Tradesight Market Preview for 9/12/12

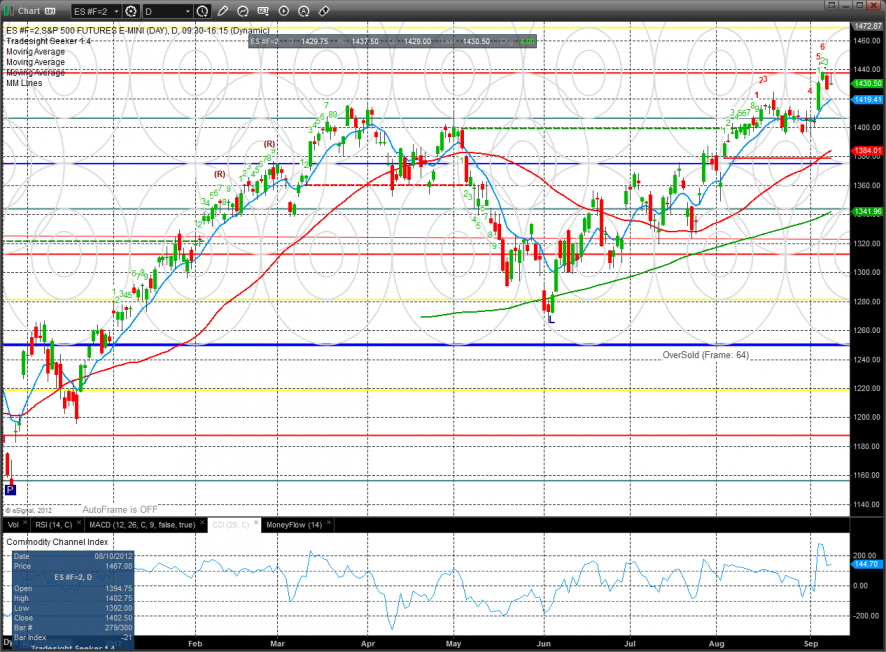

The ES gained 4 on the day after trying higher prices but failing which leaves a tall tail on the chart but doesn’t make a classic distribution day. Tuesday’s close keeps the chart above the short-term trend defining 10ema.

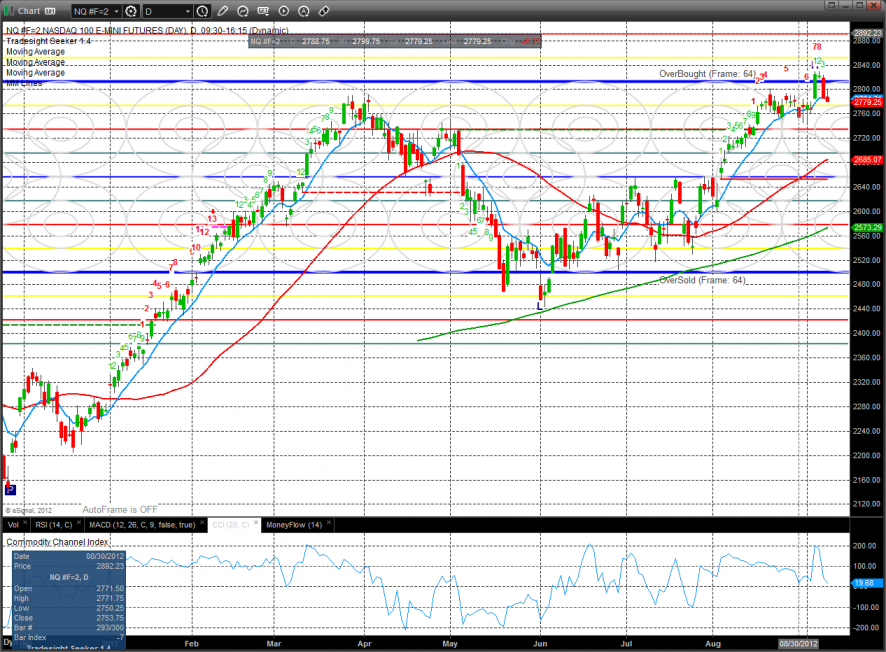

The NQ futures were much weaker than the ES all session making for a bifurcated day. Price has settled below the 10ema and not strong market has ever been built on the foundation of a weak NDX.

The 10-day Trin remains neutral making the market neither over bought nor oversold.

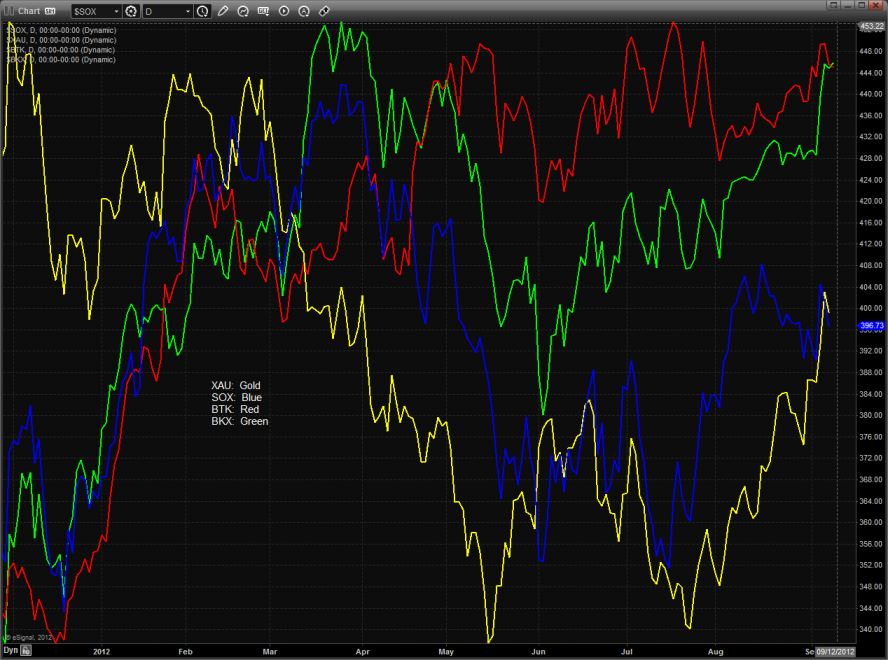

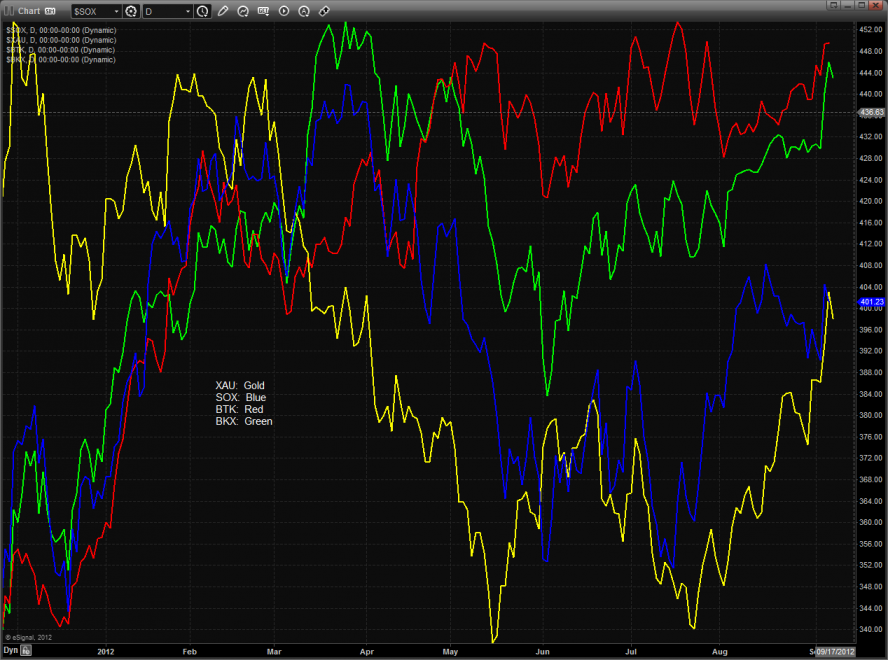

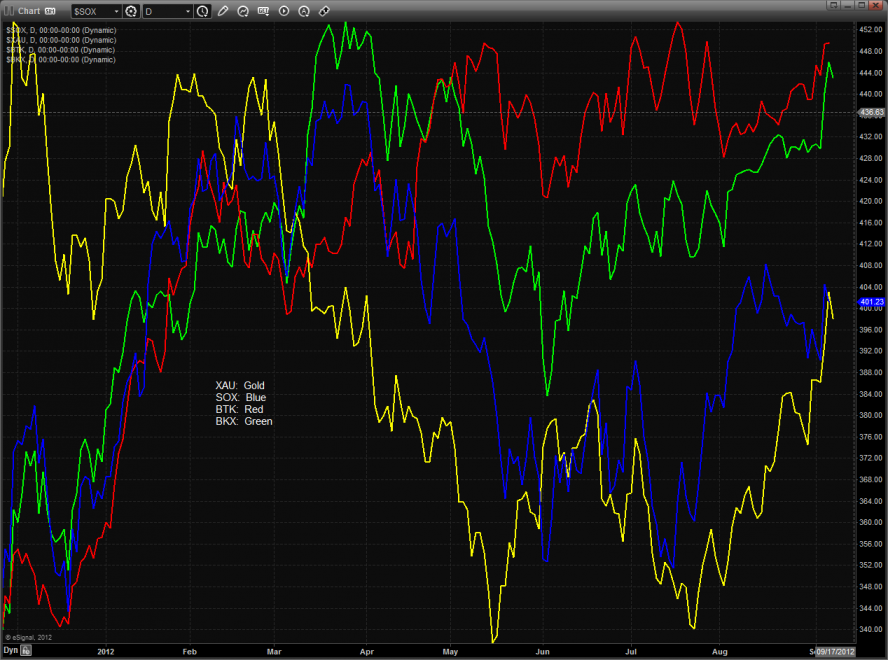

Multi sector daily chart:

The SPX actually picked up some relative strength vs. the TLT. This should be surprising and somewhat mitigates the relative weakness in the NDX.

The OSX was the top gun on the day besting all of the other major sectors. This is a new high on the move and has turned all of the moving averages. The next important overhead level is the active static trend line.

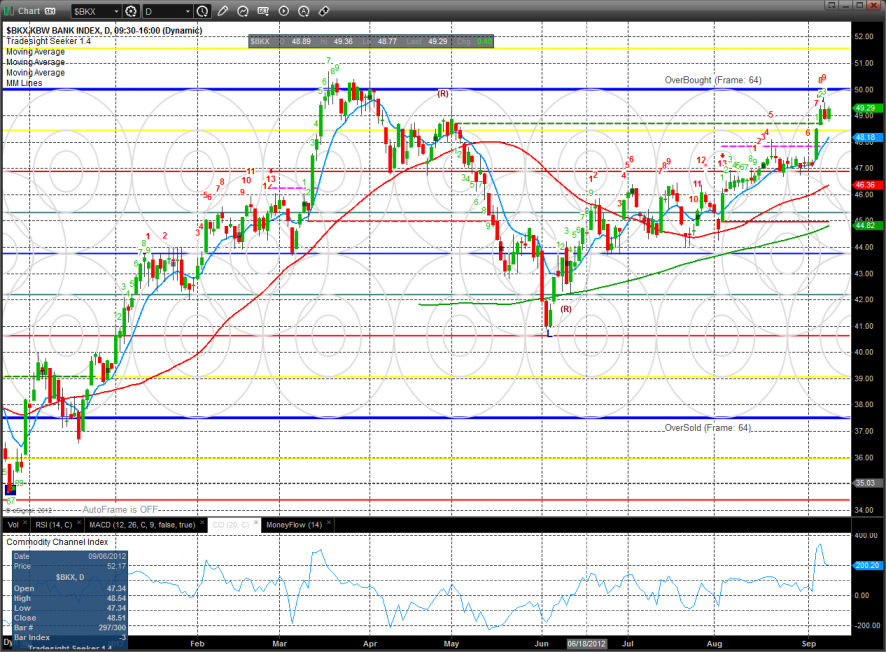

The BKX made a marginal new high on the move. Next overhead is the key 8/8 Murrey math level.

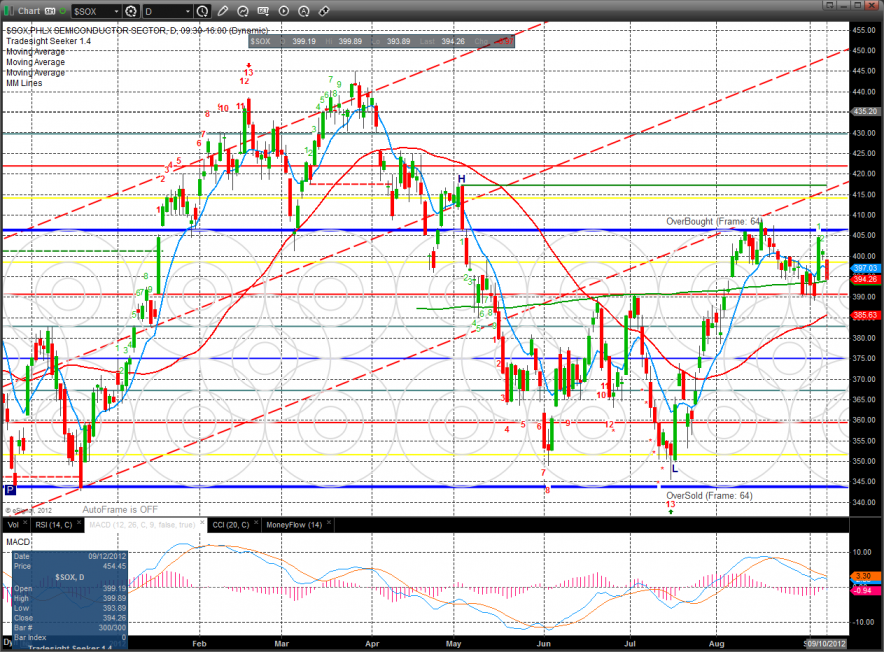

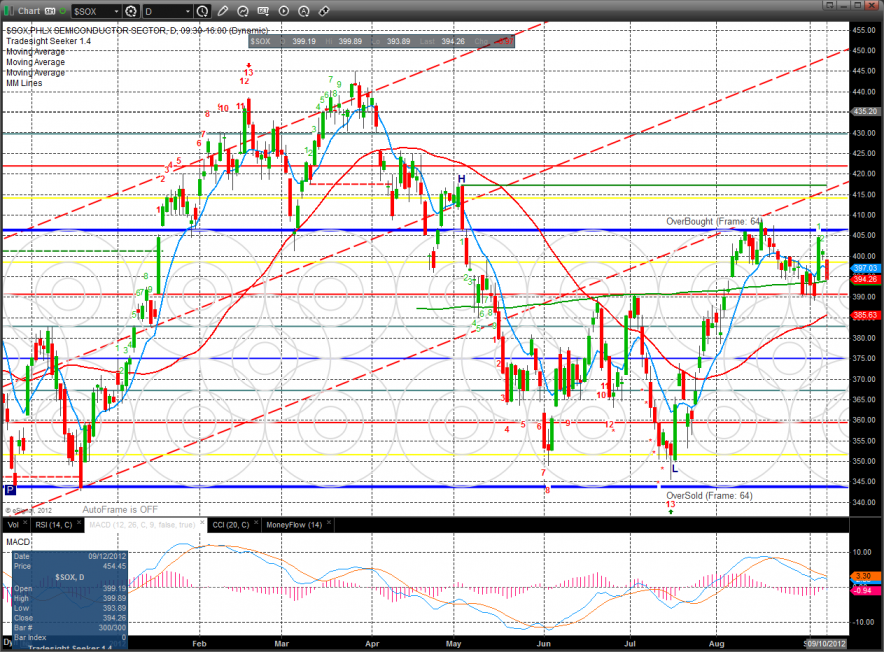

The SOX was higher on the day but is still below the 10ema. The 8/8 level continues to be a wall. Note that the MACD is still in a deteriorating buy condition.

The BTK was the weakest major sector on the day but remains above all the key moving averages.

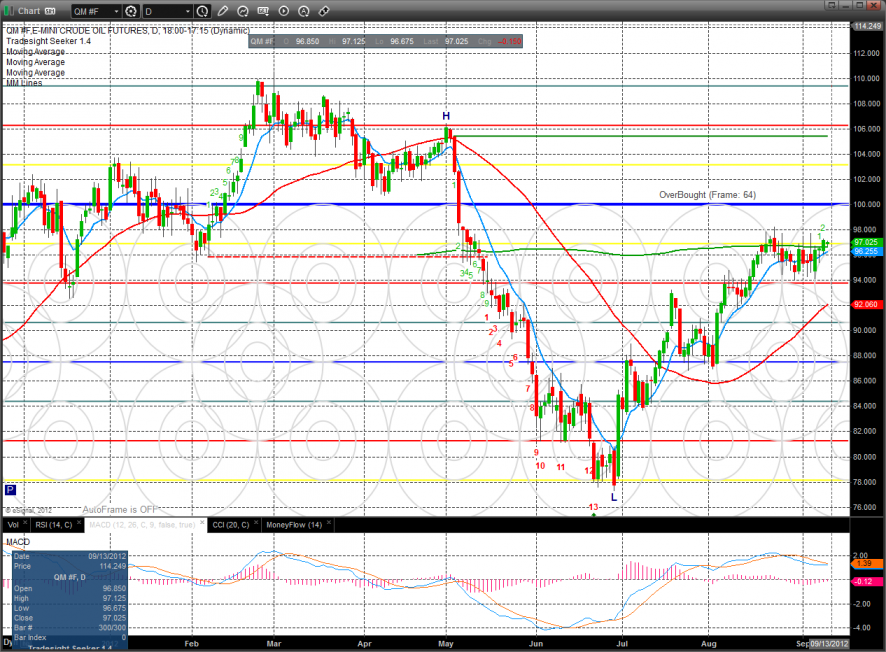

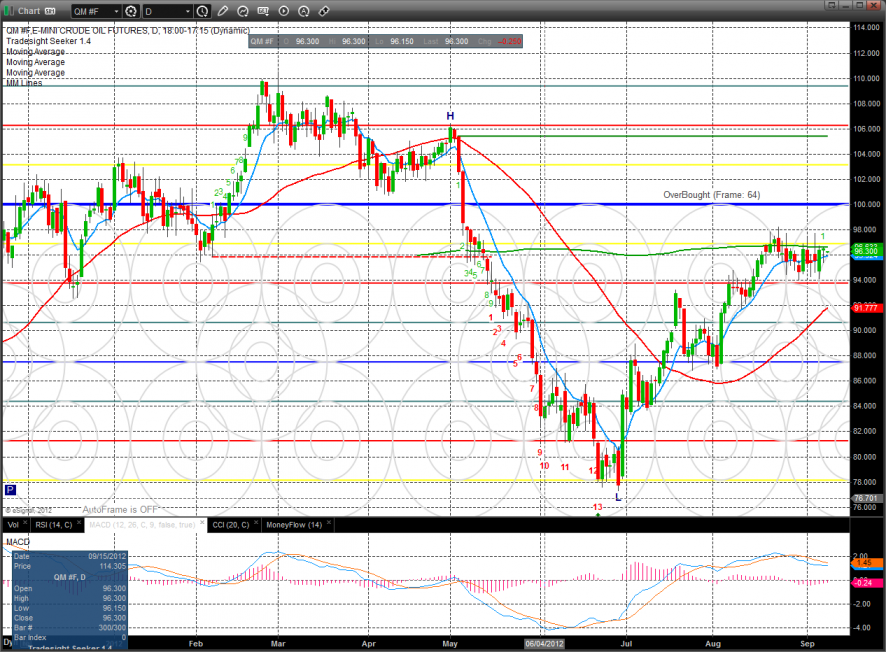

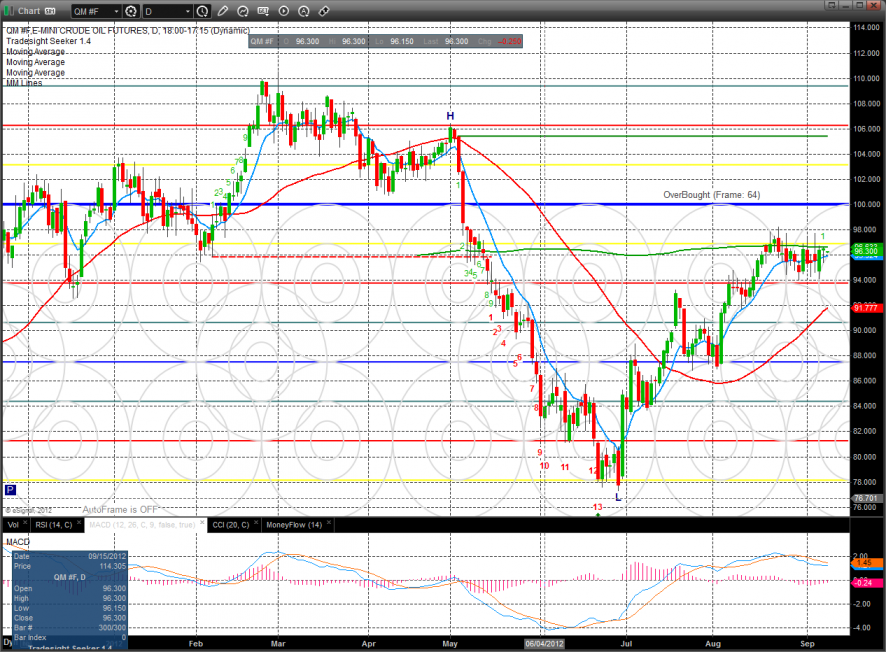

Oil:

Gold:

Silver:

Stock Picks Recap for 9/11/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NUAN triggered long (with market support) and worked enough for a partial:

MAKO gapped over, no play.

MPEL triggered long at the close, not enough time to work:

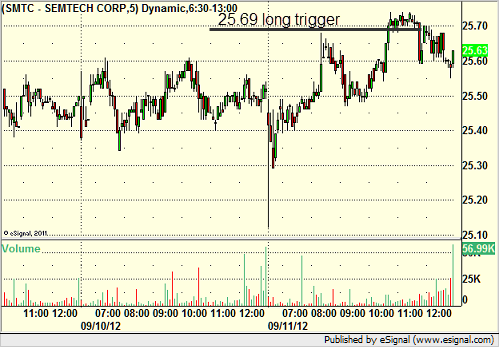

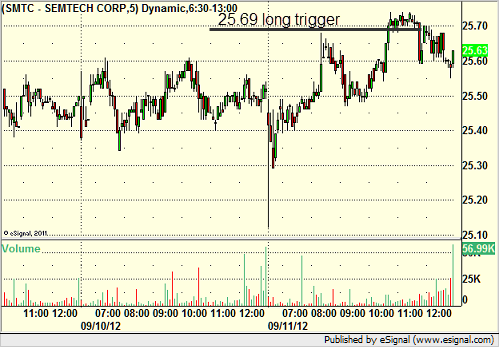

SMTC triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Mark's AKAM triggered long (with market support) and didn't work:

His LRCX opened at the trigger, no play.

Rich's WFC triggered long (with market support) and worked:

His GOOG triggered short (without market support) and worked:

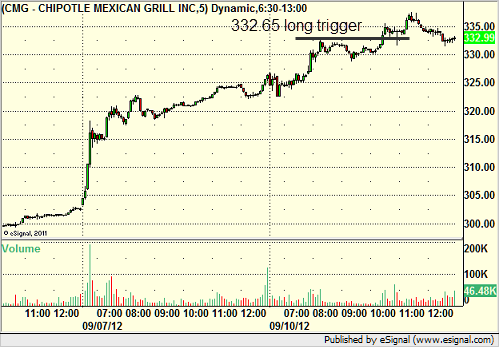

His CMG triggered long (with market support) and worked:

His IBM triggered long (with market support) and worked:

His CLF triggered long (with market support) and worked:

His AAPL triggered short (without market support) and worked:

His second AAPL call triggered short (with market support) and worked:

His AMZN triggered short (without market support) and didn't work:

His GDX triggered short (ETF, so no market support needed) and worked:

His AGQ triggered short (ETF, so no market support needed) and worked:

In total, that's 10 trades triggering with market support, 8 of them worked, 2 did not.

Stock Picks Recap for 9/11/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NUAN triggered long (with market support) and worked enough for a partial:

MAKO gapped over, no play.

MPEL triggered long at the close, not enough time to work:

SMTC triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Mark's AKAM triggered long (with market support) and didn't work:

His LRCX opened at the trigger, no play.

Rich's WFC triggered long (with market support) and worked:

His GOOG triggered short (without market support) and worked:

His CMG triggered long (with market support) and worked:

His IBM triggered long (with market support) and worked:

His CLF triggered long (with market support) and worked:

His AAPL triggered short (without market support) and worked:

His second AAPL call triggered short (with market support) and worked:

His AMZN triggered short (without market support) and didn't work:

His GDX triggered short (ETF, so no market support needed) and worked:

His AGQ triggered short (ETF, so no market support needed) and worked:

In total, that's 10 trades triggering with market support, 8 of them worked, 2 did not.

Futures Calls Recap for 9/11/12

Two winners and a loser for the session, which proved to be fine as volume was light again at 1.4 billion NASDAQ shares as we head into a Fed meeting and announcement (Thursday).

Net ticks: +3 ticks.

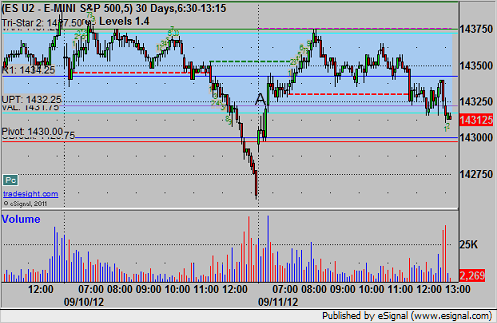

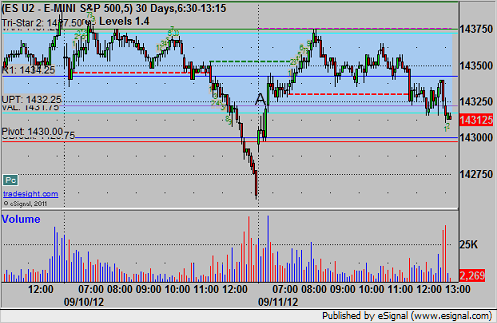

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

My call triggered long at A over the UPT at 1434.75, hit 6 ticks for the first target, and raised stop twice and stopped at 1435.75:

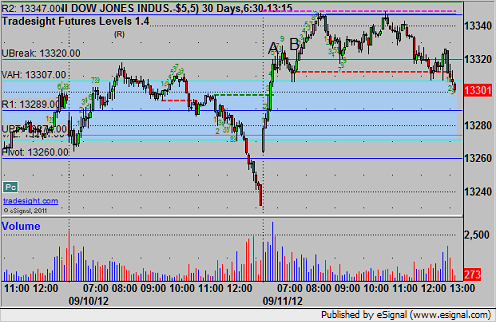

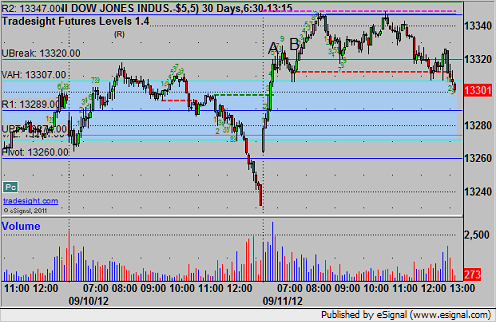

YM:

Mark's call triggered long once at A at 13325 and stopped for 11 ticks, then triggered again shortly thereafter, hit the first target for 10 ticks and closed out the final piece for 8 ticks:

Futures Calls Recap for 9/11/12

Two winners and a loser for the session, which proved to be fine as volume was light again at 1.4 billion NASDAQ shares as we head into a Fed meeting and announcement (Thursday).

Net ticks: +3 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

My call triggered long at A over the UPT at 1434.75, hit 6 ticks for the first target, and raised stop twice and stopped at 1435.75:

YM:

Mark's call triggered long once at A at 13325 and stopped for 11 ticks, then triggered again shortly thereafter, hit the first target for 10 ticks and closed out the final piece for 8 ticks:

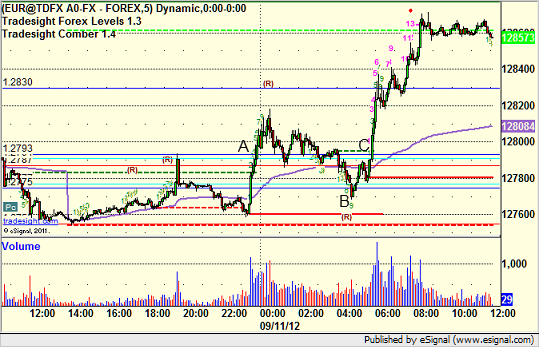

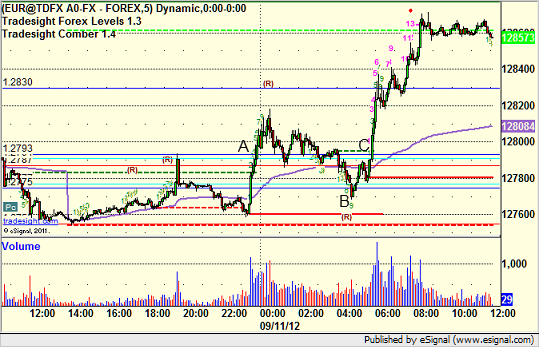

Forex Calls Recap for 9/11/12

One trade just barely stopped, see the EURUSD below. The move was really after Trade Balance. We remain half size all week as we have two days of Fed meeting and then the CPI ahead.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A and stopped at B just barely. Triggered long again at C and this would have worked great, but for our rules of counting, it was a little early (by about 15 minutes):

Forex Calls Recap for 9/11/12

One trade just barely stopped, see the EURUSD below. The move was really after Trade Balance. We remain half size all week as we have two days of Fed meeting and then the CPI ahead.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A and stopped at B just barely. Triggered long again at C and this would have worked great, but for our rules of counting, it was a little early (by about 15 minutes):

Tradesight Market Overview for 9/11/12

The ES reversed lower losing 12 on the day. Key support is the March highs which coincides with the 10ema. Note that he CCI is in a very short-term overbought condition.

The NQ futures lost 39 on the day and like the ES posted a very negative day but did not register a key reversal. Volume was lower than the previous day and a new high was not traded. The 10ema is key support.

The 10-day Trin is still neutral.

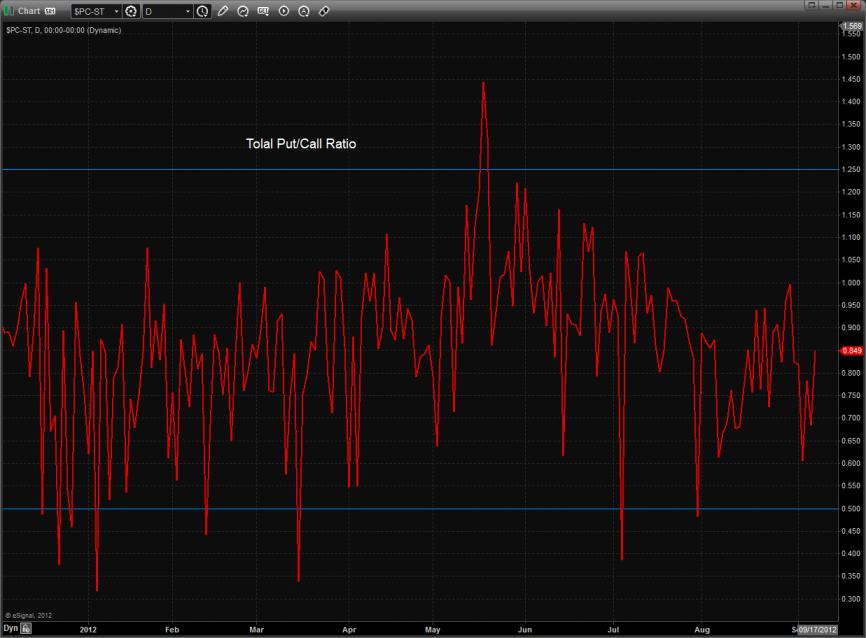

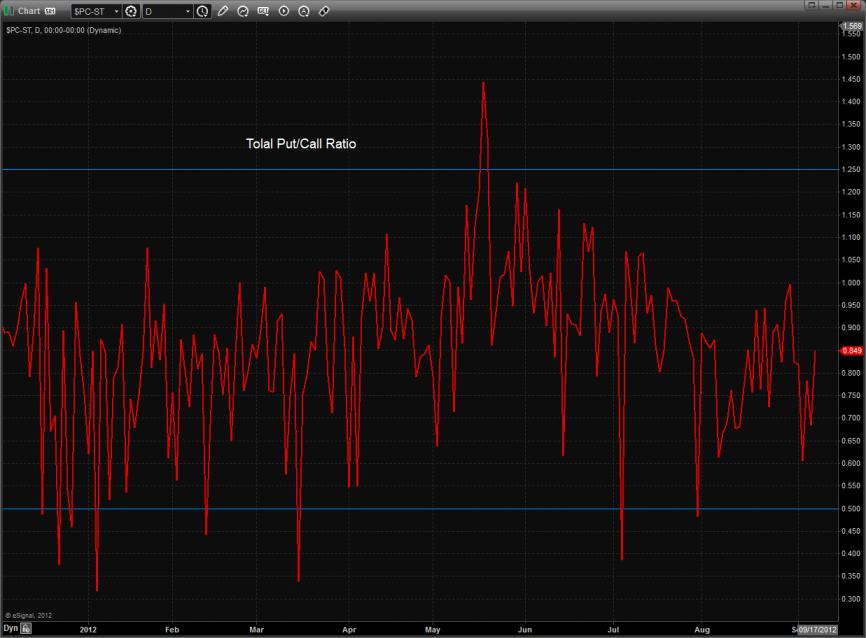

Nothing new in the total put/call ratio which is neither over bought nor oversold.

Multi sector daily chart:

The double tops in the SPX ns NDX have been broken and need to follow through to qualify.

While the double tops have been broken the SPX/TLT still needs to record a new high to confirm the strength in equities over the perceived safety of bonds.

The BTK was the strongest major sector on the day. A new high has yet to be recorded and the pattern is in no meaningful way overbought.

The OSX posted an inside day:

The SOX was the last laggard on the day by a wide margin, settling at the 50dma. Note that price has now settled below the 10ema.

Oil:

Gold:

Silver:

Tradesight Market Overview for 9/11/12

The ES reversed lower losing 12 on the day. Key support is the March highs which coincides with the 10ema. Note that he CCI is in a very short-term overbought condition.

The NQ futures lost 39 on the day and like the ES posted a very negative day but did not register a key reversal. Volume was lower than the previous day and a new high was not traded. The 10ema is key support.

The 10-day Trin is still neutral.

Nothing new in the total put/call ratio which is neither over bought nor oversold.

Multi sector daily chart:

The double tops in the SPX ns NDX have been broken and need to follow through to qualify.

While the double tops have been broken the SPX/TLT still needs to record a new high to confirm the strength in equities over the perceived safety of bonds.

The BTK was the strongest major sector on the day. A new high has yet to be recorded and the pattern is in no meaningful way overbought.

The OSX posted an inside day:

The SOX was the last laggard on the day by a wide margin, settling at the 50dma. Note that price has now settled below the 10ema.

Oil:

Gold:

Silver:

Stock Picks Recap for 9/10/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Couple of big winners today despite a lighter-volume, flatter day in the market.

From the report, JIVE triggered short (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's IBM triggered long (with market support) and worked:

His GOOG triggered long (with market support) and didn't work:

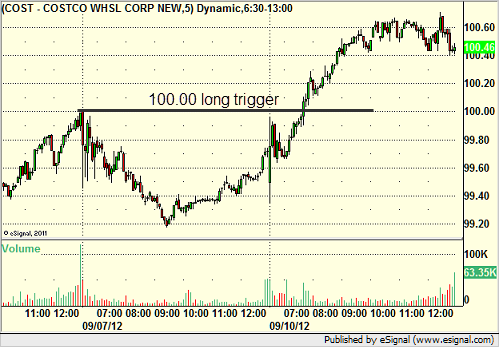

COST triggered long (with market support) and worked:

Rich's CMG triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.