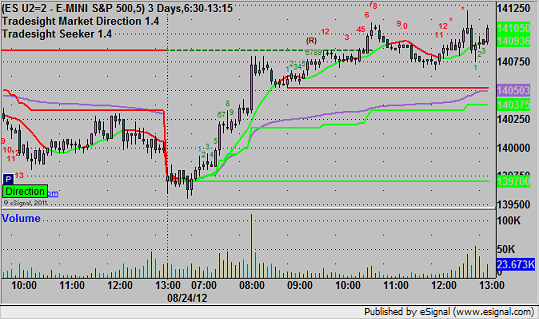

Futures Calls Recap for 8/24/12

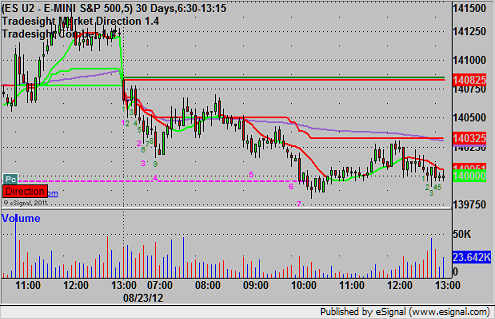

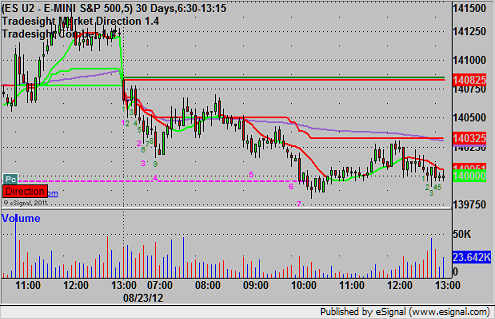

No calls today as expected once we saw how bad the volume was (NASDAQ volume closed at under 1.3 billion). Ironically, the ES made a classic Value Area move anyway (see below).

Net ticks: +0 ticks.

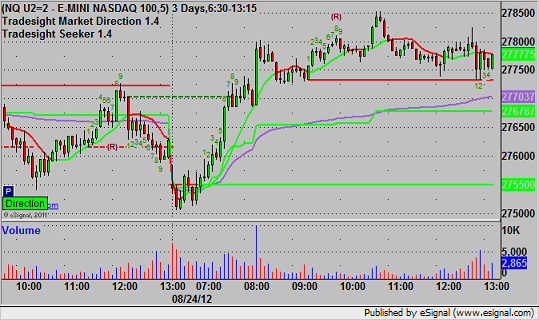

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Forex Calls Recap for 8/24/12

A winning trade to close out a light week. See EURUSD below.

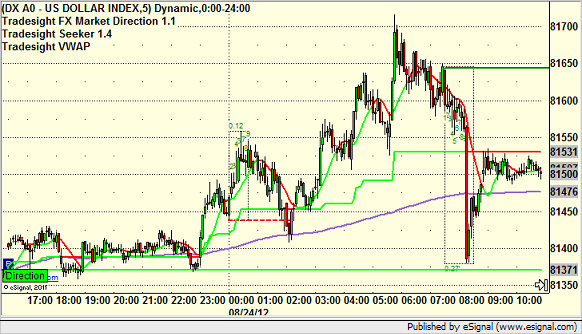

As usual on the Sunday report, we will take a look at the action from Thursday night/Friday, then look at the daily charts heading into the new week (no patterns, but see GBPUSD), and then look at the US Dollar Index.

Next week should be light as we wrap up August and head into Labor Day weekend. I will be half size all week.

