Futures Calls Recap for 9/14/12

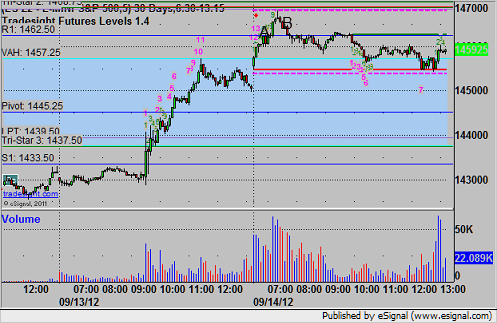

Nice winner on the ES to close out the week. See that section below.

Net ticks: +8.5 ticks.

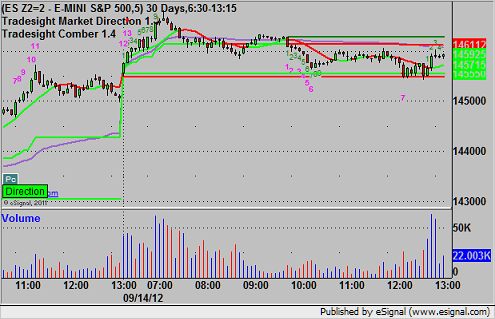

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's ES call triggered long at A at 1462.75, hit the first target for six ticks, and stopped the final piece at 1465.50 at B:

Forex Calls Recap for 9/14/12

A nice winner (125 pips to final exit) in the EURUSD to close out the week. See that section below.

As usual on the Sunday report, we will take a look at the action from Thursday night/Friday (remember the EURUSD 1.2824 breakout posted last weekend?), then look at the daily charts heading into the new week, and then glance at the US Dollar Index.

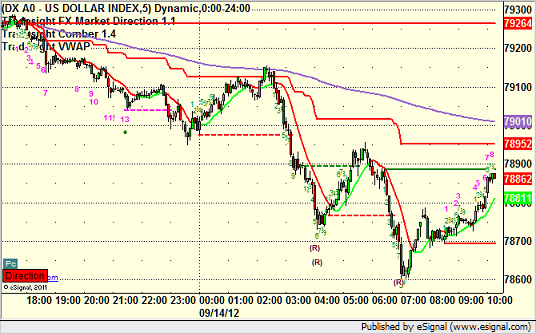

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

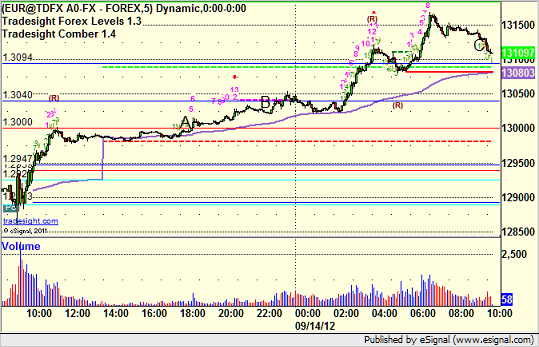

EURUSD:

Triggered long at A, hit first target at B, and closed the final piece at C for 125 pips after updating the stop a few times:

Stock Picks Recap for 9/13/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

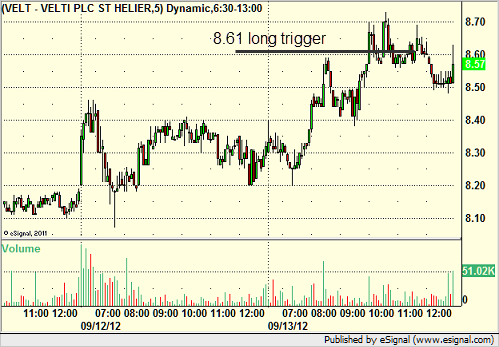

From the report, VELT triggered long (with market support) and didn't go enough in either direction to count:

From the Messenger/Tradesight_st Twitter Feed, Rich's VMW triggered long (without market support) and worked enough for a partial:

His BIDU triggered long (with market support) and didn't work:

His EQIX triggered short (with market support) and worked:

His VXX triggered short (ETF, so no market support needed) and worked:

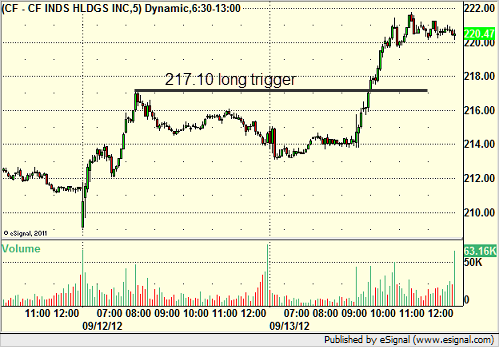

His CF triggered long (with market support) and worked:

His CLF triggered long (with market support) and worked:

AMZN triggered long (with market support) and worked:

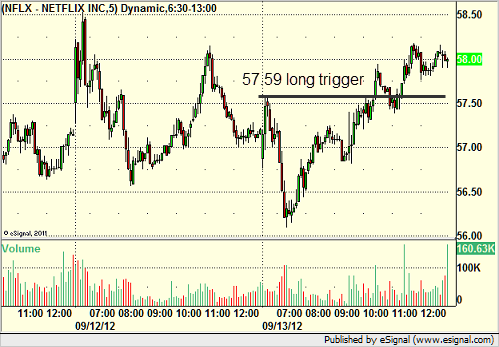

NFLX triggered long (with market support) and worked enough for a partial:

Rich's X triggered long (with market support) and didn't work:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not.

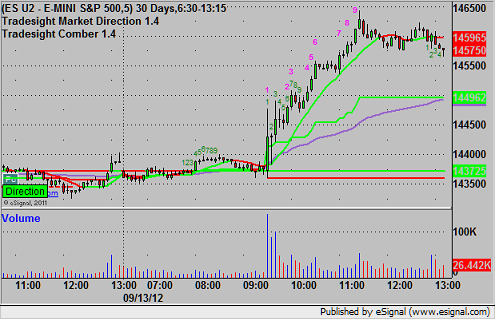

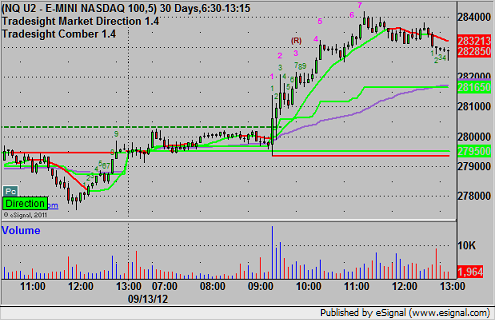

Futures Calls Recap for 9/13/12

No calls for the session. We had a dead flat morning as expected ahead of the Fed, and then the spike on the news was pretty big and would have been impossible to execute on. After that, we just kept going with no pauses or setups. I can't remember a day that the market reached R4 on the ES and also traded at the Pivot for the session.

Net ticks: +0 ticks.

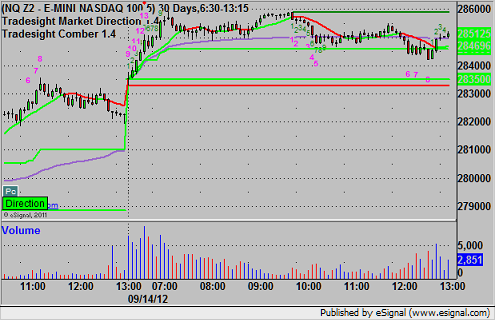

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

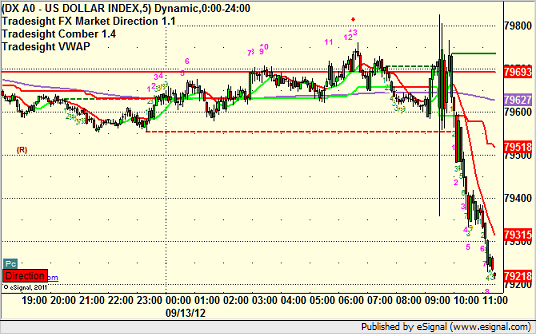

Forex Calls Recap for 9/13/12

Flat overnight as expected ahead of the Fed announcement, and then some crazy spikes on the announcement before the market settled on moving against the US Dollar. The announcement was after we cancel trades for a session.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

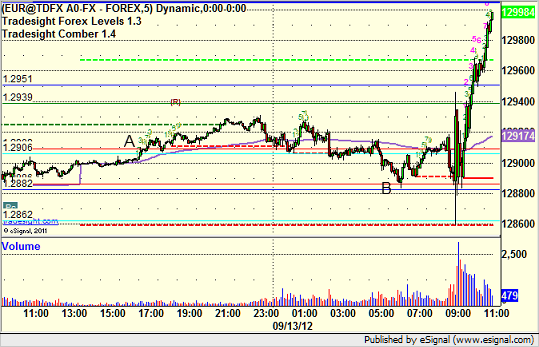

EURUSD:

Triggered long at A, finally stopped at B:

Tradesight Market Preview for 9/13/12

The ES was higher on the day making a new high close on the move. Note that the gap from Tuesday is still open and not yet filled.

The NQ futures were higher by 17 but still have a MACD that is pointing lower. Price closed indecisively right at the 10ema. The major averages were likely waiting on word from the Fed who will communicate any policy changes on Thursday afternoon.

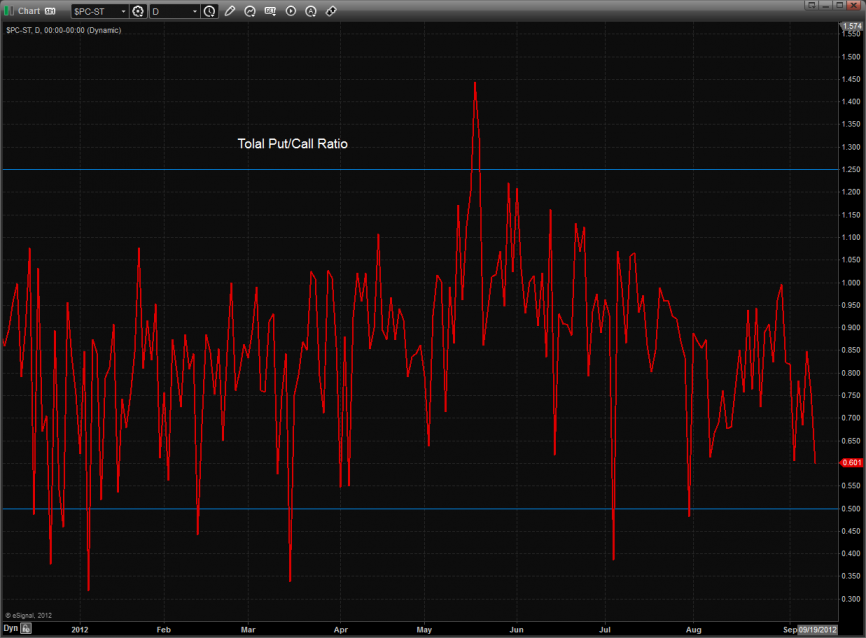

The put/call ratio has a downward bias but has yet to record a climatic close.

Multi sector daily chart:

The SPX bullishly made a new high vs. the defensive TLT which is what one should expect after a new high close in the broad market. There is no divergence here.

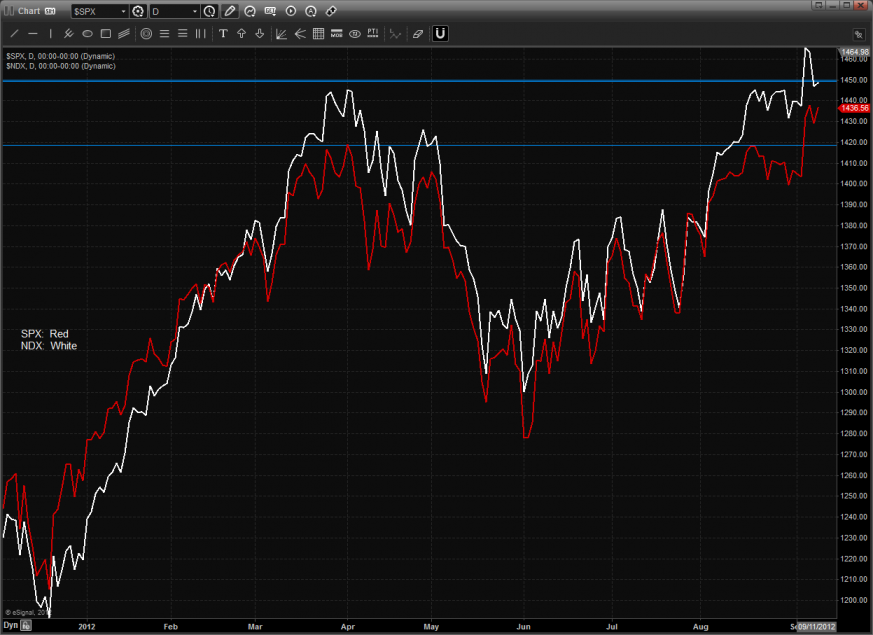

The SPX/NDX relative performance chart shows relative weakness in the NDX which is a divergence and needs to reverse for the SPX to follow through.

The BTK was the top gun on the day but since no new high was produced there is nothing new technically.

The OSX was nicely higher on the day and at this point in the cycle should be showing leadership. The static trend line is the key overhead.

The defensive XAU recouped a huge intraday drop and settled just above the open today.

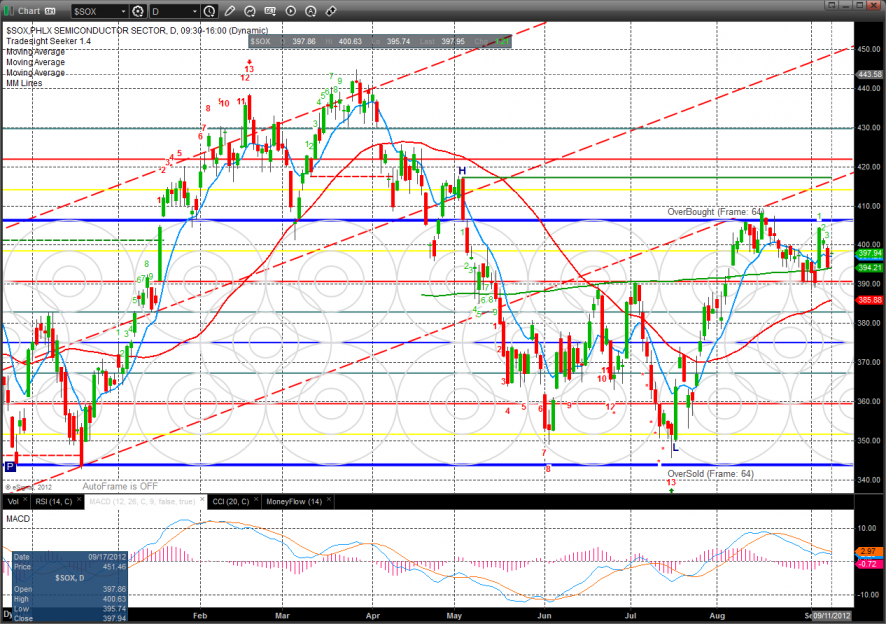

The SOX really lagged all of the indexes and was only higher by one on the day.

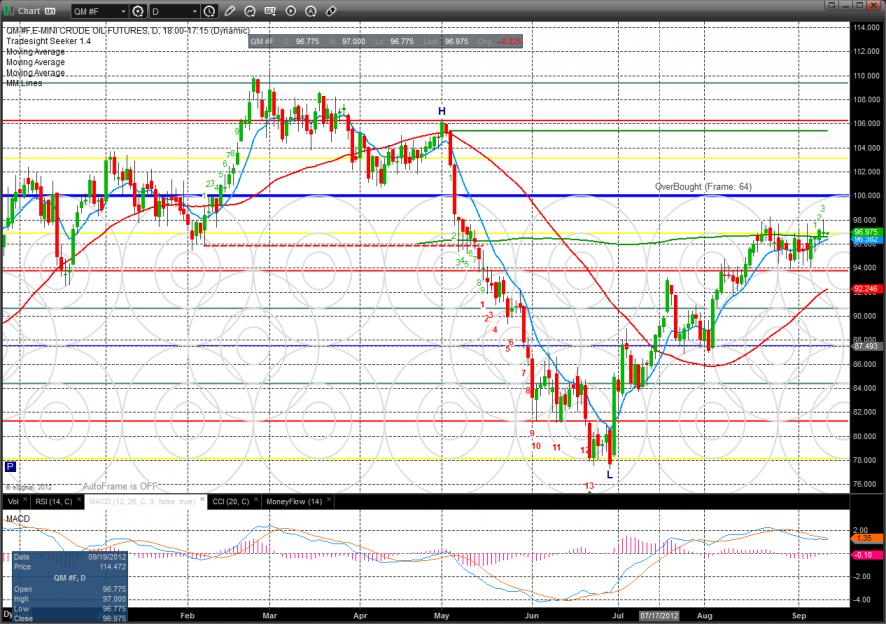

Oil:

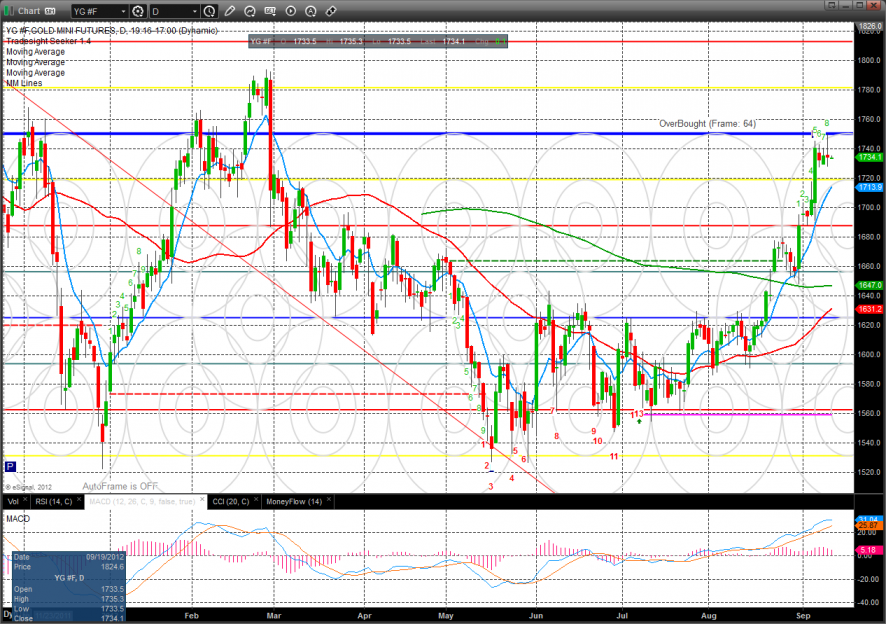

Gold:

Silver:

Stock Picks Recap for 9/12/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

All of the calls in the report either gapped over or didn't trigger.

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (without market support due to opening 5 minutes) and worked:

His FB triggered short (without market support) and didn't work:

COST triggered long (with market support) and worked:

Rich's GOOG triggered short (with market support) and worked enough for a partial:

His BIDU triggered short (with market support) and didn't work:

Rich's AAPL triggered short midday (without market support) and didn't work:

His other AAPL call triggered long after that (with market support) and worked enough for a partial (over a point):

FSLR triggered long (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

Stock Picks Recap for 9/12/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

All of the calls in the report either gapped over or didn't trigger.

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (without market support due to opening 5 minutes) and worked:

His FB triggered short (without market support) and didn't work:

COST triggered long (with market support) and worked:

Rich's GOOG triggered short (with market support) and worked enough for a partial:

His BIDU triggered short (with market support) and didn't work:

Rich's AAPL triggered short midday (without market support) and didn't work:

His other AAPL call triggered long after that (with market support) and worked enough for a partial (over a point):

FSLR triggered long (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

Futures Calls Recap for 9/12/12

Four triggers, and three of them worked (ES, YM, NQ, YM again) to their first targets. See those sections below. In the end, though, even though market volume was up (NASDAQ volume closed at 1.6 billion shares), the ES was only in a 5-point range as the market awaits the Fed on Thursday.

Net ticks: +1 tick.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

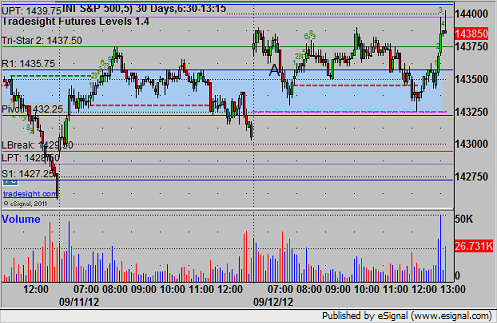

ES:

Triggered short at A at 1435.75, hit first target for six ticks, second half stopped at 1435.25:

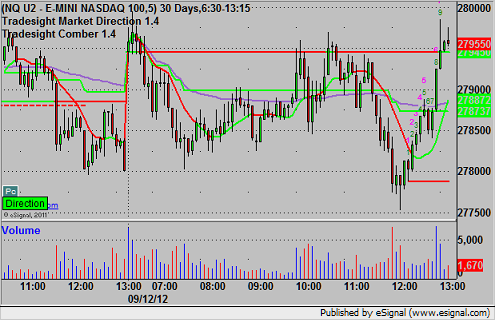

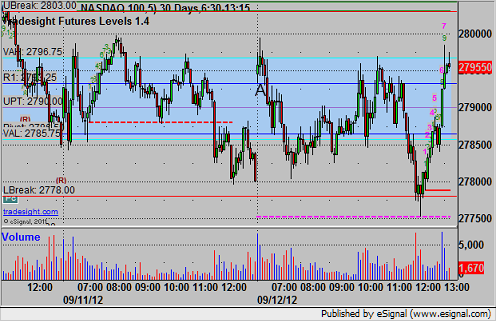

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 2792.50, hit first target for 6 ticks, lowered stop over entry at stopped just barely on the next bar:

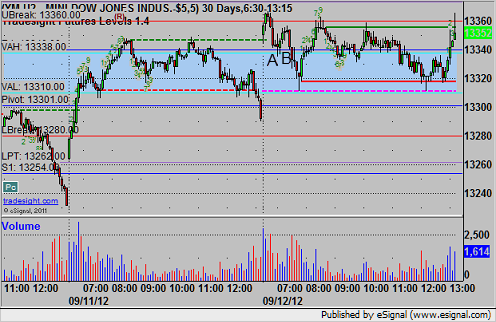

YM:

Mark's call triggered short at 14337 at A and stopped for 10 ticks initially, then triggered again at B and hit first target for 10 ticks, then stopped under the entry:

Forex Calls Recap for 9/12/12

Basically a wash of a night with a loser on the EURUSD and a winner on the GBPUSD. See both sections below. Still half size with the Fed announcement tomorrow and CPI on Friday.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

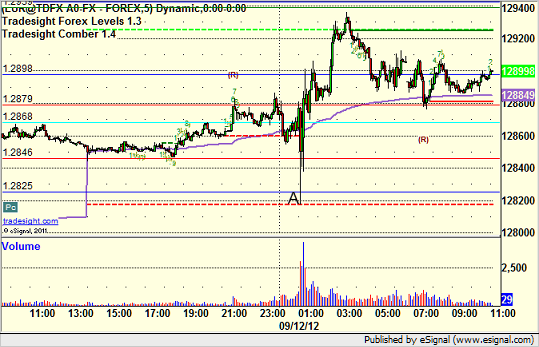

EURUSD:

Triggered short at A on a spike down on news and stopped for 25 pips:

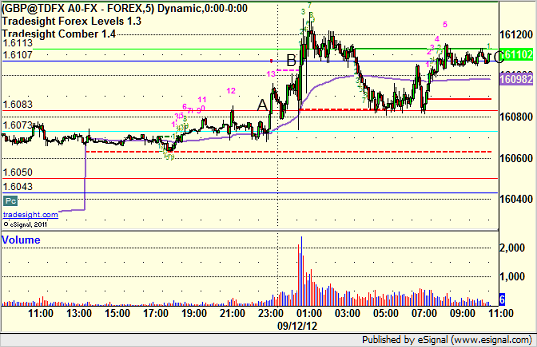

GBPUSD:

Triggered long at A, hit first target at B, closed final piece at C at R1: