Stock Picks Recap for 8/30/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CHKP gapped under the trigger, no play.

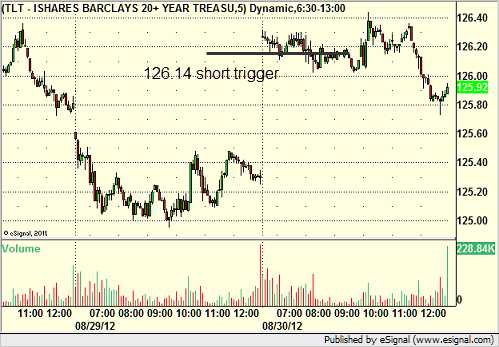

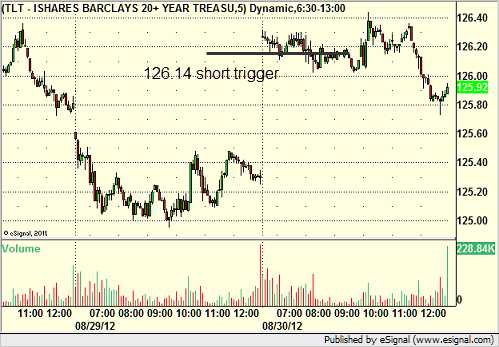

From the Messenger/Tradesight_st Twitter Feed, TLT triggered short (ETF, so no market support needed) and didn't work:

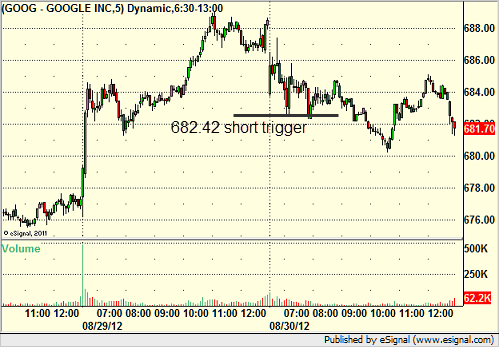

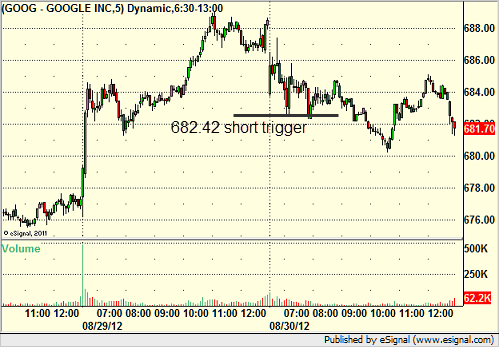

GOOG triggered short (with market support) and didn't work:

Mark's NAV triggered short (with market support) and worked:

In total, that's x trades triggering with market support, y of them worked, z did not.

Stock Picks Recap for 8/30/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CHKP gapped under the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, TLT triggered short (ETF, so no market support needed) and didn't work:

GOOG triggered short (with market support) and didn't work:

Mark's NAV triggered short (with market support) and worked:

In total, that's x trades triggering with market support, y of them worked, z did not.

Futures Calls Recap for 8/30/12

No calls for the session again as previously stated as volume is acting like last week of the year junk. NASDAQ volume closed out at 1.1 billion shares. Ouch. Expect no calls Friday. Monday is a Holiday. Back to work Tuesday finally.

Net ticks: +0 ticks.

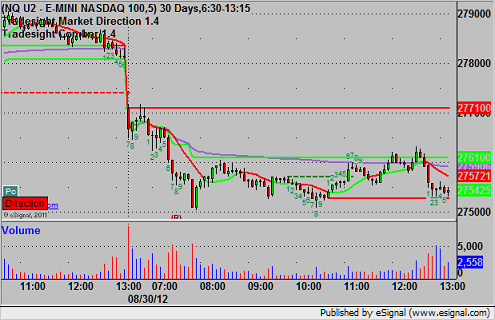

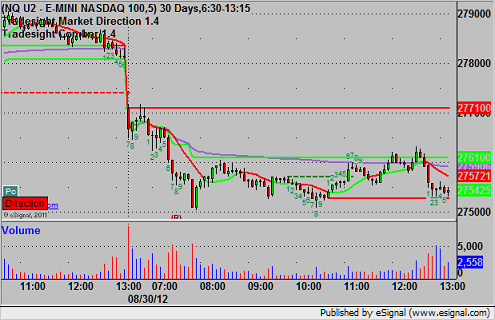

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Futures Calls Recap for 8/30/12

No calls for the session again as previously stated as volume is acting like last week of the year junk. NASDAQ volume closed out at 1.1 billion shares. Ouch. Expect no calls Friday. Monday is a Holiday. Back to work Tuesday finally.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

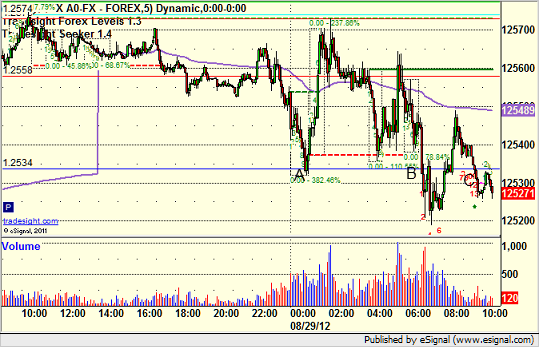

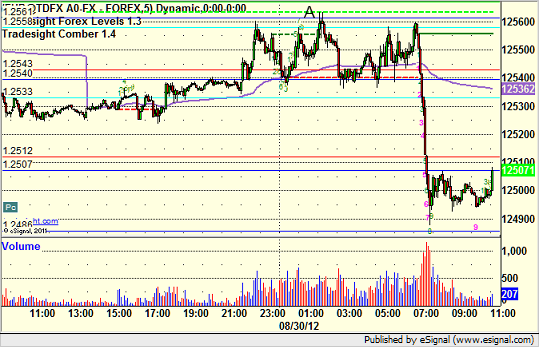

Forex Calls Recap for 8/30/12

A winner and a loser (the winner is still going) for the session.

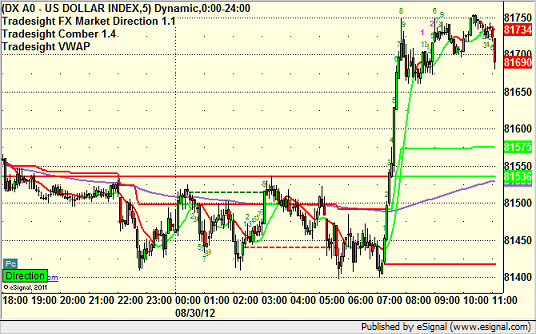

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A and stopped:

GBPUSD:

Triggered short at A or the next move, hit first target at B, holding with a stop over S1:

Stock Picks Recap for 8/29/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ONTY triggered long (with market support) and didn't go more than five cents either way, so we don't count it:

TRMB triggered long (without market support) and didn't work:

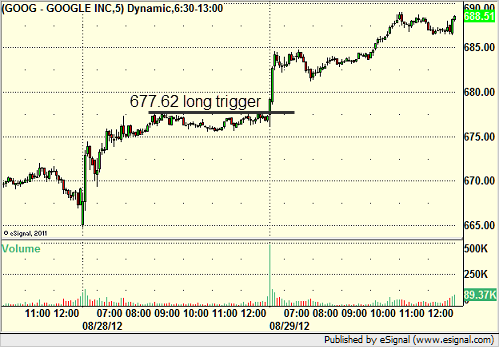

In the Messenger, GOOG triggered long (without market support due to opening 5 minutes) and worked great:

NFLX triggered long (with market support) and didn't work:

In total, that's 1 trades triggering with market support, it didn't work, but GOOG was the big winner for the session.

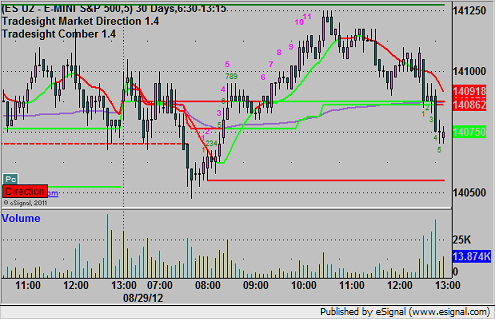

Futures Calls Recap for 8/29/12

No calls due to volume, and that might be the case for the rest of the week. However, using the Seeker and Comber tools, we can have some educational discussions even in the light volume environment, so take a look at the NQ and YM below for examples of how you can spot general entry points even in dull markets (without the type of specific entry points that we would put in the Messenger).

Net ticks: +0 ticks.

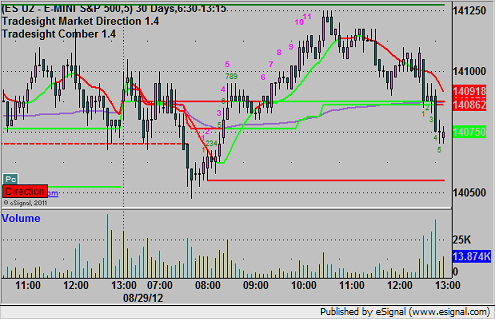

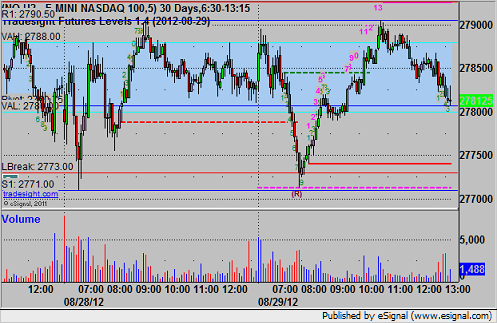

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

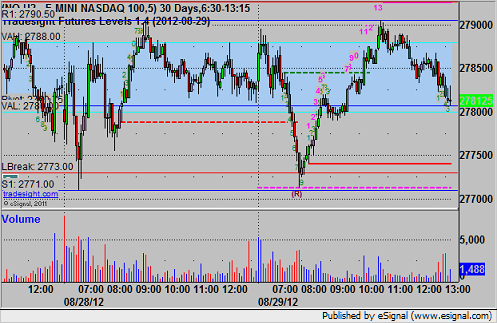

Note that the NQ hit R1 on exactly a Comber 13 sell signal in light volume activity, which gave us the exact top. The market is often dragged to the VWAP/midpoint without volume, and this signal gave you the entry point for the fade back to the VWAP:

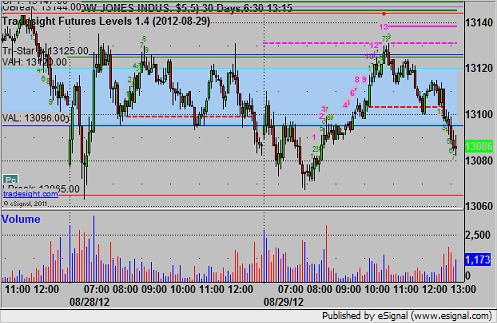

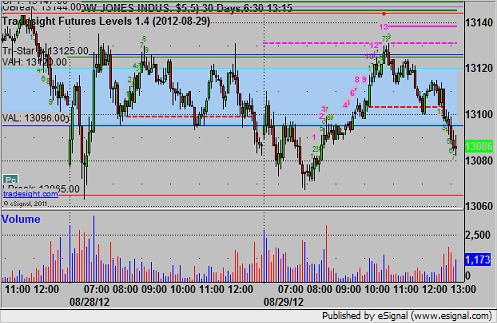

YM:

Note that the YM did the same with the 13 signal calling the top around the same time:

Futures Calls Recap for 8/29/12

No calls due to volume, and that might be the case for the rest of the week. However, using the Seeker and Comber tools, we can have some educational discussions even in the light volume environment, so take a look at the NQ and YM below for examples of how you can spot general entry points even in dull markets (without the type of specific entry points that we would put in the Messenger).

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Note that the NQ hit R1 on exactly a Comber 13 sell signal in light volume activity, which gave us the exact top. The market is often dragged to the VWAP/midpoint without volume, and this signal gave you the entry point for the fade back to the VWAP:

YM:

Note that the YM did the same with the 13 signal calling the top around the same time:

Forex Calls Recap for 8/29/12

Another dull session. See EURUSD for trigger results below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

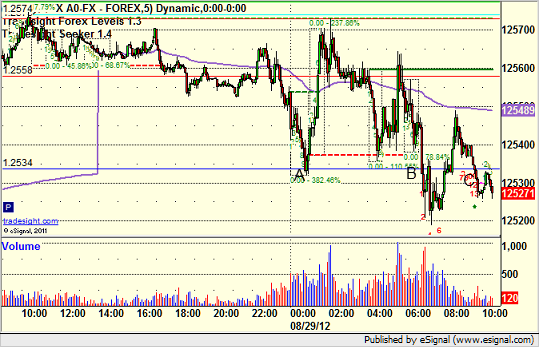

EURUSD:

You know you have the right triggers when the market basically addresses both of them overnight. At A on the chart, we went 2 pips under the trigger line, which would have been your first of three entries using our order staggering method, and that was it. That stopped (so a third of half size). Meanwhile, in the morning we triggered short at B, never hit the target or stop, and I closed at C as the 13 Seeker buy signal was forming:

Forex Calls Recap for 8/29/12

Another dull session. See EURUSD for trigger results below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

You know you have the right triggers when the market basically addresses both of them overnight. At A on the chart, we went 2 pips under the trigger line, which would have been your first of three entries using our order staggering method, and that was it. That stopped (so a third of half size). Meanwhile, in the morning we triggered short at B, never hit the target or stop, and I closed at C as the 13 Seeker buy signal was forming: