Futures Calls Recap for 9/7/12

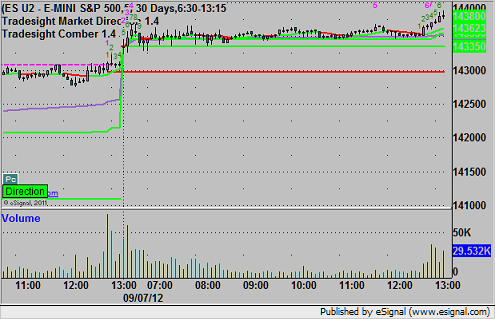

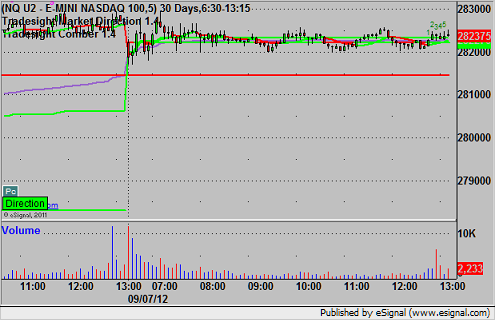

Not nearly as interesting as Thursday. The market gapped up a little and went literally dead flat all session. Our ER trade stopped twice before we just ended it for the week, see that section below.

Net ticks: -16 ticks.

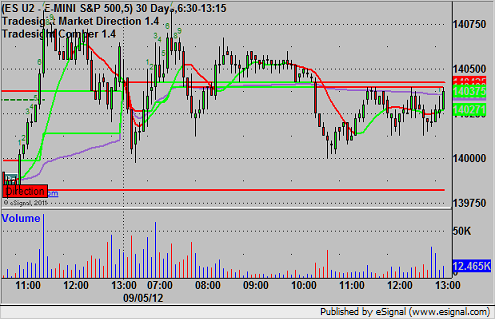

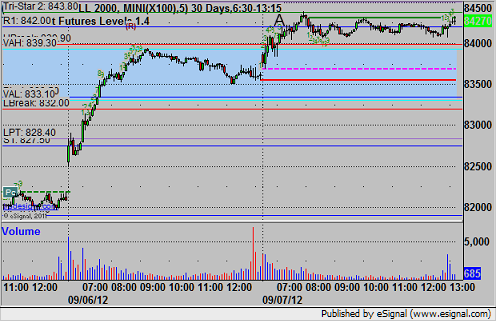

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ER:

Mark's trade triggered long at A at 842.10 and stopped for 8 ticks (we go a little wider on the ER because it jumps a bit). It triggered again a few minutes later and stopped again. Mark cancelled the trade going forward. It did trigger again and make it just to first target, but no further:

Forex Calls Recap for 9/7/12

A great two days for Forex trading, a great 2 days for the stock market as volume finally came back, but a poor day for the US Dollar itself.

We carried forward the second half of the trade from the prior day, which never stopped and continued with the new trade. The trade from the prior session closed out 190 pips in the money, and the trade from today worked nicely for about 150 pips. See EURUSD section below.

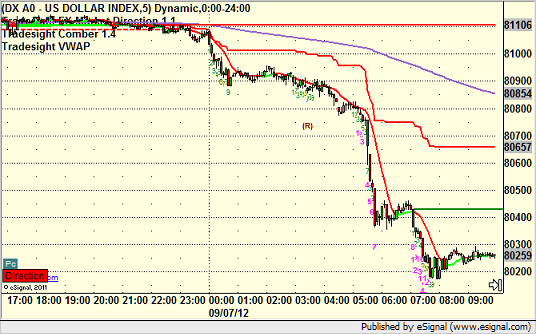

As usual on the Sunday report, we will take a look at the action from Thursday night/Friday, then look at the daily charts heading into the new week, and then discuss the US Dollar Index.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

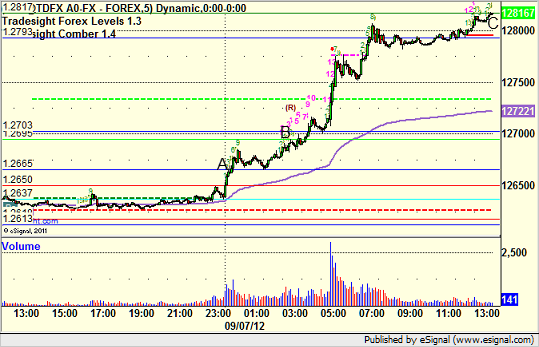

EURUSD:

We came into the session still long the second half of the prior day's trade with a stop under LBreak, which never hit overnight. New trade call triggered long at A, hit first target at B, adjusted stop in the morning, and closed out both trades at C for end of week (+150 pips and +190 pips, respectively, to final exits):

Stock Picks Recap for 9/6/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SINA triggered long (with market support) and worked huge, as a top pick should with volume and market support:

CROX triggered long (with market support) and worked:

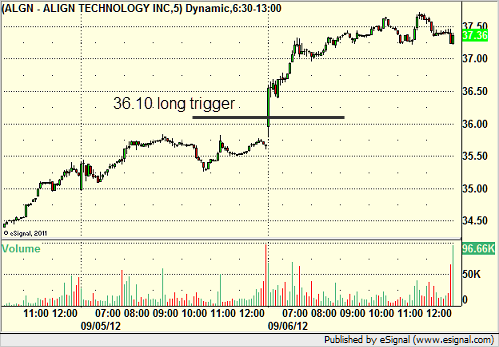

ALGN triggered long (without market support due to opening 5 minutes) and worked:

FIRE triggered long (with market support) and worked:

MTGE triggered long (with market support) and didn't go enough in either direction to count:

MYGN triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's SHLD triggered long (with market support) and didn't work:

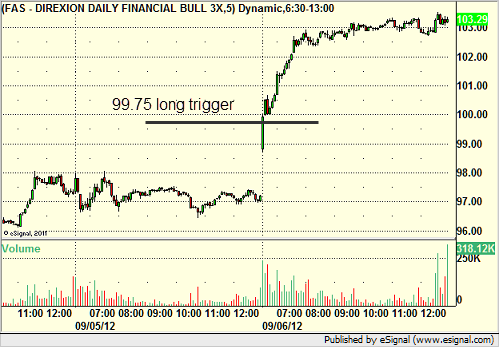

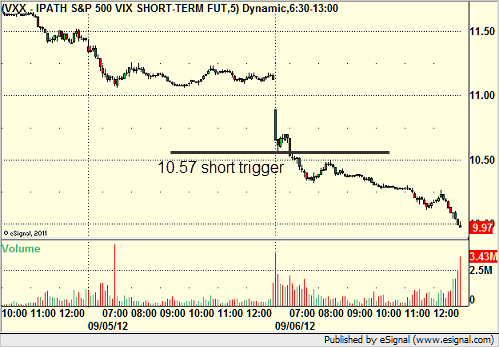

Rich's FAS triggered long (ETF, so no market support needed) and worked great:

His FB triggered long (with market support) and worked:

His COST triggered long (with market support) and worked:

His VXX triggered short (ETF, so no market support needed) and worked:

In total, that's 9 trades triggering with market support, 8 of them worked, 1 did not. Some of the winners were huge, and this is exactly what a normal market with just average volume should trade like 3 days a week.

Futures Calls Recap for 9/6/12

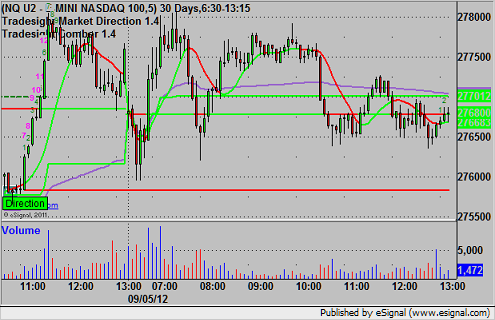

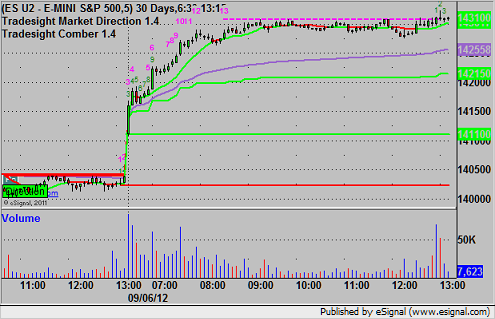

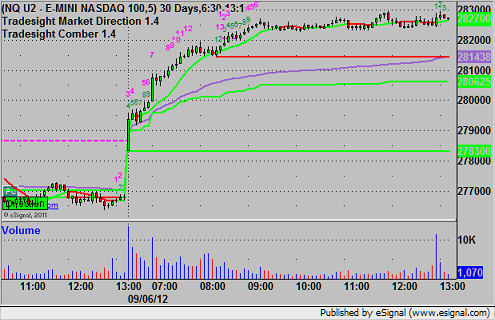

A big winner for the session after a huge gap up in the market, which turned into a strong "gap and go" morning, although the afternoon was slow. See YM section below. Total volume was 1.8 billion NASDAQ shares.

Net ticks: +34.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

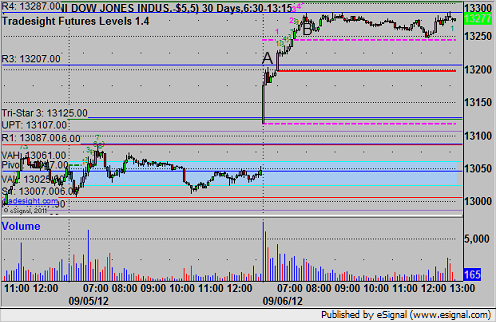

YM:

Triggered long at 13208 at A, hit first target for 10 ticks. Mark adjusted the stop several times and finally stopped at 13267 at B, well in the money:

Forex Calls Recap for 9/6/12

Strange night with two winners and a loser. See the EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A and gave you hours to enter. Hit first target at B, second half stopped. Triggered short at C and stopped. Triggered long at D, hit first target at E, holding second half with a stop under UBreak:

Forex Calls Recap for 9/6/12

Strange night with two winners and a loser. See the EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A and gave you hours to enter. Hit first target at B, second half stopped. Triggered short at C and stopped. Triggered long at D, hit first target at E, holding second half with a stop under UBreak:

Tradesight Market Preview for 9/6/12

The ES futures remain trapped in the range with no resolution yet. There is nothing new technically.

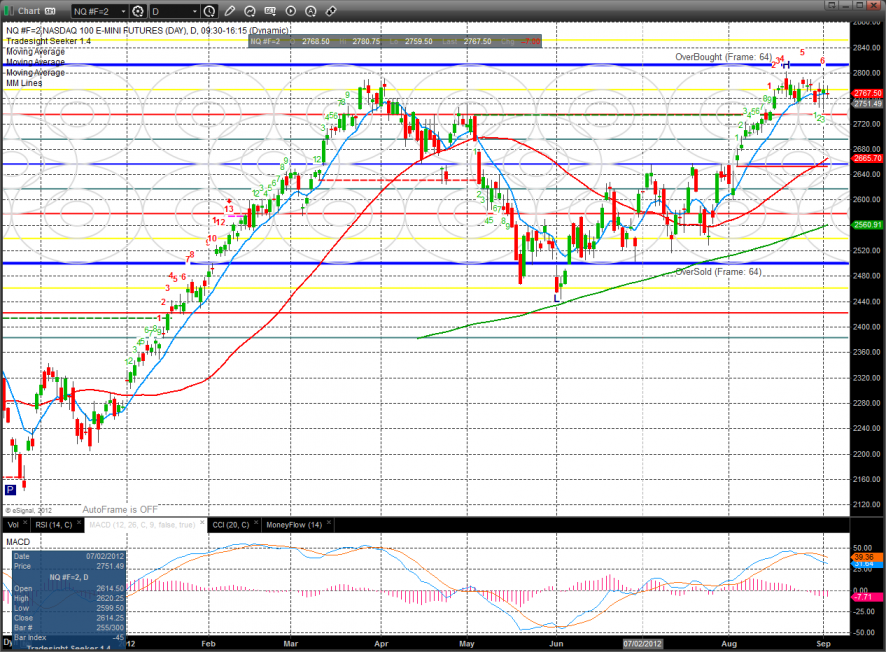

The NQ’s were slightly lower on the day settling right at the trend defining, or non-defining, 10ema. Note that like the ES futures the MACD is negative and heading lower.

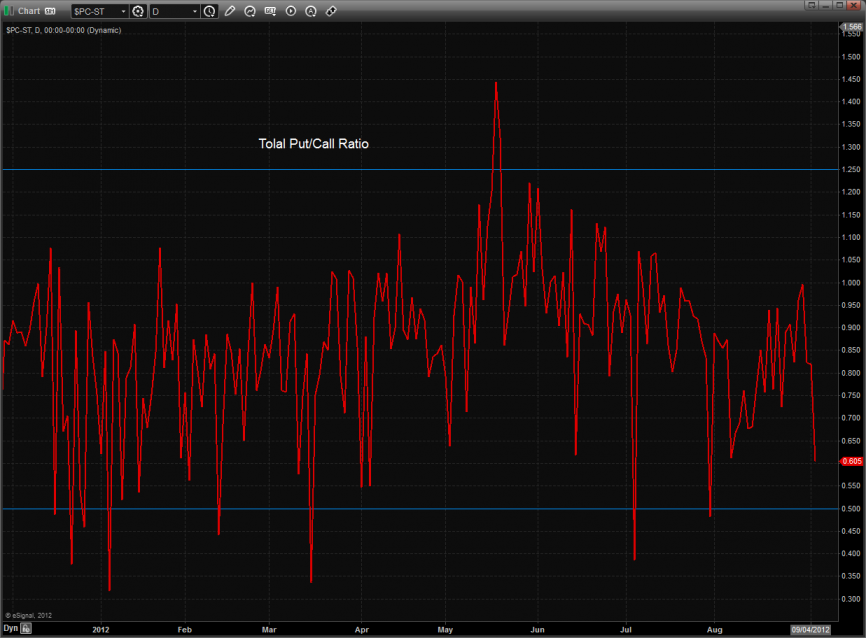

The total put/call ratio took a hit but did not get to the overbought threshold.

Trin is still neutral:

Multi sector daily chart:

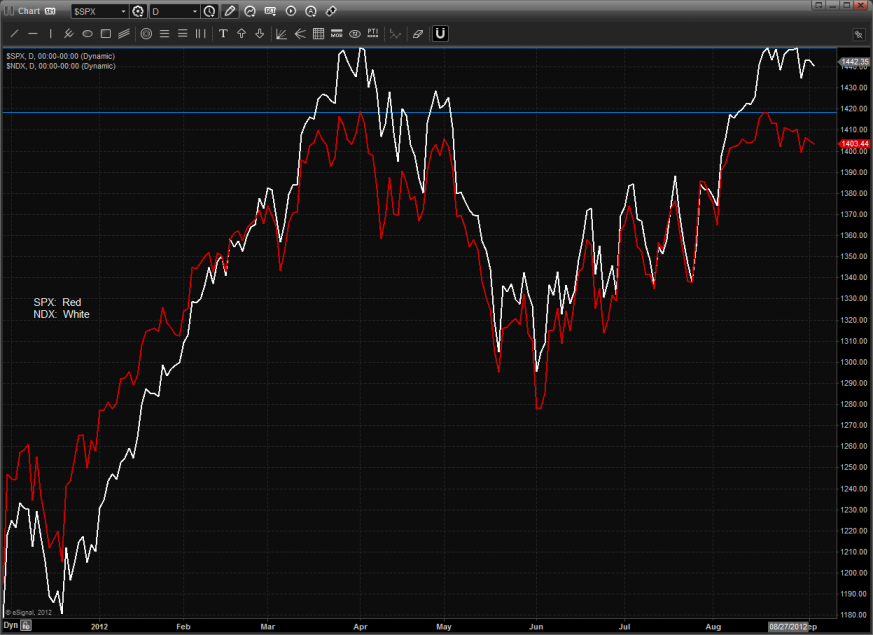

The double top in both the SPX and NDX continues to be the sheriff in town and the most important pattern in the major indexes.

The NDX/SPX cross has rallied to near the prior high but has not broken out. If this chart does not breakout to the upside the double top in the cash indicies will make good and take prices lower. Also worth noting is that if the SPX breaks out to a new high and is not confirmed by the NDX/SPX cross chart the breakout in the SPX will likely fail since the NDX would be showing relative weaknes..

The defensive XAU was the top major sector on the day. There is key overhead at the 200dma and 8/8 level on the chart.

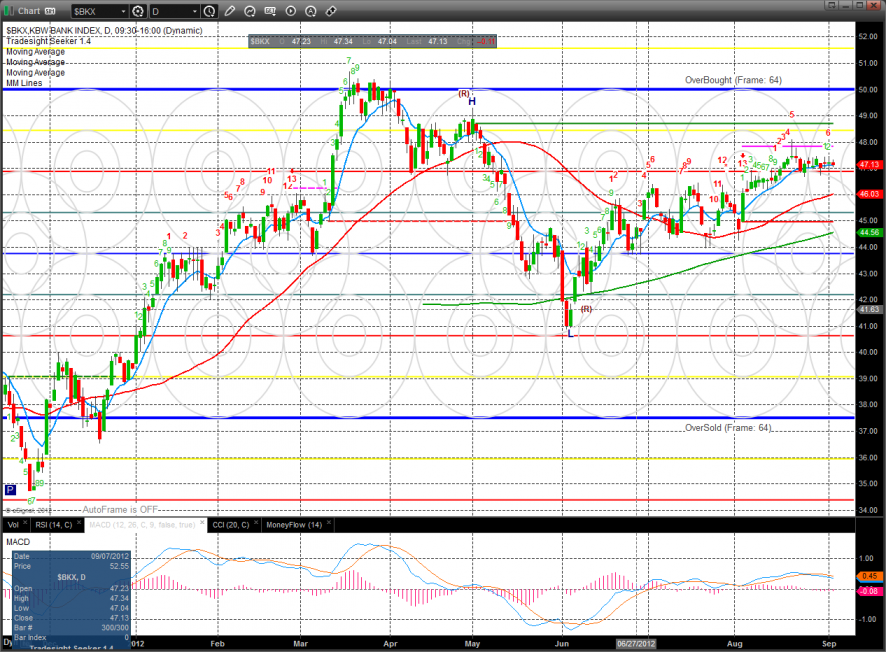

The BKX did nothing and is still trapped, ‘nuff said.

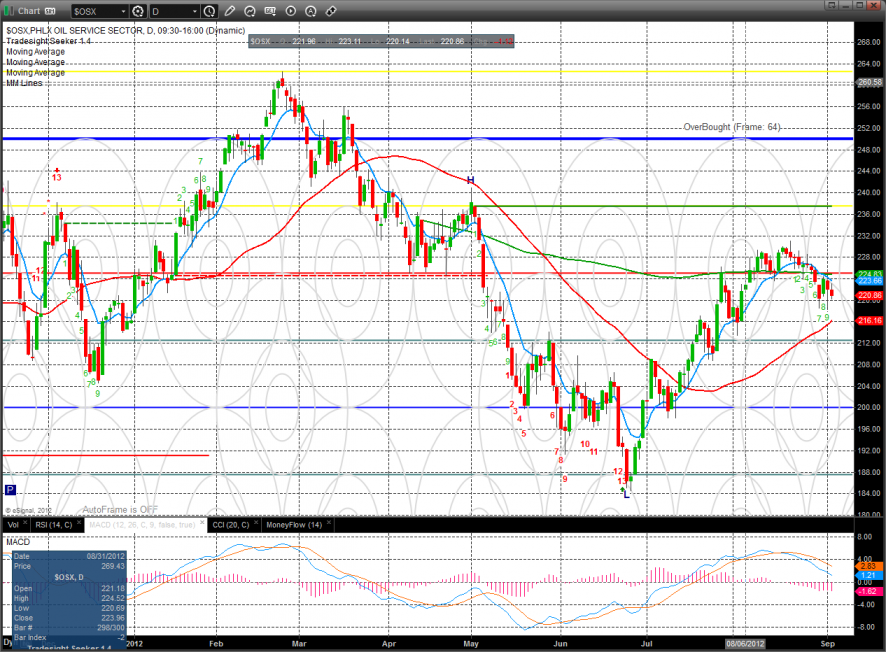

The OSX lost a little more gound but is still 9 days down in the Seeker count.

The SOX made a new low close on the move and is now below the 10ema and 200dma. Expect good support at the 50dma if it gets there.

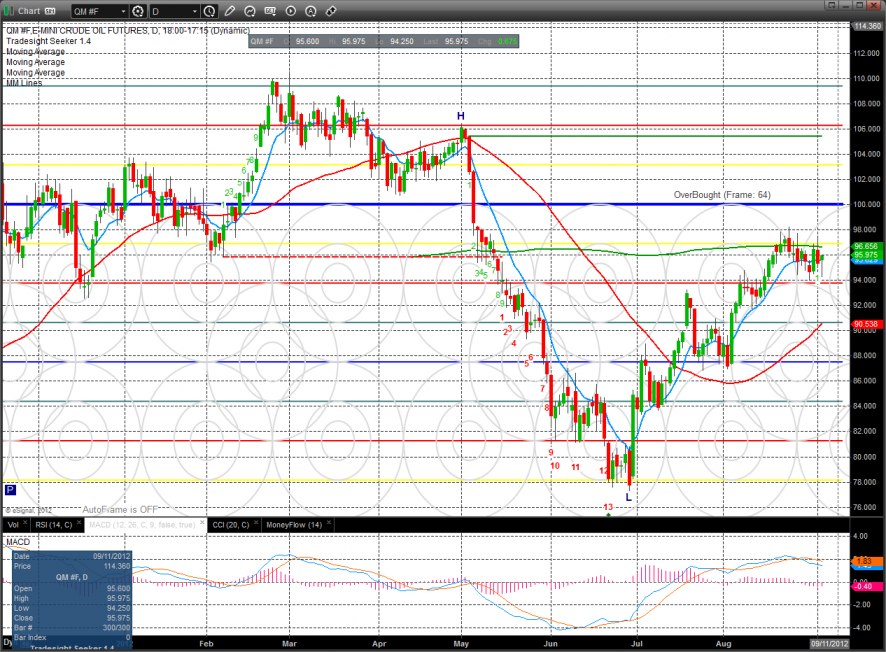

Oil:

Gold:

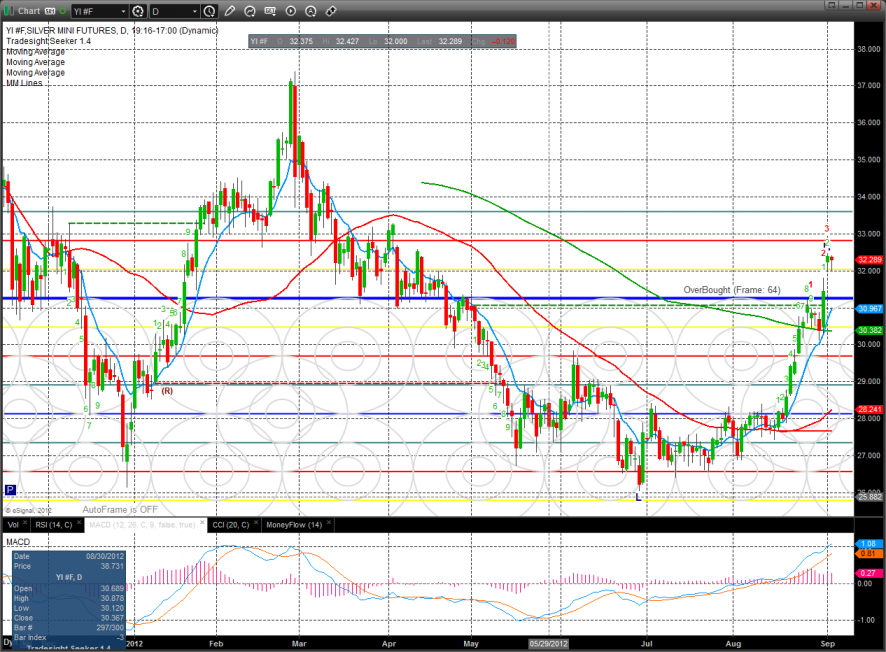

Silver:

Stock Picks Recap for 9/5/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, THLD triggered long (with market support) and worked enough for a partial:

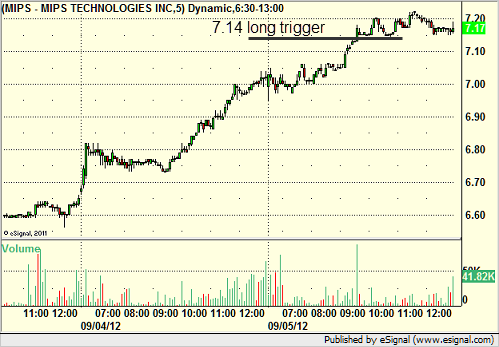

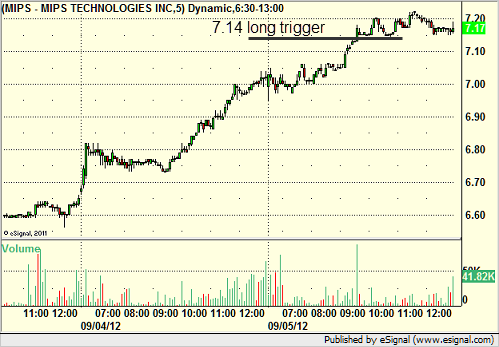

MIPS triggered long (with market support) and didn't go enough in either direction to count:

From the Messenger/Tradesight_st Twitter Feed, BIDU triggered short (without market support) and didn't work initially:

Rich's CLF triggered long (without market support) and worked:

His SBUX triggered long (with market support) and worked:

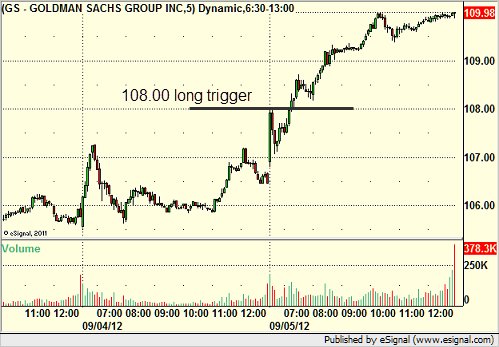

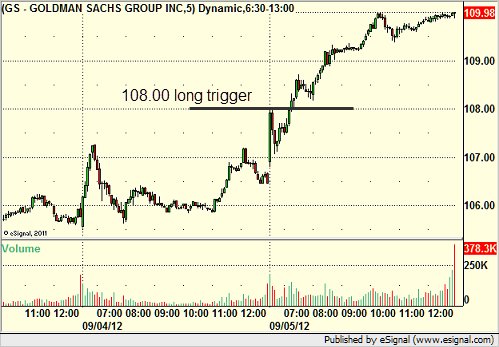

GS triggered long (with market support) and worked:

Rich's JAZZ triggered long (with market support) and worked enough for a partial:

His CLF triggered long (without market support, new trigger) and worked:

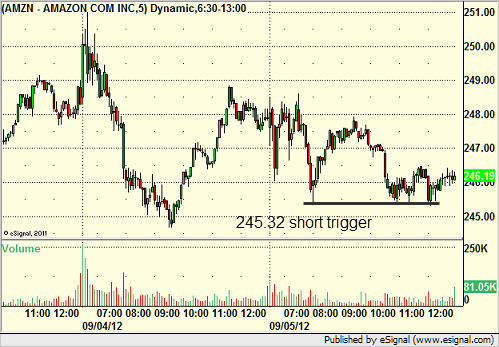

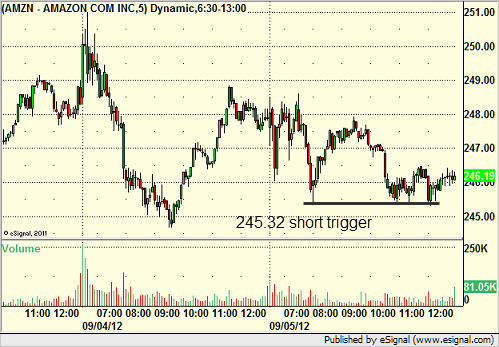

AMZN triggered short (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Stock Picks Recap for 9/5/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, THLD triggered long (with market support) and worked enough for a partial:

MIPS triggered long (with market support) and didn't go enough in either direction to count:

From the Messenger/Tradesight_st Twitter Feed, BIDU triggered short (without market support) and didn't work initially:

Rich's CLF triggered long (without market support) and worked:

His SBUX triggered long (with market support) and worked:

GS triggered long (with market support) and worked:

Rich's JAZZ triggered long (with market support) and worked enough for a partial:

His CLF triggered long (without market support, new trigger) and worked:

AMZN triggered short (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 9/5/12

Couple of nice setups that we called, but nothing triggered as the market established its range very early and never broke to highs or lows after that. Volume was only 1.4 billion on the NASDAQ.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session: