Stock Picks Recap for 8/28/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, INFA triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, AAPL triggered short (without market support) and worked enough for a partial (over a point):

In total, that's 1 trades triggering with market support, it worked.

Stock Picks Recap for 8/28/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, INFA triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, AAPL triggered short (without market support) and worked enough for a partial (over a point):

In total, that's 1 trades triggering with market support, it worked.

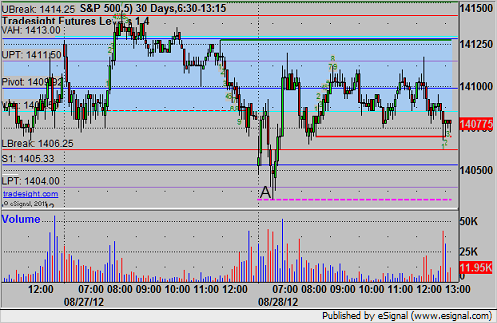

Futures Calls Recap for 8/28/12

The lightest non-Holiday volume day of the year. One ES call triggered short on news and stopped, and we didn't add any more in a sweep-y mess. NASDAQ volume ended at 1.2 billion shares. This might be the rest of the week. Certainly, Friday is going to be awful.

Net ticks: -7 ticks.

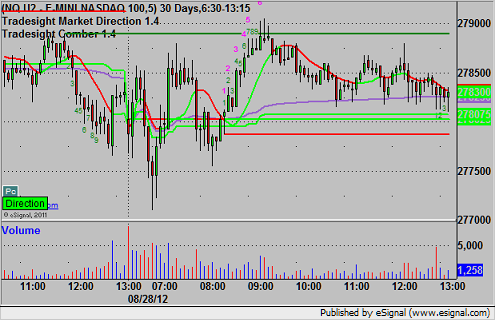

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's short triggered at A at 1403.75 and stopped for 7 ticks:

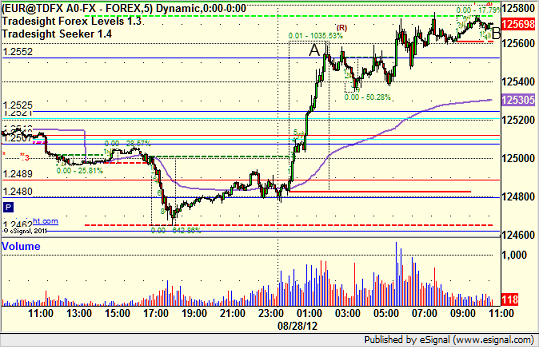

Forex Calls Recap for 8/28/12

A tiny winner on the EURUSD as ranges at least expanded out. See that section below.

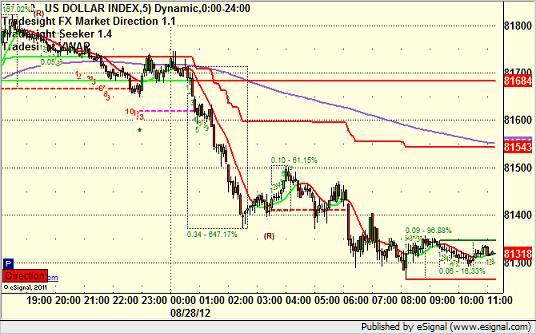

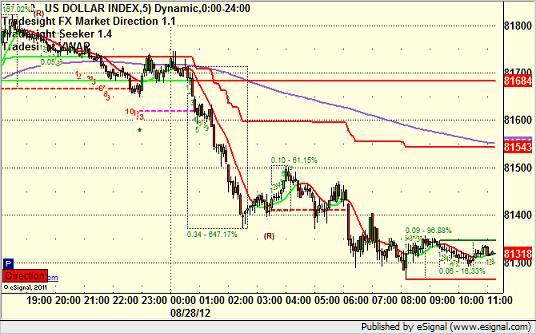

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

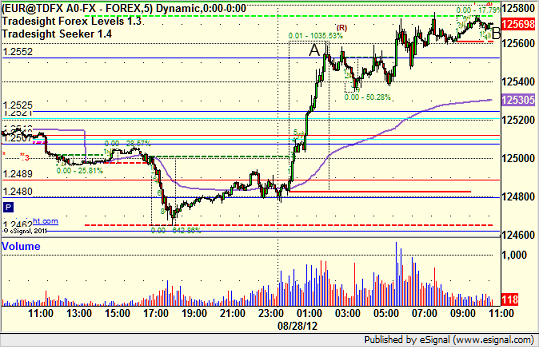

EURUSD:

After a move down that didn't reach our short trigger, finally triggered long at A, but didn't hit stop or first target and I finally closed for a 10 pip gain at B:

Forex Calls Recap for 8/28/12

A tiny winner on the EURUSD as ranges at least expanded out. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

After a move down that didn't reach our short trigger, finally triggered long at A, but didn't hit stop or first target and I finally closed for a 10 pip gain at B:

Stock Picks Recap for 8/27/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TITN triggred short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed: AMZN triggered short (with market support) and didn't work initially, worked later:

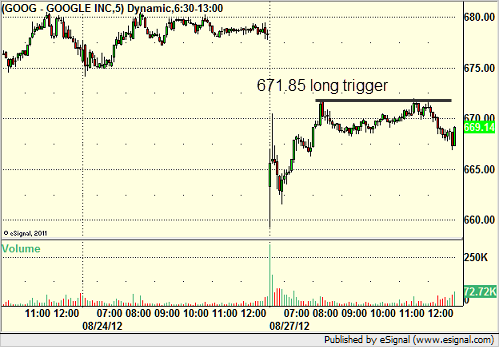

GOOG triggered long (with market support) and didn't work:

Mark's LRCX triggered short (with market support) and worked:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

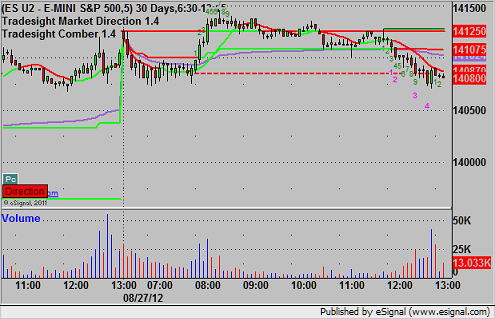

Futures Calls Recap for 8/27/12

One winner on the NQ and then volume was so bad after the first hour that we just put in some non-full size trades for those that wanted to force something. Really shouldn't be trading beyond the first 90 minutes in this volume.

Net ticks: +2.5 ticks.

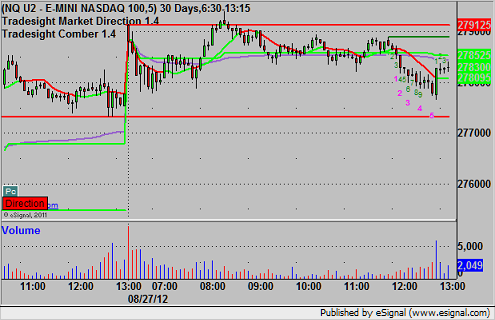

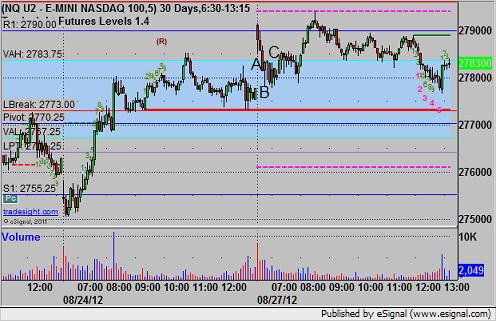

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short into the Value Area at 2783.50 at A, hit first target for 6 ticks at B, but never got going after that. Eventually stopped a tick above the entry at C:

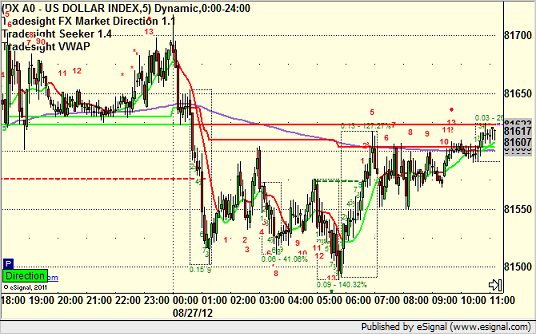

Forex Calls Recap for 8/27/12

For the third time in six trading sessions, neither of our trades triggered, which is fine when the EURUSD is stuck in a 40 pip range for 24 hours. This was probably made worse by the UK Holiday.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

Stock Picks Recap for 8/24/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

We kept the calls to a few because of the volume and did pretty good.

From the report, CBST triggered long (with market support) and worked:

CELG triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's TNA triggered long (ETF, so no market support needed) and worked:

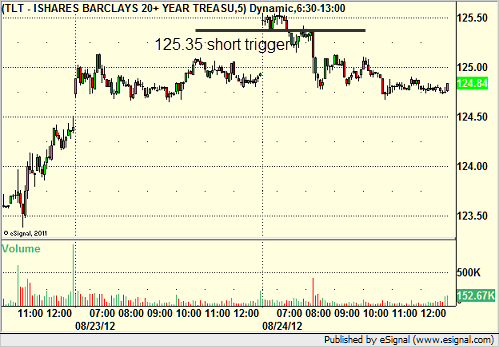

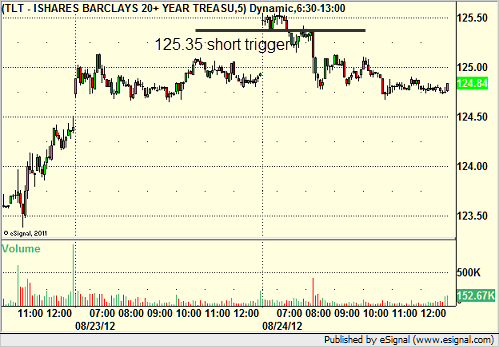

TLT triggered short (ETF, so no market support needed) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked.

Stock Picks Recap for 8/24/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

We kept the calls to a few because of the volume and did pretty good.

From the report, CBST triggered long (with market support) and worked:

CELG triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's TNA triggered long (ETF, so no market support needed) and worked:

TLT triggered short (ETF, so no market support needed) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked.