012

Number of trades: 35

Number of losers: 16

Winning percentage: 54.2%

Net ticks: +17.5

September started out strong after Labor Day, but there were still a lot of flatter, light-volume days. In fact, we only had 16 days in the month that a trade triggered. However, our total number of trades was up for the month (35), so there is some activity picking up. The first week of the month looked strong out of the gate, and I thought we might be back to a more normal environment, but everything after that thinned out a bit.

We closed the month with 17.5 ticks in net gains, which is nice but nothing spectacular. Our system continues to reflect a good, low-risk strategy though. We won about 55% of our triggered trades, and our stop-loss management system doesn't let anything get too far out of control to the downside. The issue remains that less than 6 trading days this month saw ranges above the 6-month average daily range (ADR), which isn't enough for some of the bigger winners to play out.

We look forward to October and November, which are typically two of the better trading months of the year, to see if volume and range comes back like it started to at the beginning of September.

Tradesight September 2012 Futures Results

Before we get to September’s numbers, here is a short reminder of the results from July. The full report from August can be found here.

Tradesight Tick Results for August 2012

Number of trades: 31

Number of losers: 14

Winning percentage: 54.8%

Net ticks: +6.5

Reminder: Here are the rules.

1) Totals for the month are based on trades that occurred on trading days in the calendar month.

2) Trades are based on the calls in the Messenger exactly as we call them and manage them and do not count everything you could have done from taking our courses and using our tools.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 6 ticks on one half and 12 on the second, that’s a 9-tick winner.

4) Pure losers (trades that just stop out) are considered 7 tick losers. We don’t risk more than that in the Messenger calls.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Tick Results for September 2012

Number of trades: 35

Number of losers: 16

Winning percentage: 54.2%

Net ticks: +17.5

September started out strong after Labor Day, but there were still a lot of flatter, light-volume days. In fact, we only had 16 days in the month that a trade triggered. However, our total number of trades was up for the month (35), so there is some activity picking up. The first week of the month looked strong out of the gate, and I thought we might be back to a more normal environment, but everything after that thinned out a bit.

We closed the month with 17.5 ticks in net gains, which is nice but nothing spectacular. Our system continues to reflect a good, low-risk strategy though. We won about 55% of our triggered trades, and our stop-loss management system doesn't let anything get too far out of control to the downside. The issue remains that less than 6 trading days this month saw ranges above the 6-month average daily range (ADR), which isn't enough for some of the bigger winners to play out.

We look forward to October and November, which are typically two of the better trading months of the year, to see if volume and range comes back like it started to at the beginning of September.

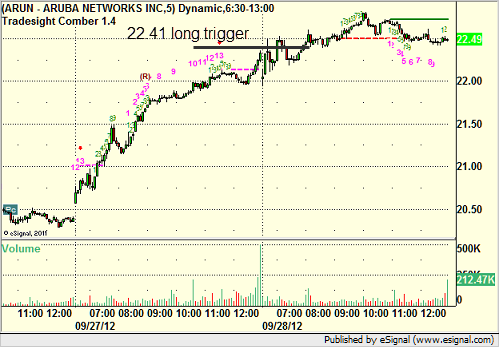

Stock Picks Recap for 9/28/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

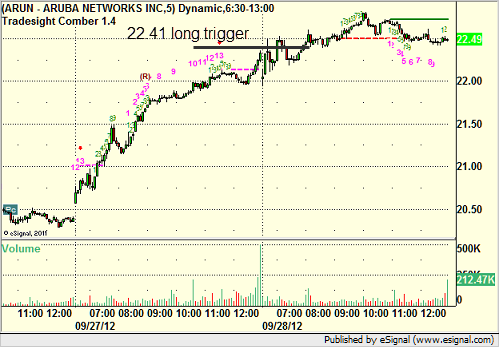

From the report, ARUN triggered long (without market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's QCOR triggered short (without market support due to opening 5 minutes) and worked:

His FAS triggered short (ETF, so no market support needed) and didn't work:

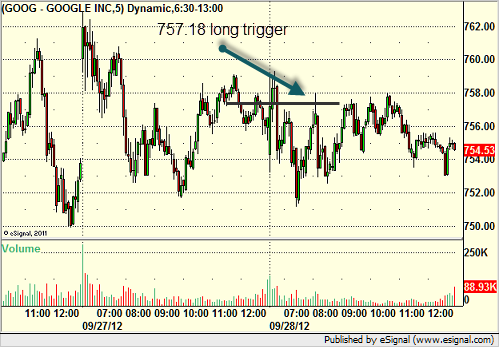

His GOOG triggered long (without market support due to opening 5 minutes) and worked enough for a partial):

His IBM triggered long (with market support) and didn't work:

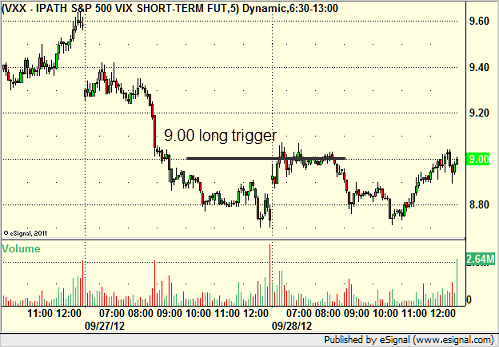

His VXX triggered long (ETF, so no market support needed) and didn't work:

NFLX triggered short (with market support) and worked:

Rich's CAT triggered short (with market support) and didn't work:

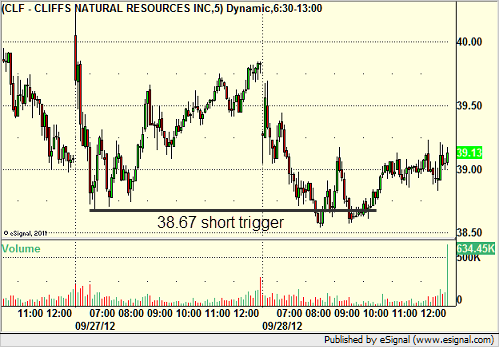

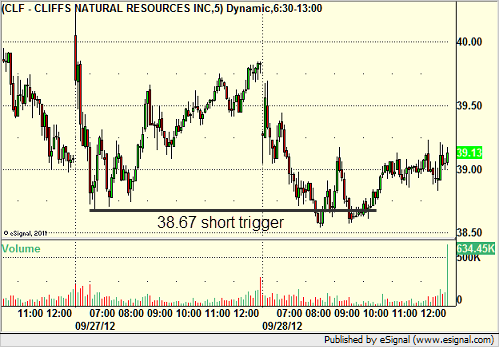

His CLF triggered short (with market support) and didn't work:

His AAPL triggered short (without market support) and worked:

His ALXN triggered long (with market support) and didn't work:

His FB triggered long (with market support) and didn't work:

In total, that's 8 trades triggering with market support, 1 of them worked, 7 did not. Easily the worst trigger to win ratio of the year, and no surprise on end of quarter.

Stock Picks Recap for 9/28/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ARUN triggered long (without market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's QCOR triggered short (without market support due to opening 5 minutes) and worked:

His FAS triggered short (ETF, so no market support needed) and didn't work:

His GOOG triggered long (without market support due to opening 5 minutes) and worked enough for a partial):

His IBM triggered long (with market support) and didn't work:

His VXX triggered long (ETF, so no market support needed) and didn't work:

NFLX triggered short (with market support) and worked:

Rich's CAT triggered short (with market support) and didn't work:

His CLF triggered short (with market support) and didn't work:

His AAPL triggered short (without market support) and worked:

His ALXN triggered long (with market support) and didn't work:

His FB triggered long (with market support) and didn't work:

In total, that's 8 trades triggering with market support, 1 of them worked, 7 did not. Easily the worst trigger to win ratio of the year, and no surprise on end of quarter.