Forex Calls Recap for 9/20/12

A winner in the EURUSD on the short side for us, see that section below. Ranges continue to be small.

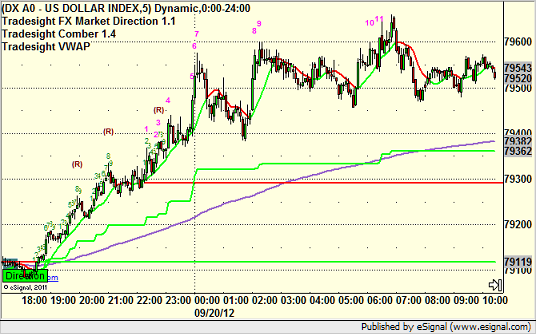

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

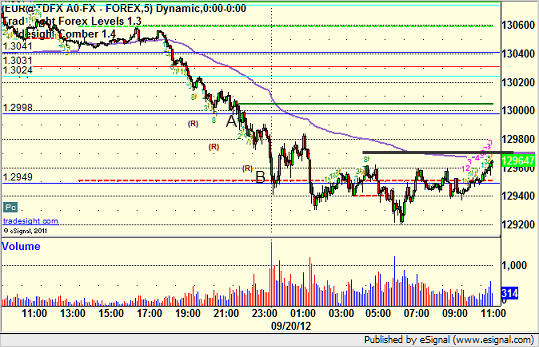

EURUSD:

Triggered short at A, hit first target at B, currently holding the second half of the trade with a stop over the black line:

Tradesight Market Preview for 9/20/12

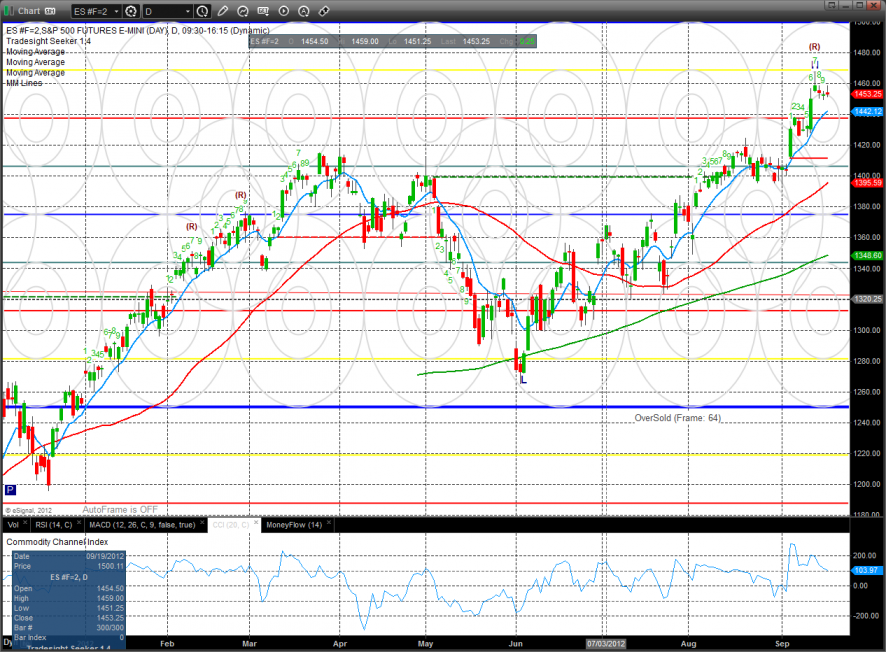

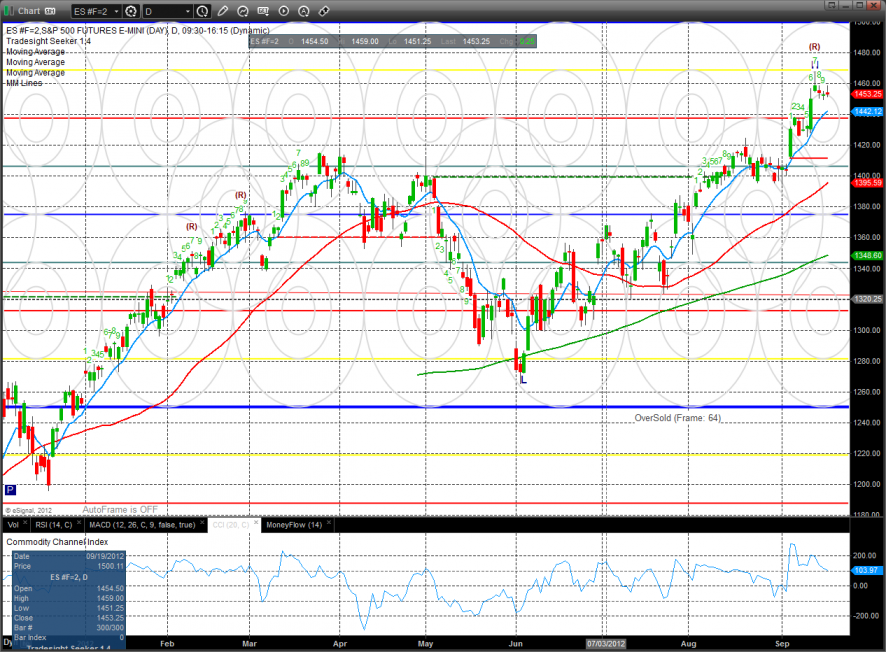

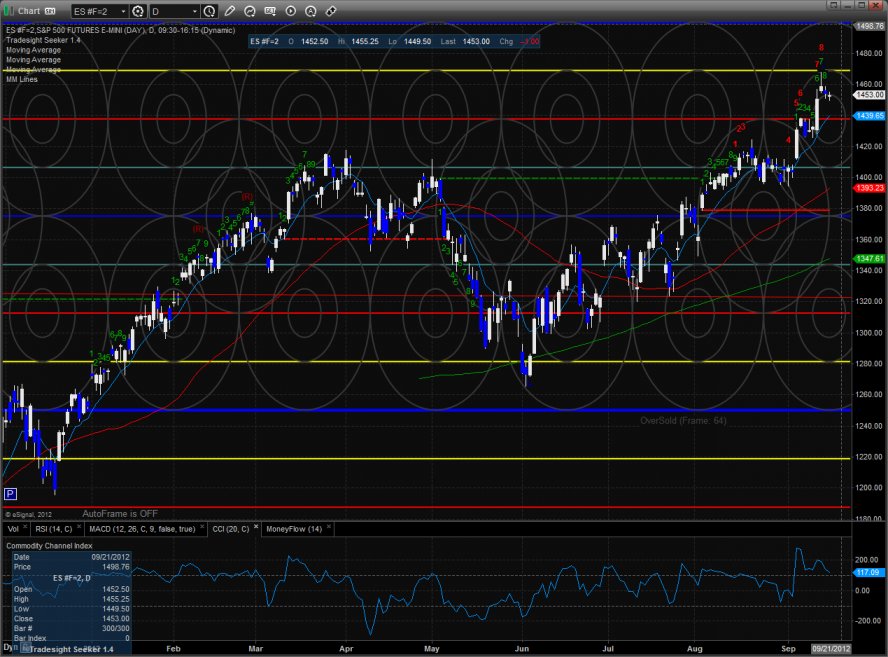

The ES was unchanged on the day and we saw no evidence of options unraveling. Be ready for a bias to develop tomorrow after 60mins into the session.

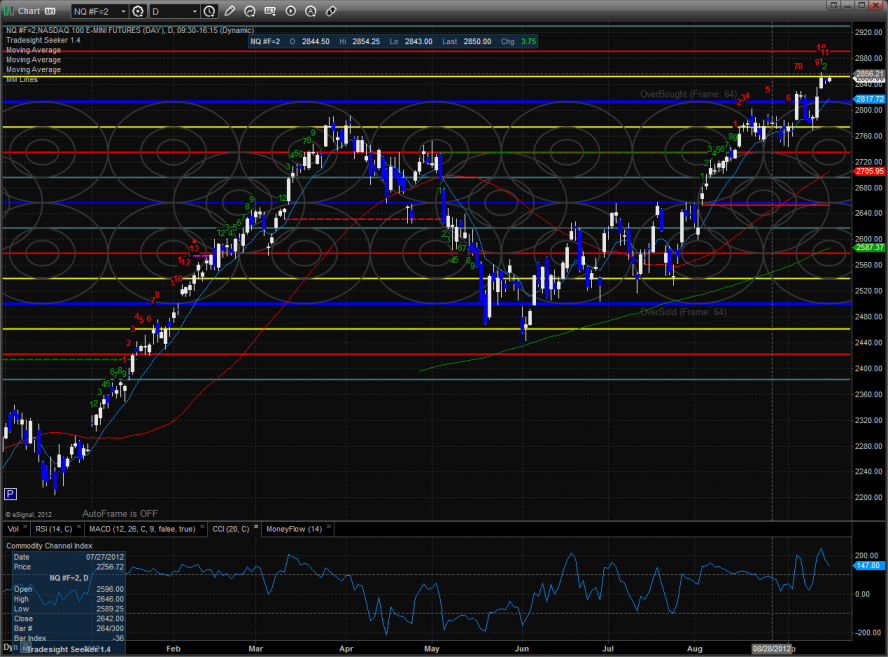

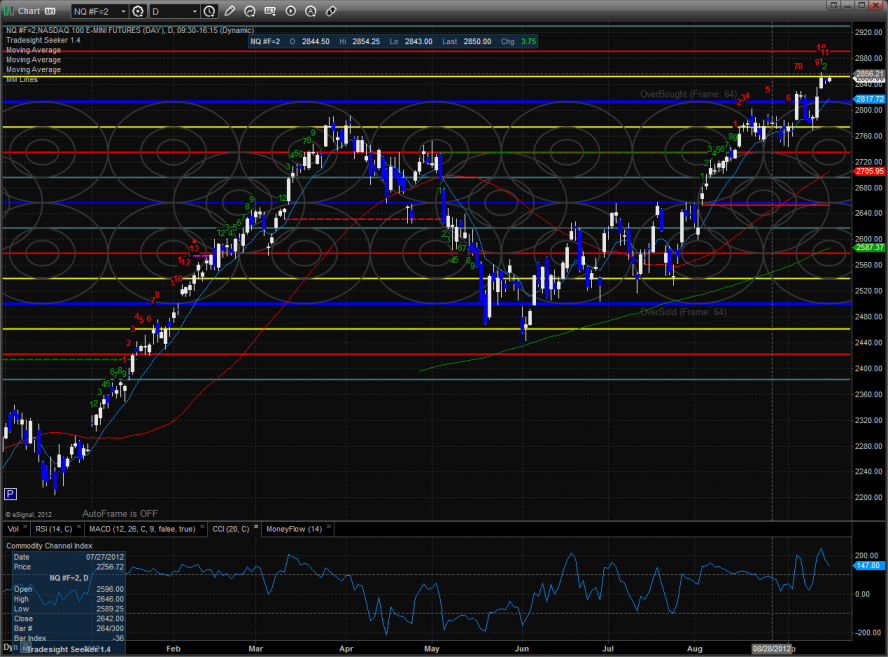

The NQ futures are also in the waiting room for expiration. Note that the Seeker pattern is now 12 days up.

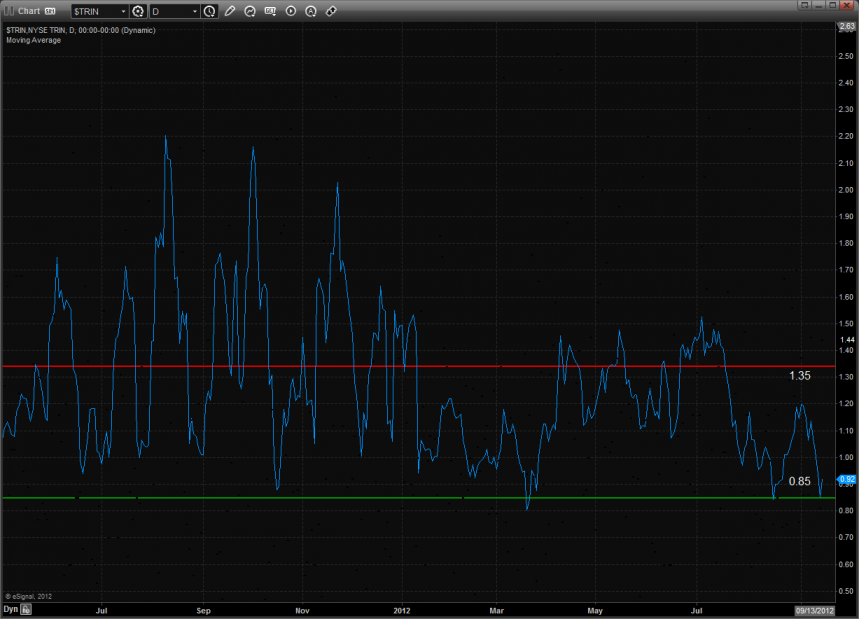

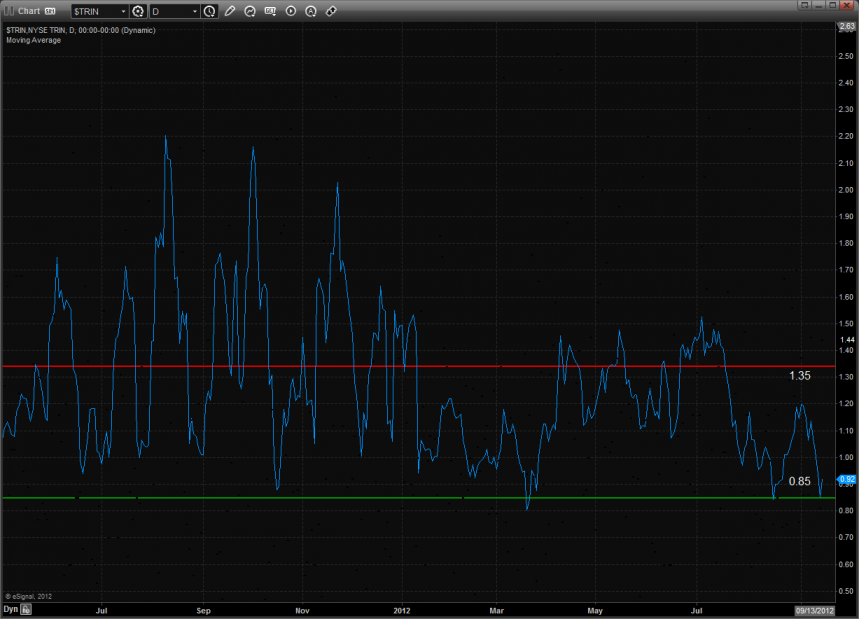

10-day Trin:

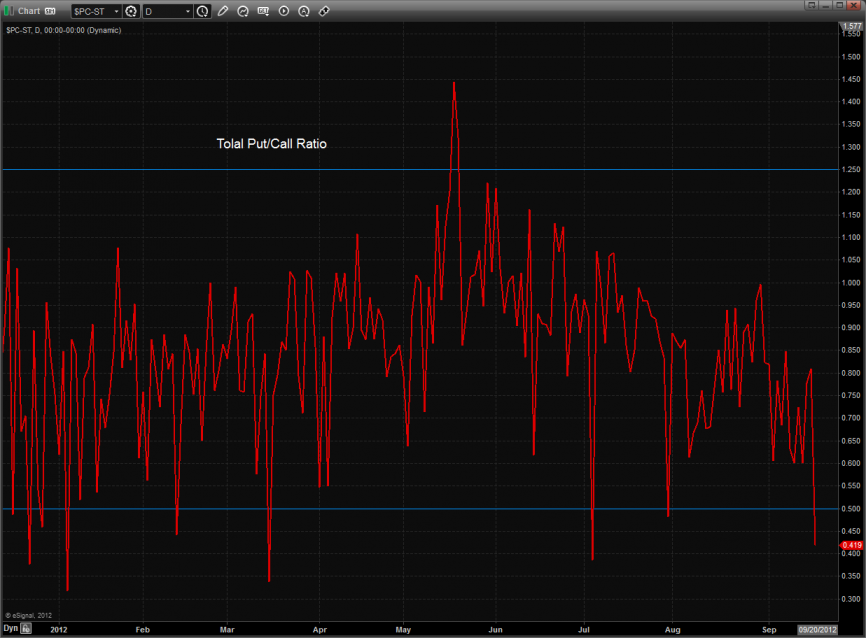

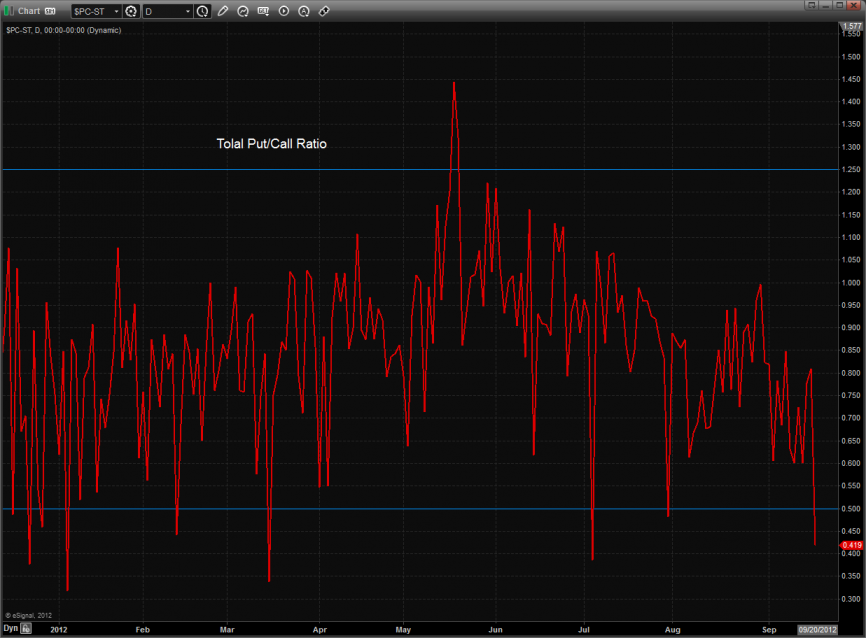

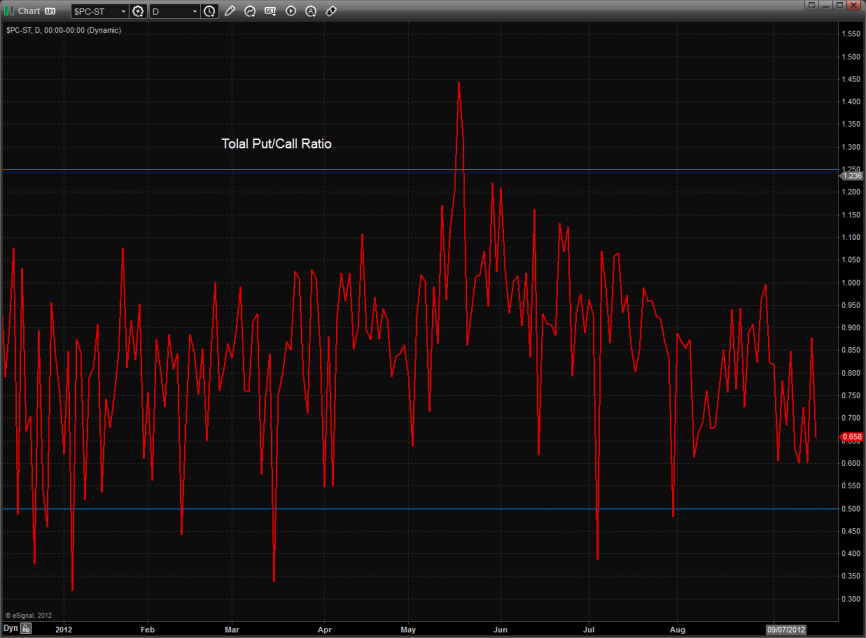

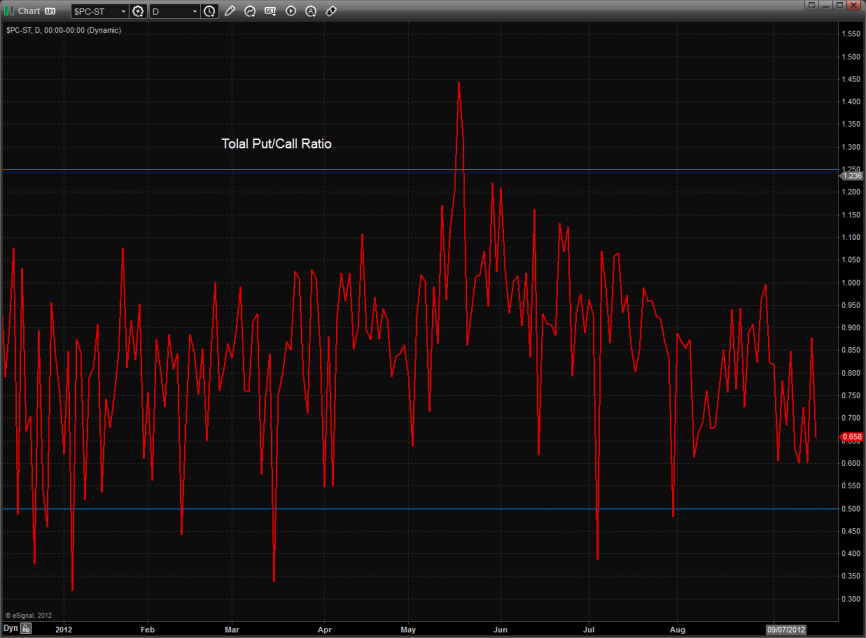

The total put/call ratio has recorded a climatic reading and is overbought:

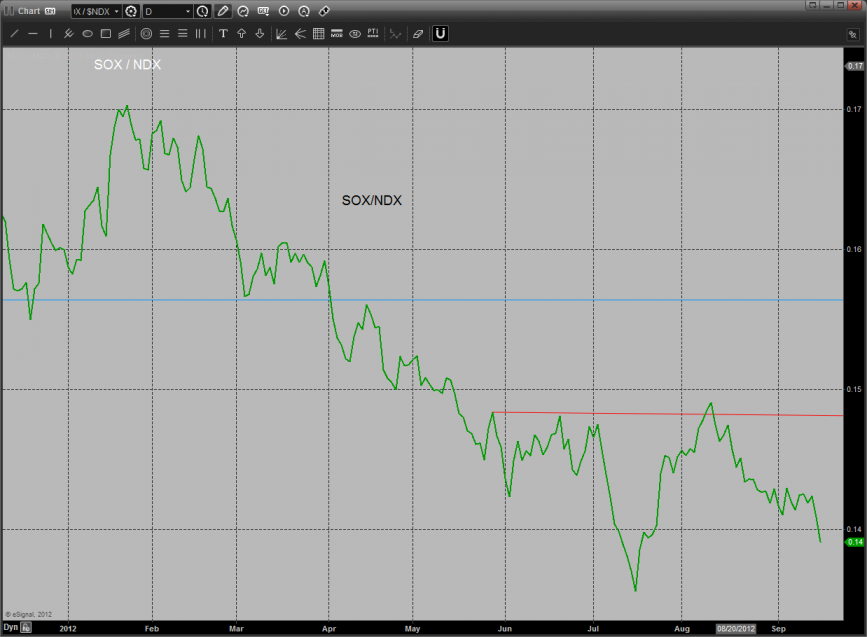

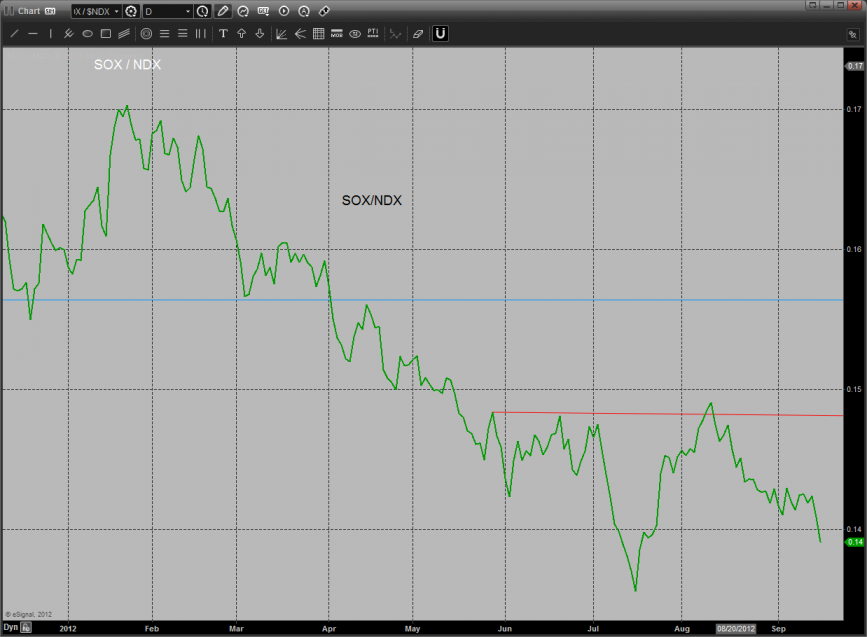

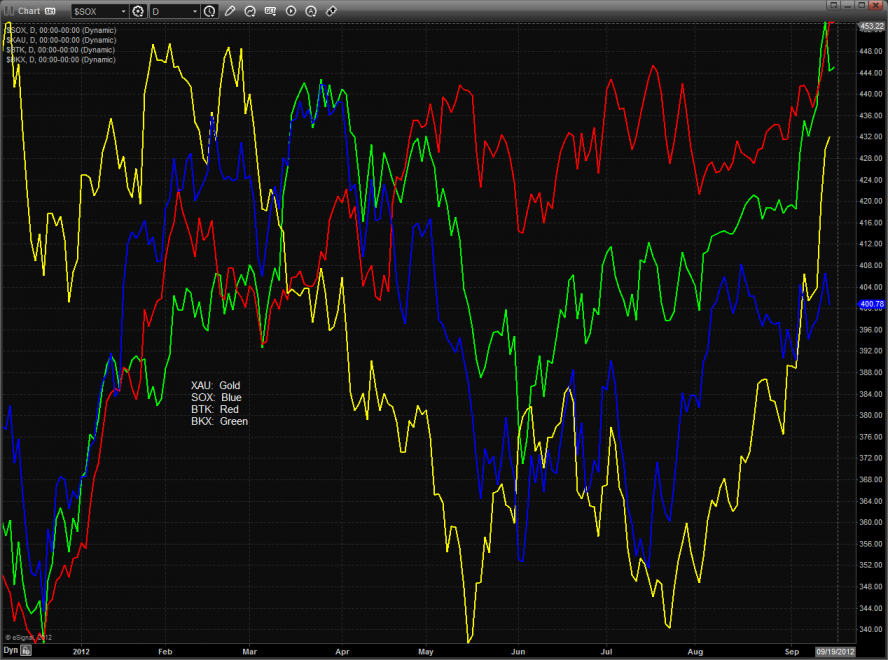

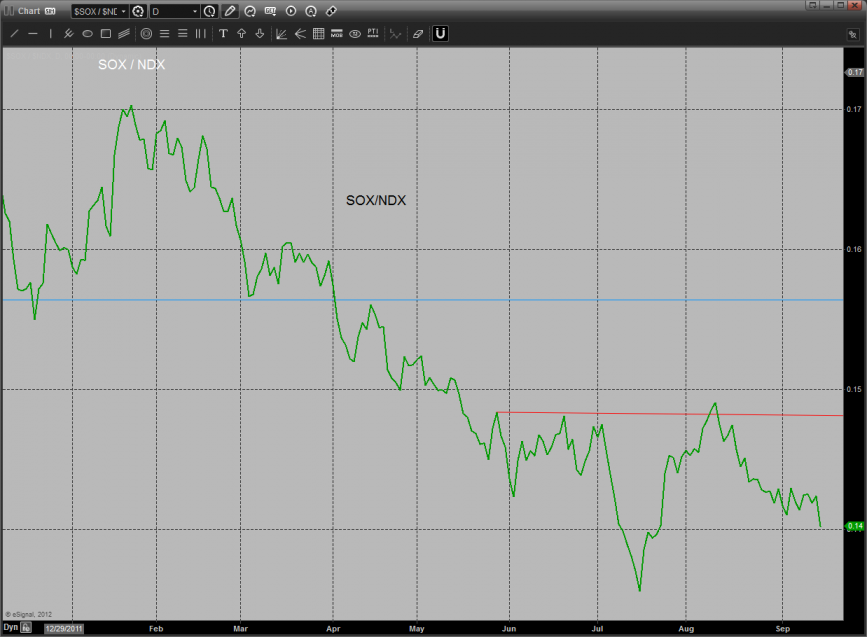

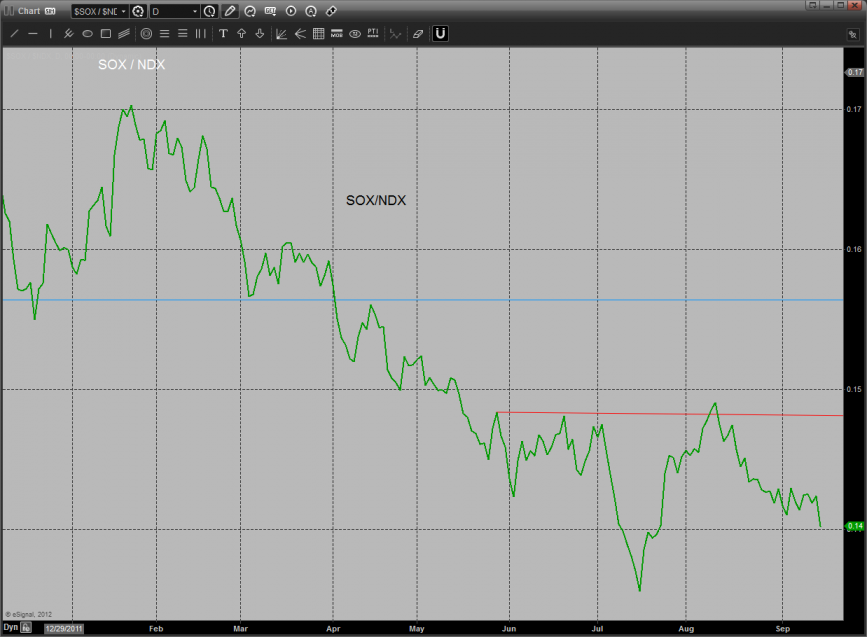

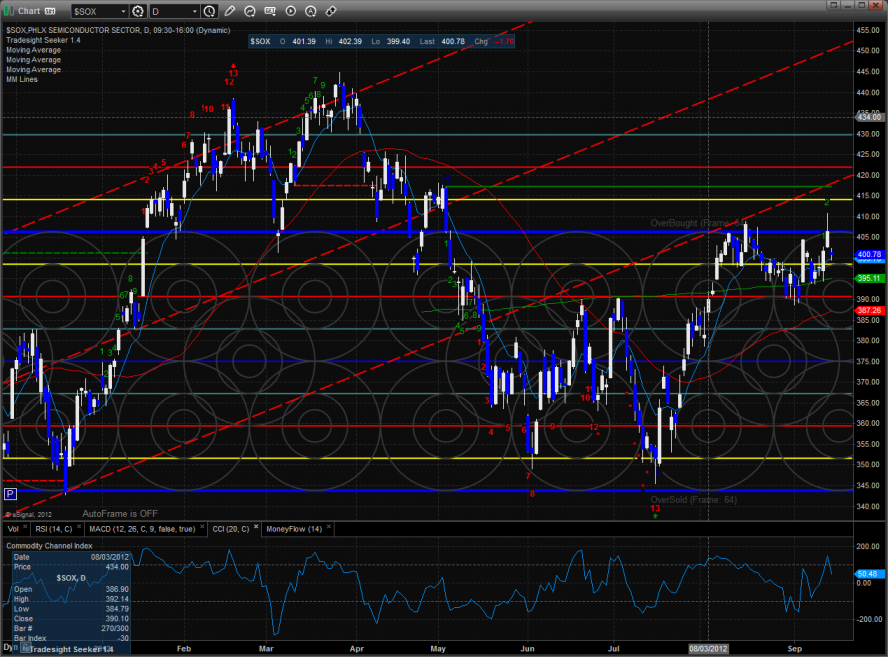

The SOX/NDX cross still looks terrible and is real cause for concern to the NDX longs.

The SPX/TLT took a big hit in favor of bond safety over equity exposure.

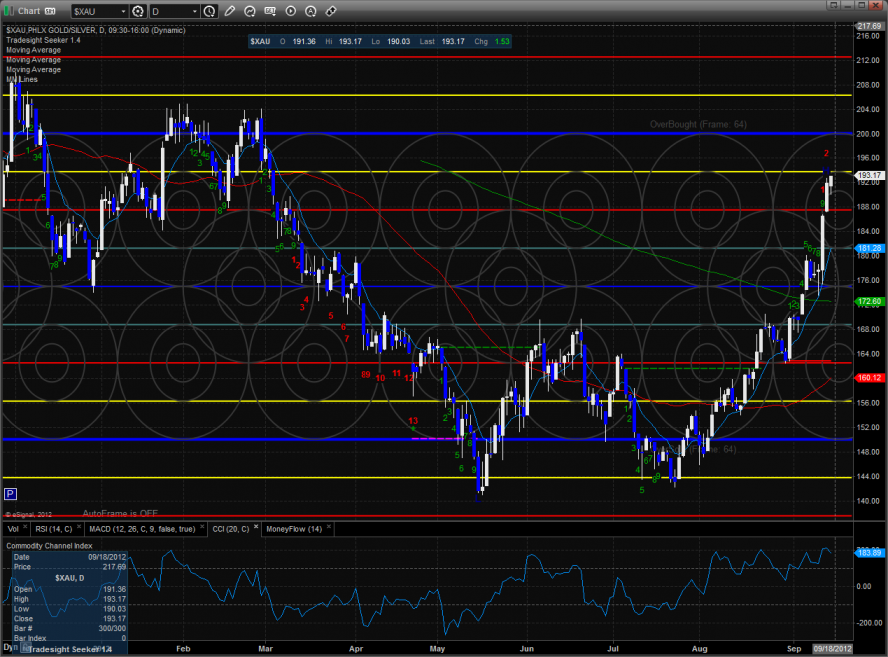

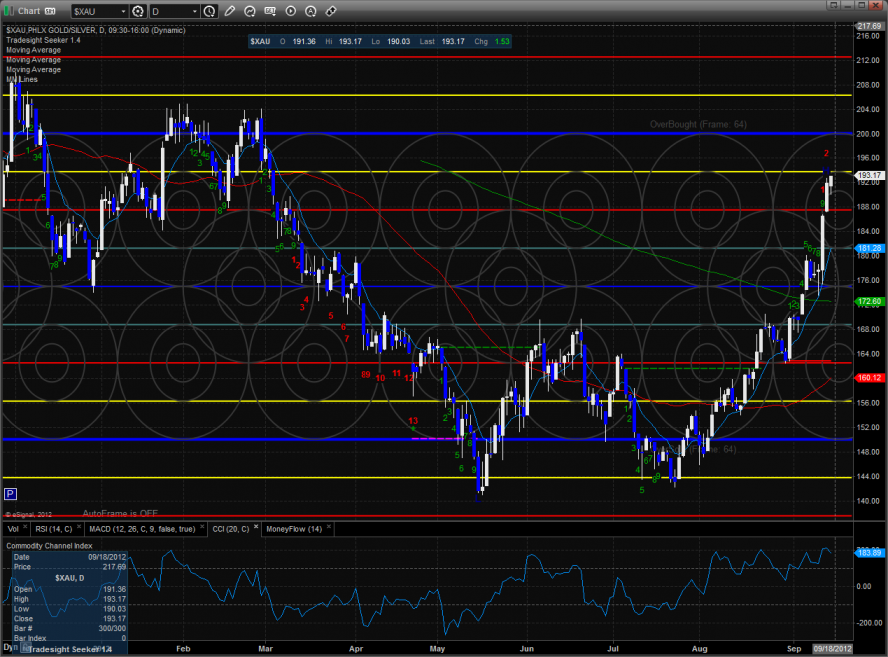

The XAU made a new high on the move clearing the 7/8 level. 8/8 is next and also the area of the prior highs.

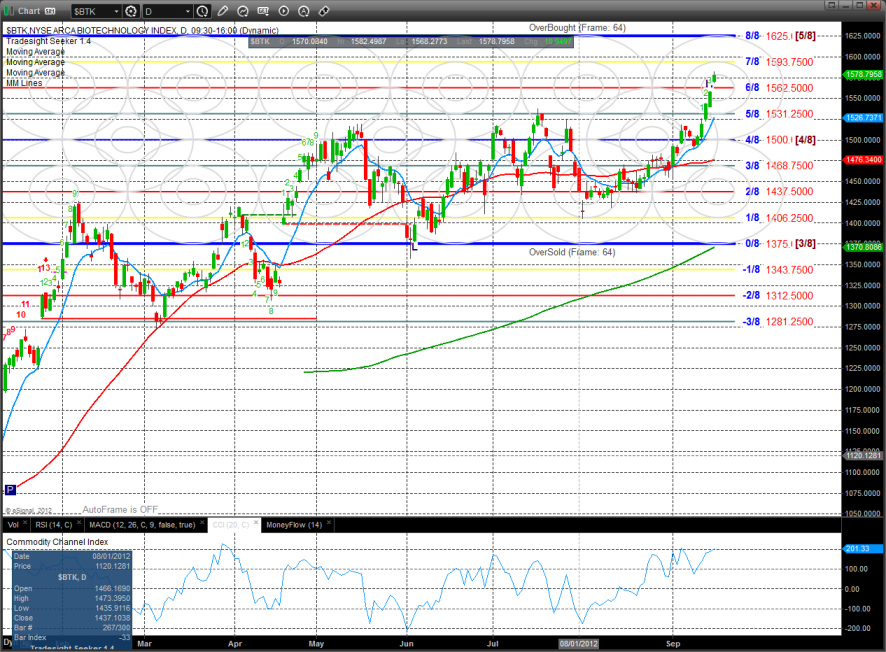

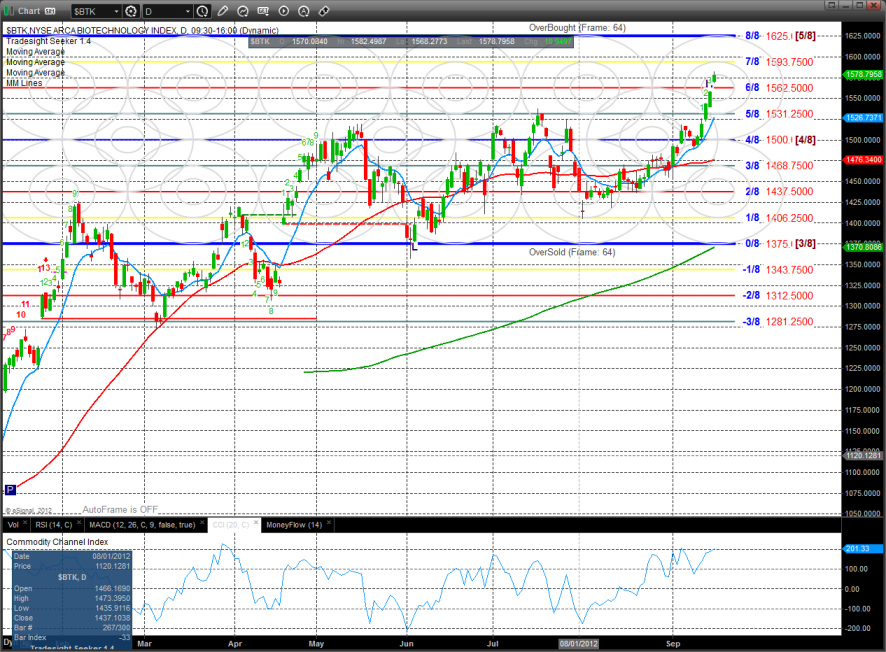

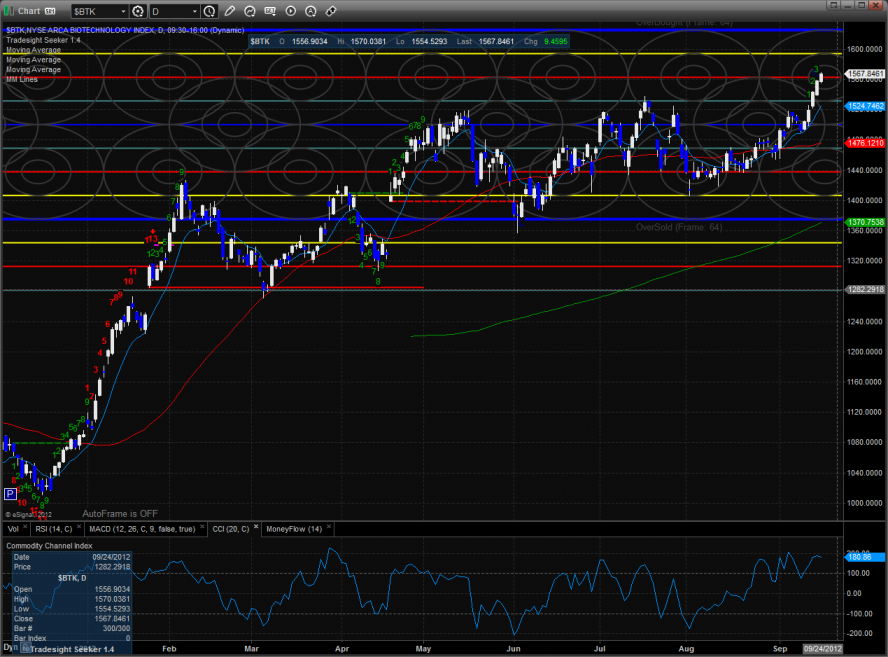

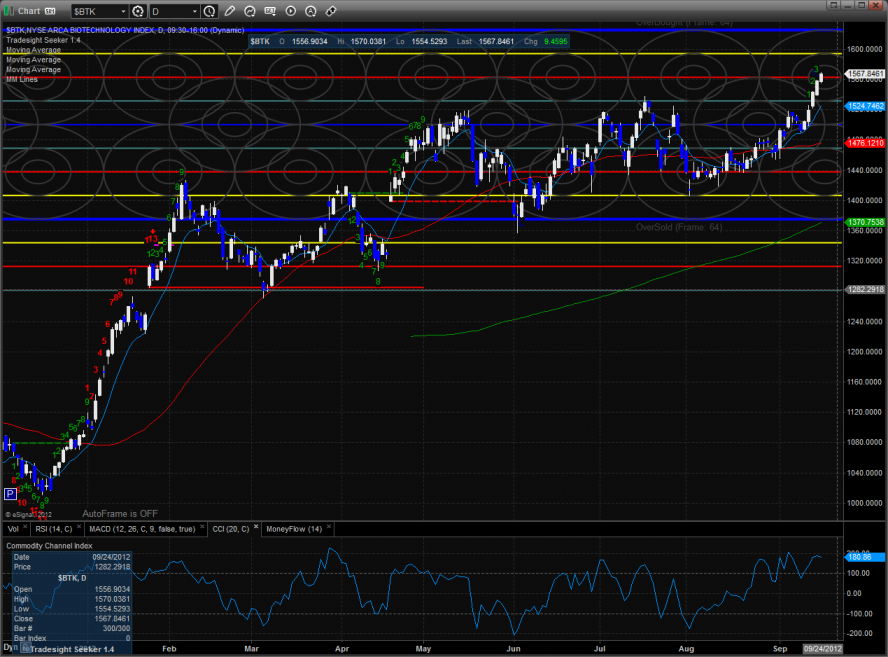

The BTK extended the run and is driving towards the next overhead at 1593.

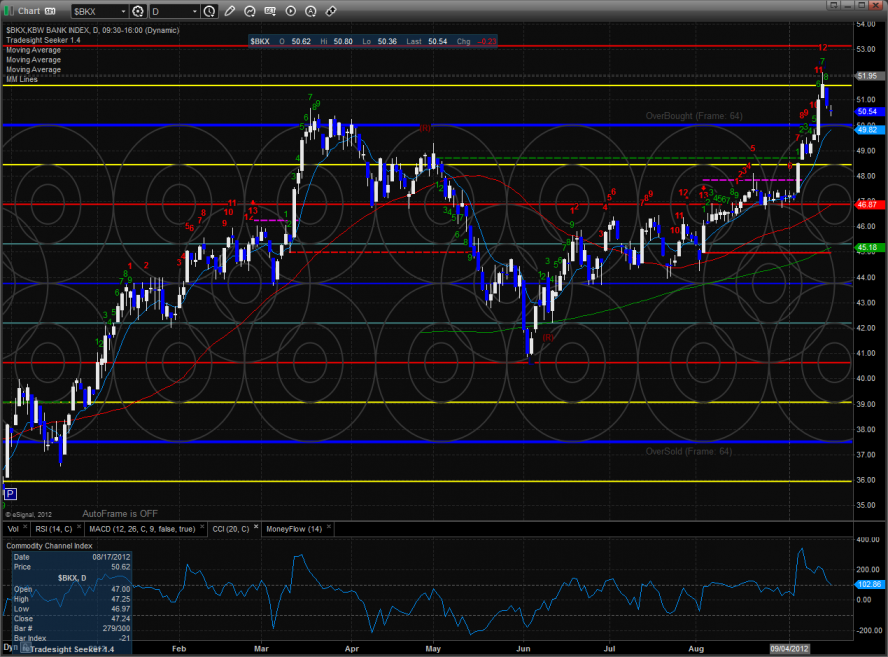

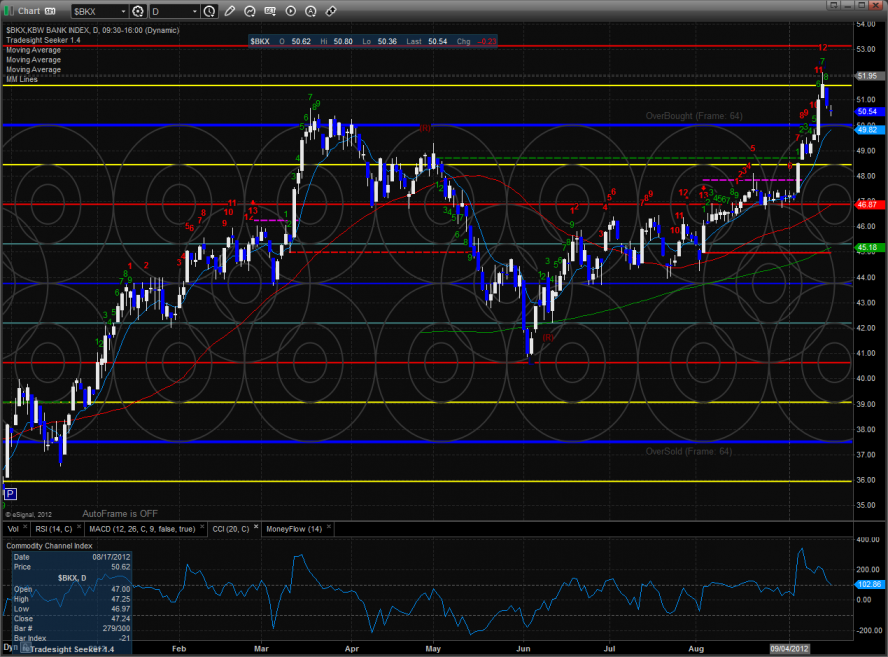

The BKX was a little higher on the day and should find support at the 8/8 level on the retest. If that area fails to hold it will be a false breakout and real trouble for the pattern.

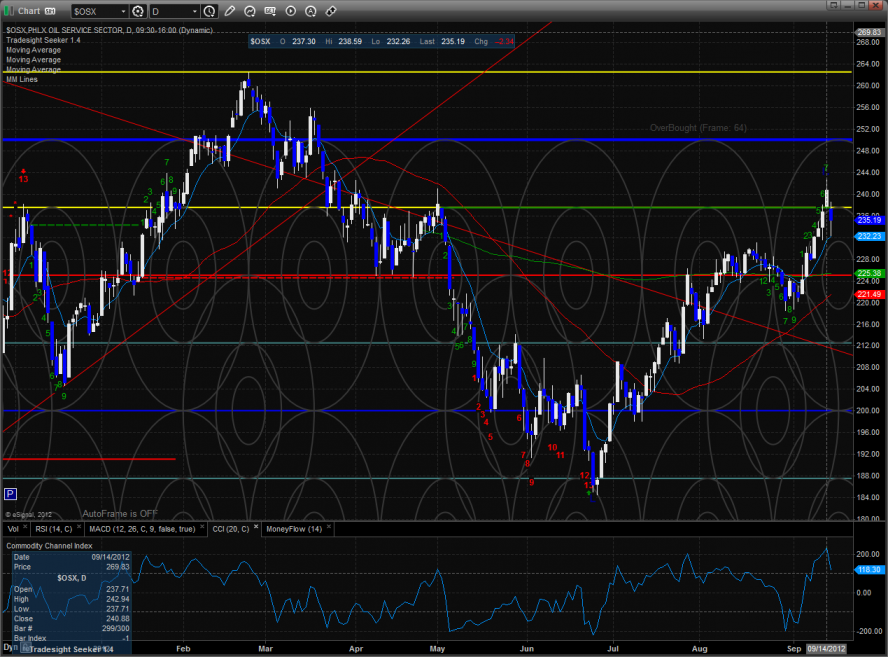

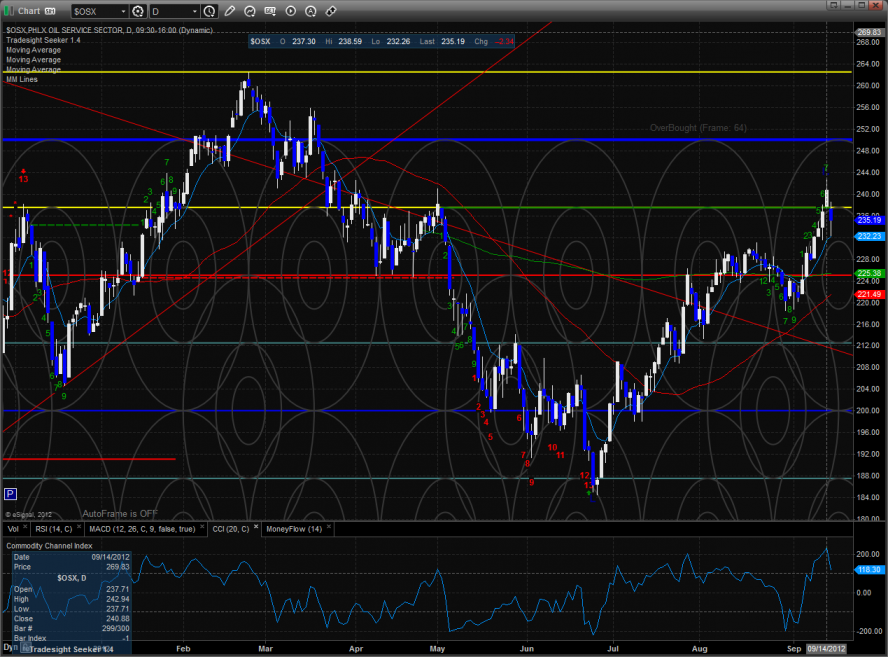

The OSX gapped lower and settled right at the 10ema. If we get a settlement below the 10ema the trend will turn short-term negative.

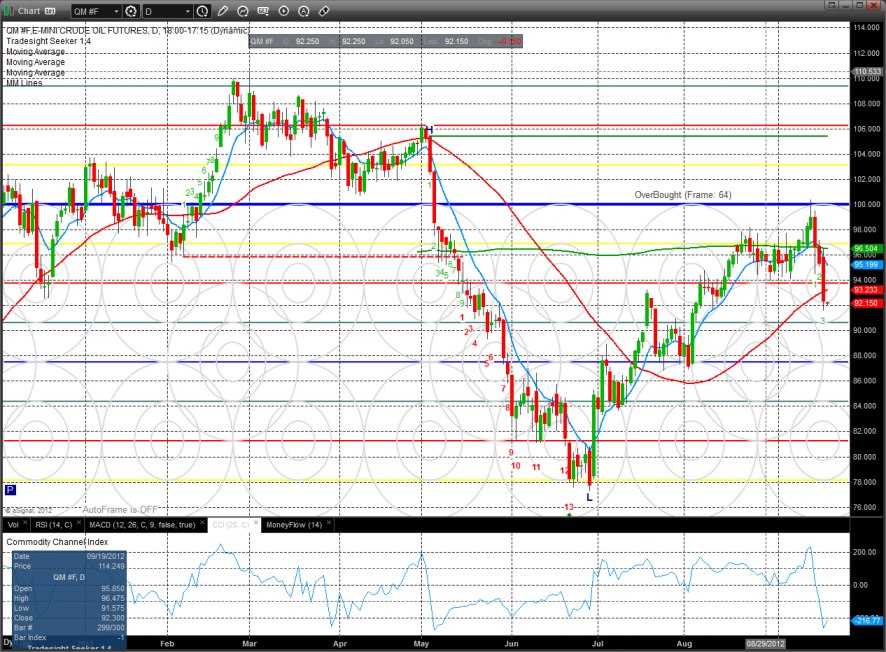

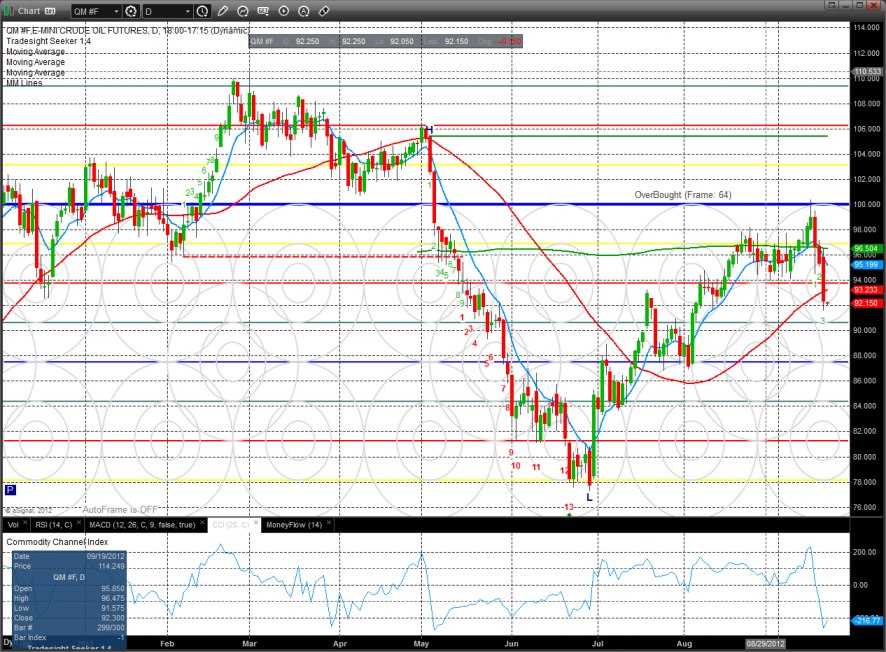

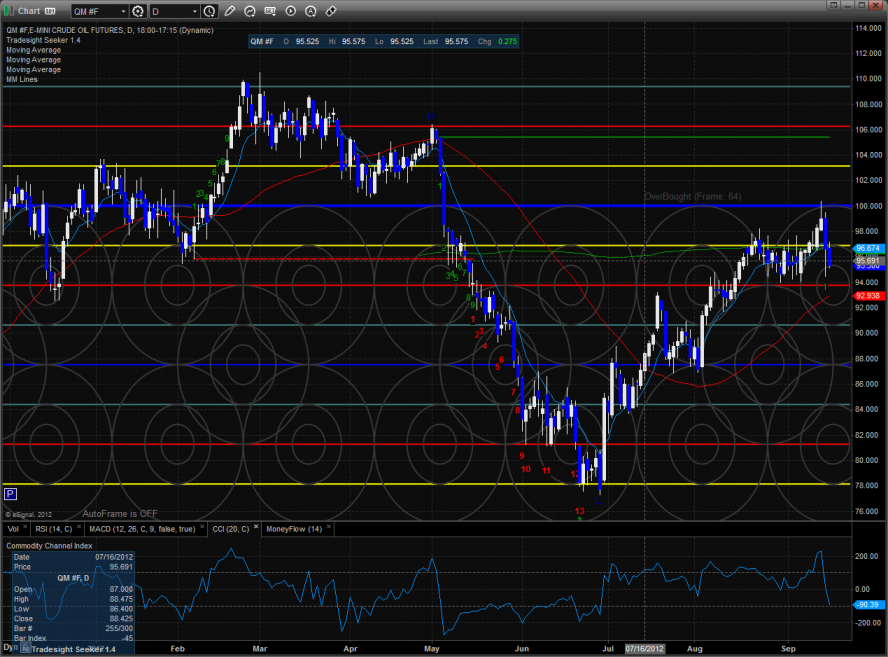

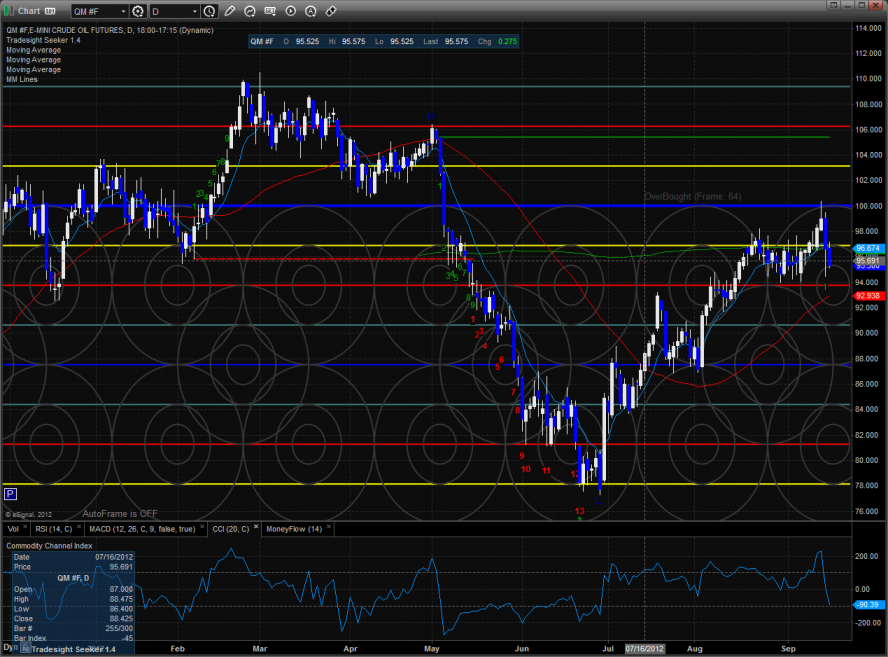

Oil broke hard and settled below all of the major moving averages. The 4/8 level could be a reasonable target.

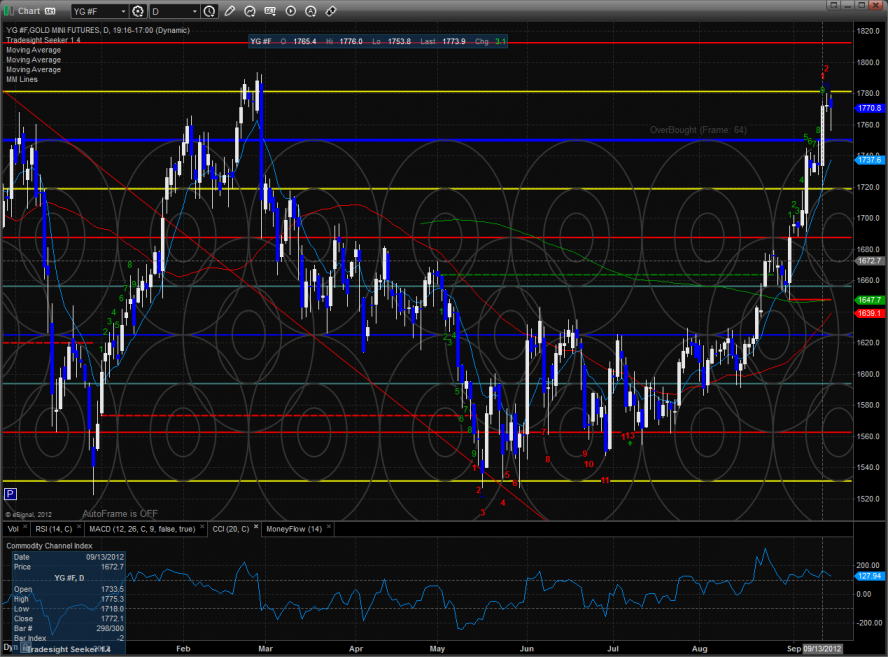

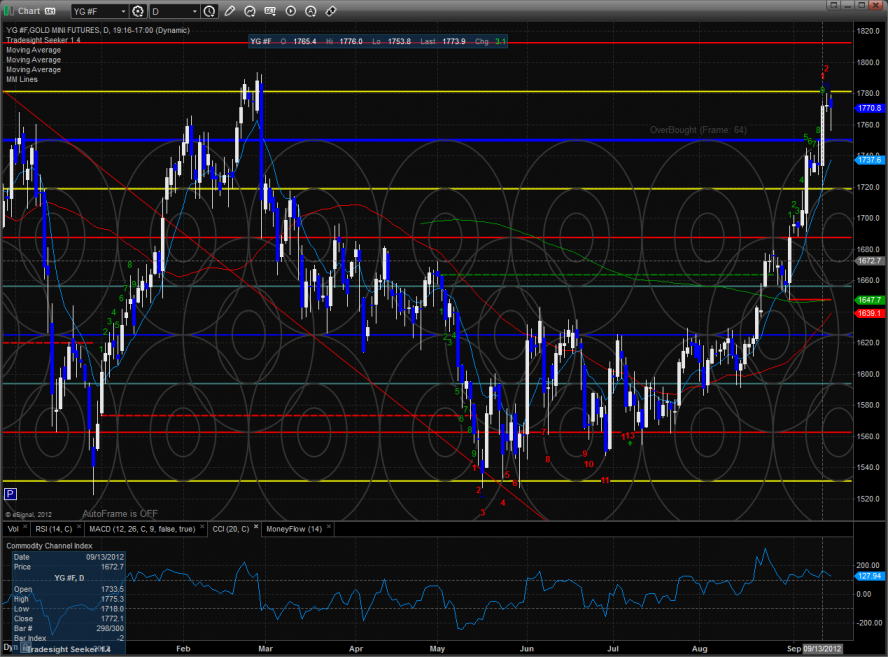

Gold:

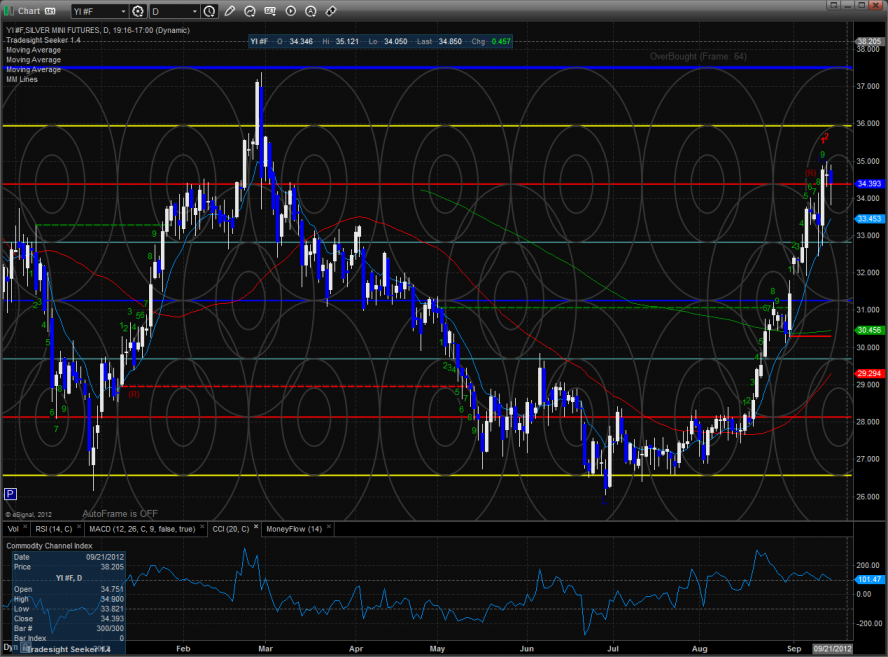

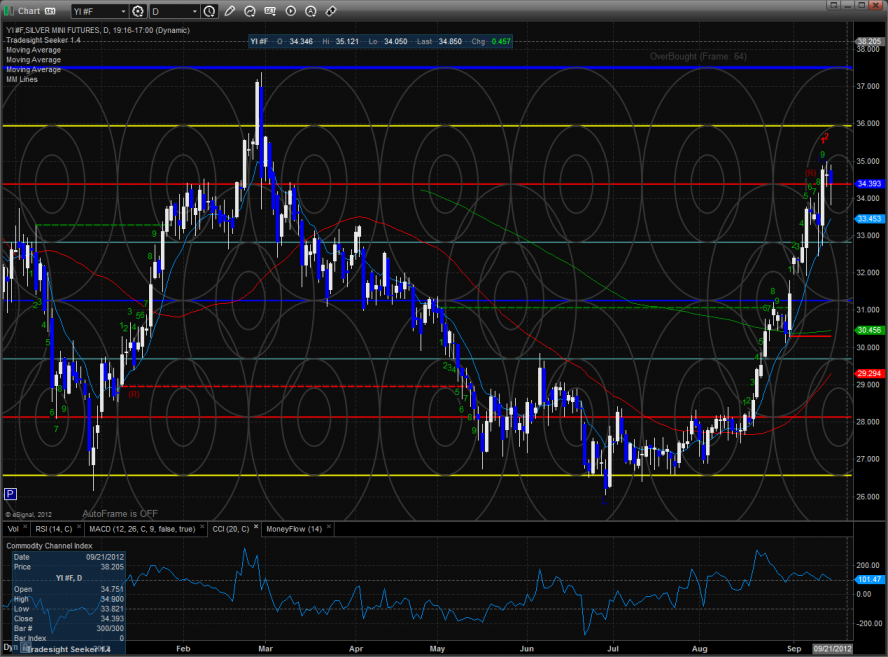

Silver:

Tradesight Market Preview for 9/20/12

The ES was unchanged on the day and we saw no evidence of options unraveling. Be ready for a bias to develop tomorrow after 60mins into the session.

The NQ futures are also in the waiting room for expiration. Note that the Seeker pattern is now 12 days up.

10-day Trin:

The total put/call ratio has recorded a climatic reading and is overbought:

The SOX/NDX cross still looks terrible and is real cause for concern to the NDX longs.

The SPX/TLT took a big hit in favor of bond safety over equity exposure.

The XAU made a new high on the move clearing the 7/8 level. 8/8 is next and also the area of the prior highs.

The BTK extended the run and is driving towards the next overhead at 1593.

The BKX was a little higher on the day and should find support at the 8/8 level on the retest. If that area fails to hold it will be a false breakout and real trouble for the pattern.

The OSX gapped lower and settled right at the 10ema. If we get a settlement below the 10ema the trend will turn short-term negative.

Oil broke hard and settled below all of the major moving averages. The 4/8 level could be a reasonable target.

Gold:

Silver:

Stock Picks Recap for 9/19/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, IPXL triggered long (with market support) and worked:

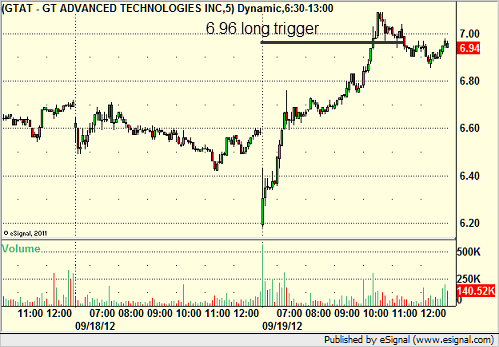

GTAT triggered long (with market support) and didn't go enough in either direction to count:

ROST triggered short (with market support) and worked:

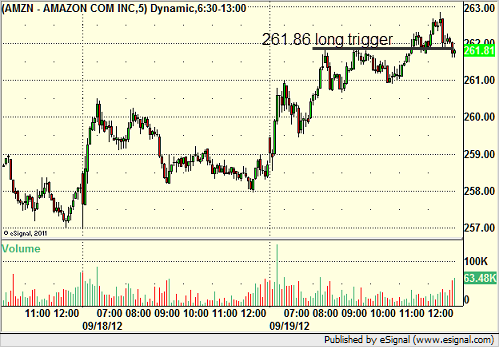

From the Messenger/Tradesight_st Twitter Feed, AMZN triggered long (with market support) and didn't work:

Rich's CF triggered long (with market support) and didn't work initially:

His ENR triggered long (with market support) and worked:

AMZN in the afternoon triggered long (with market support) and worked enough for a partial:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

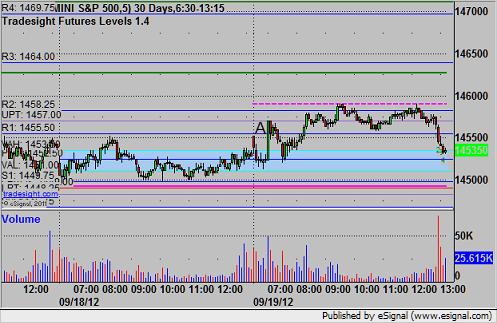

Futures Calls Recap for 9/19/12

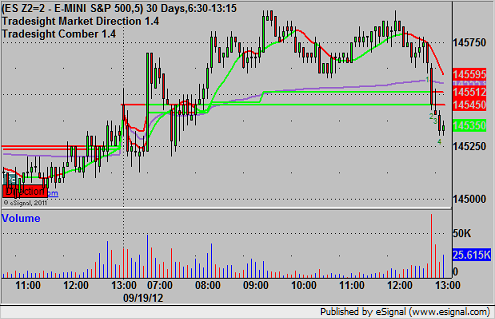

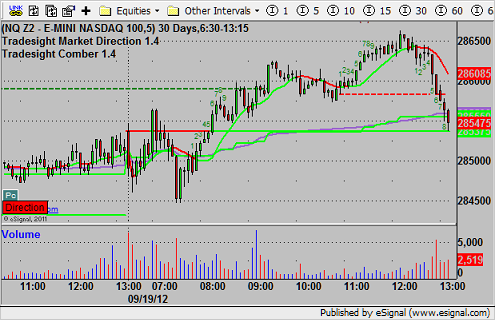

A couple of calls but only one trigger on what was a slightly disappointing day that could have seen triple-witching options unraveling, but instead saw the ES stuck in just over a 5 point range again.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at 1455.75 at A and stopped one tick short of the first target (although our UPT was the wall there) before eventually rolling over and stopping. A retrigger would have worked on the same call:

Forex Calls Recap for 9/19/2012

Another boring session that went nowhere, even if ranges were a little better. I'll continue to stick with half size.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

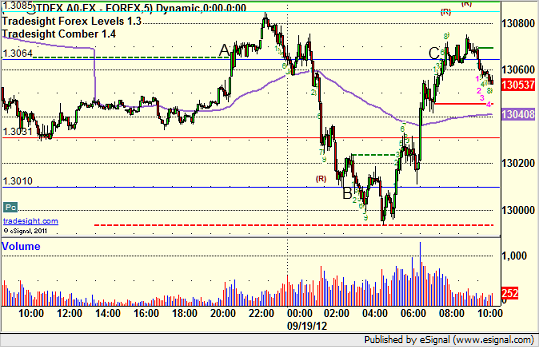

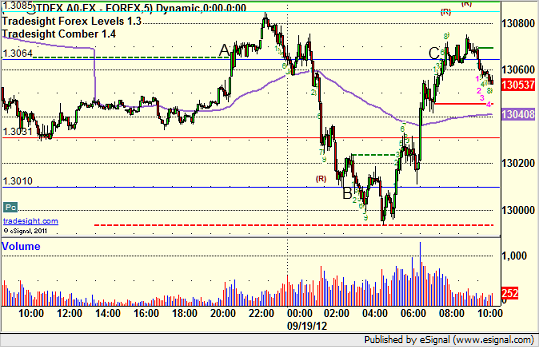

EURUSD:

