Stock Picks Recap for 9/18/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SFLY triggered long (with market support) and worked:

VVUS triggered long (without market support) and didn't work initially, worked later:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (without market support) and didn't work:

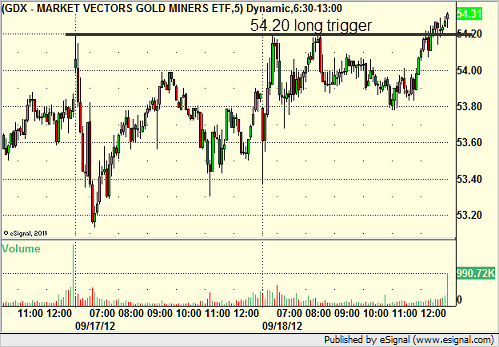

His GDX triggered long (ETF, so no market support needed) but too late in the day to get going or count:

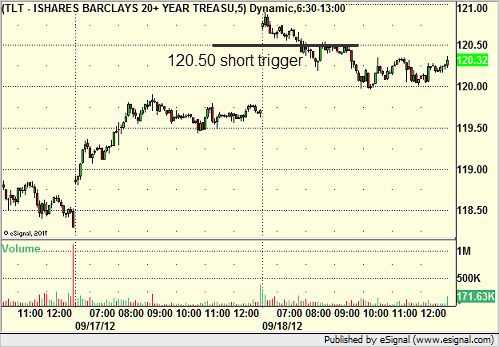

TLT triggered short (ETF, so no market support needed) and worked, and I posted the final exit at 120:

Rich's ENR triggered long (without market support) and worked:

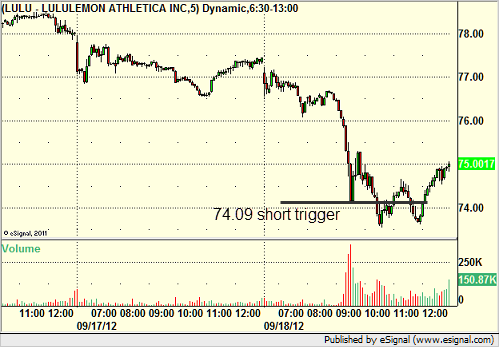

His LULU triggered short (with market support) and worked:

In total, that's just 3 trades triggering with market support, all of them worked.

Futures Calls Recap for 9/18/12

Another dead flat session with little volume. NASDAQ volume closed out at 1.4 billion shares, and the ES range was only 5 points. Our NQ trigger stopped twice, see that section below.

Net ticks: -14 ticks.

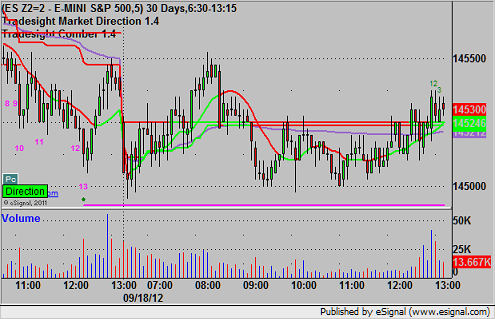

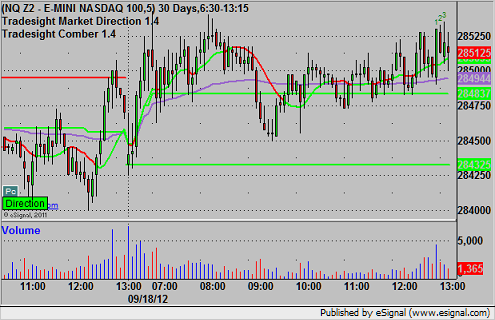

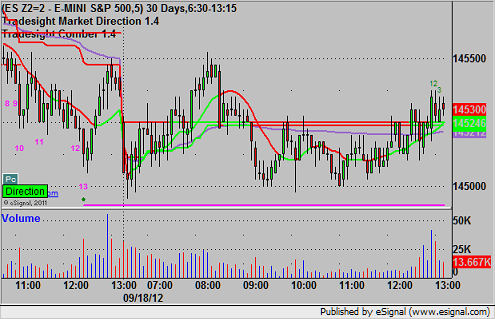

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

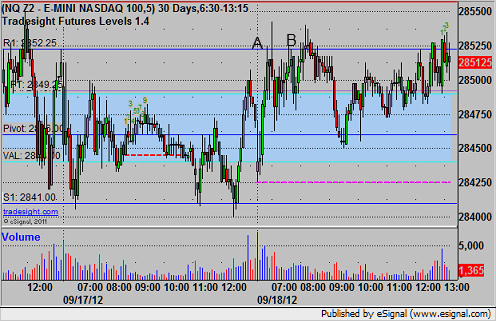

NQ:

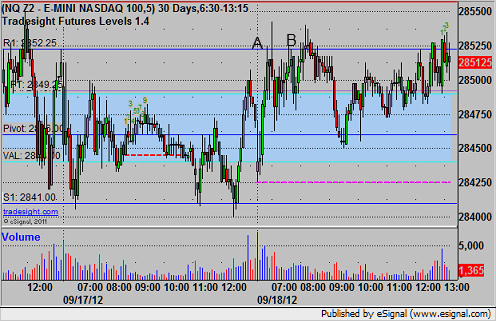

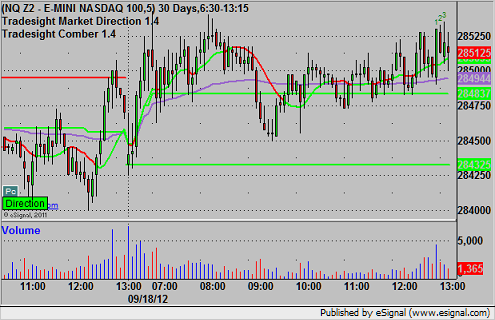

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's long triggered at 2852.50 at A and stopped for 7 ticks, and then again at B and stopped for 7 ticks:

Futures Calls Recap for 9/18/12

Another dead flat session with little volume. NASDAQ volume closed out at 1.4 billion shares, and the ES range was only 5 points. Our NQ trigger stopped twice, see that section below.

Net ticks: -14 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's long triggered at 2852.50 at A and stopped for 7 ticks, and then again at B and stopped for 7 ticks:

Forex Calls Recap for 9/18/12

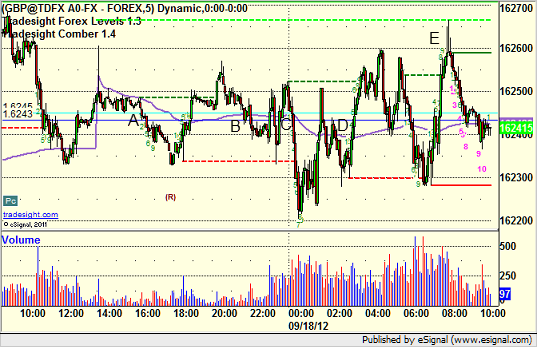

I keep getting emails from subscribers asking when we are going to go back to full size. The answer is the same every year. August is typically a slow month, and then the big traders tend to get back to work at some point after Labor Day. Just because we get a one-day spike due to a Fed announcement doesn't mean that ranges are back to normal. I want to see 2-3 days of good ranges that aren't just because of a news spike. Until then...have a look at the GBPUSD this session. Basically, 40 pips of range. Who wants to be trading heavy in that? See that section below for today's trigger.

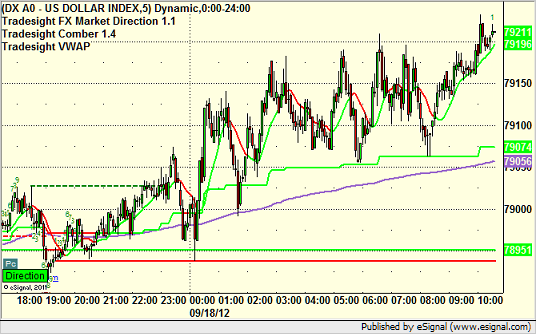

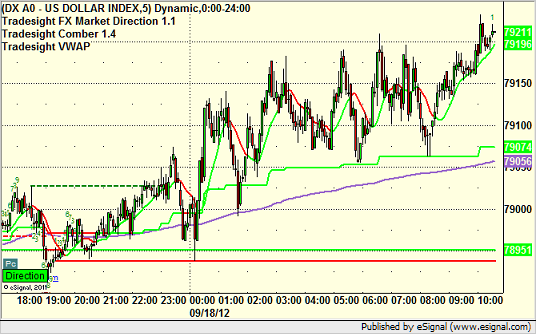

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

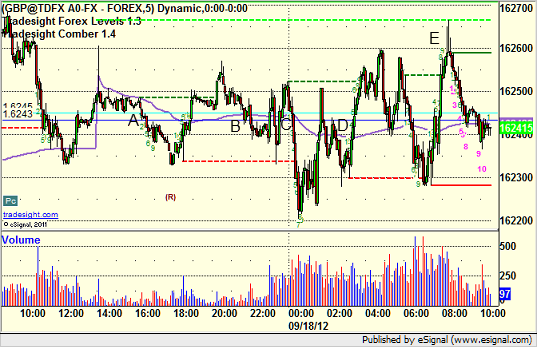

GBPUSD:

Triggered short early at A, but gave you chances all session at B, C, D and more to enter, and finally stopped at E:

Forex Calls Recap for 9/18/12

I keep getting emails from subscribers asking when we are going to go back to full size. The answer is the same every year. August is typically a slow month, and then the big traders tend to get back to work at some point after Labor Day. Just because we get a one-day spike due to a Fed announcement doesn't mean that ranges are back to normal. I want to see 2-3 days of good ranges that aren't just because of a news spike. Until then...have a look at the GBPUSD this session. Basically, 40 pips of range. Who wants to be trading heavy in that? See that section below for today's trigger.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

GBPUSD:

Triggered short early at A, but gave you chances all session at B, C, D and more to enter, and finally stopped at E:

Tradesight Market Preview for 9/18/12

The ES futures lost 5 on the day leaving a topping tail in the chart.

The NQ futures posted an indecisive inside day.

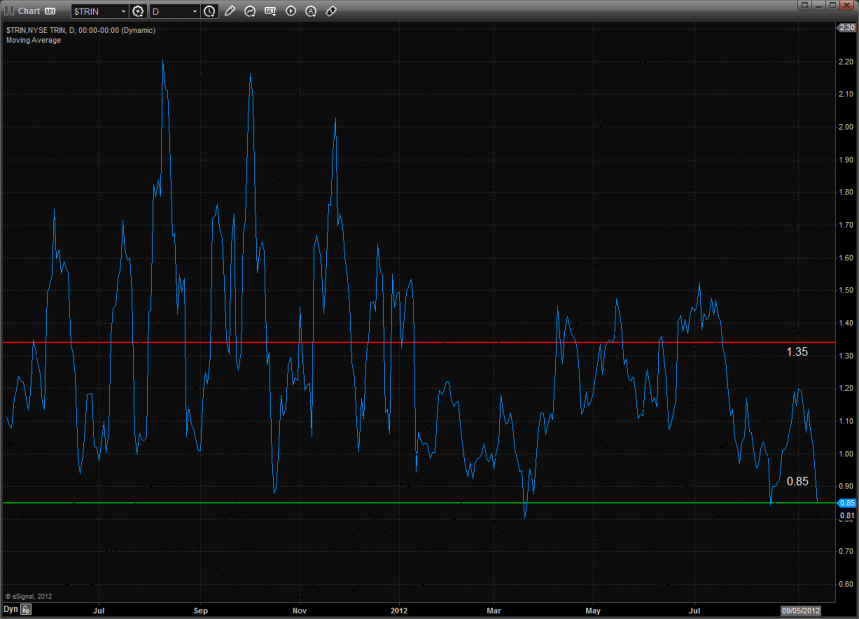

This is the only important development that traders should pay attention to. The 10-day Trin has produced an overbought signal as of last week. It is only the third time that this has happened in 2012.

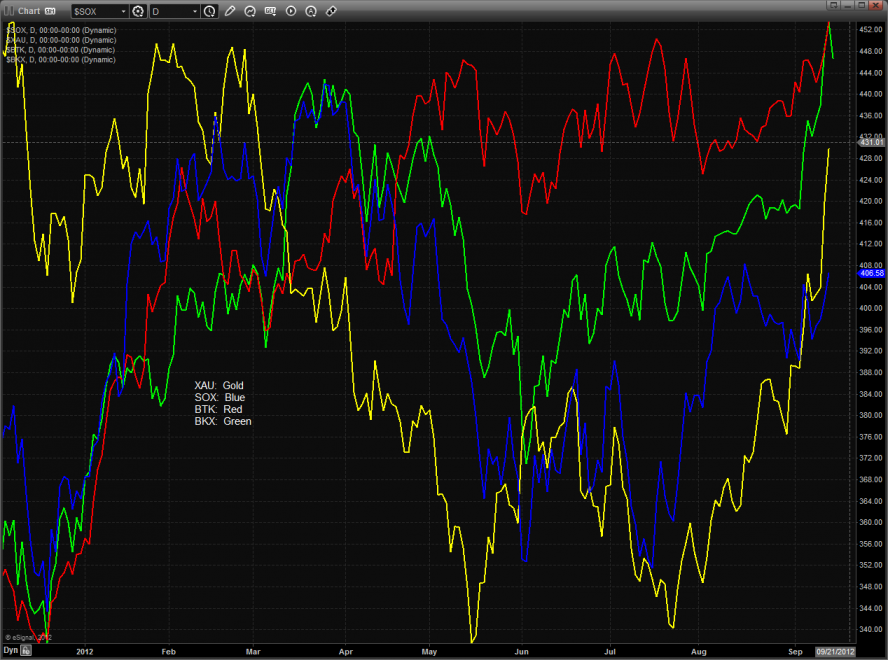

Multi sector daily chart:

Stock Picks Recap for 9/17/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

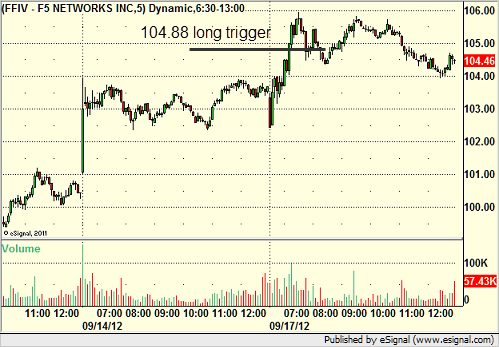

From the report, FFIV triggered long (with market support) and worked:

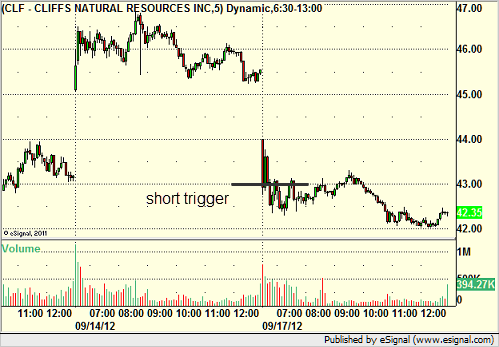

From the Messenger/Tradesight_st Twitter Feed, Rich's CLF triggered short (with market support) and worked enough for a partial:

His JOY triggered short (with market support) and worked enough for a partial:

AMZN triggered short (with market support) and worked:

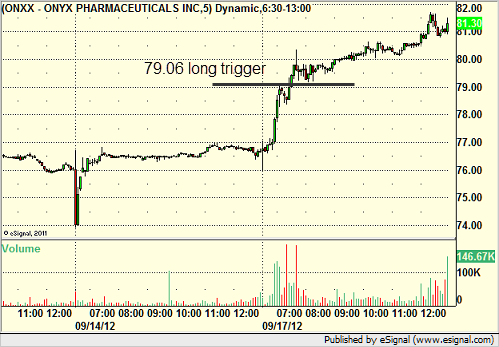

Rich's ONXX triggered long (with market support) and worked:

NFLX triggered too late in the day to be meaningful.

In total, that's 5 trades triggering with market support, all 5 of them worked, some of them very nicely considering the market.

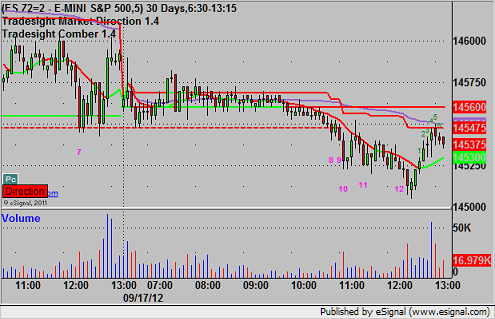

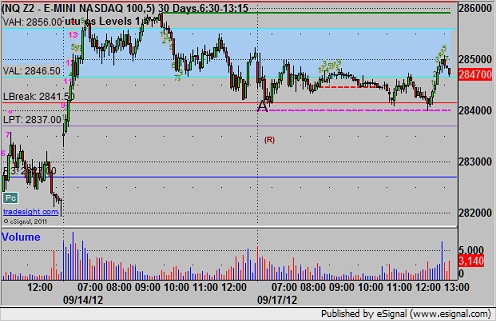

Futures Calls Recap for 9/17/12

What was that? An absolutely flat day, like no one was around trading. NQ triggered and stopped, but volume was just horrible.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered short at 2841.00 at A and stopped for 7 ticks:

Forex Calls Recap for 9/17/12

Always no range to speak of, especially during the European session. A few triggers on the EURUSD, and neither worked.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

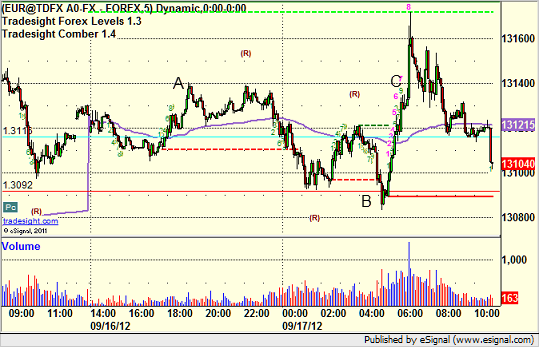

EURUSD:

Part of the trade triggered long early at A and eventually stopped. Short triggered at B and stopped. In the morning, we finally made a stab at a move, triggering long at C and stopping:

Stock Picks Recap for 9/14/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, Z triggered long (without market support due to opening 5 minutes) and worked enough for a partial:

NXPI gapped over, no play.

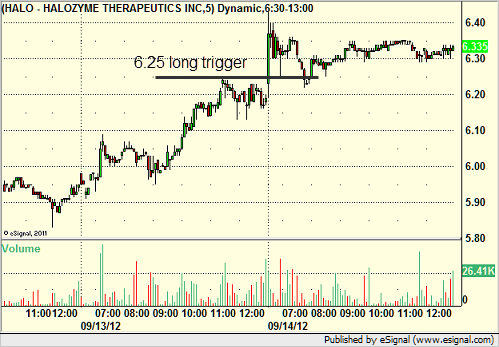

HALO triggered long (without market support due to opening 5 minutes) and didn't work:

FNSR triggered long (without market support due to opening 5 minutes) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's JPM triggered short (without market support due to opening 5 minutes) and didn't work:

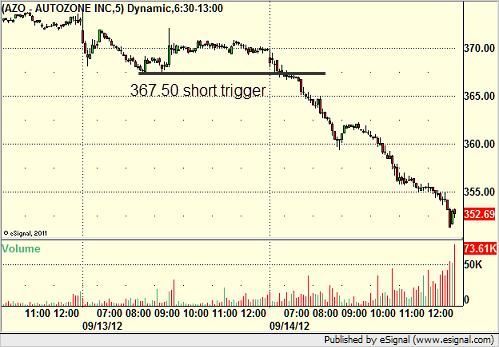

His AZO triggered short (without market support) and worked big:

NTES triggered long (with market support) and worked:

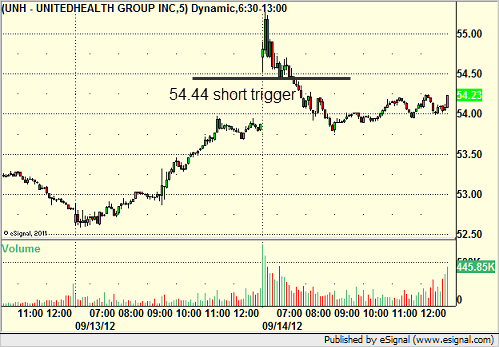

Rich's UNH triggered short (without market support) and worked:

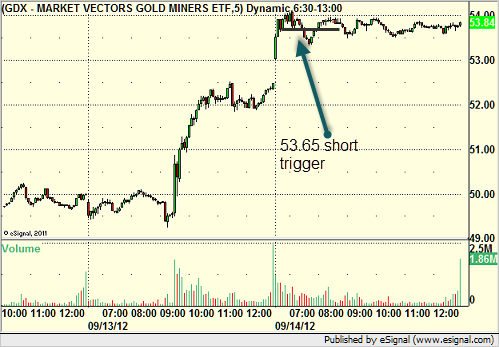

His GDX triggered short (ETF, so no market support needed) and worked enough for a partial:

His TQQQ triggered short (ETF, so no market support needed) and didn't work:

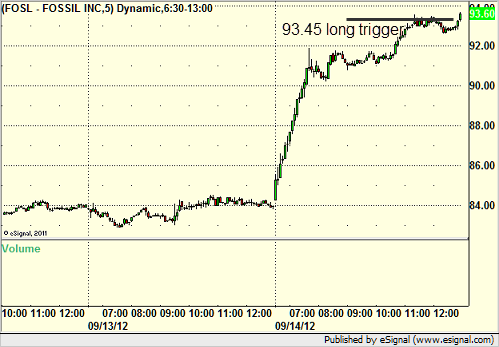

His FOSL triggered long (without market support) and didn't work:

His AAPL triggered short with no time left.

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.