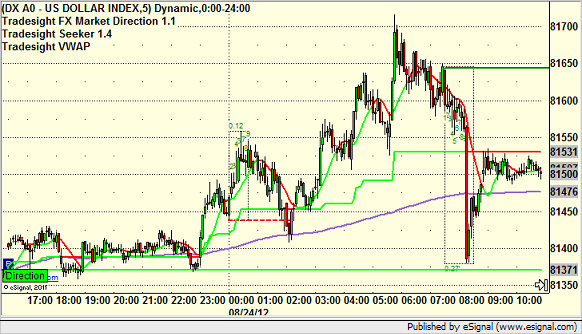

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

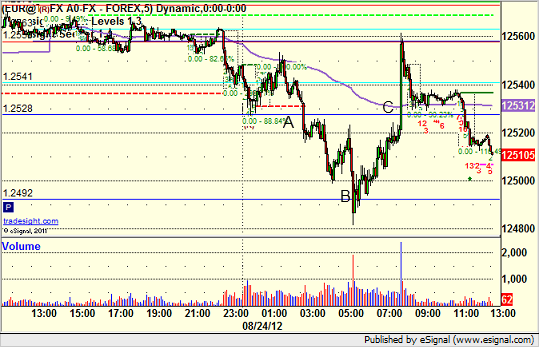

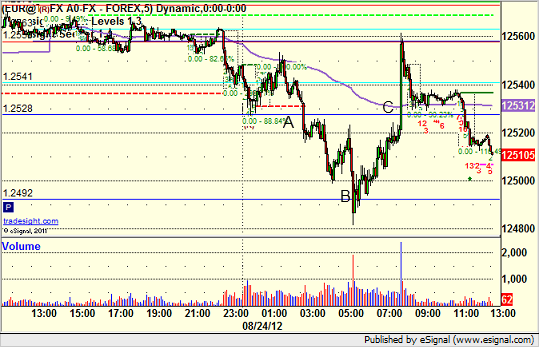

EURUSD:

Triggered short at A, hit first target at B, lowered stop over entry and stopped at C somewhere on a news spike:

Forex Calls Recap for 8/24/12

A winning trade to close out a light week. See EURUSD below.

As usual on the Sunday report, we will take a look at the action from Thursday night/Friday, then look at the daily charts heading into the new week (no patterns, but see GBPUSD), and then look at the US Dollar Index.

Next week should be light as we wrap up August and head into Labor Day weekend. I will be half size all week.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered short at A, hit first target at B, lowered stop over entry and stopped at C somewhere on a news spike:

Stock Picks Recap for 8/23/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Nothing triggered off of the report.

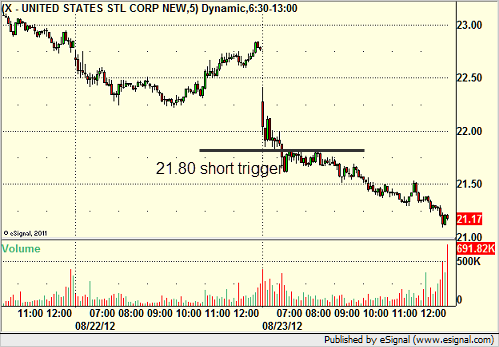

From the Messenger/Tradesight_st Twitter Feed, Rich's X triggered short (with market support) and worked:

EBAY triggered short (with market support) and worked:

Rich's VXX triggered long (ETF, so no market support needed) and didn't go enough either way to count, closed on the trigger:

His AAPL triggered long (with market support) and didn't work:

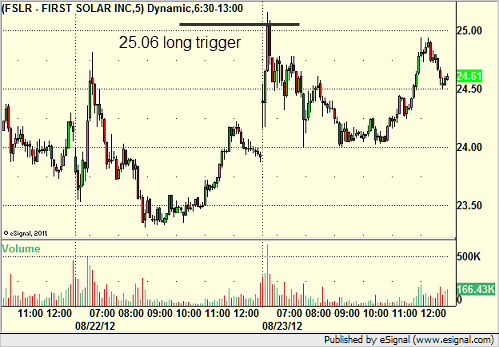

His FLSR triggered long (with market support) and didn't work:

His FAS triggered short (ETF, so no market support needed) and worked:

His AAPL triggered short (with market support) and didn't work:

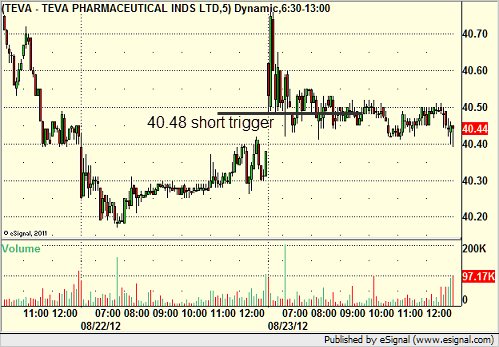

TEVA triggered short (with market support) and didn't go enough in either direction to count:

AMZN triggered short (with market support) and worked:

In total, that's 7 trades triggering with market support, 4 of them worked, 3 did not.

Futures Calls Recap for 8/23/12

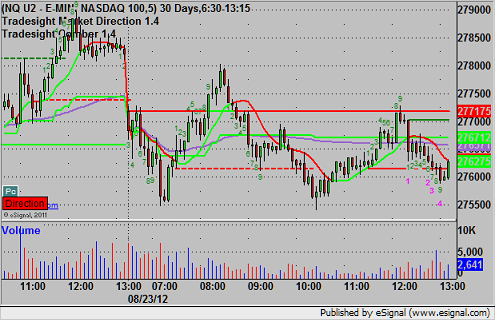

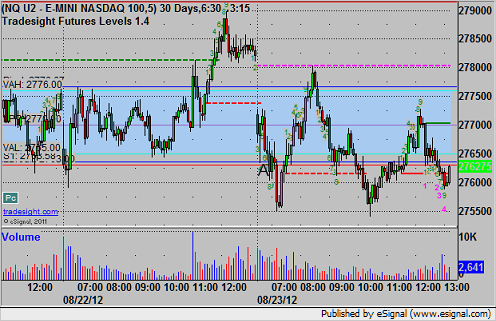

Only one trigger and then we called off any further trades when it was clear that volume was going to be as low as we have seen yet. See NQ below. We may or may not make any calls Friday with volume this bad.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

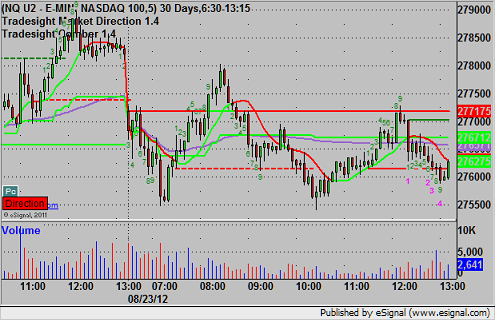

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered short at A at 2762.50 and stopped for 7 ticks:

Futures Calls Recap for 8/23/12

Only one trigger and then we called off any further trades when it was clear that volume was going to be as low as we have seen yet. See NQ below. We may or may not make any calls Friday with volume this bad.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered short at A at 2762.50 and stopped for 7 ticks:

Forex Calls Recap for 8/23/12

Well, that's a record. Two days in one week without one of our trades triggering as the market is so flat. Better that than triggering and stopping out.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

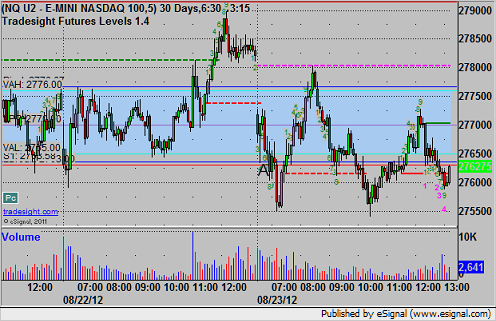

Tradesight Market Preview for 8/23/12

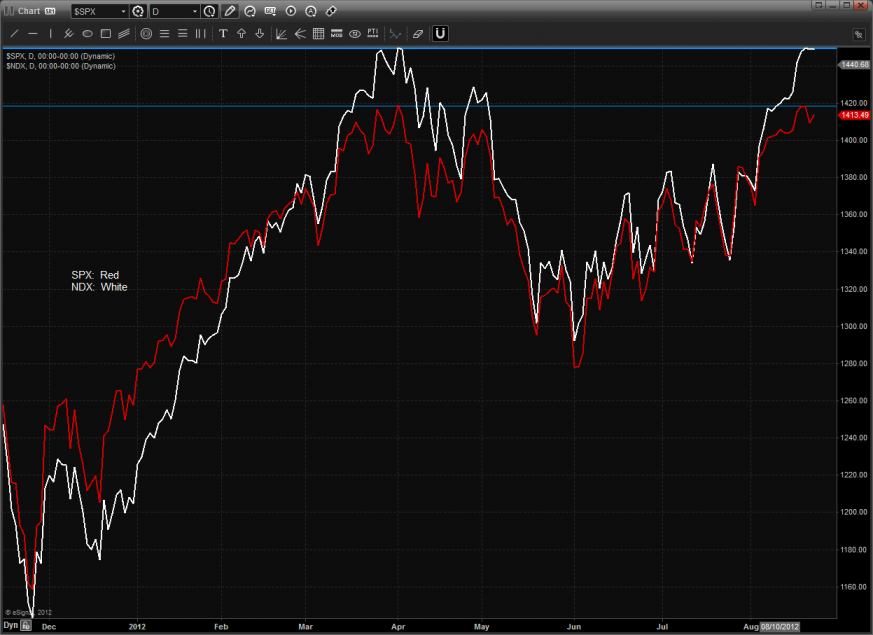

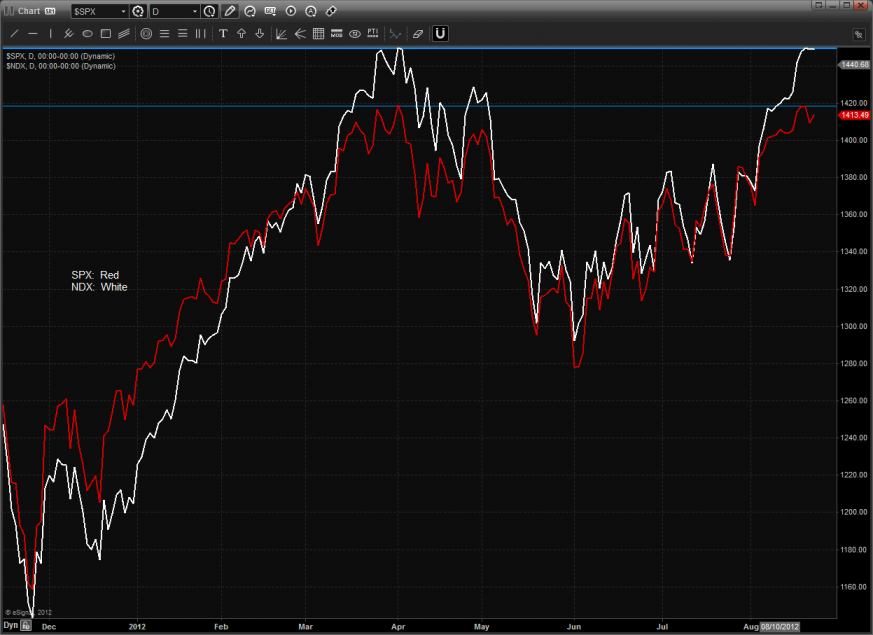

The ES found support at the 10ema and closed unchanged. Keep in mind that changes in trend take time as both the bulls and bears take measure of each other.

The NQ’s showed relative strength gaining 7 on the day which was good enough to match the high close of the move. Keep in mind that the bulls have major overhead at the 8/8 level 2812.50.

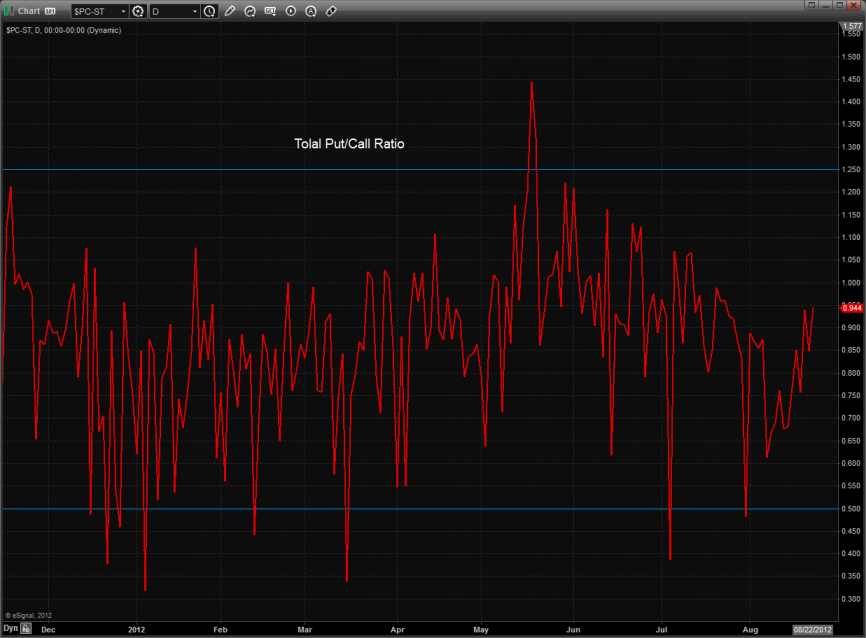

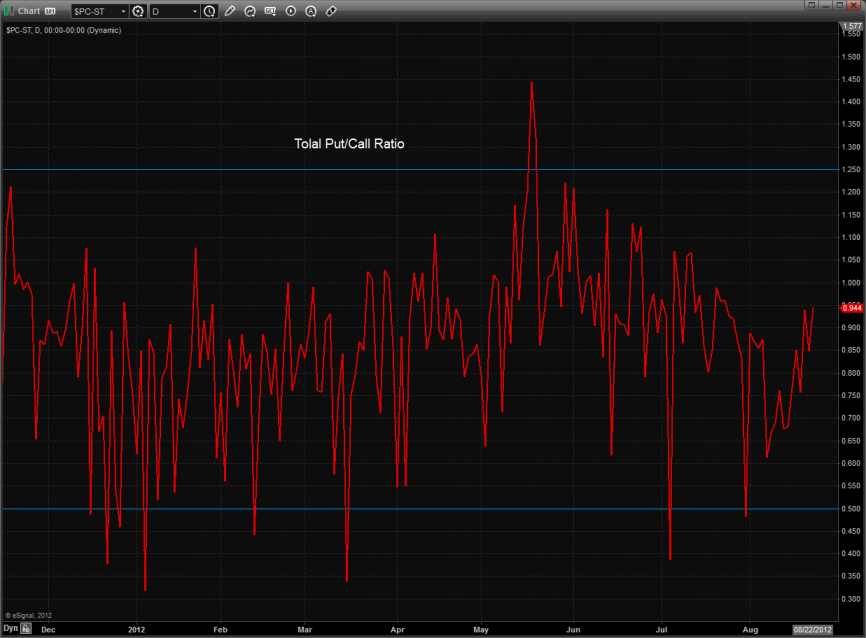

The total put/call ratio is climbing but nowhere near climatic.

Multi sector daily chart:

The Dow/gold ratio took a good sized hit which is a defensive development.

The double tops are still in place for both the SPX and NDX.

The defensive XAU was the top gun on the day. This is a new high close on the move and qualifies the higher low.

The OSX was little changed on the day. There is a critical convergence of the 10ema and the 200dma which will quickly turn the chart negative if they are lost.

The SOX was bearishly much weaker than the NDX and broad market. Price settled below the 10ema and a downside follow through will weigh heavily on all the key averages. Be on guard for the MACD to confirm a turn.

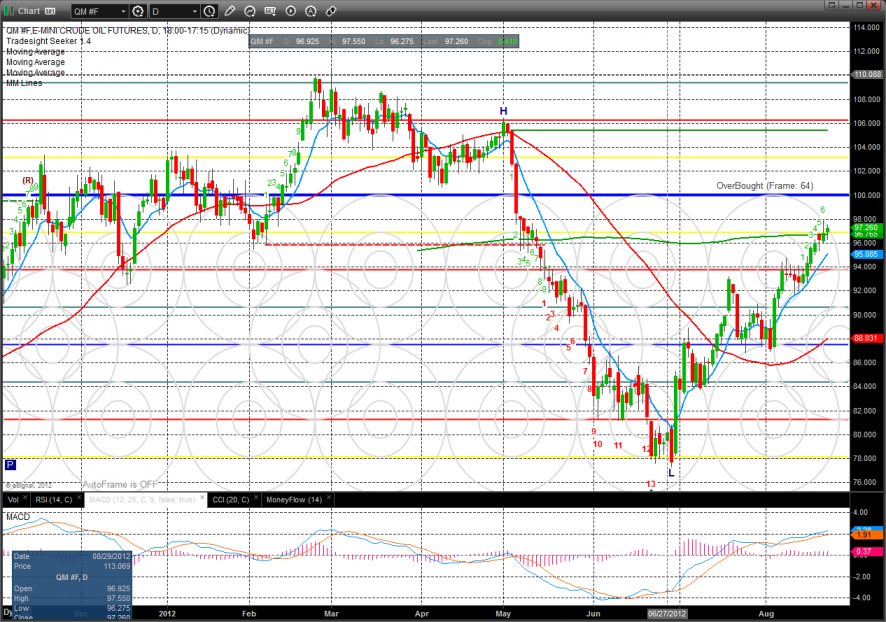

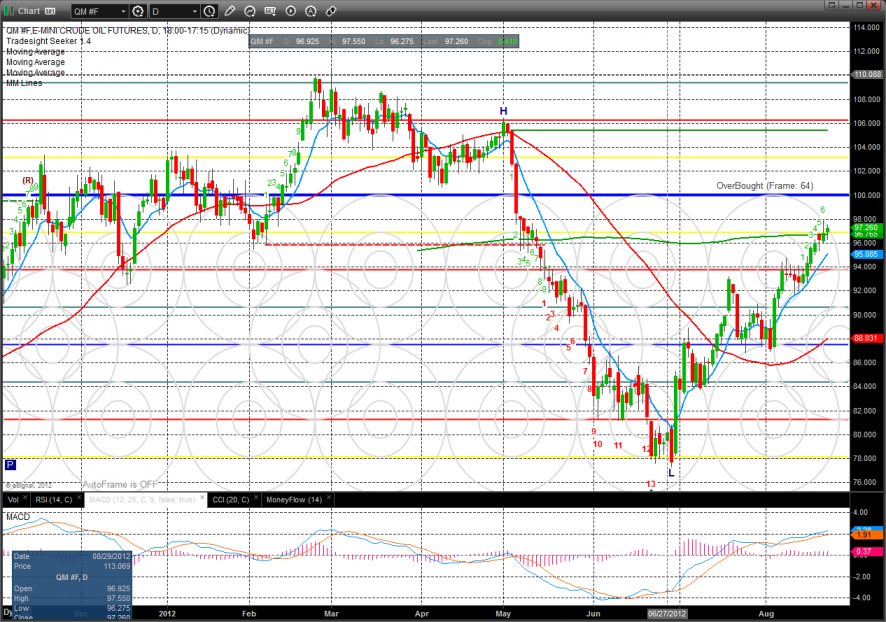

Oil:

Gold:

Silver:

Bonds:

Tradesight Market Preview for 8/23/12

The ES found support at the 10ema and closed unchanged. Keep in mind that changes in trend take time as both the bulls and bears take measure of each other.

The NQ’s showed relative strength gaining 7 on the day which was good enough to match the high close of the move. Keep in mind that the bulls have major overhead at the 8/8 level 2812.50.

The total put/call ratio is climbing but nowhere near climatic.

Multi sector daily chart:

The Dow/gold ratio took a good sized hit which is a defensive development.

The double tops are still in place for both the SPX and NDX.

The defensive XAU was the top gun on the day. This is a new high close on the move and qualifies the higher low.

The OSX was little changed on the day. There is a critical convergence of the 10ema and the 200dma which will quickly turn the chart negative if they are lost.

The SOX was bearishly much weaker than the NDX and broad market. Price settled below the 10ema and a downside follow through will weigh heavily on all the key averages. Be on guard for the MACD to confirm a turn.

Oil:

Gold:

Silver:

Bonds:

Stock Picks Recap for 8/22/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, GMCR triggered long (with market support) and worked enough for a partial:

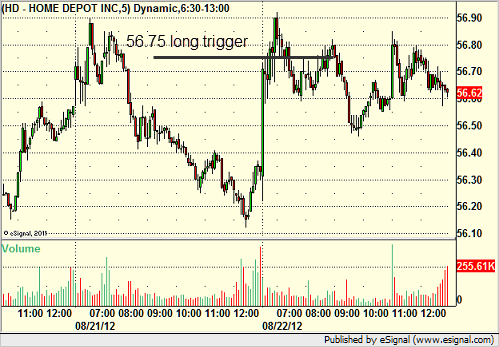

From the Messenger/Tradesight_st Twitter Feed, Rich's HD triggered long (with market support) and didn't work:

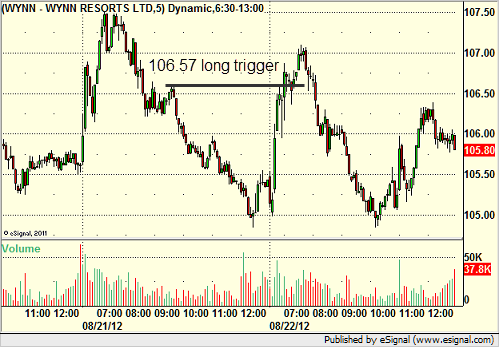

His WYNN triggered long (with market support) and worked:

AAPL triggered long (with market support) and didn't work, although it worked later:

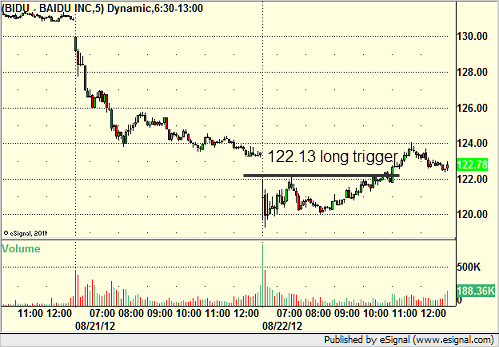

Rich's BIDU triggered long (without market support) and worked:

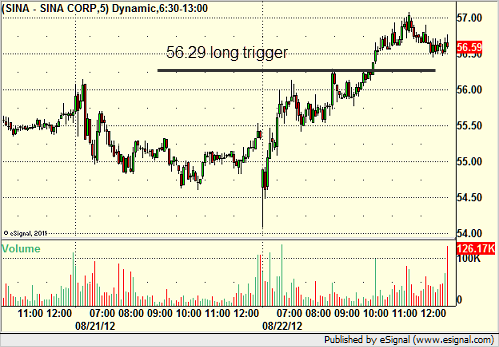

His SINA triggered long (without market support) and worked:

GOOG triggered long (with market support) and worked:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.