Triggered long at A and stopped. Triggered short at B and stopped. Triggered long at C and closed for end of session:

Forex Calls Recap for 9/19/2012

Another boring session that went nowhere, even if ranges were a little better. I'll continue to stick with half size.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A and stopped. Triggered short at B and stopped. Triggered long at C and closed for end of session:

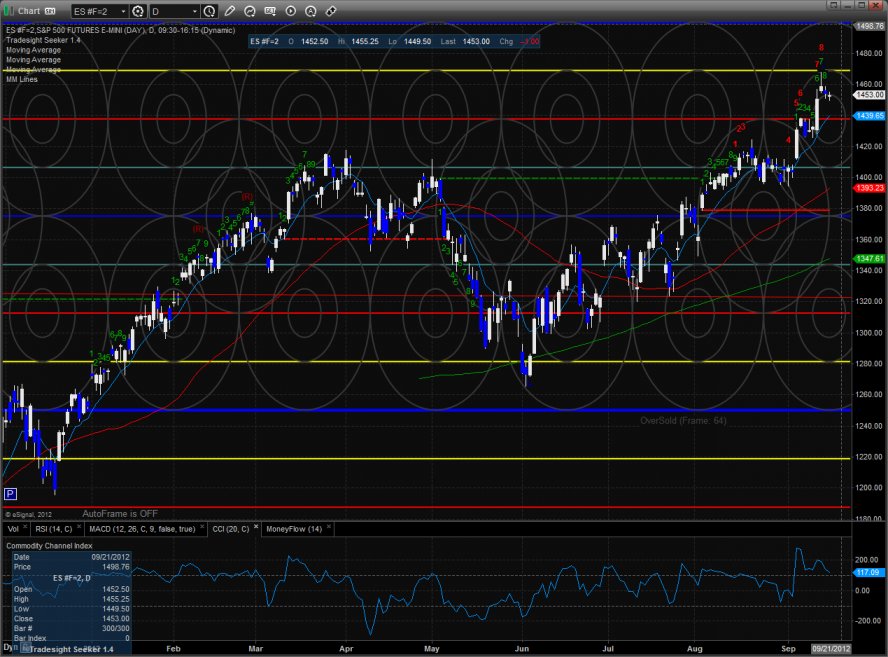

Tradesight Market Preview for 9/19/12

The ES treaded water ahead of option expiration Friday. There is nothing new technically and the chart has posted a couple of very small range bars that have worked off the large impulse from last week.

The NQ futures were a little stronger than the broad market and were higher on the day by 4 handles. Note that the Seeker countdown is now 12 days up.

10-Day Trin still has overbought energy:

Total put/call ratio:

Pc

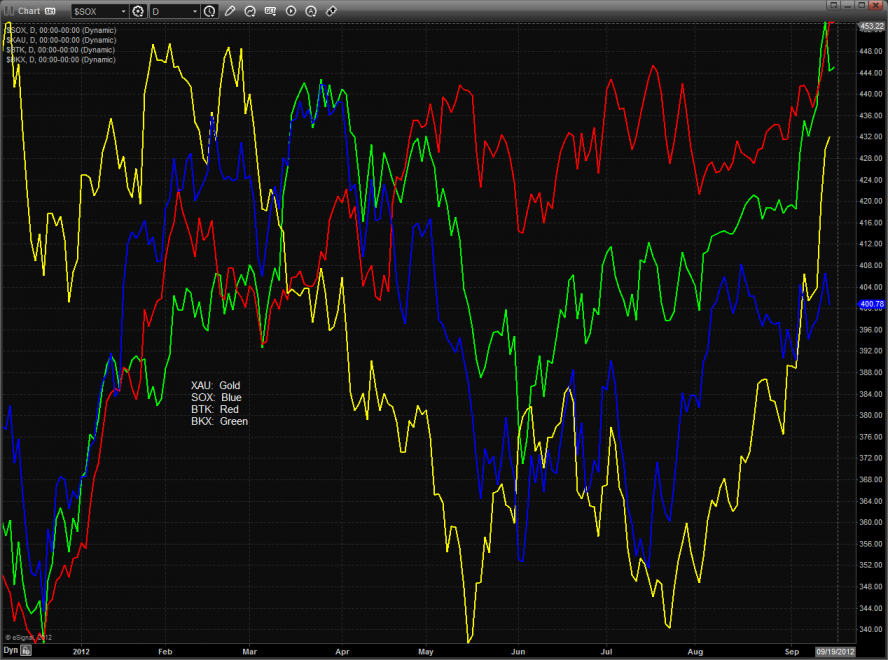

Multi sector daily chart:

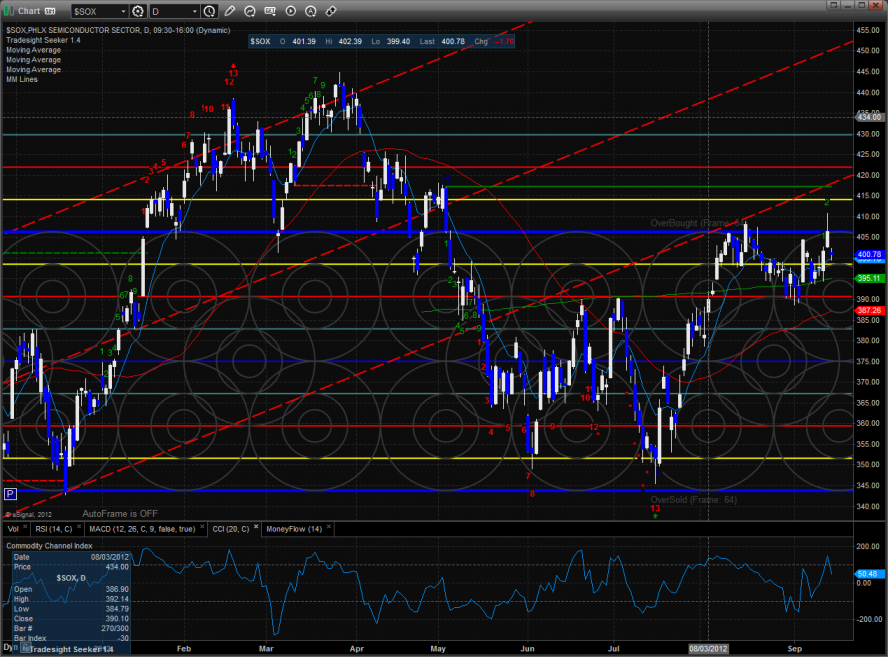

The SOX is still relatively weak and a real issue for the broad market.

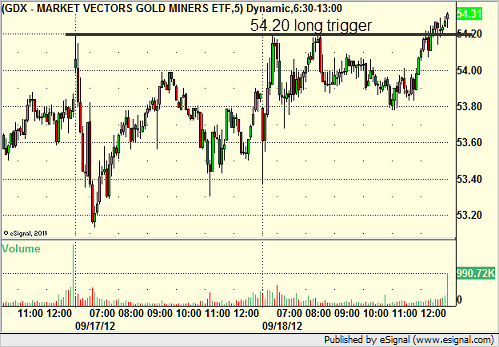

The XAU was the top gun on the day and made a new high on the move. The next trade-to-target will be the 8/8 level.

The BTK is making new highs on the move and the CCI has more room before it gets terminally overbought.

The SOX was down small and is still trapped below the 8/8 level.

The BKX is setting up for a Seeker sell signal. Keep a close eye on this key indicator.

The OSX was weaker than the broad market and is now 8 days up.

Gold:

Silver:

Oil:

Tradesight Market Preview for 9/19/12

The ES treaded water ahead of option expiration Friday. There is nothing new technically and the chart has posted a couple of very small range bars that have worked off the large impulse from last week.

The NQ futures were a little stronger than the broad market and were higher on the day by 4 handles. Note that the Seeker countdown is now 12 days up.

10-Day Trin still has overbought energy:

Total put/call ratio:

Pc

Multi sector daily chart:

The SOX is still relatively weak and a real issue for the broad market.

The XAU was the top gun on the day and made a new high on the move. The next trade-to-target will be the 8/8 level.

The BTK is making new highs on the move and the CCI has more room before it gets terminally overbought.

The SOX was down small and is still trapped below the 8/8 level.

The BKX is setting up for a Seeker sell signal. Keep a close eye on this key indicator.

The OSX was weaker than the broad market and is now 8 days up.

Gold:

Silver:

Oil:

Stock Picks Recap for 9/18/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SFLY triggered long (with market support) and worked:

VVUS triggered long (without market support) and didn't work initially, worked later:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (without market support) and didn't work:

His GDX triggered long (ETF, so no market support needed) but too late in the day to get going or count:

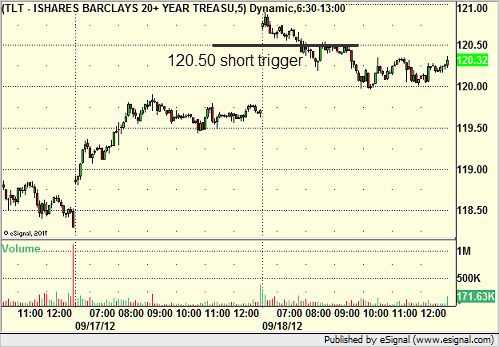

TLT triggered short (ETF, so no market support needed) and worked, and I posted the final exit at 120:

Rich's ENR triggered long (without market support) and worked:

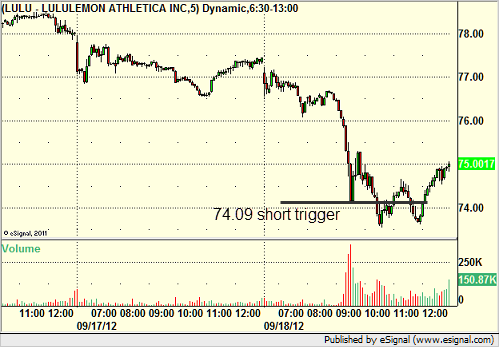

His LULU triggered short (with market support) and worked:

In total, that's just 3 trades triggering with market support, all of them worked.