Futures Calls Recap for 9/26/12

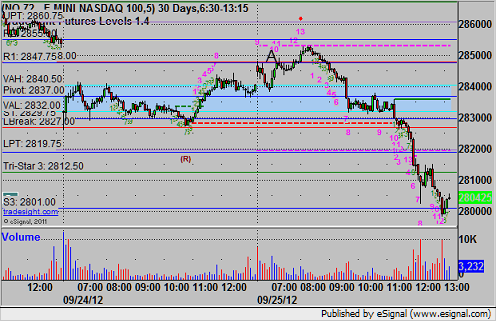

A nice call in the morning on the NQ, although unfortunately it stopped once first before retriggering and working. See that section below. The afternoon was dead. Volume closed at 1.7 billion NASDAQ shares.

Net ticks: +2.5 ticks.

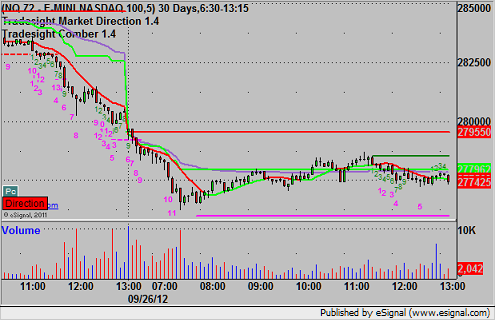

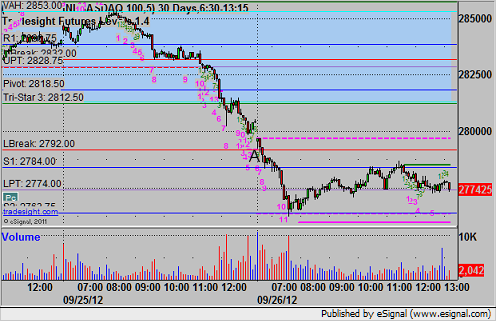

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 2791.50, stopped once for 7 ticks, re-entered, and then triggered, hit first target for six ticks. Lowered stop twice and stopped at 2786.00:

Forex Calls Recap for 9/26/12

Initially, I posted no calls for the session as all of the Levels were too bunched together from the poor ranges. I ended up putting up a EURUSD call after it set the S1 perfectly, and after 12 hours with it, it went nowhere. See that section below.

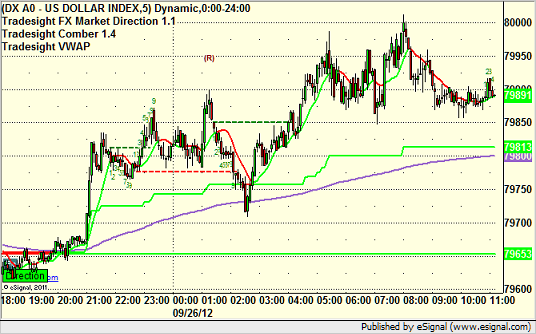

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

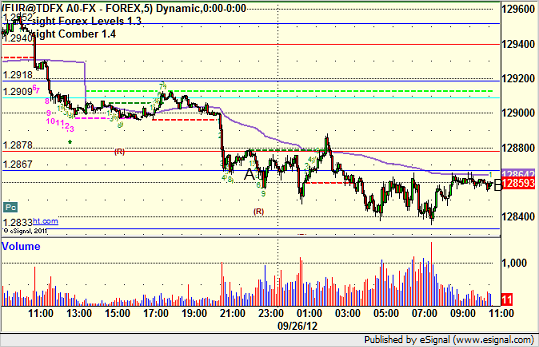

EURUSD:

Took the short under S1 at A after it hit the level just before that. Never hit stop or first target, finally closed at B a few pips in the money:

Tradesight Market Preview for 9/26/12

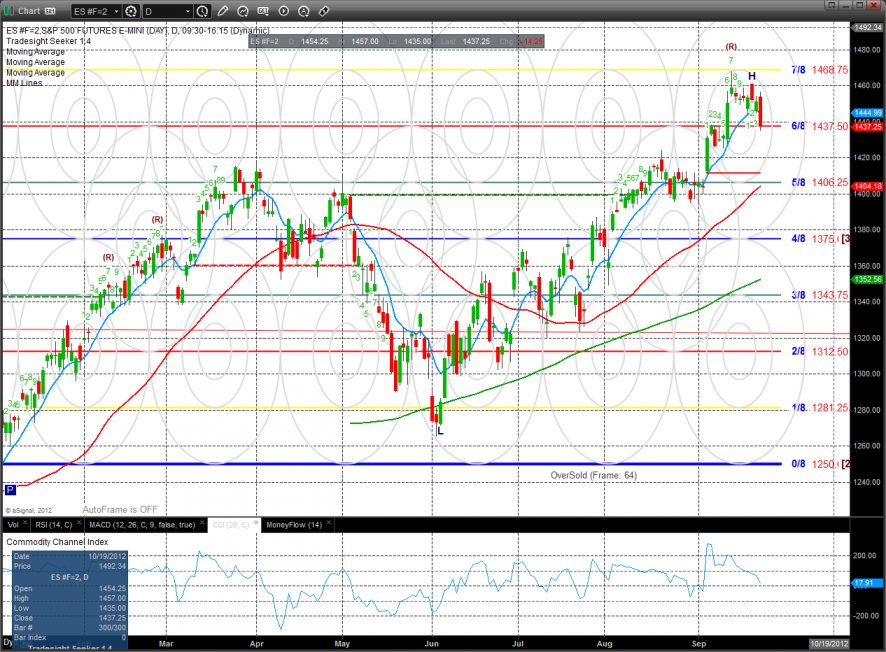

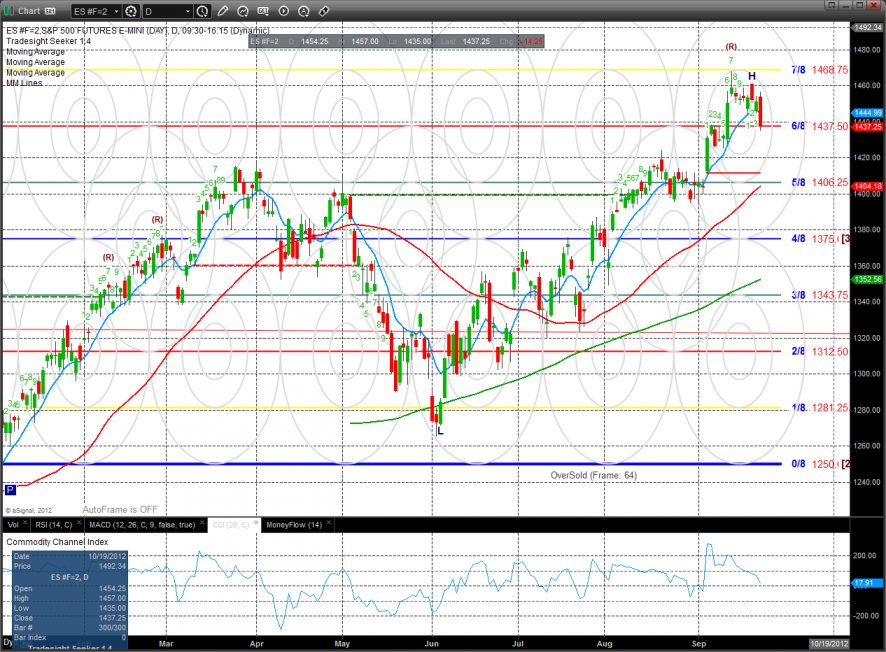

The ES lost 14 on the day decisively settling below the 10ema, turning the short-term trend negative. The next key support is very obvious on the chart where the Q1 highs align with the active static trend line.

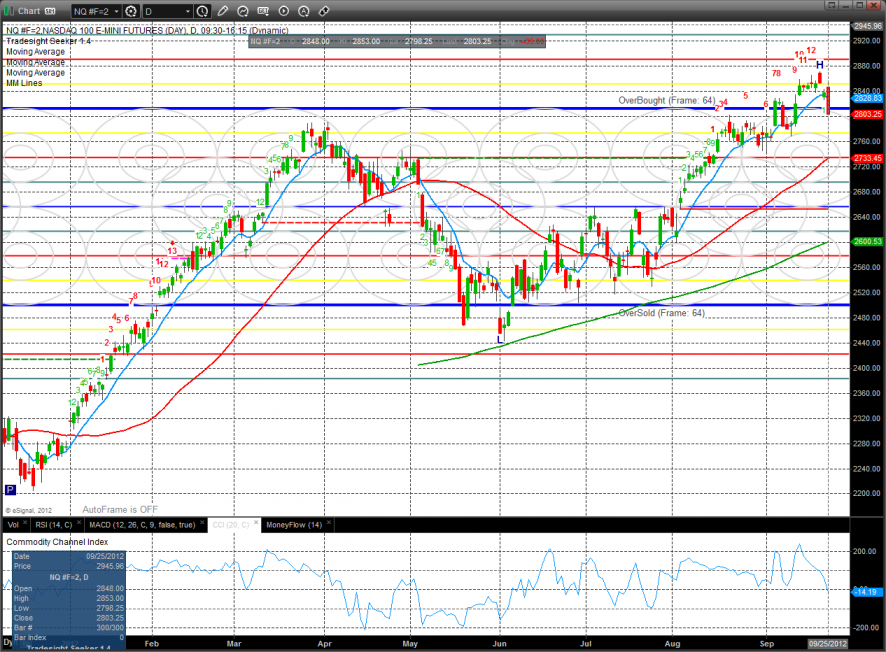

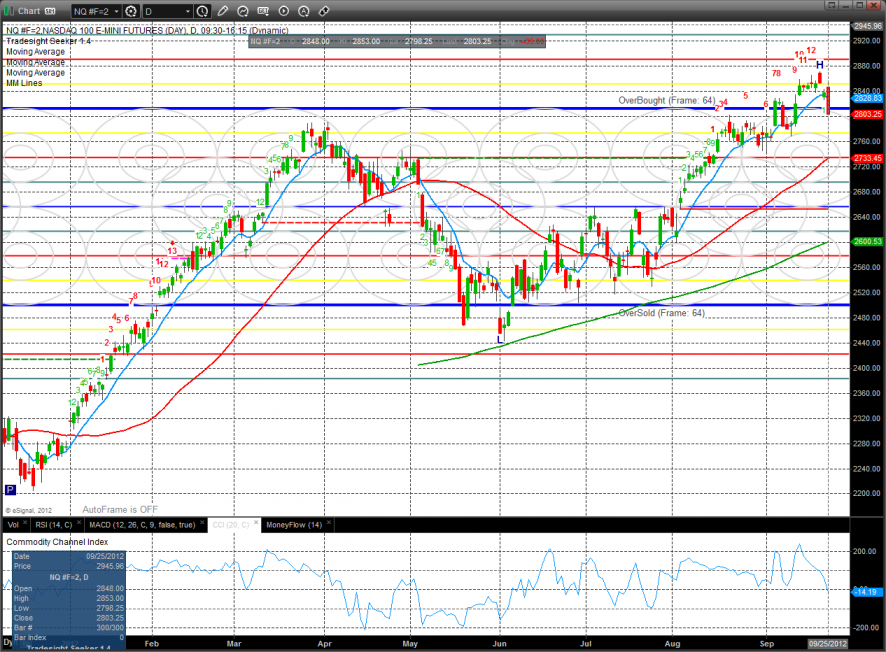

The NQ futures were weaker than the broad market and already are much closer to the key Q1 highs. Note that the pattern is 12 days up in the Seeker countdown so a bounce an retest of the highs will likely fail.

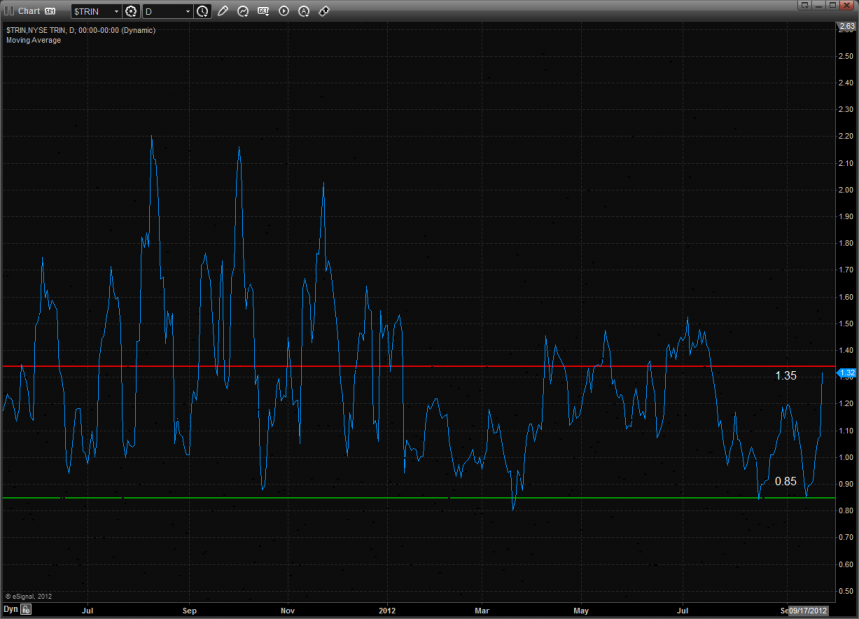

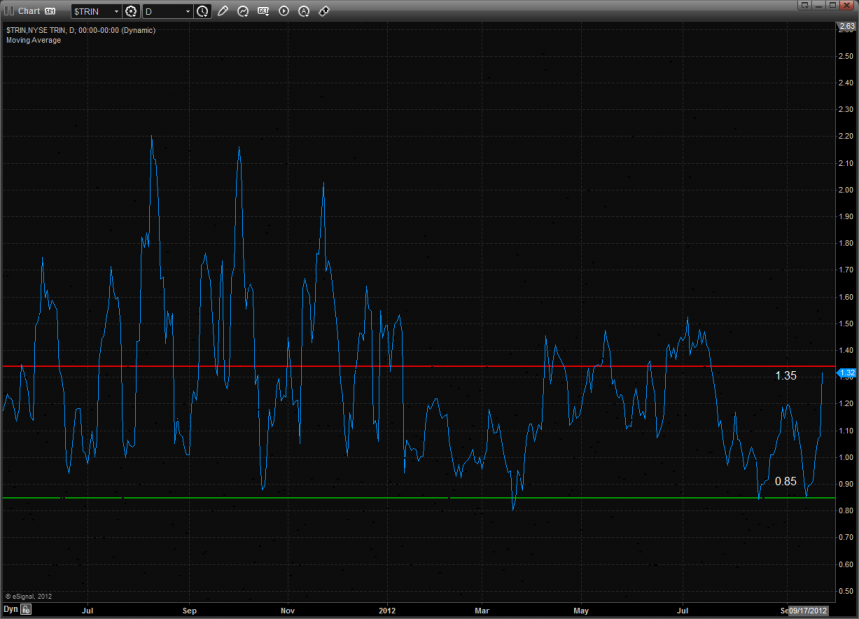

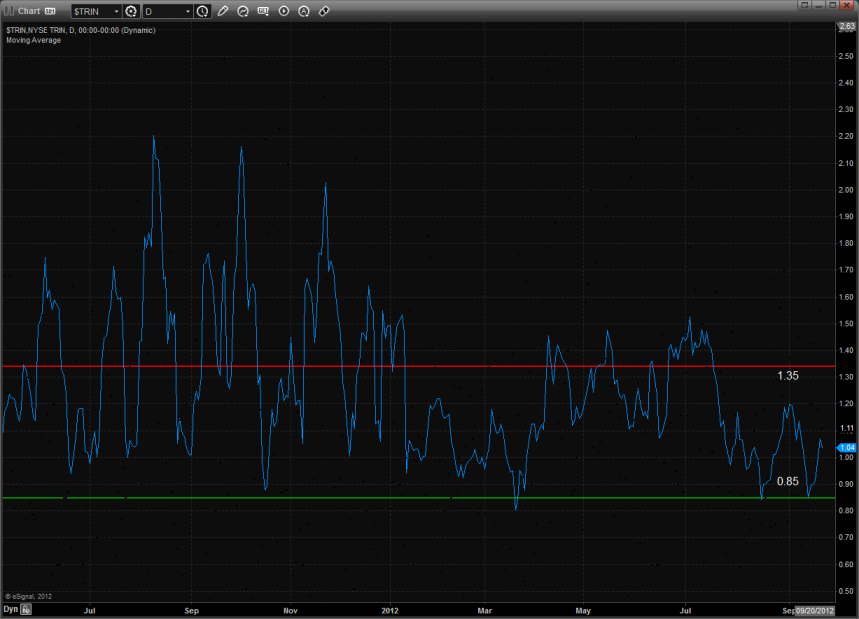

The intraday Trin closed at a very high level and almost has the 10-day average in the oversold range.

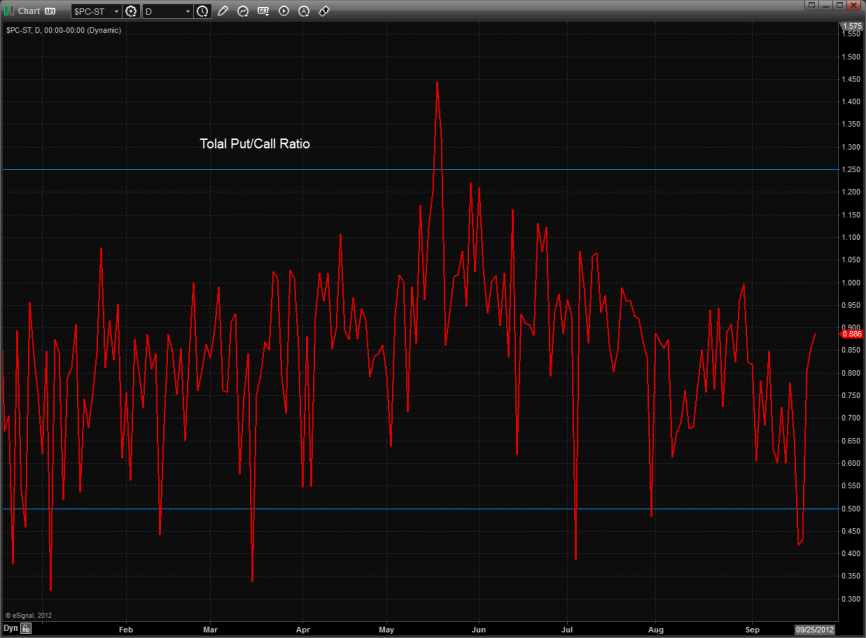

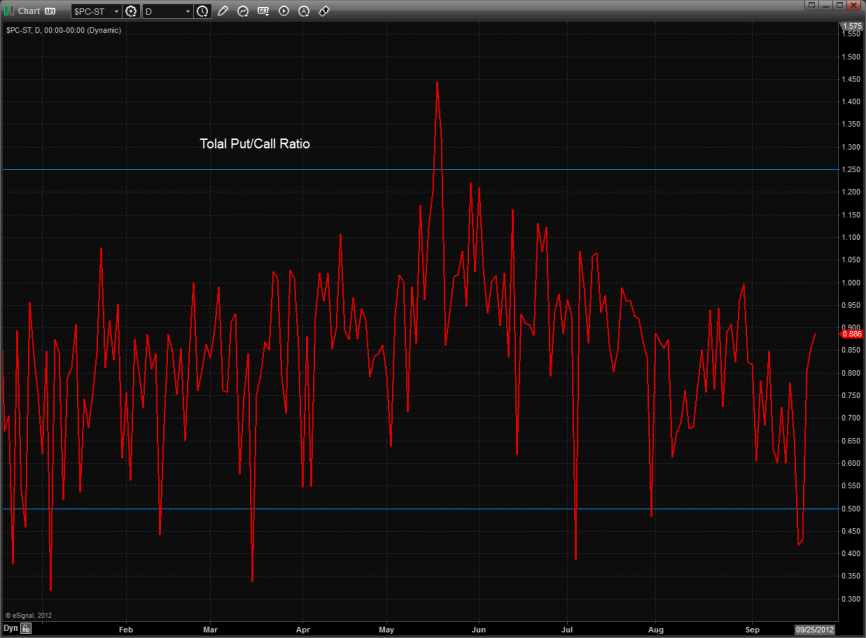

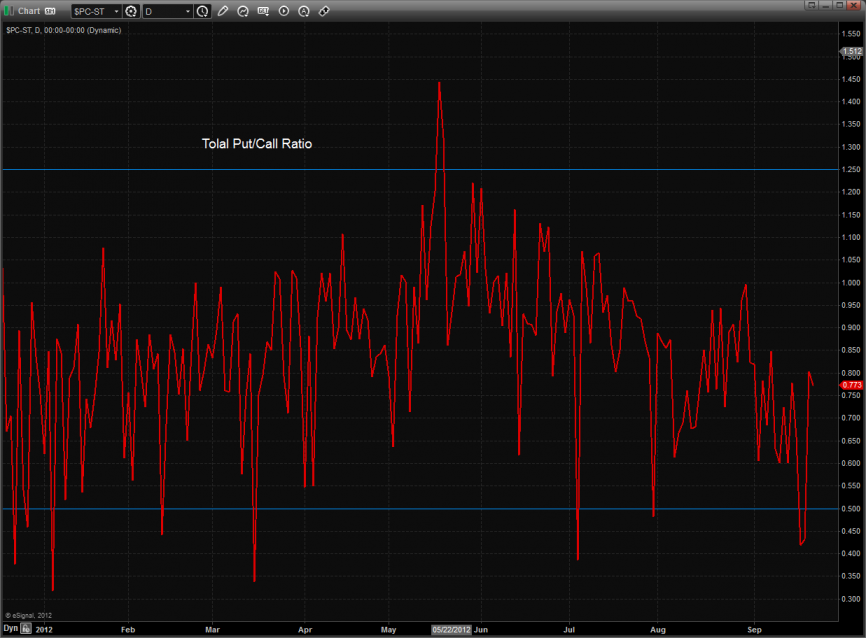

Total put/call ratio:

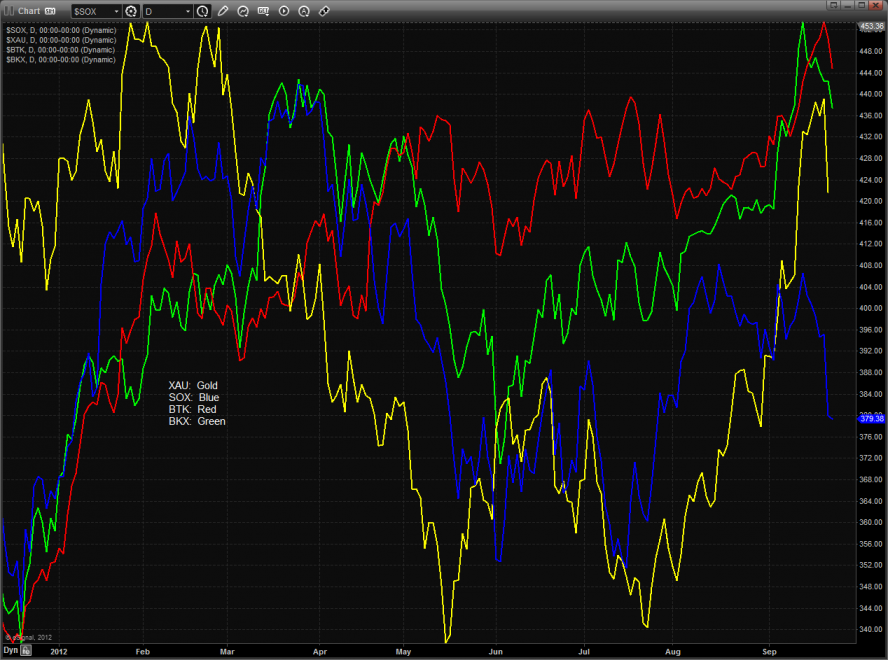

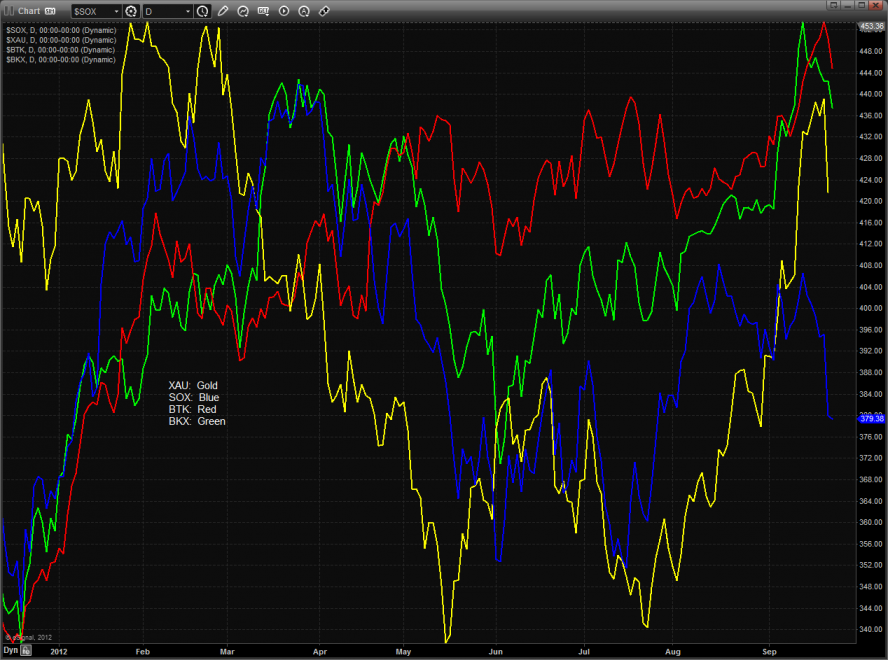

Multi sector daily chart:

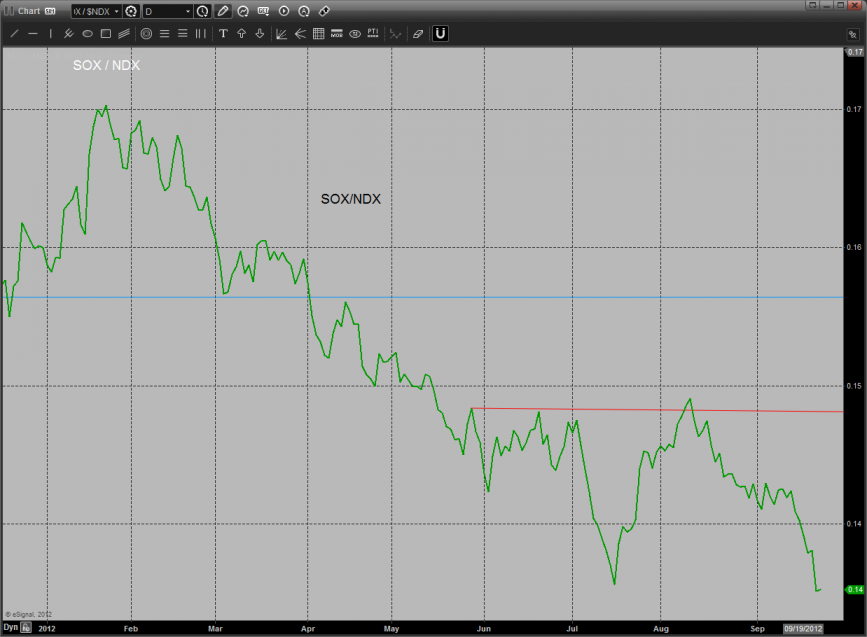

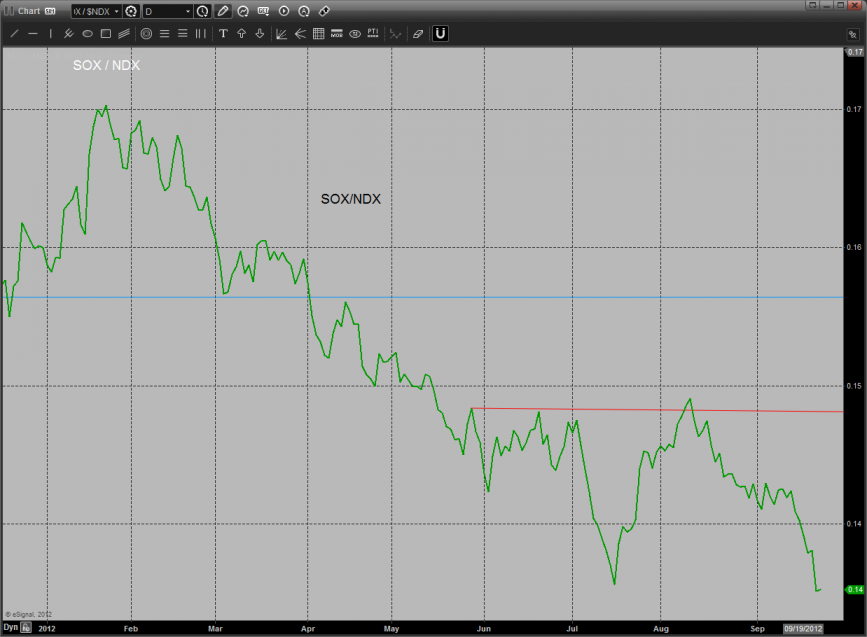

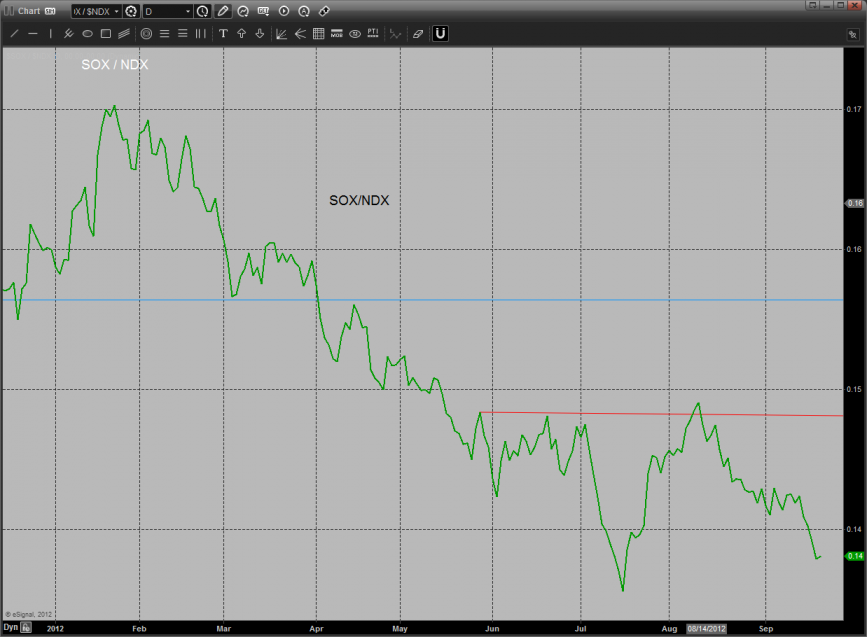

The SOX/NDX cross made a new marginal low on the move. A follow through to the downside would be very bearish for the overall NDX.

All of the major averages were lower on the day with the BTK being the best of the worst. There is key support just below at the previous breakout level.

The OSX traded in line with the broad market and is dangerously close to breaking below the 50 and 200dma’s. If they are taken out, look out below.

The BKX settled below the 8/8 level and more importantly below the Q1 highs showing relative weakness on the day. There is a lot of space between settlement and the next support area defined by the static trend line.

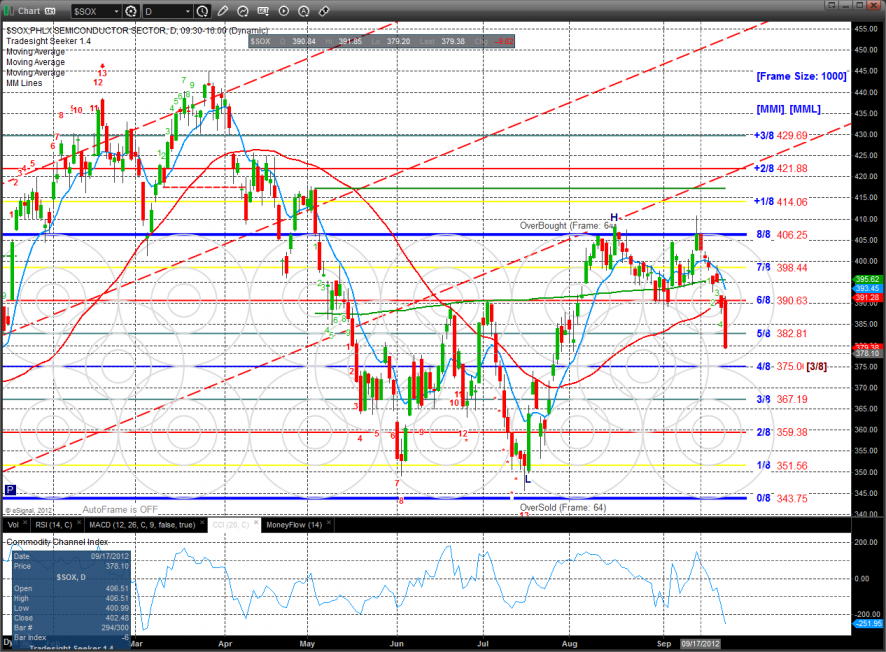

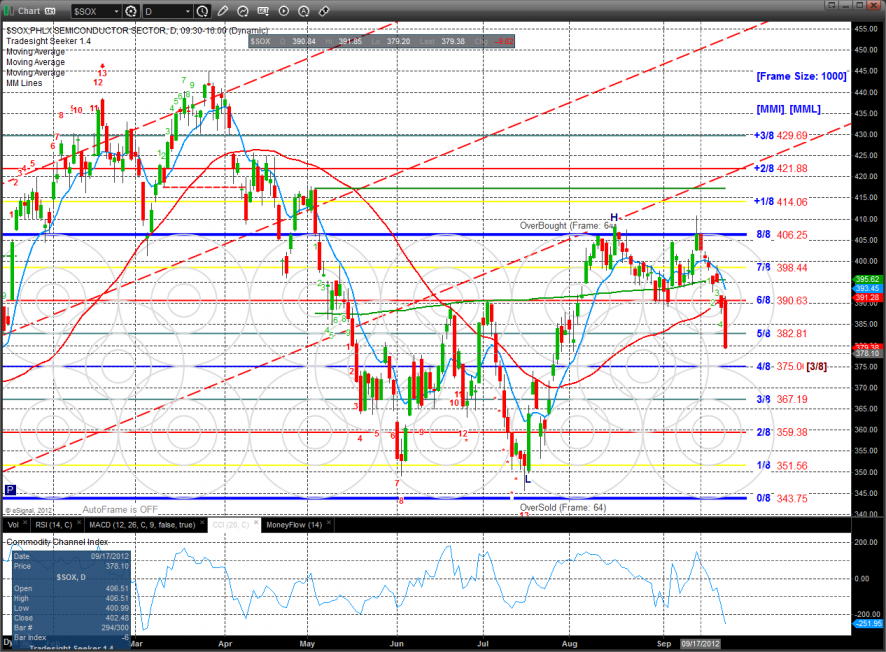

The important SOX index had a horrible day losing 2.5% and settling decisively below all the major moving averages. This is real problem for the NDX and by association the SPX. The chart is short term oversold but should find resistance on bounces to the 6/8 level

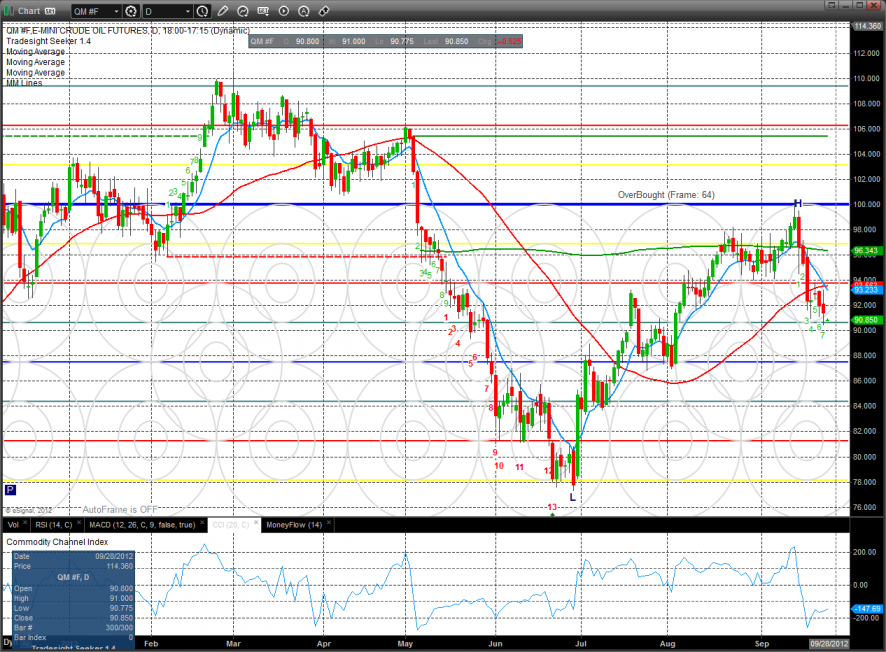

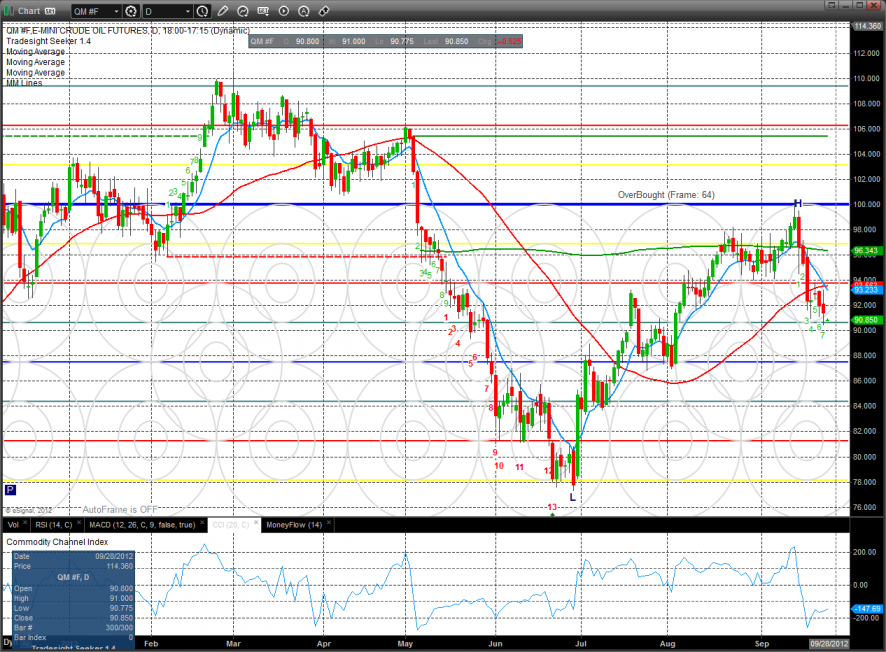

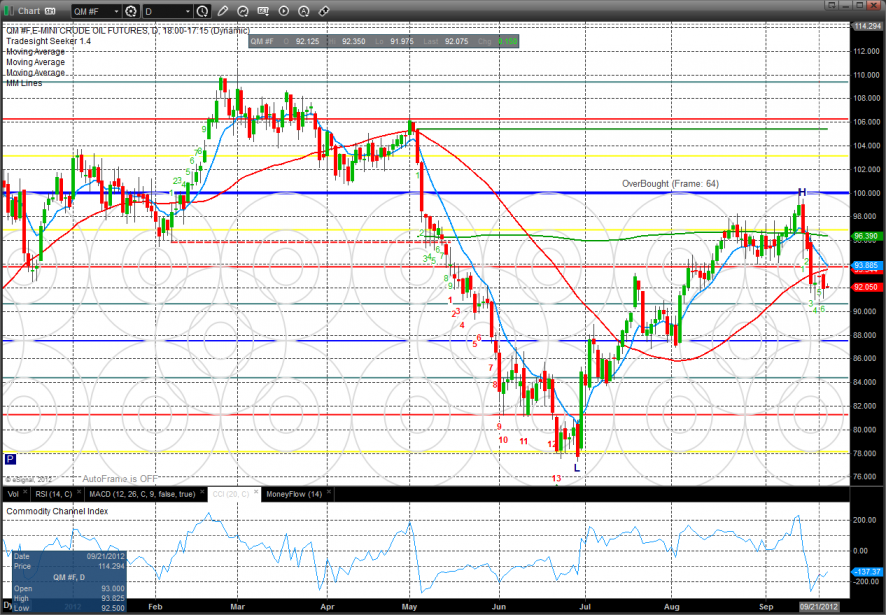

Oil:

Gold:

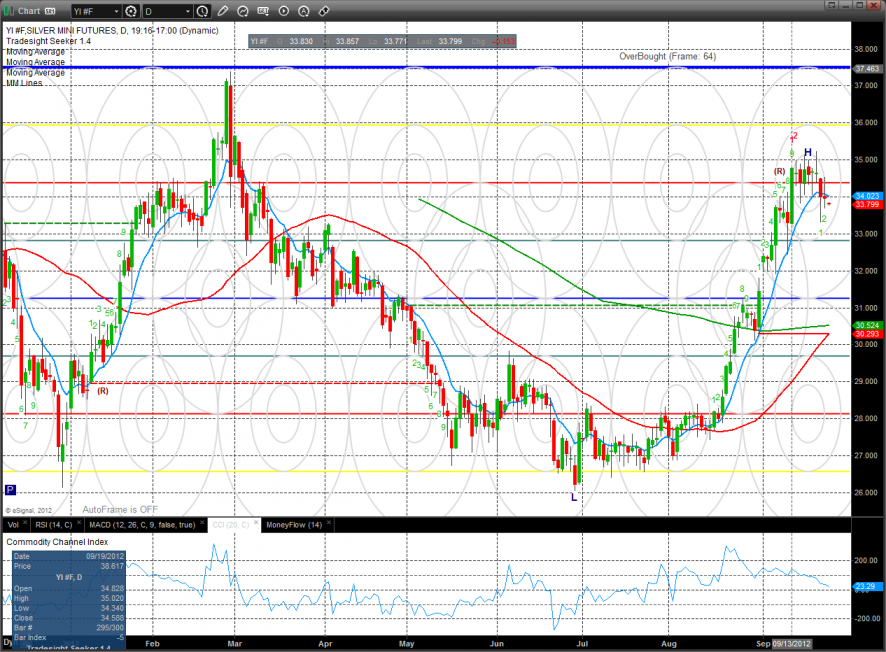

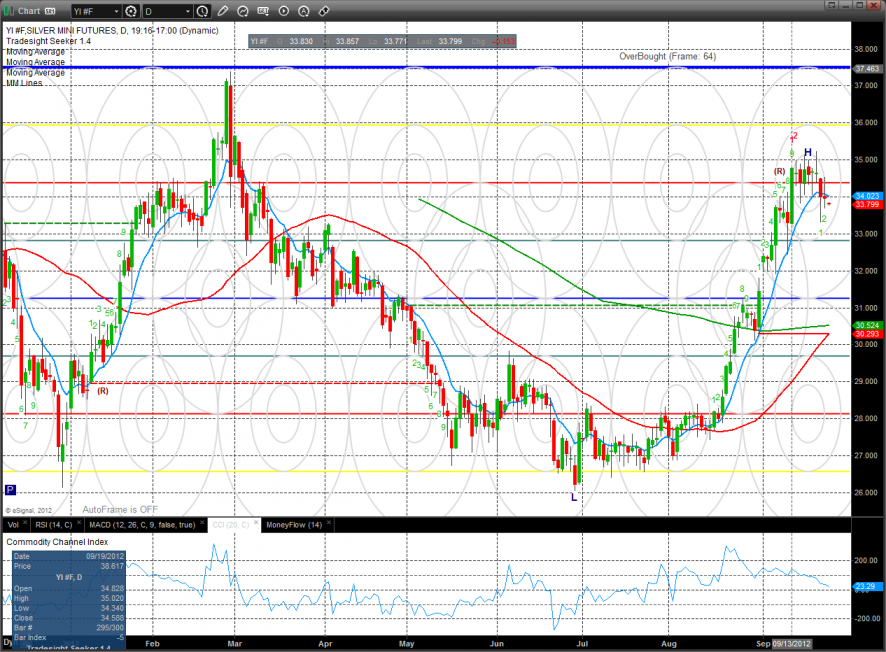

Silver:

Tradesight Market Preview for 9/26/12

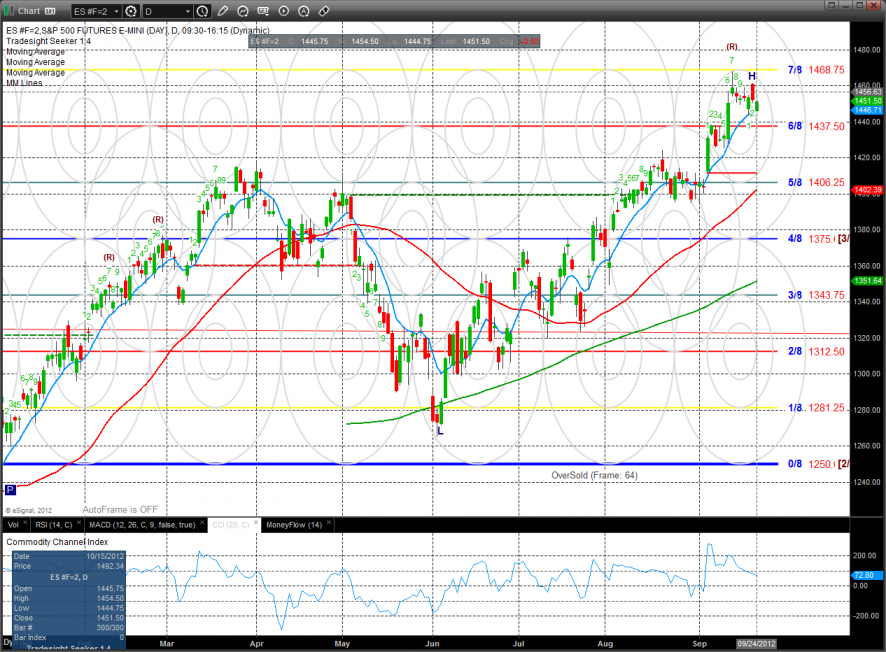

The ES lost 14 on the day decisively settling below the 10ema, turning the short-term trend negative. The next key support is very obvious on the chart where the Q1 highs align with the active static trend line.

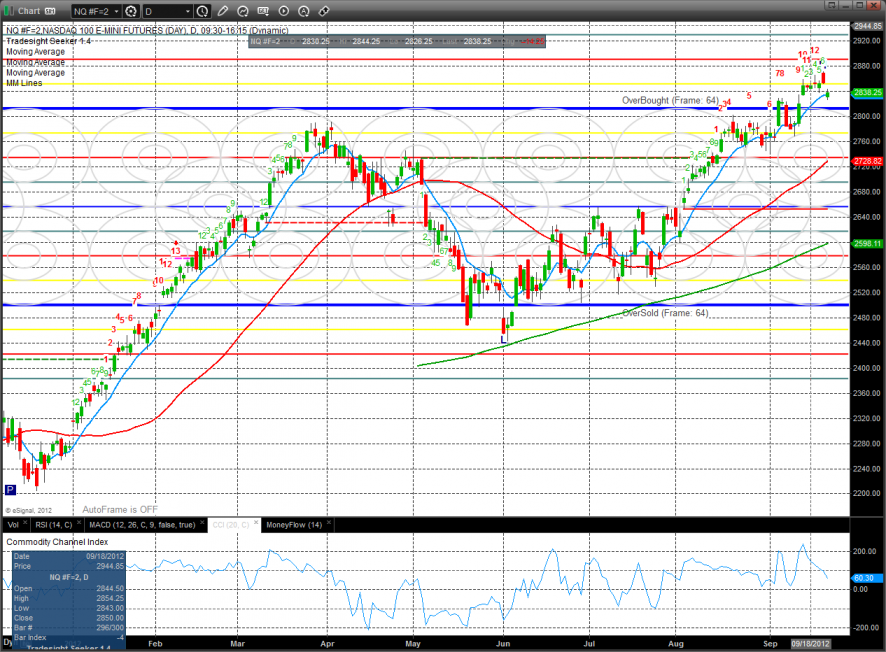

The NQ futures were weaker than the broad market and already are much closer to the key Q1 highs. Note that the pattern is 12 days up in the Seeker countdown so a bounce an retest of the highs will likely fail.

The intraday Trin closed at a very high level and almost has the 10-day average in the oversold range.

Total put/call ratio:

Multi sector daily chart:

The SOX/NDX cross made a new marginal low on the move. A follow through to the downside would be very bearish for the overall NDX.

All of the major averages were lower on the day with the BTK being the best of the worst. There is key support just below at the previous breakout level.

The OSX traded in line with the broad market and is dangerously close to breaking below the 50 and 200dma’s. If they are taken out, look out below.

The BKX settled below the 8/8 level and more importantly below the Q1 highs showing relative weakness on the day. There is a lot of space between settlement and the next support area defined by the static trend line.

The important SOX index had a horrible day losing 2.5% and settling decisively below all the major moving averages. This is real problem for the NDX and by association the SPX. The chart is short term oversold but should find resistance on bounces to the 6/8 level

Oil:

Gold:

Silver:

Stock Picks Recap for 9/25/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ROSG triggered long (without market support due to opening 5 minutes) and worked enough for a partial:

HSIC triggered long (with market support) and worked:

AKRX triggered short (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's X triggered long (without market support due to opening 5 minutes) and didn't work:

His FCX opened above his trigger, no play.

His AAPL triggered short in the afternoon (with market support) and worked:

His HR triggered long (with market support) and didn't work:

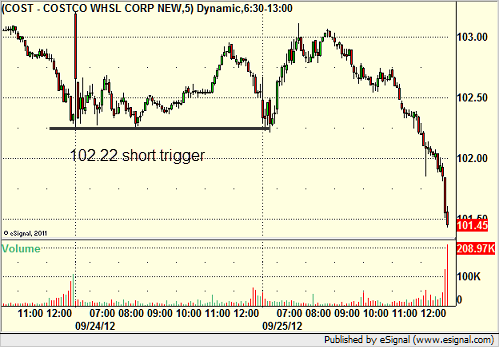

COST triggered short (with market support) and didn't work:

GS triggered short (without market support) and worked:

Rich's BWLD triggered short (with market support) and worked:

His GDX triggered long (ETF, so no market support needed) and didn't work:

My AAPL triggered short (with market support) and worked:

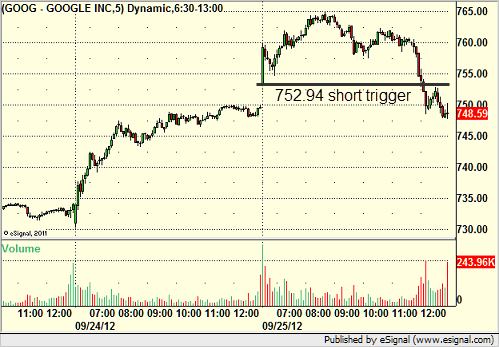

GOOG triggered short (with market support) and worked:

Rich's CLF triggered short (with market support) and worked:

In total, that's 10 trades triggering with market support, 6 of them worked, 4 did not.

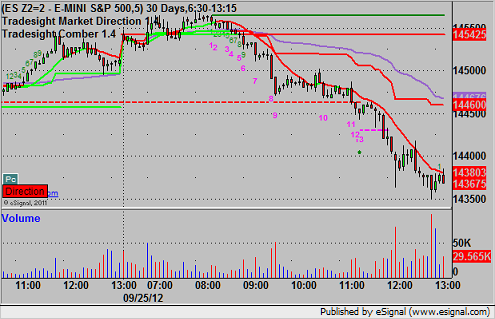

Futures Calls Recap for 9/25/12

We had a couple of nice setups on the long side early that triggered when both the ES and NQ were getting Comber and Seeker sell signals on the 5-minute charts, so we cut the trades short before they hit targets or stops. See both sections below.

Net ticks: -3 ticks.

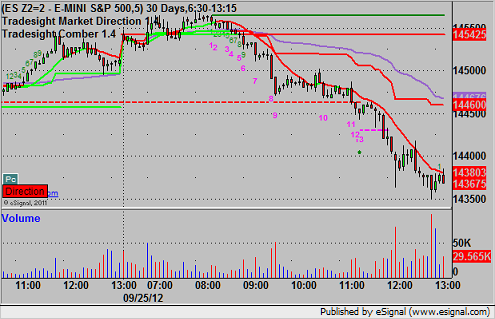

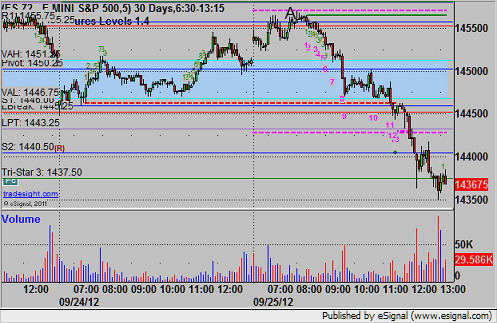

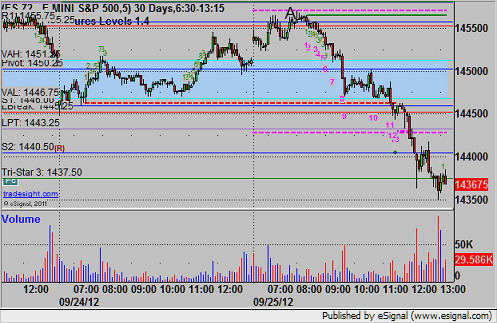

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at 1456.00 at A and was closed at 1455.00 for 4 ticks when the market stalled on the Seeker and Comber signals:

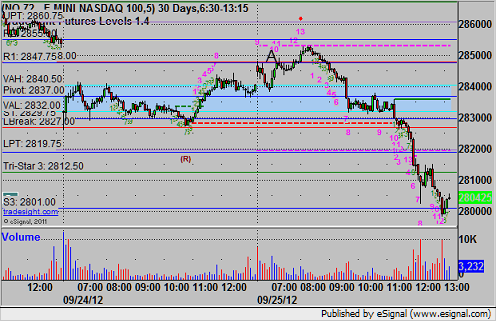

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My NQ triggered long at 2848.50 at A and I closed it at 2849.00 for a tick gain on the Seeker and Comber signals:

Futures Calls Recap for 9/25/12

We had a couple of nice setups on the long side early that triggered when both the ES and NQ were getting Comber and Seeker sell signals on the 5-minute charts, so we cut the trades short before they hit targets or stops. See both sections below.

Net ticks: -3 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at 1456.00 at A and was closed at 1455.00 for 4 ticks when the market stalled on the Seeker and Comber signals:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My NQ triggered long at 2848.50 at A and I closed it at 2849.00 for a tick gain on the Seeker and Comber signals:

Forex Calls Recap for 9/25/12

Another dull session. See EURUSD below.

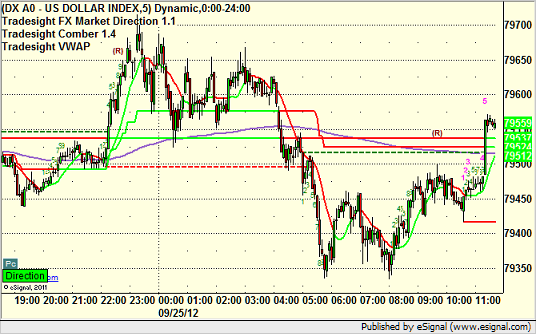

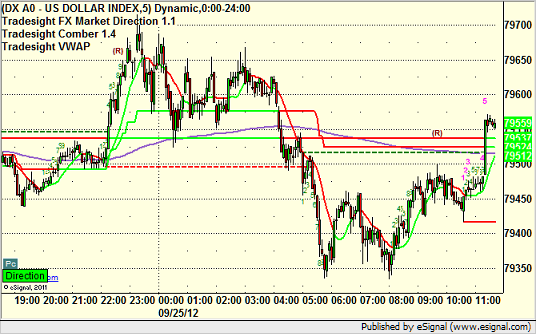

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

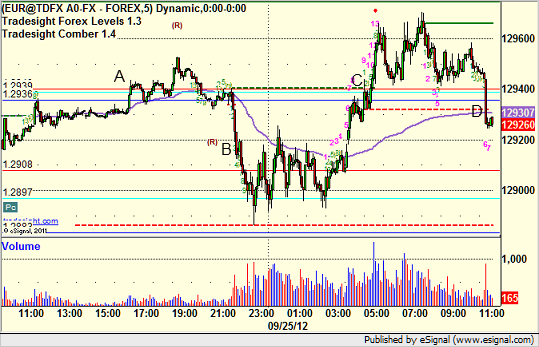

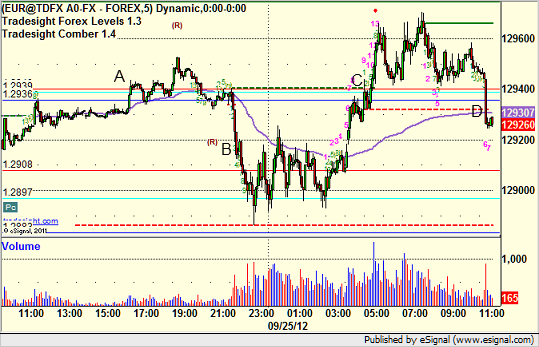

EURUSD:

Triggered long at A very early (so less than half size) and stopped at B. Triggered long at C, held up a long time, finally rolled and we closed it at D before it even hit the stop for end of session:

Forex Calls Recap for 9/25/12

Another dull session. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A very early (so less than half size) and stopped at B. Triggered long at C, held up a long time, finally rolled and we closed it at D before it even hit the stop for end of session:

Tradesight Market Preview for 9/25/12

The SP gapped down in the neighborhood of the LPT and was able to close the gap and ultimately settle flat on the day. This is a technical win for the longs because of the large gap if the bears wanted to press the opportunity was there. Price is still above the short-term trend defining 10ema.

The NQ futures also settled above the 10ema but did not close the gap and closed down 14 on the day. Note that the Seeker count is only one strong candle away from an exhaustion signal.

10-day Trin:

The total put/call ratio has recently recorded a climatically bullish reading.

The multi sector daily chart highlights the relative strength of the BTK sector and weakness of the SOX.

The SOX/NDX ratio chart shows the bearish and sustained underperformance of the SOX. If the ratio breaks to a new low then the overall NDX is likely going to tank.

A breakout in the SPX/TLT cross would be bullish for the broad market but the ratio is currently retreating indicating more conservative flows for new money.

NDX/SPX cross is neutral:

The BKX was the top major sector on the day, taking a bounce off the key 8/8 level. Note how the breakout above the March highs is still holding.

The BTK was slightly lower on the day but is still well above the 10ema and looks poised to challenge the 8/8 level.

The OSX was weaker than the broad market:

The XAU suffered a major distribution day off of range high. The trend will turn negative on a close below the 10ema.

Oil:

Gold:

Silver: